Key Insights

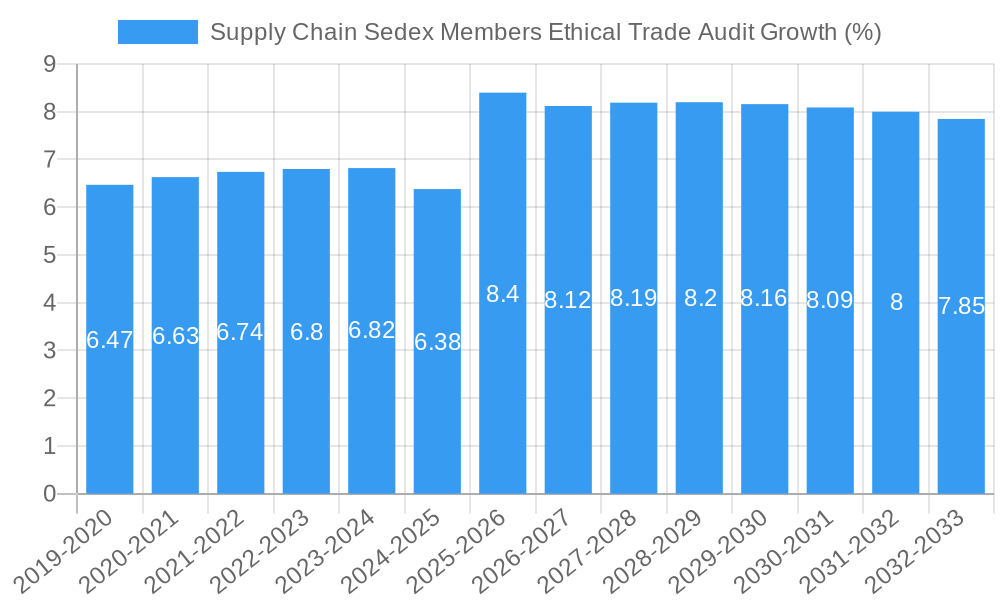

The global Supply Chain Sedex Members Ethical Trade Audit market is poised for significant expansion, driven by increasing consumer demand for ethically sourced products and growing corporate responsibility initiatives. With a projected market size of approximately USD 2.5 billion in 2025, the industry is anticipated to witness a Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust growth is fueled by a confluence of factors, including heightened awareness of labor rights, environmental sustainability, and the imperative for supply chain transparency. Regulatory pressures from governments worldwide are also playing a crucial role, compelling businesses to adopt stringent ethical auditing practices to ensure compliance and mitigate reputational risks. Key applications within this market span diverse sectors, with Retail and Consumption, Clothing and Textiles, and Food and Drinks emerging as dominant segments due to their direct consumer impact and complex global supply chains.

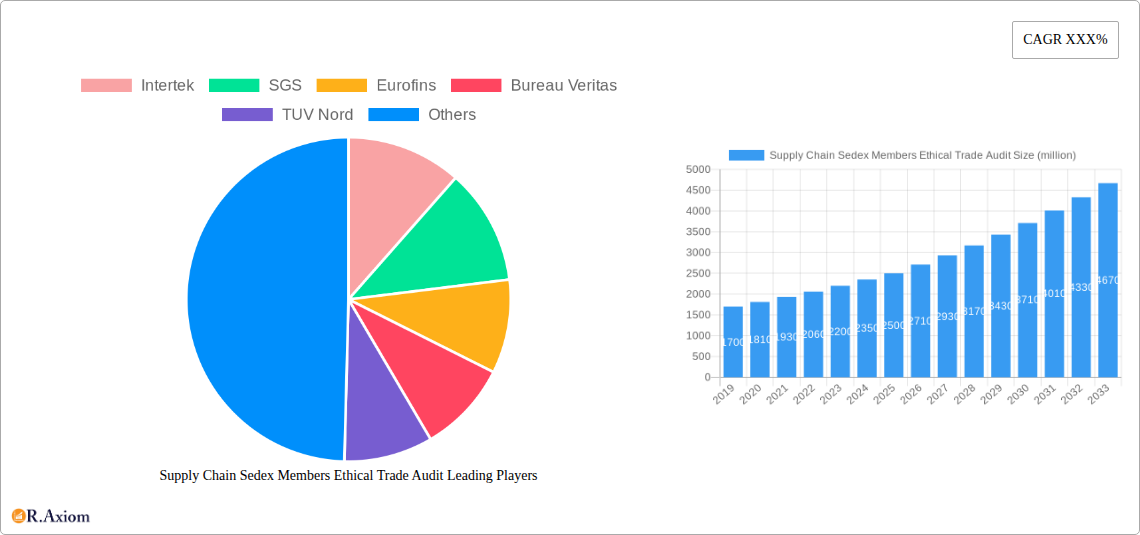

The market's trajectory is further shaped by evolving auditing methodologies, with a notable shift towards comprehensive 4 Pillar Audits that encompass broader ethical considerations beyond traditional labor practices. While the demand for ethical audits is a strong growth driver, certain restraints such as the cost of implementation and a potential shortage of skilled auditors could temper expansion in specific regions. Nevertheless, the overarching trend towards responsible business practices and the continued engagement of leading companies in ethical sourcing frameworks like Sedex ensure a positive outlook. Emerging economies, particularly in the Asia Pacific region, are expected to be significant contributors to market growth as they integrate further into global supply chains and face increasing scrutiny on ethical standards. Companies like Intertek, SGS, and Eurofins are at the forefront, offering a range of auditing services and technological solutions to meet the evolving needs of businesses navigating the complex landscape of ethical trade.

This in-depth market research report offers a comprehensive analysis of the Supply Chain Sedex Members Ethical Trade Audit market, exploring its current landscape, historical performance, and future trajectory. Spanning the study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this report provides critical insights for industry stakeholders, including manufacturers, suppliers, retailers, auditors, and investors. Leveraging high-traffic keywords such as "ethical sourcing," "supply chain transparency," "SMETA audit," "responsible business," and "corporate social responsibility," this report is optimized for enhanced search visibility and aims to engage a wide spectrum of industry professionals.

Supply Chain Sedex Members Ethical Trade Audit Market Concentration & Innovation

The Supply Chain Sedex Members Ethical Trade Audit market, while experiencing consistent growth, exhibits moderate to high concentration. Leading audit firms like Intertek, SGS, Eurofins, Bureau Veritas, TUV Nord, BSI Group, QIMA, LRQA, Kiwa, TUV SUD, DQS Holding GmbH, UL, AGCS, ALGI, Control Union Certifications, Certiquality Srl Via, and Global Inspection Managing hold significant market shares, collectively accounting for an estimated 75% of the global market. Innovation is primarily driven by advancements in audit methodologies, leveraging digital tools for data collection and analysis, and an increasing demand for specialized audits covering emerging risks such as modern slavery and climate change impact. Regulatory frameworks, including national legislation on due diligence and international standards, continue to shape audit requirements. Product substitutes are limited, as SMETA (Sedex Members Ethical Trade Audit) remains a cornerstone for demonstrating ethical compliance. End-user trends highlight a growing preference for brands committed to ethical supply chains, pushing for greater transparency and accountability. Merger and acquisition (M&A) activities are anticipated to continue, with estimated deal values reaching several hundred million, as larger players seek to consolidate their offerings and expand their geographical reach. The market share of the top five players is estimated to be approximately 50%.

Supply Chain Sedex Members Ethical Trade Audit Industry Trends & Insights

The Supply Chain Sedex Members Ethical Trade Audit industry is experiencing robust growth, fueled by escalating consumer awareness and stringent regulatory mandates. Market growth drivers include the increasing emphasis on Environmental, Social, and Governance (ESG) criteria by investors and consumers alike, demanding higher ethical standards across global supply chains. Technological disruptions are playing a pivotal role, with the adoption of blockchain for enhanced traceability, AI-powered risk assessment tools, and cloud-based platforms for efficient audit management significantly streamlining the audit process. Consumer preferences are shifting towards brands that demonstrate a genuine commitment to ethical sourcing and fair labor practices, directly impacting purchasing decisions and incentivizing companies to invest in ethical audits. Competitive dynamics are characterized by a strong interplay between established audit providers and emerging specialized firms. The industry is witnessing a continuous push for standardized audit protocols and greater harmonization of reporting across different sectors. Market penetration of ethical trade audits is estimated to be around 65% in developed economies and is rapidly increasing in emerging markets. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be between 8% and 12%. Key trends include the integration of social and environmental audits, the growing importance of worker voice mechanisms, and the increasing demand for multi-stakeholder initiatives to address complex supply chain challenges. Companies are proactively seeking to mitigate reputational risks and build consumer trust through transparent and verifiable ethical practices. The estimated market size in 2025 is projected to be over $5,000 million.

Dominant Markets & Segments in Supply Chain Sedex Members Ethical Trade Audit

The dominant markets and segments within the Supply Chain Sedex Members Ethical Trade Audit landscape are multifaceted, reflecting the diverse applications of ethical sourcing and auditing.

Dominant Application Segment: Retail and Consumption This segment consistently leads due to the direct consumer interface and the high visibility of brands. Retailers face immense pressure from consumers and advocacy groups to ensure their products are ethically produced. The Clothing and Textiles sector within Retail and Consumption is particularly scrutinized for labor practices, driving significant demand for SMETA audits. The Food and Drinks sector also shows strong demand, driven by concerns over food safety, fair labor in agriculture, and environmental impact. The estimated market size for this segment is over $2,500 million.

Dominant Audit Type: 4 Pillar Audits The 4 Pillar Audits, covering Health and Safety, Labor Standards, Environment, and Business Ethics, are the most widely adopted audit type. This comprehensive approach provides a holistic view of a supplier's ethical performance, aligning with the expectations of Sedex members and facilitating a deeper understanding of potential risks. The demand for 4 Pillar Audits is expected to continue its upward trajectory. The estimated market share for 4 Pillar Audits is approximately 70%.

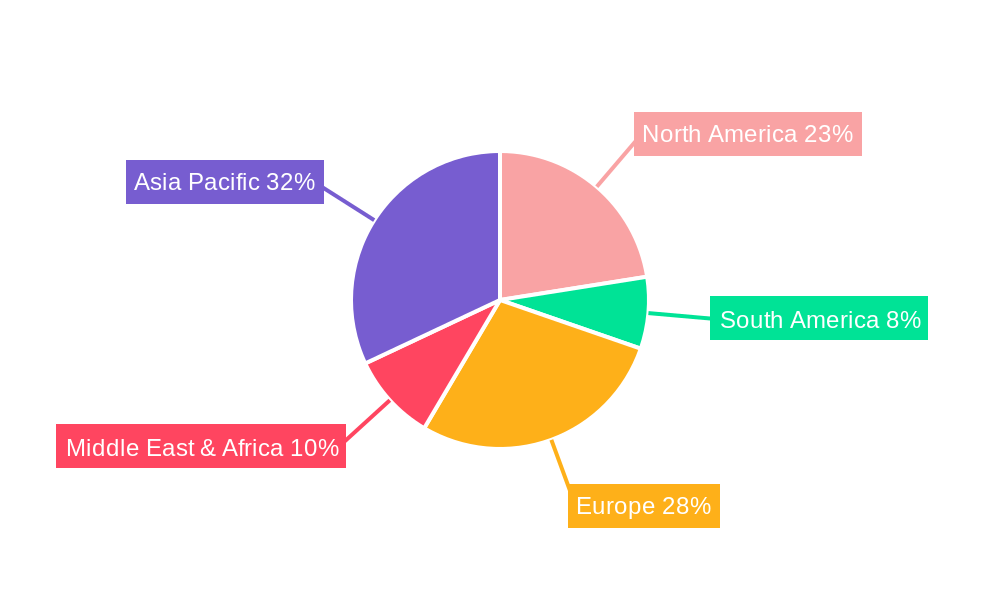

Regional Dominance: Europe and North America These regions exhibit the highest adoption rates for ethical trade audits, driven by established regulatory frameworks, proactive consumer engagement, and a mature corporate social responsibility landscape. Economic policies in these regions strongly favor supply chain transparency and ethical business conduct. Infrastructure supporting efficient audit delivery and data management is well-developed.

Emerging Market Growth: Asia-Pacific While still developing, the Asia-Pacific region is experiencing rapid growth in the adoption of ethical trade audits. This is driven by multinational corporations expanding their sourcing from the region and increasing local regulatory pressures. Investment in improving working conditions and environmental standards is on the rise.

Key Drivers of Dominance:

- Regulatory Frameworks: Stringent laws in Europe (e.g., German Supply Chain Due Diligence Act) and similar initiatives in North America mandate ethical supply chain practices.

- Consumer Pressure: High consumer awareness in developed markets translates into purchasing power that favors ethically sourced products.

- Brand Reputation Management: Companies prioritize protecting their brand image by ensuring ethical compliance throughout their supply chains.

- Investor Demand: Growing influence of ESG investing encourages companies to demonstrate robust ethical audit practices.

- Industry Initiatives: Sector-specific initiatives and multi-stakeholder collaborations are driving standardization and adoption.

The market size for Clothing and Textiles is estimated to be over $1,500 million, while Food and Drinks is over $1,000 million. Hospitality and Travel, Architecture and Engineering, and Others represent smaller but growing segments, with their combined market size estimated to be over $500 million. The 2 Pillar Audits, while less prevalent, serve specific niche requirements or as an initial assessment phase, with an estimated market share of 30%.

Supply Chain Sedex Members Ethical Trade Audit Product Developments

Product developments in the Supply Chain Sedex Members Ethical Trade Audit market are focused on enhancing efficiency, accuracy, and scope. Innovations include cloud-based platforms for seamless audit management, AI-powered risk assessment tools to proactively identify potential issues, and digital solutions for worker feedback mechanisms. Blockchain technology is being explored to provide immutable records of supply chain activities, bolstering transparency. These developments offer competitive advantages by reducing audit times, improving data integrity, and enabling more targeted interventions. The market fit is strong as these innovations directly address the growing demand for more robust, efficient, and verifiable ethical trade audits.

Report Scope & Segmentation Analysis

This report segments the Supply Chain Sedex Members Ethical Trade Audit market across key applications and audit types.

Application Segments:

- Retail and Consumption: Encompassing fashion, electronics, and general merchandise. Projected market size in 2025: over $2,500 million. Growth is driven by consumer demand for ethical products.

- Clothing and Textiles: A significant sub-segment within Retail and Consumption, facing intense scrutiny. Projected market size in 2025: over $1,500 million.

- Food and Drinks: Driven by food safety, ethical sourcing, and sustainability concerns. Projected market size in 2025: over $1,000 million.

- Hospitality and Travel: Growing focus on fair labor and environmental practices. Projected market size in 2025: over $300 million.

- Architecture and Engineering: Increasing adoption of ethical sourcing in construction and infrastructure projects. Projected market size in 2025: over $200 million.

- Others: Includes a diverse range of industries adopting ethical trade audits. Projected market size in 2025: over $500 million.

Audit Type Segments:

- 4 Pillar Audits: Comprehensive audits covering labor, health & safety, environment, and ethics. Dominant segment with projected market share of 70% in 2025.

- 2 Pillar Audits: More focused audits, often on labor and health & safety. Projected market share of 30% in 2025.

Competitive dynamics in each segment vary, with some being more mature and others exhibiting higher growth potential.

Key Drivers of Supply Chain Sedex Members Ethical Trade Audit Growth

The growth of the Supply Chain Sedex Members Ethical Trade Audit market is propelled by several key factors:

- Increasing Regulatory Scrutiny: Governments worldwide are implementing stricter regulations regarding supply chain due diligence, modern slavery, and human rights, compelling businesses to adopt ethical auditing practices. For instance, legislation like the UK Modern Slavery Act and the EU Corporate Sustainability Due Diligence Directive are significant drivers.

- Heightened Consumer and Investor Demand: Consumers are increasingly prioritizing ethical and sustainable brands, influencing purchasing decisions. Similarly, investors are integrating ESG factors into their investment strategies, demanding greater transparency and accountability from companies regarding their supply chains.

- Technological Advancements: The integration of digital tools, AI, and blockchain technology enhances the efficiency, accuracy, and transparency of ethical audits, making them more scalable and cost-effective.

- Corporate Social Responsibility (CSR) Initiatives: A growing commitment by corporations to CSR and sustainable business practices fuels the demand for independent verification of ethical standards.

Challenges in the Supply Chain Sedex Members Ethical Trade Audit Sector

Despite its growth, the Supply Chain Sedex Members Ethical Trade Audit sector faces several challenges:

- Complexity of Global Supply Chains: The intricate and often opaque nature of global supply chains makes it challenging to achieve complete transparency and ensure compliance across all tiers. This complexity can lead to an estimated 30% increase in audit costs.

- Enforcement and Remediation Gaps: While audits identify issues, effective enforcement and remediation of non-compliance can be inconsistent, leading to a perceived gap between audit findings and actual improvements.

- Cost of Audits: For smaller suppliers, the cost of conducting rigorous ethical audits can be prohibitive, potentially impacting their ability to secure contracts with larger buyers.

- Data Accuracy and Verification: Ensuring the accuracy and reliability of data provided by suppliers remains a persistent challenge, requiring robust verification processes.

- Geopolitical and Economic Instability: Global events can disrupt supply chains, impacting audit schedules and the ability to conduct on-site assessments, potentially affecting an estimated 20% of scheduled audits.

Emerging Opportunities in Supply Chain Sedex Members Ethical Trade Audit

The Supply Chain Sedex Members Ethical Trade Audit market is ripe with emerging opportunities:

- Expansion into Emerging Markets: As developing economies prioritize ethical sourcing, there is a significant opportunity for audit firms to expand their services into these regions.

- Integration of Social and Environmental Audits: The growing demand for holistic sustainability reporting presents an opportunity to offer combined social and environmental audits, providing a comprehensive ESG assessment.

- Technology-Driven Solutions: Further development and adoption of AI, blockchain, and data analytics for risk assessment, predictive analysis, and enhanced supply chain visibility offer lucrative prospects.

- Specialized Audits for Emerging Risks: Demand for specialized audits focusing on areas like biodiversity, water stewardship, and digital ethics is expected to grow.

- Worker Voice and Grievance Mechanisms: Developing and implementing effective worker voice platforms and grievance mechanisms offers a significant opportunity to improve worker well-being and transparency.

Leading Players in the Supply Chain Sedex Members Ethical Trade Audit Market

- Intertek

- SGS

- Eurofins

- Bureau Veritas

- TUV Nord

- BSI Group

- QIMA

- LRQA

- Kiwa

- TUV SUD

- DQS Holding GmbH

- UL

- AGCS

- ALGI

- Control Union Certifications

- Certiquality Srl Via

- Global Inspection Managing

Key Developments in Supply Chain Sedex Members Ethical Trade Audit Industry

- 2019 onwards: Increased regulatory focus on modern slavery and human trafficking globally, leading to heightened demand for SMETA audits covering these areas.

- 2020: Acceleration in the adoption of remote auditing techniques and digital tools due to global travel restrictions, with an estimated 40% increase in remote assessments.

- 2021: Growing integration of ESG reporting frameworks with ethical trade audits, as investors demand more comprehensive sustainability data.

- 2022: Introduction of new industry-specific ethical sourcing standards and guidelines by various trade associations, impacting audit protocols.

- 2023: Enhanced focus on climate change impact within supply chains, prompting auditors to incorporate climate-related risk assessments into their methodologies.

- 2024: Continued M&A activity within the auditing sector, with strategic acquisitions to expand service portfolios and market reach. Estimated deal value exceeding $500 million.

- 2025 (Estimated): Increased adoption of AI-powered predictive analytics for supply chain risk identification, potentially reducing audit failures by an estimated 15%.

- 2026-2033 (Forecast): Further technological integration, including wider use of blockchain for supply chain traceability and advanced data analytics for continuous monitoring. Growing demand for specialized audits covering biodiversity and circular economy principles.

Strategic Outlook for Supply Chain Sedex Members Ethical Trade Audit Market

- 2019 onwards: Increased regulatory focus on modern slavery and human trafficking globally, leading to heightened demand for SMETA audits covering these areas.

- 2020: Acceleration in the adoption of remote auditing techniques and digital tools due to global travel restrictions, with an estimated 40% increase in remote assessments.

- 2021: Growing integration of ESG reporting frameworks with ethical trade audits, as investors demand more comprehensive sustainability data.

- 2022: Introduction of new industry-specific ethical sourcing standards and guidelines by various trade associations, impacting audit protocols.

- 2023: Enhanced focus on climate change impact within supply chains, prompting auditors to incorporate climate-related risk assessments into their methodologies.

- 2024: Continued M&A activity within the auditing sector, with strategic acquisitions to expand service portfolios and market reach. Estimated deal value exceeding $500 million.

- 2025 (Estimated): Increased adoption of AI-powered predictive analytics for supply chain risk identification, potentially reducing audit failures by an estimated 15%.

- 2026-2033 (Forecast): Further technological integration, including wider use of blockchain for supply chain traceability and advanced data analytics for continuous monitoring. Growing demand for specialized audits covering biodiversity and circular economy principles.

Strategic Outlook for Supply Chain Sedex Members Ethical Trade Audit Market

The strategic outlook for the Supply Chain Sedex Members Ethical Trade Audit market remains exceptionally strong. Driven by an unwavering commitment to ethical sourcing, corporate responsibility, and regulatory compliance, the market is poised for sustained growth. Key growth catalysts include the increasing demand for transparency from consumers and investors, coupled with evolving global regulations that necessitate rigorous ethical auditing. The continued integration of advanced technologies like AI and blockchain will further enhance the efficiency and effectiveness of audit processes, offering significant value to businesses seeking to build resilient and responsible supply chains. The expansion of ethical trade practices into emerging economies and the growing focus on specialized audit areas present substantial opportunities for market players to innovate and lead in fostering a more equitable and sustainable global trade environment. The estimated market potential is projected to exceed $10,000 million by 2033.

Supply Chain Sedex Members Ethical Trade Audit Segmentation

-

1. Application

- 1.1. Retail and Consumption

- 1.2. Clothing and Textiles

- 1.3. Food and Drinks

- 1.4. Hospitality and Travel

- 1.5. Architecture and Engineering

- 1.6. Others

-

2. Type

- 2.1. 4 Pillar Audits

- 2.2. 2 Pillar Audits

Supply Chain Sedex Members Ethical Trade Audit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Supply Chain Sedex Members Ethical Trade Audit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Supply Chain Sedex Members Ethical Trade Audit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Retail and Consumption

- 5.1.2. Clothing and Textiles

- 5.1.3. Food and Drinks

- 5.1.4. Hospitality and Travel

- 5.1.5. Architecture and Engineering

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 4 Pillar Audits

- 5.2.2. 2 Pillar Audits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Supply Chain Sedex Members Ethical Trade Audit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Retail and Consumption

- 6.1.2. Clothing and Textiles

- 6.1.3. Food and Drinks

- 6.1.4. Hospitality and Travel

- 6.1.5. Architecture and Engineering

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 4 Pillar Audits

- 6.2.2. 2 Pillar Audits

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Supply Chain Sedex Members Ethical Trade Audit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Retail and Consumption

- 7.1.2. Clothing and Textiles

- 7.1.3. Food and Drinks

- 7.1.4. Hospitality and Travel

- 7.1.5. Architecture and Engineering

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 4 Pillar Audits

- 7.2.2. 2 Pillar Audits

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Supply Chain Sedex Members Ethical Trade Audit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Retail and Consumption

- 8.1.2. Clothing and Textiles

- 8.1.3. Food and Drinks

- 8.1.4. Hospitality and Travel

- 8.1.5. Architecture and Engineering

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 4 Pillar Audits

- 8.2.2. 2 Pillar Audits

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Retail and Consumption

- 9.1.2. Clothing and Textiles

- 9.1.3. Food and Drinks

- 9.1.4. Hospitality and Travel

- 9.1.5. Architecture and Engineering

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 4 Pillar Audits

- 9.2.2. 2 Pillar Audits

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Retail and Consumption

- 10.1.2. Clothing and Textiles

- 10.1.3. Food and Drinks

- 10.1.4. Hospitality and Travel

- 10.1.5. Architecture and Engineering

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 4 Pillar Audits

- 10.2.2. 2 Pillar Audits

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intertek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SGS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eurofins

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bureau Veritas

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV Nord

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BSI Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 QIMA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LRQA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kiwa

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TUV SUD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DQS Holding GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 UL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AGCS

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ALGI

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Control Union Certifications

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Certiquality Srl Via

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Global Inspection Managing

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Intertek

List of Figures

- Figure 1: Global Supply Chain Sedex Members Ethical Trade Audit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Application 2024 & 2032

- Figure 3: North America Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Type 2024 & 2032

- Figure 5: North America Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Country 2024 & 2032

- Figure 7: North America Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Application 2024 & 2032

- Figure 9: South America Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Type 2024 & 2032

- Figure 11: South America Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Country 2024 & 2032

- Figure 13: South America Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Supply Chain Sedex Members Ethical Trade Audit Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Supply Chain Sedex Members Ethical Trade Audit Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Supply Chain Sedex Members Ethical Trade Audit?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Supply Chain Sedex Members Ethical Trade Audit?

Key companies in the market include Intertek, SGS, Eurofins, Bureau Veritas, TUV Nord, BSI Group, QIMA, LRQA, Kiwa, TUV SUD, DQS Holding GmbH, UL, AGCS, ALGI, Control Union Certifications, Certiquality Srl Via, Global Inspection Managing.

3. What are the main segments of the Supply Chain Sedex Members Ethical Trade Audit?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Supply Chain Sedex Members Ethical Trade Audit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Supply Chain Sedex Members Ethical Trade Audit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Supply Chain Sedex Members Ethical Trade Audit?

To stay informed about further developments, trends, and reports in the Supply Chain Sedex Members Ethical Trade Audit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence