Key Insights

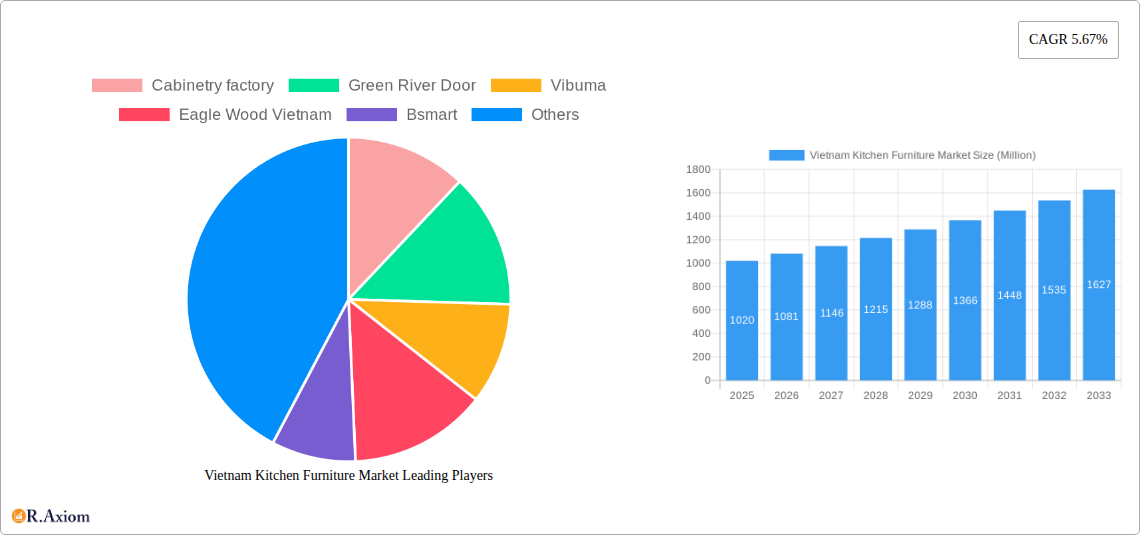

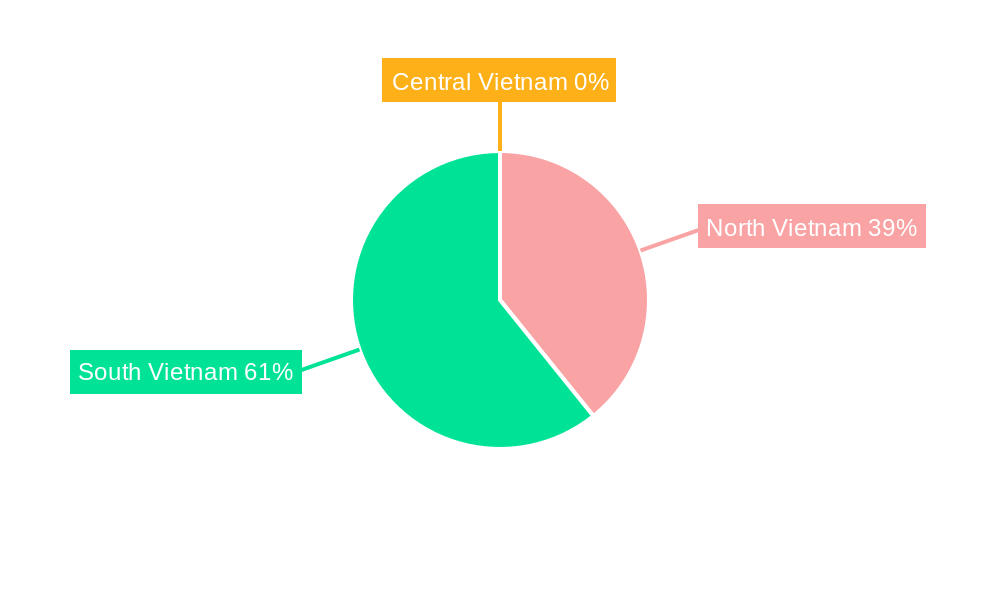

The Vietnam kitchen furniture market, valued at $1.02 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class with increasing disposable incomes and a preference for modern, stylish kitchens. Rising urbanization and the expansion of the construction sector further fuel market demand. Consumers are increasingly prioritizing ergonomic design, smart storage solutions, and durable, high-quality materials, influencing product development and market segmentation. The e-commerce channel is experiencing significant growth, offering convenient access and wider product selections to consumers nationwide. While the dominance of supermarkets and hypermarkets remains significant for mass-market products, specialty stores catering to higher-end segments are also expanding their presence. Competition is intense, with both established domestic players like Cabinetry Factory and Eagle Wood Vietnam, and international brands such as Ikea vying for market share. However, challenges remain, including fluctuating raw material prices and potential supply chain disruptions, requiring manufacturers to adopt agile and efficient operational strategies.

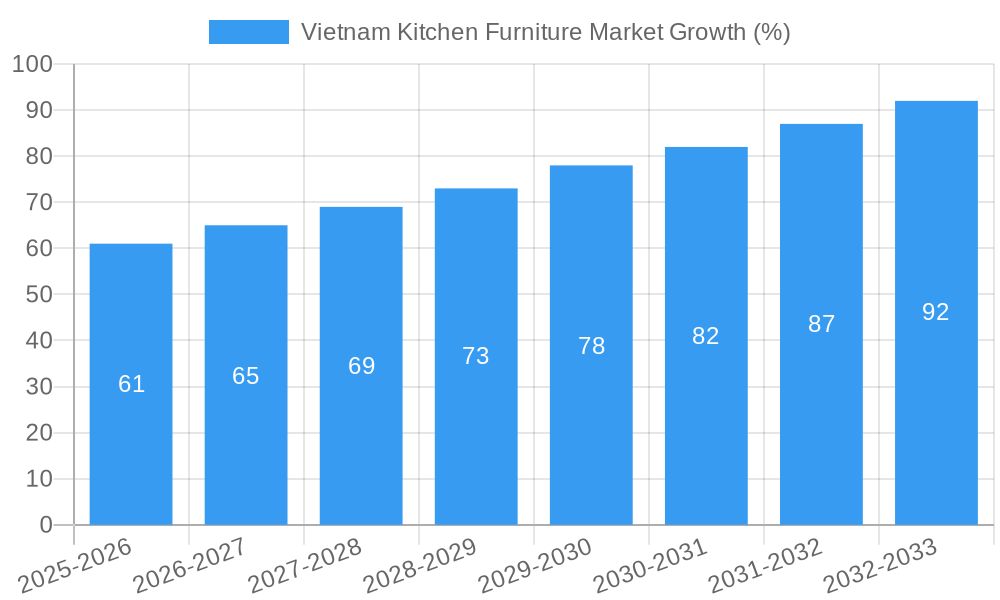

The market segmentation reveals a diverse landscape. Kitchen cabinets constitute the largest segment, followed by tables and chairs. The "Other Furniture Types" segment, encompassing items like kitchen islands, pantries, and storage solutions, is also experiencing growth, reflecting evolving consumer needs. The strong CAGR of 5.67% suggests a sustained period of expansion throughout the forecast period (2025-2033). This growth is expected to be influenced by government initiatives promoting sustainable construction and the increasing adoption of eco-friendly materials in kitchen furniture manufacturing. Further diversification into specialized kitchen furniture niches and strategic partnerships with interior designers will be crucial for companies to maintain a competitive edge in this dynamic market.

Vietnam Kitchen Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam kitchen furniture market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on growth opportunities within this dynamic sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The market size is estimated at xx Million in 2025 and is projected to witness significant growth throughout the forecast period.

Vietnam Kitchen Furniture Market Concentration & Innovation

The Vietnam kitchen furniture market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, local manufacturers fosters competition and innovation. Market share data for individual players like Cabinetry factory, Green River Door, Vibuma, Eagle Wood Vietnam, Bsmart, Vietnam Blue Lake Furniture, Star Marine Furniture Company Ltd, Ixina, Pacific Craftworks, and Ikea are being analyzed and will be presented in the full report. Innovation is driven by increasing consumer demand for modern designs, sustainable materials, and technologically advanced features. Regulatory frameworks, while evolving, aim to promote safety standards and sustainable manufacturing practices. The market witnesses continuous product substitution, with new materials and designs replacing traditional ones. End-user trends lean towards customized, space-saving, and multi-functional kitchen furniture. M&A activity remains moderate, with deal values varying depending on the size and strategic goals of the companies involved. For example, the recent strategic partnership between Yoshimoto Sangyo Co., Ltd. and Vinh An Interior & Decor signifies a potential increase in foreign investment and market consolidation. We anticipate xx Million in M&A deal value in the forecast period.

Vietnam Kitchen Furniture Market Industry Trends & Insights

The Vietnam kitchen furniture market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for modern kitchen designs. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period. Technological disruptions, including the adoption of advanced manufacturing techniques and digital marketing strategies, are reshaping the competitive landscape. Consumer preferences are shifting towards stylish, durable, and environmentally friendly furniture, fueling demand for eco-friendly materials and sustainable manufacturing practices. The market exhibits strong competitive dynamics, with both established players and new entrants vying for market share. Market penetration of modern kitchen furniture styles is estimated at xx% in 2025, expected to rise to xx% by 2033 due to increased consumer awareness and affordability.

Dominant Markets & Segments in Vietnam Kitchen Furniture Market

By Furniture Type: Kitchen cabinets constitute the largest segment, driven by high demand for customized and modular solutions. Kitchen tables and chairs follow, while the "Other Furniture Types" segment shows moderate growth, driven by increasing demand for kitchen storage and specialized items.

By Distribution Channel: Specialty stores currently dominate, providing a wider range of products and personalized service. E-commerce is rapidly expanding, offering convenience and wider reach to consumers. Supermarkets and hypermarkets hold a smaller, but steadily growing share.

Key drivers for dominance include:

- Economic Policies: Government initiatives promoting infrastructure development and consumer spending significantly influence market growth.

- Infrastructure: Improved infrastructure facilitates efficient distribution and supply chain operations, supporting market expansion.

- Consumer Preferences: The increasing adoption of modern kitchen styles is a primary driver in the dominance of specific segments.

Vietnam Kitchen Furniture Market Product Developments

Significant product innovations involve the incorporation of smart technologies, such as integrated lighting and power outlets, along with the use of sustainable and durable materials like bamboo and reclaimed wood. These developments enhance product functionality, aesthetics, and market appeal, creating competitive advantages for manufacturers embracing these trends. The market is increasingly focusing on modular and customizable furniture to meet diverse consumer preferences and space constraints.

Report Scope & Segmentation Analysis

This report segments the Vietnam kitchen furniture market by furniture type (Kitchen Cabinets, Kitchen Chairs, Kitchen Tables, Other Furniture Types) and distribution channel (Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Other Distribution Channels). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the kitchen cabinets segment is expected to exhibit the highest growth rate, driven by rising demand for modern kitchen designs. The e-commerce segment showcases the fastest growth in distribution channels, reflecting the increasing adoption of online shopping.

Key Drivers of Vietnam Kitchen Furniture Market Growth

The Vietnam kitchen furniture market's growth is fueled by a confluence of factors including rapid urbanization, rising disposable incomes, increasing awareness of modern kitchen aesthetics, and government initiatives promoting economic development. Technological advancements in manufacturing and design have also played a significant role in expanding product offerings and accessibility. The burgeoning e-commerce sector further boosts market expansion by broadening consumer reach and providing ease of access to a wider array of products.

Challenges in the Vietnam Kitchen Furniture Market Sector

Challenges include fluctuating raw material prices, intense competition from both domestic and international players, and the need to comply with evolving safety and environmental regulations. Supply chain disruptions, particularly evident following recent global events, have impacted production and delivery timelines. These factors impact profitability and market stability, demanding manufacturers adapt quickly to changing conditions.

Emerging Opportunities in Vietnam Kitchen Furniture Market

Emerging opportunities lie in the expansion of e-commerce channels, the growing demand for sustainable and eco-friendly furniture, and the increasing adoption of smart home technologies integrated into kitchen furniture. The market presents potential for niche products catering to specific consumer needs and preferences, particularly for modular designs and customized solutions that address space constraints in modern Vietnamese housing.

Leading Players in the Vietnam Kitchen Furniture Market

- Cabinetry factory

- Green River Door

- Vibuma

- Eagle Wood Vietnam

- Bsmart

- Vietnam Blue Lake Furniture

- Star Marine Furniture Company Ltd

- Ixina

- Pacific Craftworks

- Ikea

Key Developments in Vietnam Kitchen Furniture Market Industry

April 2023: Yoshimoto Sangyo Co., Ltd. and Vinh An Interior & Decor formed a strategic partnership, marking Yoshimoto's entry into the Vietnamese market. This signifies increased foreign investment and potential market disruption.

April 2022: Julius Blum opened its second store in Vietnam, strengthening its presence and influencing design trends through its hardware offerings. This indicates a growing demand for high-quality furniture components and potentially signifies positive market sentiment.

Strategic Outlook for Vietnam Kitchen Furniture Market

The Vietnam kitchen furniture market is poised for continued growth, driven by sustained economic expansion, evolving consumer preferences, and technological advancements. Opportunities exist for companies focusing on sustainable products, innovative designs, and effective e-commerce strategies. The market is expected to witness increased consolidation as larger players acquire smaller businesses and foreign investment continues to increase. A focus on meeting the diverse needs of a growing and increasingly discerning consumer base will be crucial for success in this dynamic market.

Vietnam Kitchen Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Kitchen Furniture Market Segmentation By Geography

- 1. Vietnam

Vietnam Kitchen Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Investments in Residential Sector is Boosting the Kitchen Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Kitchen Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cabinetry factory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Green River Door

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vibuma

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eagle Wood Vietnam

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bsmart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vietnam Blue Lake Furniture**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Star Marine Furniture Company Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ixina

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pacific Craftworks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cabinetry factory

List of Figures

- Figure 1: Vietnam Kitchen Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Kitchen Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Vietnam Kitchen Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Kitchen Furniture Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Vietnam Kitchen Furniture Market?

Key companies in the market include Cabinetry factory, Green River Door, Vibuma, Eagle Wood Vietnam, Bsmart, Vietnam Blue Lake Furniture**List Not Exhaustive, Star Marine Furniture Company Ltd, Ixina, Pacific Craftworks, Ikea.

3. What are the main segments of the Vietnam Kitchen Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Investments in Residential Sector is Boosting the Kitchen Furniture Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2023: Yoshimoto Sangyo Co., Ltd. and Vinh An Interior & Decor formalized a strategic partnership with the signing of an agreement in the Vietnamese capital of Hanoi. This marked Yoshimoto's official entry into the Vietnamese market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Kitchen Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Kitchen Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Kitchen Furniture Market?

To stay informed about further developments, trends, and reports in the Vietnam Kitchen Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence