Key Insights

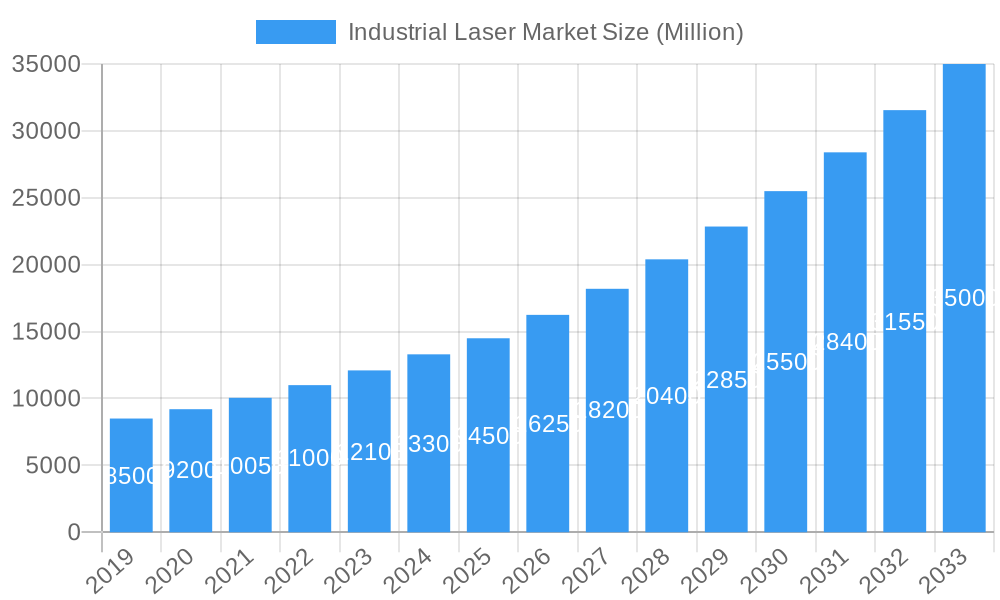

The global Industrial Laser Market is projected for significant expansion, reaching a market size of $23.9 billion by 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 12.7% from the base year 2025 through 2033. Key drivers include the increasing adoption of advanced manufacturing processes in sectors such as automotive, electronics, and aerospace. Laser solutions offer superior precision, speed, and cost-effectiveness for cutting, welding, marking, and engraving, surpassing traditional methods. Expanding applications in medical, cosmetic, research & development, and defense sectors also contribute to this upward trend. Fiber lasers are expected to lead, with diode and CO/CO2 lasers also experiencing steady demand.

Industrial Laser Market Market Size (In Billion)

Key market trends encompass the development of higher-power industrial lasers, miniaturization for improved portability and integration, and the increasing use of advanced software for process optimization. Innovations in solid-state laser technology further fuel market growth. Challenges, such as high initial investment costs and the requirement for skilled operators, may influence adoption rates in certain segments. Geographically, the Asia Pacific region, particularly China, is anticipated to lead in market size and growth due to its strong manufacturing base and rapid technological advancements. North America and Europe remain significant markets, driven by continuous innovation and automation. The market is competitive, with key players like IPG Photonics, Coherent Corp, and TRUMPF investing in research and development.

Industrial Laser Market Company Market Share

Industrial Laser Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a meticulous examination of the global Industrial Laser Market, encompassing a detailed analysis of market dynamics, segmentation, key players, and future growth trajectories. Spanning a study period from 2019 to 2033, with a base year of 2025, this report offers critical insights into the evolving landscape of industrial laser technologies and their widespread applications. We project the market to reach an estimated XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.X% during the forecast period of 2025–2033. Our analysis is built upon a robust historical dataset from 2019–2024, ensuring a comprehensive understanding of past performance and future potential.

Industrial Laser Market Market Concentration & Innovation

The Industrial Laser Market exhibits a moderate to high level of concentration, with key players like TRUMPF, IPG Photonics Corporation, and Jenoptik AG holding significant market shares, estimated to be around 30-40% collectively. Innovation is a primary driver of market growth, with substantial investments in research and development by leading entities focusing on enhancing laser efficiency, power output, and precision across various applications such as advanced materials processing and medical procedures. Regulatory frameworks, particularly those concerning safety standards and environmental impact, play a crucial role in shaping market entry and product development. Product substitutes, such as traditional machining methods, continue to exist but are increasingly being surpassed by the superior capabilities offered by industrial lasers. End-user trends lean towards automation, miniaturization, and the demand for higher throughput in manufacturing processes, which directly fuels the adoption of advanced laser solutions. Mergers and acquisitions (M&A) activities are prevalent, with deal values often reaching hundreds of millions of dollars, indicating a strategic consolidation to gain market dominance and technological synergy. For example, the acquisition of Coherent, Inc. by IIVI Incorporated in July 2022, valued at an estimated $7 Billion, highlights this trend.

Industrial Laser Market Industry Trends & Insights

The Industrial Laser Market is experiencing robust growth, propelled by an escalating demand for precision manufacturing, automation, and advanced technological solutions across diverse industries. Key growth drivers include the increasing adoption of laser-based systems in automotive manufacturing for welding and cutting, the burgeoning electronics sector for micro-machining and assembly, and the medical field for surgical procedures and diagnostics. Technological disruptions, such as the advancement of high-power fiber lasers and the development of ultrashort pulse lasers, are revolutionizing traditional manufacturing processes, enabling faster, more efficient, and higher-quality production. Consumer preferences are shifting towards customized products and on-demand manufacturing, where the flexibility and precision of industrial lasers are paramount. Competitive dynamics are characterized by intense innovation, with companies constantly striving to develop more powerful, energy-efficient, and cost-effective laser solutions. Market penetration is steadily increasing across emerging economies as industrialization accelerates. The market penetration of fiber lasers, for instance, is estimated to be over 60% in the industrial applications segment, underscoring its dominance. The CAGR is projected to remain strong, driven by ongoing technological advancements and the expanding application base. The average lifespan of industrial laser systems is also a factor, as replacements and upgrades contribute to sustained market demand.

Dominant Markets & Segments in Industrial Laser Market

The Asia-Pacific region stands out as the dominant market for industrial lasers, largely driven by China's significant manufacturing capabilities and its substantial investments in advanced technologies. Within this region, China itself commands the largest market share, influenced by supportive government policies, a robust industrial base, and a growing emphasis on high-tech manufacturing.

Type Segment Dominance:

- Fiber Lasers: This segment is the clear leader, holding over 60% of the market share. Key drivers include their high efficiency, low maintenance requirements, excellent beam quality, and versatility in applications like cutting, welding, and marking. The ongoing advancements in fiber laser technology, such as increased power output and improved beam delivery systems, further solidify their dominance.

- Diode Lasers: While second to fiber lasers, diode lasers are experiencing significant growth, particularly in medical and cosmetic applications, as well as in certain materials processing tasks. Their compact size, energy efficiency, and cost-effectiveness make them attractive for specific use cases.

- CO/CO2 Lasers: These lasers remain important, especially in heavy industries for cutting thick materials and for specific applications like marking and engraving. However, their market share is gradually being eroded by the superior performance of fiber lasers in many applications.

- Solid State Lasers: This category, including Nd:YAG and disk lasers, continues to hold a niche, particularly in specialized welding and cutting applications where their unique beam characteristics are advantageous.

- Other Types: This segment includes emerging technologies and less common laser types, which are gaining traction in specialized research and niche industrial applications.

Application Segment Dominance:

- Materials Processing: This is the largest application segment, encompassing cutting, welding, marking, engraving, drilling, and surface treatment across industries like automotive, aerospace, electronics, and heavy machinery. The demand for precision, speed, and automation in manufacturing directly fuels this segment's growth. For instance, laser cutting in the automotive sector alone accounts for an estimated XX% of the materials processing market.

- Communications: Fiber lasers are critical for telecommunications, powering optical networks. The ongoing expansion of 5G infrastructure and the increasing demand for high-speed data transmission are significant drivers for this segment.

- Medical and Cosmetics: Lasers are widely used in surgery, ophthalmology, dermatology, and dentistry. The growing healthcare sector and the increasing acceptance of laser-based treatments contribute to the steady growth of this segment.

- Lithography: While a specialized segment, extreme ultraviolet (EUV) lithography lasers are crucial for semiconductor manufacturing, a sector that is experiencing high demand.

- Research and Development: Lasers are indispensable tools in scientific research, driving innovation across various fields.

- Military and Defense: Lasers are employed in target designation, rangefinding, and directed energy weapons systems, a segment with significant government funding.

- Sensors and Displays: Lasers are increasingly used in advanced sensor technologies and in the manufacturing of display components.

Industrial Laser Market Product Developments

The Industrial Laser Market is characterized by continuous product innovation focused on enhancing performance, efficiency, and application versatility. Key developments include the introduction of higher-power fiber lasers exceeding 100 kW, enabling faster and deeper cutting of thick materials, and the advancement of ultrashort pulse (USP) lasers for highly precise, non-thermal material processing, ideal for sensitive components. Innovations in beam manipulation and optical delivery systems are also crucial, allowing for more flexible and automated integration into production lines. These advancements offer manufacturers improved throughput, reduced operating costs, and the ability to process novel materials, thereby expanding the market's reach into new industrial sectors.

Report Scope & Segmentation Analysis

This report meticulously segments the Industrial Laser Market by Type and Application, offering granular insights into each category. The Type segmentation includes Fiber Lasers, Diode Lasers, CO/CO2 Lasers, Solid State Lasers, and Other Types. Fiber lasers are projected to maintain their leading position due to their versatility and efficiency in materials processing, with an estimated market size of XX Million in 2025 and a projected CAGR of X.X%. Diode lasers are expected to witness robust growth in medical and cosmetic applications, reaching XX Million by 2025. The Application segmentation encompasses Communications, Materials Processing, Medical and Cosmetics, Lithography, Research and Development, Military and Defense, Sensors, Displays, and Other Applications. Materials Processing is anticipated to dominate, valued at XX Million in 2025, driven by automation trends in manufacturing. The Communications segment is also a significant contributor, with steady growth driven by the expansion of optical networks.

Key Drivers of Industrial Laser Market Growth

The Industrial Laser Market's growth is propelled by several critical factors. The increasing demand for automation and Industry 4.0 initiatives across manufacturing sectors is a primary driver, as lasers offer precision and efficiency in automated processes. Advancements in laser technology, particularly in power, beam quality, and efficiency, are enabling new applications and improving existing ones, leading to higher adoption rates. The expanding use of lasers in emerging economies, fueled by industrialization and economic development, further bolsters growth. Furthermore, the growing adoption of laser-based solutions in the medical and electronics industries, driven by the need for intricate and precise treatments and component fabrication, contributes significantly.

Challenges in the Industrial Laser Market Sector

Despite its strong growth trajectory, the Industrial Laser Market faces several challenges. The high initial capital investment required for advanced laser systems can be a barrier for small and medium-sized enterprises (SMEs). Intense competition among manufacturers can lead to price pressures, impacting profit margins. Fluctuations in raw material costs and supply chain disruptions can affect production and lead times. Additionally, the need for skilled personnel to operate and maintain sophisticated laser equipment presents a talent gap challenge. Evolving regulatory landscapes concerning laser safety and environmental compliance also require constant adaptation from industry players.

Emerging Opportunities in Industrial Laser Market

The Industrial Laser Market is ripe with emerging opportunities. The growing demand for additive manufacturing and 3D printing technologies presents a significant avenue for laser suppliers, as lasers are integral to these processes. Expansion into new application areas, such as advanced materials processing for renewable energy technologies and the development of laser-based solutions for quantum computing, offers substantial growth potential. The increasing focus on sustainability and energy efficiency in manufacturing also creates opportunities for laser companies that can offer more power-efficient and environmentally friendly solutions. Furthermore, the market penetration in developing economies, coupled with the increasing adoption of lasers in niche sectors like agriculture and food processing, represents untapped growth potential.

Leading Players in the Industrial Laser Market Market

- Coherent Corp

- EKSPLA

- Han's Laser Technology Industry Group Co Ltd

- IPG Photonics Corporation

- Jenoptik AG

- Keyence Corporation

- Lumentum Operations LLC

- LUMIBIRD

- Maxphotonics Co Ltd

- nLIGHT Inc

- Novanta Inc

- TRUMPF

- Wuhan Raycus Fiber Laser Technologies Co Ltd

Key Developments in Industrial Laser Market Industry

- October 2022: Lumentum Holdings Inc expanded its operations and advanced research and development in Slovenia for specialty optical fibers and related products. The facility includes a Center of Excellence for advanced research and development to devise fundamental laser component technology and products.

- July 2022: IIVI Incorporated announced the acquisition of Coherent, Inc., forming a global leader in materials, networking, and lasers. The combined company will serve four markets, i.e., industrial, communications, electronics, and instrumentation.

Strategic Outlook for Industrial Laser Market Market

The strategic outlook for the Industrial Laser Market remains highly positive, driven by the relentless pace of technological innovation and the expanding application base across diverse industries. Key growth catalysts include the continued drive towards automation, the need for precision and efficiency in manufacturing, and the increasing sophistication of materials being processed. Emerging markets offer significant untapped potential, while established markets are seeing growth through upgrades and the adoption of more advanced laser technologies. Strategic partnerships, ongoing research and development focused on higher power, greater precision, and novel applications will be crucial for players seeking to maintain a competitive edge and capitalize on future market opportunities. The integration of artificial intelligence and machine learning into laser systems for optimized performance and predictive maintenance is also a significant future trend.

Industrial Laser Market Segmentation

-

1. Type

- 1.1. Fiber Lasers

- 1.2. Diode Lasers

- 1.3. CO/CO2 Lasers

- 1.4. Solid State Lasers

- 1.5. Other Types

-

2. Application

- 2.1. Communications

- 2.2. Materials Processing

- 2.3. Medical and Cosmetics

- 2.4. Lithography

- 2.5. Research and Development

- 2.6. Military and Defense

- 2.7. Sensors

- 2.8. Displays

- 2.9. Other Ap

Industrial Laser Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Industrial Laser Market Regional Market Share

Geographic Coverage of Industrial Laser Market

Industrial Laser Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Laser Systems from the Electronics Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Laser Systems from the Electronics Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Communication Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Laser Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fiber Lasers

- 5.1.2. Diode Lasers

- 5.1.3. CO/CO2 Lasers

- 5.1.4. Solid State Lasers

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Communications

- 5.2.2. Materials Processing

- 5.2.3. Medical and Cosmetics

- 5.2.4. Lithography

- 5.2.5. Research and Development

- 5.2.6. Military and Defense

- 5.2.7. Sensors

- 5.2.8. Displays

- 5.2.9. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Industrial Laser Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fiber Lasers

- 6.1.2. Diode Lasers

- 6.1.3. CO/CO2 Lasers

- 6.1.4. Solid State Lasers

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Communications

- 6.2.2. Materials Processing

- 6.2.3. Medical and Cosmetics

- 6.2.4. Lithography

- 6.2.5. Research and Development

- 6.2.6. Military and Defense

- 6.2.7. Sensors

- 6.2.8. Displays

- 6.2.9. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Industrial Laser Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fiber Lasers

- 7.1.2. Diode Lasers

- 7.1.3. CO/CO2 Lasers

- 7.1.4. Solid State Lasers

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Communications

- 7.2.2. Materials Processing

- 7.2.3. Medical and Cosmetics

- 7.2.4. Lithography

- 7.2.5. Research and Development

- 7.2.6. Military and Defense

- 7.2.7. Sensors

- 7.2.8. Displays

- 7.2.9. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Industrial Laser Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fiber Lasers

- 8.1.2. Diode Lasers

- 8.1.3. CO/CO2 Lasers

- 8.1.4. Solid State Lasers

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Communications

- 8.2.2. Materials Processing

- 8.2.3. Medical and Cosmetics

- 8.2.4. Lithography

- 8.2.5. Research and Development

- 8.2.6. Military and Defense

- 8.2.7. Sensors

- 8.2.8. Displays

- 8.2.9. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Industrial Laser Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fiber Lasers

- 9.1.2. Diode Lasers

- 9.1.3. CO/CO2 Lasers

- 9.1.4. Solid State Lasers

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Communications

- 9.2.2. Materials Processing

- 9.2.3. Medical and Cosmetics

- 9.2.4. Lithography

- 9.2.5. Research and Development

- 9.2.6. Military and Defense

- 9.2.7. Sensors

- 9.2.8. Displays

- 9.2.9. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Coherent Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EKSPLA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Han's Laser Technology Industry Group Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IPG Photonics Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jenoptik AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Keyence Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lumentum Operations LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LUMIBIRD

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Maxphotonics Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 nLIGHT Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Novanta Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 TRUMPF

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Wuhan Raycus Fiber Laser Technologies Co Ltd*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Coherent Corp

List of Figures

- Figure 1: Global Industrial Laser Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Industrial Laser Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Industrial Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Industrial Laser Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Industrial Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Industrial Laser Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Industrial Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Industrial Laser Market Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Industrial Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Industrial Laser Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Industrial Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Industrial Laser Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Industrial Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Industrial Laser Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Industrial Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Industrial Laser Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Industrial Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Industrial Laser Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Industrial Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Industrial Laser Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Industrial Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Industrial Laser Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Industrial Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Industrial Laser Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Industrial Laser Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Laser Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Laser Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Industrial Laser Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Laser Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Industrial Laser Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Industrial Laser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Industrial Laser Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Industrial Laser Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Industrial Laser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Industrial Laser Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Industrial Laser Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Industrial Laser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Industrial Laser Market Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Industrial Laser Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Industrial Laser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: South America Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Industrial Laser Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Laser Market?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the Industrial Laser Market?

Key companies in the market include Coherent Corp, EKSPLA, Han's Laser Technology Industry Group Co Ltd, IPG Photonics Corporation, Jenoptik AG, Keyence Corporation, Lumentum Operations LLC, LUMIBIRD, Maxphotonics Co Ltd, nLIGHT Inc, Novanta Inc, TRUMPF, Wuhan Raycus Fiber Laser Technologies Co Ltd*List Not Exhaustive.

3. What are the main segments of the Industrial Laser Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Laser Systems from the Electronics Industry; Other Drivers.

6. What are the notable trends driving market growth?

Communication Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Laser Systems from the Electronics Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

In October 2022, Lumentum Holdings Inc expanded its operations and advanced research and development in Slovenia for specialty optical fibers and related products. The facility includes a Center of Excellence for advanced research and development to devise fundamental laser component technology and products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Laser Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Laser Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Laser Market?

To stay informed about further developments, trends, and reports in the Industrial Laser Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence