Key Insights

The North America awnings market is poised for significant expansion, projected to reach $11042.7 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.2%. This growth is propelled by rising consumer interest in energy-efficient, aesthetically enhancing outdoor living solutions. Key drivers include increased awareness of awnings' energy-saving benefits, improved curb appeal, and protection against harsh weather. Innovations in durable, UV-resistant materials and automated retractable systems are further stimulating market adoption. The residential sector leads demand, while the commercial sector, particularly hospitality and retail, sees growth through enhanced brand visibility and customer experience. Market expansion is supported by increasing construction and disposable incomes.

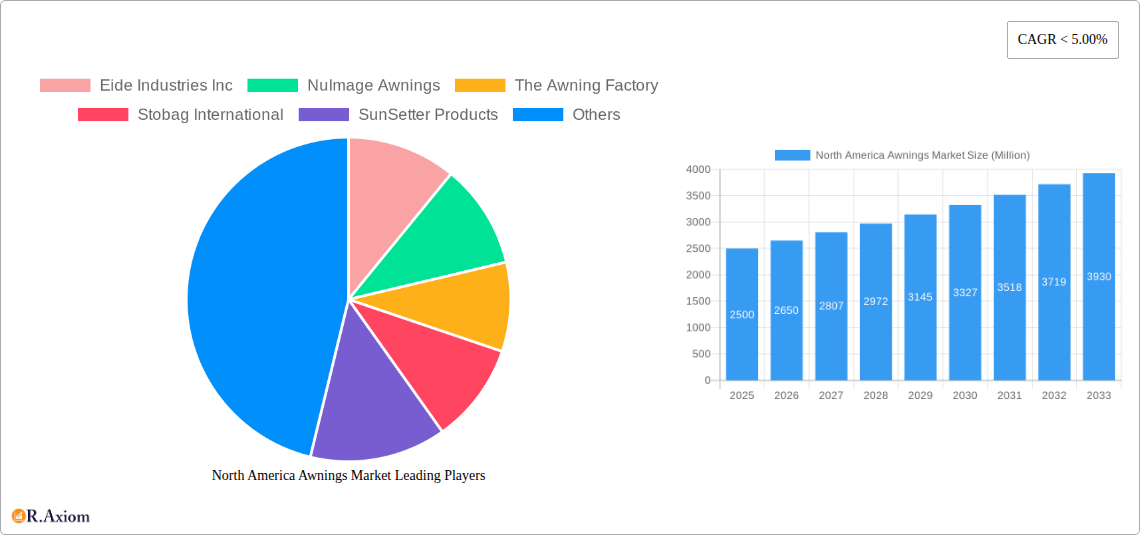

North America Awnings Market Market Size (In Billion)

Anticipated regional growth may be higher in sunnier areas. Competitive landscapes feature established players and specialized providers. Differentiation will stem from innovative designs, materials, smart home integration, customized solutions, and superior customer service. A growing emphasis on sustainability is driving demand for eco-friendly and energy-efficient awning options. The North America awnings market outlook is strong, influenced by economic, technological, and evolving consumer preferences.

North America Awnings Market Company Market Share

North America Awnings Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America awnings market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on market opportunities. The report covers the period from 2019 to 2033, with 2025 as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period encompasses 2019-2024. The market is segmented by product type (Retractable Awnings, Vertical Retractable Awnings, Stationary Awnings), application (Residential, Commercial), and country (United States, Canada). Key players analyzed include Eide Industries Inc, NuImage Awnings, The Awning Factory, Stobag International, SunSetter Products, Marygrove Awnings, Awning Company of America Inc, Thompson Awnings Company, Carroll Awning Company, and Sunair Awnings. This list is not exhaustive.

North America Awnings Market Market Concentration & Innovation

The North America awnings market presents a moderately concentrated landscape, characterized by the dominance of a few key players who command a significant portion of the market share. Nevertheless, the dynamic presence of numerous smaller, regional suppliers and burgeoning innovative firms fuels robust competition. Market data for 2024 indicates that the leading five entities collectively held approximately **[Insert specific xx%]** of the market, leaving considerable avenues for organic growth, market disruption, and the emergence of new players. Innovation remains a pivotal force, propelled by advancements in cutting-edge materials, such as highly durable fabrics and sophisticated automated control systems, alongside innovative design approaches, including sophisticated retractable and motorized awning systems. The integration of smart technology is also a growing trend, enhancing functionality and user experience. Regulatory frameworks, particularly those pertaining to energy efficiency standards and building codes, exert a notable influence on product design, material selection, and overall adoption rates. While product substitutes like pergolas and other shading solutions exist, their competitive threat is generally considered niche. End-user preferences are increasingly leaning towards awnings that are not only aesthetically appealing but also highly durable and energy-efficient, thereby driving demand for premium product offerings. Mergers and acquisitions (M&A) within the sector, exemplified by LCI Industries' strategic acquisition of Girard Systems, underscore a discernible consolidation trend. This activity signals a deliberate focus on expanding product portfolios, enhancing market reach, and capitalizing on synergistic opportunities. Deal values in recent years have ranged from **[Insert specific xx Million]** to **[Insert specific xx Million]**, reflecting substantial market interest and a promising investment landscape.

North America Awnings Market Industry Trends & Insights

The North America awnings market is currently experiencing a period of robust and sustained growth, propelled by a confluence of influential factors. A significant driver is the rise in consumer disposable incomes, coupled with an amplified focus on home improvement projects, which is directly contributing to increased demand within the residential sector. Concurrently, the commercial sector is witnessing considerable expansion, attributed to a surge in construction activity and a heightened emphasis on implementing energy-efficient solutions in commercial building designs. Technological advancements are playing a crucial role in shaping the market, with the advent of smart awnings featuring automated controls and solar-powered options significantly enhancing product appeal and opening up entirely new market segments. Consumer preferences are steadily evolving towards awnings that offer superior aesthetic versatility, exceptional durability, and ease of maintenance. The market is also observing a pronounced increase in the adoption of retractable awnings, largely due to their inherent adaptability and space-saving advantages. Projections indicate a Compound Annual Growth Rate (CAGR) for the market between 2025 and 2033 to be approximately **[Insert specific xx%]**, with market penetration anticipated to reach around **[Insert specific xx%]** by 2033, clearly demonstrating strong future growth prospects. The competitive landscape is dynamic, comprising both established industry leaders and agile new entrants. This scenario compels companies to strategically focus on product differentiation, robust brand building initiatives, and aggressive expansion into new geographical markets. Furthermore, heightened consumer awareness regarding the importance of UV protection is a growing impetus for the broader adoption of awnings.

Dominant Markets & Segments in North America Awnings Market

The United States dominates the North America awnings market, accounting for approximately xx% of the total market value in 2024. This dominance stems from a larger population base, higher construction activity, and stronger consumer spending.

- Key Drivers of US Market Dominance:

- Higher disposable income compared to Canada

- Larger housing market

- Robust construction industry

- Favorable government policies related to energy efficiency

- Increased awareness of the benefits of awnings

Canada holds the remaining market share, with slower growth compared to the US. The residential segment represents the largest share of the market, driven by a growing focus on home improvement and outdoor living. The commercial segment is growing steadily, propelled by increased construction and refurbishment activities in commercial spaces. Retractable awnings are the leading product type, benefiting from their versatility and convenience.

North America Awnings Market Product Developments

Recent product innovations focus on enhancing energy efficiency, durability, and aesthetics. Smart awnings with automated controls, solar-powered options, and integration with home automation systems are gaining traction. Manufacturers are emphasizing lightweight yet strong materials and innovative designs to cater to various architectural styles. The market is witnessing the introduction of awnings with advanced features such as wind sensors and rain sensors enhancing usability and longevity. This focus on innovation is crucial for companies to enhance their competitive positioning within the market.

Report Scope & Segmentation Analysis

This comprehensive report delves into a granular segmentation analysis of the North America awnings market, offering in-depth insights across various crucial segments.

By Product Type: The market is meticulously categorized into Retractable Awnings (projected to reach **[Insert specific xx Million]** by 2033), Vertical Retractable Awnings (projected to reach **[Insert specific xx Million]** by 2033), and Stationary Awnings (projected to reach **[Insert specific xx Million]** by 2033). Each of these segments is exhibiting distinct growth trajectories, heavily influenced by factors such as relative cost, inherent functionality, and evolving consumer needs.

By Application: The residential segment is demonstrating robust growth, largely fueled by the escalating trend of home renovations and an increased investment in outdoor living spaces. Conversely, the commercial sector is expected to exhibit steady and consistent growth, driven by new construction projects and ongoing renovation initiatives (residential segment projected to reach **[Insert specific xx Million]** by 2033, and the commercial segment projected to reach **[Insert specific xx Million]** by 2033).

By Country: The United States currently commands a dominant position in the market (projected to reach **[Insert specific xx Million]** by 2033), closely followed by Canada (projected to reach **[Insert specific xx Million]** by 2033). Both nations' market performance is significantly influenced by their respective economic growth trajectories and ongoing construction activity. Competitive dynamics exhibit considerable variation across these segments, with larger, established players often dominating certain segments while smaller, highly specialized companies excel in niche areas.

Key Drivers of North America Awnings Market Growth

Several pivotal factors are acting as significant catalysts for the sustained growth of the North America awnings market. These include a discernible increase in consumer spending dedicated to home improvement initiatives, a burgeoning preference for enhancing and expanding outdoor living spaces, and the escalating demand for energy-efficient solutions aimed at reducing cooling costs. Furthermore, continuous advancements in material science and technology are leading to demonstrably improved product performance, enhanced durability, and more appealing aesthetics. Government incentives designed to promote energy efficiency further contribute to stimulating market growth. Additionally, a growing societal awareness regarding the importance of sun protection and the potential health risks associated with prolonged sun exposure is also playing a crucial role in fueling market expansion.

Challenges in the North America Awnings Market Sector

The North America awnings market faces several challenges. Fluctuations in raw material prices, particularly for fabrics and aluminum, impact production costs and profitability. Supply chain disruptions can lead to delays and shortages. Intense competition from various shading solutions and the need for skilled labor for installation pose significant challenges. Furthermore, stringent regulatory compliance requirements concerning safety and energy efficiency add complexity to the manufacturing and sales processes.

Emerging Opportunities in North America Awnings Market

Several emerging opportunities exist in the North America awnings market. The integration of smart technology, such as automated controls and remote monitoring, offers significant potential for market expansion. Growth in the eco-friendly materials segment, including recycled and sustainable fabrics, represents another key opportunity. The increasing demand for customized and personalized awning solutions presents a niche market for specialized manufacturers. Expansion into new geographical areas and underserved markets can also yield substantial growth.

Leading Players in the North America Awnings Market Market

- Eide Industries Inc

- NuImage Awnings

- The Awning Factory

- Stobag International

- SunSetter Products

- Marygrove Awnings

- Awning Company of America Inc

- Thompson Awnings Company

- Carroll Awning Company

- Sunair Awnings

Key Developments in North America Awnings Market Industry

March 2022: LCI Industries, through its subsidiary Lippert Components Manufacturing, Inc., successfully acquired Girard Systems and Girard Products LLC. This strategic acquisition significantly expands LCI's footprint in the motorized awning segment, thereby strengthening its overall market position and enriching its diverse product portfolio.

November 2021: The Awning Factory announced a substantial 32% expansion of its manufacturing facility located in Orlando. This expansion signifies an intentional increase in production capacity, underscoring the company's commitment to effectively meeting the escalating market demand. This strategic move signals strong confidence in the market's ongoing and future growth potential.

Strategic Outlook for North America Awnings Market Market

The North America awnings market is poised for continued growth, driven by favorable macroeconomic conditions, increasing consumer demand for aesthetic and functional improvements to homes and businesses, and technological innovation. Opportunities abound for companies focused on product differentiation, sustainable materials, and smart technology integration. Strategic alliances and acquisitions will likely play a pivotal role in shaping the market landscape in the coming years, with increased competition expected across all segments. The market's future potential is substantial, indicating significant opportunities for investment and growth.

North America Awnings Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

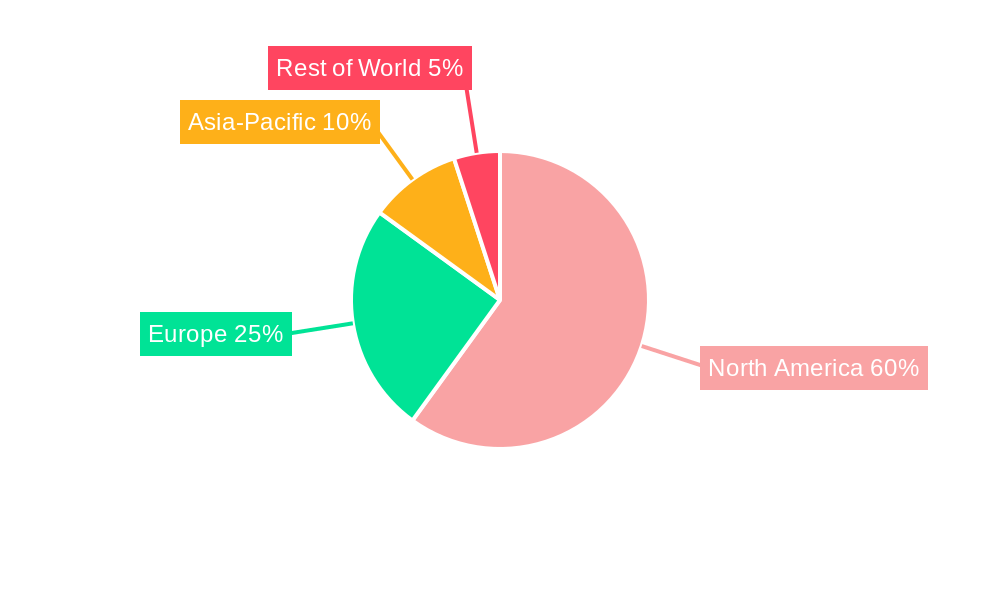

North America Awnings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Awnings Market Regional Market Share

Geographic Coverage of North America Awnings Market

North America Awnings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Aesthetically Appealing Products to Fuel the Growth of the Stone Flooring Market; Demand for Stone Floors as a Decorative Tool in the Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Initial Cost; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Residential Application Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Awnings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eide Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NuImage Awnings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Awning Factory

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stobag International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SunSetter Products

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marygrove Awnings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Awning Company of America Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thompson Awnings Company**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carroll Awning Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sunair Awnings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Eide Industries Inc

List of Figures

- Figure 1: North America Awnings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Awnings Market Share (%) by Company 2025

List of Tables

- Table 1: North America Awnings Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Awnings Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Awnings Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Awnings Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Awnings Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Awnings Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North America Awnings Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Awnings Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Awnings Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Awnings Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Awnings Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Awnings Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North America Awnings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Awnings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Awnings Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Awnings Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the North America Awnings Market?

Key companies in the market include Eide Industries Inc, NuImage Awnings, The Awning Factory, Stobag International, SunSetter Products, Marygrove Awnings, Awning Company of America Inc, Thompson Awnings Company**List Not Exhaustive, Carroll Awning Company, Sunair Awnings.

3. What are the main segments of the North America Awnings Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11042.7 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Aesthetically Appealing Products to Fuel the Growth of the Stone Flooring Market; Demand for Stone Floors as a Decorative Tool in the Construction Industry.

6. What are the notable trends driving market growth?

Residential Application Dominates the Market.

7. Are there any restraints impacting market growth?

High Initial Cost; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

March 2022 - LCI Industries which, supplies, domestically and internationally, a broad array of highly engineered components for the leading original equipment manufacturers in the recreation and transportation product markets, and the related aftermarkets of those industries, announced that its subsidiary, Lippert Components Manufacturing, Inc., has acquired substantially all of the business assets of Girard Systems and Girard Products LLC, a manufacturer and distributor of proprietary awnings and tankless water heaters for OEMs. Having created a significant niche in the motorized segment of the market, Girard's patented awnings are featured on many of the premier Class A motorized units. Girard's strategically-placed locations in Alabama, California, and Indiana make it well-positioned to serve customers across the U.S. as it continues to grow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Awnings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Awnings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Awnings Market?

To stay informed about further developments, trends, and reports in the North America Awnings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence