Key Insights

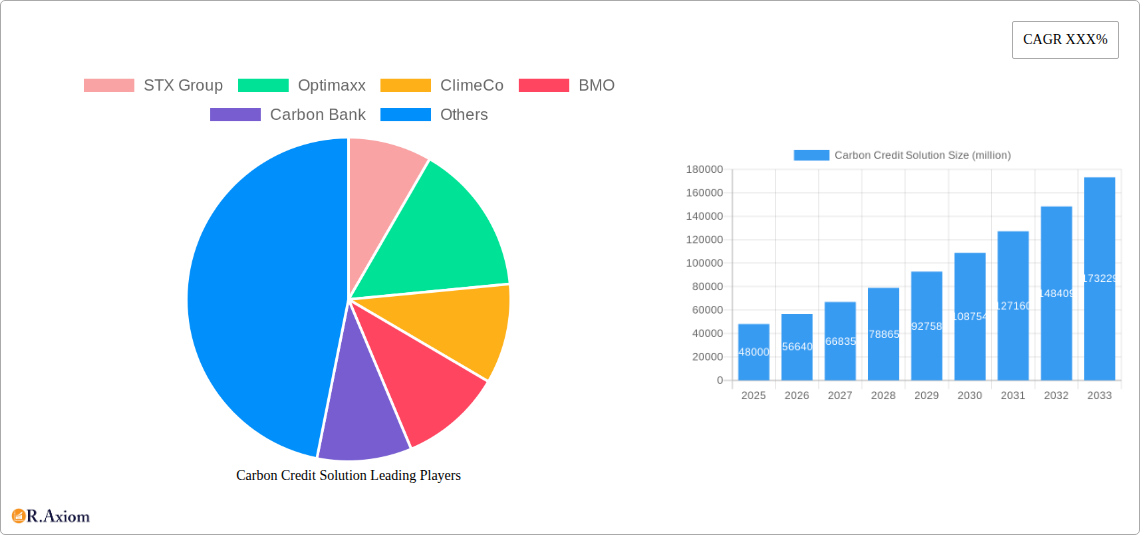

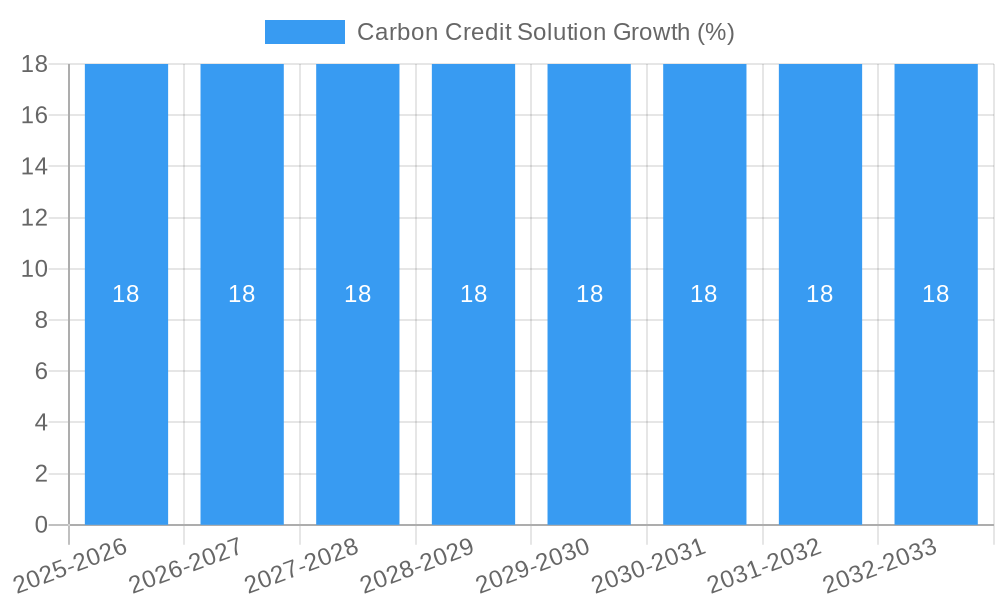

The global carbon credit solution market is poised for substantial expansion, projected to reach a market size of approximately $48 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 18% through 2033. This robust growth is fueled by an increasing global commitment to climate change mitigation and the escalating demand for verifiable mechanisms to offset carbon emissions. Key drivers include stringent government regulations, corporate sustainability initiatives, and the rising awareness of environmental, social, and governance (ESG) factors among investors and consumers. The market is segmented into regulated carbon credits, driven by compliance markets like the EU Emissions Trading System (ETS) and California's Cap-and-Trade program, and voluntary carbon credits, where companies voluntarily purchase credits to meet their sustainability goals or enhance their brand image. Emerging economies, particularly in the Asia Pacific region, are expected to become significant growth centers due to rapid industrialization and increasing environmental consciousness.

The market's trajectory is further shaped by several influential trends. The proliferation of digital platforms and blockchain technology is enhancing transparency, traceability, and efficiency in carbon credit trading, making the market more accessible and trustworthy. There's also a growing emphasis on high-quality carbon credits backed by projects with co-benefits, such as biodiversity conservation and community development. However, the market faces certain restraints, including concerns about the additionality and integrity of some carbon offset projects, potential price volatility, and the evolving regulatory landscape. Despite these challenges, the increasing participation of major corporations and financial institutions, alongside specialized companies like STX Group, ClimeCo, and Anthesis, indicates a strong underlying demand and a commitment to developing a more mature and effective carbon market. North America and Europe currently lead in market share, but Asia Pacific is anticipated to witness the most dynamic growth in the coming years.

Here's the SEO-optimized, detailed report description for Carbon Credit Solutions, designed for maximum visibility and engagement without requiring further modification.

Carbon Credit Solution Market Concentration & Innovation

The Carbon Credit Solution market is characterized by a dynamic blend of concentration and rapid innovation, driven by evolving climate regulations and corporate sustainability mandates. Key innovation drivers include advancements in carbon accounting software, blockchain-based tracking for credit integrity, and novel nature-based solutions. Regulatory frameworks are increasingly shaping market dynamics, with governments worldwide establishing compliance markets and incentivizing participation in voluntary schemes. The report analyzes the influence of these frameworks on market entry and growth. Product substitutes, while nascent, are being closely monitored, encompassing insetting projects and direct emissions reduction technologies that could alter demand for traditional carbon credits. End-user trends reveal a growing preference for high-quality, verifiable credits from reputable sources, with a particular emphasis on co-benefits like biodiversity enhancement and community development. Mergers and acquisitions (M&A) activities are a significant indicator of market maturation. Over the Study Period (2019–2033), we anticipate a substantial increase in M&A deal values, potentially reaching tens of millions, as larger entities seek to consolidate their market positions and expand their service offerings. Market share analysis will highlight the leading players and their strategic approaches to capturing growth opportunities in this competitive landscape.

Carbon Credit Solution Industry Trends & Insights

The Carbon Credit Solution industry is poised for exponential growth, fueled by a confluence of pressing environmental concerns and robust economic drivers. The global push towards net-zero emissions targets, coupled with stringent climate policies and rising public awareness, is propelling demand for effective carbon mitigation strategies. Technological disruptions are at the forefront of this evolution, with innovative approaches to carbon sequestration, measurement, reporting, and verification (MRV) enhancing the credibility and scalability of carbon credit projects. Blockchain technology, for instance, is revolutionizing transparency and preventing double-counting, thereby bolstering investor confidence. Consumer preferences are shifting towards sustainable practices, compelling businesses to actively engage in carbon offsetting and insetting to meet stakeholder expectations and enhance brand reputation. The competitive landscape is intensifying, with established financial institutions, specialized carbon consultancies, and emerging technology startups vying for market share. We project a Compound Annual Growth Rate (CAGR) of over 15% for the global carbon credit market during the Forecast Period (2025–2033). Market penetration is expected to reach approximately 70% among large enterprises and 40% among government agencies by the end of the forecast period, underscoring the widespread adoption of carbon credit solutions. Industry developments like the increasing standardization of carbon accounting methodologies and the development of new project types, such as direct air capture, are further shaping the market's trajectory. The historical period (2019–2024) laid the groundwork for this expansion, witnessing a steady rise in both regulated and voluntary carbon market activities.

Dominant Markets & Segments in Carbon Credit Solution

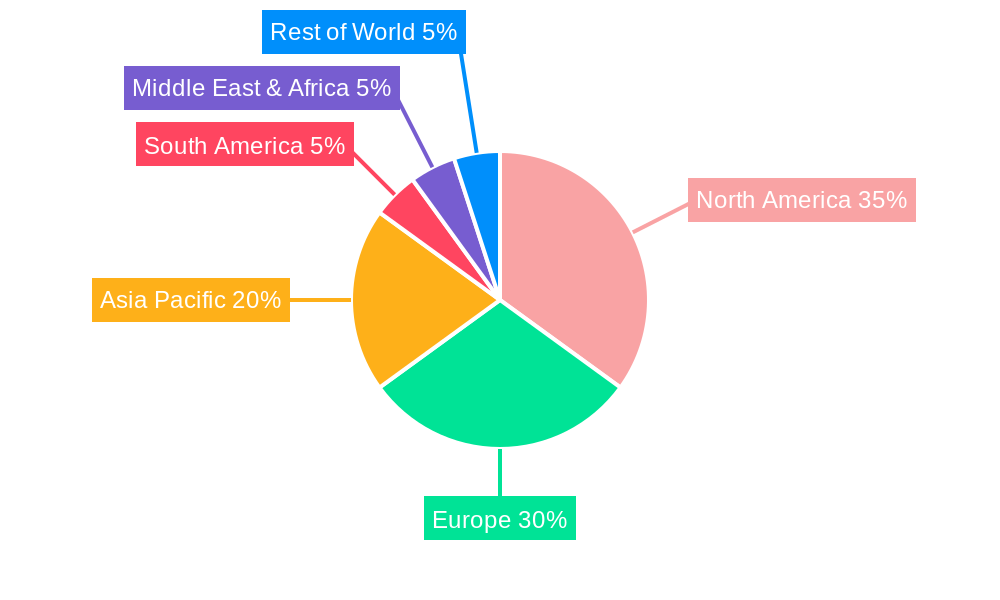

The Carbon Credit Solution market's dominance is a multifaceted phenomenon, influenced by regional economic policies, governmental initiatives, and the specific needs of various industry segments.

Leading Region and Country Dominance:

- North America: This region is a powerhouse, driven by strong regulatory frameworks in jurisdictions like California and a proactive corporate sector committed to sustainability goals. Significant investments are being channeled into both regulated and voluntary carbon markets, with a focus on innovative project development and robust MRV systems.

- Europe: Led by the European Union's Emissions Trading System (EU ETS), Europe has a mature regulated carbon market. The increasing emphasis on the European Green Deal further strengthens its position, fostering demand for high-quality voluntary carbon credits to supplement compliance efforts and achieve ambitious climate targets.

- Asia-Pacific: This rapidly developing region presents immense growth potential, with countries like China and India making substantial strides in establishing their carbon markets and promoting renewable energy projects. The burgeoning industrial sector and growing environmental consciousness are key drivers.

Dominant Segments:

- Application: Enterprise:

- Economic Policies & Corporate ESG Goals: Businesses are increasingly integrating carbon credit procurement into their Environmental, Social, and Governance (ESG) strategies to meet regulatory requirements, achieve net-zero commitments, and enhance stakeholder trust.

- Brand Reputation and Consumer Demand: Companies are leveraging carbon offsetting to demonstrate environmental responsibility, attracting environmentally conscious consumers and investors.

- Operational Efficiency and Cost Management: For some industries, carbon credit solutions offer a cost-effective pathway to achieve emissions reductions compared to direct abatement measures.

- Application: Government Agency:

- Climate Policy Implementation: Government agencies are instrumental in designing and enforcing carbon pricing mechanisms, cap-and-trade systems, and emissions standards, directly influencing demand for regulated carbon credits.

- International Climate Commitments: National governments are utilizing carbon credit markets to meet their Nationally Determined Contributions (NDCs) under the Paris Agreement, driving both domestic and international project development.

- Public Procurement and Green Initiatives: Agencies are increasingly incorporating carbon neutrality into their procurement policies, creating demand for verified carbon credits.

- Application: Financial Institution:

- Investment Opportunities and Risk Management: Financial institutions are actively involved in the trading and financing of carbon credits, recognizing them as a new asset class and a tool for managing climate-related financial risks.

- Development of Financial Products: Banks and investment firms are developing innovative financial instruments and advisory services around carbon markets.

- Client Advisory Services: Providing expertise to corporate clients on carbon strategy, compliance, and procurement.

- Type: Regulated Carbon Credits:

- Mandatory Compliance: Driven by legal obligations under cap-and-trade schemes and emissions standards, ensuring a baseline demand.

- Market Stability and Liquidity: These markets often exhibit greater stability and liquidity due to their mandatory nature.

- Industry-Specific Reductions: Primarily linked to emissions from heavy industries, power generation, and transportation.

- Type: Voluntary Carbon Credits:

- Corporate Sustainability Ambitions: Driven by voluntary net-zero commitments, ESG targets, and brand-building initiatives.

- Project Diversity and Innovation: Encompasses a wide range of projects, including renewable energy, forestry, conservation, and technological solutions.

- Growing Demand for Quality and Co-benefits: Focus on credits with strong additionality, permanence, and positive social and environmental co-benefits.

Carbon Credit Solution Product Developments

Recent product developments in the Carbon Credit Solution space are emphasizing enhanced transparency, verification, and innovative credit generation. Advances in AI-powered MRV systems are providing more accurate and real-time emissions data, boosting the credibility of carbon credits. Blockchain integration is becoming standard for tracking credit provenance and preventing double-counting, offering unparalleled integrity. Furthermore, there's a surge in nature-based solutions, with novel methodologies for afforestation, reforestation, and soil carbon sequestration projects gaining traction. The competitive advantage lies in offerings that can demonstrate robust additionality, long-term permanence, and significant co-benefits, aligning with the evolving demands of enterprises, government agencies, and financial institutions seeking high-impact climate solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Carbon Credit Solution market, segmented by application and type. The Application segments include Enterprise, focusing on corporate emissions reduction strategies and ESG compliance; Government Agency, examining policy implementation and climate targets; Financial Institution, detailing market trading, investment, and advisory services; and Others, encompassing NGOs, research bodies, and individual initiatives. The Type segmentation differentiates between Regulated Carbon Credits, driven by mandatory compliance schemes and cap-and-trade systems, and Voluntary Carbon Credits, arising from self-imposed emissions reduction goals and sustainability commitments. Each segment's market size, growth projections for the 2025–2033 forecast period, and competitive dynamics are thoroughly evaluated, providing granular insights into the market's multifaceted structure and future potential.

Key Drivers of Carbon Credit Solution Growth

The significant growth drivers in the Carbon Credit Solution market are multi-faceted, encompassing technological, economic, and regulatory factors.

- Technological Advancements: Innovations in carbon accounting software, MRV technologies, and blockchain are enhancing the credibility, transparency, and efficiency of carbon credit markets, making them more attractive to participants.

- Economic Policies and ESG Mandates: Government regulations, such as emissions trading schemes, and the increasing corporate focus on ESG performance are creating a strong demand for carbon credits as a means of compliance and responsible corporate citizenship.

- Growing Environmental Awareness and Climate Action: A global surge in awareness regarding climate change and the urgent need for decarbonization is compelling businesses and governments to actively seek solutions for emissions mitigation, with carbon credits playing a crucial role.

- Development of New Project Types: The expansion of project methodologies beyond traditional forestry to include areas like direct air capture, bioenergy with carbon capture and storage (BECCS), and enhanced soil carbon sequestration is broadening the supply and appeal of carbon credits.

Challenges in the Carbon Credit Solution Sector

The Carbon Credit Solution sector faces several significant challenges that can impede its growth and effectiveness.

- Regulatory Uncertainty and Fragmentation: Variations in regulations across different jurisdictions and the evolving nature of climate policies can create uncertainty for market participants and hinder standardization.

- Integrity and Transparency Concerns: Ensuring the additionality, permanence, and accurate measurement of emission reductions remains a critical challenge, with instances of greenwashing impacting market trust.

- Supply Chain Bottlenecks and Project Development Hurdles: Developing high-quality carbon credit projects can be complex and time-consuming, facing challenges in land access, community engagement, and the availability of robust MRV infrastructure.

- Market Volatility and Price Fluctuations: The carbon credit market can be subject to price volatility, influenced by supply-demand dynamics, policy changes, and economic conditions, which can affect investment decisions and project viability.

Emerging Opportunities in Carbon Credit Solution

Emerging opportunities in the Carbon Credit Solution sector are ripe for innovation and strategic investment. The growing demand for high-integrity credits with demonstrable social and biodiversity co-benefits presents a significant avenue for differentiation. The expansion of nature-based solutions, including blue carbon initiatives (e.g., mangrove restoration) and regenerative agriculture, offers vast potential for new project development. Furthermore, the integration of AI and blockchain technologies into MRV systems is creating opportunities for more robust, transparent, and efficient carbon accounting. The increasing focus on Scope 3 emissions also opens new markets for businesses seeking to offset or reduce their value chain emissions.

Leading Players in the Carbon Credit Solution Market

- STX Group

- Optimaxx

- ClimeCo

- BMO

- Carbon Bank

- Anthesis

- StoneX

- BanQu

- Arbor Day Carbon

- Carbon Asset Solutions

- Carbon Market Solutions

- BNZ Green

- Shell

Key Developments in Carbon Credit Solution Industry

- 2023: STX Group and Optimaxx announce a strategic partnership to enhance transparency and liquidity in the voluntary carbon market, aiming to facilitate over ten million tons of carbon credits trading annually.

- 2023: ClimeCo launches a new initiative focusing on nature-based solutions in South America, projecting the development of projects capable of sequestering millions of tons of CO2 over the next decade.

- 2022: BMO commits to investing one million dollars in various carbon removal technologies, signaling strong financial sector interest.

- 2022: Anthesis acquires a leading carbon accounting software company, bolstering its service offering for enterprise clients with advanced tracking capabilities.

- 2021: Carbon Bank pilots a blockchain-based platform for fractionalized carbon credit ownership, with initial transactions reaching over one million dollars in value.

- 2020: Arbor Day Carbon partners with regional governments to launch large-scale reforestation programs expected to generate millions of carbon credits.

- 2019: Shell announces its intention to invest up to one million dollars in nature-based carbon offset projects globally.

Strategic Outlook for Carbon Credit Solution Market

The strategic outlook for the Carbon Credit Solution market remains exceptionally positive, driven by accelerating global decarbonization efforts and increasingly stringent climate regulations. The forecast period (2025–2033) is anticipated to witness substantial growth, with a projected market expansion into the billions. Key growth catalysts include the continued innovation in MRV technologies, the increasing demand for high-quality and co-beneficial credits, and the expansion of regulated markets. The rising integration of carbon finance into mainstream investment strategies by financial institutions will further fuel market liquidity and project development. Strategic players will focus on building robust portfolios of diverse and verifiable carbon projects, leveraging technology for enhanced transparency, and offering comprehensive solutions that address the evolving needs of enterprises and government agencies aiming to achieve their ambitious climate targets.

Carbon Credit Solution Segmentation

-

1. Application

- 1.1. Enterprise

- 1.2. Government Agency

- 1.3. Financial Institution

- 1.4. Others

-

2. Type

- 2.1. Regulated Carbon Credits

- 2.2. Voluntary Carbon Credits

Carbon Credit Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Carbon Credit Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Carbon Credit Solution Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise

- 5.1.2. Government Agency

- 5.1.3. Financial Institution

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Regulated Carbon Credits

- 5.2.2. Voluntary Carbon Credits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Carbon Credit Solution Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Enterprise

- 6.1.2. Government Agency

- 6.1.3. Financial Institution

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Regulated Carbon Credits

- 6.2.2. Voluntary Carbon Credits

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Carbon Credit Solution Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Enterprise

- 7.1.2. Government Agency

- 7.1.3. Financial Institution

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Regulated Carbon Credits

- 7.2.2. Voluntary Carbon Credits

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Carbon Credit Solution Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Enterprise

- 8.1.2. Government Agency

- 8.1.3. Financial Institution

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Regulated Carbon Credits

- 8.2.2. Voluntary Carbon Credits

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Carbon Credit Solution Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Enterprise

- 9.1.2. Government Agency

- 9.1.3. Financial Institution

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Regulated Carbon Credits

- 9.2.2. Voluntary Carbon Credits

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Carbon Credit Solution Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Enterprise

- 10.1.2. Government Agency

- 10.1.3. Financial Institution

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Regulated Carbon Credits

- 10.2.2. Voluntary Carbon Credits

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 STX Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Optimaxx

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ClimeCo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BMO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carbon Bank

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Anthesis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 StoneX

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BanQu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arbor Day Carbon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Carbon Asset Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Carbon Market Solutions

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BNZ Green

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shell

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 STX Group

List of Figures

- Figure 1: Global Carbon Credit Solution Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Carbon Credit Solution Revenue (million), by Application 2024 & 2032

- Figure 3: North America Carbon Credit Solution Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Carbon Credit Solution Revenue (million), by Type 2024 & 2032

- Figure 5: North America Carbon Credit Solution Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Carbon Credit Solution Revenue (million), by Country 2024 & 2032

- Figure 7: North America Carbon Credit Solution Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Carbon Credit Solution Revenue (million), by Application 2024 & 2032

- Figure 9: South America Carbon Credit Solution Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Carbon Credit Solution Revenue (million), by Type 2024 & 2032

- Figure 11: South America Carbon Credit Solution Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Carbon Credit Solution Revenue (million), by Country 2024 & 2032

- Figure 13: South America Carbon Credit Solution Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Carbon Credit Solution Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Carbon Credit Solution Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Carbon Credit Solution Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Carbon Credit Solution Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Carbon Credit Solution Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Carbon Credit Solution Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Carbon Credit Solution Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Carbon Credit Solution Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Carbon Credit Solution Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Carbon Credit Solution Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Carbon Credit Solution Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Carbon Credit Solution Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Carbon Credit Solution Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Carbon Credit Solution Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Carbon Credit Solution Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Carbon Credit Solution Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Carbon Credit Solution Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Carbon Credit Solution Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Carbon Credit Solution Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Carbon Credit Solution Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Carbon Credit Solution Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Carbon Credit Solution Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Carbon Credit Solution Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Carbon Credit Solution Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Carbon Credit Solution Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Carbon Credit Solution Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Carbon Credit Solution Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Carbon Credit Solution Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Carbon Credit Solution Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Carbon Credit Solution Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Carbon Credit Solution Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Carbon Credit Solution Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Carbon Credit Solution Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Carbon Credit Solution Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Carbon Credit Solution Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Carbon Credit Solution Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Carbon Credit Solution Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Carbon Credit Solution Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Credit Solution?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Carbon Credit Solution?

Key companies in the market include STX Group, Optimaxx, ClimeCo, BMO, Carbon Bank, Anthesis, StoneX, BanQu, Arbor Day Carbon, Carbon Asset Solutions, Carbon Market Solutions, BNZ Green, Shell.

3. What are the main segments of the Carbon Credit Solution?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Carbon Credit Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Carbon Credit Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Carbon Credit Solution?

To stay informed about further developments, trends, and reports in the Carbon Credit Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence