Key Insights

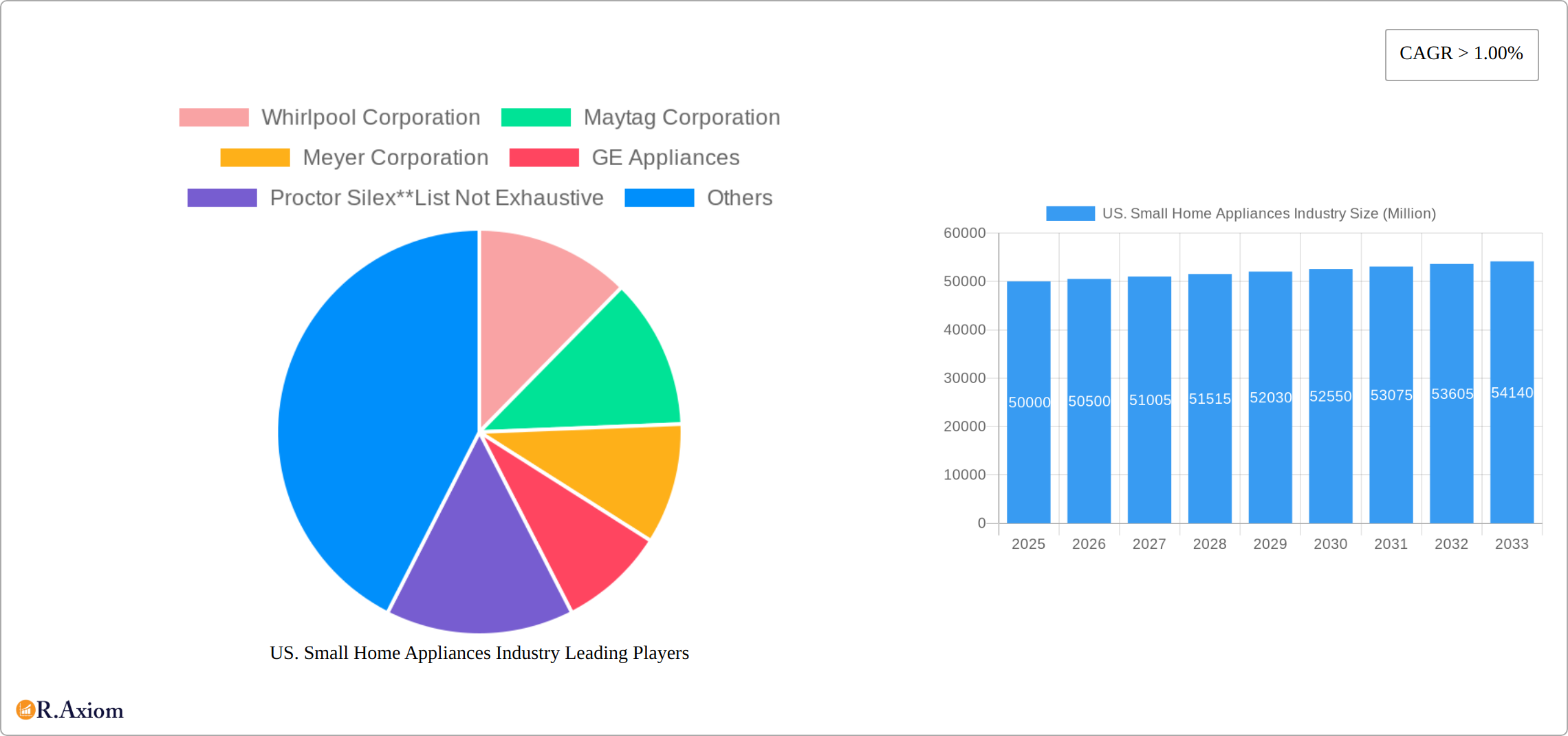

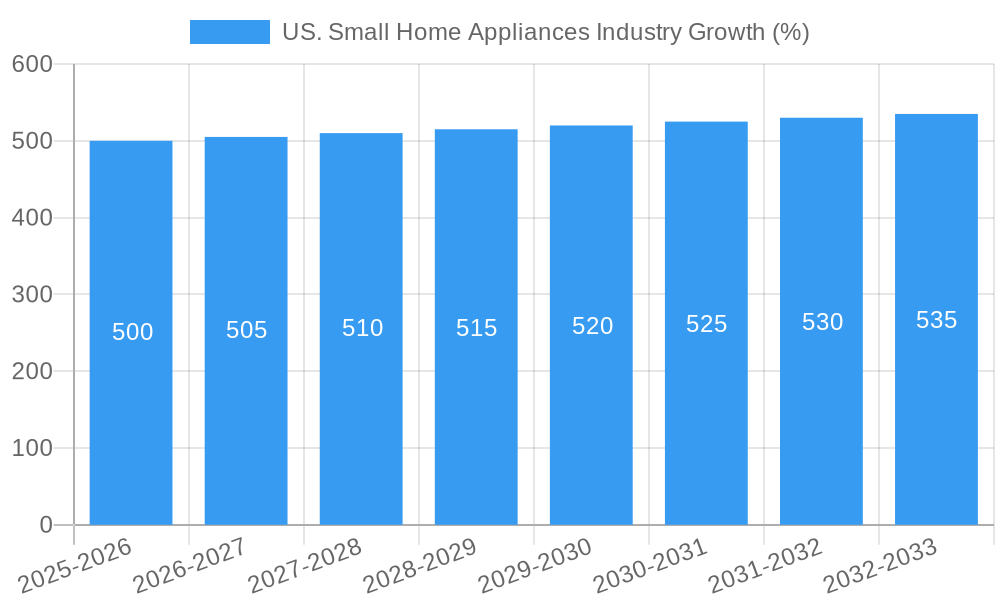

The US small home appliance market, encompassing vacuum cleaners, hair clippers, irons, toasters, hair dryers, coffee machines, grills, and roasters, presents a robust growth opportunity. With a current market size exceeding $XX million (estimated based on available data and industry growth trends for similar markets), a CAGR of over 1.00%, and a projected forecast period of 2025-2033, the industry is poised for sustained expansion. Key drivers include increasing disposable incomes, a growing preference for convenience, and the rise of online retail channels, particularly e-commerce platforms specializing in small home appliances. Emerging trends like smart home integration, energy-efficient models, and a focus on sustainable materials are shaping product development and consumer demand. While potential restraints include fluctuating raw material prices and increasing competition, particularly from emerging brands offering cost-effective options, the overall market outlook remains positive. The segmental breakdown reveals strong performance across various product categories, with coffee machines and vacuum cleaners consistently showing high demand. Online sales are expected to witness significant growth fueled by advancements in digital marketing and convenient delivery options. Multi-branded stores and specialty stores continue to maintain a substantial share of the distribution channels, highlighting the importance of a multi-channel approach for market success.

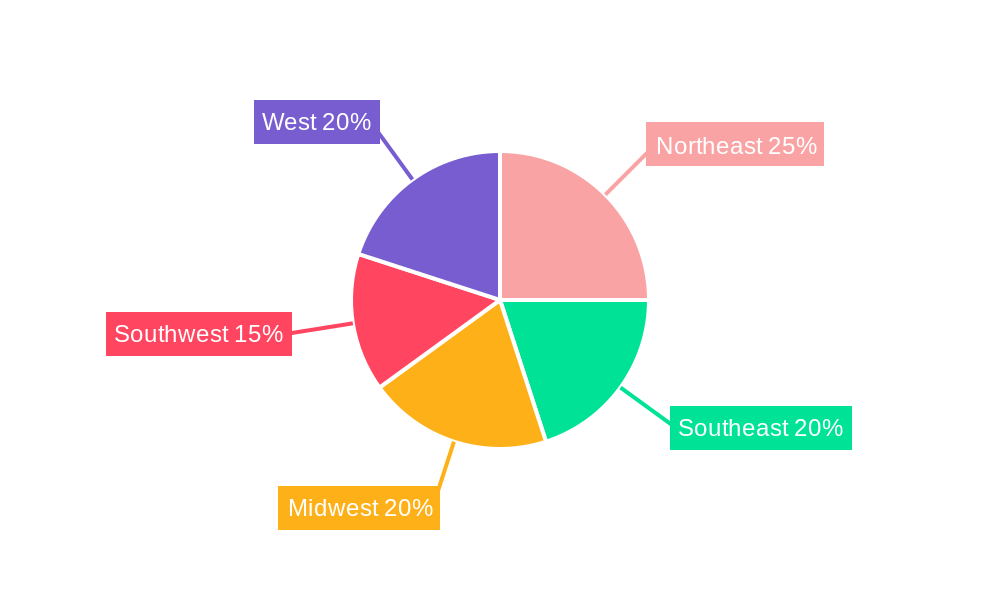

The competitive landscape is characterized by established players such as Whirlpool, Maytag, and GE Appliances, alongside a mix of smaller, specialized brands. These companies are investing heavily in research and development to innovate and cater to evolving consumer preferences. Regional variations exist within the US market, with the Northeast and West Coast exhibiting higher per capita spending on small home appliances. This indicates strong potential for targeting these regions with premium product offerings and personalized marketing campaigns. However, growth opportunities also exist in other regions as consumer preferences evolve and economic conditions improve. Strategic partnerships, innovative marketing strategies, and a deep understanding of consumer behavior will prove crucial for sustained success within this dynamic and competitive market.

US Small Home Appliances Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the US small home appliances industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025-2033, and the historical period covers 2019-2024. Key segments analyzed include vacuum cleaners, hair clippers, irons, toasters, hair dryers, coffee machines, grills and roasters, and other small appliances. Distribution channels examined include multi-branded stores, specialty stores, online retailers, and other channels. Leading players such as Whirlpool Corporation, Maytag Corporation, Meyer Corporation, GE Appliances, Proctor Silex, Viking Range, Russell Hobbs Inc, KitchenAid, Frigidaire, and Hamilton Beach Brands are profiled.

US. Small Home Appliances Industry Market Concentration & Innovation

The US small home appliances market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Whirlpool Corporation and GE Appliances, for example, command substantial portions of the overall market, but numerous smaller players contribute to the market's dynamism. The industry is characterized by ongoing innovation driven by consumer demand for enhanced features, energy efficiency, and smart functionalities. Regulatory frameworks, particularly those related to energy consumption and safety, significantly impact product design and manufacturing. Substitute products, such as alternative cooking methods or cleaning solutions, present a degree of competitive pressure. End-user trends indicate a growing preference for multi-functional appliances and smart home integration. The industry witnesses moderate levels of mergers and acquisitions (M&A) activity, with deal values ranging from xx Million to xx Million in recent years, primarily focused on expanding product portfolios and market reach.

- Market Share: Whirlpool Corporation holds an estimated xx% market share in 2025. GE Appliances holds approximately xx%.

- M&A Activity: Recent M&A activity has focused on consolidating market share and expanding product lines. The average deal value over the past five years has been approximately xx Million.

- Innovation Drivers: Consumer demand for convenience, smart features (e.g., app control), and energy efficiency are key drivers.

US. Small Home Appliances Industry Industry Trends & Insights

The US small home appliances market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by rising disposable incomes, increasing urbanization, and a growing preference for convenience. Technological disruptions, such as the integration of smart technology and the adoption of IoT (Internet of Things) capabilities, are reshaping the industry landscape. Consumer preferences are shifting towards compact, energy-efficient appliances with aesthetically pleasing designs. Intense competition among established players and the emergence of new entrants are shaping the market dynamics. Market penetration for smart appliances is estimated at xx% in 2025, projected to rise to xx% by 2033. The market demonstrates a strong preference for online retail channels, with their share projected to increase further in the coming years. The market size in 2025 is estimated at xx Million, expected to reach xx Million by 2033.

Dominant Markets & Segments in US. Small Home Appliances Industry

The US small home appliances market is a dynamic sector with distinct leadership in specific product categories and distribution channels. Currently, Coffee Machines stand out as the dominant segment, propelled by a surging interest in artisanal coffee experiences at home and the widespread adoption of convenient single-serve brewing technologies. Complementing this, online distribution channels have ascended to prominence, a trend fueled by the convenience of e-commerce, expansive product selections, and efficient home delivery services. Geographically, the South-Eastern region of the United States emerges as the largest market, attributed to its robust population density and a generally favorable economic climate.

-

Key Drivers Behind Coffee Machine Segment Dominance:

- The persistent demand for convenience and the growing trend of consuming specialty coffee within the comfort of one's home.

- Continuous innovation in single-serve brewing systems and capsule-based technologies, offering a wide variety of flavors and brewing options.

- Rising disposable incomes empowering consumers to invest in premium coffee makers and high-quality coffee beans, enhancing the at-home brewing experience.

-

Key Drivers Fueling Online Channel Dominance:

- Unparalleled consumer convenience, access to an extensive array of brands and models, and the ease of direct comparison.

- Aggressive competitive pricing strategies, frequent promotional campaigns, and attractive discount offers.

- Significant advancements in logistics and delivery infrastructure, ensuring timely and reliable product fulfillment.

-

Factors Contributing to Regional Dominance (Southeast):

- A substantial and growing population base coupled with a higher average household disposable income.

- Favorable demographic trends, including an increasing number of younger households, and a heightened demand for modern, feature-rich appliances.

US. Small Home Appliances Industry Product Developments

Recent product innovations focus on enhanced functionality, energy efficiency, and smart home integration. Many manufacturers are incorporating features like app connectivity, voice control, and automatic cleaning cycles to improve user experience. The competitive advantage lies in offering unique product features, superior design aesthetics, and user-friendly interfaces that cater to evolving consumer preferences and lifestyle demands. Key technological trends include the increased adoption of IoT technology and the development of more energy-efficient motors and heating elements.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the US small home appliances market across various dimensions. The analysis encompasses product types such as Vacuum Cleaners, Hair Clippers, Irons, Toasters, Hair Dryers, Coffee Machines, Grills and Roasters, and a miscellaneous "Others" category. Distribution channels are categorized into Multi-Branded Stores, Specialty Stores, Online platforms, and Other Distribution Channels. For each segment, the report provides in-depth analysis of market size, future growth projections, and the prevailing competitive landscape. Notably, the online channel is identified as the fastest-growing distribution segment, while coffee machines continue to hold the position of the largest product segment. It's important to note that market sizes and growth trajectories exhibit considerable variation across different product categories and distribution channels.

Key Drivers of US. Small Home Appliances Industry Growth

Several factors are driving growth in the US small home appliances industry. Rising disposable incomes enable consumers to purchase more appliances, while increasing urbanization leads to a greater demand for space-saving, multi-functional products. The growth of e-commerce facilitates easier access to a wider variety of appliances. Technological advancements, like smart home integration and energy-efficient designs, fuel demand for upgraded models. Government regulations encouraging energy efficiency further stimulate product innovation and market expansion.

Challenges in the US. Small Home Appliances Industry Sector

The US small home appliances industry is navigating a complex landscape marked by several significant challenges. Rising raw material costs continue to exert pressure on profit margins, while global supply chain disruptions create volatility in production timelines and increase operational expenses. The market is also characterized by intense competition from both established domestic manufacturers and agile international players. Furthermore, stringent regulatory compliance, particularly concerning energy efficiency standards and product safety certifications, adds layers of complexity and incurs additional costs for manufacturers. Economic uncertainties and fluctuating consumer spending patterns can also directly impact market demand and sales performance.

Emerging Opportunities in US. Small Home Appliances Industry

The US small home appliances industry is ripe with emerging opportunities for growth and innovation. The sector can capitalize on expanding into niche markets that cater to specific consumer needs, such as appliances designed for specialized dietary requirements or those emphasizing health-conscious features. The continued integration of smart home technologies presents a substantial avenue for growth, offering consumers enhanced connectivity, convenience, and control. Moreover, incorporating sustainable and eco-friendly materials into appliance manufacturing aligns with a growing consumer preference for environmentally responsible products and addresses the evolving landscape of environmental regulations.

Leading Players in the US. Small Home Appliances Industry Market

- Whirlpool Corporation

- Maytag Corporation

- Meyer Corporation

- GE Appliances

- Proctor Silex

- Viking Range

- Russell Hobbs Inc

- KitchenAid

- Frigidaire

- Hamilton Beach Brands

Key Developments in US. Small Home Appliances Industry Industry

- April 2nd, 2022: Whirlpool unveiled a new range of Neo Fresh Glassdoor Frost-Free refrigerators, expanding its product portfolio and enhancing its competitive positioning.

- March 11th, 2022: Whirlpool Corporation committed to real-world action towards a low-carbon future with the U.S. Department of Energy, highlighting the growing emphasis on sustainability within the industry.

Strategic Outlook for US. Small Home Appliances Industry Market

The outlook for the US small home appliances market is decidedly positive, buoyed by consistent technological advancements, shifting consumer preferences, and the continued expansion of e-commerce. Companies that strategically focus on integrating smart home capabilities, prioritizing energy efficiency, and championing sustainability will be exceptionally well-positioned to seize future market opportunities. The long-term success of this market will hinge on the industry's agility in adapting to evolving consumer demands, its willingness to embrace cutting-edge technological innovations, and its capacity to effectively navigate the complexities and volatilities inherent in global supply chains.

US. Small Home Appliances Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US. Small Home Appliances Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US. Small Home Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Smart Home is boosting the Market

- 3.3. Market Restrains

- 3.3.1. Flactuting Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Small Kitchen Appliances Segment is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Northeast US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US. Small Home Appliances Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Whirlpool Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Maytag Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Meyer Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 GE Appliances

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Proctor Silex**List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Viking Range

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Russell Hobbs Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 KitchenAid

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Frigidaire

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Hamilton Beach Brands

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global US. Small Home Appliances Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US. Small Home Appliances Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US. Small Home Appliances Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US. Small Home Appliances Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 5: North America US. Small Home Appliances Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 6: North America US. Small Home Appliances Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 7: North America US. Small Home Appliances Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 8: North America US. Small Home Appliances Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 9: North America US. Small Home Appliances Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 10: North America US. Small Home Appliances Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 11: North America US. Small Home Appliances Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 12: North America US. Small Home Appliances Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 13: North America US. Small Home Appliances Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 14: North America US. Small Home Appliances Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America US. Small Home Appliances Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America US. Small Home Appliances Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 17: South America US. Small Home Appliances Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 18: South America US. Small Home Appliances Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 19: South America US. Small Home Appliances Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 20: South America US. Small Home Appliances Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 21: South America US. Small Home Appliances Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 22: South America US. Small Home Appliances Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 23: South America US. Small Home Appliances Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 24: South America US. Small Home Appliances Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 25: South America US. Small Home Appliances Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 26: South America US. Small Home Appliances Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America US. Small Home Appliances Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe US. Small Home Appliances Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 29: Europe US. Small Home Appliances Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 30: Europe US. Small Home Appliances Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 31: Europe US. Small Home Appliances Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 32: Europe US. Small Home Appliances Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 33: Europe US. Small Home Appliances Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 34: Europe US. Small Home Appliances Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 35: Europe US. Small Home Appliances Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 36: Europe US. Small Home Appliances Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 37: Europe US. Small Home Appliances Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 38: Europe US. Small Home Appliances Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Europe US. Small Home Appliances Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Middle East & Africa US. Small Home Appliances Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 41: Middle East & Africa US. Small Home Appliances Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 42: Middle East & Africa US. Small Home Appliances Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 43: Middle East & Africa US. Small Home Appliances Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 44: Middle East & Africa US. Small Home Appliances Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 45: Middle East & Africa US. Small Home Appliances Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 46: Middle East & Africa US. Small Home Appliances Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 47: Middle East & Africa US. Small Home Appliances Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 48: Middle East & Africa US. Small Home Appliances Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 49: Middle East & Africa US. Small Home Appliances Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 50: Middle East & Africa US. Small Home Appliances Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East & Africa US. Small Home Appliances Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Asia Pacific US. Small Home Appliances Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 53: Asia Pacific US. Small Home Appliances Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 54: Asia Pacific US. Small Home Appliances Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 55: Asia Pacific US. Small Home Appliances Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 56: Asia Pacific US. Small Home Appliances Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 57: Asia Pacific US. Small Home Appliances Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 58: Asia Pacific US. Small Home Appliances Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 59: Asia Pacific US. Small Home Appliances Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 60: Asia Pacific US. Small Home Appliances Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 61: Asia Pacific US. Small Home Appliances Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 62: Asia Pacific US. Small Home Appliances Industry Revenue (Million), by Country 2024 & 2032

- Figure 63: Asia Pacific US. Small Home Appliances Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US. Small Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US. Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global US. Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global US. Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global US. Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global US. Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global US. Small Home Appliances Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global US. Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northeast US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southeast US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Midwest US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southwest US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: West US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global US. Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 15: Global US. Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 16: Global US. Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Global US. Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Global US. Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 19: Global US. Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US. Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 24: Global US. Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 25: Global US. Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 26: Global US. Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 27: Global US. Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 28: Global US. Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global US. Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 33: Global US. Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Global US. Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Global US. Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Global US. Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 37: Global US. Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Germany US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Benelux US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Nordics US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global US. Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 48: Global US. Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 49: Global US. Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 50: Global US. Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 51: Global US. Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 52: Global US. Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Turkey US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Israel US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: GCC US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: North Africa US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East & Africa US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global US. Small Home Appliances Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 60: Global US. Small Home Appliances Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 61: Global US. Small Home Appliances Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 62: Global US. Small Home Appliances Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 63: Global US. Small Home Appliances Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 64: Global US. Small Home Appliances Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: China US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: India US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: ASEAN US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Oceania US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Asia Pacific US. Small Home Appliances Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US. Small Home Appliances Industry?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the US. Small Home Appliances Industry?

Key companies in the market include Whirlpool Corporation, Maytag Corporation, Meyer Corporation, GE Appliances, Proctor Silex**List Not Exhaustive, Viking Range, Russell Hobbs Inc, KitchenAid, Frigidaire, Hamilton Beach Brands.

3. What are the main segments of the US. Small Home Appliances Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Smart Home is boosting the Market.

6. What are the notable trends driving market growth?

Small Kitchen Appliances Segment is Driving the Market.

7. Are there any restraints impacting market growth?

Flactuting Raw Material Cost.

8. Can you provide examples of recent developments in the market?

On April 2nd 2022, Whirl pool has unveiled a new range of Neo Fresh Glassdoor Frost-Free refrigerators and increased its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US. Small Home Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US. Small Home Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US. Small Home Appliances Industry?

To stay informed about further developments, trends, and reports in the US. Small Home Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence