Key Insights

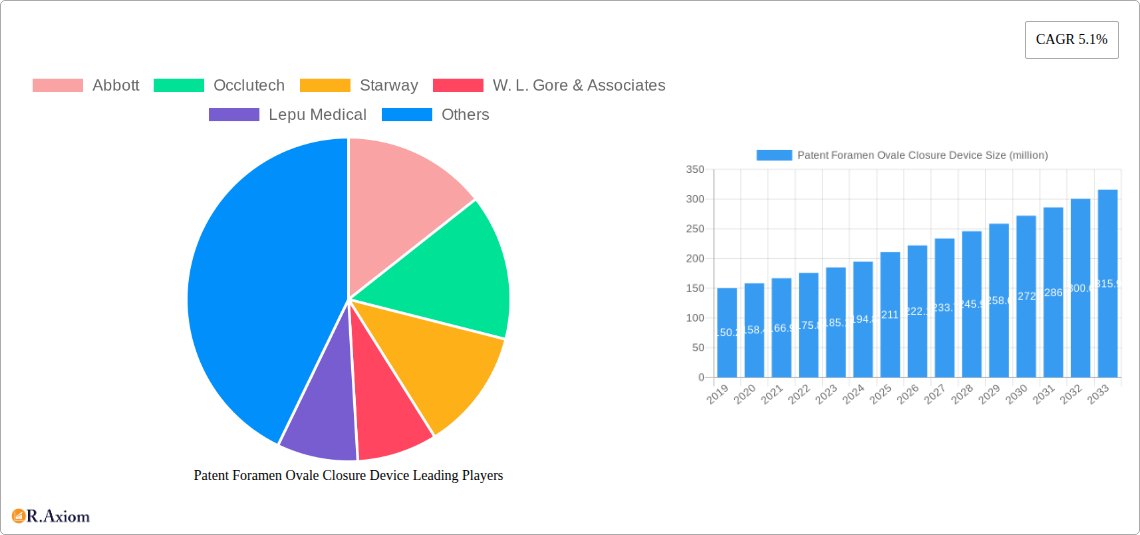

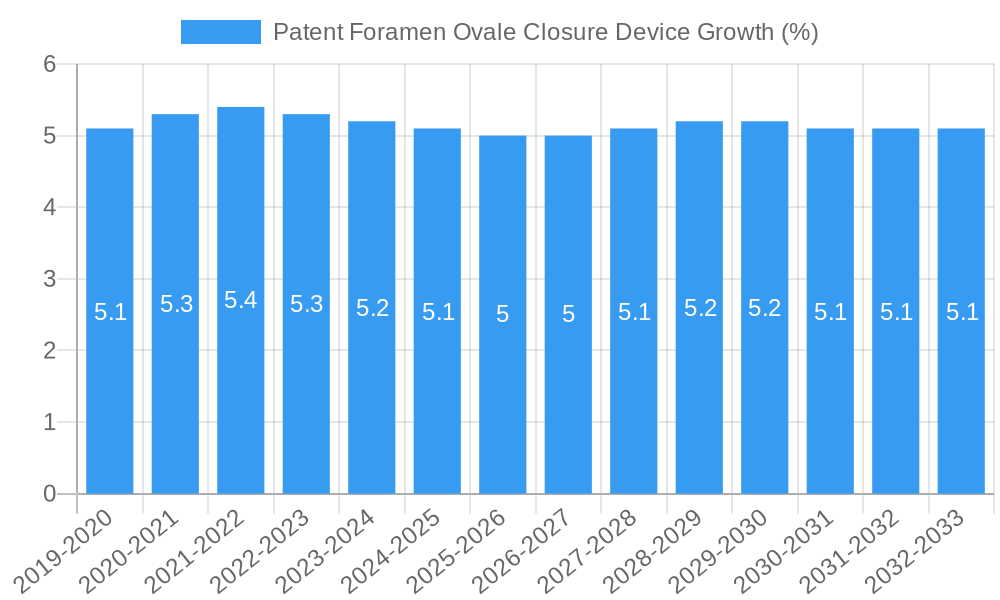

The global Patent Foramen Ovale (PFO) closure device market is poised for robust growth, projected to reach a substantial market size of $211 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.1% from 2019 to 2033. This expansion is driven by an increasing prevalence of stroke and transient ischemic attack (TIA) cases, where PFO is a significant contributing factor. Advancements in minimally invasive techniques and the development of more sophisticated and patient-specific PFO closure devices are further fueling market adoption. Healthcare providers are increasingly recognizing the benefits of early intervention for patients at high risk of paradoxical embolism, leading to a greater demand for these specialized medical devices in interventional cardiology and neurology procedures. The growing awareness among both medical professionals and patients regarding PFO as a treatable condition is also a critical growth catalyst.

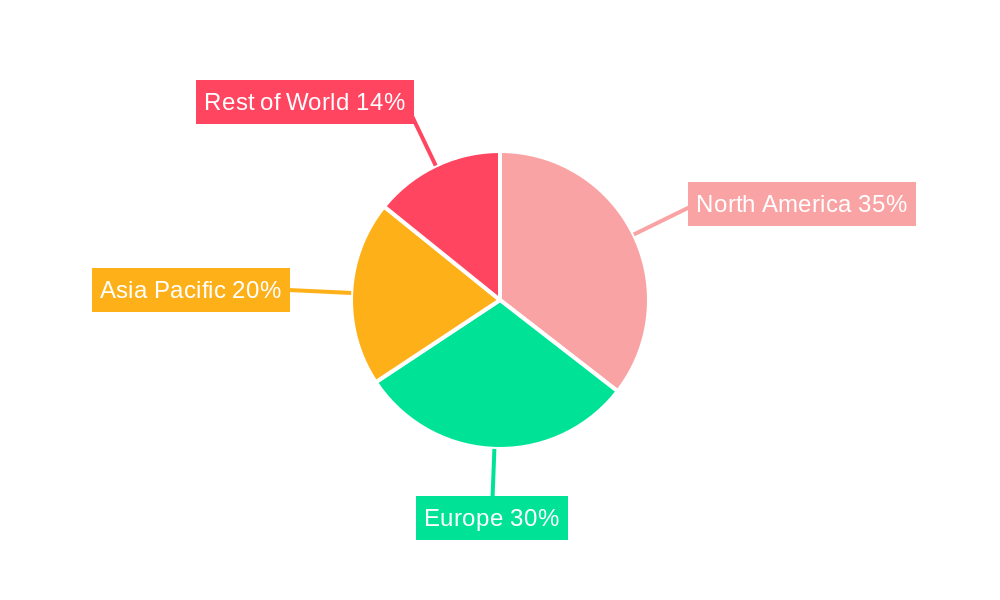

The market segmentation reveals key areas of focus for manufacturers and stakeholders. The "Hospital" application segment is expected to dominate, owing to the established infrastructure and specialized teams capable of performing PFO closure procedures. Within the "Type" segmentation, while non-degradable devices currently hold a significant share due to their established efficacy and availability, degradable PFO closure devices are emerging as a trend, offering potential advantages such as reduced long-term foreign body presence and improved tissue integration. Geographically, North America and Europe are anticipated to lead the market, driven by high healthcare expenditure, advanced medical technologies, and a strong emphasis on preventative cardiovascular care. However, the Asia Pacific region is projected to witness the fastest growth, fueled by a rising stroke burden, increasing healthcare investments, and expanding access to advanced medical treatments. Key players like Abbott, Occlutech, and W. L. Gore & Associates are actively investing in research and development to innovate and capture a larger share of this expanding market.

Patent Foramen Ovale Closure Device Market Concentration & Innovation

The global Patent Foramen Ovale (PFO) closure device market exhibits moderate to high concentration, driven by a few dominant players and a growing landscape of innovative medical device manufacturers. Key innovators like Abbott, W. L. Gore & Associates, and Occlutech are at the forefront, investing millions in research and development to refine existing technologies and introduce novel PFO closure solutions. These advancements are spurred by the increasing understanding of PFO's role in conditions like stroke and migraine, leading to greater demand for effective transcatheter closure devices. Regulatory frameworks, while stringent, are also adapting to facilitate the approval of safe and efficacious devices. Product substitutes, primarily surgical closure, are gradually being overshadowed by minimally invasive PFO closure devices due to reduced patient recovery times and lower complication rates. End-user trends are shifting towards less invasive procedures, influencing product design and adoption. Mergers and acquisitions (M&A) activities are likely to continue as larger companies seek to expand their portfolios and gain access to proprietary technologies, with estimated M&A deal values potentially reaching hundreds of millions annually. Market share is closely held, with the top three companies controlling an estimated 60% of the market.

Patent Foramen Ovale Closure Device Industry Trends & Insights

The Patent Foramen Ovale (PFO) closure device market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This robust expansion is fueled by several interconnected factors. Firstly, a growing global prevalence of cryptogenic stroke, where PFO is increasingly recognized as a significant contributing factor, is a primary market driver. As diagnostic capabilities improve and awareness among cardiologists and neurologists rises, more patients are being identified as candidates for PFO closure. This has led to an estimated market penetration of close to 15% in stroke patients in developed nations, with significant room for expansion.

Technological disruptions are continuously reshaping the PFO closure device landscape. Innovations are focused on developing devices with enhanced deliverability, improved sealing efficacy, and reduced thrombotic risk. The shift from traditional surgical methods to transcatheter interventional procedures is a major trend, driven by patient preference for minimally invasive interventions and shorter hospital stays. This trend has seen the market for transcatheter devices grow exponentially, exceeding hundreds of millions in value annually.

Consumer preferences are increasingly aligned with less invasive and faster recovery options. Patients are actively seeking alternatives to open-heart surgery, making PFO closure devices a preferred choice. This sentiment directly impacts market demand and encourages further development of user-friendly and effective devices.

Competitive dynamics are intense, with established players like Abbott, W. L. Gore & Associates, and Occlutech, alongside emerging companies such as Lepu Medical and LifeTech, vying for market share. Strategic partnerships, product launches, and clinical trial data are critical competitive tools. The market is characterized by ongoing innovation and product differentiation, with companies investing millions in advanced materials and designs. The increasing body of clinical evidence supporting the efficacy and safety of PFO closure devices is a significant catalyst, further solidifying the market's upward trajectory. The estimated market size for PFO closure devices is projected to reach over a billion dollars by 2025, with substantial growth expected in the forecast period.

Dominant Markets & Segments in Patent Foramen Ovale Closure Device

The global Patent Foramen Ovale (PFO) closure device market exhibits a clear regional and segmental dominance, driven by a confluence of economic, demographic, and healthcare infrastructure factors. North America, particularly the United States, currently dominates the market, with an estimated market share exceeding 35%. This dominance is attributable to several key drivers:

- Advanced Healthcare Infrastructure: The presence of a well-established healthcare system with a high density of interventional cardiology centers and skilled medical professionals ensures widespread adoption of PFO closure devices.

- High Incidence of Stroke: A significant prevalence of stroke, coupled with increased awareness and diagnostic capabilities for identifying PFO as a contributing factor, fuels demand.

- Reimbursement Policies: Favorable reimbursement policies from major insurance providers facilitate patient access to these advanced medical devices.

- Technological Adoption: North America is a rapid adopter of new medical technologies, with a strong focus on minimally invasive procedures.

Within North America, the Hospital segment for PFO closure devices is the dominant application, commanding an estimated 70% of the market share. This is due to the complexity of procedures, the need for specialized equipment, and the inpatient care required for patients undergoing PFO closure. Clinics, while growing, represent a smaller but expanding segment, particularly for follow-up care and less complex cases.

Geographically, beyond North America, Europe, with countries like Germany, the UK, and France, represents the second-largest market, followed by the Asia Pacific region. The Asia Pacific market is exhibiting the fastest growth rate, driven by increasing healthcare expenditure, rising awareness of cardiovascular diseases, and expanding access to advanced medical technologies, with countries like China and India showing significant potential.

In terms of product type, the Non-degradable segment of PFO closure devices holds the largest market share, estimated at over 80%. This dominance stems from their long-standing clinical track record, established safety profiles, and a wide range of available designs and sizes. These devices are typically made from biocompatible metals like nitinol, which are proven for long-term implantation.

- Key Drivers for Non-degradable Dominance:

- Proven long-term efficacy and safety.

- Wide availability and established manufacturing processes.

- Extensive clinical data supporting their use.

- Cost-effectiveness compared to newer degradable alternatives.

The Degradable segment, while currently smaller, is a rapidly emerging area with significant growth potential. Driven by advancements in biomaterials, these devices offer the advantage of gradual absorption into the body over time, potentially reducing long-term complications and the need for permanent implants. The market for degradable PFO closure devices is expected to grow at a CAGR exceeding 12% during the forecast period, driven by ongoing research and development and increasing clinical interest.

- Key Drivers for Degradable Growth:

- Reduced risk of long-term implant-related issues.

- Improved patient comfort and potentially less imaging required post-procedure.

- Innovation in biodegradable polymers and composite materials.

Patent Foramen Ovale Closure Device Product Developments

Product developments in the Patent Foramen Ovale (PFO) closure device market are characterized by a relentless pursuit of improved patient outcomes through enhanced safety, efficacy, and user-friendliness. Key innovations include the development of devices with more robust sealing mechanisms to prevent paradoxical embolism, reduced profiles for easier delivery through smaller introducers, and advanced biomaterials that promote rapid endothelialization and minimize thrombogenicity. Companies are also focusing on creating devices suitable for a wider range of PFO anatomies, including those with complex defects. Competitive advantages are derived from superior imaging compatibility, ease of deployment for physicians, and minimized procedural complications, all contributing to greater market adoption.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Patent Foramen Ovale (PFO) closure device market. The market is segmented by Application into Hospital and Clinics. The Hospital segment is expected to dominate in terms of market size and revenue, driven by the procedural complexity and the need for specialized cardiac catheterization laboratories. However, the Clinics segment is projected for robust growth as outpatient PFO closure procedures become more prevalent and accepted.

The market is further segmented by Type into Non-degradable and Degradable devices. The Non-degradable segment currently holds the leading market share due to its established track record and widespread availability. Nevertheless, the Degradable segment is anticipated to experience significant growth, fueled by ongoing research and development in advanced biomaterials and a rising demand for absorbable implants. Detailed projections for market size and competitive dynamics within each of these segments are provided.

Key Drivers of Patent Foramen Ovale Closure Device Growth

The growth of the Patent Foramen Ovale (PFO) closure device market is underpinned by several critical drivers. Firstly, a surge in the diagnosis and understanding of PFO's association with cryptogenic stroke is a primary catalyst, prompting increased demand for effective closure solutions. Secondly, advancements in transcatheter interventional technologies have made PFO closure a safer and less invasive alternative to surgical interventions, appealing to both patients and clinicians. Furthermore, a growing elderly population globally, more susceptible to cardiovascular events, contributes to the rising incidence of PFO-related conditions. Favorable reimbursement policies in key markets are also crucial, ensuring broader patient access to these life-saving devices.

Challenges in the Patent Foramen Ovale Closure Device Sector

Despite its promising growth, the Patent Foramen Ovale (PFO) closure device sector faces notable challenges. Stringent and evolving regulatory approvals for novel devices can lead to extended market entry timelines and substantial development costs, potentially reaching hundreds of millions. High device manufacturing costs, particularly for advanced materials and intricate designs, can also impact affordability and adoption rates in price-sensitive markets. Furthermore, while clinical evidence is mounting, the long-term comparative efficacy and safety of different PFO closure devices, especially newer degradable options versus established non-degradable ones, are still areas of ongoing research and debate, potentially creating hesitation among some clinicians.

Emerging Opportunities in Patent Foramen Ovale Closure Device

Emerging opportunities in the Patent Foramen Ovale (PFO) closure device market are abundant and poised to shape its future trajectory. The increasing recognition of PFO's role in conditions beyond stroke, such as migraine with aura, presents a significant untapped market. Advancements in materials science are paving the way for next-generation degradable PFO closure devices that offer improved biocompatibility and faster integration, reducing the need for permanent implants. Expansion into under-penetrated emerging markets in the Asia Pacific and Latin America, where cardiovascular disease burden is rising and healthcare infrastructure is developing, represents substantial growth potential. Furthermore, the development of more cost-effective and user-friendly devices could democratize access to PFO closure, further expanding the market.

Leading Players in the Patent Foramen Ovale Closure Device Market

- Abbott

- Occlutech

- Starway

- W. L. Gore & Associates

- Lepu Medical

- LifeTech

Key Developments in Patent Foramen Ovale Closure Device Industry

- 2023/08: Abbott receives FDA approval for its next-generation Amplatzer PFO Occluder, featuring an enhanced design for improved deliverability and sealing.

- 2023/05: W. L. Gore & Associates initiates pivotal clinical trials for its new GORE® CARDIOFORM PFO Occluder, aiming to demonstrate superior long-term outcomes.

- 2022/11: Lepu Medical launches its proprietary PFO closure device in China, marking a significant step in expanding its presence in the Asian market.

- 2022/07: Occlutech announces positive interim results from a study investigating its PFO closure device for the prevention of migraine.

- 2021/10: Starway receives CE Mark for its innovative PFO closure system, targeting European markets with a focus on patient safety and procedural efficiency.

- 2021/04: LifeTech secures significant funding to accelerate the development and commercialization of its novel degradable PFO closure technology.

Strategic Outlook for Patent Foramen Ovale Closure Device Market

The strategic outlook for the Patent Foramen Ovale (PFO) closure device market is exceptionally positive, driven by a compelling combination of increasing clinical evidence, technological innovation, and expanding patient indications. Future growth will be significantly catalyzed by the ongoing shift towards minimally invasive procedures, further entrenching transcatheter PFO closure as the standard of care for many patients. Strategic focus on developing devices for a broader spectrum of PFO anatomies and exploring new therapeutic applications beyond stroke prevention, such as in the management of hereditary hemorrhagic telangiectasia (HHT), will unlock new market segments. Furthermore, strategic partnerships between device manufacturers and research institutions will be crucial for advancing the development of degradable PFO closure technologies, which hold immense promise for reducing long-term implant-related complications and enhancing patient quality of life.

Patent Foramen Ovale Closure Device Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinics

-

2. Type

- 2.1. Non-degradable

- 2.2. Degradable

Patent Foramen Ovale Closure Device Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Patent Foramen Ovale Closure Device REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Patent Foramen Ovale Closure Device Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinics

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Non-degradable

- 5.2.2. Degradable

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Patent Foramen Ovale Closure Device Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinics

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Non-degradable

- 6.2.2. Degradable

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Patent Foramen Ovale Closure Device Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinics

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Non-degradable

- 7.2.2. Degradable

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Patent Foramen Ovale Closure Device Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinics

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Non-degradable

- 8.2.2. Degradable

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Patent Foramen Ovale Closure Device Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinics

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Non-degradable

- 9.2.2. Degradable

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Patent Foramen Ovale Closure Device Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinics

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Non-degradable

- 10.2.2. Degradable

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Abbott

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Occlutech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Starway

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 W. L. Gore & Associates

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lepu Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LifeTech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Abbott

List of Figures

- Figure 1: Global Patent Foramen Ovale Closure Device Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Patent Foramen Ovale Closure Device Revenue (million), by Application 2024 & 2032

- Figure 3: North America Patent Foramen Ovale Closure Device Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Patent Foramen Ovale Closure Device Revenue (million), by Type 2024 & 2032

- Figure 5: North America Patent Foramen Ovale Closure Device Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Patent Foramen Ovale Closure Device Revenue (million), by Country 2024 & 2032

- Figure 7: North America Patent Foramen Ovale Closure Device Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Patent Foramen Ovale Closure Device Revenue (million), by Application 2024 & 2032

- Figure 9: South America Patent Foramen Ovale Closure Device Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Patent Foramen Ovale Closure Device Revenue (million), by Type 2024 & 2032

- Figure 11: South America Patent Foramen Ovale Closure Device Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Patent Foramen Ovale Closure Device Revenue (million), by Country 2024 & 2032

- Figure 13: South America Patent Foramen Ovale Closure Device Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Patent Foramen Ovale Closure Device Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Patent Foramen Ovale Closure Device Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Patent Foramen Ovale Closure Device Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Patent Foramen Ovale Closure Device Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Patent Foramen Ovale Closure Device Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Patent Foramen Ovale Closure Device Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Patent Foramen Ovale Closure Device Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Patent Foramen Ovale Closure Device Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Patent Foramen Ovale Closure Device Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Patent Foramen Ovale Closure Device Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Patent Foramen Ovale Closure Device Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Patent Foramen Ovale Closure Device Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Patent Foramen Ovale Closure Device Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Patent Foramen Ovale Closure Device Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Patent Foramen Ovale Closure Device Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Patent Foramen Ovale Closure Device Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Patent Foramen Ovale Closure Device Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Patent Foramen Ovale Closure Device Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Patent Foramen Ovale Closure Device Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Patent Foramen Ovale Closure Device Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Patent Foramen Ovale Closure Device?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Patent Foramen Ovale Closure Device?

Key companies in the market include Abbott, Occlutech, Starway, W. L. Gore & Associates, Lepu Medical, LifeTech.

3. What are the main segments of the Patent Foramen Ovale Closure Device?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 211 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Patent Foramen Ovale Closure Device," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Patent Foramen Ovale Closure Device report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Patent Foramen Ovale Closure Device?

To stay informed about further developments, trends, and reports in the Patent Foramen Ovale Closure Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence