Key Insights

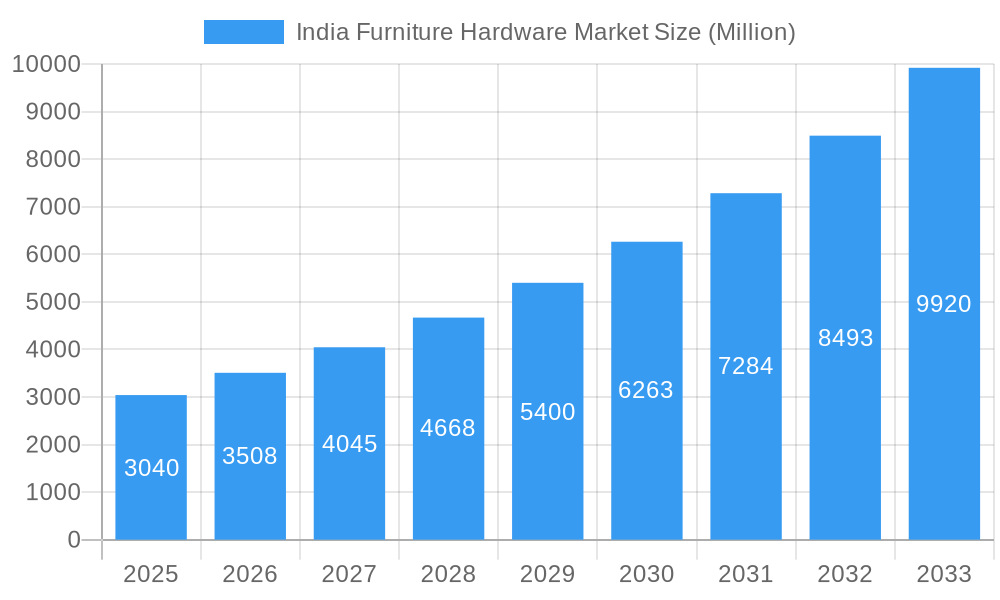

The India furniture hardware market, valued at approximately ₹3040 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.49% from 2025 to 2033. This surge is driven by several factors, including the burgeoning construction and real estate sectors, increasing disposable incomes fueling higher consumer spending on home improvement and furniture, and a rising preference for modern, aesthetically pleasing furniture designs requiring sophisticated hardware. The market is segmented by product type (hinges, runner systems, lift systems, etc.), end-user (residential and commercial), and distribution channel (B2B and B2C). The residential segment currently dominates, however, the commercial sector is expected to witness significant growth due to increasing commercial construction activity, particularly in metropolitan areas. Key players like Hafele India, Godrej & Boyce, and Blum India are driving innovation and enhancing product offerings to cater to evolving consumer preferences. The increasing adoption of online retail channels is also shaping the market landscape, providing wider reach and convenience to both B2B and B2C customers. Competition is intense, with both domestic and international players vying for market share, leading to price competitiveness and product diversification. Challenges include the dependence on imported raw materials and fluctuations in commodity prices, which can impact profitability.

India Furniture Hardware Market Market Size (In Billion)

The regional distribution of the market reflects India's diverse economic landscape. While precise regional data is unavailable, the North and West regions likely hold a larger market share due to higher urbanization and economic activity. However, the South and East regions are also expected to exhibit strong growth fueled by increasing infrastructure development and rising middle-class disposable incomes. Looking ahead, the market's growth trajectory will be further shaped by government initiatives promoting affordable housing and infrastructure development, as well as evolving consumer preferences towards sustainable and smart home technologies which are influencing demand for technologically advanced furniture hardware.

India Furniture Hardware Market Company Market Share

India Furniture Hardware Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Furniture Hardware Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscape, growth drivers, and future opportunities, making it an essential resource for industry stakeholders, investors, and businesses operating within or planning to enter this dynamic sector. The report's findings are based on rigorous research and data analysis, projecting a market valued at xx Million in 2025 and showcasing a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

India Furniture Hardware Market Concentration & Innovation

The India furniture hardware market exhibits a moderately concentrated structure, with several large players holding significant market share. However, a considerable number of smaller and regional players also contribute substantially to the overall market volume. The top five players – Hafele India, Godrej & Boyce, Hettich India, Blum India, and Ozone Overseas – collectively hold an estimated xx% market share in 2025, with Hafele and Godrej leading the way. Innovation is a key driver, with companies focusing on developing technologically advanced products to enhance functionality, durability, and aesthetics. This is reflected in the introduction of smart hardware solutions, advanced material utilization, and improved design features.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Smart hardware, advanced materials, improved designs.

- Regulatory Framework: Stringent quality standards (BIS) and environmental regulations influence market trends.

- Product Substitutes: Limited direct substitutes, but competition exists from low-cost imports and alternative materials.

- End-User Trends: Increasing preference for modular and custom furniture is fueling demand for diverse hardware solutions.

- M&A Activities: While specific deal values are not publicly available for all transactions, several acquisitions and strategic partnerships have been observed in recent years, driving consolidation within the market.

India Furniture Hardware Market Industry Trends & Insights

The India Furniture Hardware Market is experiencing robust growth, driven by a surge in construction activity, rising disposable incomes, and a growing preference for modern and stylish furniture. Urbanization and the expanding middle class are further accelerating market expansion. The market size is projected to reach xx Million by 2033, reflecting a healthy CAGR of xx%. Technological advancements, including smart home integration and automation features in furniture hardware, are influencing consumer preferences and product development. Competitive intensity is moderate, with both domestic and international players vying for market dominance. Market penetration of premium hardware products is increasing, reflecting heightened consumer awareness and demand for high-quality, durable products.

Dominant Markets & Segments in India Furniture Hardware Market

Dominant Region: The Western region of India, specifically Maharashtra and Gujarat, currently commands the largest market share owing to significant urban development, higher construction activity, and a well-established furniture industry.

Dominant Product Type: Hinges continue to lead the product segment, followed closely by runner systems. The high demand for kitchen cabinets and wardrobes drives this trend.

Dominant End-User: The residential segment dominates market share, driven by the expansion of urban areas and a growing preference for home renovation and improvement projects. However, the commercial sector is demonstrating significant growth potential, owing to increasing investments in commercial real estate.

Dominant Distribution Channel: B2B (Business-to-Business) channels currently dominate the market, with substantial sales to real estate developers and contractors. However, the B2C (Business-to-Consumer) segment is gaining traction with the growth of e-commerce and organized retail.

- Key Drivers (Residential): Rising disposable incomes, increased homeownership, home renovation projects.

- Key Drivers (Commercial): Growth in commercial real estate, infrastructure development, hospitality industry expansion.

- Key Drivers (B2B): Strong project pipeline, preference for established brands, bulk procurement advantages.

- Key Drivers (B2C): Rise of e-commerce, organized retail growth, increased consumer awareness.

India Furniture Hardware Market Product Developments

Recent product innovations include the integration of soft-close mechanisms, advanced drawer systems, and smart locking systems. These developments emphasize improved functionality, durability, and ease of use. Companies are focusing on cost-effective manufacturing and sustainable sourcing of materials to remain competitive. The market trend indicates a shift toward premium, high-quality hardware solutions, catering to evolving consumer preferences for superior aesthetics and functionality.

Report Scope & Segmentation Analysis

This report segments the Indian furniture hardware market across three key dimensions:

Product Type: Hinges, Runner Systems, Lift Systems, Box Systems, Wire Baskets, Sliding Door Systems, Handles, Pulls, and Knobs, Fasteners (Screw, Bolts, Nuts, etc.), Other Products. Each segment's growth is projected based on current market size, consumer preferences, and technological advancements. Competitive dynamics vary by product segment, with some dominated by established players and others presenting opportunities for new entrants.

End User: Residential and Commercial segments are analyzed separately, considering their unique needs and purchasing behaviors. Growth projections for each segment are influenced by factors like real estate development, urbanization, and economic conditions. Competitive landscapes within these segments differ due to pricing strategies, branding, and product differentiation.

Distribution Channel: B2B/Projects (Real Estate Developers, Contractors) and B2C/Retail channels are evaluated based on market size, growth potential, and evolving distribution strategies. The report analyzes the competitive advantages and challenges each channel presents for manufacturers.

Key Drivers of India Furniture Hardware Market Growth

The market's robust growth is propelled by several factors, including:

- Rising Disposable Incomes: Increased purchasing power fuels demand for higher-quality furniture and hardware.

- Urbanization and Real Estate Boom: Rapid urbanization and increased construction activity create significant demand.

- Government Initiatives: Policies promoting affordable housing and infrastructure development stimulate market growth.

- Technological Advancements: Innovation in material science, designs and smart hardware integration enhance functionality and consumer appeal.

Challenges in the India Furniture Hardware Market Sector

The sector faces several challenges, such as:

- Supply Chain Disruptions: Global supply chain volatility can impact raw material availability and pricing.

- Intense Competition: The market is competitive, with both domestic and international players vying for market share.

- Fluctuating Raw Material Prices: Variations in raw material costs can affect profitability and product pricing.

- Counterfeit Products: The presence of counterfeit products impacts brand image and sales.

Emerging Opportunities in India Furniture Hardware Market

Promising opportunities abound in the India Furniture Hardware Market. These include:

- Growing Demand for Smart Home Technology: Integration of smart functionalities in furniture hardware.

- Expansion of E-commerce: Online retail channels present avenues for direct-to-consumer sales and increased reach.

- Focus on Sustainable Products: Environmentally conscious consumers drive demand for eco-friendly materials and manufacturing practices.

- Entry into Tier II and Tier III Cities: Untapped market potential in smaller cities offers significant growth prospects.

Leading Players in the India Furniture Hardware Market Market

- KAFF

- Kich Architectural Products Pvt Ltd

- Denz Enterprise

- FGV (Hindware Home Innovation Limited)

- Godrej & Boyce Manufacturing Company Limited

- Hafele India Private Limited

- Ozone Overseas Pvt Ltd

- Blum India Pvt Ltd

- Dorset Industries Pvt Ltd

- Hettich India Pvt Ltd

- Ebco Private Limited

- ASSA ABLOY

- Hexa Wood Pvt Ltd

- Salice India Pvt Ltd

- Hepo India Pvt Ltd

- GRASS (an Austrian Manufacturer)

Key Developments in India Furniture Hardware Market Industry

- March 2024: Blum India launches "Sliker India," a new distributor showroom in Jodhpur, expanding its reach to 130 cities and over 425 outlets.

- May 2023: Ozone Overseas secures INR 250 crore funding from PAG-backed Nuvama Private Equity, boosting domestic manufacturing and international expansion plans.

Strategic Outlook for India Furniture Hardware Market Market

The India Furniture Hardware Market is poised for sustained growth, driven by a confluence of factors including rising disposable incomes, rapid urbanization, and technological advancements. Strategic focus on product innovation, enhanced distribution networks, and effective branding will be crucial for success. Expanding into untapped markets and leveraging the growing e-commerce sector will present significant opportunities for market players. Embracing sustainable manufacturing practices and adhering to evolving consumer preferences will further solidify competitive positioning and contribute to long-term market dominance.

India Furniture Hardware Market Segmentation

-

1. Product Type

- 1.1. Hinges

- 1.2. Runner Systems

- 1.3. Lift Systems

- 1.4. Box Systems

- 1.5. Wire Baskets

- 1.6. Sliding Door Systems

- 1.7. Handles, Pulls, and Knobs

- 1.8. Fasteners (Screw, Bolts, Nuts, etc.)

- 1.9. Other Products

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. B2B/Proj

- 3.2. B2C/Retail

India Furniture Hardware Market Segmentation By Geography

- 1. India

India Furniture Hardware Market Regional Market Share

Geographic Coverage of India Furniture Hardware Market

India Furniture Hardware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Urban Expansion is Fueling Residential Construction

- 3.2.2 Spurring the Need for Furniture and Architectural Hardware; The Growth of Commercial Spaces like Offices and Hotels Bolsters the Demand for Furniture Hardware

- 3.3. Market Restrains

- 3.3.1 The Market's High Sensitivity to Prices is Impacting the Adoption of Premium Hardware Solutions; Ensuring Consistent Quality Across Diverse Products and Suppliers Poses Challenges

- 3.3.2 Impacting Customer Satisfaction and Brand Loyalty

- 3.4. Market Trends

- 3.4.1. Increase in Residential Furniture Hardware is Fuelling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Furniture Hardware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hinges

- 5.1.2. Runner Systems

- 5.1.3. Lift Systems

- 5.1.4. Box Systems

- 5.1.5. Wire Baskets

- 5.1.6. Sliding Door Systems

- 5.1.7. Handles, Pulls, and Knobs

- 5.1.8. Fasteners (Screw, Bolts, Nuts, etc.)

- 5.1.9. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. B2B/Proj

- 5.3.2. B2C/Retail

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KAFF

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kich Architectural Products Pvt Ltd**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Denz Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FGV (Hindware Home Innovation Limited)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Godrej & Boyce Manufacturing Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hafele India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ozone Overseas Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Blum India Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dorset Industries Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hettich India Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ebco Private Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ASSA ABLOY

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hexa Wood Pvt Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Salice India Pvt Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Hepo India Pvt Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 GRASS (an Austrian Manufacturer)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 KAFF

List of Figures

- Figure 1: India Furniture Hardware Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Furniture Hardware Market Share (%) by Company 2025

List of Tables

- Table 1: India Furniture Hardware Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Furniture Hardware Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: India Furniture Hardware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: India Furniture Hardware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: India Furniture Hardware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Furniture Hardware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Furniture Hardware Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Furniture Hardware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: India Furniture Hardware Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: India Furniture Hardware Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: India Furniture Hardware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: India Furniture Hardware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: India Furniture Hardware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Furniture Hardware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Furniture Hardware Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Furniture Hardware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Furniture Hardware Market?

The projected CAGR is approximately 15.49%.

2. Which companies are prominent players in the India Furniture Hardware Market?

Key companies in the market include KAFF, Kich Architectural Products Pvt Ltd**List Not Exhaustive, Denz Enterprise, FGV (Hindware Home Innovation Limited), Godrej & Boyce Manufacturing Company Limited, Hafele India Private Limited, Ozone Overseas Pvt Ltd, Blum India Pvt Ltd, Dorset Industries Pvt Ltd, Hettich India Pvt Ltd, Ebco Private Limited, ASSA ABLOY, Hexa Wood Pvt Ltd, Salice India Pvt Ltd, Hepo India Pvt Ltd, GRASS (an Austrian Manufacturer).

3. What are the main segments of the India Furniture Hardware Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Urban Expansion is Fueling Residential Construction. Spurring the Need for Furniture and Architectural Hardware; The Growth of Commercial Spaces like Offices and Hotels Bolsters the Demand for Furniture Hardware.

6. What are the notable trends driving market growth?

Increase in Residential Furniture Hardware is Fuelling the Market.

7. Are there any restraints impacting market growth?

The Market's High Sensitivity to Prices is Impacting the Adoption of Premium Hardware Solutions; Ensuring Consistent Quality Across Diverse Products and Suppliers Poses Challenges. Impacting Customer Satisfaction and Brand Loyalty.

8. Can you provide examples of recent developments in the market?

March 2024: Blum, an esteemed Austrian furniture fittings manufacturer, unveiled its latest distributor showroom, "Sliker India," in Jodhpur. This move further solidifies Blum India's extensive network, spanning 130 cities and boasting over 425 outlets nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Furniture Hardware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Furniture Hardware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Furniture Hardware Market?

To stay informed about further developments, trends, and reports in the India Furniture Hardware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence