Key Insights

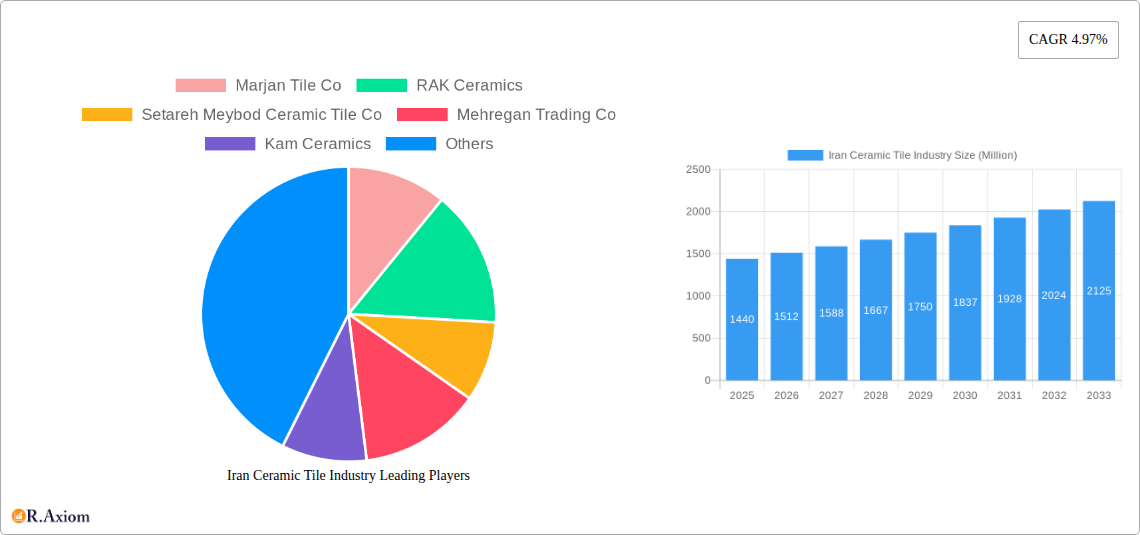

The Iranian ceramic tile industry is poised for significant growth, projected to reach a market size of $1.44 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.97% expected throughout the forecast period of 2025-2033. This expansion is fueled by a confluence of dynamic market drivers, including a burgeoning construction sector, government initiatives supporting infrastructure development, and increasing domestic demand for aesthetically pleasing and durable building materials. The country's rich history in ceramic production, coupled with advancements in manufacturing technology and design innovation, further propels this upward trajectory. The market is segmented into production, consumption, import, and export analyses, each offering a unique perspective on the industry's intricate dynamics. Production is likely to be dominated by domestic players, while consumption will be driven by both residential and commercial construction projects. Import and export activities, though subject to global economic conditions and trade policies, will play a crucial role in balancing supply and demand and in showcasing Iran's manufacturing prowess on the international stage.

Iran Ceramic Tile Industry Market Size (In Billion)

Several key trends are shaping the Iranian ceramic tile market. A notable trend is the increasing adoption of digital printing technology, allowing for intricate designs and realistic finishes that mimic natural materials like marble and wood. Sustainability is also gaining traction, with manufacturers focusing on eco-friendly production processes and the development of recyclable ceramic tiles. Furthermore, the demand for larger format tiles and specialized finishes, such as anti-slip and anti-bacterial surfaces, is on the rise, catering to evolving architectural and consumer preferences. However, the industry faces certain restraints, including fluctuations in raw material prices, potential import duties, and the need for continuous investment in modernization to remain competitive. Despite these challenges, the resilience of the Iranian construction sector and the strategic importance of this industry for job creation and economic contribution suggest a promising future for ceramic tile manufacturers in the region. Major players like Marjan Tile Co, RAK Ceramics, and Setareh Meybod Ceramic Tile Co are at the forefront of this evolving landscape, driving innovation and market expansion.

Iran Ceramic Tile Industry Company Market Share

This in-depth report offers an exhaustive analysis of the Iran Ceramic Tile Industry, covering historical data from 2019 to 2024, a base year of 2025, and an extensive forecast period from 2025 to 2033. The study delves into critical market segments including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, providing actionable insights for industry stakeholders, investors, and decision-makers. We meticulously examine market dynamics, technological advancements, regulatory landscapes, and emerging opportunities within this dynamic sector.

Iran Ceramic Tile Industry Market Concentration & Innovation

The Iran Ceramic Tile Industry exhibits a moderate level of market concentration, with a significant portion of production capacity held by a few key players. Innovation is a critical driver, fueled by increasing demand for aesthetically diverse and technologically advanced ceramic tiles. Key innovation drivers include the adoption of digital printing technologies for intricate designs, advancements in glaze formulations for enhanced durability and unique finishes, and a growing emphasis on eco-friendly manufacturing processes. The regulatory framework, while evolving, plays a crucial role in shaping production standards and trade policies. Potential product substitutes, such as vinyl flooring and natural stone, pose a competitive challenge, necessitating continuous product development and differentiation. End-user trends indicate a strong preference for durable, aesthetically pleasing, and low-maintenance tiling solutions across residential and commercial applications. Mergers and acquisitions (M&A) activities, while not extensively documented, are anticipated to increase as companies seek to expand their market reach and consolidate their positions. The estimated M&A deal values are projected to be in the range of tens to hundreds of million dollars, driven by strategic partnerships and consolidation efforts. Market share analysis reveals that the top 5 companies collectively hold approximately 40-50% of the domestic market share.

Iran Ceramic Tile Industry Industry Trends & Insights

The Iran Ceramic Tile Industry is poised for significant growth, driven by several interconnected trends. Robust domestic demand, particularly from the construction sector, continues to be a primary growth catalyst. This is further amplified by government initiatives aimed at boosting housing development and infrastructure projects, which directly translate into increased consumption of ceramic tiles. Technological disruptions are rapidly reshaping the production landscape. The adoption of advanced digital printing technologies, such as inkjet printing for intricate designs and high-resolution imagery, is becoming increasingly prevalent. This allows manufacturers to offer a wider variety of aesthetically appealing products, catering to diverse consumer preferences. Furthermore, advancements in glazing techniques are leading to the development of tiles with enhanced durability, scratch resistance, and antimicrobial properties. The shift towards sustainable production practices is another critical trend. As global environmental consciousness grows, Iranian manufacturers are investing in eco-friendly technologies and processes to reduce their carbon footprint and minimize waste. This includes the implementation of energy-efficient kilns and the use of recycled materials. Consumer preferences are evolving, with a growing demand for large-format tiles, natural stone look-alike tiles, and eco-friendly options. The competitive dynamics within the industry are intensifying, with both domestic and international players vying for market share. Companies are focusing on product differentiation, cost optimization, and strategic partnerships to gain a competitive edge. The estimated Compound Annual Growth Rate (CAGR) for the Iran Ceramic Tile Industry is projected to be between 6.5% and 7.5% over the forecast period. Market penetration is currently estimated at approximately 70% for essential tiling needs, with significant room for growth in premium and specialized segments.

Dominant Markets & Segments in Iran Ceramic Tile Industry

Production Analysis: The dominant region in Iran's ceramic tile production is the Central Plateau, owing to its abundant natural resources like clay and feldspar, and established industrial infrastructure. Provinces such as Yazd and Qom are key hubs, housing a significant number of large-scale manufacturing facilities. The primary production segment is dominated by floor tiles, accounting for approximately 55% of total production volume, driven by their widespread application in residential and commercial spaces. Wall tiles follow, representing around 35%, with decorative and specialty tiles making up the remaining 10%. Key drivers for production dominance include favorable government policies supporting industrial growth, access to raw materials, and the presence of a skilled labor force.

Consumption Analysis: The dominant market for ceramic tile consumption in Iran is the residential construction sector, accounting for an estimated 60% of total demand. Urban areas, with their rapidly developing infrastructure and housing projects, represent the largest consumption centers. The commercial construction segment, including retail spaces, offices, and hospitality venues, contributes approximately 30% to consumption. Infrastructure projects, such as airports, hospitals, and public facilities, make up the remaining 10%. Key drivers for consumption dominance include population growth, urbanization trends, increasing disposable incomes, and the aesthetic appeal and durability of ceramic tiles compared to alternatives.

Import Market Analysis (Value & Volume): While Iran is a significant producer, its import market, though smaller in volume, is driven by demand for highly specialized, premium, or technologically advanced ceramic tiles not readily available domestically. Value-wise, imports are dominated by high-end decorative tiles and specific types of porcelain stoneware, often sourced from European countries like Italy and Spain, known for their design innovation and quality. Volume-wise, imports are relatively modest, estimated at less than 1 Million tons annually, valued at approximately USD 80-100 Million. Key drivers for import dominance include the desire for imported brands, unique designs, and specialized applications where domestic production may not yet meet specific requirements.

Export Market Analysis (Value & Volume): Iran's export market for ceramic tiles is a crucial segment for industry growth. Key export destinations include neighboring countries in the Middle East, Central Asia, and parts of Africa. Volume-wise, exports are substantial, estimated to reach 50-60 Million square meters annually, valued at approximately USD 250-300 Million. Floor tiles and ceramic wall tiles constitute the majority of export volumes. Key drivers for export dominance include competitive pricing due to lower production costs, improving quality standards, strategic geographical location facilitating trade, and trade agreements with regional partners.

Price Trend Analysis: Price trends in the Iran Ceramic Tile Industry are influenced by several factors. Raw material costs, energy prices, and currency fluctuations are significant drivers. The domestic market price for standard ceramic floor tiles ranges from USD 5 to USD 15 per square meter, while wall tiles range from USD 4 to USD 12 per square meter. Premium and designer tiles can command prices upwards of USD 30 per square meter. For export markets, prices are generally more competitive, ranging from USD 3 to USD 10 per square meter, depending on the product type and destination. Key drivers for price trends include inflation, global commodity prices for raw materials like feldspar and kaolin, energy costs for kilns, and the exchange rate of the Iranian Rial.

Iran Ceramic Tile Industry Product Developments

Recent product developments in the Iran Ceramic Tile Industry are focusing on enhanced aesthetics, durability, and sustainability. Innovations in digital printing technology are enabling the creation of hyper-realistic textures, intricate patterns, and custom designs, mimicking natural materials like marble and wood with unprecedented fidelity. The introduction of larger format tiles is gaining traction, offering a seamless and modern look for both floors and walls. Advances in glaze technology are leading to the development of tiles with superior scratch resistance, stain repellency, and antimicrobial properties, catering to high-traffic areas and hygiene-conscious environments. Furthermore, there is a growing emphasis on eco-friendly tiles produced using recycled materials and energy-efficient manufacturing processes, aligning with global sustainability trends. These product developments are driven by a desire to meet evolving consumer preferences and to gain a competitive edge in both domestic and international markets.

Report Scope & Segmentation Analysis

The scope of this report encompasses a comprehensive analysis of the Iran Ceramic Tile Industry. The market is segmented across Production Analysis, detailing output volumes and capacities; Consumption Analysis, examining domestic demand across various end-use sectors; Import Market Analysis, quantifying incoming trade by value and volume; Export Market Analysis, assessing outgoing trade dynamics; and Price Trend Analysis, tracking price fluctuations and influencing factors. Growth projections for each segment are provided, with market sizes estimated in millions of dollars and tons. Competitive dynamics within each segment are scrutinized, highlighting key players and their market influence. The forecast period for these segments extends to 2033, offering a long-term perspective on market evolution.

Key Drivers of Iran Ceramic Tile Industry Growth

The Iran Ceramic Tile Industry's growth is propelled by a confluence of powerful drivers. A consistently strong demand from the burgeoning construction sector, fueled by urbanization and infrastructure development projects, forms the bedrock of this growth. Government support through favorable industrial policies and incentives further bolsters domestic production and investment. Technological advancements, particularly in digital printing and advanced glazing techniques, are enabling product innovation and diversification, leading to higher value-added offerings. The increasing affordability and aesthetic appeal of ceramic tiles compared to traditional materials like natural stone also contribute significantly. Furthermore, Iran's strategic geographical location provides a competitive advantage for export markets, opening avenues for international market penetration.

Challenges in the Iran Ceramic Tile Industry Sector

Despite its growth potential, the Iran Ceramic Tile Industry faces several significant challenges. Fluctuations in the global and domestic economic landscape, including currency volatility and inflation, can impact raw material costs and consumer purchasing power, creating price instability. Sanctions and international trade restrictions can limit access to essential imported raw materials, advanced machinery, and export markets. Energy price volatility poses a considerable challenge, as kilns are energy-intensive, directly impacting production costs. Intense competition, both from domestic players and international imports, necessitates continuous efforts in cost optimization and product differentiation. Supply chain disruptions, exacerbated by geopolitical factors, can affect the timely procurement of raw materials and the distribution of finished goods.

Emerging Opportunities in Iran Ceramic Tile Industry

The Iran Ceramic Tile Industry is ripe with emerging opportunities. The growing demand for sustainable and eco-friendly building materials presents a significant avenue for growth, encouraging investment in green manufacturing technologies. The rise of smart homes and modern architectural designs is creating demand for specialized tiles with enhanced functionalities, such as antimicrobial properties and integrated lighting. Expansion into untapped export markets in Africa and Southeast Asia, leveraging competitive pricing and product quality, offers substantial growth potential. The increasing focus on renovation and refurbishment projects within existing urban infrastructure also presents a consistent demand stream. Furthermore, fostering collaborations with international technology providers can accelerate the adoption of cutting-edge production techniques and product innovations.

Leading Players in the Iran Ceramic Tile Industry Market

- Marjan Tile Co

- RAK Ceramics

- Setareh Meybod Ceramic Tile Co

- Mehregan Trading Co

- Kam Ceramics

- Sina Tile and Ceramic co

- Ardakan Industrial Ceramics Co

- Saba Tile

- Ceramara Co

Key Developments in Iran Ceramic Tile Industry Industry

- May 2023: Durst and Altadia Group unveiled a strategic collaboration aimed at spearheading product innovation in the ceramic sector, with Durst set to deploy advanced digital printing and glazing technology at Esmalglass's technology center.

- August 2022: RAK Ceramics invested approximately USD 1.23 Million in state-of-the-art manufacturing technologies and sustainability programs, emphasizing sustainable production to meet growing demand for distinctive and sustainable ceramic floor tiles.

Strategic Outlook for Iran Ceramic Tile Industry Market

The strategic outlook for the Iran Ceramic Tile Industry is one of sustained growth and innovation. The industry is well-positioned to capitalize on the robust domestic demand driven by infrastructure development and housing needs. A key strategic focus will be on further technological adoption, particularly in digital printing and sustainable manufacturing, to enhance product offerings and competitiveness. Expanding export reach into new geographical markets and strengthening existing trade relationships will be crucial for market diversification. Companies that prioritize innovation, cost efficiency, and sustainability will likely gain a significant competitive advantage. The industry's ability to navigate economic uncertainties and adapt to evolving global trends will be paramount to its continued success.

Iran Ceramic Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Ceramic Tile Industry Segmentation By Geography

- 1. Iran

Iran Ceramic Tile Industry Regional Market Share

Geographic Coverage of Iran Ceramic Tile Industry

Iran Ceramic Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending on Home Renovations and Luxury Bathroom Fittings Driving the Market Growth; Increasing Government Spending on Infrastructure Projects including Residential and Commercial Buildings Boosting the Market

- 3.3. Market Restrains

- 3.3.1. Highly Competitive Market with Numerous Local and International Players; Volatility in the Prices of Raw Materials Used in the Production of Ceramic Tiles

- 3.4. Market Trends

- 3.4.1. Rising Construction Activity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Ceramic Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marjan Tile Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RAK Ceramics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Setareh Meybod Ceramic Tile Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mehregan Trading Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kam Ceramics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sina Tile and Ceramic co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ardakan Industrial Ceramics Co**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saba Tile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ceramara Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Marjan Tile Co

List of Figures

- Figure 1: Iran Ceramic Tile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iran Ceramic Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: Iran Ceramic Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Iran Ceramic Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Iran Ceramic Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Iran Ceramic Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Iran Ceramic Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Iran Ceramic Tile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Iran Ceramic Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Iran Ceramic Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Iran Ceramic Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Iran Ceramic Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Iran Ceramic Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Iran Ceramic Tile Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Ceramic Tile Industry?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Iran Ceramic Tile Industry?

Key companies in the market include Marjan Tile Co, RAK Ceramics, Setareh Meybod Ceramic Tile Co, Mehregan Trading Co, Kam Ceramics, Sina Tile and Ceramic co, Ardakan Industrial Ceramics Co**List Not Exhaustive, Saba Tile, Ceramara Co.

3. What are the main segments of the Iran Ceramic Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending on Home Renovations and Luxury Bathroom Fittings Driving the Market Growth; Increasing Government Spending on Infrastructure Projects including Residential and Commercial Buildings Boosting the Market.

6. What are the notable trends driving market growth?

Rising Construction Activity is Driving the Market.

7. Are there any restraints impacting market growth?

Highly Competitive Market with Numerous Local and International Players; Volatility in the Prices of Raw Materials Used in the Production of Ceramic Tiles.

8. Can you provide examples of recent developments in the market?

In May 2023, Durst and Altadia Group have recently unveiled a strategic collaboration aimed at spearheading product innovation in the ceramic sector. In a notable move, Durst is set to deploy its cutting-edge technology, including the Gamma DG digital glazing machine and the Durst Gamma XD digital tile printer, at Esmalglass's technology center in Sassuolo. Esmalglass, a global leader in frits, glazes, colors, and inks for the ceramic industry, owns the center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Ceramic Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Ceramic Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Ceramic Tile Industry?

To stay informed about further developments, trends, and reports in the Iran Ceramic Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence