Key Insights

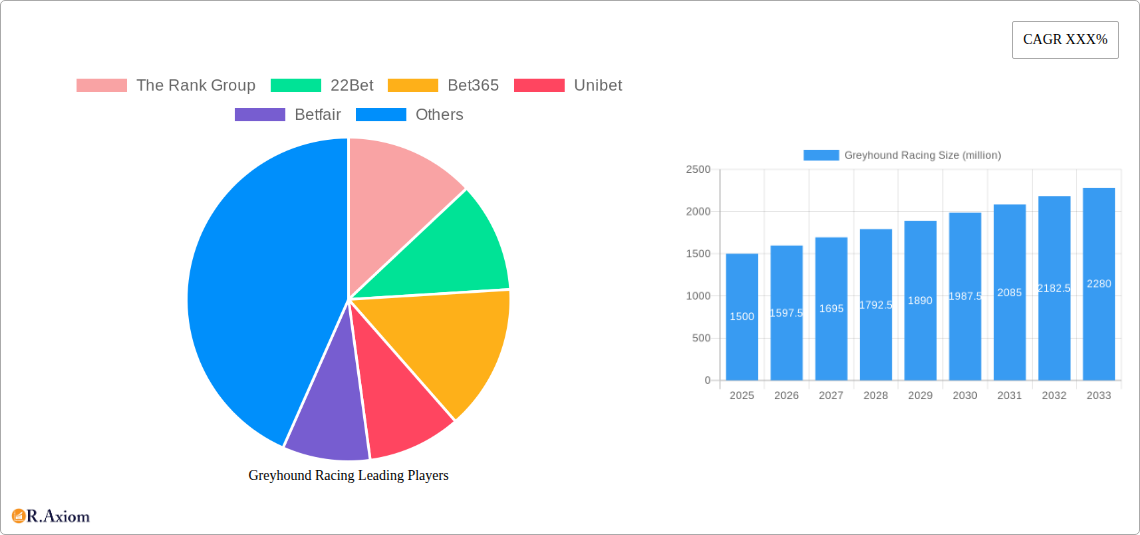

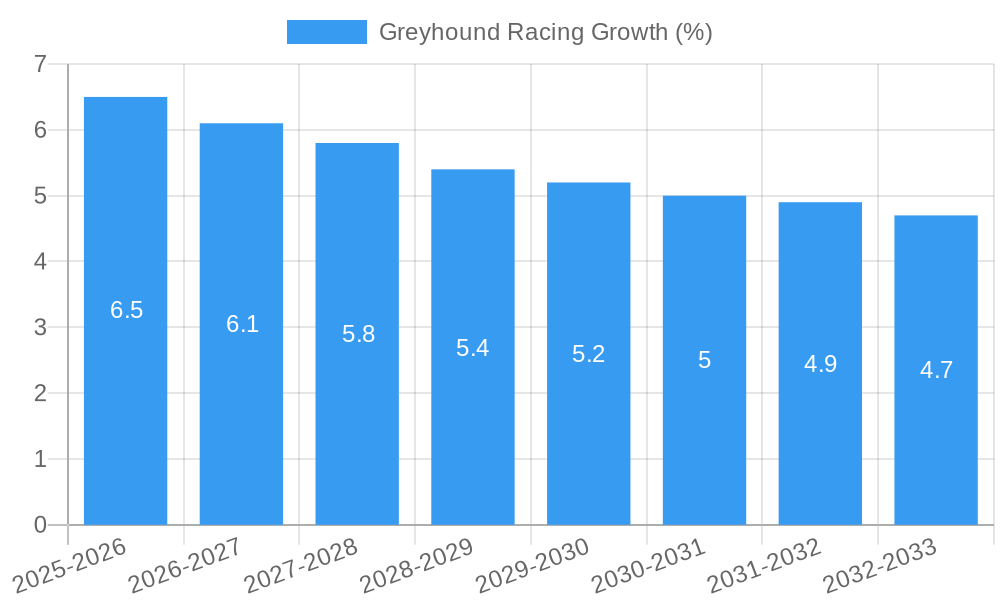

The global greyhound racing market is poised for significant growth, projected to reach a substantial market size of approximately $1.5 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 6.5% anticipated through 2033. This robust expansion is primarily fueled by increasing accessibility to online betting platforms and the rising popularity of dog racing as a spectator sport. Major drivers include technological advancements enabling seamless online wagering, a growing interest in niche sports betting, and strategic marketing efforts by leading industry players like Bet365, Unibet, and Betfair, which are enhancing fan engagement and broadening the market reach. The market encompasses various applications, with a dominant segment in general gambling, alongside specialized avenues like dog racing tracks and tours, indicating a diverse revenue stream.

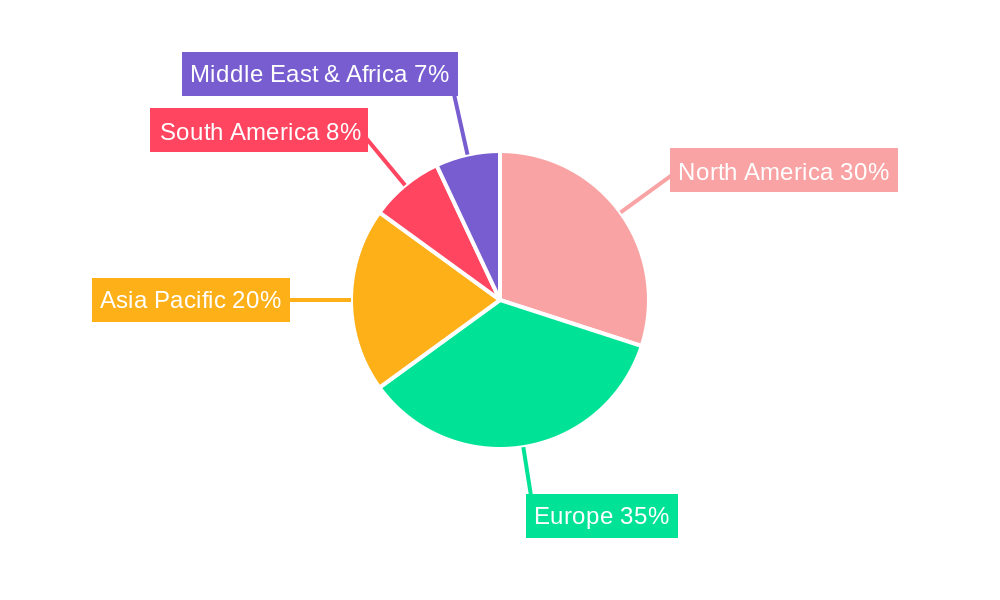

The market is segmented by application into gambling, dog racing tracks, and tours, with gambling activities representing the largest share. The race track segment also contributes significantly, alongside niche tour opportunities. However, the industry faces certain restraints, including evolving regulatory landscapes in different regions and growing concerns regarding animal welfare, which necessitate responsible practices and ethical considerations. Despite these challenges, the market's resilience is evident in its steady growth trajectory. Geographically, North America and Europe are expected to lead the market, driven by established betting cultures and significant investment in infrastructure and online platforms. Emerging markets in Asia Pacific, particularly China and India, also present considerable growth potential due to their large populations and increasing disposable incomes, which could translate to higher demand for greyhound racing and associated betting activities.

Greyhound Racing Market Concentration & Innovation

The global greyhound racing market, valued at an estimated $XXX million in the base year of 2025, is characterized by moderate concentration. Key players like The Rank Group, Bet365, Unibet, and Betfair hold significant market shares, primarily within the Gambling application segment, estimated at over $XXX million in 2025. Innovation in greyhound racing is driven by advancements in breeding technology, improved track conditions, and enhanced betting platforms. Regulatory frameworks, while varying significantly by region, play a crucial role in shaping market dynamics. The ongoing debate surrounding animal welfare continues to influence regulatory decisions and public perception. Product substitutes, such as other forms of horse racing and sports betting, present a constant competitive challenge. End-user trends reveal a growing demand for digital betting experiences, with a significant portion of the market originating from online platforms. Mergers and acquisitions (M&A) activities, though not consistently high, have seen strategic consolidations, with estimated deal values reaching into the tens of millions of dollars, aimed at expanding geographic reach and consolidating online betting operations. For instance, a hypothetical acquisition in the online betting sector could involve a value of $XX million.

Greyhound Racing Industry Trends & Insights

The greyhound racing industry is poised for steady growth, with an anticipated Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This growth is propelled by several interconnected trends and insights. Market penetration is expanding, particularly within emerging digital betting ecosystems, reaching an estimated XX% by 2025. Technological disruptions are at the forefront, with live streaming of races, sophisticated data analytics for betting insights, and the integration of mobile betting applications significantly enhancing accessibility and engagement. Advances in greyhound welfare technologies, including advanced veterinary care and track safety measures, are also becoming increasingly important to stakeholders and consumers. Consumer preferences are evolving, with a greater emphasis on responsible gambling initiatives and transparent race integrity. The demographic of greyhound racing enthusiasts is diversifying, attracting a younger, digitally native audience through social media engagement and fantasy sports-style betting products. Competitive dynamics are intensifying, with established operators like Bet365 and Unibet investing heavily in user experience and marketing campaigns. New entrants, often leveraging blockchain technology for transparent betting, are also beginning to emerge. The growth in Gambling applications is a primary driver, with an estimated market size of $XXX million in 2025. The Dog Racing Track segment, though facing scrutiny, remains a foundational element, contributing an estimated $XX million to the overall market in 2025.

Dominant Markets & Segments in Greyhound Racing

The Gambling application segment stands as the dominant force within the global greyhound racing market, projected to reach over $XXX million in 2025. This dominance is fueled by extensive online betting infrastructure and robust regulatory frameworks in key regions that support wagering on greyhound events.

- Key Drivers of Gambling Segment Dominance:

- Accessibility: Online platforms and mobile applications provide 24/7 access to betting, irrespective of physical location. Companies like Bet365 and 22Bet have invested millions in sophisticated online betting portals.

- Variety of Betting Options: A wide array of betting markets, including win, place, exacta, trifecta, and exotic bets, cater to diverse punter preferences, generating significant revenue.

- Technological Advancements: Live streaming of races, real-time odds updates, and data-driven insights enhance the betting experience, attracting and retaining customers. TVG is a prime example of a company focusing on broadcasting and integrated betting.

- Global Reach: Online operators transcend geographical limitations, allowing for a global customer base.

- Marketing and Promotions: Aggressive marketing campaigns and attractive sign-up bonuses by companies such as Unibet and Betfair continually draw in new users.

The Race Track type, encompassing physical venues where greyhound racing takes place, remains a significant contributor, estimated at $XXX million in 2025, but faces evolving challenges.

- Key Drivers of Race Track Segment Significance:

- Traditional Fanbase: A loyal segment of enthusiasts prefers the in-person experience of attending races.

- On-Course Betting: Physical tracks offer on-site betting facilities, contributing to revenue. Pensacola Greyhound Track represents a localized example of such a venue.

- Live Event Appeal: The excitement and atmosphere of live racing attract spectators.

- Regulatory Support (in certain regions): Some jurisdictions continue to support physical race tracks through licensing and operational regulations.

The Tour type, while less prominent, contributes to the overall ecosystem through events and associated travel, estimated at $XX million in 2025.

- Key Drivers of Tour Segment Contribution:

- Specialized Events: Major racing festivals and championships draw international interest and dedicated followers.

- Hospitality and Tourism: Associated hospitality services and travel packages contribute to the niche tourism sector.

The Dog Racing Track application, while a physical manifestation, is intrinsically linked to the Gambling segment, with its financial viability heavily dependent on betting revenue. Its estimated market contribution within the broader application is intrinsically tied to the operational costs and revenue generated from betting activities at these venues, estimated at $XX million in 2025.

Greyhound Racing Product Developments

Recent product developments in greyhound racing are centered on enhancing the betting experience and improving animal welfare. Innovations include sophisticated live streaming technologies offering high-definition broadcasts with multiple camera angles, alongside real-time data feeds for in-depth analysis. Mobile betting applications have been optimized for seamless user interfaces, allowing for instant wagers from anywhere. Furthermore, advancements in genetic profiling and advanced veterinary diagnostics are being integrated to monitor and improve the health and performance of racing greyhounds, thereby enhancing race integrity and animal welfare. These developments provide competitive advantages by increasing engagement, fostering responsible betting practices, and appealing to a more discerning audience.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Greyhound Racing market, segmented by Application, Type, and Region. The Application segments include Gambling ($XXX million in 2025, projected to grow at XX% CAGR), Dog Racing Track ($XX million in 2025, with moderate growth influenced by regulatory shifts), and implicitly includes other ancillary betting services. The Type segments are Race Track ($XXX million in 2025, with stable to moderate growth driven by live event appeal) and Tour ($XX million in 2025, a niche segment with potential for growth through specialized events). The analysis covers the historical period 2019–2024, the base year 2025, and forecasts market evolution through 2033, providing a comprehensive outlook on market sizes, growth projections, and competitive dynamics within each segment.

Key Drivers of Greyhound Racing Growth

Several key factors are driving the growth of the greyhound racing sector. Technologically, the proliferation of online betting platforms and live streaming services has dramatically expanded accessibility and engagement for a global audience. Economically, the growing disposable income in key markets and the increasing popularity of sports betting as a leisure activity contribute to higher wagering volumes. Regulatory factors, where favorable, such as clear licensing frameworks for online operators like 22Bet and Bet365, have fostered business expansion. Furthermore, a continued emphasis on improved animal welfare standards, driven by industry self-regulation and public demand, is crucial for long-term sustainability and public acceptance, indirectly supporting the market's growth by mitigating negative sentiment.

Challenges in the Greyhound Racing Sector

The greyhound racing sector faces significant challenges. Foremost are the regulatory hurdles, with increasing scrutiny and bans in certain regions due to animal welfare concerns, impacting operational viability. Supply chain issues, particularly concerning the breeding and training of greyhounds, can affect the availability and quality of participants. Competitive pressures from other established and emerging forms of entertainment and gambling, including esports and daily fantasy sports, divert consumer attention and spending. Quantifiably, these pressures can lead to a decline in attendance at physical tracks, estimated to reduce on-course revenue by XX% annually in affected regions, and could see online betting market share diverted to other sports by up to XX%.

Emerging Opportunities in Greyhound Racing

Emerging opportunities in the greyhound racing market lie in embracing technological innovation and expanding into new demographics. The development of blockchain-based betting platforms offers enhanced transparency and security, appealing to a tech-savvy audience. Expanding into underserved geographic markets with the establishment of new online betting partnerships and localized marketing strategies presents significant potential. Furthermore, focusing on responsible gambling initiatives and demonstrable improvements in animal welfare can rebuild public trust and attract a broader, more socially conscious consumer base. The creation of enhanced interactive betting experiences, such as gamified betting or virtual reality race viewing, also holds promise for engaging younger demographics.

Leading Players in the Greyhound Racing Market

The leading players in the Greyhound Racing Market include: The Rank Group 22Bet Bet365 Unibet Betfair OffTrackBetting BlueBet Pensacola Greyhound Track TVG

Key Developments in Greyhound Racing Industry

- 2023/2024: Increased investment in live streaming technology by major bookmakers to enhance remote betting experience.

- 2023: Launch of advanced data analytics tools by companies like Bet365 for punters seeking deeper insights.

- 2022: Growing adoption of enhanced welfare protocols and independent welfare oversight bodies by racing authorities.

- 2021: Several countries implemented stricter regulations on greyhound racing, leading to market contractions in those regions.

- 2020: Significant shift towards online betting platforms, with companies like Betfair experiencing substantial growth in greyhound racing turnover.

- 2019: Introduction of new betting products and markets by operators like Unibet to cater to evolving consumer preferences.

Strategic Outlook for Greyhound Racing Market

The strategic outlook for the greyhound racing market is cautiously optimistic, heavily reliant on adapting to evolving consumer preferences and regulatory landscapes. Growth catalysts include the continued expansion of digital betting infrastructure, the integration of cutting-edge technologies for enhanced user experience, and a steadfast commitment to animal welfare and responsible gambling. Focusing on niche market segments and developing innovative betting products will be crucial. The market's future potential lies in its ability to maintain relevance by embracing transparency, demonstrating ethical practices, and leveraging technology to create engaging and accessible wagering opportunities, particularly within the global Gambling application segment.

Greyhound Racing Segmentation

-

1. Application

- 1.1. Gambling

- 1.2. Dog Racing Track

-

2. Type

- 2.1. Race Track

- 2.2. Tour

Greyhound Racing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Greyhound Racing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Greyhound Racing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Gambling

- 5.1.2. Dog Racing Track

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Race Track

- 5.2.2. Tour

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Greyhound Racing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Gambling

- 6.1.2. Dog Racing Track

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Race Track

- 6.2.2. Tour

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Greyhound Racing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Gambling

- 7.1.2. Dog Racing Track

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Race Track

- 7.2.2. Tour

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Greyhound Racing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Gambling

- 8.1.2. Dog Racing Track

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Race Track

- 8.2.2. Tour

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Greyhound Racing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Gambling

- 9.1.2. Dog Racing Track

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Race Track

- 9.2.2. Tour

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Greyhound Racing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Gambling

- 10.1.2. Dog Racing Track

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Race Track

- 10.2.2. Tour

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 The Rank Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 22Bet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bet365

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unibet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Betfair

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OffTrackBetting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BlueBet

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pensacola Greyhound Track

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TVG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 The Rank Group

List of Figures

- Figure 1: Global Greyhound Racing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Greyhound Racing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Greyhound Racing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Greyhound Racing Revenue (million), by Type 2024 & 2032

- Figure 5: North America Greyhound Racing Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Greyhound Racing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Greyhound Racing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Greyhound Racing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Greyhound Racing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Greyhound Racing Revenue (million), by Type 2024 & 2032

- Figure 11: South America Greyhound Racing Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Greyhound Racing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Greyhound Racing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Greyhound Racing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Greyhound Racing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Greyhound Racing Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Greyhound Racing Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Greyhound Racing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Greyhound Racing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Greyhound Racing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Greyhound Racing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Greyhound Racing Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Greyhound Racing Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Greyhound Racing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Greyhound Racing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Greyhound Racing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Greyhound Racing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Greyhound Racing Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Greyhound Racing Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Greyhound Racing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Greyhound Racing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Greyhound Racing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Greyhound Racing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Greyhound Racing Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Greyhound Racing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Greyhound Racing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Greyhound Racing Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Greyhound Racing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Greyhound Racing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Greyhound Racing Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Greyhound Racing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Greyhound Racing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Greyhound Racing Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Greyhound Racing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Greyhound Racing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Greyhound Racing Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Greyhound Racing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Greyhound Racing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Greyhound Racing Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Greyhound Racing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Greyhound Racing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greyhound Racing?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Greyhound Racing?

Key companies in the market include The Rank Group, 22Bet, Bet365, Unibet, Betfair, OffTrackBetting, BlueBet, Pensacola Greyhound Track, TVG.

3. What are the main segments of the Greyhound Racing?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greyhound Racing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greyhound Racing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greyhound Racing?

To stay informed about further developments, trends, and reports in the Greyhound Racing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence