Key Insights

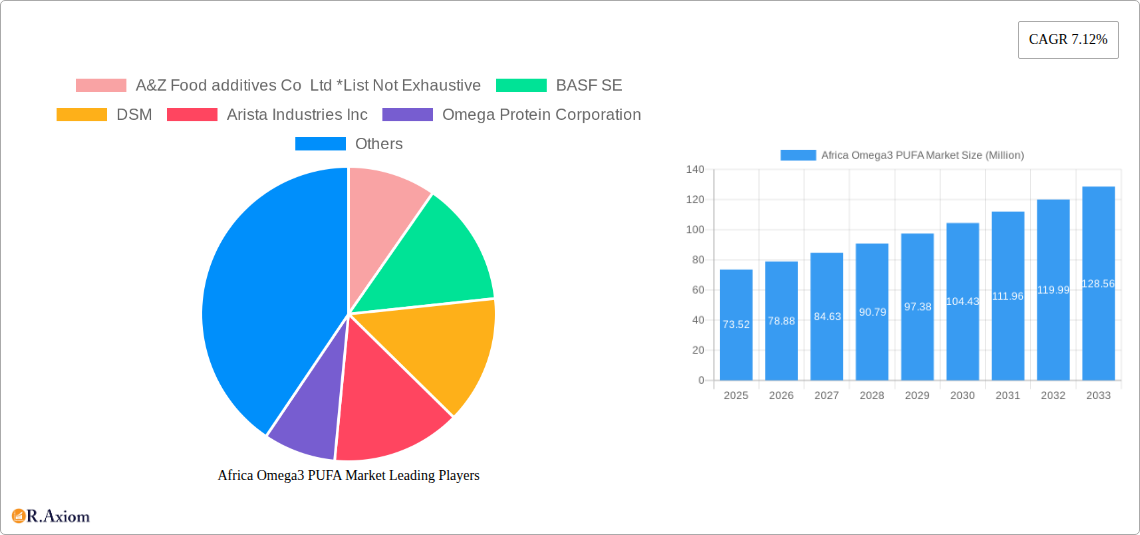

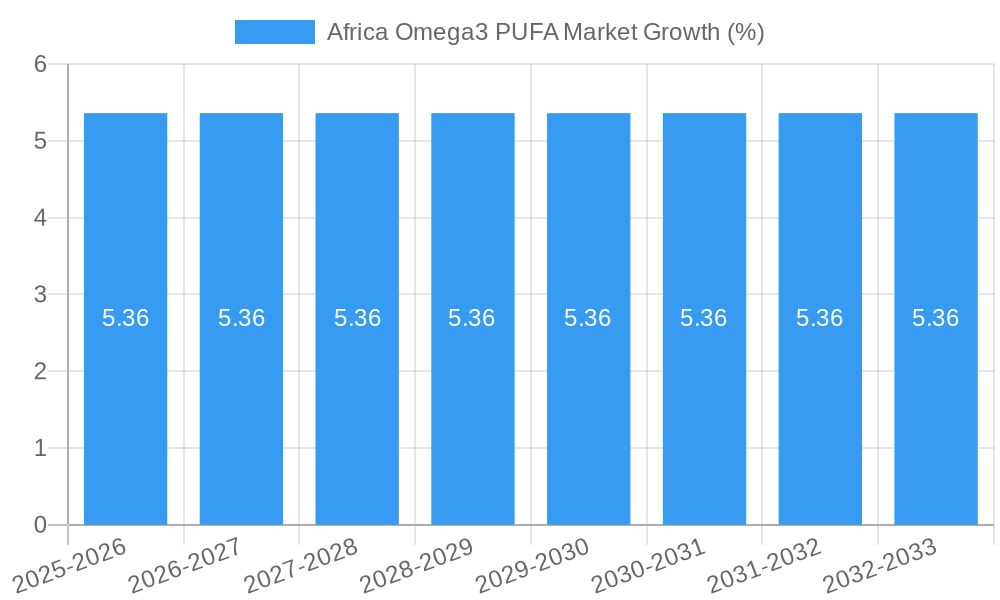

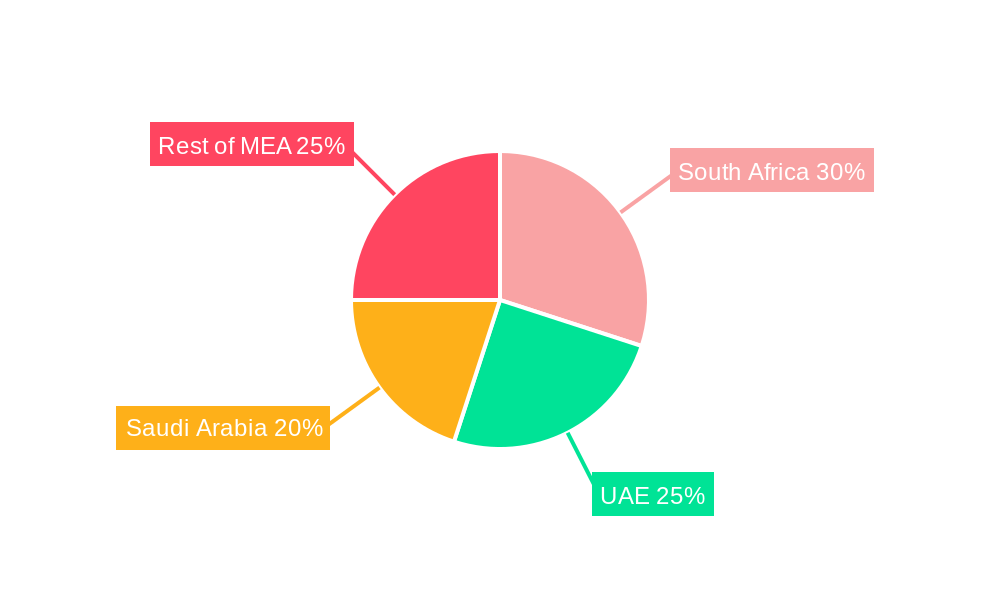

The Africa Omega-3 PUFA market, valued at $73.52 million in 2025, is projected to experience robust growth, driven by increasing awareness of the health benefits of omega-3 fatty acids and rising demand for nutritional supplements across the region. The market's Compound Annual Growth Rate (CAGR) of 7.12% from 2025 to 2033 indicates a significant expansion potential. Key application segments include food and beverages, infant nutrition, pharmaceuticals, and animal feed, reflecting the diverse utility of omega-3 PUFAs. Within the type segment, Docosahexaenoic Acid (DHA) and Eicosapentaenoic Acid (EPA) are likely to dominate, owing to their established health benefits and widespread use in various applications. Growth is further fueled by the rising prevalence of chronic diseases, increasing disposable incomes, and the growing adoption of functional foods and nutraceuticals in several African countries. However, market penetration may be challenged by factors such as fluctuating raw material prices, high production costs, and limited access to advanced technology in certain regions. The Middle East and Africa region, with countries like the UAE, South Africa, and Saudi Arabia leading the market, are experiencing substantial growth due to increased consumer awareness and proactive government initiatives focusing on health and wellness. This presents opportunities for companies like A&Z Food additives Co Ltd, BASF SE, DSM, Arista Industries Inc, Omega Protein Corporation, and Croda Inc to capitalize on the expanding market through product diversification and strategic partnerships.

The projected growth of the Africa Omega-3 PUFA market necessitates a comprehensive understanding of regional nuances and consumer preferences. While the market presents considerable potential, challenges related to infrastructure, distribution networks, and consumer education must be addressed to fully unlock the market's capacity. Companies that invest in research and development, build strong distribution channels, and tailor their product offerings to meet the specific needs of the African market are best positioned to capture significant market share. The increasing adoption of sustainable and ethical sourcing practices will also play a critical role in shaping the market's future trajectory. Focus on educating consumers about the health benefits of omega-3 PUFAs, particularly in relation to preventing and managing chronic diseases, will further propel market growth and solidify the position of Omega-3 PUFAs as a crucial component of healthy diets across the African continent.

Africa Omega-3 PUFA Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Omega-3 PUFA market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base year and forecast extending to 2033. The report meticulously examines market dynamics, segmentation, leading players, and future growth prospects. The market size is projected at xx Million in 2025 and is expected to witness significant growth over the forecast period.

Africa Omega-3 PUFA Market Concentration & Innovation

This section analyzes the competitive landscape of the African Omega-3 PUFA market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities.

The market exhibits a moderately concentrated structure, with key players like BASF SE, DSM, and Croda Inc holding significant market share. However, smaller regional players and new entrants are also emerging, driving competition. The exact market share distribution for each key player requires further investigation for precise figures. Innovation is driven by the increasing demand for healthier food products, the development of sustainable sourcing methods, and advancements in extraction and purification technologies. Regulatory frameworks vary across African countries, influencing market dynamics. Plant-based Omega-3 sources and other PUFA sources represent key substitutes. End-user trends are shifting towards functional foods and dietary supplements, bolstering market growth. M&A activity has been moderate, with deal values varying depending on the size and strategic objectives of the companies involved. For example, a potential M&A event could involve a larger multinational acquiring a smaller regional producer to expand its market reach, potentially impacting the market share of the key players.

Africa Omega-3 PUFA Market Industry Trends & Insights

This section delves into the major trends and insights shaping the Africa Omega-3 PUFA market. The market is experiencing robust growth, driven by factors such as rising health consciousness, increasing disposable incomes in certain regions, and growing awareness of the health benefits of Omega-3 PUFAs. Technological advancements in extraction and purification techniques are improving the quality and affordability of Omega-3 products. Consumer preferences are shifting towards convenient, natural, and sustainably sourced products. Competitive dynamics are characterized by both established global players and emerging regional companies vying for market share. The market's compound annual growth rate (CAGR) is projected to be xx% during the forecast period. Market penetration rates vary across different segments and regions, with higher penetration in urban areas and among higher-income groups.

Dominant Markets & Segments in Africa Omega-3 PUFA Market

This section identifies the leading regions, countries, and segments within the Africa Omega-3 PUFA market. Specific data on market dominance requires a deeper dive into the available market research, and region-specific analyses. This would necessitate further research and data collection, and specific figures are unavailable at this time.

By Application:

- Food and Beverages: This segment is projected to be a major driver of market growth due to increasing demand for functional foods enriched with Omega-3 PUFAs.

- Infant Nutrition: The demand for infant formula and other infant nutrition products fortified with Omega-3s is rapidly growing.

- Dietary Supplements: The popularity of Omega-3 supplements is increasing in Africa, driven by health awareness.

- Pharmaceuticals: Omega-3 PUFAs are used in the pharmaceutical industry for various health applications.

- Animal Nutrition: The demand for animal feed containing Omega-3 PUFAs is growing to enhance animal health and product quality.

By Type:

- Docosahexaenoic Acid (DHA): DHA is gaining significant traction due to its cognitive and cardiovascular benefits.

- Eicosapentaenoic Acid (EPA): EPA also holds great importance because of its cardiovascular benefits.

- Alpha-Linolenic Acid (ALA): ALA is a popular choice due to its widespread availability in plant sources.

- Others: This segment encompasses various other Omega-3 PUFAs with growing applications.

Key drivers for dominance in specific regions/segments would include factors like economic growth, favorable government regulations, and health awareness initiatives.

Africa Omega-3 PUFA Market Product Developments

Recent product innovations focus on enhancing bioavailability, taste, and stability of Omega-3 PUFA products. Companies are developing novel delivery systems, such as microencapsulation, to improve product efficacy and shelf life. Technological advancements in extraction and purification methods are enabling the production of high-quality Omega-3 PUFAs from sustainable sources. These innovations cater to the growing consumer demand for natural, effective, and convenient Omega-3 supplements and functional foods.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Africa Omega-3 PUFA market, segmenting it by application (Food and Beverages, Infant Nutrition, Dietary Supplements, Pharmaceuticals, Animal Nutrition) and type (Docosahexaenoic Acid (DHA), Eicosapentaenoic Acid (EPA), Alpha-Linolenic Acid (ALA), Others). Each segment's growth projection, market size, and competitive dynamics are explored in detail. Further, region-specific analysis will delve into the opportunities and challenges present in different African countries. (Specific figures unavailable at this time).

Key Drivers of Africa Omega-3 PUFA Market Growth

Several key factors are driving the growth of the Africa Omega-3 PUFA market, including: increasing awareness of the health benefits of Omega-3s, rising disposable incomes in certain regions, technological advancements leading to increased production efficiency, and increasing demand for functional foods and dietary supplements. The growing pharmaceutical application of Omega-3 PUFAs and the increasing demand from the animal nutrition industry also contribute to market growth.

Challenges in the Africa Omega-3 PUFA Market Sector

The Africa Omega-3 PUFA market faces several challenges, including: limited access to advanced technologies in some regions, supply chain disruptions, high cost of Omega-3 products limiting market penetration in some segments, and varied regulatory frameworks across African countries. Fluctuations in raw material prices and intense competition from other health supplements also present hurdles to market expansion.

Emerging Opportunities in Africa Omega-3 PUFA Market

The Africa Omega-3 PUFA market presents several emerging opportunities, including: the growth of the middle class and increased health consciousness, expansion into untapped markets, the development of novel delivery systems, and potential for partnerships with local companies to develop sustainable sourcing and production. The rising demand for sustainably sourced Omega-3s presents further opportunities for companies specializing in eco-friendly extraction and production methods.

Leading Players in the Africa Omega-3 PUFA Market

- A&Z Food additives Co Ltd

- BASF SE

- DSM

- Arista Industries Inc

- Omega Protein Corporation

- Croda Inc

Key Developments in Africa Omega-3 PUFA Industry

Specific key developments with dates are unavailable at this time. Further research would be needed to incorporate this information.

Strategic Outlook for Africa Omega-3 PUFA Market

The Africa Omega-3 PUFA market holds significant growth potential. Continued growth is anticipated due to several factors, including increasing consumer awareness, technological innovations, and the development of new product applications. Companies that adopt strategies focused on product innovation, sustainable sourcing, and market penetration in underserved regions are poised for significant success in this expanding market.

Africa Omega3 PUFA Market Segmentation

-

1. Type

- 1.1. Docosahexaenoic Acid (DHA)

- 1.2. Eicosapentaenoic Acid (EPA)

- 1.3. Alpha-Linolenic Acid (ALA)

- 1.4. Others

-

2. Application

-

2.1. Food and Beverages

- 2.1.1. Functional Food and Beverages

- 2.1.2. Infant Nutrition

- 2.2. Dietary Supplements

- 2.3. Pharmaceuticals

- 2.4. Animal Nutrition

-

2.1. Food and Beverages

-

3. Geography

- 3.1. South Africa

- 3.2. Nigeria

- 3.3. Egypt

- 3.4. Rest of Africa

Africa Omega3 PUFA Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Egypt

- 4. Rest of Africa

Africa Omega3 PUFA Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Health Benefits Associated with Tocotrienol; Escalating Demand for Anti-Aging Products Containing Tocotrienol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Rising Demand for Omega 3 ingredient in Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Docosahexaenoic Acid (DHA)

- 5.1.2. Eicosapentaenoic Acid (EPA)

- 5.1.3. Alpha-Linolenic Acid (ALA)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.1.1. Functional Food and Beverages

- 5.2.1.2. Infant Nutrition

- 5.2.2. Dietary Supplements

- 5.2.3. Pharmaceuticals

- 5.2.4. Animal Nutrition

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Nigeria

- 5.3.3. Egypt

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Egypt

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Docosahexaenoic Acid (DHA)

- 6.1.2. Eicosapentaenoic Acid (EPA)

- 6.1.3. Alpha-Linolenic Acid (ALA)

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.1.1. Functional Food and Beverages

- 6.2.1.2. Infant Nutrition

- 6.2.2. Dietary Supplements

- 6.2.3. Pharmaceuticals

- 6.2.4. Animal Nutrition

- 6.2.1. Food and Beverages

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Nigeria

- 6.3.3. Egypt

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Nigeria Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Docosahexaenoic Acid (DHA)

- 7.1.2. Eicosapentaenoic Acid (EPA)

- 7.1.3. Alpha-Linolenic Acid (ALA)

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.1.1. Functional Food and Beverages

- 7.2.1.2. Infant Nutrition

- 7.2.2. Dietary Supplements

- 7.2.3. Pharmaceuticals

- 7.2.4. Animal Nutrition

- 7.2.1. Food and Beverages

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Nigeria

- 7.3.3. Egypt

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Egypt Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Docosahexaenoic Acid (DHA)

- 8.1.2. Eicosapentaenoic Acid (EPA)

- 8.1.3. Alpha-Linolenic Acid (ALA)

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.1.1. Functional Food and Beverages

- 8.2.1.2. Infant Nutrition

- 8.2.2. Dietary Supplements

- 8.2.3. Pharmaceuticals

- 8.2.4. Animal Nutrition

- 8.2.1. Food and Beverages

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Nigeria

- 8.3.3. Egypt

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Africa Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Docosahexaenoic Acid (DHA)

- 9.1.2. Eicosapentaenoic Acid (EPA)

- 9.1.3. Alpha-Linolenic Acid (ALA)

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.1.1. Functional Food and Beverages

- 9.2.1.2. Infant Nutrition

- 9.2.2. Dietary Supplements

- 9.2.3. Pharmaceuticals

- 9.2.4. Animal Nutrition

- 9.2.1. Food and Beverages

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Nigeria

- 9.3.3. Egypt

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. UAE Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 11. South Africa Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 12. Saudi Arabia Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of MEA Africa Omega3 PUFA Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 A&Z Food additives Co Ltd *List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 BASF SE

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 DSM

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Arista Industries Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Omega Protein Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Croda Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.1 A&Z Food additives Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: Africa Omega3 PUFA Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Omega3 PUFA Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Omega3 PUFA Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Omega3 PUFA Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Omega3 PUFA Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Africa Omega3 PUFA Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Africa Omega3 PUFA Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Omega3 PUFA Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Africa Omega3 PUFA Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Africa Omega3 PUFA Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Africa Omega3 PUFA Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Africa Omega3 PUFA Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Omega3 PUFA Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Africa Omega3 PUFA Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Africa Omega3 PUFA Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Africa Omega3 PUFA Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Africa Omega3 PUFA Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Africa Omega3 PUFA Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Africa Omega3 PUFA Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Africa Omega3 PUFA Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Africa Omega3 PUFA Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Africa Omega3 PUFA Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Africa Omega3 PUFA Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Africa Omega3 PUFA Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Africa Omega3 PUFA Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Africa Omega3 PUFA Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Africa Omega3 PUFA Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Africa Omega3 PUFA Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Omega3 PUFA Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the Africa Omega3 PUFA Market?

Key companies in the market include A&Z Food additives Co Ltd *List Not Exhaustive, BASF SE, DSM, Arista Industries Inc, Omega Protein Corporation, Croda Inc.

3. What are the main segments of the Africa Omega3 PUFA Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Health Benefits Associated with Tocotrienol; Escalating Demand for Anti-Aging Products Containing Tocotrienol.

6. What are the notable trends driving market growth?

Rising Demand for Omega 3 ingredient in Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Omega3 PUFA Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Omega3 PUFA Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Omega3 PUFA Market?

To stay informed about further developments, trends, and reports in the Africa Omega3 PUFA Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence