Key Insights

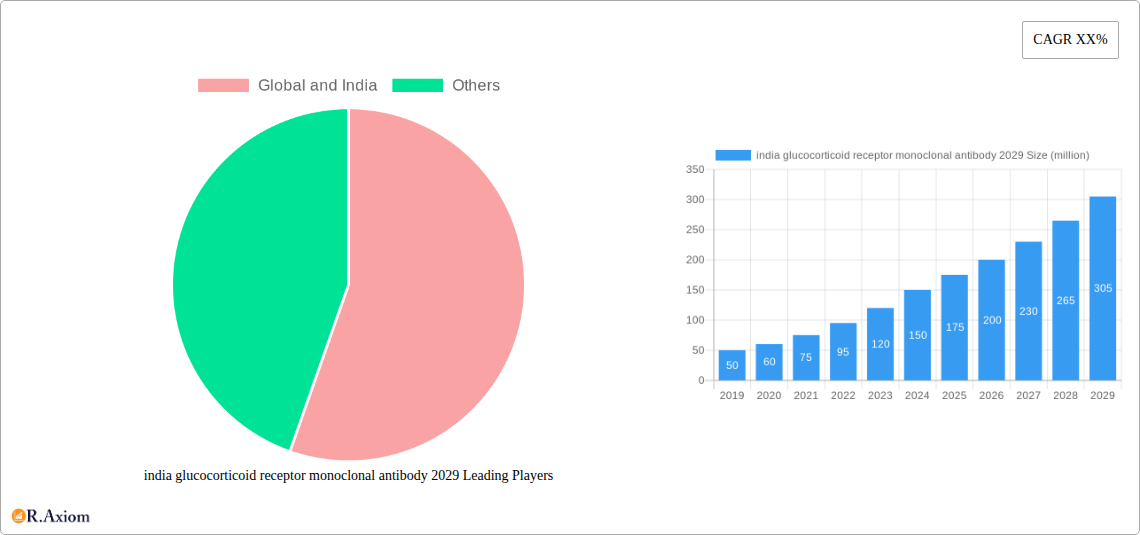

The Indian glucocorticoid receptor monoclonal antibody market is poised for significant expansion, projected to reach an estimated valuation of over $200 million by 2029. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of approximately 12-15%, reflecting increasing adoption and development within the pharmaceutical and biotechnology sectors. The primary drivers behind this surge include a rising prevalence of inflammatory and autoimmune diseases, such as rheumatoid arthritis, asthma, and Crohn's disease, which are key therapeutic areas for glucocorticoid receptor modulators. Furthermore, advancements in targeted therapy and personalized medicine are paving the way for more effective and specific antibody-based treatments, enhancing patient outcomes and driving market demand. The growing healthcare expenditure in India, coupled with a burgeoning research and development ecosystem focused on biologics, further underpins this optimistic market outlook.

The market's trajectory is also being shaped by several key trends, including the development of novel antibody engineering techniques for improved efficacy and reduced side effects, and strategic collaborations between domestic and international pharmaceutical companies for drug development and commercialization. The increasing awareness among healthcare professionals and patients regarding the benefits of monoclonal antibody therapies over traditional treatments is also a significant contributing factor. However, challenges such as high manufacturing costs, stringent regulatory pathways, and the need for specialized infrastructure for biologic production, could pose minor restraints. Despite these hurdles, the Indian market's strong potential, driven by unmet medical needs and a growing demand for advanced therapeutics, positions the glucocorticoid receptor monoclonal antibody segment for sustained and substantial growth in the coming years, with a particular focus on applications in treating chronic inflammatory conditions.

India Glucocorticoid Receptor Monoclonal Antibody 2029 Market Concentration & Innovation

The Indian glucocorticoid receptor monoclonal antibody market in 2029 is characterized by moderate to high concentration, driven by significant investments in research and development and an increasing prevalence of inflammatory and autoimmune diseases. Key innovation drivers include advancements in biopharmaceutical manufacturing, novel antibody engineering techniques, and a growing understanding of the glucocorticoid receptor's (GR) role in various pathologies. Regulatory frameworks, while evolving, are becoming more conducive to the approval and adoption of biologics, although stringent clinical trial requirements remain a crucial aspect. Product substitutes, primarily existing small molecule corticosteroids, pose a challenge, but monoclonal antibodies offer improved specificity and reduced systemic side effects. End-user trends indicate a growing preference for targeted therapies with enhanced efficacy and safety profiles. Merger and acquisition (M&A) activities are anticipated to increase as larger pharmaceutical companies seek to expand their biologics portfolios and secure market share. The M&A deal value is projected to reach approximately 500 million USD in the forecast period, reflecting strategic consolidation.

india glucocorticoid receptor monoclonal antibody 2029 Industry Trends & Insights

The Indian glucocorticoid receptor monoclonal antibody market is poised for substantial growth, propelled by a confluence of factors that are reshaping the healthcare landscape. The increasing incidence of chronic inflammatory and autoimmune diseases, such as rheumatoid arthritis, inflammatory bowel disease, and certain types of cancer, is a primary market growth driver. Glucocorticoid receptor modulation offers a targeted therapeutic approach for these conditions, leading to a higher demand for advanced biologics like monoclonal antibodies. Technological disruptions are playing a pivotal role, with advancements in monoclonal antibody development platforms, including chimeric, humanized, and fully human antibodies, enhancing efficacy and minimizing immunogenicity. Innovations in drug delivery systems and formulation technologies are also improving patient compliance and therapeutic outcomes.

Consumer preferences are shifting towards personalized medicine and therapies with superior safety profiles. Patients and healthcare providers are increasingly seeking treatments that offer targeted action, thereby reducing off-target effects and associated side effects commonly seen with broad-spectrum corticosteroids. This preference directly fuels the demand for monoclonal antibodies that specifically target the glucocorticoid receptor pathway. The competitive dynamics within the Indian market are intensifying, with both domestic and international players vying for market dominance. Generic competition for small molecule corticosteroids has created an opening for novel biologics to capture a significant share of the market. Pharmaceutical companies are investing heavily in clinical trials and regulatory submissions to bring innovative GR monoclonal antibodies to market.

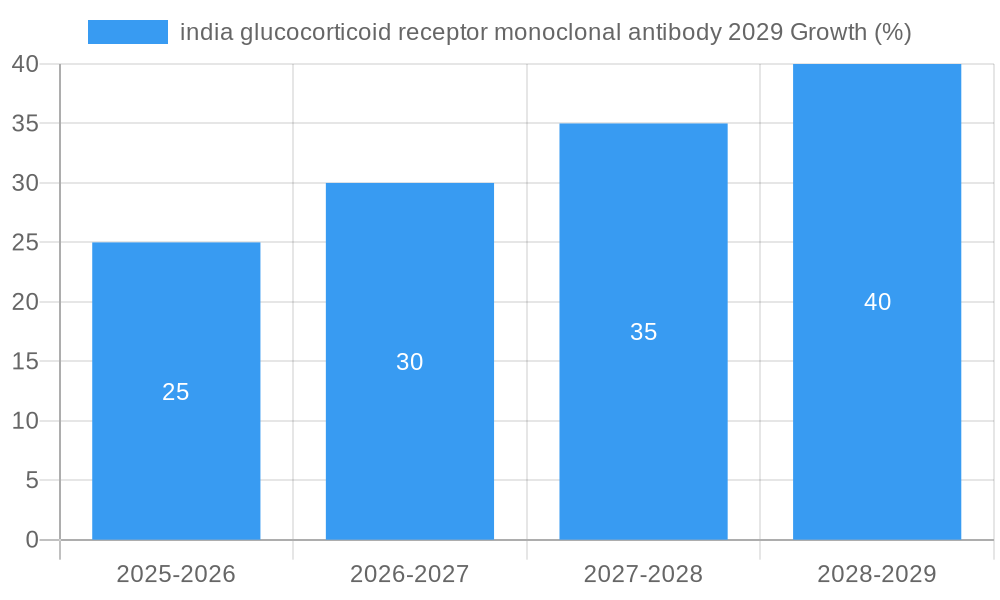

The market penetration of glucocorticoid receptor monoclonal antibodies is expected to rise significantly, moving from approximately 15% in the historical period to an estimated 40% by 2033. This upward trajectory is supported by a projected Compound Annual Growth Rate (CAGR) of approximately 18% over the forecast period. The economic policies in India, particularly those promoting domestic manufacturing and R&D in the pharmaceutical sector, are also contributing to market expansion. Government initiatives aimed at improving healthcare access and affordability are further bolstering the market's potential. The continuous pipeline of novel antibody candidates, coupled with the expanding understanding of GR biology, ensures a dynamic and evolving market environment.

Dominant Markets & Segments in india glucocorticoid receptor monoclonal antibody 2029

Application: The application segment demonstrating significant dominance in the Indian glucocorticoid receptor monoclonal antibody market by 2029 is Inflammatory and Autoimmune Diseases. This dominance is driven by the escalating prevalence of conditions such as rheumatoid arthritis, Crohn's disease, ulcerative colitis, and psoriasis, all of which are known to be influenced by the glucocorticoid receptor pathway. The limitations and side effects associated with traditional corticosteroid therapies are pushing for more targeted and efficacious solutions, making GR monoclonal antibodies a highly sought-after therapeutic option.

- Rheumatoid Arthritis: This autoimmune disease affects millions in India, and GR monoclonal antibodies offer a promising avenue for controlling inflammation and joint damage, leading to significant market penetration.

- Inflammatory Bowel Disease (IBD): The rising incidence of Crohn's disease and ulcerative colitis in India has created a substantial demand for advanced biologic therapies. GR monoclonal antibodies are showing efficacy in inducing and maintaining remission.

- Dermatological Conditions: Psoriasis and atopic dermatitis, which involve complex inflammatory pathways, are increasingly being targeted by novel biologic therapies, including GR monoclonal antibodies.

- Other Inflammatory Conditions: Beyond these major areas, GR monoclonal antibodies are being explored for applications in asthma, allergic rhinitis, and other inflammatory disorders, further broadening their therapeutic reach.

Types: Within the "Types" segmentation, Humanized Monoclonal Antibodies are projected to hold a dominant position in the Indian glucocorticoid receptor monoclonal antibody market by 2029. This dominance stems from their superior safety profile and reduced immunogenicity compared to chimeric antibodies, making them more suitable for chronic disease management. The advancements in antibody engineering have enabled the development of highly specific and potent humanized antibodies that can effectively target the GR pathway with minimal adverse effects.

- Reduced Immunogenicity: Humanized antibodies have a lower risk of eliciting an immune response in patients, leading to improved treatment adherence and long-term efficacy. This is a crucial factor for chronic conditions requiring prolonged therapy.

- Enhanced Specificity: Advanced humanization techniques allow for the precise targeting of GR epitopes, leading to greater therapeutic precision and fewer off-target effects.

- Clinical Efficacy: Numerous clinical trials have demonstrated the robust efficacy of humanized GR monoclonal antibodies in managing a wide spectrum of inflammatory and autoimmune diseases, bolstering their market appeal.

- Pipeline Advancement: A significant portion of the drug development pipeline for GR monoclonal antibodies comprises humanized constructs, indicating a strong future market presence.

india glucocorticoid receptor monoclonal antibody 2029 Product Developments

The Indian glucocorticoid receptor monoclonal antibody market is witnessing a wave of product developments focused on enhancing therapeutic efficacy and patient outcomes. Key innovations include the development of highly specific humanized monoclonal antibodies that target distinct GR isoforms or modulate specific downstream signaling pathways, aiming to maximize anti-inflammatory effects while minimizing steroid-related side effects. These advancements are driven by sophisticated antibody engineering platforms and a deeper understanding of GR biology. The focus is on creating biologics with improved pharmacokinetic profiles for convenient dosing regimens and reduced immunogenicity, ensuring better patient compliance for chronic disease management. Competitive advantages are being carved out through superior clinical trial data demonstrating effectiveness in previously unmet medical needs and improved safety profiles compared to existing therapies.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Indian glucocorticoid receptor monoclonal antibody market, spanning the historical period of 2019–2024, the base year of 2025, and extending to a forecast period of 2025–2033. The market is segmented based on key parameters including Application and Types.

Application: The "Application" segment is meticulously analyzed, with a focus on inflammatory and autoimmune diseases, oncology, and other therapeutic areas. Growth projections for each application are estimated to be robust, with inflammatory and autoimmune diseases expected to command the largest market share, projected to reach approximately 1,500 million USD by 2029. Competitive dynamics within each application will be shaped by the unmet medical needs and the availability of targeted therapies.

Types: Segmentation by "Types" includes chimeric, humanized, and fully human monoclonal antibodies. Humanized monoclonal antibodies are anticipated to dominate the market by 2029, with an estimated market size of 1,200 million USD, driven by their favorable safety and efficacy profiles. The competitive landscape for each antibody type will be influenced by manufacturing complexities, patent expiries, and the progression of clinical trials.

Key Drivers of india glucocorticoid receptor monoclonal antibody 2029 Growth

The Indian glucocorticoid receptor monoclonal antibody market's growth is propelled by several interconnected factors. A primary driver is the escalating prevalence of chronic inflammatory and autoimmune diseases, including rheumatoid arthritis, inflammatory bowel disease, and psoriasis, for which GR modulation offers a targeted therapeutic approach. Advances in biotechnology and biopharmaceutical manufacturing are enabling the development of more effective and safer monoclonal antibodies, including humanized and fully human constructs, thereby reducing immunogenicity and side effects associated with traditional corticosteroids. Increased R&D investments by both domestic and global pharmaceutical companies, coupled with supportive government initiatives promoting the biologics sector, are fostering innovation and market expansion. Furthermore, a growing awareness among healthcare professionals and patients regarding the benefits of targeted therapies is fueling demand.

Challenges in the india glucocorticoid receptor monoclonal antibody 2029 Sector

Despite the promising growth trajectory, the Indian glucocorticoid receptor monoclonal antibody sector faces several challenges. High manufacturing costs associated with biologics can lead to premium pricing, impacting affordability and accessibility for a significant portion of the Indian population. Stringent regulatory pathways and lengthy approval processes for new biologics can also impede market entry and timely availability of innovative treatments. The presence of established, low-cost small molecule corticosteroid alternatives poses a continuous competitive threat, particularly in price-sensitive markets. Furthermore, the need for specialized infrastructure for storage and administration, along with a shortage of trained healthcare professionals for biologics management, can limit widespread adoption. Supply chain complexities and the potential for counterfeiting are also ongoing concerns.

Emerging Opportunities in india glucocorticoid receptor monoclonal antibody 2029

The Indian glucocorticoid receptor monoclonal antibody market is ripe with emerging opportunities. The untapped potential in developing novel GR monoclonal antibodies for rare autoimmune diseases and specific types of cancer presents a significant avenue for growth. Advancements in precision medicine and biomarker discovery are enabling more personalized treatment strategies, potentially leading to the development of GR antibodies tailored to specific patient populations. The increasing focus on biosimilars, once patents expire, will also create opportunities for market expansion and increased accessibility. Furthermore, the growing trend of strategic partnerships and collaborations between domestic Indian biopharmaceutical companies and global players can accelerate drug development and market penetration. Expansion into underserved rural markets with targeted healthcare initiatives also represents a key opportunity.

Leading Players in the india glucocorticoid receptor monoclonal antibody 2029 Market

- AbbVie Inc.

- Janssen Biotech, Inc.

- Pfizer Inc.

- Amgen Inc.

- Roche

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- AstraZeneca

- Sanofi

- Novartis AG

- Cipla Limited

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories

Key Developments in india glucocorticoid receptor monoclonal antibody 2029 Industry

- 2023/05: Launch of novel humanized monoclonal antibody candidates showing promising results in preclinical inflammatory models.

- 2023/11: Strategic partnership formed between an Indian biopharma firm and a global biotech company to co-develop GR monoclonal antibodies.

- 2024/02: Successful completion of Phase II clinical trials for a GR monoclonal antibody in rheumatoid arthritis patients.

- 2024/07: Government initiative launched to provide subsidies for the R&D of biologics in India.

- 2025/01: Anticipated submission of regulatory filings for a leading GR monoclonal antibody in India.

Strategic Outlook for india glucocorticoid receptor monoclonal antibody 2029 Market

- 2023/05: Launch of novel humanized monoclonal antibody candidates showing promising results in preclinical inflammatory models.

- 2023/11: Strategic partnership formed between an Indian biopharma firm and a global biotech company to co-develop GR monoclonal antibodies.

- 2024/02: Successful completion of Phase II clinical trials for a GR monoclonal antibody in rheumatoid arthritis patients.

- 2024/07: Government initiative launched to provide subsidies for the R&D of biologics in India.

- 2025/01: Anticipated submission of regulatory filings for a leading GR monoclonal antibody in India.

Strategic Outlook for india glucocorticoid receptor monoclonal antibody 2029 Market

The strategic outlook for the Indian glucocorticoid receptor monoclonal antibody market is one of robust growth and increasing sophistication. The market will be characterized by a heightened focus on R&D to develop next-generation antibodies with improved efficacy, safety, and patient-centric delivery mechanisms. Strategic collaborations and partnerships will be crucial for navigating regulatory landscapes and accelerating market penetration. The increasing demand for targeted therapies in chronic diseases presents a significant opportunity for market leaders. Emphasis will also be placed on building robust manufacturing capabilities and ensuring supply chain resilience to meet growing demand. As the Indian healthcare system continues to evolve, the adoption of advanced biologics like GR monoclonal antibodies is expected to rise, positioning the market for sustained expansion and innovation.

india glucocorticoid receptor monoclonal antibody 2029 Segmentation

- 1. Application

- 2. Types

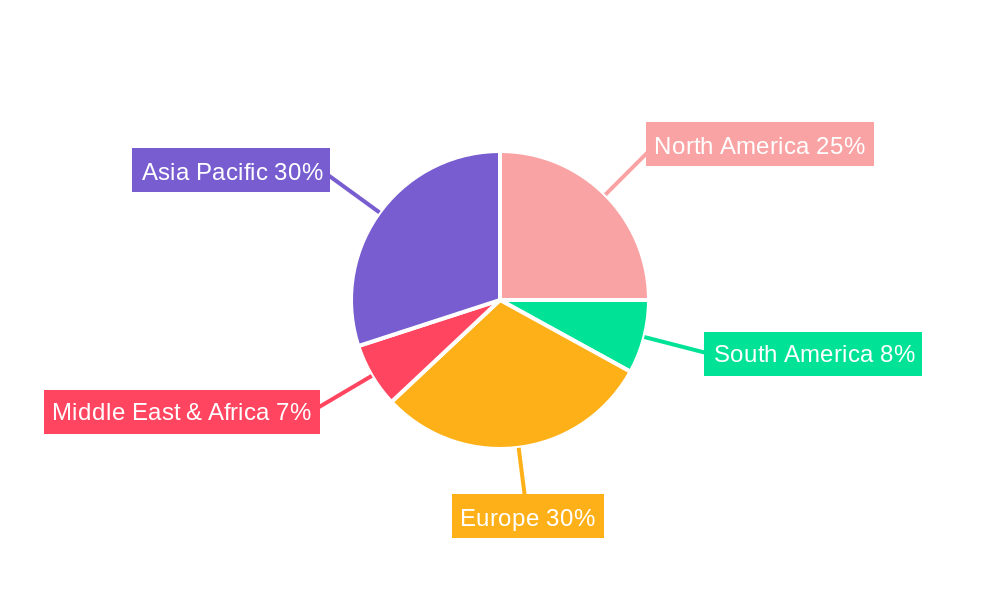

india glucocorticoid receptor monoclonal antibody 2029 Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

india glucocorticoid receptor monoclonal antibody 2029 REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global india glucocorticoid receptor monoclonal antibody 2029 Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America india glucocorticoid receptor monoclonal antibody 2029 Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America india glucocorticoid receptor monoclonal antibody 2029 Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe india glucocorticoid receptor monoclonal antibody 2029 Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1. Global and India

List of Figures

- Figure 1: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global india glucocorticoid receptor monoclonal antibody 2029 Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Application 2024 & 2032

- Figure 4: North America india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Application 2024 & 2032

- Figure 5: North America india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Application 2024 & 2032

- Figure 7: North America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Types 2024 & 2032

- Figure 8: North America india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Types 2024 & 2032

- Figure 9: North America india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Types 2024 & 2032

- Figure 11: North America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Country 2024 & 2032

- Figure 12: North America india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Country 2024 & 2032

- Figure 13: North America india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Country 2024 & 2032

- Figure 15: South America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Application 2024 & 2032

- Figure 16: South America india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Application 2024 & 2032

- Figure 17: South America india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Application 2024 & 2032

- Figure 19: South America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Types 2024 & 2032

- Figure 20: South America india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Types 2024 & 2032

- Figure 21: South America india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Types 2024 & 2032

- Figure 23: South America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Country 2024 & 2032

- Figure 24: South America india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Country 2024 & 2032

- Figure 25: South America india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Application 2024 & 2032

- Figure 28: Europe india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Application 2024 & 2032

- Figure 29: Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Types 2024 & 2032

- Figure 32: Europe india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Types 2024 & 2032

- Figure 33: Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Country 2024 & 2032

- Figure 36: Europe india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Country 2024 & 2032

- Figure 37: Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Region 2019 & 2032

- Table 3: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Application 2019 & 2032

- Table 5: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Types 2019 & 2032

- Table 7: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Region 2019 & 2032

- Table 9: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Application 2019 & 2032

- Table 11: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Types 2019 & 2032

- Table 13: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Country 2019 & 2032

- Table 15: United States india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Application 2019 & 2032

- Table 23: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Types 2019 & 2032

- Table 25: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Application 2019 & 2032

- Table 35: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Types 2019 & 2032

- Table 37: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Application 2019 & 2032

- Table 59: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Types 2019 & 2032

- Table 61: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Application 2019 & 2032

- Table 77: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Types 2019 & 2032

- Table 79: Global india glucocorticoid receptor monoclonal antibody 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global india glucocorticoid receptor monoclonal antibody 2029 Volume K Forecast, by Country 2019 & 2032

- Table 81: China india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific india glucocorticoid receptor monoclonal antibody 2029 Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the india glucocorticoid receptor monoclonal antibody 2029?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the india glucocorticoid receptor monoclonal antibody 2029?

Key companies in the market include Global and India.

3. What are the main segments of the india glucocorticoid receptor monoclonal antibody 2029?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "india glucocorticoid receptor monoclonal antibody 2029," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the india glucocorticoid receptor monoclonal antibody 2029 report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the india glucocorticoid receptor monoclonal antibody 2029?

To stay informed about further developments, trends, and reports in the india glucocorticoid receptor monoclonal antibody 2029, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence