Key Insights

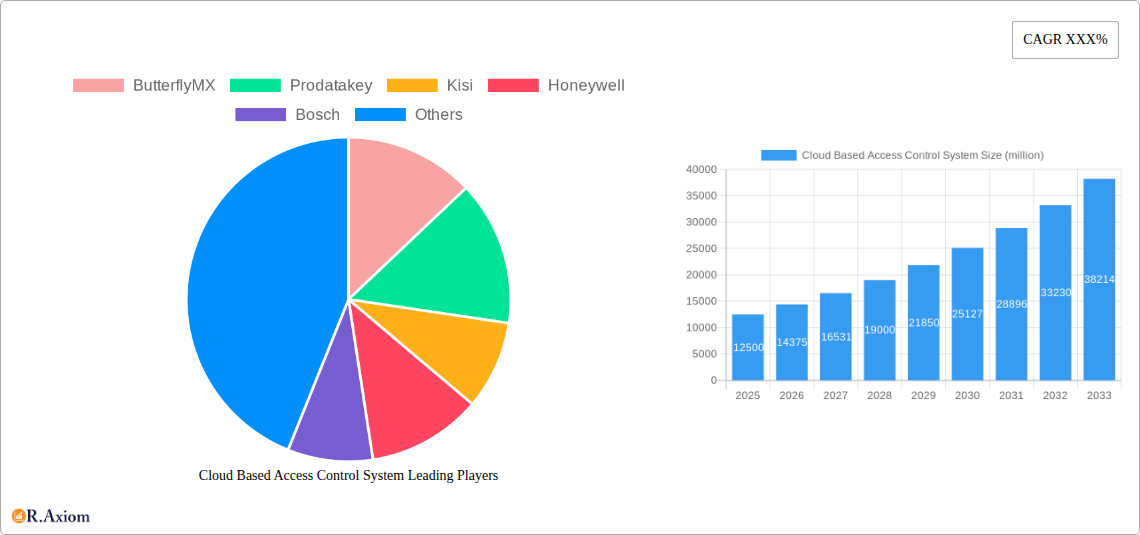

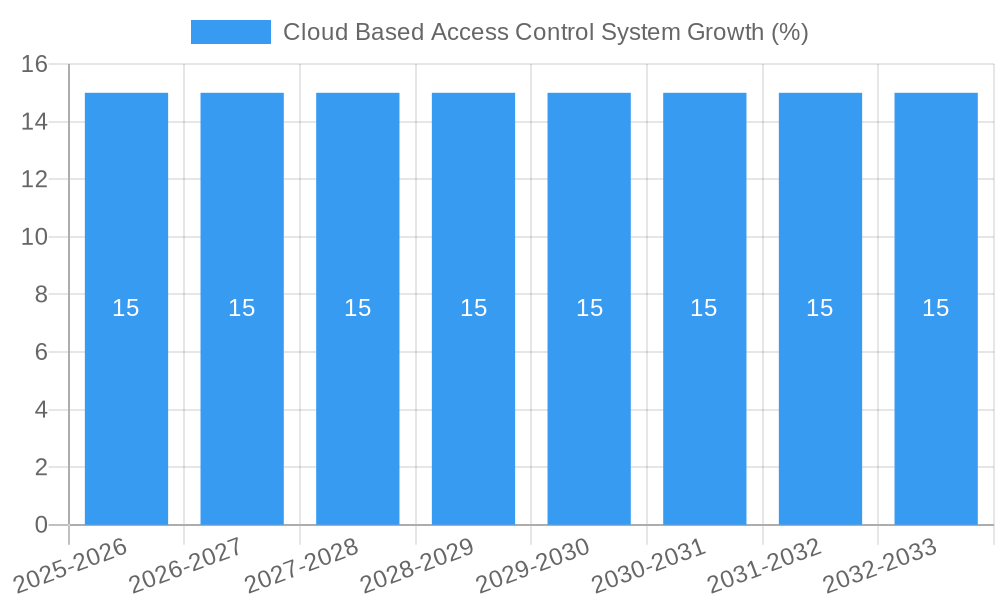

The global Cloud Based Access Control System market is poised for significant expansion, projected to reach an estimated $12,500 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 15% through 2033. This surge is primarily driven by the escalating demand for enhanced security solutions across commercial, residential, and industrial sectors. Businesses are increasingly adopting cloud-based systems for their scalability, remote management capabilities, and superior data security, which mitigates the risks associated with on-premise server vulnerabilities. Furthermore, the integration of advanced technologies like biometric and card access control systems with cloud platforms offers unparalleled convenience and precision in managing access credentials. The residential segment is witnessing accelerated adoption due to smart home technology proliferation and a growing consumer awareness of advanced security measures.

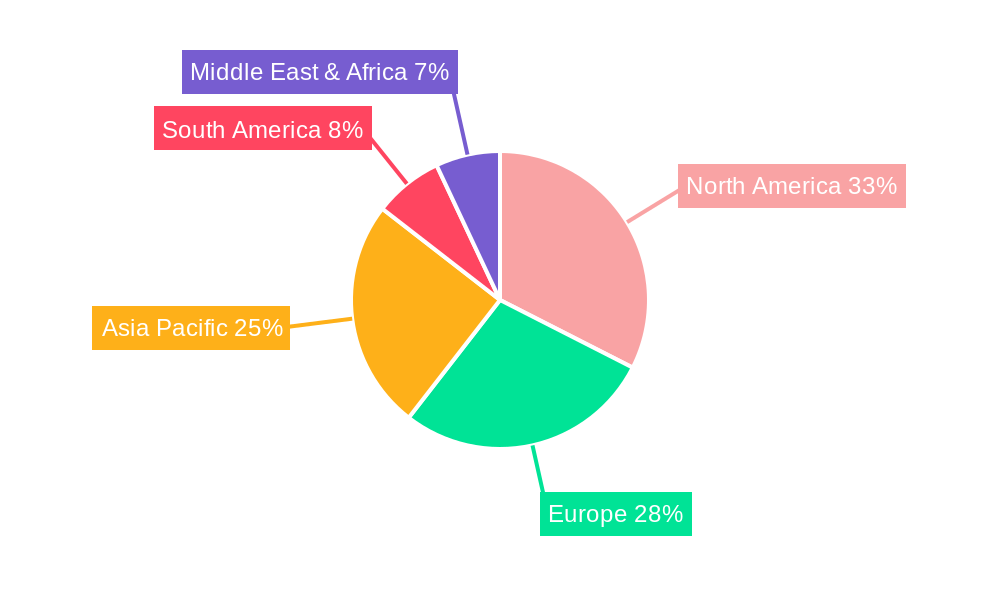

Key trends shaping this market include the rise of AI and machine learning for predictive security analytics, enabling proactive threat detection and automated responses. The market is also experiencing a notable shift towards integrated security platforms, where cloud access control systems seamlessly communicate with other building management and security systems, creating a holistic security ecosystem. However, challenges such as data privacy concerns and the initial investment cost for smaller enterprises can act as restraints. Despite these, the continuous innovation in product offerings, including user-friendly interfaces and advanced encryption protocols, alongside strategic partnerships and mergers among key players like ButterflyMX, Honeywell, and ASSA ABLOY, are expected to propel market growth. The Asia Pacific region, with its rapidly developing economies and increasing security investments, is anticipated to emerge as a dominant growth engine in the coming years.

This in-depth report provides a detailed analysis of the global Cloud Based Access Control System market, encompassing market concentration, innovation, industry trends, dominant segments, product developments, and strategic outlooks. Spanning the study period of 2019–2033, with a base and estimated year of 2025 and a forecast period from 2025–2033, this report offers actionable insights for industry stakeholders. Historical data from 2019–2024 informs current market dynamics.

Cloud Based Access Control System Market Concentration & Innovation

The cloud-based access control system market is characterized by a moderate to high concentration, with key players like Honeywell, Bosch, ASSA ABLOY, and Genetec holding significant market share, estimated to be over 40 million in collective revenue in 2025. Innovation is primarily driven by the increasing demand for enhanced security, remote management capabilities, and integration with other smart building technologies. Regulatory frameworks, such as data privacy laws (e.g., GDPR, CCPA), are shaping product development and deployment strategies, influencing market dynamics by millions of dollars in compliance costs. Product substitutes, including traditional on-premise access control systems and physical security measures, are present but are increasingly being overshadowed by the flexibility and scalability of cloud solutions. End-user trends favor sophisticated, user-friendly systems that offer seamless access and comprehensive audit trails, driving adoption across commercial, residential, and industrial segments. Mergers and acquisitions (M&A) activities are a key factor in market consolidation, with estimated M&A deal values exceeding 200 million over the historical period, further concentrating market power in the hands of leading entities. Companies actively pursuing this strategy include Vertex Security and Brivo, aiming to expand their product portfolios and geographical reach.

Cloud Based Access Control System Industry Trends & Insights

The cloud-based access control system market is experiencing robust growth, propelled by a confluence of technological advancements and evolving security needs. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at 18.5%, with the global market size expected to reach over 80 million by 2033. This expansion is fueled by the increasing adoption of IoT devices and the broader digitalization of infrastructure, creating a fertile ground for connected security solutions. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) for anomaly detection and predictive analytics, are redefining access control functionalities, moving beyond mere entry management to proactive threat mitigation. Consumer preferences are shifting towards convenience, scalability, and cost-effectiveness, with businesses and homeowners alike seeking solutions that can be easily managed remotely and scaled up or down as needed. This has led to a significant rise in the market penetration of cloud-based solutions, particularly in urban centers and developing economies where the infrastructure for digital connectivity is rapidly improving. Competitive dynamics are intensifying, with established players like Siemens and LenelS2 investing heavily in R&D to maintain their market leadership, while agile startups such as Swiftlane and Verkada are disrupting the market with innovative, user-centric products. The increasing reliance on cloud infrastructure also presents opportunities for cybersecurity firms and software providers to offer integrated security platforms, further enhancing the value proposition of cloud-based access control. The market penetration of cloud-based access control systems is projected to reach over 75% by 2033, significantly outpacing traditional systems.

Dominant Markets & Segments in Cloud Based Access Control System

The global cloud-based access control system market is witnessing significant growth across various regions and segments, with the Commercial application segment emerging as the dominant force. This dominance is driven by the stringent security requirements of businesses, the need for centralized management of multiple access points, and the increasing adoption of smart building technologies in corporate environments. The market value attributed to the commercial segment alone is projected to exceed 45 million by 2033.

- Dominant Region: North America is currently the leading region, driven by a mature market for security technologies, high disposable incomes, and a strong regulatory framework mandating robust security measures. Significant investments in smart city initiatives and commercial real estate development further bolster this dominance, with an estimated market share of over 30%.

- Dominant Country: The United States leads the global market, owing to a high concentration of large enterprises, early adoption of cloud technologies, and a well-established ecosystem of security solution providers. Economic policies supporting technological innovation and infrastructure upgrades play a crucial role.

- Dominant Application Segment:

- Commercial: This segment is characterized by high demand for sophisticated access control solutions in office buildings, retail spaces, healthcare facilities, and educational institutions. Key drivers include the need for employee and visitor management, compliance with industry regulations, and integration with building management systems.

- Residential: While historically a smaller segment, residential adoption is rapidly growing due to increased awareness of home security and the convenience offered by smart locks and cloud-managed systems. The increasing popularity of multi-dwelling units and smart home ecosystems is a major growth catalyst.

- Industrial: This segment encompasses manufacturing plants, warehouses, and critical infrastructure. Security needs here are paramount, focusing on preventing unauthorized access to sensitive areas and assets. The integration of IoT for supply chain visibility and operational efficiency also drives demand.

- Dominant Type Segment:

- Card Access Control Systems: This remains a foundational technology, with cloud-enabled card systems offering enhanced management and reporting capabilities. Their widespread existing infrastructure makes them a natural progression for cloud adoption.

- Biometric Access Control Systems: Driven by the demand for higher security and convenience, biometric systems (fingerprint, facial recognition) integrated with cloud platforms are gaining traction, particularly in high-security environments.

- Electronic Locks Access Control Systems: These are increasingly integrated with cloud platforms, offering remote locking/unlocking and access management, especially popular in the residential and small commercial sectors.

- Others: This includes emerging technologies like mobile credentialing and AI-powered access solutions, which are rapidly gaining market share due to their innovative features and user experience.

Cloud Based Access Control System Product Developments

Product developments in the cloud-based access control system market are focused on enhancing security, usability, and integration capabilities. Innovations include advanced AI-powered facial recognition for frictionless entry, mobile credentialing allowing smartphone-based access, and robust integration APIs enabling seamless connection with building management systems, video surveillance, and HR platforms. Companies like Verkada and Swiftlane are leading this charge with intuitive interfaces and comprehensive cloud dashboards. Competitive advantages stem from offering scalable, cost-effective solutions with robust cybersecurity protocols, attracting a diverse customer base seeking modern, efficient access management.

Report Scope & Segmentation Analysis

This report meticulously segments the cloud-based access control system market across key categories to provide a granular understanding of market dynamics. The analysis covers the Application: Commercial, Residential, and Industrial segments, each exhibiting distinct growth trajectories and market sizes.

- Commercial: This segment, projected to account for over 60% of the market share by 2033, is driven by the demand for centralized management in large enterprises, retail chains, and healthcare institutions. Its projected growth is estimated at 20 million in market value by 2033, fueled by robust cloud infrastructure adoption and the need for advanced security protocols.

- Residential: This segment, with an estimated market size of over 15 million by 2033, is experiencing rapid expansion due to increasing smart home adoption and the demand for convenient, remotely managed security solutions. Growth drivers include lower price points for entry-level systems and a growing awareness of the benefits of connected home security.

- Industrial: Valued at over 10 million by 2033, this segment is characterized by specialized security needs in manufacturing, logistics, and critical infrastructure. Key growth catalysts include the integration with IoT for operational efficiency and the stringent security requirements for asset protection.

Further segmentation includes the Type: Card Access Control Systems, Biometric Access Control Systems, Electronic Locks Access Control Systems, and Others, each with its own market dynamics and growth projections.

Key Drivers of Cloud Based Access Control System Growth

The explosive growth of the cloud-based access control system market is propelled by several critical factors. Technologically, the proliferation of IoT devices and the increasing sophistication of cloud computing infrastructure enable more robust, scalable, and remotely manageable access solutions. Economically, the subscription-based models offered by many cloud solutions reduce upfront capital expenditure, making advanced security accessible to a wider range of businesses and individuals. Regulatory frameworks, while sometimes a challenge, also act as drivers, as compliance requirements for data security and privacy often necessitate advanced, auditable access control systems. Furthermore, the growing demand for enhanced convenience and user experience, with features like mobile credentials and seamless integration with other smart building systems, significantly contributes to market expansion.

Challenges in the Cloud Based Access Control System Sector

Despite its robust growth, the cloud-based access control system sector faces several significant challenges. Regulatory hurdles related to data privacy and cross-border data transfer can create compliance complexities and add millions in operational costs. Supply chain issues for hardware components, exacerbated by global demand and geopolitical factors, can lead to extended lead times and increased costs. Furthermore, the intense competitive pressure from both established security giants and agile startups necessitates continuous innovation and aggressive pricing strategies, potentially impacting profit margins. The perceived security risks associated with cloud-based systems, particularly data breaches, continue to be a concern for some potential adopters, requiring ongoing investment in cybersecurity measures and trust-building initiatives.

Emerging Opportunities in Cloud Based Access Control System

The cloud-based access control system market is ripe with emerging opportunities. The expansion into underserved markets, particularly in developing economies with rapidly growing infrastructure, presents a significant untapped potential. The integration of advanced AI and machine learning algorithms for predictive analytics and anomaly detection offers opportunities for more proactive security solutions. The growing demand for interoperability and the development of open APIs foster the creation of integrated smart building ecosystems, where access control plays a central role. Furthermore, the increasing focus on hybrid work models creates a demand for flexible, remote access management solutions that can cater to a distributed workforce, opening new avenues for service providers. The trend towards sustainability and energy efficiency in buildings also presents opportunities for access control systems that can integrate with building automation for optimized energy consumption.

Leading Players in the Cloud Based Access Control System Market

The leading players in the Cloud Based Access Control System market include:

- ButterflyMX

- Prodatakey

- Kisi

- Honeywell

- Bosch

- Vertex Security

- Brivo

- Siemens

- ASSA ABLOY

- Openpath

- SALTO KS

- Genetec

- STANLEY Security

- LenelS2

- Swiftlane

- Verkada

- Spectra

- Nice

Key Developments in Cloud Based Access Control System Industry

- 2024 January: Honeywell launches a new suite of cloud-connected access control readers with enhanced cybersecurity features, aiming to combat rising cyber threats.

- 2023 December: ASSA ABLOY acquires a significant stake in a leading smart lock manufacturer, strengthening its position in the residential cloud access control market.

- 2023 November: Genetec introduces an AI-powered analytics module for its cloud access control platform, enabling advanced threat detection and behavioral analysis.

- 2023 October: Verkada expands its product offering with integrated visitor management and license plate recognition capabilities within its cloud platform.

- 2023 September: Brivo announces a strategic partnership with a major cybersecurity firm to enhance the security posture of its cloud-based access control solutions.

- 2023 August: Bosch introduces a new cloud-managed video intercom system that integrates seamlessly with its access control solutions, offering enhanced building security.

- 2023 July: Swiftlane launches a new mobile-first access control system designed for small to medium-sized businesses, emphasizing ease of use and affordability.

- 2023 June: LenelS2 enhances its cloud platform with expanded integration capabilities for third-party smart building technologies.

- 2023 May: Prodatakey rolls out a new series of encrypted access control readers designed for high-security applications.

- 2023 April: ButterflyMX announces significant growth in its multi-family residential installations, highlighting the increasing adoption of its cloud-based intercom and access control system.

- 2023 March: Siemens partners with a leading cloud service provider to further bolster the scalability and reliability of its cloud access control solutions.

- 2023 February: SALTO KS introduces enhanced API capabilities, allowing for greater customization and integration with diverse business workflows.

- 2023 January: Vertex Security expands its service offerings to include comprehensive cloud-based access control system deployment and management for industrial clients.

- 2022 December: Openpath expands its mobile credentialing technology to support a wider range of mobile devices and operating systems.

- 2022 November: Spectra launches a new cloud-based access control system tailored for the healthcare industry, focusing on HIPAA compliance and patient privacy.

- 2022 October: Nice introduces a new range of smart entry solutions with cloud connectivity for both residential and commercial applications.

- 2022 September: STANLEY Security enhances its managed services for cloud-based access control, offering end-to-end security solutions.

Strategic Outlook for Cloud Based Access Control System Market

The strategic outlook for the cloud-based access control system market remains exceptionally positive, driven by continued technological advancements and evolving security demands. Key growth catalysts include the increasing adoption of IoT and AI, the ongoing shift towards subscription-based security models, and the growing need for flexible, remotely manageable access solutions in a hybrid work environment. The market is poised for sustained expansion, with significant opportunities in emerging economies and specialized industry verticals. Strategic focus on cybersecurity, seamless integration, and user-centric design will be paramount for market leaders to maintain a competitive edge and capitalize on the vast potential of this dynamic sector.

Cloud Based Access Control System Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

- 1.3. Industrial

-

2. Type

- 2.1. Card Access Control Systems

- 2.2. Biometric Access Control Systems

- 2.3. Electronic Locks Access Control Systems

- 2.4. Others

Cloud Based Access Control System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cloud Based Access Control System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Based Access Control System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Card Access Control Systems

- 5.2.2. Biometric Access Control Systems

- 5.2.3. Electronic Locks Access Control Systems

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cloud Based Access Control System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Card Access Control Systems

- 6.2.2. Biometric Access Control Systems

- 6.2.3. Electronic Locks Access Control Systems

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cloud Based Access Control System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Card Access Control Systems

- 7.2.2. Biometric Access Control Systems

- 7.2.3. Electronic Locks Access Control Systems

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cloud Based Access Control System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Card Access Control Systems

- 8.2.2. Biometric Access Control Systems

- 8.2.3. Electronic Locks Access Control Systems

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cloud Based Access Control System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Card Access Control Systems

- 9.2.2. Biometric Access Control Systems

- 9.2.3. Electronic Locks Access Control Systems

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cloud Based Access Control System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Residential

- 10.1.3. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Card Access Control Systems

- 10.2.2. Biometric Access Control Systems

- 10.2.3. Electronic Locks Access Control Systems

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ButterflyMX

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Prodatakey

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kisi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vertex Security

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brivo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ASSA ABLOY

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Openpath

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SALTO KS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Genetec

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 STANLEY Security

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LenelS2

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Swiftlane

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Verkada

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Spectra

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Nice

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 ButterflyMX

List of Figures

- Figure 1: Global Cloud Based Access Control System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Based Access Control System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cloud Based Access Control System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cloud Based Access Control System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Cloud Based Access Control System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cloud Based Access Control System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cloud Based Access Control System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud Based Access Control System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cloud Based Access Control System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cloud Based Access Control System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Cloud Based Access Control System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Cloud Based Access Control System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cloud Based Access Control System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cloud Based Access Control System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cloud Based Access Control System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cloud Based Access Control System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Cloud Based Access Control System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Cloud Based Access Control System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cloud Based Access Control System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cloud Based Access Control System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cloud Based Access Control System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cloud Based Access Control System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Cloud Based Access Control System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Cloud Based Access Control System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cloud Based Access Control System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cloud Based Access Control System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cloud Based Access Control System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cloud Based Access Control System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Cloud Based Access Control System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Cloud Based Access Control System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cloud Based Access Control System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Based Access Control System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Based Access Control System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cloud Based Access Control System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cloud Based Access Control System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Based Access Control System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cloud Based Access Control System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Cloud Based Access Control System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Based Access Control System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cloud Based Access Control System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Cloud Based Access Control System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cloud Based Access Control System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cloud Based Access Control System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Cloud Based Access Control System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cloud Based Access Control System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cloud Based Access Control System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Cloud Based Access Control System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cloud Based Access Control System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cloud Based Access Control System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Cloud Based Access Control System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cloud Based Access Control System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Based Access Control System?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Cloud Based Access Control System?

Key companies in the market include ButterflyMX, Prodatakey, Kisi, Honeywell, Bosch, Vertex Security, Brivo, Siemens, ASSA ABLOY, Openpath, SALTO KS, Genetec, STANLEY Security, LenelS2, Swiftlane, Verkada, Spectra, Nice.

3. What are the main segments of the Cloud Based Access Control System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Based Access Control System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Based Access Control System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Based Access Control System?

To stay informed about further developments, trends, and reports in the Cloud Based Access Control System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence