Key Insights

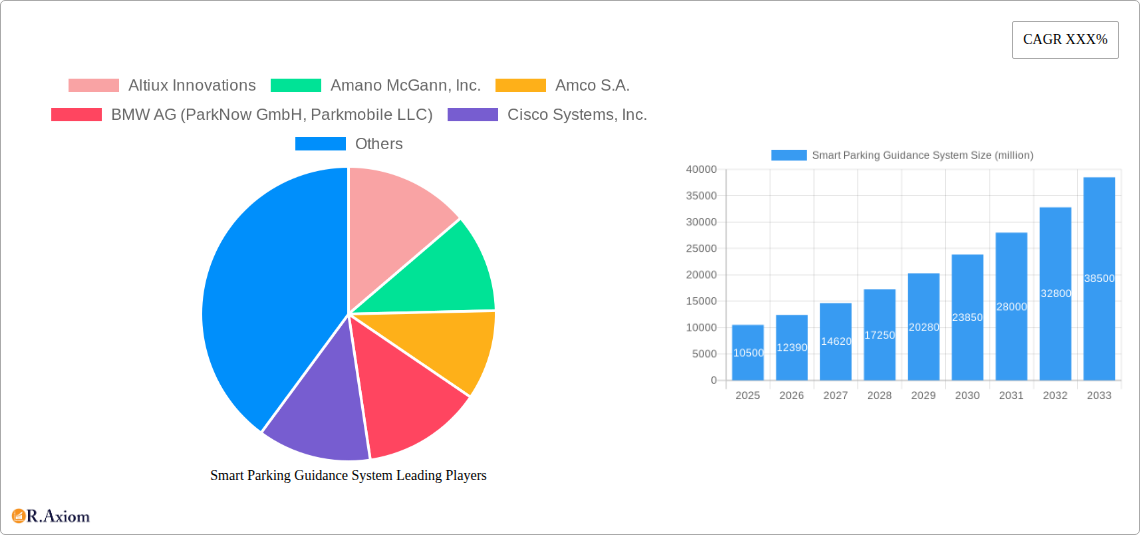

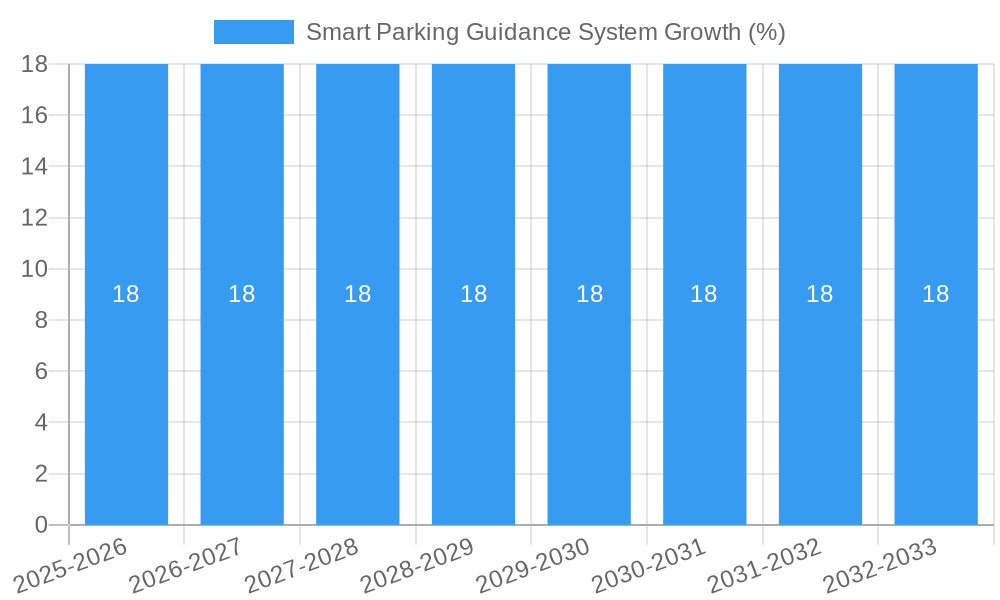

The global Smart Parking Guidance System market is poised for substantial growth, estimated to reach approximately \$10,500 million by 2025. This expansion is driven by a confluence of factors, including the escalating urbanization leading to increased traffic congestion and parking scarcity, a growing adoption of IoT and AI technologies for enhanced efficiency, and supportive government initiatives promoting smart city infrastructure. The market is projected to witness a Compound Annual Growth Rate (CAGR) of around 18% from 2025 to 2033, indicating a robust and sustained upward trajectory. The increasing demand for intelligent transportation solutions, coupled with a rising awareness of environmental concerns and the need for optimized resource utilization, further bolsters the market's potential. Furthermore, technological advancements in sensor technology, data analytics, and real-time communication are continuously improving the functionality and appeal of smart parking solutions, making them indispensable for modern urban environments.

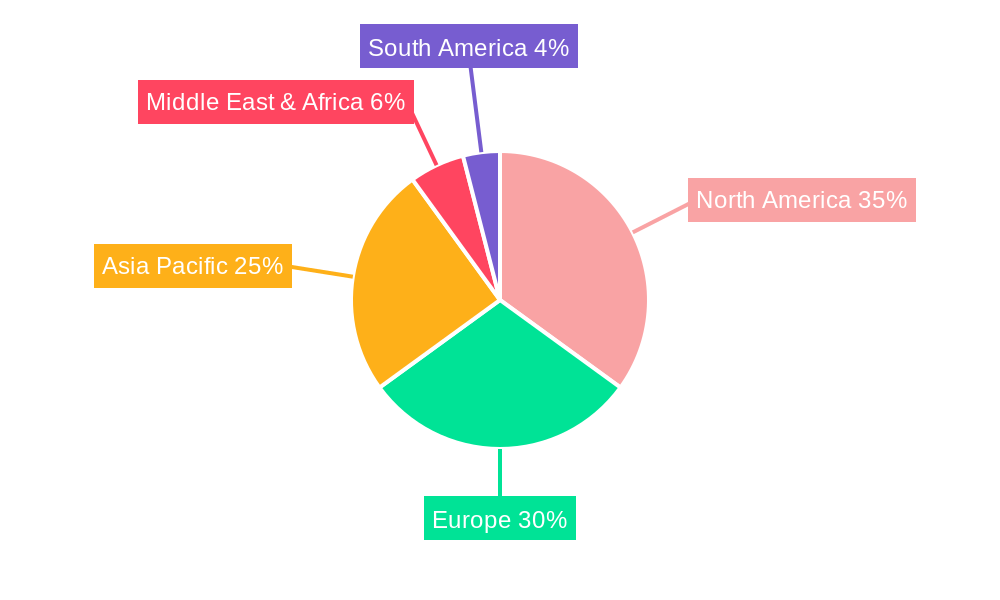

The market is segmented by application into Commercial, Government, and Transport Transit. Commercial applications, encompassing retail spaces, business parks, and public parking facilities, are expected to dominate the market share due to the high density of vehicles and the direct economic benefits derived from efficient parking management. The Transport Transit segment, including airports and railway stations, also presents significant growth opportunities. By type, the market is divided into Hardware, Software, and Service. While hardware components like sensors and cameras form the foundational infrastructure, the software solutions that enable real-time data processing, analytics, and user interfaces are crucial for providing a seamless experience. The service segment, including installation, maintenance, and consulting, is also gaining prominence as organizations increasingly seek end-to-end solutions. Geographically, North America is anticipated to lead the market, followed closely by Europe and the Asia Pacific region, driven by early adoption of smart technologies and significant investments in smart city projects. Key players are actively investing in research and development to innovate and expand their offerings, contributing to the overall market dynamism.

Here is a comprehensive, SEO-optimized report description for the Smart Parking Guidance System market, designed for immediate use without modification.

Smart Parking Guidance System Market Concentration & Innovation

The Smart Parking Guidance System market is characterized by a moderate to high level of concentration, with several key players vying for market share. Leading companies like Siemens AG, Robert Bosch GmbH, Kapsch TrafficCom, and SKIDATA AG have established strong footholds through extensive R&D and strategic acquisitions. For instance, M&A activities in the forecast period are projected to reach a cumulative value of over 500 million in deal values, indicating ongoing consolidation and strategic expansion. Innovation in this sector is primarily driven by the escalating demand for smart city solutions, the increasing adoption of IoT devices, and the need for efficient urban mobility management. Regulatory frameworks, particularly those promoting sustainable urban development and traffic reduction, play a crucial role in shaping market dynamics. Altiux Innovations and gtechna are actively developing advanced sensor technologies and data analytics platforms to enhance parking efficiency. Product substitutes, such as traditional manual parking systems and basic app-based parking payment solutions, are gradually being replaced by integrated smart guidance systems that offer real-time occupancy data, dynamic pricing, and seamless payment integration. End-user trends lean towards convenience, cost-effectiveness, and environmental consciousness, driving the adoption of systems that reduce search times and fuel consumption.

Smart Parking Guidance System Industry Trends & Insights

The global Smart Parking Guidance System market is experiencing robust growth, driven by an increasing urbanization rate and a growing need to alleviate traffic congestion and parking scarcity in cities worldwide. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. Market penetration is expected to rise significantly, with smart parking solutions being integrated into over 35% of new commercial and public parking infrastructures by 2033. Technological disruptions, including advancements in Artificial Intelligence (AI) for predictive analytics, machine learning for dynamic pricing optimization, and the proliferation of 5G networks for enhanced connectivity, are revolutionizing the industry. Companies such as CivicSmart, Inc. and Flowbird are at the forefront of developing intelligent algorithms to guide drivers to available spots efficiently. Consumer preferences are shifting towards user-friendly mobile applications that offer real-time information, pre-booking facilities, and integrated payment options, thereby enhancing the overall parking experience. Competitive dynamics are intensifying, with both established players and emerging startups actively innovating and expanding their offerings. Park Assist and ParkHelp Technologies are focusing on providing comprehensive end-to-end solutions, encompassing hardware, software, and installation services. The integration of payment gateways with parking guidance systems, as seen with solutions from Parkmobile LLC (a BMW AG subsidiary) and SpotHero, Inc., is a critical trend that is simplifying the user journey and driving market adoption. Furthermore, the increasing focus on data-driven urban planning by government entities, supported by solutions from Kapsch TrafficCom and Siemens AG, is creating a favorable environment for the widespread deployment of smart parking technologies. The development of interoperable systems that can communicate with other smart city infrastructure components, such as traffic lights and public transport, is also a significant emerging trend. The market is also witnessing a trend towards subscription-based software models and managed services, which provide recurring revenue streams for providers and offer flexibility to end-users. The economic benefits, including reduced fuel consumption, lower emissions, and increased efficiency for parking operators, are significant drivers for the adoption of these advanced systems. The global market size for smart parking guidance systems is estimated to reach over 10 billion by 2025 and is projected to grow to over 25 billion by 2033, reflecting a substantial market opportunity.

Dominant Markets & Segments in Smart Parking Guidance System

The Smart Parking Guidance System market exhibits distinct dominance across various geographical regions and market segments.

Regional Dominance: North America and Europe Lead Adoption

- North America: This region, particularly the United States, is a dominant force in the smart parking guidance system market. High levels of urbanization, coupled with significant investments in smart city initiatives and a strong consumer appetite for technology-driven solutions, drive this dominance. Key drivers include supportive government policies promoting technological adoption, substantial private sector investment in infrastructure upgrades, and a mature automotive market with a high rate of connected vehicle penetration. Cities are actively implementing these systems to manage traffic congestion and improve urban living.

- Europe: Europe, with its densely populated cities and progressive environmental regulations, is another leading region. Countries like Germany, the UK, and France are at the forefront of adopting smart parking solutions to achieve their sustainability goals. The presence of major industry players like SWARCO AG and NEDAP N.V., coupled with strong governmental support for smart mobility projects, significantly bolsters the European market. The emphasis on reducing carbon footprints and improving the quality of urban life makes smart parking systems a natural fit for European cities.

Application Dominance: Commercial and Government Sectors Drive Demand

- Commercial Application: The commercial segment, encompassing retail spaces, shopping malls, airports, and corporate campuses, represents a significant portion of the market. Businesses are increasingly recognizing the value of smart parking systems in enhancing customer experience, improving operational efficiency, and generating additional revenue streams through dynamic pricing and premium parking options. Amano McGann, Inc. and Flowbird are prominent providers catering to this segment, offering solutions that optimize parking lot utilization and streamline payment processes.

- Government Application: Municipalities and government bodies are crucial stakeholders, driven by the need to manage urban congestion, improve traffic flow, and enhance citizen services. Government initiatives focused on smart city development and sustainable transportation are major catalysts. Solutions from companies like Kapsch TrafficCom and Siemens AG are integral to public parking management, smart traffic enforcement, and intelligent transportation systems. The ability of these systems to collect valuable data for urban planning and traffic management further strengthens government adoption.

- Transport Transit Application: This segment is gaining traction, with smart parking solutions being integrated into public transportation hubs, train stations, and bus depots. The goal is to provide seamless connectivity between various modes of transport, facilitating last-mile solutions and encouraging the use of public transit. Companies like INDECT Electronics & Distribution GmbH are developing integrated solutions for these complex environments.

Type Dominance: Software and Service Segments Show Strong Growth

- Software: The software component of smart parking guidance systems is experiencing rapid growth. This includes cloud-based platforms, mobile applications, data analytics dashboards, and AI-powered algorithms for real-time guidance and predictive parking availability. Companies like ParkMe Inc. and Urbiotica, S.L. are focusing on developing sophisticated software solutions that form the intelligence backbone of these systems. The ability to offer scalable, adaptable, and data-rich software is crucial for market leadership.

- Service: The service segment, encompassing installation, maintenance, consulting, and managed services, is equally vital. As smart parking systems become more complex, end-users increasingly rely on specialized services to ensure optimal performance and uptime. Municipal Parking Services, Inc. and Meter Feeder, Inc. offer comprehensive service packages, contributing to the overall market value. The trend towards managed services provides ongoing support and ensures the long-term effectiveness of the deployed systems.

- Hardware: While hardware components like sensors, cameras, and digital displays remain essential, the market is increasingly leaning towards integrated solutions where hardware is part of a larger software and service offering. Companies such as Libelium Comunicaciones Distribuidas S.L. are innovating in sensor technology, providing accurate real-time data that fuels the software.

Smart Parking Guidance System Product Developments

- Commercial Application: The commercial segment, encompassing retail spaces, shopping malls, airports, and corporate campuses, represents a significant portion of the market. Businesses are increasingly recognizing the value of smart parking systems in enhancing customer experience, improving operational efficiency, and generating additional revenue streams through dynamic pricing and premium parking options. Amano McGann, Inc. and Flowbird are prominent providers catering to this segment, offering solutions that optimize parking lot utilization and streamline payment processes.

- Government Application: Municipalities and government bodies are crucial stakeholders, driven by the need to manage urban congestion, improve traffic flow, and enhance citizen services. Government initiatives focused on smart city development and sustainable transportation are major catalysts. Solutions from companies like Kapsch TrafficCom and Siemens AG are integral to public parking management, smart traffic enforcement, and intelligent transportation systems. The ability of these systems to collect valuable data for urban planning and traffic management further strengthens government adoption.

- Transport Transit Application: This segment is gaining traction, with smart parking solutions being integrated into public transportation hubs, train stations, and bus depots. The goal is to provide seamless connectivity between various modes of transport, facilitating last-mile solutions and encouraging the use of public transit. Companies like INDECT Electronics & Distribution GmbH are developing integrated solutions for these complex environments.

Type Dominance: Software and Service Segments Show Strong Growth

- Software: The software component of smart parking guidance systems is experiencing rapid growth. This includes cloud-based platforms, mobile applications, data analytics dashboards, and AI-powered algorithms for real-time guidance and predictive parking availability. Companies like ParkMe Inc. and Urbiotica, S.L. are focusing on developing sophisticated software solutions that form the intelligence backbone of these systems. The ability to offer scalable, adaptable, and data-rich software is crucial for market leadership.

- Service: The service segment, encompassing installation, maintenance, consulting, and managed services, is equally vital. As smart parking systems become more complex, end-users increasingly rely on specialized services to ensure optimal performance and uptime. Municipal Parking Services, Inc. and Meter Feeder, Inc. offer comprehensive service packages, contributing to the overall market value. The trend towards managed services provides ongoing support and ensures the long-term effectiveness of the deployed systems.

- Hardware: While hardware components like sensors, cameras, and digital displays remain essential, the market is increasingly leaning towards integrated solutions where hardware is part of a larger software and service offering. Companies such as Libelium Comunicaciones Distribuidas S.L. are innovating in sensor technology, providing accurate real-time data that fuels the software.

Smart Parking Guidance System Product Developments

Product development in the Smart Parking Guidance System market is characterized by a strong focus on technological integration and user-centric design. Innovations include advanced IoT sensors for real-time occupancy detection with an accuracy rate of over 99%, AI-driven analytics for predicting parking availability and optimizing traffic flow, and seamless integration with mobile applications for intuitive navigation and payment. Competitive advantages are being gained through the development of interoperable systems that can communicate with broader smart city infrastructure, offering data-driven insights for urban planning. Companies like Mindteck are developing scalable and robust platforms that can be customized for diverse environments, from large urban centers to private parking facilities.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Smart Parking Guidance System market, segmented across key areas to offer detailed insights.

- Application Segmentation: The market is analyzed based on its application in Commercial, Government, and Transport Transit sectors. The commercial segment is projected to grow at a CAGR of over 13%, driven by retail and corporate demand. The government segment is expected to see a CAGR of approximately 12%, fueled by smart city initiatives, while the transport transit segment, with a projected CAGR of 11.5%, benefits from the increasing need for integrated mobility solutions.

- Type Segmentation: The report further segments the market by type into Hardware, Software, and Service. The software segment is anticipated to exhibit the highest growth, with a CAGR exceeding 14%, due to the increasing demand for intelligent analytics and user-friendly interfaces. The service segment is projected to grow at a CAGR of around 13.5%, as end-users opt for comprehensive installation and maintenance packages. The hardware segment, while foundational, is expected to grow at a CAGR of approximately 11%, driven by advancements in sensor technology.

Key Drivers of Smart Parking Guidance System Growth

The growth of the Smart Parking Guidance System market is propelled by several interconnected factors. The increasing rate of urbanization and the resultant rise in vehicular traffic are creating significant parking challenges in cities worldwide. Government initiatives promoting smart city development and sustainable urban mobility are providing a strong impetus for the adoption of these systems. Technological advancements, particularly in IoT, AI, and cloud computing, are enabling the development of more sophisticated and efficient parking solutions. Furthermore, a growing consumer demand for convenience, reduced search times, and a seamless parking experience is a crucial driver. The economic benefits, including reduced fuel consumption and lower emission levels, are also contributing to market expansion.

Challenges in the Smart Parking Guidance System Sector

Despite the promising growth, the Smart Parking Guidance System sector faces several challenges. High initial investment costs for infrastructure deployment can be a deterrent for some municipalities and private operators. The complexity of integrating diverse hardware and software components from various vendors can lead to interoperability issues and technical hurdles. Cybersecurity concerns, related to the vast amounts of data collected and transmitted, require robust security measures. Additionally, regulatory fragmentation across different regions and the need for standardized protocols can slow down widespread adoption. Competition from established players and emerging startups also intensifies pricing pressures.

Emerging Opportunities in Smart Parking Guidance System

The Smart Parking Guidance System market presents numerous emerging opportunities. The expansion of smart city ecosystems offers significant potential for integrating parking guidance with other urban services like traffic management, public transport, and emergency response systems. The development of advanced analytics and AI-powered predictive models for parking demand forecasting and dynamic pricing presents a lucrative avenue. The growing adoption of electric vehicles (EVs) creates opportunities for smart charging infrastructure integrated with parking guidance systems. Furthermore, the increasing focus on data monetization and the development of new revenue streams through parking data analytics are opening up new business models. Expansion into developing economies with rapidly growing urban populations also represents a significant growth opportunity.

Leading Players in the Smart Parking Guidance System Market

- Altiux Innovations

- Amano McGann, Inc.

- Amco S.A.

- BMW AG (ParkNow GmbH, Parkmobile LLC)

- Cisco Systems, Inc.

- CivicSmart, Inc.

- Deteq Solutions

- Flowbird

- gtechna

- INDECT Electronics & Distribution GmbH

- Kapsch TrafficCom

- Libelium Comunicaciones Distribuidas S.L.

- Meter Feeder, Inc.

- Mindteck

- Municipal Parking Services, Inc.

- Nedap N.V.

- Park Assist

- ParkHelp Technologies

- ParkJockey

- ParkMe Inc.

- Robert Bosch GmbH

- Siemens AG

- SKIDATA AG

- Smart Parking Ltd.

- SpotHero, Inc.

- Swarco AG

- Urbiotica, S.L.

Key Developments in Smart Parking Guidance System Industry

- 2023/04: Siemens AG announced a strategic partnership with a major urban development authority to implement an integrated smart parking solution across multiple city districts, aiming to reduce congestion by over 20%.

- 2023/08: Park Assist launched its next-generation AI-powered camera system, offering real-time occupancy detection with 99.5% accuracy and advanced analytics for parking lot management.

- 2023/10: Flowbird acquired a leading provider of dynamic pricing software, enhancing its capabilities to offer flexible and optimized parking fees for its clients.

- 2024/01: Kapsch TrafficCom unveiled a new cloud-based platform designed to seamlessly integrate various smart parking hardware and software solutions, promoting interoperability.

- 2024/03: BMW AG (Parkmobile LLC) expanded its integration with major navigation platforms, allowing users to directly find and pay for parking from their in-car infotainment systems.

- 2024/05: Nedap N.V. introduced a new energy-efficient sensor technology for smart parking, significantly reducing the operational costs for parking operators.

Strategic Outlook for Smart Parking Guidance System Market

The strategic outlook for the Smart Parking Guidance System market remains exceptionally positive. The continuous evolution of smart city infrastructure, coupled with increasing governmental and private sector investment, will serve as major growth catalysts. The focus on sustainability and efficiency in urban environments will further drive the adoption of these intelligent systems. Opportunities lie in developing more integrated solutions that connect parking with broader mobility services, capitalizing on the growing demand for seamless and data-driven urban living. The market is poised for substantial expansion as technology continues to mature and end-user acceptance grows.

Smart Parking Guidance System Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Government

- 1.3. Transport Transit

-

2. Type

- 2.1. Hardware

- 2.2. Software

- 2.3. Service

Smart Parking Guidance System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Smart Parking Guidance System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Parking Guidance System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Government

- 5.1.3. Transport Transit

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Service

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Smart Parking Guidance System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Government

- 6.1.3. Transport Transit

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Service

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Smart Parking Guidance System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Government

- 7.1.3. Transport Transit

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Service

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Smart Parking Guidance System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Government

- 8.1.3. Transport Transit

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Service

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Smart Parking Guidance System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Government

- 9.1.3. Transport Transit

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Service

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Smart Parking Guidance System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Government

- 10.1.3. Transport Transit

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Service

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Altiux Innovations

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amano McGann Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amco S.A.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BMW AG (ParkNow GmbH Parkmobile LLC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CivicSmart Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Deteq Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flowbird

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 gtechna

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 INDECT Electronics & Distribution GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kapsch TrafficCom

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Libelium Comunicaciones Distribuidas S.L.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Meter Feeder Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mindteck

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Municipal Parking Services Inc.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Nedap N.V.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Park Assist

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ParkHelp Technologies

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 ParkJockey

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 ParkMe Inc.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Robert Bosch GmbH

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Siemens AG

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 SKIDATA AG

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Smart Parking Ltd.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 SpotHero Inc.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Swarco AG

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Urbiotica S.L.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Altiux Innovations

List of Figures

- Figure 1: Global Smart Parking Guidance System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Smart Parking Guidance System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Smart Parking Guidance System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Smart Parking Guidance System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Smart Parking Guidance System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Smart Parking Guidance System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Smart Parking Guidance System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Smart Parking Guidance System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Smart Parking Guidance System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Smart Parking Guidance System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Smart Parking Guidance System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Smart Parking Guidance System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Smart Parking Guidance System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Smart Parking Guidance System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Smart Parking Guidance System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Smart Parking Guidance System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Smart Parking Guidance System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Smart Parking Guidance System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Smart Parking Guidance System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Smart Parking Guidance System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Smart Parking Guidance System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Smart Parking Guidance System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Smart Parking Guidance System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Smart Parking Guidance System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Smart Parking Guidance System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Smart Parking Guidance System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Smart Parking Guidance System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Smart Parking Guidance System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Smart Parking Guidance System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Smart Parking Guidance System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Smart Parking Guidance System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Parking Guidance System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Parking Guidance System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Smart Parking Guidance System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Smart Parking Guidance System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Smart Parking Guidance System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Smart Parking Guidance System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Smart Parking Guidance System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Smart Parking Guidance System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Smart Parking Guidance System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Smart Parking Guidance System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Smart Parking Guidance System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Smart Parking Guidance System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Smart Parking Guidance System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Smart Parking Guidance System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Smart Parking Guidance System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Smart Parking Guidance System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Smart Parking Guidance System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Smart Parking Guidance System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Smart Parking Guidance System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Smart Parking Guidance System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Parking Guidance System?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Smart Parking Guidance System?

Key companies in the market include Altiux Innovations, Amano McGann, Inc., Amco S.A., BMW AG (ParkNow GmbH, Parkmobile LLC), Cisco Systems, Inc., CivicSmart, Inc., Deteq Solutions, Flowbird, gtechna, INDECT Electronics & Distribution GmbH, Kapsch TrafficCom, Libelium Comunicaciones Distribuidas S.L., Meter Feeder, Inc., Mindteck, Municipal Parking Services, Inc., Nedap N.V., Park Assist, ParkHelp Technologies, ParkJockey, ParkMe Inc., Robert Bosch GmbH, Siemens AG, SKIDATA AG, Smart Parking Ltd., SpotHero, Inc., Swarco AG, Urbiotica, S.L..

3. What are the main segments of the Smart Parking Guidance System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Parking Guidance System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Parking Guidance System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Parking Guidance System?

To stay informed about further developments, trends, and reports in the Smart Parking Guidance System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence