Key Insights

The India Metal Fabrication Market is projected for substantial growth, driven by robust expansion in the construction, automotive, and manufacturing sectors. Key growth drivers include government infrastructure development initiatives, increasing urbanization, and industrialization. Technological advancements such as laser cutting, robotic welding, and 3D printing are enhancing efficiency and innovation. Despite challenges like fluctuating raw material prices and skilled labor shortages, the market outlook remains positive. Leading contributors include Salasar Techno Engineering Ltd, Kirby Building Systems, and Zamil Industrial Investment Co. The demand for lightweight, high-strength metal components in aerospace and renewable energy further fuels market dynamism.

India Metal Fabrication Market Market Size (In Billion)

The competitive landscape features established firms enhancing production capacity and supply chains, alongside agile emerging enterprises targeting niche segments. This dynamic interplay anticipates continued growth and evolving market opportunities for both domestic and international participants. The forecast period indicates significant expansion through organic growth and strategic acquisitions, solidifying the market's contribution to India's industrial sector.

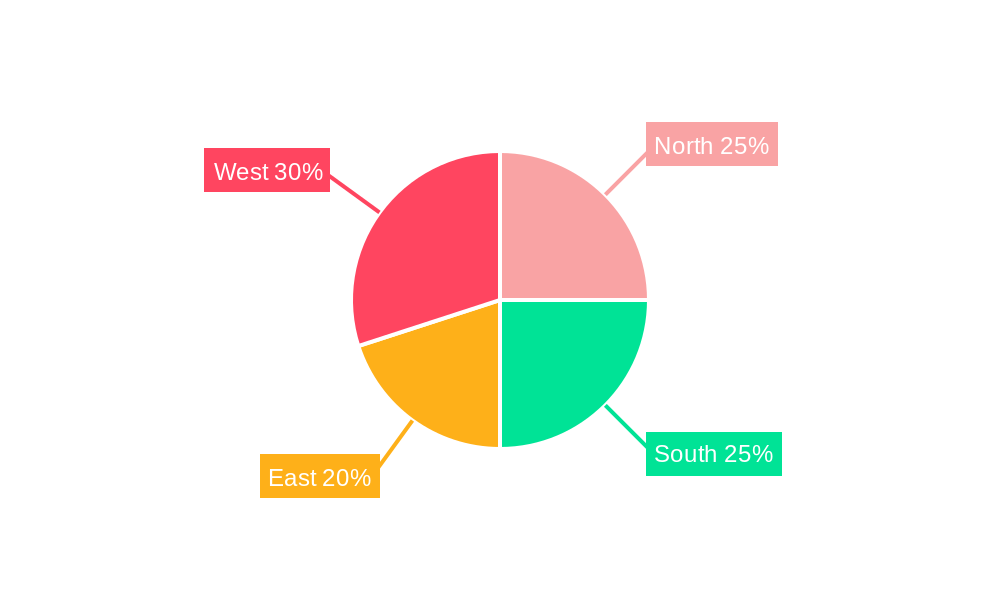

India Metal Fabrication Market Company Market Share

This report delivers a detailed analysis of the India Metal Fabrication Market, providing actionable insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, the study utilizes historical data (2019-2024) to predict future trends. The analysis includes market size estimations, key segment examination, leading player identification, and emerging opportunities.

The India metal fabrication market is expected to reach a size of $2.91 billion by 2033, expanding at a compound annual growth rate (CAGR) of 5.27% from the base year 2025.

India Metal Fabrication Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian metal fabrication market, exploring market concentration, innovation drivers, regulatory influences, and recent M&A activities. The market exhibits a moderately concentrated structure, with a few large players commanding significant market share. However, several smaller, specialized firms also contribute significantly. Key players include: Salasar Techno Engineering Ltd, Kirby Building Systems, Zamil Industrial Investment Co, Pennar Group, ISGEC Heavy Engineering Ltd, Godrej Process Equipment, TEMA India, Larsen & Toubro Ltd, Diamond Group, Novatech Projects (India) Private Limited, SKV Engineering India Pvt LTD, Karamtara Engineering Pvt Ltd, and 63 other companies.

Market Concentration: The top 5 players hold an estimated xx% market share (2024), indicative of a moderately consolidated market. Further analysis reveals a Herfindahl-Hirschman Index (HHI) of xx, suggesting moderate competition.

Innovation Drivers: Government initiatives promoting "Make in India" and infrastructure development are significant drivers. Technological advancements in automation, robotics, and 3D printing are transforming fabrication processes, improving efficiency and quality.

Regulatory Framework: Government regulations regarding safety, environmental standards, and labor laws impact operational costs and innovation strategies. Compliance costs contribute to higher fabrication prices and can stifle smaller firms.

Product Substitutes: While metal fabrication is dominant, the emergence of alternative materials such as composites and advanced polymers represents a gradual, yet growing, substitute threat.

End-User Trends: The construction, automotive, and renewable energy sectors are key end-users, with demand fluctuating according to economic cycles and government spending. Increasing demand for sustainable building materials and lightweight vehicles is driving innovation in metal fabrication techniques.

M&A Activities: The past five years have witnessed xx M&A deals in the Indian metal fabrication sector, with a total estimated value of xx Million. These activities reflect consolidation efforts and attempts to gain access to new technologies and markets.

India Metal Fabrication Market Industry Trends & Insights

The Indian metal fabrication market is experiencing robust growth, driven by a combination of factors. The country's expanding infrastructure development, a burgeoning automotive sector, and rising demand for consumer durables are key growth drivers. Technological disruptions, such as the adoption of advanced manufacturing technologies and automation, are further enhancing productivity and efficiency. Consumer preference for customized and high-quality products is driving innovation in design and fabrication techniques. However, competitive dynamics remain intense, with established players facing challenges from both domestic and international competitors.

Market Growth: The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million by 2033. This growth is primarily fueled by the robust growth of the construction and manufacturing sectors.

Technological Disruptions: The integration of AI, machine learning, and automation technologies is transforming the sector, leading to improved precision, reduced waste, and increased production capacity. 3D printing is also emerging as a promising technology for customized fabrication.

Market Penetration: The market penetration of advanced technologies remains relatively low, offering significant potential for future growth. The adoption of Industry 4.0 technologies is expected to accelerate in the coming years.

Competitive Dynamics: The market is characterized by intense competition among both domestic and international players. Price competition and differentiation through quality and innovation are crucial factors for success.

Dominant Markets & Segments in India Metal Fabrication Market

The Indian metal fabrication market exhibits significant regional variations in growth and dynamics. While precise granular data is still developing, preliminary observations highlight the Western and Southern regions as key hubs. This concentration is primarily attributed to their established industrial ecosystems and ongoing large-scale infrastructure development projects.

-

Factors Influencing Regional Dominance:

-

Pro-Industry Government Policies: Targeted government initiatives, including economic stimulus packages, tax incentives, and streamlined regulatory frameworks, actively encourage investment and expansion, thereby shaping regional market leadership.

-

Advanced Infrastructure Networks: Regions boasting well-developed transportation logistics, reliable energy supply, and proximity to essential resources are inherently more attractive for metal fabrication enterprises, facilitating efficient operations and market access.

-

Availability of a Skilled Workforce: A strong presence of technical educational institutions and a readily available pool of skilled engineers and technicians provide a crucial competitive edge, ensuring the capacity for complex fabrication processes.

-

The market is broadly segmented by material (including steel, aluminum, stainless steel, and others), fabrication processes (such as cutting, bending, forming, welding, and finishing), and end-use industries (spanning construction, automotive, machinery, energy, and various other sectors). While detailed regional segmentation will be elaborated in the full report, steel fabrication currently commands the largest market share, largely propelled by its extensive application in India's ongoing infrastructure development and construction boom.

India Metal Fabrication Market Product Developments

The Indian metal fabrication market is witnessing continuous product innovation, driven by technological advancements and evolving customer needs. This includes the development of high-strength, lightweight materials, improved fabrication processes, and the integration of smart technologies. Companies are focusing on delivering customized solutions tailored to specific industry needs, enhancing product performance, and reducing production costs. The trend toward sustainable manufacturing practices is also driving innovation in materials and processes.

Report Scope & Segmentation Analysis

This comprehensive report delves into the intricacies of the India Metal Fabrication Market. It offers a granular segmentation by material type (steel, aluminum, stainless steel, others), fabrication process (cutting, bending, forming, welding, finishing), application (construction, automotive, machinery, energy, others), and geographic region (North, South, East, West). For each meticulously defined segment, the report analyzes its projected growth trajectory, estimated market size, and prevailing competitive dynamics. Detailed growth projections are provided for each segment throughout the forecast period (2025-2033). Furthermore, the competitive landscape within each segment is examined in depth to offer strategic insights.

Key Drivers of India Metal Fabrication Market Growth

The India Metal Fabrication Market is experiencing robust expansion, fueled by a dynamic interplay of factors. The government's unwavering commitment to infrastructure enhancement, epitomized by initiatives like "Make in India," serves as a primary catalyst. This is complemented by the sustained high growth rates observed in the construction and automotive sectors. The burgeoning demand for consumer durables and the increasing adoption of sophisticated manufacturing technologies further contribute to market acceleration. The rapidly expanding renewable energy sector, particularly solar and wind power, is generating substantial demand for fabricated components. Moreover, supportive government policies and targeted incentives continue to foster an environment conducive to investment and industrial growth.

Challenges in the India Metal Fabrication Market Sector

Despite its promising growth trajectory, the Indian metal fabrication market navigates several significant challenges. Volatility in raw material prices poses a constant concern, impacting cost predictability. The complex and evolving regulatory landscape can create administrative hurdles. Furthermore, supply chain disruptions, often exacerbated by external factors, can impede production schedules. Stringent environmental regulations, while necessary, can lead to increased operational expenditures. Intense market competition and a persistent shortage of skilled labor also present significant constraints. The substantial capital investment required for the adoption of advanced automation technologies remains a barrier, particularly for small and medium-sized enterprises (SMEs), limiting their ability to embrace cutting-edge solutions.

Emerging Opportunities in India Metal Fabrication Market

The future of the India Metal Fabrication Market is bright with numerous emerging opportunities. The accelerating growth of the renewable energy sector presents a significant avenue for expansion. The automotive industry's increasing focus on lightweight and high-strength materials is driving demand for specialized fabrication. The transformative potential of 3D printing (additive manufacturing) promises to revolutionize customized fabrication, enabling intricate designs and on-demand production. The expanding reach of e-commerce and the proliferation of online marketplaces offer new avenues for metal fabrication companies to broaden their market presence. A growing emphasis on sustainable and green fabrication techniques is also paving the way for innovative solutions and eco-conscious market differentiation.

Leading Players in the India Metal Fabrication Market Market

- Salasar Techno Engineering Ltd

- Kirby Building Systems

- Zamil Industrial Investment Co

- Pennar Group

- ISGEC Heavy Engineering Ltd

- Godrej Process Equipment

- TEMA India

- Larsen & Toubro Ltd

- Diamond Group

- Novatech Projects (India) Private Limited

- SKV Engineering India Pvt LTD

- Karamtara Engineering Pvt Ltd

- 63 Other Companies

Key Developments in India Metal Fabrication Market Industry

October 2023: JSP's Angul steel plant expansion plans (5.6 mtpa to 24 mtpa by 2027) signal significant growth in steel production capacity, impacting raw material availability and market dynamics for metal fabricators. The plant's trial production completion and projected commercial production by 2024 represents a considerable injection of capacity within the industry.

July 2023: The MoU between ArcelorMittal Nippon Steel India and Festo India for the development of NAMTECH highlights a focus on advanced skills development, which is crucial for the growth and technological advancement of the metal fabrication sector. This initiative could potentially enhance the availability of a skilled workforce, improving productivity and innovation within the industry.

Strategic Outlook for India Metal Fabrication Market Market

The Indian metal fabrication market holds immense potential for growth, driven by sustained infrastructure development, industrial expansion, and technological innovation. Strategic partnerships, investments in advanced technologies, and a focus on sustainability are crucial for success. Companies that can adapt to evolving market dynamics, embrace Industry 4.0 technologies, and cater to the increasing demand for customized and high-quality products will be well-positioned to capture significant market share in the years to come. The growth of the renewable energy sector and the increasing focus on lightweighting across various industries will also provide significant opportunities for market participants.

India Metal Fabrication Market Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Utilities

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

- 2.3. Other Material Types

-

3. Service Type

- 3.1. Casting

- 3.2. Forging

- 3.3. Machining

- 3.4. Welding and Tubing

- 3.5. Other Services

India Metal Fabrication Market Segmentation By Geography

- 1. India

India Metal Fabrication Market Regional Market Share

Geographic Coverage of India Metal Fabrication Market

India Metal Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market

- 3.4. Market Trends

- 3.4.1. Manufacturing Sector is Shaping the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Metal Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Utilities

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Casting

- 5.3.2. Forging

- 5.3.3. Machining

- 5.3.4. Welding and Tubing

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Salasar Techno Engineering Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kirby Building Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zamil Industrial Investment Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pennar Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ISGEC Heavy Engineering Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Godrej Process Equipment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TEMA India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Larsen & Toubro Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Diamond Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novatech Projects (India) Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SKV Engineering India Pvt LTD

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Karamtara Engineering Pvt Ltd**List Not Exhaustive 6 3 Other Companie

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Salasar Techno Engineering Ltd

List of Figures

- Figure 1: India Metal Fabrication Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Metal Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: India Metal Fabrication Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: India Metal Fabrication Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: India Metal Fabrication Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 4: India Metal Fabrication Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Metal Fabrication Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Metal Fabrication Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: India Metal Fabrication Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: India Metal Fabrication Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Metal Fabrication Market?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the India Metal Fabrication Market?

Key companies in the market include Salasar Techno Engineering Ltd, Kirby Building Systems, Zamil Industrial Investment Co, Pennar Group, ISGEC Heavy Engineering Ltd, Godrej Process Equipment, TEMA India, Larsen & Toubro Ltd, Diamond Group, Novatech Projects (India) Private Limited, SKV Engineering India Pvt LTD, Karamtara Engineering Pvt Ltd**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the India Metal Fabrication Market?

The market segments include End-user Industry, Material Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market.

6. What are the notable trends driving market growth?

Manufacturing Sector is Shaping the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: JSP’s Angul unit, located in Odisha, was set to become India’s biggest single-location steel manufacturing plant. The capacity of the current Angul plant is estimated to be 5.6 mtpa per annum. However, the plan was to double it to 11 mtpa and 24 mtpa by 2023 and 2027, respectively. JSP’s steel plant, located in Raghurhat, was also expected to expand its capacity from 3.6 tpa per annum to 9 tpa by 2023. JSP finalized trial production at Angul in 2023 and commercial production by 2024. Jindal Steel and Power expects the Indian steel industry to grow in line with government infrastructure projects and domestic demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Metal Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Metal Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Metal Fabrication Market?

To stay informed about further developments, trends, and reports in the India Metal Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence