Key Insights

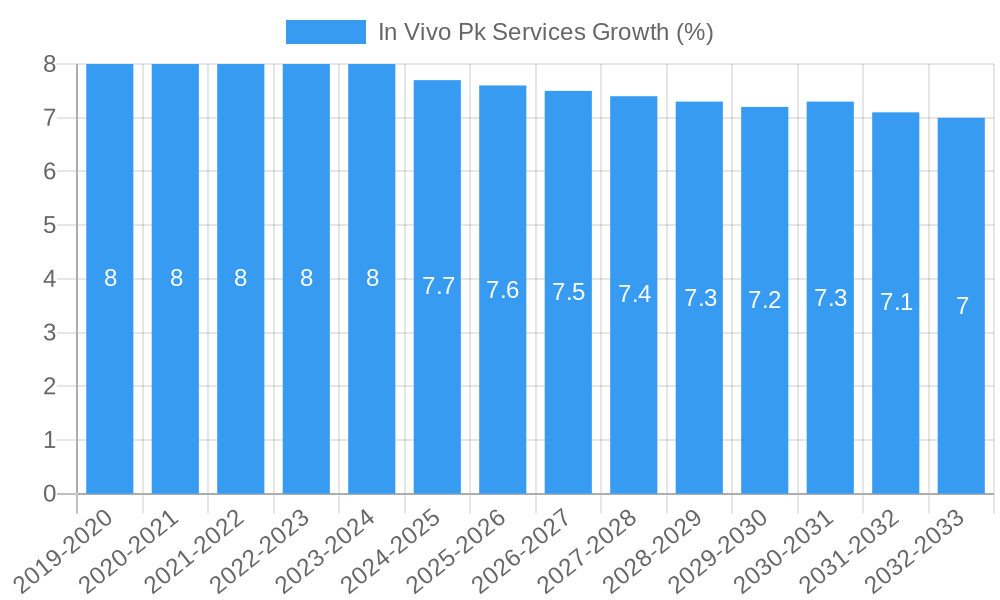

The global In Vivo PK (Pharmacokinetics) Services market is poised for significant expansion, projected to reach a substantial market size of approximately \$2.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily propelled by the escalating demand for efficient and reliable drug development and testing processes. Key drivers include the increasing complexity of novel drug candidates requiring sophisticated pharmacokinetic profiling, a burgeoning pipeline of biologics and biosimilars, and stringent regulatory requirements that necessitate comprehensive in vivo studies. Furthermore, the expanding research and development activities within the pharmaceutical and biotechnology sectors, coupled with a growing emphasis on personalized medicine, are fueling the need for specialized PK services that can accurately predict drug behavior in living organisms. The market is segmented by application, with hospitals, clinics, and research institutions all contributing to the demand for these critical services. The biological sample development, verification, and testing segments are all integral to the overall value chain of in vivo PK services.

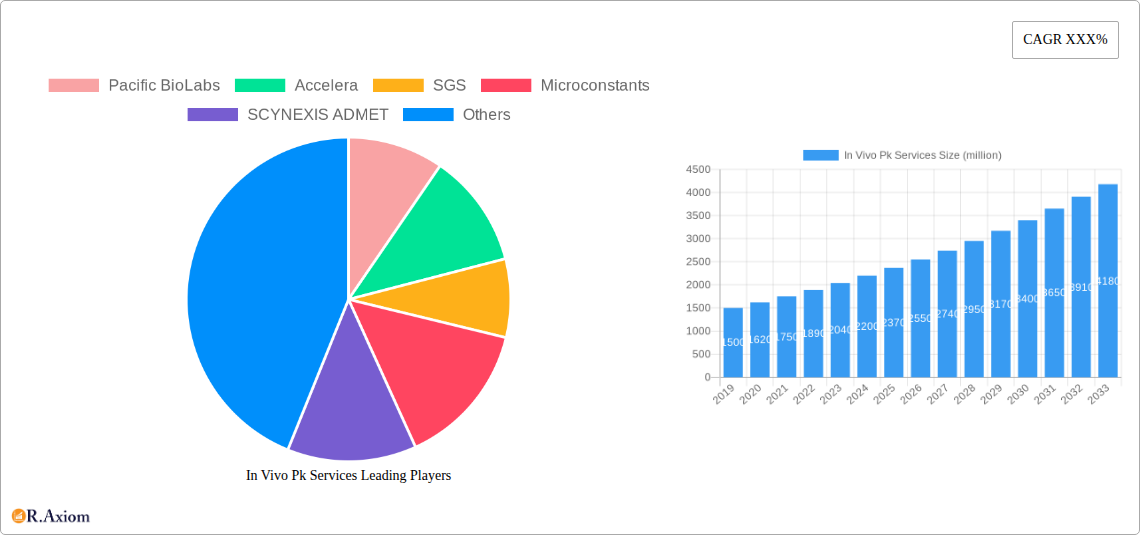

The market's trajectory is further influenced by several emerging trends, including the increasing adoption of advanced technologies such as bioanalytical techniques and sophisticated modeling and simulation tools to enhance the accuracy and speed of PK studies. There's also a noticeable trend towards outsourcing these specialized services to Contract Research Organizations (CROs) and specialized PK service providers, driven by the need for expertise, cost-efficiency, and access to cutting-edge infrastructure. Major players like Eurofins, Accelera, and SGS are at the forefront of this market, offering a comprehensive suite of services to a global clientele. Despite the promising outlook, certain restraints could impact the market's pace, such as the high cost associated with conducting extensive in vivo studies and the evolving regulatory landscape that may introduce new compliance challenges. However, the continuous innovation in drug discovery and development, coupled with a persistent need for understanding drug efficacy and safety profiles, is expected to sustain the strong growth momentum for in vivo PK services in the coming years.

Comprehensive In Vivo PK Services Market Report: Navigating Drug Development Success

This in-depth market research report provides a comprehensive analysis of the global In Vivo Pharmacokinetic (PK) Services market, offering actionable insights for stakeholders in the pharmaceutical and biotechnology industries. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report delves into market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. Utilizing millions for all quantitative values and incorporating high-traffic keywords, this report is designed to enhance search visibility and equip industry professionals with critical market intelligence for strategic decision-making.

In Vivo Pk Services Market Concentration & Innovation

The In Vivo PK Services market is characterized by a moderate level of concentration, with several key players holding significant market share. Leading companies like Pacific BioLabs, Accelera, SGS, Microconstants, SCYNEXIS ADMET, Frontage, Drug Development Solutions, Altasciences, NorthEast BioLab, Eurofins, BioPharma Services, and Smithers are actively engaged in providing a wide range of PK studies. Innovation in this sector is primarily driven by advancements in bioanalytical techniques, preclinical research methodologies, and regulatory requirements for drug safety and efficacy. The growing complexity of drug candidates, including biologics and gene therapies, necessitates sophisticated in vivo PK assessments. Regulatory frameworks, such as those established by the FDA and EMA, play a crucial role in shaping service offerings and ensuring the quality and reliability of PK data. Product substitutes are limited, as in vivo studies remain a cornerstone of preclinical drug development. End-user trends highlight an increasing demand for specialized PK services, faster turnaround times, and integrated solutions that encompass broader drug discovery and development phases. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with deal values often reaching into the hundreds of millions of dollars as companies seek to expand their service portfolios and geographical reach. For instance, recent M&A activities have focused on acquiring companies with specialized expertise in niche therapeutic areas or advanced bioanalytical capabilities.

In Vivo Pk Services Industry Trends & Insights

The In Vivo PK Services market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This expansion is fueled by several key drivers, including the escalating investment in pharmaceutical R&D, the growing pipeline of novel drug candidates, and the increasing outsourcing of preclinical drug development activities by pharmaceutical and biotechnology companies. Technological disruptions are playing a pivotal role, with the adoption of advanced analytical instruments, high-throughput screening technologies, and sophisticated data analysis software enhancing the efficiency and accuracy of in vivo PK studies. The advent of precision medicine and personalized therapies is also driving demand for more tailored and complex PK assessments. Consumer preferences within the industry are shifting towards integrated service providers that offer a seamless experience from early-stage discovery to late-stage preclinical development. This includes a preference for CROs with a strong track record in regulatory compliance and scientific expertise. Competitive dynamics are intensifying, with established players and emerging niche providers vying for market share. Companies are differentiating themselves through specialized service offerings, cost-effectiveness, and geographical expansion. The penetration of in vivo PK services across various therapeutic areas, including oncology, infectious diseases, and rare diseases, is steadily increasing. Furthermore, the growing emphasis on drug repurposing and the development of biosimilars are also contributing to the sustained demand for comprehensive PK evaluations. The global market for in vivo PK services is expected to surpass $5,000 million by the end of the forecast period, underscoring its significant economic importance.

Dominant Markets & Segments in In Vivo Pk Services

The Hospital segment, within the Application category, is a dominant force in the In Vivo PK Services market, driven by its pivotal role in clinical trial execution and patient sample collection. Hospitals are integral to conducting human studies, a critical component of late-stage drug development where in vivo PK data is essential for understanding drug absorption, distribution, metabolism, and excretion (ADME) in humans.

- Key Drivers for Hospital Dominance:

- Clinical Trial Infrastructure: Hospitals possess the necessary infrastructure, including specialized wards, research facilities, and trained personnel, to conduct ethically approved and scientifically sound in vivo studies involving human subjects.

- Patient Access: Proximity to diverse patient populations facilitates patient recruitment for clinical trials, a crucial factor in obtaining statistically relevant PK data.

- Regulatory Oversight: Hospitals operate under stringent regulatory oversight, ensuring adherence to Good Clinical Practice (GCP) and other relevant guidelines, which is vital for the acceptance of PK data by regulatory authorities.

- Collaboration with Researchers: Close collaboration between hospital clinicians, researchers, and pharmaceutical companies fosters the seamless integration of PK assessments into broader clinical development programs.

Within the Type segmentation, Biological Sample Testing represents the largest and most crucial segment. This encompasses the analysis of various biological matrices such as blood, plasma, urine, and tissues collected during in vivo studies to quantify drug concentrations and their metabolites.

- Key Drivers for Biological Sample Testing Dominance:

- Core PK Data Generation: Biological sample testing is the fundamental activity for generating essential in vivo PK parameters like Cmax (maximum concentration), Tmax (time to maximum concentration), AUC (area under the curve), and half-life.

- Technological Advancements: Continuous advancements in bioanalytical techniques, including Liquid Chromatography-Mass Spectrometry (LC-MS/MS) and immunoassays, have enabled the detection of drugs and metabolites at very low concentrations with high accuracy and precision.

- Regulatory Requirements: Regulatory agencies worldwide mandate comprehensive bioanalytical data from in vivo studies for drug approval, making sample testing a non-negotiable component.

- High Volume of Studies: The sheer volume of preclinical and clinical studies requiring PK evaluations translates into a high demand for biological sample testing services.

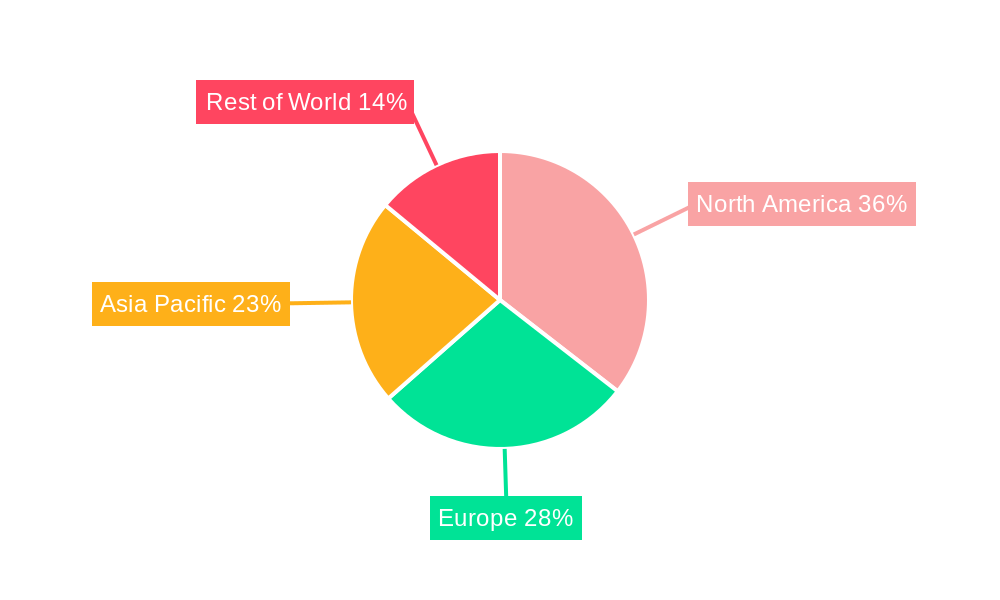

Geographically, North America and Europe currently dominate the In Vivo PK Services market due to the established presence of major pharmaceutical companies, robust R&D ecosystems, and favorable regulatory environments. However, the Asia-Pacific region is rapidly emerging as a significant growth market, driven by increasing investments in drug development, a growing pool of skilled scientific talent, and cost-effectiveness.

In Vivo Pk Services Product Developments

The In Vivo PK Services market is witnessing continuous product development focused on enhancing the efficiency, accuracy, and comprehensiveness of pharmacokinetic studies. Innovations in bioanalytical instrumentation, such as advanced LC-MS/MS systems and high-resolution mass spectrometers, allow for the detection and quantification of a wider range of analytes at lower limits of detection. Furthermore, the development of novel assay technologies, including cell-based assays and biomarkers, provides deeper insights into drug metabolism and transporter interactions. These advancements are crucial for understanding drug efficacy and potential toxicity early in the development lifecycle, offering a competitive advantage to service providers and accelerating the drug development process for their clients.

Report Scope & Segmentation Analysis

This report meticulously segments the In Vivo PK Services market across key dimensions to provide granular insights.

Application Segments:

- Hospital: Driven by clinical trials and human studies, this segment is projected to witness steady growth, with market sizes expected to reach over $2,000 million by 2033.

- Clinic: Clinics also play a role in conducting specific PK studies, particularly in outpatient settings. Their contribution to the market is estimated to be around $1,000 million.

- Research Institutions: Academic and independent research institutions are crucial for early-stage discovery and mechanistic PK studies, contributing an estimated $1,500 million to the market.

Type Segments:

- Biological Sample Development: This includes the development and validation of bioanalytical methods for various matrices, contributing an estimated $1,200 million.

- Biological Sample Verification: Focused on ensuring the accuracy and reliability of existing methods, this segment is valued at approximately $1,300 million.

- Biological Sample Testing: The core of PK services, this segment, encompassing the actual quantification of drug concentrations, is the largest, projected to exceed $2,500 million by 2033.

Key Drivers of In Vivo Pk Services Growth

The growth of the In Vivo PK Services market is propelled by several intertwined factors. Firstly, the escalating investment by pharmaceutical and biotechnology companies in novel drug discovery and development fuels the demand for essential preclinical and clinical PK studies. Secondly, the increasing complexity of drug candidates, including biologics, personalized medicines, and advanced therapies, necessitates sophisticated and specialized PK assessments to understand their behavior in biological systems. Regulatory bodies worldwide continue to emphasize the critical role of comprehensive PK data for drug safety and efficacy, acting as a significant driver for service utilization. Furthermore, the growing trend of outsourcing non-core R&D activities to Contract Research Organizations (CROs) allows drug developers to leverage specialized expertise and infrastructure, thereby driving the demand for in vivo PK services. The cost-effectiveness and efficiency gains associated with outsourcing also contribute to this trend.

Challenges in the In Vivo Pk Services Sector

Despite its robust growth, the In Vivo PK Services sector faces several challenges. Stringent and evolving regulatory requirements across different global markets can create complexities and increase compliance costs for service providers. The high cost of advanced analytical instrumentation and specialized reagents can pose a significant barrier, especially for smaller CROs. Maintaining a highly skilled workforce of scientists and technicians with expertise in bioanalysis and preclinical research is an ongoing challenge. Furthermore, intense competition among a large number of CROs can lead to price pressures, impacting profit margins. Supply chain disruptions for critical reagents and consumables can also affect project timelines and operational efficiency.

Emerging Opportunities in In Vivo Pk Services

The In Vivo PK Services market presents numerous emerging opportunities. The growing focus on personalized medicine and companion diagnostics is creating a demand for highly specialized PK studies tailored to specific patient populations and genetic profiles. The expansion of biopharmaceutical development, including cell and gene therapies, requires innovative PK approaches to assess these novel modalities. Advancements in digital technologies, such as AI and machine learning, offer opportunities for optimizing study design, data analysis, and predictive modeling in PK assessments. The increasing demand for bioequivalence studies for generic drugs and biosimilar development also presents a significant market opportunity. Furthermore, the growing emphasis on understanding drug-drug interactions and the impact of disease states on PK profiles opens avenues for specialized service offerings.

Leading Players in the In Vivo Pk Services Market

- Pacific BioLabs

- Accelera

- SGS

- Microconstants

- SCYNEXIS ADMET

- Frontage

- Drug Development Solutions

- Altasciences

- NorthEast BioLab

- Eurofins

- BioPharma Services

- Smithers

Key Developments in In Vivo Pk Services Industry

- 2023: Expansion of bioanalytical capabilities by major CROs to accommodate complex biologics and large molecule analysis.

- 2023: Increased adoption of automated liquid handling systems and high-throughput screening technologies for faster and more efficient sample processing.

- 2022: Significant M&A activity focused on acquiring companies with niche expertise in specific therapeutic areas or advanced PK modeling.

- 2022: Growing demand for integrated services that combine in vivo PK with pharmacodynamics (PD) and toxicological assessments.

- 2021: Introduction of novel bioanalytical methods for the quantification of antibody-drug conjugates (ADCs) and other complex therapeutic modalities.

- 2021: Enhanced focus on data integrity and compliance with evolving regulatory guidelines for bioanalytical method validation.

Strategic Outlook for In Vivo Pk Services Market

The strategic outlook for the In Vivo PK Services market remains exceptionally positive, driven by the continuous innovation in drug discovery and development. The increasing prevalence of chronic diseases and the ongoing pursuit of novel treatments for unmet medical needs will sustain the demand for robust PK evaluations. Companies that can offer integrated, end-to-end solutions, leverage cutting-edge technologies, and maintain high standards of regulatory compliance are best positioned for success. Strategic partnerships and collaborations with pharmaceutical and biotechnology firms, along with a focus on expanding service offerings to cater to emerging therapeutic modalities like gene and cell therapies, will be crucial for sustained growth and market leadership. The market is poised for continued expansion as the global healthcare landscape evolves.

In Vivo Pk Services Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Research Institutions

-

2. Type

- 2.1. Biological Sample Development

- 2.2. Biological Sample Verification

- 2.3. Biological Sample Testing

In Vivo Pk Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

In Vivo Pk Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In Vivo Pk Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Research Institutions

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Biological Sample Development

- 5.2.2. Biological Sample Verification

- 5.2.3. Biological Sample Testing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America In Vivo Pk Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Research Institutions

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Biological Sample Development

- 6.2.2. Biological Sample Verification

- 6.2.3. Biological Sample Testing

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America In Vivo Pk Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Research Institutions

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Biological Sample Development

- 7.2.2. Biological Sample Verification

- 7.2.3. Biological Sample Testing

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe In Vivo Pk Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Research Institutions

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Biological Sample Development

- 8.2.2. Biological Sample Verification

- 8.2.3. Biological Sample Testing

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa In Vivo Pk Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Research Institutions

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Biological Sample Development

- 9.2.2. Biological Sample Verification

- 9.2.3. Biological Sample Testing

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific In Vivo Pk Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Research Institutions

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Biological Sample Development

- 10.2.2. Biological Sample Verification

- 10.2.3. Biological Sample Testing

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pacific BioLabs

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accelera

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SGS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microconstants

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SCYNEXIS ADMET

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Frontage

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Drug Development Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Altasciences

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NorthEast BioLab

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurofins

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BioPharma Services

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Smithers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Pacific BioLabs

List of Figures

- Figure 1: Global In Vivo Pk Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America In Vivo Pk Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America In Vivo Pk Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America In Vivo Pk Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America In Vivo Pk Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America In Vivo Pk Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America In Vivo Pk Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America In Vivo Pk Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America In Vivo Pk Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America In Vivo Pk Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America In Vivo Pk Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America In Vivo Pk Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America In Vivo Pk Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe In Vivo Pk Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe In Vivo Pk Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe In Vivo Pk Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe In Vivo Pk Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe In Vivo Pk Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe In Vivo Pk Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa In Vivo Pk Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa In Vivo Pk Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa In Vivo Pk Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa In Vivo Pk Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa In Vivo Pk Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa In Vivo Pk Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific In Vivo Pk Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific In Vivo Pk Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific In Vivo Pk Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific In Vivo Pk Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific In Vivo Pk Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific In Vivo Pk Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global In Vivo Pk Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global In Vivo Pk Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global In Vivo Pk Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global In Vivo Pk Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global In Vivo Pk Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global In Vivo Pk Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global In Vivo Pk Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global In Vivo Pk Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global In Vivo Pk Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global In Vivo Pk Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global In Vivo Pk Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global In Vivo Pk Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global In Vivo Pk Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global In Vivo Pk Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global In Vivo Pk Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global In Vivo Pk Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global In Vivo Pk Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global In Vivo Pk Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global In Vivo Pk Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific In Vivo Pk Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In Vivo Pk Services?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the In Vivo Pk Services?

Key companies in the market include Pacific BioLabs, Accelera, SGS, Microconstants, SCYNEXIS ADMET, Frontage, Drug Development Solutions, Altasciences, NorthEast BioLab, Eurofins, BioPharma Services, Smithers.

3. What are the main segments of the In Vivo Pk Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In Vivo Pk Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In Vivo Pk Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In Vivo Pk Services?

To stay informed about further developments, trends, and reports in the In Vivo Pk Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence