Key Insights

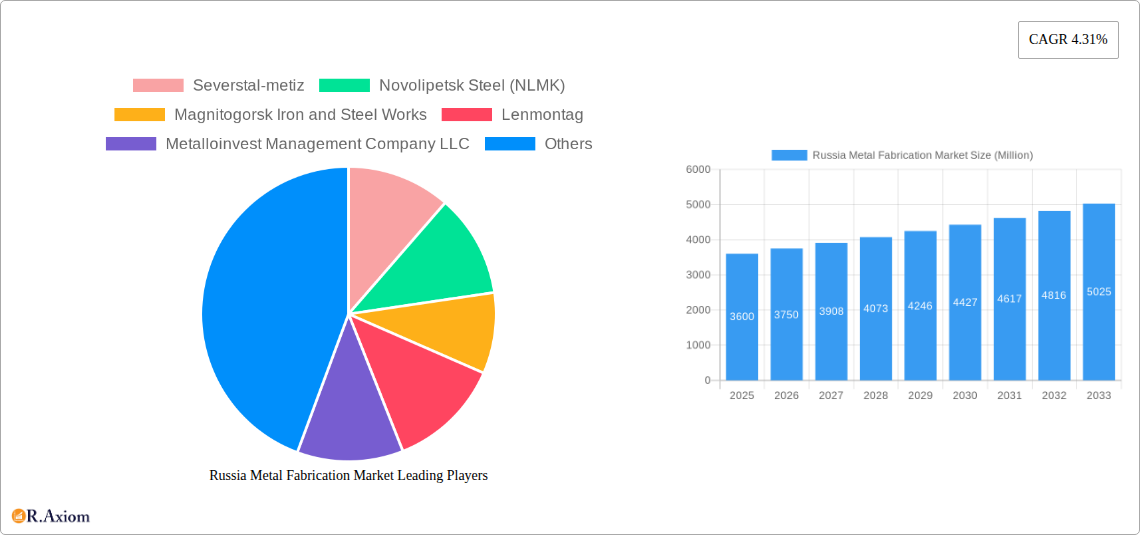

The Russia metal fabrication market, valued at $3.60 billion in 2025, is projected to experience steady growth, driven by robust infrastructure development, particularly in sectors like construction and energy. A Compound Annual Growth Rate (CAGR) of 4.31% from 2025 to 2033 indicates a significant expansion, reaching an estimated value exceeding $5 billion by 2033. This growth is fueled by increasing government investment in modernization projects, a rising demand for metal products across various industries, and ongoing efforts to diversify the Russian economy beyond its reliance on energy exports. However, the market faces challenges including fluctuating global commodity prices, geopolitical uncertainties impacting international trade, and potential sanctions influencing material sourcing and export capabilities. The dominance of large, established players such as Severstal-metiz, NLMK, and MMK suggests a relatively consolidated market landscape, though smaller, specialized fabricators also contribute significantly. Future growth will likely depend on technological advancements in fabrication processes, the adoption of sustainable manufacturing practices, and the ability to navigate geopolitical complexities. The ongoing development of the Russian Far East and Siberia may unlock significant growth potential, creating new demand for metal fabrication services.

Russia Metal Fabrication Market Market Size (In Billion)

The competitive landscape features a mix of large integrated steel mills and smaller specialized companies. While major players benefit from economies of scale, smaller firms are likely to focus on niche markets and specialized applications, such as high-precision components for specific industries. The ongoing trend towards automation and digitalization in manufacturing will likely reshape the market, favoring companies that embrace innovation and advanced technologies. The segment breakdown, while not explicitly provided, is likely comprised of structural steel fabrication, sheet metal work, precision machining, and specialized metal forming applications. The success of individual companies will hinge on their ability to adapt to technological advancements, manage supply chain risks, and respond effectively to fluctuating market demands.

Russia Metal Fabrication Market Company Market Share

Russia Metal Fabrication Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia Metal Fabrication Market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, including manufacturers, investors, and policymakers, navigating the complexities of this dynamic market. With a focus on key trends, challenges, and opportunities, this report is an essential resource for understanding the current state and future trajectory of the Russian metal fabrication sector. The report incorporates detailed analysis of market concentration, innovation, industry trends, dominant segments, product developments, and key players, supported by robust data and forecasts.

Russia Metal Fabrication Market Concentration & Innovation

This section analyzes the competitive landscape of the Russian metal fabrication market, evaluating market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is moderately concentrated, with several major players holding significant market share. However, the presence of numerous smaller, specialized firms indicates a dynamic competitive environment.

- Market Share: Severstal-metiz, NLMK, and MMK collectively hold approximately xx% of the market share (2024), while other significant players, such as Metalloinvest and Evraz, contribute substantial portions. Smaller players focus on niche segments, offering specialized services and products. The exact market share figures are subject to change with further analysis.

- Innovation Drivers: Government initiatives promoting industrial modernization and technological advancements drive innovation. Focus on energy efficiency and environmental sustainability are also compelling forces.

- Regulatory Framework: Regulations concerning environmental compliance, worker safety, and product standards significantly impact the market. Recent changes in these regulations have accelerated the adoption of advanced technologies.

- Product Substitutes: The primary substitutes are fabricated materials from other metals and composites; however, the strength and versatility of steel maintain its dominant position.

- End-User Trends: The construction, automotive, and machinery sectors are the dominant end-users. Growth in these industries directly impacts the demand for metal fabrications.

- M&A Activities: Recent M&A activity in the Russian metal fabrication industry shows consolidation and diversification trends, with estimated deal values at approximately xx Million USD between 2019 and 2024. Further detailed analysis will provide more precise figures.

Russia Metal Fabrication Market Industry Trends & Insights

This section delves into the key trends shaping the Russian metal fabrication market. The market is experiencing moderate growth, driven by investments in infrastructure, construction activity, and the development of new industrial projects. However, geopolitical factors and economic fluctuations significantly influence market performance.

The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, with market penetration in key sectors exceeding xx%. Technological disruptions, such as the adoption of advanced manufacturing techniques like 3D printing and automation, are gradually changing the production landscape. Consumer preferences, increasingly emphasizing sustainability and environmentally friendly practices, are influencing material choices and manufacturing processes. The competitive dynamics are characterized by both collaboration and competition amongst players, with a constant push for cost reduction, efficiency improvements, and innovative product development.

Dominant Markets & Segments in Russia Metal Fabrication Market

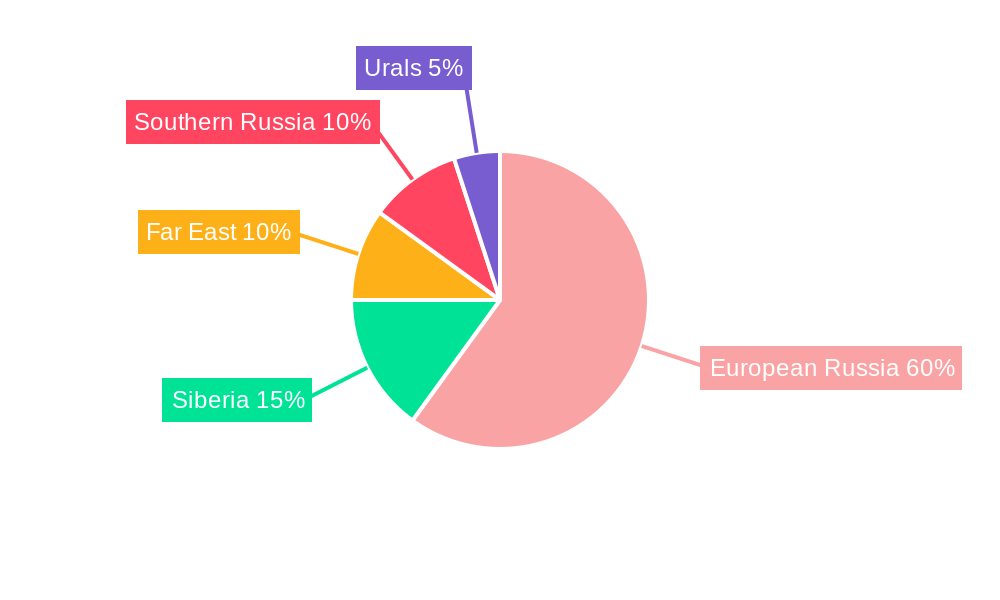

This section identifies the leading regions, countries, and segments within the Russian metal fabrication market. While comprehensive data on specific regional breakdowns requires further research, the analysis indicates that the market is largely concentrated in major industrial centers.

- Key Drivers for Dominance:

- Strong industrial base

- Government support for infrastructure development

- Access to raw materials

- Skilled labor force

The dominance of specific regions and segments stems from a combination of factors, including geographical distribution of production facilities, proximity to raw materials, and the concentration of major end-user industries. The central regions of Russia benefit from established industrial infrastructure, while other regions show varied levels of development, dependent on local economic conditions and government policies. Further detailed analysis will provide more accurate segment-wise breakdown.

Russia Metal Fabrication Market Product Developments

Recent product developments focus on improving material properties, enhancing manufacturing processes, and expanding applications. The emphasis is on high-strength, lightweight alloys, advanced surface treatments, and precision manufacturing capabilities. This reflects a response to the increasing demand for durable, efficient, and environmentally responsible metal fabrications. Technological trends include the adoption of automation, robotics, and digital manufacturing technologies to enhance productivity and improve product quality. The market fit for new products is largely determined by end-user needs and regulatory compliance requirements.

Report Scope & Segmentation Analysis

This report segments the Russia Metal Fabrication Market based on various factors, including product type (e.g., structural steel, sheet metal, pipes and tubes), fabrication process (e.g., cutting, bending, welding), end-use industry (e.g., construction, automotive, machinery), and region. Each segment demonstrates unique growth characteristics and competitive dynamics. Growth projections for each segment vary, with some experiencing faster growth than others, driven by factors like market demand, technological advancements, and government policies. Detailed market sizes and competitive analysis for each segment require further research and will be included in the final report.

Key Drivers of Russia Metal Fabrication Market Growth

The growth of the Russian metal fabrication market is propelled by several key drivers. Strong governmental support for infrastructure projects and industrial modernization initiatives fosters demand. Furthermore, growth in key end-use industries, particularly construction and manufacturing, fuels the demand for metal fabrications. Technological advancements, including automation and improved production techniques, enhance efficiency and productivity, further bolstering growth.

Challenges in the Russia Metal Fabrication Market Sector

The Russian metal fabrication market faces several significant challenges. Geopolitical uncertainties and sanctions can disrupt supply chains and hinder market growth. Fluctuations in raw material prices and energy costs impact production profitability. Additionally, stringent environmental regulations require significant investments in compliance measures, potentially increasing operating costs. Competition from international suppliers and imports can exert downward pressure on prices. Quantifiable impacts on growth rates will be provided after comprehensive data analysis.

Emerging Opportunities in Russia Metal Fabrication Market

Despite challenges, the Russian metal fabrication market presents promising opportunities. Expansion into new and emerging markets within Russia and globally is a significant growth prospect. The adoption of new technologies, such as 3D printing and advanced robotics, offers opportunities for increased efficiency and product innovation. Furthermore, increasing focus on sustainable and environmentally friendly practices creates opportunities for manufacturers who can demonstrate a commitment to green initiatives.

Leading Players in the Russia Metal Fabrication Market Market

- Severstal-metiz

- Novolipetsk Steel (NLMK)

- Magnitogorsk Iron and Steel Works

- Lenmontag

- Metalloinvest Management Company LLC

- Mechel

- Ruspolimet

- Pic Metall

- Evraz Group

- TMK

List Not Exhaustive

Key Developments in Russia Metal Fabrication Market Industry

- November 2022: Novolipetsk Steel (NLMK) upgrades its Blast Furnace No. 3 dedusting system, achieving a 99.9% dust capture rate, enhancing environmental performance and potentially setting a benchmark for the industry.

- December 2022: Metalloinvest completes the modernization of kiln No. 4 at Lebedinsky GOK's pellet plant, increasing capacity by almost 10% and improving production efficiency through reduced energy consumption. This demonstrates a commitment to modernization and cost optimization.

Strategic Outlook for Russia Metal Fabrication Market Market

The future of the Russian metal fabrication market hinges on overcoming existing challenges and capitalizing on emerging opportunities. Continued investment in infrastructure, technological innovation, and sustainable practices will be crucial for sustained growth. The ability of manufacturers to adapt to changing market conditions and regulatory requirements will determine their long-term success. The market displays potential for growth and expansion, despite existing challenges. Further research and a detailed analysis of specific market sectors will provide a more comprehensive strategic outlook.

Russia Metal Fabrication Market Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Utilities

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

- 2.3. Other Material Types

-

3. Service Type

- 3.1. Casting

- 3.2. Forging

- 3.3. Machining

- 3.4. Welding & Tubing

- 3.5. Other Service Types

Russia Metal Fabrication Market Segmentation By Geography

- 1. Russia

Russia Metal Fabrication Market Regional Market Share

Geographic Coverage of Russia Metal Fabrication Market

Russia Metal Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Number of Manufacturing Plants in Russia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Metal Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Utilities

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Casting

- 5.3.2. Forging

- 5.3.3. Machining

- 5.3.4. Welding & Tubing

- 5.3.5. Other Service Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Severstal-metiz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novolipetsk Steel (NLMK)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Magnitogorsk Iron and Steel Works

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lenmontag

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metalloinvest Management Company LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mechel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ruspolimet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pic Metall

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evraz Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TMK**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Severstal-metiz

List of Figures

- Figure 1: Russia Metal Fabrication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Metal Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Metal Fabrication Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Russia Metal Fabrication Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Russia Metal Fabrication Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: Russia Metal Fabrication Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: Russia Metal Fabrication Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Russia Metal Fabrication Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 7: Russia Metal Fabrication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Russia Metal Fabrication Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Russia Metal Fabrication Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Russia Metal Fabrication Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Russia Metal Fabrication Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Russia Metal Fabrication Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: Russia Metal Fabrication Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Russia Metal Fabrication Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 15: Russia Metal Fabrication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Russia Metal Fabrication Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Metal Fabrication Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Russia Metal Fabrication Market?

Key companies in the market include Severstal-metiz, Novolipetsk Steel (NLMK), Magnitogorsk Iron and Steel Works, Lenmontag, Metalloinvest Management Company LLC, Mechel, Ruspolimet, Pic Metall, Evraz Group, TMK**List Not Exhaustive.

3. What are the main segments of the Russia Metal Fabrication Market?

The market segments include End-user Industry, Material Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Number of Manufacturing Plants in Russia.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Novolipetsk Steel (NLMK) Lipetsk, one of the main production sites of NLMK Group, Russia's biggest producer of steel and high-valued steel products and steel makers, has upgraded its Blast Furnace No. 3 dedusting system, achieving a 99.9% dust capture rate. As a result of NLMK's ongoing environmental improvements, all of its blast furnaces now have advanced dedusting systems that are on par with the best global technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Metal Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Metal Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Metal Fabrication Market?

To stay informed about further developments, trends, and reports in the Russia Metal Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence