Key Insights

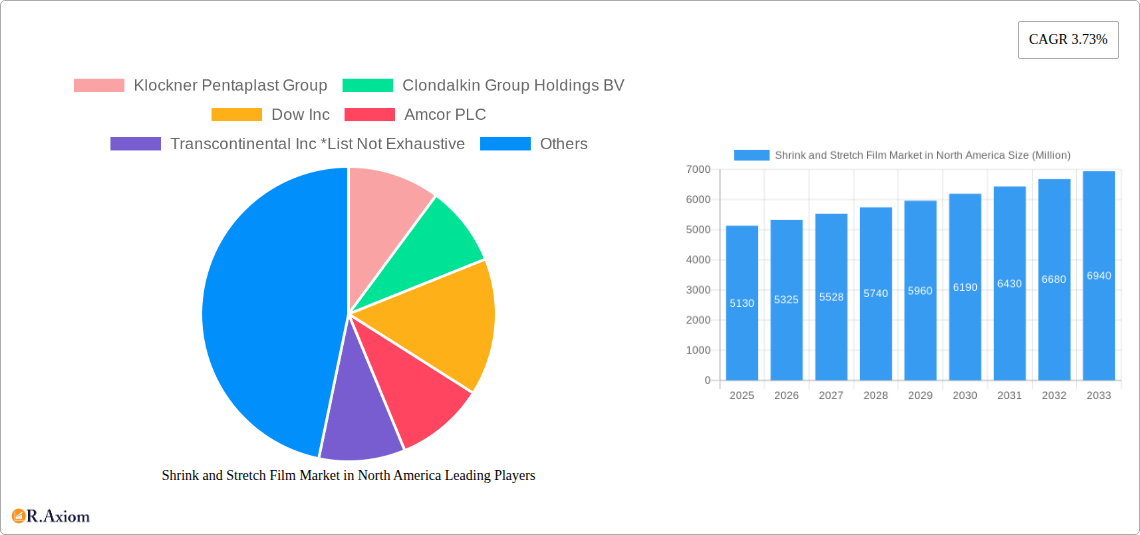

The North American shrink and stretch film market, valued at $5.13 billion in 2025, is projected to experience steady growth, driven by the expanding food and beverage, consumer goods, and pharmaceutical sectors. Increased demand for efficient and cost-effective packaging solutions across these industries is a key catalyst. The rising adoption of automated packaging systems further fuels market expansion, as these systems rely heavily on shrink and stretch films for efficient product bundling and palletizing. Growth is also anticipated from the increasing e-commerce penetration, necessitating robust and protective packaging for goods shipped across vast distances. While fluctuations in raw material prices, particularly for polymers like LDPE and LLDPE, PVC, and PET, pose a challenge, innovation in sustainable and recyclable film options is mitigating this risk. The market segmentation reveals significant demand for hoods, wraps, and sleeve labels across various materials, with LDPE and LLDPE maintaining a dominant position due to their cost-effectiveness and versatility. Major players like Amcor PLC, Berry Global Inc., and Sealed Air Corporation are strategically investing in research and development, focusing on advanced film technologies to meet evolving customer demands and address sustainability concerns.

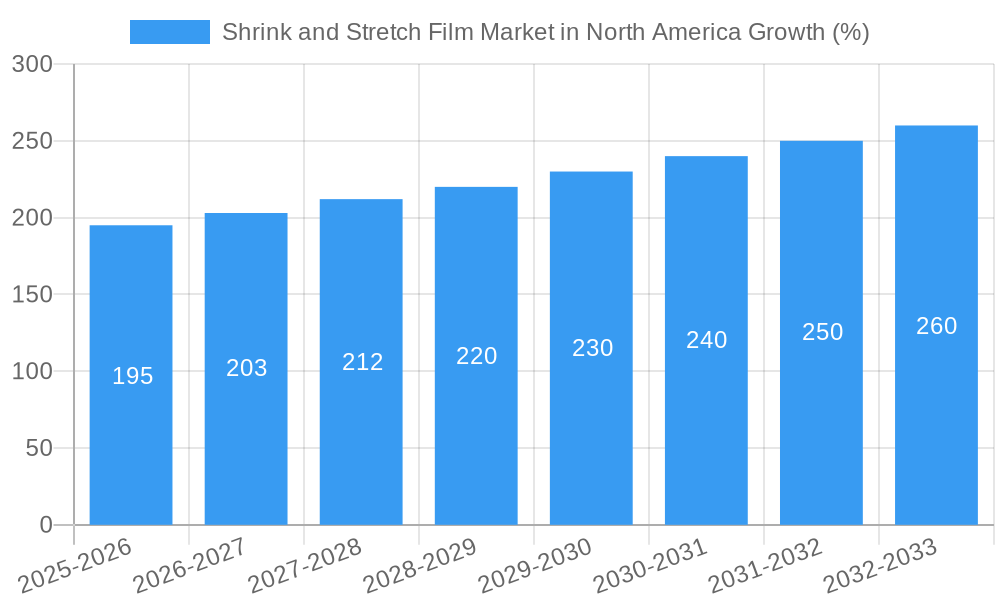

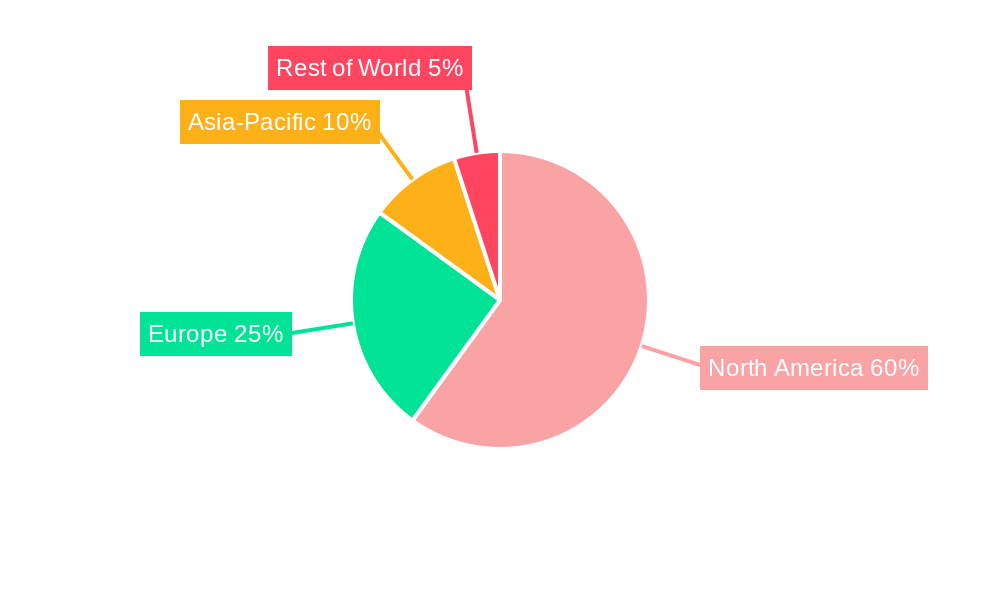

The forecast period (2025-2033) suggests continued growth, albeit at a moderated pace compared to previous years. The projected Compound Annual Growth Rate (CAGR) of 3.73% reflects a mature market experiencing incremental gains. However, the market's sustained expansion indicates a strong future outlook, particularly given the ongoing focus on optimizing supply chains and enhancing product protection. The North American region, including the United States, Canada, and Mexico, holds a significant market share due to its robust manufacturing base, large consumer market, and established distribution networks. Continued growth in these segments and regions will be paramount to the overall market success, requiring ongoing adaptation to changing consumer and industrial needs, including the increasing adoption of sustainable and eco-friendly materials and packaging processes.

Shrink and Stretch Film Market in North America: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North American shrink and stretch film market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, competitive landscape, and future growth opportunities for industry stakeholders, investors, and market entrants. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and projects the market from 2025-2033. The analysis encompasses key segments, including application, product type, and material, to deliver a holistic understanding of this evolving market.

Key areas of focus include: market size and growth projections, competitive analysis, leading companies, emerging technologies, regulatory landscape, and key challenges and opportunities.

Shrink and Stretch Film Market in North America Market Concentration & Innovation

The North American shrink and stretch film market exhibits a moderately concentrated landscape with several major players holding significant market share. Key players such as Klockner Pentaplast Group, Clondalkin Group Holdings BV, Dow Inc, Amcor PLC, Transcontinental Inc, Emsur Macdonell SA, Intertape Polymer Group Inc, Berry Global Inc, Sealed Air Corporation, and Taghleef Industries LLC compete based on product innovation, pricing strategies, and customer service. Market share data for 2024 suggests that the top 5 players hold approximately xx% of the market, indicating a moderately consolidated industry.

Innovation within the sector is driven by several factors including:

- Sustainable Packaging: Growing consumer demand for eco-friendly solutions is driving the development of films made from recycled materials and biodegradable polymers.

- Improved Film Properties: Ongoing research focuses on enhancing film strength, clarity, and barrier properties to better protect packaged goods.

- Advanced Manufacturing Techniques: Investments in advanced manufacturing technologies are aimed at improving efficiency, reducing waste, and enabling the production of customized films.

Recent M&A activity in the industry includes (estimated values in Million):

- Acquisition of xx company by yy company in 2023 for $xx Million, significantly impacting market dynamics.

- Strategic partnerships focused on developing sustainable packaging solutions.

Regulatory frameworks, such as the increased emphasis on recycled content, are also playing a crucial role in shaping innovation. Competition from alternative packaging materials is another significant factor influencing market development. The shift towards e-commerce is also increasing the demand for durable and efficient packaging solutions, driving further innovation within the market.

Shrink and Stretch Film Market in North America Industry Trends & Insights

The North American shrink and stretch film market is experiencing robust growth, projected to reach $xx Million by 2033, driven by several factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated at xx%. Growth is largely fueled by an increase in consumer spending and demand for packaged goods across various sectors. The e-commerce boom has further enhanced demand as efficient packaging becomes critical for online deliveries. Market penetration is increasing across various sectors and regions driven by technological advancements and the adoption of automated packaging systems. Increased demand for sustainable packaging solutions is also shaping the market and driving innovation towards eco-friendly and recyclable alternatives.

Technological disruptions, including the introduction of advanced film materials and enhanced manufacturing processes, are improving efficiency and expanding the range of applications for shrink and stretch films. Consumer preferences for convenience, food safety, and sustainable packaging continue to influence the demand for different types of films. Competitive dynamics are shaped by factors such as pricing strategies, product innovation, and customer service, with leading players focusing on expanding their product portfolios and strengthening their distribution networks.

Dominant Markets & Segments in Shrink and Stretch Film Market in North America

The Food and Beverage segment is currently the largest application segment within the North American shrink and stretch film market, accounting for xx% of the market in 2024. This is primarily due to the high demand for packaging solutions that ensure product safety and extend shelf life.

- Key Drivers: Stringent food safety regulations, increasing demand for processed and packaged foods, and the growing popularity of ready-to-eat meals.

The United States dominates the North American market, driven by its large population, robust manufacturing sector, and high consumption of packaged goods.

- Key Drivers: Strong economic growth, advanced infrastructure, and widespread adoption of automated packaging systems.

The LDPE and LLDPE material segment holds the largest market share due to their cost-effectiveness and versatility.

- Key Drivers: Low production cost, ease of processing, and suitability for various applications.

The Wraps product type is the most widely used owing to its versatility and suitability for various packaging applications. The Consumer Goods sector displays significant growth potential due to expanding e-commerce and consumer preference for convenience. The pharmaceutical sector is also a crucial segment, demanding high-quality packaging for product protection and compliance.

Shrink and Stretch Film Market in North America Product Developments

Recent product innovations focus on enhanced sustainability, incorporating recycled content and biodegradable materials. New film formulations offer improved barrier properties, strength, and clarity, meeting diverse packaging requirements. Technological advancements are also improving manufacturing processes, leading to greater efficiency and reduced waste. The market is witnessing the emergence of films with specialized functionalities, such as antimicrobial properties and improved shelf-life extension capabilities, catering to specific niche applications. This focus on innovation caters to the growing demand for eco-friendly and high-performance packaging solutions.

Report Scope & Segmentation Analysis

The report segments the market by application (Food and Beverage, Consumer Goods, Pharmaceutical, Material Handling, Other Packaging Types), product type (Hoods, Wraps, Sleeve Labels), and material (LDPE and LLDPE, PVC, PET, Other Materials). Each segment's market size, growth projections, and competitive landscape are analyzed. For example, the Food and Beverage segment is projected to show a CAGR of xx% from 2025 to 2033, driven by rising demand for convenient and safe food packaging. Similarly, the LDPE and LLDPE segment is expected to maintain its dominance due to cost-effectiveness, while the PET segment is showing promising growth due to its recyclability. The competitive dynamics within each segment vary, with some segments being more consolidated than others.

Key Drivers of Shrink and Stretch Film Market in North America Growth

The market's growth is primarily driven by the increasing demand for packaged goods across various sectors, expanding e-commerce, and the need for efficient and cost-effective packaging solutions. Technological advancements resulting in improved film properties and manufacturing techniques also contribute to growth. Furthermore, favorable economic conditions in North America and the increasing adoption of automated packaging systems are significant contributors. Finally, government regulations promoting sustainable packaging practices are fostering innovation and driving the demand for eco-friendly alternatives.

Challenges in the Shrink and Stretch Film Market in North America Sector

Key challenges include fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions can lead to production delays and increased costs. Stringent environmental regulations and growing concerns about plastic waste necessitate the development and adoption of sustainable packaging solutions, representing both a challenge and an opportunity. Intense competition among established players requires companies to innovate continuously to maintain market share. The market is also vulnerable to economic downturns that could impact consumer spending on packaged goods.

Emerging Opportunities in Shrink and Stretch Film Market in North America

Significant opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions, driving the development and adoption of biodegradable and compostable films. The expansion of e-commerce is creating opportunities for customized packaging solutions designed for efficient online delivery. The healthcare and pharmaceutical sectors present opportunities for specialized films offering enhanced barrier properties and tamper-evident features. Technological advancements, such as the use of advanced polymers and intelligent packaging, provide opportunities for enhanced product protection and consumer engagement.

Leading Players in the Shrink and Stretch Film Market in North America Market

- Klockner Pentaplast Group

- Clondalkin Group Holdings BV

- Dow Inc

- Amcor PLC

- Transcontinental Inc

- Emsur Macdonell SA

- Intertape Polymer Group Inc

- Berry Global Inc

- Sealed Air Corporation

- Taghleef Industries LLC

Key Developments in Shrink and Stretch Film Market in North America Industry

- February 2022: The Canadian government mandated the use of recycled plastics in shrink and stretch films and other products, driving innovation towards sustainable packaging solutions and impacting market dynamics. This regulation is likely to increase the demand for recycled content and influence material choices.

- February 2021: CCL's development of a closed-loop recycling solution for stretch sleeves demonstrates industry commitment to sustainability and circular economy principles, influencing consumer perception and potentially market share. This innovation may attract environmentally conscious customers and positively impact market growth.

Strategic Outlook for Shrink and Stretch Film Market in North America Market

The North American shrink and stretch film market is poised for continued growth, driven by several factors. The increasing demand for convenient and safe packaging, coupled with ongoing technological advancements and a growing focus on sustainability, creates a favorable outlook. Strategic partnerships focused on developing innovative and eco-friendly solutions will play a vital role in shaping future market trends. Companies with a strong focus on sustainability and advanced technologies are expected to be well-positioned for success. The market’s long-term potential is substantial, with significant opportunities for growth and innovation.

Shrink and Stretch Film Market in North America Segmentation

-

1. Product Type

- 1.1. Hoods

- 1.2. Wraps

- 1.3. Sleeve Labels

-

2. Material

- 2.1. Low-dens

- 2.2. Polyvinyl chloride (PVC)

- 2.3. Polyethylene terephthalate (PET)

- 2.4. Other Materials

-

3. End-use Industry

- 3.1. Food and Beverage

- 3.2. Consumer Goods

- 3.3. Pharmaceutical

- 3.4. Industrial

- 3.5. Other End-use Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

Shrink and Stretch Film Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

Shrink and Stretch Film Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ability to Conform to Any Size and Shape and Provide the Necessary Protection; The Need for Tamper-evident Protection to Drive Market Growth

- 3.3. Market Restrains

- 3.3.1. ; Strict Regulations regarding Single Use Plastics

- 3.4. Market Trends

- 3.4.1. The Food and Beverage Industry is one of the Significant Factors for Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hoods

- 5.1.2. Wraps

- 5.1.3. Sleeve Labels

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Low-dens

- 5.2.2. Polyvinyl chloride (PVC)

- 5.2.3. Polyethylene terephthalate (PET)

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food and Beverage

- 5.3.2. Consumer Goods

- 5.3.3. Pharmaceutical

- 5.3.4. Industrial

- 5.3.5. Other End-use Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hoods

- 6.1.2. Wraps

- 6.1.3. Sleeve Labels

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Low-dens

- 6.2.2. Polyvinyl chloride (PVC)

- 6.2.3. Polyethylene terephthalate (PET)

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by End-use Industry

- 6.3.1. Food and Beverage

- 6.3.2. Consumer Goods

- 6.3.3. Pharmaceutical

- 6.3.4. Industrial

- 6.3.5. Other End-use Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hoods

- 7.1.2. Wraps

- 7.1.3. Sleeve Labels

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Low-dens

- 7.2.2. Polyvinyl chloride (PVC)

- 7.2.3. Polyethylene terephthalate (PET)

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by End-use Industry

- 7.3.1. Food and Beverage

- 7.3.2. Consumer Goods

- 7.3.3. Pharmaceutical

- 7.3.4. Industrial

- 7.3.5. Other End-use Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. United States Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 9. Canada Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 10. Mexico Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 11. Rest of North America Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Klockner Pentaplast Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Clondalkin Group Holdings BV

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Dow Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Amcor PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Transcontinental Inc *List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Emsur Macdonell SA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Intertape Polymer Group Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Berry Global Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sealed Air Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Taghleef Industries LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Klockner Pentaplast Group

List of Figures

- Figure 1: Shrink and Stretch Film Market in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Shrink and Stretch Film Market in North America Share (%) by Company 2024

List of Tables

- Table 1: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Shrink and Stretch Film Market in North America Revenue Million Forecast, by End-use Industry 2019 & 2032

- Table 5: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Shrink and Stretch Film Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Shrink and Stretch Film Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Shrink and Stretch Film Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America Shrink and Stretch Film Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Material 2019 & 2032

- Table 14: Shrink and Stretch Film Market in North America Revenue Million Forecast, by End-use Industry 2019 & 2032

- Table 15: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Material 2019 & 2032

- Table 19: Shrink and Stretch Film Market in North America Revenue Million Forecast, by End-use Industry 2019 & 2032

- Table 20: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Shrink and Stretch Film Market in North America?

The projected CAGR is approximately 3.73%.

2. Which companies are prominent players in the Shrink and Stretch Film Market in North America?

Key companies in the market include Klockner Pentaplast Group, Clondalkin Group Holdings BV, Dow Inc, Amcor PLC, Transcontinental Inc *List Not Exhaustive, Emsur Macdonell SA, Intertape Polymer Group Inc, Berry Global Inc, Sealed Air Corporation, Taghleef Industries LLC.

3. What are the main segments of the Shrink and Stretch Film Market in North America?

The market segments include Product Type, Material, End-use Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Ability to Conform to Any Size and Shape and Provide the Necessary Protection; The Need for Tamper-evident Protection to Drive Market Growth.

6. What are the notable trends driving market growth?

The Food and Beverage Industry is one of the Significant Factors for Market Growth.

7. Are there any restraints impacting market growth?

; Strict Regulations regarding Single Use Plastics.

8. Can you provide examples of recent developments in the market?

February 2022: The federal government of Canada mandated the use of recycled plastics in shrink and stretch films and other products. The Federal Environment Agency, Environment and Climate Change Canada (ECCC), issued a notice that it plans to draft a minimum recycling content regulation, perhaps by the end of 2022. Overall, the government of Canada plans to require 50% recycled content in plastic packaging by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Shrink and Stretch Film Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Shrink and Stretch Film Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Shrink and Stretch Film Market in North America?

To stay informed about further developments, trends, and reports in the Shrink and Stretch Film Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence