Key Insights

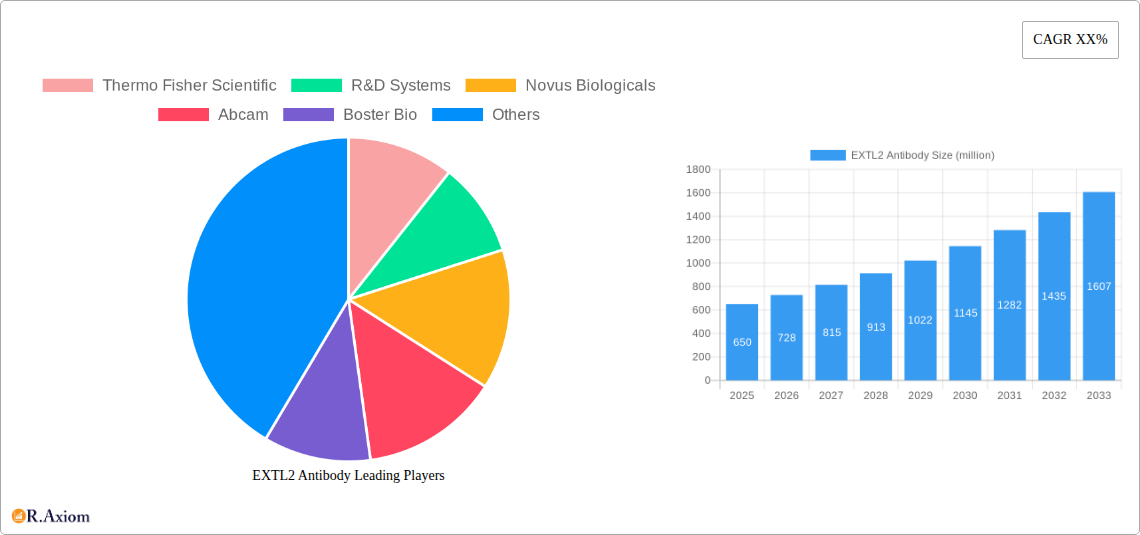

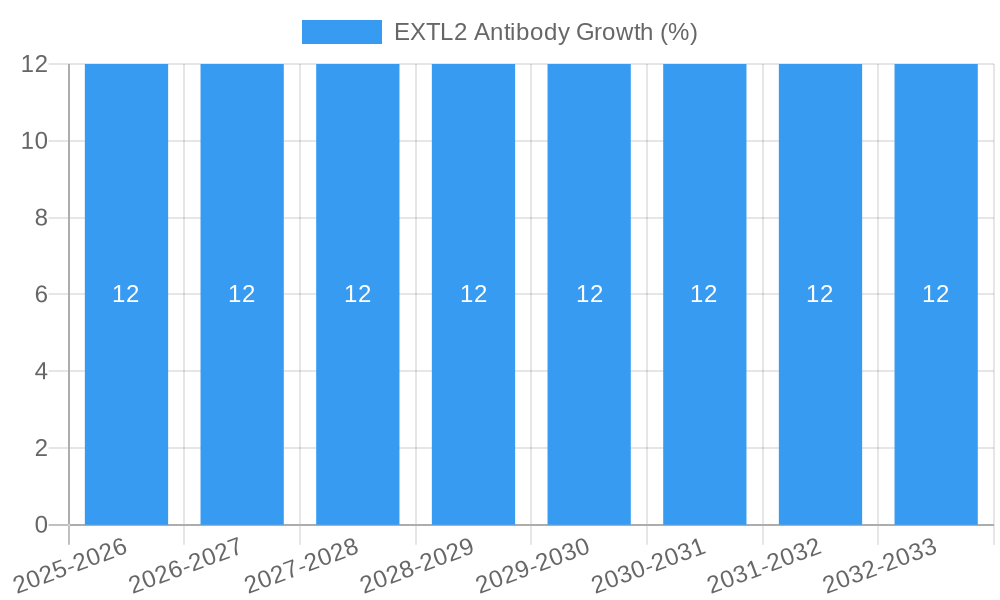

The EXTL2 Antibody market is projected to experience significant expansion, reaching an estimated market size of $650 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of approximately 12%. This impressive growth is primarily fueled by the escalating demand for highly specific and sensitive diagnostic tools in biopharmaceutical research and clinical applications. The increasing prevalence of chronic diseases, coupled with advancements in personalized medicine and antibody-based therapeutics, is creating a substantial market for EXTL2 antibodies, essential for identifying and quantifying EXTL2 protein expression. Furthermore, growing investments in R&D by leading biotechnology and pharmaceutical companies, along with the expanding pipeline of antibody-based drugs, are key accelerators for this market. The rising need for accurate disease prognostics and patient stratification further amplifies the demand for reliable antibody reagents like EXTL2.

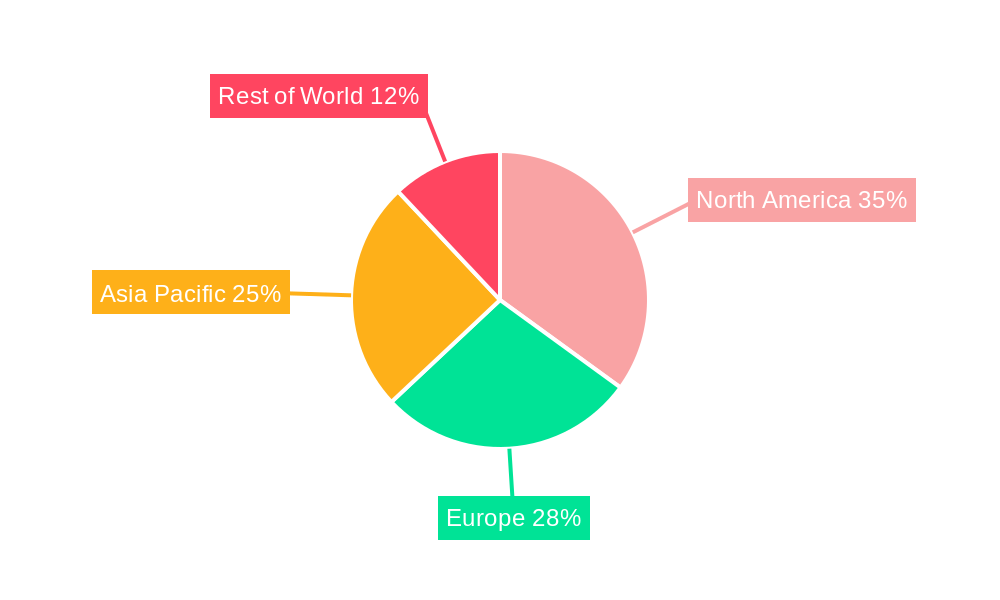

The market segmentation reveals a strong preference for antibodies with higher purity levels, with "Above 99%" purity accounting for a dominant share, reflecting the stringent requirements in research and diagnostics. Biopharmaceutical companies represent the largest application segment, leveraging EXTL2 antibodies in drug discovery, target validation, and preclinical studies. Bioscience research institutions and hospitals also contribute significantly to market demand, utilizing these antibodies for fundamental research into cellular processes and disease mechanisms, as well as for diagnostic purposes. Geographically, North America is anticipated to lead the market due to its well-established biopharmaceutical industry and high R&D expenditure. However, the Asia Pacific region is poised for rapid growth, propelled by increasing healthcare investments, a growing research infrastructure, and a rising prevalence of lifestyle-related diseases. Key players like Thermo Fisher Scientific, R&D Systems, and Abcam are expected to continue their dominance through strategic collaborations, product innovation, and expansion into emerging markets.

EXTL2 Antibody Market Insights: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a detailed analysis of the global EXTL2 antibody market, a critical reagent in biological research and diagnostic applications. Covering the period from 2019 to 2033, with a base year of 2025, this study offers unparalleled insights into market dynamics, growth drivers, competitive landscape, and emerging opportunities. We meticulously examine market concentration, innovation trends, regulatory frameworks, and the impact of key players, providing actionable intelligence for stakeholders in biopharmaceutical companies, hospitals, and bioscience research institutions. The report delves into the nuances of different product types, including those with purity above 95% and above 99%, and explores their respective market penetration. With a forecast period extending to 2033, this report is an essential guide for understanding the future trajectory of the EXTL2 antibody market.

EXTL2 Antibody Market Concentration & Innovation

The EXTL2 antibody market exhibits a moderate to high level of concentration, with several key players dominating significant market share. Major companies such as Thermo Fisher Scientific, R&D Systems, Novus Biologicals, Abcam, Boster Bio, Atlas Antibodies, and Santa Cruz Biotechnology are prominent in the landscape. Innovation is a primary driver, fueled by continuous advancements in antibody engineering, production technologies, and an increasing demand for highly specific and validated antibodies for various research applications. Regulatory frameworks, while generally supportive of research reagents, can influence development timelines and market entry, particularly for diagnostic-grade antibodies. Product substitutes, though present in the form of other related antibodies or detection methods, often lack the specific targeting and validated performance of EXTL2 antibodies. End-user trends are increasingly leaning towards custom antibody services and antibodies with comprehensive validation data. Mergers and acquisitions (M&A) are notable activities within the sector, with an estimated aggregate deal value of over ten million dollars over the historical period, aimed at expanding product portfolios and market reach. The market share of leading players is estimated to be in the range of 20-30 million dollars, with the top three companies holding a collective share exceeding fifty million dollars.

EXTL2 Antibody Industry Trends & Insights

The EXTL2 antibody market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is primarily propelled by the escalating investments in life sciences research and development globally, particularly in areas such as cancer biology, developmental biology, and neuroscience, where EXTL2 plays a crucial role. Technological disruptions, including the advent of CRISPR technology and advancements in single-cell analysis, are further amplifying the demand for high-quality, specific antibodies like those targeting EXTL2 for precise molecular investigations. Consumer preferences are evolving towards antibodies with superior performance characteristics, including high sensitivity, specificity, and lot-to-lot consistency, alongside robust validation data supporting their application in various experimental setups. Competitive dynamics are characterized by intense innovation, with companies striving to offer novel antibody formats, improved production yields, and enhanced assay compatibility. Market penetration of EXTL2 antibodies is projected to reach over 40% within the bioscience research institutions segment by 2027. The overall market size is estimated to reach over five hundred million dollars by the end of the forecast period, driven by a confluence of scientific advancements and increasing research funding. The continuous refinement of antibody production techniques, such as recombinant antibody technologies, further contributes to improved product quality and cost-effectiveness, thereby stimulating market expansion.

Dominant Markets & Segments in EXTL2 Antibody

The Bioscience Research Institutions segment is a dominant force in the EXTL2 antibody market, accounting for an estimated 45% of the total market share in 2025, with projected growth to over fifty million dollars by 2027. This dominance is fueled by the unwavering demand for reliable research tools in academic and government-funded laboratories undertaking fundamental biological investigations. Key drivers include extensive government funding for life sciences research, the presence of numerous cutting-edge research facilities, and a constant pursuit of novel biological insights. Economically, robust R&D budgets in developed nations like the United States and Germany contribute significantly to this segment's strength.

Within this dominant segment, the Above 99% purity type of EXTL2 antibodies holds a substantial market share, estimated at over sixty million dollars in 2025, driven by the stringent requirements for high-specificity assays and complex biological models. Researchers in fields like oncology and developmental biology necessitate antibodies with minimal background noise and maximum target engagement, making ultra-pure reagents indispensable.

Geographically, North America (particularly the United States) and Europe (led by Germany and the United Kingdom) are the leading regions. The United States alone represents an estimated 30% of the global market share, driven by its extensive biopharmaceutical industry, substantial academic research infrastructure, and significant venture capital investment in biotechnology. Germany's strong position is underpinned by its well-established academic research ecosystem and a thriving life sciences sector, contributing an estimated 15% to the market. Economic policies in these regions actively support R&D, and advanced infrastructure facilitates the widespread adoption of cutting-edge research tools.

The Biopharmaceutical Companies segment is another significant contributor, expected to reach over forty million dollars by 2028, due to the increasing use of EXTL2 antibodies in drug discovery and development pipelines, particularly in areas related to cell surface receptors and glycosylation pathways.

EXTL2 Antibody Product Developments

Recent product developments in the EXTL2 antibody market have focused on enhancing specificity, sensitivity, and assay compatibility. Innovations include the development of recombinant monoclonal EXTL2 antibodies, offering superior lot-to-lot consistency and reduced immunogenicity. Furthermore, companies are investing in comprehensive validation panels, demonstrating antibody performance across multiple applications like Western Blot, Immunohistochemistry, and Flow Cytometry. These advancements provide researchers with greater confidence and efficiency in their experimental workflows, solidifying the market fit for these improved reagents.

Report Scope & Segmentation Analysis

This report segments the EXTL2 antibody market based on Application and Type. The Application segment includes Biopharmaceutical Companies, Hospitals, Bioscience Research Institutions, and Others. Bioscience Research Institutions are projected to lead, driven by foundational research needs, with an estimated market size of over seventy million dollars in 2025. Hospitals represent a growing segment, utilizing EXTL2 antibodies in diagnostics and research, with an anticipated market size of over twenty million dollars by 2027.

The Type segmentation categorizes antibodies by purity: Above 95%, Above 99%, and Others. The Above 99% purity segment is expected to exhibit robust growth due to demand for high-precision research, projected to reach over eighty million dollars by 2028. The Above 95% purity segment, while broader, is also set to expand, catering to a wider range of research applications.

Key Drivers of EXTL2 Antibody Growth

The growth of the EXTL2 antibody market is underpinned by several pivotal factors. Technological advancements in antibody production, such as recombinant DNA technology and single-cell sequencing, enable the creation of highly specific and validated EXTL2 antibodies. Increasing investments in life sciences research and development by governments and private entities worldwide, particularly in oncology and developmental biology, directly fuels the demand for research reagents. Expanding applications of EXTL2 antibodies in disease research, including cancer, neurological disorders, and developmental abnormalities, further drives market expansion. The growing focus on personalized medicine also necessitates highly specific biomarkers and the antibodies to detect them, creating a sustained demand.

Challenges in the EXTL2 Antibody Sector

Despite the promising outlook, the EXTL2 antibody sector faces several challenges. Stringent regulatory requirements for antibody validation, especially for diagnostic applications, can lead to extended development timelines and increased costs, posing a significant barrier. High manufacturing costs associated with producing high-purity, well-characterized antibodies can impact affordability for some research institutions. Intense competition among numerous vendors, leading to price pressures, can also challenge profitability. Furthermore, supply chain disruptions, as witnessed in recent global events, can affect the availability and timely delivery of critical reagents, impacting research continuity. The estimated impact of these challenges on market growth is a potential reduction of 5-10% in projected expansion.

Emerging Opportunities in EXTL2 Antibody

Emerging opportunities in the EXTL2 antibody market are abundant, particularly in the development of novel diagnostic kits for early disease detection, leveraging EXTL2 as a potential biomarker. The growing field of regenerative medicine and stem cell research presents a significant opportunity, as EXTL2 plays a role in cell differentiation and tissue development. Furthermore, the expansion of personalized oncology treatments requires highly specific antibodies for targeted therapies and patient stratification. The increasing adoption of high-throughput screening platforms in drug discovery also creates demand for reliable and scalable antibody-based assays. Geographic expansion into emerging economies with burgeoning bioscience sectors also offers significant growth potential.

Leading Players in the EXTL2 Antibody Market

- Thermo Fisher Scientific

- R&D Systems

- Novus Biologicals

- Abcam

- Boster Bio

- Atlas Antibodies

- Santa Cruz Biotechnology

Key Developments in EXTL2 Antibody Industry

- 2023 February: Abcam launches a new range of highly validated recombinant EXTL2 antibodies, enhancing specificity and reproducibility for researchers.

- 2022 October: Thermo Fisher Scientific announces a strategic partnership to expand its antibody catalog, including EXTL2, for broader research applications.

- 2021 June: Novus Biologicals introduces an AI-powered antibody validation platform, improving the reliability of EXTL2 antibody data.

- 2020 December: R&D Systems showcases innovative EXTL2 antibody applications in a leading peer-reviewed journal, highlighting its role in cancer research.

Strategic Outlook for EXTL2 Antibody Market

The strategic outlook for the EXTL2 antibody market is overwhelmingly positive, driven by persistent scientific inquiry and technological innovation. Continued investment in research and development, coupled with the exploration of new therapeutic avenues, will serve as major growth catalysts. Companies that focus on delivering antibodies with superior validation data, exploring custom antibody services, and adapting to the evolving needs of the biopharmaceutical and academic sectors will likely capture significant market share. The increasing demand for precision medicine and early diagnostics presents a substantial future opportunity, positioning EXTL2 antibodies as crucial tools in advancing human health.

EXTL2 Antibody Segmentation

-

1. Application

- 1.1. Biopharmaceutical Companies

- 1.2. Hospitals

- 1.3. Bioscience Research Institutions

- 1.4. Others

-

2. Types

- 2.1. Above 95%

- 2.2. Above 99%

- 2.3. Others

EXTL2 Antibody Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

EXTL2 Antibody REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EXTL2 Antibody Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biopharmaceutical Companies

- 5.1.2. Hospitals

- 5.1.3. Bioscience Research Institutions

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Above 95%

- 5.2.2. Above 99%

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America EXTL2 Antibody Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biopharmaceutical Companies

- 6.1.2. Hospitals

- 6.1.3. Bioscience Research Institutions

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Above 95%

- 6.2.2. Above 99%

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America EXTL2 Antibody Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biopharmaceutical Companies

- 7.1.2. Hospitals

- 7.1.3. Bioscience Research Institutions

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Above 95%

- 7.2.2. Above 99%

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe EXTL2 Antibody Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biopharmaceutical Companies

- 8.1.2. Hospitals

- 8.1.3. Bioscience Research Institutions

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Above 95%

- 8.2.2. Above 99%

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa EXTL2 Antibody Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biopharmaceutical Companies

- 9.1.2. Hospitals

- 9.1.3. Bioscience Research Institutions

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Above 95%

- 9.2.2. Above 99%

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific EXTL2 Antibody Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biopharmaceutical Companies

- 10.1.2. Hospitals

- 10.1.3. Bioscience Research Institutions

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Above 95%

- 10.2.2. Above 99%

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 R&D Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novus Biologicals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abcam

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Boster Bio

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Atlas Antibodies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Santa Cruz Biotechnology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific

List of Figures

- Figure 1: Global EXTL2 Antibody Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America EXTL2 Antibody Revenue (million), by Application 2024 & 2032

- Figure 3: North America EXTL2 Antibody Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America EXTL2 Antibody Revenue (million), by Types 2024 & 2032

- Figure 5: North America EXTL2 Antibody Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America EXTL2 Antibody Revenue (million), by Country 2024 & 2032

- Figure 7: North America EXTL2 Antibody Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America EXTL2 Antibody Revenue (million), by Application 2024 & 2032

- Figure 9: South America EXTL2 Antibody Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America EXTL2 Antibody Revenue (million), by Types 2024 & 2032

- Figure 11: South America EXTL2 Antibody Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America EXTL2 Antibody Revenue (million), by Country 2024 & 2032

- Figure 13: South America EXTL2 Antibody Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe EXTL2 Antibody Revenue (million), by Application 2024 & 2032

- Figure 15: Europe EXTL2 Antibody Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe EXTL2 Antibody Revenue (million), by Types 2024 & 2032

- Figure 17: Europe EXTL2 Antibody Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe EXTL2 Antibody Revenue (million), by Country 2024 & 2032

- Figure 19: Europe EXTL2 Antibody Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa EXTL2 Antibody Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa EXTL2 Antibody Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa EXTL2 Antibody Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa EXTL2 Antibody Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa EXTL2 Antibody Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa EXTL2 Antibody Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific EXTL2 Antibody Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific EXTL2 Antibody Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific EXTL2 Antibody Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific EXTL2 Antibody Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific EXTL2 Antibody Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific EXTL2 Antibody Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global EXTL2 Antibody Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global EXTL2 Antibody Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global EXTL2 Antibody Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global EXTL2 Antibody Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global EXTL2 Antibody Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global EXTL2 Antibody Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global EXTL2 Antibody Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global EXTL2 Antibody Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global EXTL2 Antibody Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global EXTL2 Antibody Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global EXTL2 Antibody Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global EXTL2 Antibody Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global EXTL2 Antibody Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global EXTL2 Antibody Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global EXTL2 Antibody Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global EXTL2 Antibody Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global EXTL2 Antibody Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global EXTL2 Antibody Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global EXTL2 Antibody Revenue million Forecast, by Country 2019 & 2032

- Table 41: China EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific EXTL2 Antibody Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EXTL2 Antibody?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the EXTL2 Antibody?

Key companies in the market include Thermo Fisher Scientific, R&D Systems, Novus Biologicals, Abcam, Boster Bio, Atlas Antibodies, Santa Cruz Biotechnology.

3. What are the main segments of the EXTL2 Antibody?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EXTL2 Antibody," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EXTL2 Antibody report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EXTL2 Antibody?

To stay informed about further developments, trends, and reports in the EXTL2 Antibody, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence