Key Insights

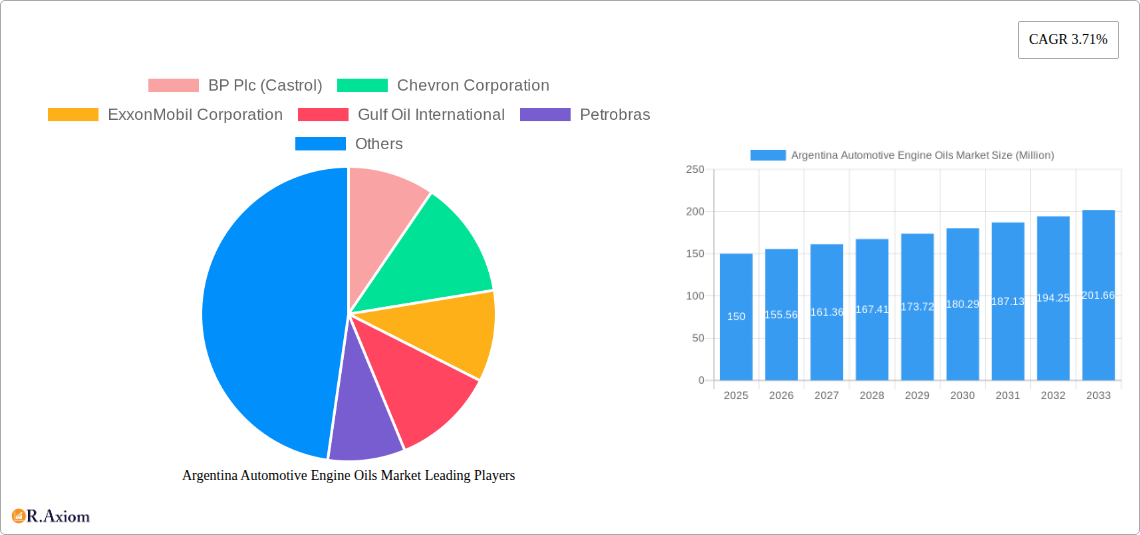

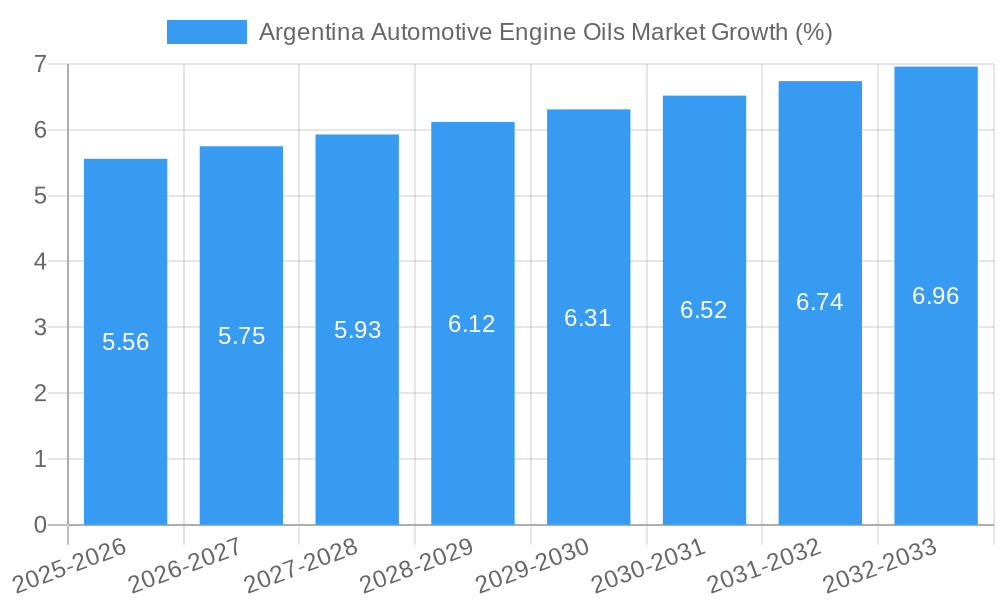

The Argentina Automotive Engine Oils Market, valued at approximately $150 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.71% from 2025 to 2033. This growth is driven by several factors. The increasing number of vehicles on Argentina's roads, fueled by a growing middle class and expanding automotive sector, constitutes a primary driver. Furthermore, stricter emission regulations are pushing the adoption of higher-quality, more environmentally friendly engine oils, stimulating demand for premium products. The rising awareness among consumers regarding the importance of regular oil changes for engine longevity and performance also contributes to market expansion. However, economic fluctuations within Argentina and potential price volatility in crude oil, a key input for engine oil production, pose challenges to market growth. The market is segmented by oil type (conventional, synthetic, semi-synthetic), viscosity grade, and application (passenger cars, commercial vehicles). Key players, including international giants like BP Plc (Castrol), Chevron, ExxonMobil, and Shell, alongside local and regional players, compete fiercely, driving innovation and competition in pricing and product quality.

The forecast period (2025-2033) indicates a continuous, albeit moderate, expansion of the Argentine automotive engine oil market. The market's growth trajectory is expected to be influenced by the overall health of the Argentine economy and its automotive industry. Government policies aimed at promoting fuel efficiency and reducing emissions will play a significant role in shaping market dynamics. The increasing penetration of fuel-efficient vehicles and the rising adoption of advanced engine technologies could further propel demand for specialized high-performance engine oils. Competitive landscape analysis reveals a dynamic market structure with both established multinational corporations and local players actively vying for market share, leading to price competition and product diversification. Opportunities exist for players focusing on developing eco-friendly and high-performance engine oils catering to the growing demand for superior quality lubricants.

Argentina Automotive Engine Oils Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Argentina Automotive Engine Oils Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period, utilizing 2025 as the base year. The report leverages extensive data analysis, incorporating key market trends, competitive dynamics, and future growth projections. This report is crucial for understanding the current market landscape and navigating the evolving dynamics within the Argentinian automotive engine oils sector.

Argentina Automotive Engine Oils Market Concentration & Innovation

The Argentina automotive engine oils market exhibits a moderately concentrated landscape, with key players such as BP Plc (Castrol), Chevron Corporation, ExxonMobil Corporation, and Shell holding significant market share. However, the market also features several regional and smaller players, fostering competition and innovation. The market is driven by technological advancements in oil formulations, focusing on improved fuel efficiency, emission reduction, and extended drain intervals. Stringent emission regulations imposed by the Argentinian government are pushing manufacturers to develop advanced engine oils that meet these standards. The market has witnessed several mergers and acquisitions (M&A) in recent years, although precise deal values are unavailable (xx Million). These activities have influenced market consolidation and technology transfer. End-user trends favor longer oil drain intervals and higher-quality lubricants, influenced by increasing vehicle sophistication and consumer awareness.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Drivers: Stringent emission regulations, demand for fuel efficiency, and technological advancements in oil formulations.

- Regulatory Framework: Government regulations influencing the development and adoption of environmentally friendly engine oils.

- Product Substitutes: Limited viable substitutes, primarily synthetic vs. conventional oils.

- M&A Activities: Several M&A deals have occurred, influencing market consolidation (xx Million in total deal value).

Argentina Automotive Engine Oils Market Industry Trends & Insights

The Argentinian automotive engine oils market is experiencing steady growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by factors such as increasing vehicle ownership, rising disposable incomes, and a growing focus on vehicle maintenance. Technological disruptions, including the introduction of advanced oil formulations with enhanced performance characteristics, are further fueling market expansion. Consumer preference is shifting towards synthetic and higher-quality engine oils, reflecting increased awareness of their benefits. Competitive dynamics are shaped by intense rivalry among major international players and local brands, leading to price competition and product differentiation strategies. Market penetration of synthetic oils is increasing steadily, indicating a growing preference for high-performance lubricants.

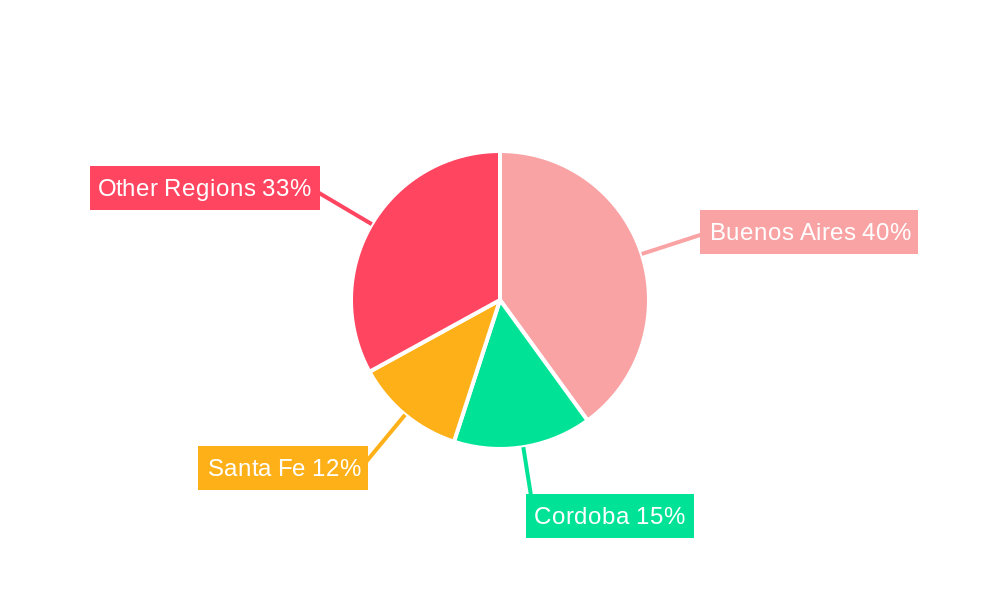

Dominant Markets & Segments in Argentina Automotive Engine Oils Market

The Buenos Aires metropolitan area represents the dominant market segment within Argentina due to its high population density, concentrated automotive sector, and robust economic activity. Key drivers contributing to its dominance include:

- Strong economic activity: The region’s high level of economic activity leads to higher vehicle sales and maintenance needs.

- Dense population: A large concentration of vehicles within this area creates substantial demand for engine oils.

- Developed infrastructure: The region boasts a well-developed distribution network for effective product delivery.

Other regions show lower but still significant growth potentials, primarily driven by increasing urbanization and economic development in other Argentinian provinces. The automotive segment itself is broken down into several smaller segments like passenger cars, light commercial vehicles, and heavy-duty vehicles, each with varied oil needs.

Argentina Automotive Engine Oils Market Product Developments

Recent product innovations within the Argentinian automotive engine oils market focus on enhanced performance characteristics, such as improved fuel economy, reduced emissions, and extended drain intervals. Manufacturers are increasingly adopting advanced additive technologies to improve oil viscosity, oxidation stability, and wear protection. These advancements cater to the growing consumer demand for high-performance and environmentally friendly engine oils. The market is witnessing a notable shift toward synthetic and semi-synthetic oils, reflecting the increasing popularity of these superior lubricant options.

Report Scope & Segmentation Analysis

This report segments the Argentina Automotive Engine Oils Market based on several key parameters:

By Product Type: Conventional, Semi-synthetic, and Synthetic engine oils, each segment exhibiting different growth projections and market sizes. Synthetic oils are experiencing faster growth due to enhanced performance features.

By Vehicle Type: Passenger cars, light commercial vehicles, and heavy-duty vehicles. This segmentation highlights differences in oil viscosity and other specifications for different engine types.

By Sales Channel: Direct sales to OEMs, sales through distributors and retailers. Understanding these channels offers insight into the competitive dynamics within the market.

By Region: Buenos Aires, other regions of Argentina to provide geographic breakdown of market demand and growth.

Key Drivers of Argentina Automotive Engine Oils Market Growth

Several factors are driving the growth of the Argentina automotive engine oils market:

- Rising vehicle ownership: Increasing affordability and consumer preference for personal vehicles are fueling market expansion.

- Government regulations: Stringent emission standards drive demand for higher-quality, environmentally friendly lubricants.

- Economic growth: Steady economic growth within Argentina contributes to increased purchasing power and higher demand for vehicle maintenance.

Challenges in the Argentina Automotive Engine Oils Market Sector

The Argentinian automotive engine oils market faces certain challenges:

- Economic volatility: Economic fluctuations in Argentina can significantly impact consumer spending on automotive maintenance.

- Import dependencies: Reliance on imported base oils and additives makes the market susceptible to global price fluctuations and supply chain disruptions.

- Counterfeit products: The presence of counterfeit products poses a significant threat to both legitimate businesses and consumers.

Emerging Opportunities in Argentina Automotive Engine Oils Market

Emerging opportunities exist within the Argentinian automotive engine oils market:

- Growth in the light commercial vehicle segment: Increasing demand for LCVs in Argentina presents a significant opportunity for oil suppliers.

- Expansion into specialized oil formulations: Developing high-performance oils catering to specific vehicle types can offer a competitive advantage.

- Focus on sustainable and environmentally friendly products: Growing environmental concerns provide an opportunity for marketers of bio-based or low-impact oils.

Leading Players in the Argentina Automotive Engine Oils Market Market

- BP Plc (Castrol)

- Chevron Corporation

- ExxonMobil Corporation

- Gulf Oil International

- Petrobras

- Petronas Lubricants International

- Puma Energy

- Royal Dutch Shell Plc

- TotalEnergies

- Valvoline Inc

- YP

Key Developments in Argentina Automotive Engine Oils Market Industry

- October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. This strengthens Valvoline's market position and distribution network.

- November 2021: Puma Energy secured a contract with Kia Argentina, expanding its market reach and establishing itself as a key supplier within the Argentinian automotive sector.

- January 2022: ExxonMobil Corporation reorganized into three business lines, potentially impacting its focus and strategies within the automotive engine oils sector. This restructuring could lead to changes in product offerings and investments.

Strategic Outlook for Argentina Automotive Engine Oils Market Market

The Argentinian automotive engine oils market holds significant future potential. Continued economic growth, rising vehicle ownership, and increasing focus on vehicle maintenance will drive market expansion. Strategic opportunities lie in developing advanced oil formulations that meet increasingly stringent emission standards and cater to evolving consumer preferences. Companies focusing on innovation, sustainable solutions, and efficient distribution networks are likely to succeed in this dynamic market. The report suggests that players who successfully navigate the economic challenges and adapt to evolving market needs will experience significant growth in the coming years.

Argentina Automotive Engine Oils Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

- 2. Product Grade

Argentina Automotive Engine Oils Market Segmentation By Geography

- 1. Argentina

Argentina Automotive Engine Oils Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.71% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Automotive Engine Oils Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BP Plc (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExxonMobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gulf Oil International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petronas Lubricants International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Puma Energy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valvoline Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 YP

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BP Plc (Castrol)

List of Figures

- Figure 1: Argentina Automotive Engine Oils Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Automotive Engine Oils Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Product Grade 2019 & 2032

- Table 4: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Product Grade 2019 & 2032

- Table 7: Argentina Automotive Engine Oils Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Automotive Engine Oils Market?

The projected CAGR is approximately 3.71%.

2. Which companies are prominent players in the Argentina Automotive Engine Oils Market?

Key companies in the market include BP Plc (Castrol), Chevron Corporation, ExxonMobil Corporation, Gulf Oil International, Petrobras, Petronas Lubricants International, Puma Energy, Royal Dutch Shell Plc, TotalEnergies, Valvoline Inc, YP.

3. What are the main segments of the Argentina Automotive Engine Oils Market?

The market segments include Vehicle Type, Product Grade.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Commercial Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.November 2021: Puma Energy recently entered into a contract with Kia Argentina. Puma is expected to provide Kia with its lubricants and oils for the optimal maintenance of Kia vehicles.October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Automotive Engine Oils Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Automotive Engine Oils Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Automotive Engine Oils Market?

To stay informed about further developments, trends, and reports in the Argentina Automotive Engine Oils Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence