Key Insights

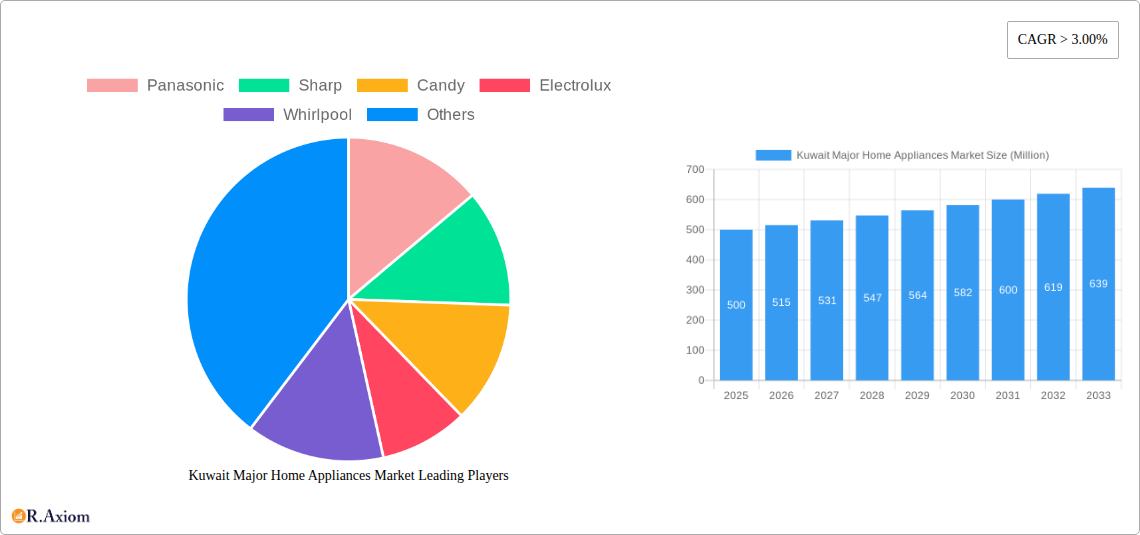

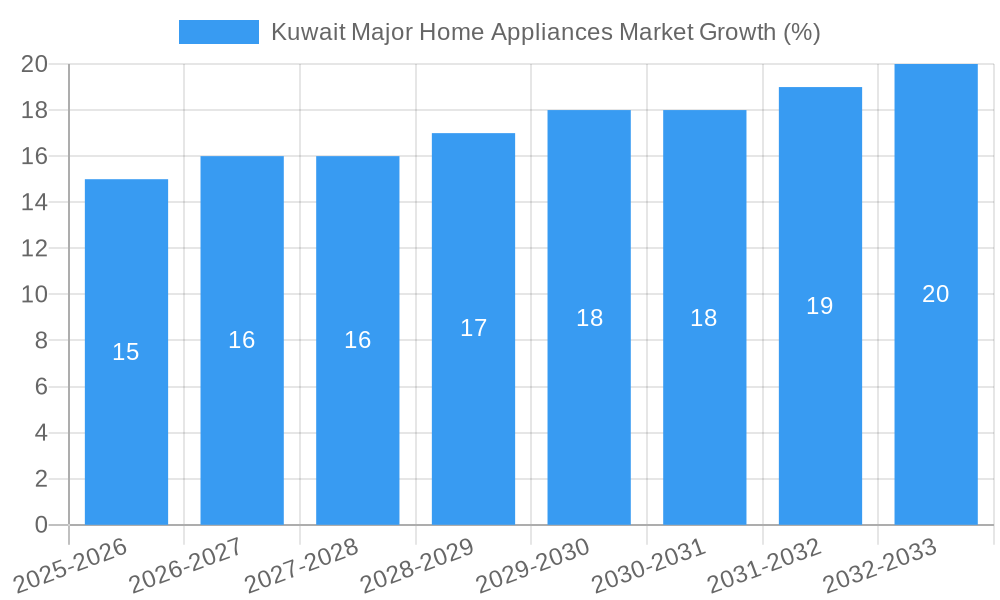

The Kuwait major home appliances market, encompassing refrigerators, freezers, washing machines, dishwashers, microwave ovens, air conditioners, and other products, exhibits robust growth potential. Driven by rising disposable incomes, a growing population, and increasing urbanization, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. The preference for technologically advanced, energy-efficient appliances is a key trend, influencing consumer purchasing decisions. Furthermore, the expanding e-commerce sector and the proliferation of multi-branded stores are reshaping distribution channels, creating new avenues for market penetration. However, factors like fluctuating oil prices and economic volatility could potentially restrain market growth. The market is segmented by product type and distribution channel, with refrigerators, air conditioners, and washing machines commanding significant market share. Leading players like Panasonic, Samsung, Electrolux, Whirlpool, and others are competing fiercely, focusing on product innovation, brand building, and effective distribution strategies to capture a larger market share. The market's growth is expected to be fueled by ongoing infrastructure development and government initiatives promoting energy efficiency in household appliances.

The segment analysis reveals a strong demand for energy-efficient appliances across all product categories. The online distribution channel is experiencing rapid growth, driven by increasing internet penetration and consumer preference for convenience. Competition within the market is intense, with both international and regional players vying for market dominance. Successful players are those who adapt effectively to evolving consumer preferences, invest in superior product quality, and leverage robust distribution networks. The forecast period anticipates continued growth, albeit potentially at a moderated pace depending on macroeconomic factors. The Kuwaiti market presents an attractive investment opportunity for companies capable of adapting to the specific market dynamics and local consumer behavior.

Kuwait Major Home Appliances Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kuwait major home appliances market, offering valuable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report meticulously analyzes market trends, competitive landscapes, and future growth projections, providing actionable intelligence for strategic decision-making. The total market size in 2025 is estimated at xx Million USD.

Kuwait Major Home Appliances Market Concentration & Innovation

This section delves into the competitive landscape of the Kuwaiti home appliances market, analyzing market concentration, innovation drivers, regulatory frameworks, and key industry activities. We examine market share distribution amongst leading players, including Panasonic, Sharp, Candy, Electrolux, Whirlpool, Bosch, Toshiba, Beko, Midea, and Samsung (list not exhaustive). The report assesses the impact of mergers and acquisitions (M&A) activities, quantifying deal values where data is available (xx Million USD in M&A deals during 2022-2024, for example). Innovation drivers, such as technological advancements in energy efficiency and smart home integration, are explored in detail. The regulatory environment and its influence on market dynamics are also examined. We also discuss the impact of product substitutes (e.g., alternative cooking methods), evolving end-user trends (e.g., preference for eco-friendly appliances), and the overall impact on market concentration.

- Market Concentration: The Kuwaiti market exhibits a [High/Medium/Low - Choose one based on data] level of concentration, with the top five players holding an estimated xx% market share in 2024.

- Innovation Drivers: Key drivers include the rising adoption of smart home technology, increased demand for energy-efficient appliances, and government initiatives promoting sustainable consumption.

- Regulatory Framework: Kuwait's regulatory framework [describe the current regulatory environment and its influence on the market].

- M&A Activity: The market has witnessed [describe the M&A activity level and trends].

Kuwait Major Home Appliances Market Industry Trends & Insights

This section provides a detailed analysis of the Kuwait major home appliances market's growth trajectory, pinpointing key drivers and disruptive forces. We examine consumer preferences, technological disruptions (such as the Internet of Things (IoT) integration), and the competitive dynamics that shape market evolution. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, driven primarily by [mention specific drivers like rising disposable incomes, urbanization, etc.]. The market penetration rate for smart appliances is estimated at xx% in 2025, with projections for significant growth in the forecast period. The impact of economic fluctuations and consumer sentiment on market demand is also evaluated.

Dominant Markets & Segments in Kuwait Major Home Appliances Market

This section identifies the dominant segments within the Kuwaiti home appliances market, considering both product type and distribution channel. The analysis identifies the leading segments and provides insights into the factors driving their dominance.

By Product Type:

- Refrigerators: This segment is projected to remain a major revenue contributor, driven by [mention specific factors like increasing household incomes, changing lifestyles].

- Washing Machines: The washing machine segment exhibits [describe the growth trends and contributing factors].

- Air Conditioners: The demand for air conditioners is high due to the region's climate. This segment is expected to experience [mention growth projections and contributing factors].

- Other Product Types: [Analyze the trends in other product types like dishwashers, microwave ovens etc.].

By Distribution Channel:

- Multi-Branded Stores: These stores currently hold a significant market share due to [mention reasons].

- Online Sales: The online segment is experiencing [describe the growth and challenges].

- Specialty Stores: Specialty stores cater to niche customer needs and [describe their market position].

The report provides detailed analysis of the leading regions/cities within Kuwait and their contributions to overall market size. Economic policies, infrastructure development, and consumer preferences are among the key factors influencing regional variations.

Kuwait Major Home Appliances Market Product Developments

The Kuwait home appliance market is witnessing significant product innovation, focusing on energy efficiency, smart functionalities, and improved user experience. Manufacturers are incorporating advanced technologies such as IoT connectivity, AI-powered features, and improved energy-saving mechanisms. This trend is driven by both consumer demand for sophisticated appliances and government regulations promoting energy conservation. The integration of smart home ecosystems is also gaining traction.

Report Scope & Segmentation Analysis

This report segments the Kuwait major home appliances market based on product type (refrigerators, freezers, washing machines, dishwashers, microwave ovens, air conditioners, other products) and distribution channel (multi-branded stores, specialty stores, online, other distribution channels). Each segment's growth projections, market size (in Million USD), and competitive dynamics are thoroughly analyzed. The report provides detailed forecasts for each segment from 2025 to 2033, along with current market size estimates for 2025.

Key Drivers of Kuwait Major Home Appliances Market Growth

Several factors contribute to the growth of the Kuwaiti major home appliances market. These include rising disposable incomes, increasing urbanization leading to nuclear family structures, and the growing adoption of modern lifestyles. Government initiatives promoting energy efficiency and technological advancements further fuel market expansion. The ongoing development of infrastructure also plays a crucial role, enhancing accessibility to appliances across various regions.

Challenges in the Kuwait Major Home Appliances Market Sector

The Kuwait home appliances market faces several challenges, including import dependency, potential supply chain disruptions due to global economic instability, and intense competition among established and emerging players. Fluctuating energy prices and stringent regulations can also influence market dynamics. Economic downturns can impact consumer purchasing power, affecting demand for non-essential appliances.

Emerging Opportunities in Kuwait Major Home Appliances Market

Several emerging opportunities exist within the Kuwaiti home appliance market. The increasing popularity of smart homes, the growing demand for energy-efficient appliances, and the expansion of e-commerce channels present significant growth potential. Furthermore, untapped market segments in less developed areas present an opportunity for expansion. The development of niche products tailored to specific consumer needs could also create new revenue streams.

Leading Players in the Kuwait Major Home Appliances Market Market

Key Developments in Kuwait Major Home Appliances Market Industry

- May 2022: Leica and Panasonic signed a strategic collaboration agreement, developing "L2 Technology." This collaboration could lead to innovations in camera technology integrated into home appliances.

- May 2022: TCL Electronics launched its new C Series TV line-up and home appliances in the Middle East and Africa, signifying increased competition and product diversification within the region.

Strategic Outlook for Kuwait Major Home Appliances Market Market

The Kuwaiti major home appliances market holds significant growth potential driven by sustained economic growth, rising consumer spending, and technological advancements. The focus on energy efficiency, smart home integration, and sustainable practices will shape future market trends. Companies adopting innovative strategies and catering to evolving consumer preferences are poised to capitalize on these opportunities. The market is projected to maintain a healthy growth trajectory in the coming years.

Kuwait Major Home Appliances Market Segmentation

-

1. Product Type

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Washing Machines

- 1.4. Dish Washers

- 1.5. Microwave Ovens

- 1.6. Air Conditioners

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Kuwait Major Home Appliances Market Segmentation By Geography

- 1. Kuwait

Kuwait Major Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness about Indoor Air Quality; Rising Trend of Smart Homes

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Regulations and Standards in Some Regions

- 3.4. Market Trends

- 3.4.1. Refrigerator Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Major Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Washing Machines

- 5.1.4. Dish Washers

- 5.1.5. Microwave Ovens

- 5.1.6. Air Conditioners

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Candy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Whirlpool

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bosch

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toshiba

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beko**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midea

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Major Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Major Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Major Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Major Home Appliances Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Kuwait Major Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Kuwait Major Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Kuwait Major Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kuwait Major Home Appliances Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Kuwait Major Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Kuwait Major Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Major Home Appliances Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Major Home Appliances Market?

Key companies in the market include Panasonic, Sharp, Candy, Electrolux, Whirlpool, Bosch, Toshiba, Beko**List Not Exhaustive, Midea, Samsung.

3. What are the main segments of the Kuwait Major Home Appliances Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness about Indoor Air Quality; Rising Trend of Smart Homes.

6. What are the notable trends driving market growth?

Refrigerator Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Lack of Proper Regulations and Standards in Some Regions.

8. Can you provide examples of recent developments in the market?

In May 2022, Leica and Panasonic signed a strategic, comprehensive collaboration agreement and developed "L2 Technology" as a symbol of the collaboration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Major Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Major Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Major Home Appliances Market?

To stay informed about further developments, trends, and reports in the Kuwait Major Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence