Key Insights

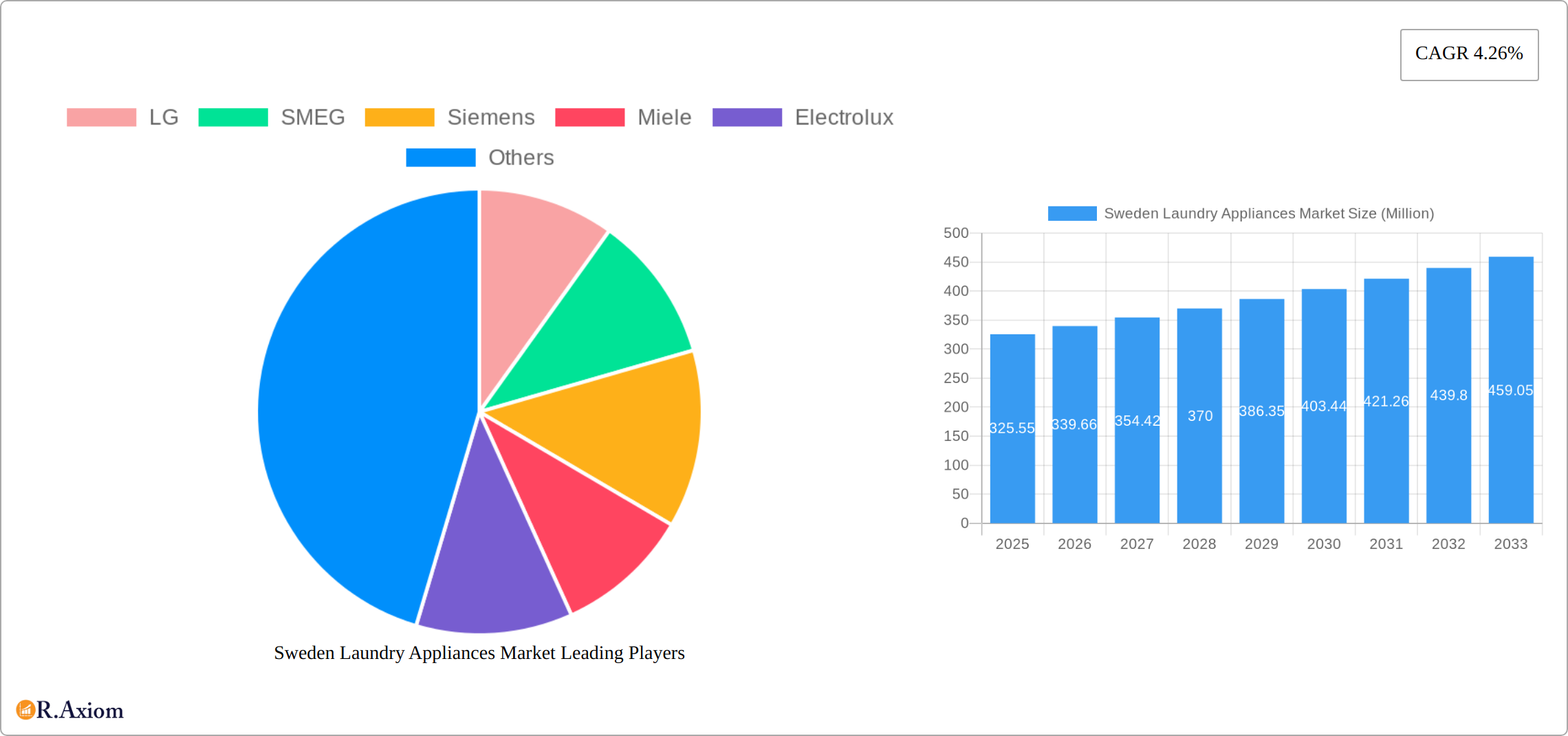

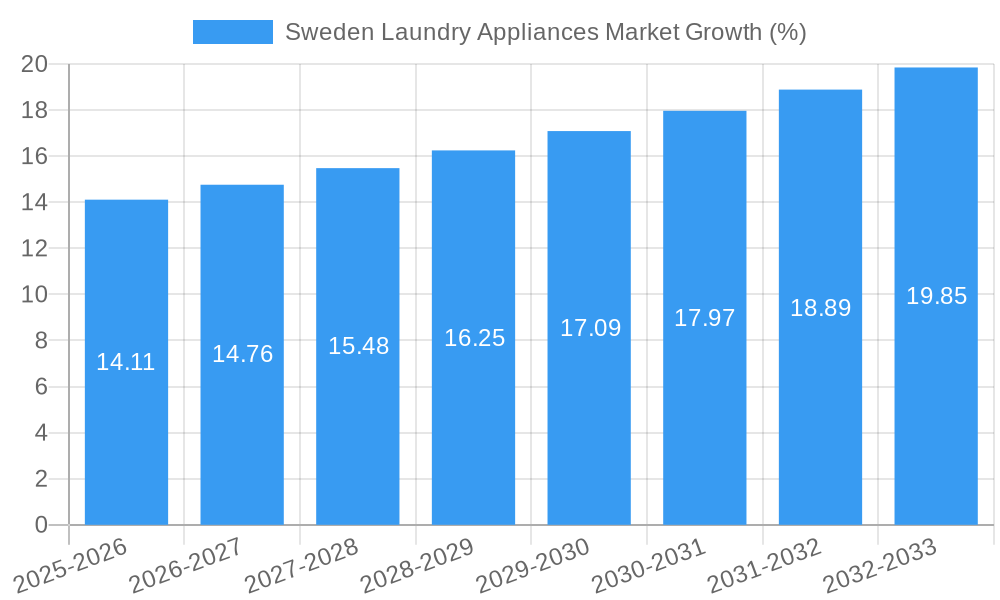

The Sweden Laundry Appliances market, valued at €325.55 million in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4.26% from 2025 to 2033. This growth is driven by several factors. Increasing disposable incomes and a rising preference for convenient and time-saving appliances are key drivers. The trend towards smaller living spaces in urban areas is boosting demand for compact, built-in laundry appliances. Furthermore, growing awareness of energy efficiency and eco-friendly technologies is fueling the adoption of automatic washing machines and dryers with advanced features. Consumers are increasingly seeking appliances with smart capabilities, such as remote control and app integration, further stimulating market expansion. While the market faces some restraints, such as fluctuating raw material prices and potential economic slowdowns, the overall outlook remains positive. The market is segmented by appliance type (freestanding, built-in), product category (washing machines, dryers, irons, others), technology (automatic, semi-automatic/manual), and distribution channel (multi-brand stores, exclusive stores, online). Key players like LG, SMEG, Siemens, Miele, Electrolux, Haier, Cylinda, AEG, Whirlpool, Fulgor, Bosch, Husqvarna, and Samsung compete in this dynamic market. The strong presence of established brands and the continuous innovation in appliance technology are expected to maintain market momentum throughout the forecast period.

The Swedish market shows a preference for high-quality, energy-efficient appliances, reflecting the country's focus on sustainability. Online sales channels are gaining traction, offering consumers greater convenience and product selection. The continued growth of e-commerce and the rising adoption of smart home technology are poised to further shape the market landscape in the coming years. Competition among established brands is intense, with manufacturers focusing on product differentiation through innovative features, design, and brand building activities. The market's future trajectory will be influenced by factors such as technological advancements, consumer preferences, and government policies promoting energy efficiency. The forecast indicates a robust and sustained expansion of the Swedish laundry appliances market, with continuous opportunities for growth and innovation.

This detailed report provides a comprehensive analysis of the Sweden laundry appliances market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and market researchers, seeking to understand the current landscape and future trajectory of this dynamic sector. The report leverages extensive data analysis and incorporates key market trends to present a clear and actionable overview.

Sweden Laundry Appliances Market Concentration & Innovation

The Sweden laundry appliances market exhibits a moderately concentrated landscape, with key players such as Electrolux, Bosch, and AEG holding significant market share. However, the market also features several smaller, niche players, particularly in the specialized built-in and premium segments. Innovation is driven by several factors, including:

- Technological advancements: The increasing integration of smart home technology, energy-efficient features (like heat pump dryers), and advanced washing cycles is driving product innovation. Companies are focusing on developing user-friendly interfaces and connected appliances offering remote monitoring and control.

- Consumer demand for sustainability: Growing environmental awareness is pushing manufacturers to develop more eco-friendly appliances with lower water and energy consumption.

- Stringent regulatory frameworks: EU regulations concerning energy efficiency and water usage are significantly impacting product design and manufacturing processes, prompting manufacturers to adapt and innovate.

- Product substitution: While traditional laundry appliances remain dominant, the rise of laundry services and subscription models presents a form of product substitution, influencing market dynamics.

- End-user trends: Consumers are increasingly demanding higher-capacity machines, more convenient features, and longer-lasting products, which fuels innovation and drives market growth.

Mergers & Acquisitions (M&A): Recent M&A activities underscore the competitive landscape. The January 2023 acquisition of a 12% stake in Husqvarna AB by Bosch reflects strategic investment in the Swedish market. Furthermore, Whirlpool’s restructuring of its European business with Arcelik significantly alters the market’s competitive dynamics, potentially leading to consolidation and shifts in market share. The total deal value for these transactions is estimated at xx Million.

Sweden Laundry Appliances Market Industry Trends & Insights

The Sweden laundry appliances market is witnessing consistent growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for convenience. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), with the market size reaching xx Million by 2033. Market penetration of automatic washing machines is already high, but further growth is anticipated in the premium segment featuring smart functionalities and energy-efficiency upgrades.

Technological disruption, particularly in smart home technology and connected appliances, is reshaping the landscape. Consumer preferences are shifting towards energy-efficient, user-friendly, and aesthetically pleasing appliances. Intense competition among established players and the emergence of new brands is driving innovation and price optimization. The market is characterized by a growing preference for built-in appliances, reflecting changing consumer lifestyles and preferences for integrated kitchen designs.

Dominant Markets & Segments in Sweden Laundry Appliances Market

The Swedish laundry appliance market, while mature with high washing machine and dryer saturation, presents diverse growth opportunities across specific segments. The market is characterized by a complex interplay of factors influencing consumer choices and market dynamics.

- Leading Segment: The built-in appliance segment outpaces freestanding models, fueled by the increasing popularity of sophisticated and integrated kitchen designs. This trend reflects a shift towards streamlined aesthetics and space optimization in modern Swedish homes.

- Leading Product: Washing machines remain the dominant product category, followed by dryers. While the electric smoothing iron market shows stability, the "Other Products" category (encompassing laundry hampers, cleaning agents, and related accessories) demonstrates consistent growth, indicating a rising focus on overall laundry convenience and a holistic approach to laundry care.

- Leading Technology: Automatic washing machines hold the largest market share, with semi-automatic/manual options steadily declining. The market is witnessing the emergence of niche segments driven by innovative technologies such as AI-powered features, advanced drying systems, and connected appliances offering remote monitoring and control.

- Leading Distribution Channel: Multi-brand stores maintain their dominant position in the distribution landscape. However, online sales channels are experiencing robust growth, mirroring the broader e-commerce expansion in Sweden and reflecting changing consumer shopping habits. This shift requires manufacturers to adapt their strategies for online engagement and fulfillment.

Market drivers vary significantly across segments. Macroeconomic factors such as disposable income levels significantly influence overall market demand. Meanwhile, infrastructural developments, particularly in the construction sector (new housing starts), directly impact the growth of the built-in appliance segment. Furthermore, evolving consumer preferences regarding sustainability and energy efficiency are key factors shaping product demand.

Sweden Laundry Appliances Market Product Developments

Recent product innovations focus on energy efficiency, smart connectivity, and enhanced user experience. Manufacturers are integrating features like steam cleaning, improved wash cycles, and remote control capabilities. The trend towards compact designs and space-saving appliances is also notable, catering to smaller living spaces. These advancements cater to growing consumer demand for efficient, convenient, and technologically advanced laundry solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the Swedish laundry appliances market across various parameters:

Type: Freestanding and Built-in – The built-in segment is expected to witness faster growth due to increasing demand for integrated kitchen solutions.

Product: Washing Machines, Dryers, Electric Smoothing Irons, Other Products – Washing machines constitute the largest segment, followed by dryers, with relatively stable growth projected for each.

Technology: Automatic, Semi-Automatic/Manual, Other Technologies – Automatic washing machines dominate the market, while semi-automatic models are gradually declining.

Distribution Channel: Multi-Brand Stores, Exclusive Stores, Online, Other Distribution Channels – Online sales are experiencing rapid growth, challenging traditional distribution channels.

Key Drivers of Sweden Laundry Appliances Market Growth

Several key factors are driving growth within the Swedish laundry appliance market:

- Rising Disposable Incomes and Changing Consumer Preferences: Increased purchasing power fuels demand for premium appliances with advanced features and superior performance. Consumer preferences are shifting towards greater convenience, energy efficiency, and smart technology integration.

- Technological Advancements and Innovation: Energy-efficient models, smart home integration capabilities (connectivity to smart home ecosystems), and improved user interfaces are key selling points driving market growth. Innovation in areas such as water conservation and reduced noise levels further enhances the appeal of modern laundry appliances.

- Government Regulations and Sustainability Initiatives: Stringent environmental regulations promote the adoption of eco-friendly appliances with reduced energy and water consumption. This regulatory environment incentivizes manufacturers to develop and market sustainable products, creating a positive feedback loop for market expansion.

- Housing Market Dynamics: New construction and renovation projects contribute to sustained demand, particularly for built-in appliances that complement modern kitchen designs. This segment's growth is closely tied to the overall health of the Swedish construction and real estate sectors.

Challenges in the Sweden Laundry Appliances Market Sector

Challenges include:

- Economic fluctuations: Economic downturns can significantly impact consumer spending on durable goods.

- Intense competition: Competition among established and emerging players puts pressure on pricing and profitability.

- Supply chain disruptions: Global supply chain issues can affect the availability of components and finished products.

Emerging Opportunities in Sweden Laundry Appliances Market

Key opportunities include:

- Growth in the smart home appliance segment: Integration of smart home features offers significant potential for growth.

- Expansion into rural markets: Reaching underserved areas presents substantial untapped potential.

- Focus on sustainable and eco-friendly appliances: Meeting the growing demand for environmentally conscious products presents a significant opportunity.

Leading Players in the Sweden Laundry Appliances Market Market

- LG

- SMEG

- Siemens

- Miele

- Electrolux

- Haier

- Cylinda

- AEG

- Whirlpool

- Fulgor

- Bosch

- Husqvarna

- Samsung

Key Developments in Sweden Laundry Appliances Market Industry

- January 2023: Bosch's increased stake in Husqvarna AB to approximately 12% signals a significant strategic investment in the Swedish market. This development has the potential to reshape the laundry appliance production and distribution landscape, potentially leading to new collaborations and market consolidation.

- January 2023: The integration of Whirlpool's European business into a new company controlled by Arcelik represents a major shift in the competitive dynamics of the European and Swedish markets. This merger is expected to lead to alterations in product offerings, pricing strategies, and distribution networks, ultimately impacting market competition and consumer choices.

Strategic Outlook for Sweden Laundry Appliances Market Market

The Sweden laundry appliances market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and a focus on sustainability. Opportunities exist in expanding smart home appliance offerings, focusing on energy efficiency, and targeting new market segments. The market's future trajectory will depend significantly on managing supply chain challenges, adapting to economic fluctuations, and responding effectively to heightened competitive pressures.

Sweden Laundry Appliances Market Segmentation

-

1. Type

- 1.1. Freestanding

- 1.2. Built in

-

2. Product

- 2.1. Washing Machines

- 2.2. Dryers

- 2.3. Electric Smoothing Irons

- 2.4. Other Products

-

3. Technology

- 3.1. Automatic

- 3.2. Semi-Automatic/Manual

- 3.3. Other Technologies

-

4. Distribution Channel

- 4.1. Multi-Brand Stores

- 4.2. Exclusive Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Sweden Laundry Appliances Market Segmentation By Geography

- 1. Sweden

Sweden Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Disposable Income is Driving the Market; Urbanization and Busy Lifestyles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Saturation in the Market and Price Sensitivity are Restraining the Market; Lack of Awareness about Development in Laundry Appliances

- 3.4. Market Trends

- 3.4.1. E-Commerce Growth is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Laundry Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Freestanding

- 5.1.2. Built in

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Washing Machines

- 5.2.2. Dryers

- 5.2.3. Electric Smoothing Irons

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Automatic

- 5.3.2. Semi-Automatic/Manual

- 5.3.3. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Multi-Brand Stores

- 5.4.2. Exclusive Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SMEG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Miele

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cylinda

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AEG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Whirlpool

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fulgor

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bosch

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Husqvarna

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Samsung

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: Sweden Laundry Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Laundry Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Laundry Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Laundry Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Sweden Laundry Appliances Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Sweden Laundry Appliances Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Sweden Laundry Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Sweden Laundry Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 7: Sweden Laundry Appliances Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: Sweden Laundry Appliances Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 9: Sweden Laundry Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: Sweden Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 11: Sweden Laundry Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Sweden Laundry Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Sweden Laundry Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Sweden Laundry Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Sweden Laundry Appliances Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Sweden Laundry Appliances Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 17: Sweden Laundry Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 18: Sweden Laundry Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 19: Sweden Laundry Appliances Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: Sweden Laundry Appliances Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 21: Sweden Laundry Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Sweden Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 23: Sweden Laundry Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Sweden Laundry Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Laundry Appliances Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Sweden Laundry Appliances Market?

Key companies in the market include LG, SMEG, Siemens, Miele, Electrolux, Haier, Cylinda, AEG, Whirlpool, Fulgor, Bosch, Husqvarna, Samsung.

3. What are the main segments of the Sweden Laundry Appliances Market?

The market segments include Type, Product, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 325.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Disposable Income is Driving the Market; Urbanization and Busy Lifestyles is Driving the Market.

6. What are the notable trends driving market growth?

E-Commerce Growth is Driving the Market.

7. Are there any restraints impacting market growth?

Saturation in the Market and Price Sensitivity are Restraining the Market; Lack of Awareness about Development in Laundry Appliances.

8. Can you provide examples of recent developments in the market?

January 2023: Bosch agreed to acquire shares in the long-established Swedish company Husqvarna AB. The acquisition increases its shareholding to roughly 12 percent of the company's total share capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the Sweden Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence