Key Insights

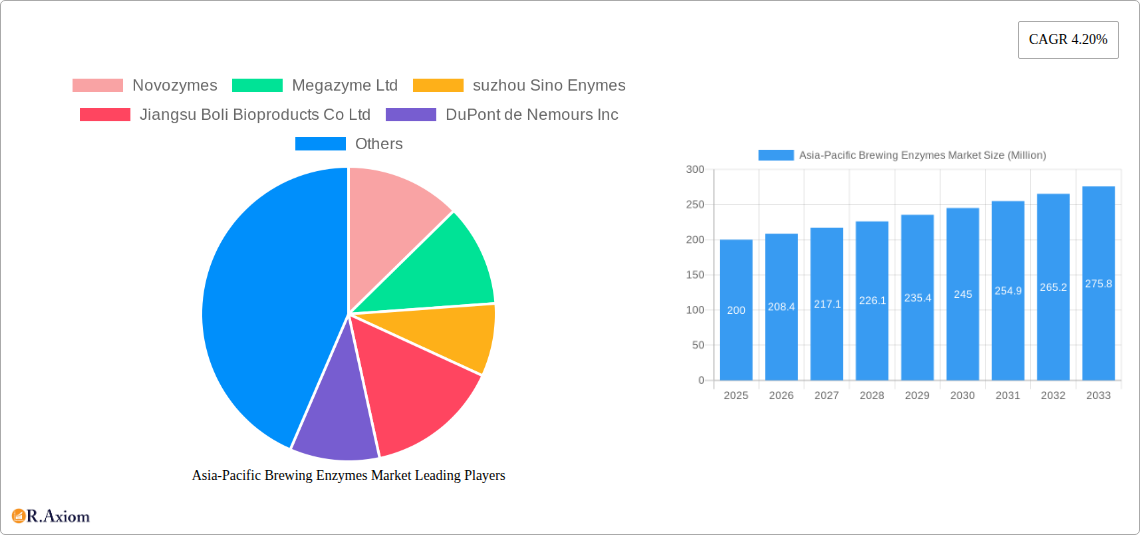

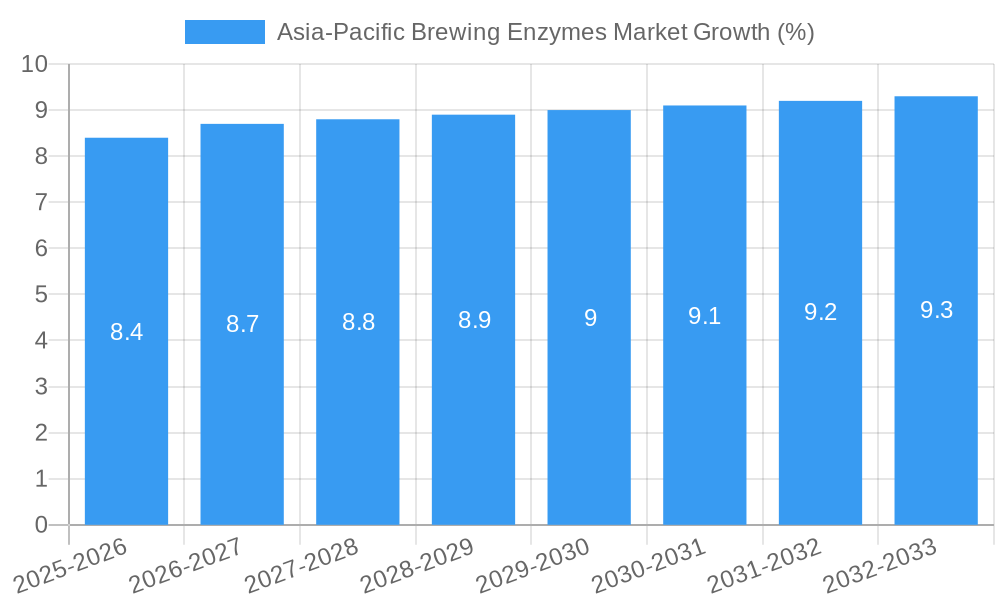

The Asia-Pacific brewing enzymes market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing beer consumption and a rising demand for high-quality brewing products. The market's Compound Annual Growth Rate (CAGR) of 4.20% from 2025 to 2033 reflects a consistent expansion fueled by several key factors. Firstly, the burgeoning craft brewing industry across the region, particularly in countries like China, Japan, and India, is a significant driver. These markets showcase a growing preference for diverse beer styles and flavors, necessitating the use of specialized enzymes to optimize brewing processes and enhance product quality. Secondly, advancements in enzyme technology are leading to the development of more efficient and effective enzymes, allowing brewers to improve yield, reduce production costs, and achieve consistent product quality. The increasing adoption of sustainable brewing practices also contributes to the demand for enzymes as they help reduce reliance on harsh chemicals. While challenges remain, such as fluctuating raw material prices and potential regulatory changes, the overall outlook for the Asia-Pacific brewing enzymes market remains positive.

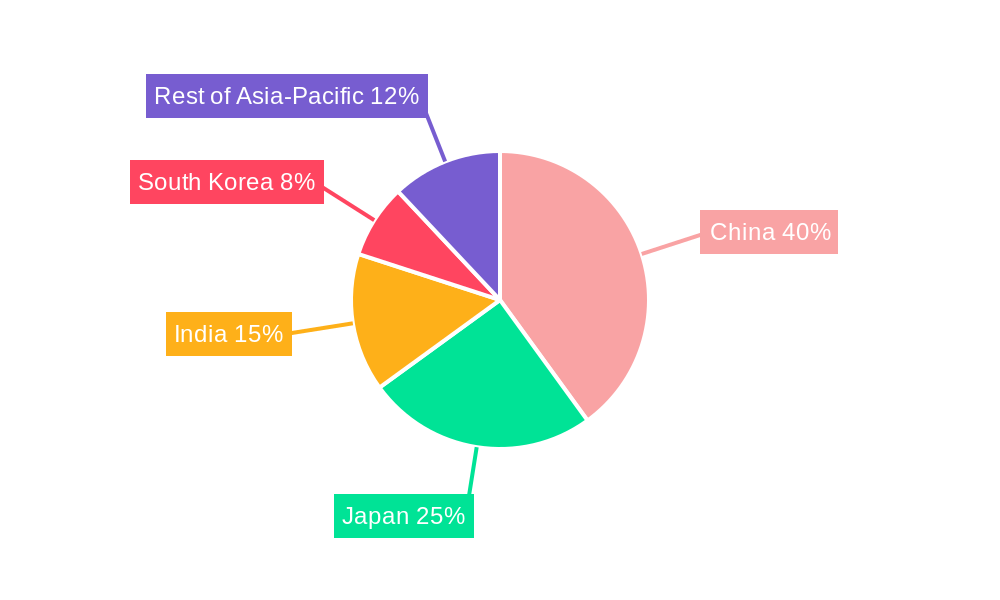

Market segmentation reveals significant opportunities within specific enzyme types. Amylases and proteases, vital for starch and protein modification respectively, dominate the market. The liquid form is currently preferred, but dry enzyme forms are gaining traction due to their ease of handling and storage. The dominance of countries like China, Japan, and India within the Asia-Pacific region reflects their large populations and growing beer consumption. However, other countries in the region, such as South Korea, Taiwan, and Australia, also present noteworthy market segments with potential for expansion, driven by evolving consumer preferences and investment in the brewing sector. Competitive landscape analysis indicates the presence of both global giants like Novozymes and DSM, and regional players, suggesting a dynamic market with diverse technological capabilities and distribution networks. Future growth will depend on continued innovation, strategic partnerships, and the ability of manufacturers to meet the diverse needs of an increasingly discerning brewing industry.

This in-depth report provides a comprehensive analysis of the Asia-Pacific brewing enzymes market, offering actionable insights for stakeholders across the value chain. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, growth drivers, challenges, and opportunities, along with detailed segmentations and competitive landscapes. It leverages extensive primary and secondary research to deliver a precise and insightful overview of this rapidly evolving market.

Asia-Pacific Brewing Enzymes Market Market Concentration & Innovation

This section analyzes the market concentration, innovation landscape, regulatory environment, and competitive dynamics within the Asia-Pacific brewing enzymes market. The report assesses market share held by key players like Novozymes, Megazyme Ltd, suzhou Sino Enymes, Jiangsu Boli Bioproducts Co Ltd, DuPont de Nemours Inc, Koninklijke DSM N.V., and ABF Ingredients. It evaluates the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market consolidation. Further, it examines the role of innovation in driving market growth, focusing on the development of novel enzyme technologies, improved enzyme efficacy, and sustainable brewing practices. The analysis also encompasses the regulatory frameworks governing enzyme production and use in the brewing industry across the Asia-Pacific region, along with an exploration of potential product substitutes and their impact on market dynamics. End-user trends and preferences are also considered, including a growing demand for premium and craft beers, driving the need for specialized brewing enzymes.

Asia-Pacific Brewing Enzymes Market Industry Trends & Insights

This section dives deep into the key industry trends shaping the Asia-Pacific brewing enzymes market. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as increasing beer consumption, particularly in emerging economies, and the rising popularity of craft brewing. Technological advancements, including enzyme engineering and process optimization, contribute significantly to market growth. Consumer preferences for healthier and more natural products are also impacting the demand for specific enzyme types. The competitive dynamics are analyzed, including market penetration rates of leading players and strategies adopted to gain a competitive edge. The analysis also assesses the impact of technological disruptions, such as automation and digitalization, on brewing processes and the overall market. The report further explores the evolving consumer preferences towards specific beer styles and their consequent influence on the demand for enzymes.

Dominant Markets & Segments in Asia-Pacific Brewing Enzymes Market

This section identifies the dominant regions, countries, and segments within the Asia-Pacific brewing enzymes market. The analysis considers market size and growth potential for each segment based on source (Microbial, Plant), type (Amylase, Alpha-amylase, Protease, Others), and form (Liquid, Dry).

Key Drivers:

- China: Strong economic growth, expanding middle class, and rising beer consumption.

- India: Growing demand for alcoholic beverages and favorable government policies.

- Japan: Established brewing industry and focus on high-quality brewing processes.

- South Korea: Developed beer market with a preference for unique flavors.

- Australia: High per capita beer consumption and sophisticated brewing culture.

Dominance Analysis: The report provides a detailed analysis of the leading segments and regions, highlighting the factors contributing to their dominance. For example, the microbial source segment is anticipated to maintain its dominance owing to cost-effectiveness and ease of production. Similarly, the Amylase segment, due to its key role in starch breakdown, is projected to hold a significant market share. The liquid form dominates because of its ease of handling and use in various brewing processes.

Asia-Pacific Brewing Enzymes Market Product Developments

The Asia-Pacific brewing enzymes market is witnessing significant product innovations focused on enhancing enzyme efficacy, improving process efficiency, and expanding applications. New enzyme variants with tailored properties for specific beer styles are being developed, catering to the growing demand for diverse flavors and improved beer quality. Companies are also focusing on developing enzymes with enhanced stability and shelf life, contributing to reduced costs and improved supply chain management. This reflects the growing industry trend towards more efficient and sustainable brewing processes. These developments enhance the competitive advantage of producers by delivering improved product performance, resulting in greater value for customers.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific brewing enzymes market based on source, type, and form.

By Source:

- Microbial: This segment is expected to dominate due to its cost-effectiveness and scalability.

- Plant: This niche segment is witnessing growth due to the increasing demand for natural and organic products.

By Type:

- Amylase: A crucial enzyme in starch breakdown, expected to maintain a large market share.

- Alpha-amylase: Similar to amylase, this enzyme plays a vital role in starch hydrolysis.

- Protease: This segment is expected to witness moderate growth driven by improvements in protein management during beer production.

- Others: This category includes various other enzymes used in niche applications.

By Form:

- Liquid: This form is preferred for its ease of handling and adaptability in various brewing processes.

- Dry: This form offers advantages in terms of storage and transportation but is expected to hold a smaller market share than liquid forms.

Key Drivers of Asia-Pacific Brewing Enzymes Market Growth

The Asia-Pacific brewing enzymes market is driven by several factors, including the increasing demand for beer, particularly in emerging economies like China and India. The growing popularity of craft brewing is further fueling market growth, as craft brewers often require specific enzymes to achieve desired beer characteristics. Technological advancements, such as enzyme engineering and improved production methods, are also contributing to market expansion. Furthermore, favorable government policies and investments in the brewing industry in several countries are fostering growth.

Challenges in the Asia-Pacific Brewing Enzymes Market Sector

The Asia-Pacific brewing enzymes market faces certain challenges, including fluctuating raw material prices that can impact production costs. The intense competition among major players requires companies to constantly innovate and improve their product offerings. Stringent regulatory requirements in certain regions can also pose barriers to market entry. Supply chain disruptions, especially during periods of uncertainty, can affect production and distribution. The market is sensitive to shifts in consumer preferences impacting demand and pricing.

Emerging Opportunities in Asia-Pacific Brewing Enzymes Market

The Asia-Pacific brewing enzymes market presents several emerging opportunities. The growing demand for premium and specialized beers is driving the need for enzymes with enhanced functionality. The increasing focus on sustainability within the brewing industry is encouraging the adoption of eco-friendly enzyme production methods. Expansion into new markets, especially in Southeast Asia, presents significant potential. Innovations in enzyme technology, including the development of novel enzyme variants with improved properties, also present opportunities for growth.

Leading Players in the Asia-Pacific Brewing Enzymes Market Market

- Novozymes

- Megazyme Ltd

- suzhou Sino Enymes

- Jiangsu Boli Bioproducts Co Ltd

- DuPont de Nemours Inc

- Koninklijke DSM N.V.

- ABF Ingredients

Key Developments in Asia-Pacific Brewing Enzymes Market Industry

- 2022-Q4: Novozymes launched a new range of brewing enzymes optimized for craft beer production.

- 2023-Q1: Megazyme announced a strategic partnership with a major brewery in China to supply specialized enzymes.

- 2023-Q2: DuPont acquired a smaller enzyme producer, expanding its market share. (Hypothetical example – replace with actual data if available)

Strategic Outlook for Asia-Pacific Brewing Enzymes Market Market

The Asia-Pacific brewing enzymes market is poised for significant growth in the coming years, driven by several factors, including increasing beer consumption, the expanding craft brewing segment, and technological advancements. The market is expected to witness further consolidation as leading players continue to invest in research and development and expand their product portfolios. Companies focusing on sustainable and innovative enzyme solutions will have a significant competitive advantage in the long term. The report concludes with recommendations and strategies for companies operating in this market, enabling them to leverage the immense growth potential.

Asia-Pacific Brewing Enzymes Market Segmentation

-

1. Source

- 1.1. Microbial

- 1.2. Plant

-

2. Type

- 2.1. Amylase

- 2.2. Alphalase

- 2.3. Protease

- 2.4. Others

-

3. Form

- 3.1. Liquid

- 3.2. Dry

Asia-Pacific Brewing Enzymes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Brewing Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Preference for Plant-Based Protein; Prevalence of Consumers Intolerant to Soy

- 3.2.2 Peanut and Other Legumes is Increasing

- 3.3. Market Restrains

- 3.3.1. Strict Regulation and Policies Pertaining to Hemp Protein

- 3.4. Market Trends

- 3.4.1. Rising Demand For Beer in The region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Microbial

- 5.1.2. Plant

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Amylase

- 5.2.2. Alphalase

- 5.2.3. Protease

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Form

- 5.3.1. Liquid

- 5.3.2. Dry

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. China Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Brewing Enzymes Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Novozymes

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Megazyme Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 suzhou Sino Enymes

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Jiangsu Boli Bioproducts Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 DuPont de Nemours Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke DSM N V

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ABF Ingredients

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Novozymes

List of Figures

- Figure 1: Asia-Pacific Brewing Enzymes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Brewing Enzymes Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Form 2019 & 2032

- Table 5: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Source 2019 & 2032

- Table 15: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Form 2019 & 2032

- Table 17: Asia-Pacific Brewing Enzymes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Brewing Enzymes Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Brewing Enzymes Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Asia-Pacific Brewing Enzymes Market?

Key companies in the market include Novozymes, Megazyme Ltd, suzhou Sino Enymes, Jiangsu Boli Bioproducts Co Ltd, DuPont de Nemours Inc, Koninklijke DSM N V, ABF Ingredients.

3. What are the main segments of the Asia-Pacific Brewing Enzymes Market?

The market segments include Source, Type, Form.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Preference for Plant-Based Protein; Prevalence of Consumers Intolerant to Soy. Peanut and Other Legumes is Increasing.

6. What are the notable trends driving market growth?

Rising Demand For Beer in The region.

7. Are there any restraints impacting market growth?

Strict Regulation and Policies Pertaining to Hemp Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Brewing Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Brewing Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Brewing Enzymes Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Brewing Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence