Key Insights

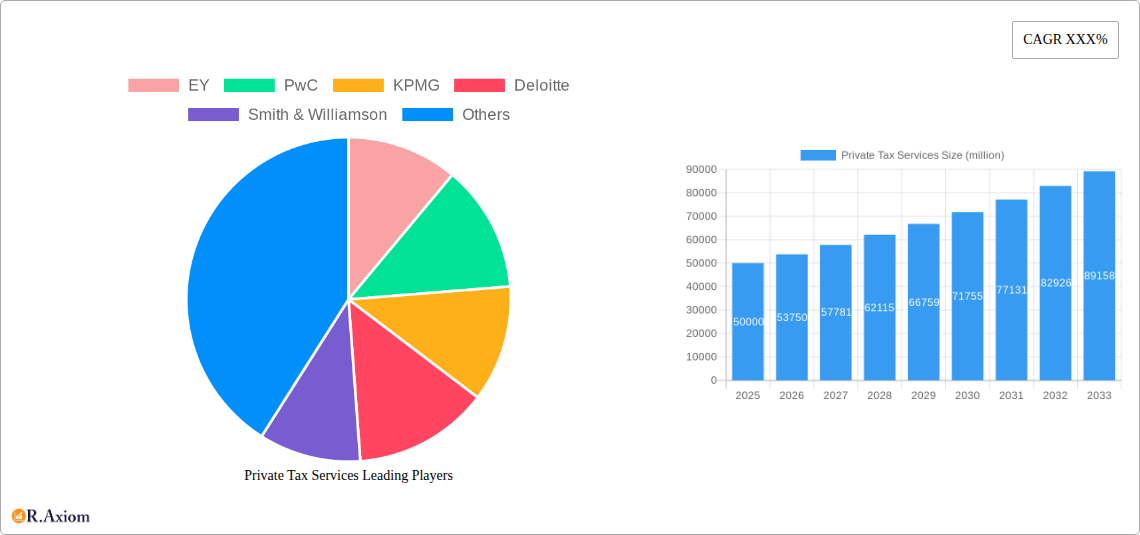

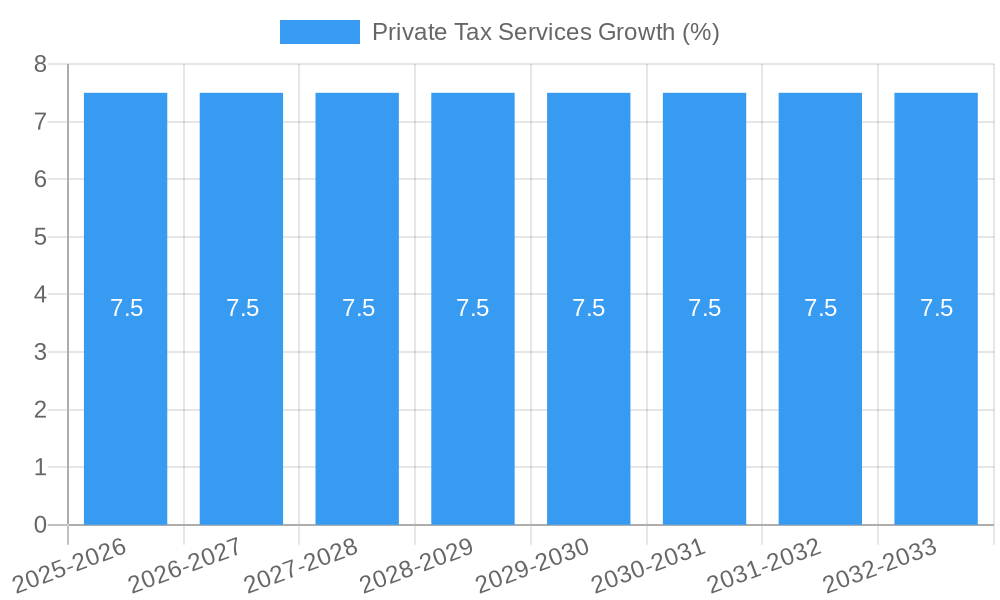

The global Private Tax Services market is poised for significant expansion, projected to reach an estimated USD 50,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated through 2033. This impressive growth is primarily fueled by the increasing complexity of tax regulations globally and a rising need among high-net-worth individuals (HNWIs) and families for specialized advisory services. Key drivers include evolving estate tax laws, the demand for sophisticated income tax planning, and the growing awareness of proactive tax management for wealth preservation and intergenerational wealth transfer. The market is segmented by application into 'Personal' and 'Others,' with 'Personal' services, encompassing individual tax preparation and planning, expected to dominate. 'Type' segmentation reveals a strong emphasis on 'Income Tax' services due to the perpetual need for optimization, alongside 'Estate Tax' planning, which gains prominence with increasing wealth accumulation and transfer.

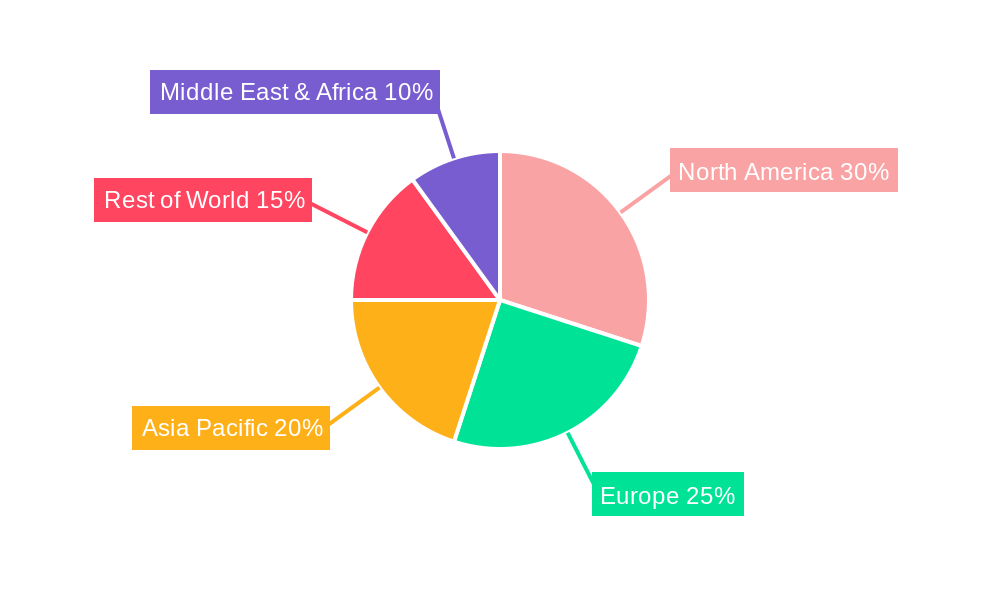

The competitive landscape for Private Tax Services is characterized by the presence of major global accounting firms, including EY, PwC, KPMG, and Deloitte, alongside specialized tax advisory firms. These players are actively innovating to offer comprehensive solutions, leveraging technology for enhanced efficiency and client experience. Emerging trends include the integration of artificial intelligence and machine learning for data analysis and predictive tax strategies, as well as a growing focus on cross-border tax compliance and wealth management. However, restraints such as the potential for regulatory changes and the ongoing challenge of attracting and retaining skilled tax professionals could moderate the market's trajectory. Geographically, North America, particularly the United States, is anticipated to hold a significant market share due to its large concentration of HNWIs and a well-established ecosystem of tax advisory services. Asia Pacific, driven by rapid economic growth and increasing wealth creation in countries like China and India, presents a substantial growth opportunity.

Here is a detailed SEO-optimized report description for Private Tax Services, designed for high search visibility and stakeholder engagement.

The private tax services market is characterized by a moderate to high concentration, with a few major accounting firms like EY, PwC, KPMG, and Deloitte dominating a significant portion of the global market share. These industry giants leverage their extensive resources, established client bases, and comprehensive service offerings to maintain their leadership. Alongside these big four accounting firms, a robust ecosystem of specialized private tax firms such as Smith & Williamson, Moss Adams LLP, Tax Innovations, Fitzroy Tax, and RSM US LLP are carving out niches by offering tailored solutions and personalized attention. M&A activities are a significant factor in market concentration, with deal values in the hundreds of millions of dollars seen as strategic moves to acquire specialized expertise, expand geographic reach, or integrate new technological capabilities. For instance, recent acquisitions have focused on firms with expertise in international tax planning and digital tax solutions. Innovation in private tax services is primarily driven by the increasing complexity of tax regulations, the growing demand for digital tax solutions, and the need for sophisticated wealth management tax strategies. Investment in AI-powered tax compliance software and advanced data analytics is transforming how services are delivered, enabling more efficient and accurate tax planning and filing. Regulatory frameworks, particularly concerning cross-border taxation and digital asset taxation, continue to evolve, creating both challenges and opportunities for service providers. Product substitutes, such as in-house tax departments or basic tax preparation software for simpler cases, exist but are generally not competitive for high-net-worth individuals and complex business structures requiring specialized expertise. End-user trends highlight a growing preference for holistic financial planning, integrating tax services with investment, estate, and retirement planning.

Private Tax Services Industry Trends & Insights

The private tax services industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year of 2025 through 2033. This significant growth is fueled by a confluence of economic, regulatory, and technological factors. Increased global wealth accumulation and the subsequent need for sophisticated tax planning and compliance for high-net-worth individuals and families are primary growth drivers. As individuals and businesses navigate increasingly complex national and international tax laws, the demand for expert guidance from firms like MNP, Perkins & Co, and Cherry Bekaert intensifies. Technological disruptions are reshaping the landscape, with the adoption of AI, machine learning, and cloud-based platforms enhancing efficiency, accuracy, and client experience. These technologies enable predictive analytics for tax liabilities, automated compliance processes, and personalized advisory services, benefiting both personal tax services and business tax services. Consumer preferences are shifting towards proactive, integrated, and digitally-enabled tax solutions. Clients expect seamless access to their tax information, real-time updates, and personalized advice that considers their entire financial picture. This necessitates a move beyond traditional reactive tax preparation to strategic tax advisory. The competitive dynamics are evolving, with traditional firms facing competition from newer, tech-savvy disruptors and specialized boutique firms. Market penetration of digital tax solutions is rapidly increasing, pushing all players to invest in technology to remain competitive. Furthermore, evolving estate tax regulations and the increasing complexity of income tax laws globally necessitate continuous adaptation and specialized knowledge, creating sustained demand for expert private tax services. The global market size is estimated to reach several hundred million dollars by 2033, with significant contributions from both developed and emerging economies.

Dominant Markets & Segments in Private Tax Services

The Personal application segment is currently the dominant force within the private tax services market, representing an estimated 70% of the total market value in the base year of 2025. This dominance is driven by several key factors.

- Growing High-Net-Worth Individual (HNWI) Population: There has been a consistent increase in the global population of HNWIs and ultra-HNWIs, particularly in regions like North America and Europe. These individuals require specialized personal tax services, including intricate income tax planning, estate tax preparation, and wealth transfer strategies to optimize their financial outcomes and preserve wealth across generations.

- Increasingly Complex Personal Tax Legislation: Tax codes worldwide are becoming more intricate, with frequent updates to income tax rates, deductions, credits, and reporting requirements. This complexity makes it challenging for individuals to manage their tax obligations independently, driving them to seek professional assistance.

- Demand for Estate Tax Planning: With an aging global population and significant intergenerational wealth transfer expected, estate tax services are in high demand. Individuals are actively seeking expert advice to minimize estate taxes, plan for charitable giving, and ensure smooth succession of assets, a key offering from firms such as Withum Smith+Brown, PC and Analie Tax.

- Cross-Border Taxation and Global Mobility: As individuals become more globally mobile and invest in international assets, the need for international personal tax services has surged. Navigating double taxation agreements, foreign tax credits, and offshore reporting requirements necessitates specialized expertise.

- Rise of Digital Assets: The burgeoning market for cryptocurrencies and other digital assets has introduced new tax complexities, creating a significant demand for advisory services in this niche area.

Geographically, North America (particularly the United States and Canada) and Europe remain the dominant markets for private tax services. This is attributable to the high concentration of wealth, mature financial markets, and well-established regulatory frameworks that necessitate professional tax assistance. Economic policies in these regions often favor detailed tax planning, and the presence of leading accounting firms like BDO USA LLP and CliftonLarsonLalen further solidifies their market leadership.

Within the Type segmentation, Income Tax services command the largest share, driven by the annual necessity for individuals and businesses to comply with income tax regulations. However, Estate Tax services are experiencing the fastest growth rate due to demographic shifts and the increasing value of intergenerational wealth transfers. The "Others" category, encompassing specialized services like international tax, digital asset tax, and specific industry tax consulting, is also expanding rapidly as client needs become more nuanced.

Private Tax Services Product Developments

Product developments in private tax services are heavily influenced by technological advancements and evolving client needs. Key innovations include the integration of Artificial Intelligence (AI) and machine learning into tax preparation and advisory platforms, enabling predictive analytics for tax liabilities and more personalized planning. Cloud-based solutions are enhancing accessibility and collaboration for both clients and service providers, while robust data security measures are paramount. Digital tax solutions are streamlining compliance and reporting for personal and business tax types. Competitive advantages are being gained through offerings that provide holistic financial planning, incorporating tax strategies with wealth management, investment, and estate planning. For example, firms are developing integrated dashboards that provide clients with a comprehensive view of their financial health, including real-time tax implications of investment decisions.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global private tax services market from 2019 to 2033, with a base year of 2025. The market is segmented by Application into Personal and Others. The Personal segment, covering individual tax planning, compliance, and wealth management, is projected to account for an estimated XX% of the market by 2033, driven by increasing HNWI populations. The Others segment, encompassing business tax services and specialized advisory, is expected to grow at a CAGR of XX%.

The market is further segmented by Type into Estate Tax, Income Tax, and Others. Income Tax services currently hold the largest market share, estimated at XX% in 2025, due to its recurring nature. Estate Tax services are anticipated to exhibit the highest growth rate, with projections indicating a XX% CAGR, fueled by intergenerational wealth transfer. The Others category, including areas like digital asset taxation and international tax, is expected to expand significantly, capturing a XX% market share by 2033.

Key Drivers of Private Tax Services Growth

The growth of the private tax services sector is propelled by several interconnected factors. Increasing global wealth accumulation and the consequent rise in the number of high-net-worth individuals necessitate sophisticated tax planning and compliance. The ever-growing complexity of national and international tax regulations across various jurisdictions, including evolving income tax laws and estate tax legislation, creates a persistent demand for expert guidance. Technological advancements, such as the adoption of AI, machine learning, and advanced analytics, are enhancing service delivery efficiency and enabling more personalized advisory. Furthermore, the trend towards holistic financial planning, where tax services are integrated with investment, retirement, and estate planning, is a significant growth catalyst.

Challenges in the Private Tax Services Sector

The private tax services sector faces several significant challenges. Navigating complex and frequently changing regulatory landscapes, both domestically and internationally, requires continuous adaptation and investment in expertise. Intensifying competition from traditional accounting firms, boutique specialized firms, and emerging technology-driven platforms puts pressure on pricing and service differentiation. Attracting and retaining top talent, particularly those with specialized knowledge in areas like international tax and digital assets, remains a persistent hurdle. Maintaining robust data security and client privacy in an increasingly digital environment is critical and requires substantial ongoing investment.

Emerging Opportunities in Private Tax Services

Emerging opportunities within the private tax services sector are abundant, driven by evolving client needs and technological innovation. The increasing focus on environmental, social, and governance (ESG) investing presents opportunities for specialized tax advisory related to ESG-compliant investments and reporting. The rapid growth of the digital asset market is creating a substantial demand for expertise in cryptocurrency and blockchain-related tax implications. Cross-border tax planning for globally mobile individuals and businesses continues to be a lucrative area. Furthermore, the development and adoption of AI-powered tax solutions offer opportunities for enhanced service delivery, predictive analytics, and personalized client experiences.

Leading Players in the Private Tax Services Market

- EY

- PwC

- KPMG

- Deloitte

- Smith & Williamson

- Moss Adams LLP

- Tax Innovations

- Fitzroy Tax

- RSM US LLP

- MNP

- Perkins & Co

- Cherry Bekaert

- Armanino LLP

- BDO USA LLP

- CliftonLarsonAllen

- HWB

- Analie Tax

- Withum Smith+Brown, PC

Key Developments in Private Tax Services Industry

- 2023/01: Major accounting firms invest hundreds of millions in AI research and development for tax applications.

- 2023/04: Increased regulatory focus on digital asset taxation globally, leading to new service offerings from specialized firms.

- 2023/07: Smith & Williamson announces strategic acquisition of a boutique estate planning firm, valued at approximately XX million.

- 2023/10: Moss Adams LLP expands its private client services with a focus on international tax planning for US expatriates.

- 2024/02: Tax Innovations launches a new cloud-based platform for real-time tax liability tracking for high-net-worth individuals.

- 2024/05: PwC releases a comprehensive report on the future of wealth management tax strategies, projecting significant market growth.

- 2024/09: RSM US LLP acquires a regional tax advisory firm to enhance its presence in the mid-market segment.

- 2025/01: Deloitte announces a partnership with a leading fintech company to integrate tax planning with investment management tools.

- 2025/03: EY enhances its virtual tax advisory services, offering personalized consultations via secure video conferencing.

- 2025/06: Fitzroy Tax expands its offerings to include specialized tax consulting for the burgeoning creator economy.

- 2025/09: MNP strengthens its cross-border tax expertise through strategic hires and training programs.

- 2026/01: Perkins & Co launches a dedicated practice for the taxation of non-fungible tokens (NFTs) and other digital collectibles.

- 2026/04: Cherry Bekaert invests in advanced data analytics to provide deeper insights into client tax exposures.

- 2026/08: Armanino LLP enhances its cybersecurity measures to safeguard sensitive client tax data.

- 2027/01: BDO USA LLP acquires a firm specializing in renewable energy tax credits, tapping into a growing market.

- 2027/05: CliftonLarsonAllen introduces a new suite of services for family offices, integrating tax, legal, and financial planning.

- 2027/11: HWB expands its international tax services to cater to the increasing globalization of businesses.

- 2028/03: Analie Tax develops an AI-powered tool for identifying potential tax deductions and credits for individuals.

- 2028/07: Withum Smith+Brown, PC launches a comprehensive tax planning service for entrepreneurs exiting their businesses.

Strategic Outlook for Private Tax Services Market

The strategic outlook for the private tax services market is overwhelmingly positive, characterized by sustained growth and evolving service demands. The increasing complexity of global tax laws, coupled with a rising tide of global wealth, ensures a continuous need for expert advisory. The successful players will be those who embrace technological innovation, particularly in AI and digital platforms, to enhance efficiency and client experience. Furthermore, a strategic focus on specialized niches, such as digital asset taxation, international mobility, and ESG-related tax planning, will unlock significant growth opportunities. The integration of tax services with broader financial and wealth management strategies will become a critical differentiator, positioning firms as indispensable partners for their clients' long-term financial success.

Private Tax Services Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Others

-

2. Type

- 2.1. Estate Tax

- 2.2. Income Tax

- 2.3. Others

Private Tax Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Private Tax Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private Tax Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Estate Tax

- 5.2.2. Income Tax

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Private Tax Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Estate Tax

- 6.2.2. Income Tax

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Private Tax Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Estate Tax

- 7.2.2. Income Tax

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Private Tax Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Estate Tax

- 8.2.2. Income Tax

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Private Tax Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Estate Tax

- 9.2.2. Income Tax

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Private Tax Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Estate Tax

- 10.2.2. Income Tax

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 EY

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PwC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KPMG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deloitte

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smith & Williamson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Moss Adams LLP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tax Innovations

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fitzroy Tax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RSM US LLP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MNP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Perkins & Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cherry Bekaert

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Armanino LLP

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BDO USA LLP

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CliftonLarsonAllen

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 HWB

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Analie Tax

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Withum Smith+Brown PC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 EY

List of Figures

- Figure 1: Global Private Tax Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Private Tax Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Private Tax Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Private Tax Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Private Tax Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Private Tax Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Private Tax Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Private Tax Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Private Tax Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Private Tax Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Private Tax Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Private Tax Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Private Tax Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Private Tax Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Private Tax Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Private Tax Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Private Tax Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Private Tax Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Private Tax Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Private Tax Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Private Tax Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Private Tax Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Private Tax Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Private Tax Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Private Tax Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Private Tax Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Private Tax Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Private Tax Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Private Tax Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Private Tax Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Private Tax Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Private Tax Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Private Tax Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Private Tax Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Private Tax Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Private Tax Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Private Tax Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Private Tax Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Private Tax Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Private Tax Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Private Tax Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Private Tax Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Private Tax Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Private Tax Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Private Tax Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Private Tax Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Private Tax Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Private Tax Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Private Tax Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Private Tax Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Private Tax Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Private Tax Services?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Private Tax Services?

Key companies in the market include EY, PwC, KPMG, Deloitte, Smith & Williamson, Moss Adams LLP, Tax Innovations, Fitzroy Tax, RSM US LLP, MNP, Perkins & Co, Cherry Bekaert, Armanino LLP, BDO USA LLP, CliftonLarsonAllen, HWB, Analie Tax, Withum Smith+Brown, PC.

3. What are the main segments of the Private Tax Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Private Tax Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Private Tax Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Private Tax Services?

To stay informed about further developments, trends, and reports in the Private Tax Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence