Key Insights

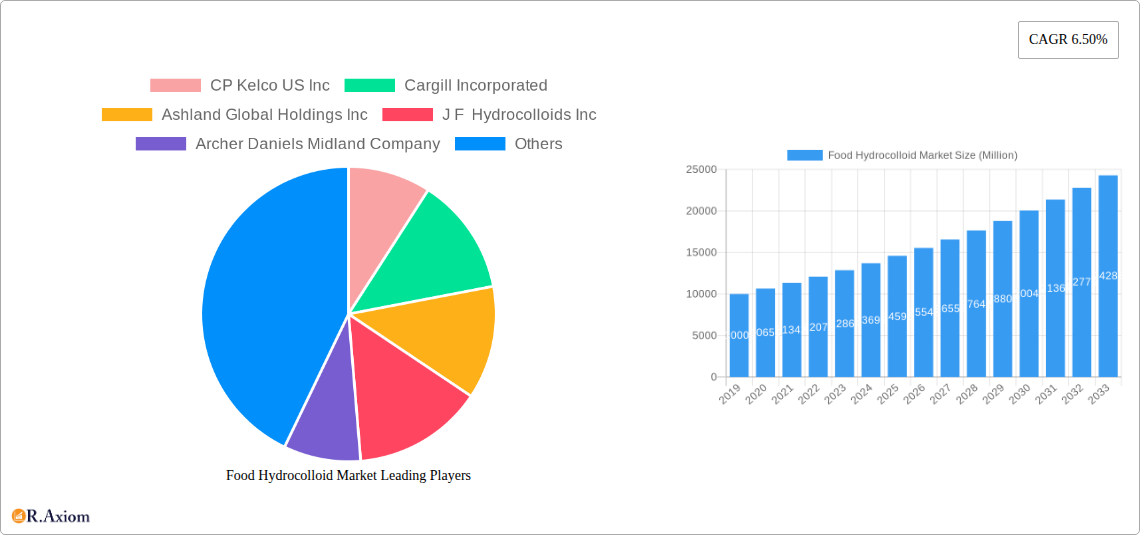

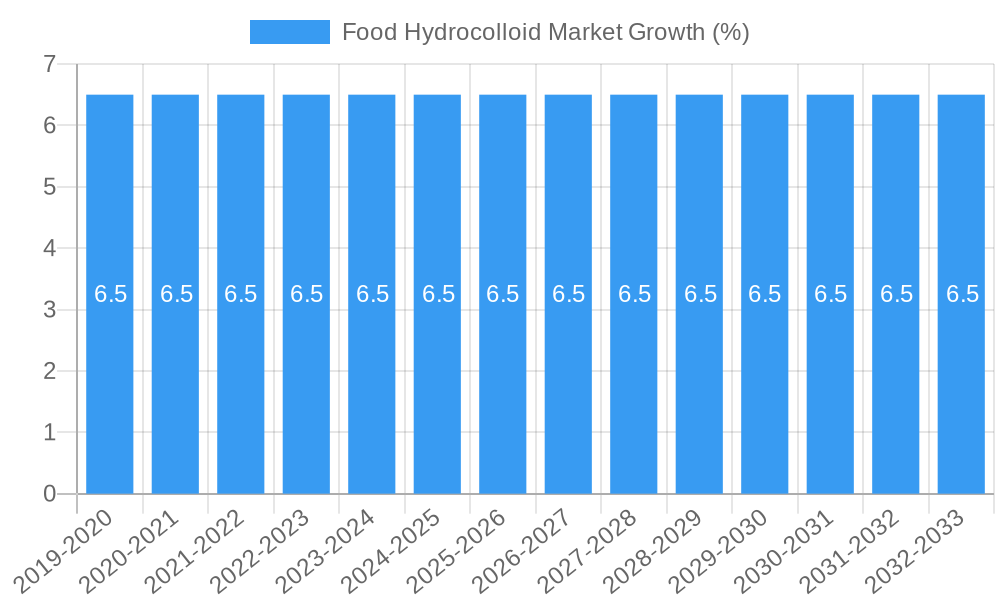

The global Food Hydrocolloid Market is poised for robust expansion, projected to reach an estimated market size of approximately $15,000 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 6.50% through 2033. This significant growth is primarily fueled by the increasing consumer demand for processed and convenience foods, coupled with a growing awareness of the functional benefits hydrocolloids offer, such as improved texture, stability, and shelf-life. The "Other Types" of hydrocolloids segment, likely encompassing novel and emerging gelling agents and thickeners, is expected to witness the fastest growth as food manufacturers seek innovative solutions to meet evolving consumer preferences for clean labels and specific textural experiences. Dairy and Frozen Products, along with Bakery, are anticipated to remain dominant application segments due to the widespread use of hydrocolloids in yogurts, ice creams, baked goods, and fillings.

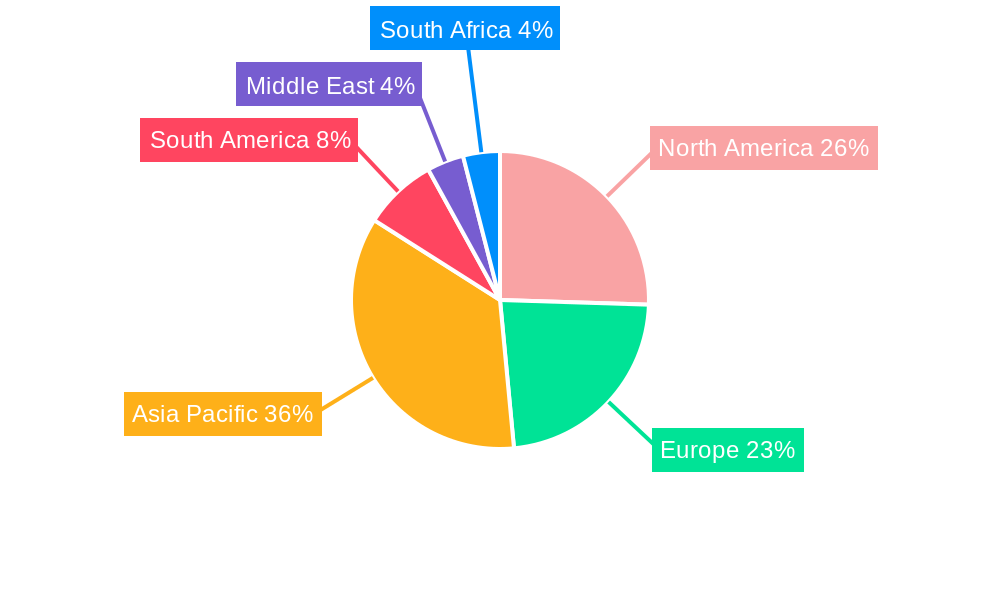

Market dynamics are further shaped by several key trends. The rising popularity of plant-based diets is driving demand for non-animal derived hydrocolloids like pectin, xanthan gum, and guar gum. Furthermore, advancements in extraction and modification technologies are enhancing the functionality and versatility of existing hydrocolloids, opening up new application possibilities. However, the market is not without its restraints. Fluctuations in the prices of raw materials, such as seaweed and plant-based sources, can impact profit margins for manufacturers. Regulatory hurdles and the need for stringent quality control for food-grade hydrocolloids also present challenges. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a significant growth engine due to its large population, expanding middle class, and rapid urbanization, leading to increased consumption of packaged foods. North America and Europe, with their mature food industries, will continue to be substantial markets, driven by innovation and a focus on premium food products.

Here is the SEO-optimized, detailed report description for the Food Hydrocolloid Market, incorporating high-traffic keywords and structured as requested.

Food Hydrocolloid Market Market Concentration & Innovation

The global Food Hydrocolloid Market is characterized by a moderate to high degree of concentration, with key players like CP Kelco US Inc, Cargill Incorporated, Ashland Global Holdings Inc, and DuPont holding significant market shares, estimated to be over 65% collectively. Innovation is a critical driver, fueled by a growing demand for clean-label ingredients, improved functionalities, and sustainable sourcing. Regulatory frameworks, such as those from the FDA and EFSA, are evolving, impacting product approvals and labeling. Product substitutes, including starches and proteins, present ongoing competition. End-user trends are heavily influenced by the demand for healthier, plant-based, and texturally appealing food products. Mergers and acquisitions (M&A) are a notable strategy for market expansion and technological advancement. Notable M&A activities in the historical period (2019-2024) have seen deal values ranging from tens to hundreds of millions of dollars, strengthening the competitive landscape.

- Market Share Snapshot: Leading companies collectively hold over 65% of the market.

- Innovation Focus: Clean-label, plant-based alternatives, enhanced texture, and improved sustainability are paramount.

- Regulatory Influence: FDA, EFSA, and other regional bodies shape product development and market entry.

- Competitive Landscape: Intense competition from established players and emerging substitute ingredients.

- M&A Activity: Strategic acquisitions and partnerships are common to enhance portfolios and market reach.

Food Hydrocolloid Market Industry Trends & Insights

The Food Hydrocolloid Market is experiencing robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and a dynamic global food industry. The estimated market size for the base year 2025 is projected to be approximately USD 8,900 million, with a projected Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2025–2033. This significant expansion is largely attributable to the increasing demand for processed and convenience foods, where hydrocolloids play a crucial role in texture modification, stabilization, and shelf-life extension. Consumer awareness regarding health and wellness is also a major catalyst, leading to a surge in demand for natural and clean-label hydrocolloids such as pectin, guar gum, and xanthan gum, especially in applications like plant-based dairy alternatives and low-fat formulations.

Technological disruptions are continuously reshaping the market. Advances in extraction and modification techniques are enabling the development of hydrocolloids with superior functionalities, such as improved heat stability, acid resistance, and emulsification properties. The rise of biotechnology is also contributing to the development of novel hydrocolloids through fermentation processes, offering more sustainable and cost-effective production methods. These innovations are crucial for meeting the diverse needs of various food applications, from dairy and bakery to beverages and confectionery.

Consumer preferences are shifting towards healthier options, pushing manufacturers to reformulate products. Hydrocolloids are instrumental in achieving desirable textures and mouthfeels in reduced-sugar, reduced-fat, and gluten-free products, thereby supporting this trend. For instance, the demand for gelatin-free alternatives in confectionery and dairy products is boosting the market for plant-derived hydrocolloids.

The competitive dynamics within the food hydrocolloid sector are intense. Key players are actively engaged in research and development, strategic partnerships, and capacity expansions to maintain their market positions and capture emerging opportunities. The market penetration of hydrocolloids is steadily increasing across all food categories, reflecting their indispensability in modern food production. Supply chain resilience and the sourcing of sustainable raw materials are becoming increasingly important strategic considerations for manufacturers, influencing ingredient choices and product development strategies. The global market is poised for continued expansion as these trends reinforce each other.

Dominant Markets & Segments in Food Hydrocolloid Market

The global Food Hydrocolloid Market is segmented by type and application, with significant variations in regional dominance and segment penetration. The forecast period of 2025–2033 anticipates continued leadership in certain regions and applications due to sustained demand and favorable market conditions.

Dominant Regions: North America and Europe currently represent the largest markets, driven by established food processing industries, high consumer spending, and a strong preference for convenience foods and innovative dairy and bakery products. Asia Pacific, however, is emerging as the fastest-growing region, fueled by rapid industrialization, a burgeoning middle class with increasing disposable incomes, and a growing demand for processed foods, beverages, and confectioneries. Economic policies that support food manufacturing and investment in agricultural infrastructure in countries like China and India are key drivers for this growth.

Dominant Segments (Type):

- Xanthan Gum: This segment holds a significant market share due to its versatile applications as a thickener, stabilizer, and emulsifier in a wide range of food products, including sauces, dressings, beverages, and gluten-free baked goods. Its ability to provide excellent stability and texture even in acidic or high-salt environments makes it highly sought after.

- Guar Gum: Another dominant player, guar gum is widely used in dairy products, bakery, and confectionery due to its excellent thickening and stabilizing properties, especially in cold systems. Its increasing use as a fat replacer in low-fat products further bolsters its market position.

- Pectin: With the growing trend of clean-label ingredients and plant-based alternatives, pectin is experiencing substantial growth, particularly in jams, jellies, fruit preparations for dairy, and confectionery. Its gelling and stabilizing capabilities in acidic systems are invaluable.

- Carrageenan: This hydrocolloid is a staple in dairy products, beverages, and processed meats for its thickening, gelling, and stabilizing functions. While facing some consumer scrutiny, its effectiveness in specific applications ensures continued demand.

- Gelatin Gum: Primarily used in confectionery, dairy, and meat products for its gelling and emulsifying properties, gelatin gum remains a significant segment, though alternatives are gaining traction.

Dominant Segments (Application):

- Dairy and Frozen Products: This application segment is a major consumer of hydrocolloids, utilizing them for texture enhancement, stabilization, and preventing ice crystal formation in ice cream and frozen desserts, as well as for viscosity control in yogurts and cultured dairy products.

- Bakery: Hydrocolloids are crucial in bakery for improving dough consistency, crumb structure, moisture retention, and shelf-life extension in various baked goods.

- Beverages: In the beverage industry, hydrocolloids are used to provide mouthfeel, suspend solids, stabilize emulsions, and control viscosity in products ranging from juices and smoothies to alcoholic beverages.

- Confectionery: This sector relies heavily on hydrocolloids for gelling, texturizing, and stabilizing candies, chocolates, and other sweet treats.

Key drivers for segment dominance include the innovation in product formulations tailored to these applications, the cost-effectiveness of hydrocolloids in achieving desired textures, and the increasing consumer acceptance of processed foods containing these ingredients.

Food Hydrocolloid Market Product Developments

The Food Hydrocolloid Market is witnessing continuous product innovation, driven by the demand for enhanced functionalities and consumer-friendly ingredients. Companies are focusing on developing hydrocolloids with improved heat stability, acid resistance, and specific textural properties, catering to a wide array of applications. Recent product launches emphasize clean-label attributes, sustainable sourcing, and the ability to replace traditional ingredients. For instance, the development of specialized pectin grades for low-sugar applications or xanthan gum variants offering superior emulsion stability are examples of how technological advancements are meeting evolving market needs and providing competitive advantages.

Report Scope & Segmentation Analysis

The Food Hydrocolloid Market report provides a comprehensive analysis across key segments. The Type segmentation includes Gelatin Gum, Pectin, Xanthan Gum, Guar Gum, Carrageenan, and Other Types, each offering unique functional properties utilized across the food industry. The Application segmentation covers Dairy and Frozen Products, Bakery, Beverages, Confectionery, Meat and Seafood Products, Oils and Fats, and Other Applications, reflecting the diverse end-uses of hydrocolloids. The report details market sizes, growth projections, and competitive dynamics for each segment, offering granular insights into regional and application-specific trends from 2019–2033.

Key Drivers of Food Hydrocolloid Market Growth

The growth of the Food Hydrocolloid Market is propelled by several key factors. Firstly, the escalating demand for processed and convenience foods globally, particularly in emerging economies, necessitates the use of hydrocolloids for texture, stabilization, and shelf-life extension. Secondly, the rising consumer preference for clean-label ingredients, plant-based alternatives, and healthier food options is driving innovation in natural and functional hydrocolloids like pectin and guar gum. Technological advancements in extraction and modification techniques allow for the development of hydrocolloids with superior functionalities, meeting specific application needs. Furthermore, evolving regulatory landscapes that support the use of approved hydrocolloids in various food categories contribute to market expansion.

Challenges in the Food Hydrocolloid Market Sector

Despite robust growth, the Food Hydrocolloid Market faces certain challenges. Volatility in raw material prices and availability, influenced by weather patterns and agricultural yields, can impact production costs and supply chain stability. Stringent regulatory approvals for novel hydrocolloids or changes in existing regulations in different regions can create hurdles for market entry and expansion. Consumer perception and concerns, particularly surrounding certain hydrocolloids, can lead to demand shifts and necessitate reformulation efforts. Intense competition from both established players and emerging substitute ingredients, such as modified starches and proteins, also exerts pressure on market share and pricing.

Emerging Opportunities in Food Hydrocolloid Market

Emerging opportunities in the Food Hydrocolloid Market are primarily centered around the growing demand for specialized functionalities and sustainable ingredients. The expansion of the plant-based food sector presents a significant opportunity for natural and vegan hydrocolloids. Innovations in biotechnological production methods are paving the way for cost-effective and environmentally friendly hydrocolloids. Furthermore, the increasing focus on gut health and functional foods is creating avenues for hydrocolloids that can act as prebiotics or delivery systems for bioactive compounds. The development of hybrid hydrocolloid systems that combine multiple functionalities is also a promising area for future growth.

Leading Players in the Food Hydrocolloid Market Market

- CP Kelco US Inc

- Cargill Incorporated

- Ashland Global Holdings Inc

- J F Hydrocolloids Inc

- Archer Daniels Midland Company

- Koninklijke DSM N V

- DuPont

- Behn Meyer Holding AG

- Lucid Colloids Ltd

- Hebei Xinhe Biochemical Co Ltd

Key Developments in Food Hydrocolloid Market Industry

- November 2021: Ingredion added a range of single hydrocolloids to its extensive food and beverage portfolio. The new products offered are Pre-Hydrated Gum Arabic Spray Dry Powder, TIC Gum Arabic FT Powder, Ticalose CMC 400 Granular Powder, TIC Tara Gum 100, and Ticaxan Xanthan EC.

- December 2020: CP Kelco launched GENU Pectin YM-FP-2100, a clean-label-friendly ingredient that provides a medium-to-high viscosity in the fruited drinking yogurt and with ease of pumpability at the fruit preparation stage.

- May 2019: Cargill invested USD 150 million in the construction of a pectin plant in Bebedouro, Brazil. It will produce HM pectin, derived from citrus fruits, to help meet the increasing global demand for label-friendly pectins for fruit preparations, dairy, confectionery, and bakery food applications.

Strategic Outlook for Food Hydrocolloid Market Market

The strategic outlook for the Food Hydrocolloid Market is highly positive, with continued growth anticipated through 2033. Key growth catalysts include the relentless demand for processed foods, the accelerating shift towards plant-based and clean-label products, and ongoing technological innovations that enhance hydrocolloid functionalities. Companies are expected to focus on expanding their portfolios with natural and sustainable hydrocolloids, investing in R&D for novel applications, and strengthening their global supply chains to ensure resilience. Strategic collaborations and acquisitions will likely continue as key players aim to consolidate market position and access new technologies and markets. The estimated market size for 2025 is USD 8,900 million, with robust expansion predicted.

Food Hydrocolloid Market Segmentation

-

1. Type

- 1.1. Gelatin Gum

- 1.2. Pectin

- 1.3. Xanthan Gum

- 1.4. Guar Gum

- 1.5. Carrageenan

- 1.6. Other Types

-

2. Application

- 2.1. Dairy and Frozen Products

- 2.2. Bakery

- 2.3. Beverages

- 2.4. Confectionery

- 2.5. Meat and Seafood Products

- 2.6. Oils and Fats

- 2.7. Other Applications

Food Hydrocolloid Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. United Arab Emirates

- 6.2. Rest of Middle East

Food Hydrocolloid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Bakery and Confectionery Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gelatin Gum

- 5.1.2. Pectin

- 5.1.3. Xanthan Gum

- 5.1.4. Guar Gum

- 5.1.5. Carrageenan

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy and Frozen Products

- 5.2.2. Bakery

- 5.2.3. Beverages

- 5.2.4. Confectionery

- 5.2.5. Meat and Seafood Products

- 5.2.6. Oils and Fats

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Gelatin Gum

- 6.1.2. Pectin

- 6.1.3. Xanthan Gum

- 6.1.4. Guar Gum

- 6.1.5. Carrageenan

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy and Frozen Products

- 6.2.2. Bakery

- 6.2.3. Beverages

- 6.2.4. Confectionery

- 6.2.5. Meat and Seafood Products

- 6.2.6. Oils and Fats

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Gelatin Gum

- 7.1.2. Pectin

- 7.1.3. Xanthan Gum

- 7.1.4. Guar Gum

- 7.1.5. Carrageenan

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy and Frozen Products

- 7.2.2. Bakery

- 7.2.3. Beverages

- 7.2.4. Confectionery

- 7.2.5. Meat and Seafood Products

- 7.2.6. Oils and Fats

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Gelatin Gum

- 8.1.2. Pectin

- 8.1.3. Xanthan Gum

- 8.1.4. Guar Gum

- 8.1.5. Carrageenan

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy and Frozen Products

- 8.2.2. Bakery

- 8.2.3. Beverages

- 8.2.4. Confectionery

- 8.2.5. Meat and Seafood Products

- 8.2.6. Oils and Fats

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Gelatin Gum

- 9.1.2. Pectin

- 9.1.3. Xanthan Gum

- 9.1.4. Guar Gum

- 9.1.5. Carrageenan

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy and Frozen Products

- 9.2.2. Bakery

- 9.2.3. Beverages

- 9.2.4. Confectionery

- 9.2.5. Meat and Seafood Products

- 9.2.6. Oils and Fats

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Gelatin Gum

- 10.1.2. Pectin

- 10.1.3. Xanthan Gum

- 10.1.4. Guar Gum

- 10.1.5. Carrageenan

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy and Frozen Products

- 10.2.2. Bakery

- 10.2.3. Beverages

- 10.2.4. Confectionery

- 10.2.5. Meat and Seafood Products

- 10.2.6. Oils and Fats

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Gelatin Gum

- 11.1.2. Pectin

- 11.1.3. Xanthan Gum

- 11.1.4. Guar Gum

- 11.1.5. Carrageenan

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dairy and Frozen Products

- 11.2.2. Bakery

- 11.2.3. Beverages

- 11.2.4. Confectionery

- 11.2.5. Meat and Seafood Products

- 11.2.6. Oils and Fats

- 11.2.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 12.1.4 Rest of North America

- 13. Europe Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Spain

- 13.1.2 United Kingdom

- 13.1.3 Germany

- 13.1.4 France

- 13.1.5 Italy

- 13.1.6 Russia

- 13.1.7 Rest of Europe

- 14. Asia Pacific Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Australia

- 14.1.5 Rest of Asia Pacific

- 15. South America Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. South Africa Food Hydrocolloid Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Rest of Middle East

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 CP Kelco US Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Cargill Incorporated

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Ashland Global Holdings Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 J F Hydrocolloids Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Archer Daniels Midland Company

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Koninklijke DSM N V

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 DuPont

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Behn Meyer Holding AG

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Lucid Colloids Ltd *List Not Exhaustive

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Hebei Xinhe Biochemical Co Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 CP Kelco US Inc

List of Figures

- Figure 1: Global Food Hydrocolloid Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South Africa Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South Africa Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Food Hydrocolloid Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Food Hydrocolloid Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Food Hydrocolloid Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Food Hydrocolloid Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Food Hydrocolloid Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Food Hydrocolloid Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Food Hydrocolloid Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Food Hydrocolloid Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Food Hydrocolloid Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Food Hydrocolloid Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Food Hydrocolloid Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Food Hydrocolloid Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Food Hydrocolloid Market Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Food Hydrocolloid Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Food Hydrocolloid Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East Food Hydrocolloid Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East Food Hydrocolloid Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East Food Hydrocolloid Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: South Africa Food Hydrocolloid Market Revenue (Million), by Type 2024 & 2032

- Figure 43: South Africa Food Hydrocolloid Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: South Africa Food Hydrocolloid Market Revenue (Million), by Application 2024 & 2032

- Figure 45: South Africa Food Hydrocolloid Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: South Africa Food Hydrocolloid Market Revenue (Million), by Country 2024 & 2032

- Figure 47: South Africa Food Hydrocolloid Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Hydrocolloid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Food Hydrocolloid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Spain Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Russia Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Arab Emirates Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of North America Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Spain Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Germany Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Russia Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Europe Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Japan Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Australia Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Brazil Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Argentina Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of South America Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Global Food Hydrocolloid Market Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global Food Hydrocolloid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 67: Global Food Hydrocolloid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: United Arab Emirates Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Middle East Food Hydrocolloid Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Hydrocolloid Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Food Hydrocolloid Market?

Key companies in the market include CP Kelco US Inc, Cargill Incorporated, Ashland Global Holdings Inc, J F Hydrocolloids Inc, Archer Daniels Midland Company, Koninklijke DSM N V, DuPont, Behn Meyer Holding AG, Lucid Colloids Ltd *List Not Exhaustive, Hebei Xinhe Biochemical Co Ltd.

3. What are the main segments of the Food Hydrocolloid Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand from Bakery and Confectionery Segment.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

In November 2021, Ingredion has added a range of single hydrocolloids to its extensive food and beverage portfolio. The new products offered are Pre-Hydrated Gum Arabic Spray Dry Powder, TIC Gum Arabic FT Powder, Ticalose CMC 400 Granular Powder, TIC Tara Gum 100, and Ticaxan Xanthan EC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Hydrocolloid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Hydrocolloid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Hydrocolloid Market?

To stay informed about further developments, trends, and reports in the Food Hydrocolloid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence