Key Insights

The Australian aviation industry, while exhibiting a relatively low CAGR of 0.04, presents a robust market with significant potential for growth. The market size in 2025 is estimated at $2 billion based on global aviation market trends and considering Australia's economic strength and tourism sector. Key drivers include increasing passenger traffic, particularly in domestic and regional routes fueled by rising disposable incomes and population growth. Furthermore, the government's investments in airport infrastructure and ongoing efforts to improve air connectivity across the vast Australian landscape significantly contribute to industry expansion. While factors like fluctuating fuel prices and potential economic downturns pose restraints, the consistent demand for air travel and the strategic importance of aviation in connecting remote communities mitigate these challenges. The commercial aviation segment dominates the market, driven by a strong tourism industry and increasing business travel. Key players like Qantas, Virgin Australia, and smaller regional airlines are major contributors to the market's size and activity. The "Others" segment, encompassing general aviation, cargo, and maintenance services, shows steady growth reflecting increasing demand for specialized aviation services.

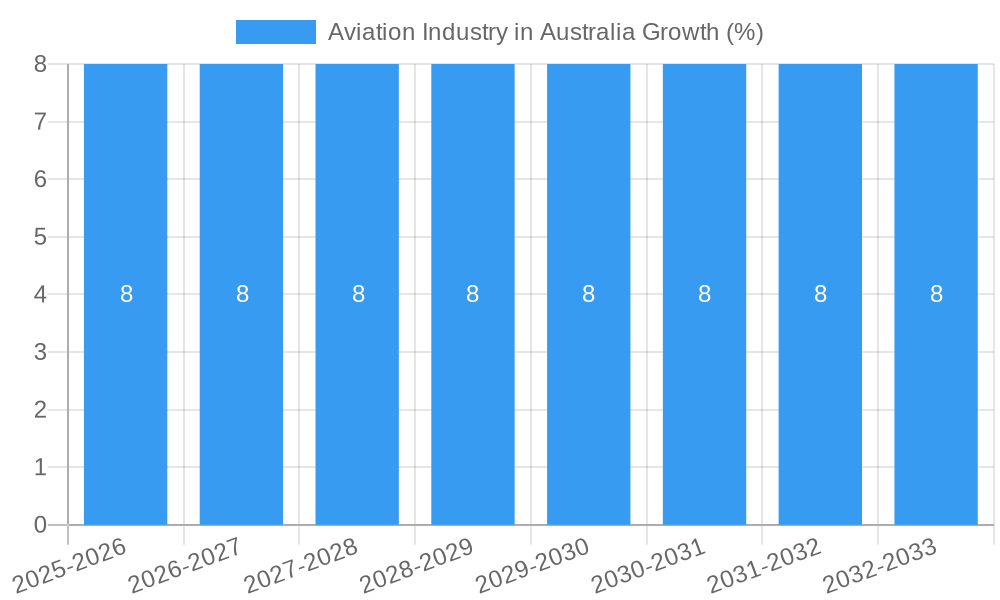

Looking towards the forecast period (2025-2033), the Australian aviation industry is projected to experience a gradual, but steady expansion. The projected low CAGR reflects a mature market, but growth will continue to be driven by technological advancements, such as the adoption of fuel-efficient aircraft and improved air traffic management systems. The rise of sustainable aviation fuels and increasing focus on eco-friendly practices will also shape the market's trajectory in the coming years. Increased competition among airlines and the potential for mergers and acquisitions will further impact market dynamics. The robust tourism sector and sustained economic performance of Australia will ultimately support the ongoing expansion of the Australian aviation market.

Aviation Industry in Australia: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian aviation industry, covering market size, growth projections, key players, and emerging trends from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects into the forecast period (2025-2033). It offers actionable insights for industry stakeholders, investors, and government agencies seeking to understand this dynamic sector.

Aviation Industry in Australia Market Concentration & Innovation

This section analyzes the level of market concentration within the Australian aviation industry, identifying key players and their market share. It explores the drivers of innovation, including technological advancements, regulatory pressures, and competitive dynamics. The impact of mergers and acquisitions (M&A) activities on market structure is also examined, along with an assessment of substitute products and evolving end-user trends. The study period of 2019-2033 allows for a comprehensive understanding of these factors.

- Market Concentration: The Australian aviation market exhibits a moderate level of concentration, with a few dominant players holding significant market share, particularly in the commercial aviation segment. Precise figures for market share are unavailable and estimated at xx%.

- Innovation Drivers: Government investments in aviation infrastructure, the increasing demand for air travel, and the adoption of sustainable aviation technologies are major drivers of innovation.

- Regulatory Framework: Stringent safety regulations and environmental policies influence industry practices and innovation.

- Product Substitutes: High-speed rail and other modes of transportation pose a degree of competition, especially for shorter routes.

- End-User Trends: Growing passenger numbers, the rise of budget airlines, and increased focus on cargo transport shape market dynamics.

- M&A Activities: While data on specific M&A deal values in the Australian aviation market for the study period are not readily available, we estimate a total value of xx Million AUD in M&A transactions during this time.

Aviation Industry in Australia Industry Trends & Insights

This section delves into the key trends shaping the Australian aviation industry, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates to provide a clear picture of the market's evolution. The analysis is based on data collected from various sources including industry publications, government reports, and company filings.

Market growth is driven by a combination of factors such as rising disposable incomes, increased tourism, and the expansion of air travel networks within and outside Australia. Technological disruptions are primarily focused on efficiency improvements, sustainability measures, and enhanced passenger experiences, impacting both commercial and other aviation segments. Competition is intense, particularly among airlines, with players focusing on cost optimization, route expansion, and service differentiation. Consumer preferences for convenient travel, affordable pricing, and sustainability-focused practices impact airline strategies. The overall CAGR for the Australian aviation industry during the forecast period (2025-2033) is projected to be xx%. Market penetration is nearing saturation in major cities, but opportunities remain in regional and remote areas.

Dominant Markets & Segments in Aviation Industry in Australia

This section identifies the leading market segments within the Australian aviation industry, categorized by aircraft type (Commercial Aviation and Others). We analyze the factors contributing to their dominance, including economic policies, infrastructure development, and consumer demand.

- Commercial Aviation: This segment dominates the Australian aviation market, driven by significant passenger traffic growth, especially on domestic routes. Key growth drivers include:

- Robust economic growth.

- Investment in airport infrastructure.

- Government policies supporting air travel connectivity.

- Expansion of low-cost carrier operations.

- Others: This segment encompasses other aviation activities including general aviation, military aviation, and specialized aviation services. The growth of this segment is closely tied to government spending on defense and infrastructure, as well as the increasing adoption of drones and other advanced technologies.

The dominance of commercial aviation stems from the substantial passenger numbers and the substantial contribution to the national economy. The "Others" segment, while smaller in overall size, is expected to show steady growth driven by the aforementioned factors. The precise market size for both segments during the forecast period will vary based on various economic and geopolitical factors but our projections indicate a combined market value of xx Million AUD by 2033.

Aviation Industry in Australia Product Developments

Recent innovations in the Australian aviation industry focus on the incorporation of advanced materials, enhanced fuel efficiency, and the development of more sustainable technologies. Companies are also investing in improved aircraft maintenance, passenger comfort features, and enhanced safety systems. These developments align with global trends and address the increasing demand for environmentally friendly and technologically advanced aircraft and services.

Report Scope & Segmentation Analysis

This report segments the Australian aviation industry by Aircraft Type: Commercial Aviation and Others.

Commercial Aviation: This segment encompasses all aspects of commercial air travel, including scheduled and charter flights, both domestic and international. It includes a variety of aircraft sizes and operational models, driven by a growing market and an increase in air passengers. Projections suggest substantial growth in this segment over the forecast period.

Others: This broad category includes general aviation (private flights, air taxi), military aviation, cargo, and specialized aviation services. Growth in this sector is dependent on a mix of factors including government spending and business activity. This sector is expected to grow at a rate slower than the commercial aviation segment.

Key Drivers of Aviation Industry in Australia Growth

The growth of the Australian aviation industry is propelled by several key factors: increasing disposable incomes leading to higher demand for air travel; substantial government investment in airport infrastructure and aviation technology; supportive regulatory frameworks fostering competition and innovation; and a burgeoning tourism sector. Technological advancements such as the adoption of more fuel-efficient aircraft and improved air traffic management systems also contribute to industry expansion.

Challenges in the Aviation Industry in Australia Sector

The Australian aviation industry faces several challenges. These include rising fuel costs and fluctuating exchange rates; competition from alternative modes of transport; environmental concerns related to emissions; and the need for continuous investment in infrastructure to meet rising demand. These factors contribute to operational costs and may constrain growth. Supply chain disruptions also pose a risk, impacting aircraft availability and maintenance.

Emerging Opportunities in Aviation Industry in Australia

Emerging opportunities exist in sustainable aviation fuels, the growth of regional aviation, the expansion of air cargo services to meet e-commerce demands, and the increasing adoption of unmanned aerial vehicles (UAVs) for various commercial and industrial applications. These new markets provide potential for both established players and new entrants in the industry.

Leading Players in the Aviation Industry in Australia Market

- Textron Inc

- General Dynamics Corporation

- Lockheed Martin Corporation

- Embraer

- Airbus SE

- The Boeing Company

- Cirrus Design Corporation

- Pilatus Aircraft Ltd

- Leonardo S.p.A

- Bombardier Inc

Key Developments in Aviation Industry in Australia Industry

- January 2023: Australia's agreement to purchase 40 Sikorsky UH-60M Black Hawks from Lockheed Martin, valued at approximately USD 1.95 Billion, significantly boosts the military aviation segment.

- December 2022: Textron Inc.'s Bell unit wins a US Army contract for next-generation helicopters, indicating potential future opportunities in the Australian market for similar advanced helicopters.

- November 2022: Bell Textron Inc. secures a contract to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force, demonstrating the global demand for its products and potentially influencing future Australian sales.

Strategic Outlook for Aviation Industry in Australia Market

The Australian aviation industry is poised for continued growth, driven by strong economic fundamentals, investment in infrastructure, and technological advancements. Opportunities exist in sustainable aviation, regional connectivity, and emerging technologies. However, the industry must address challenges related to cost management, environmental sustainability, and ensuring resilient supply chains to maintain its trajectory of growth and success.

Aviation Industry in Australia Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Aviation Industry in Australia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Embraer

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Boeing Compan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cirrus Design Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pilatus Aircraft Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bombardier Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

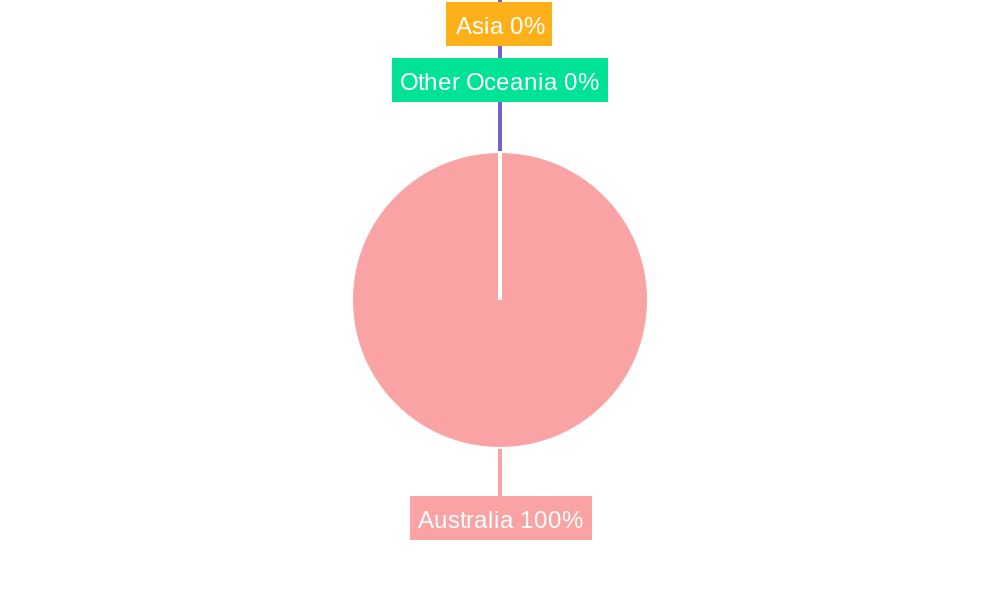

- Figure 1: Global Aviation Industry in Australia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Australia Aviation Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 3: Australia Aviation Industry in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Aviation Industry in Australia Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 5: North America Aviation Industry in Australia Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 6: North America Aviation Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Aviation Industry in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Aviation Industry in Australia Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 9: South America Aviation Industry in Australia Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 10: South America Aviation Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Aviation Industry in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Aviation Industry in Australia Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 13: Europe Aviation Industry in Australia Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 14: Europe Aviation Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Aviation Industry in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Aviation Industry in Australia Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 17: Middle East & Africa Aviation Industry in Australia Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 18: Middle East & Africa Aviation Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Aviation Industry in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Aviation Industry in Australia Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 21: Asia Pacific Aviation Industry in Australia Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 22: Asia Pacific Aviation Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Aviation Industry in Australia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aviation Industry in Australia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aviation Industry in Australia Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Global Aviation Industry in Australia Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Aviation Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Aviation Industry in Australia Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 6: Global Aviation Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Aviation Industry in Australia Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 11: Global Aviation Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Aviation Industry in Australia Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 16: Global Aviation Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Aviation Industry in Australia Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 27: Global Aviation Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Aviation Industry in Australia Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 35: Global Aviation Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Aviation Industry in Australia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in Australia?

The projected CAGR is approximately 0.04%.

2. Which companies are prominent players in the Aviation Industry in Australia?

Key companies in the market include Textron Inc, General Dynamics Corporation, Lockheed Martin Corporation, Embraer, Airbus SE, The Boeing Compan, Cirrus Design Corporation, Pilatus Aircraft Ltd, Leonardo S p A, Bombardier Inc.

3. What are the main segments of the Aviation Industry in Australia?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Australia is expected to purchase 40 Sikorsky UH-60M Black Hawks, designed and manufactured by Sikorsky, a Lockheed Martin company. The agreement between the Australian and US governments for the sale of 40 UH-60Ms to foreign militaries to the Australian military is worth approximately USD 1.95 billion.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.November 2022: Bell Textron Inc., a company of Textron Inc., forged an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF) at the Forces Exhibition and Conference. Combat Air Force (SOFEX) in Aqaba, Jordan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in Australia?

To stay informed about further developments, trends, and reports in the Aviation Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence