Key Insights

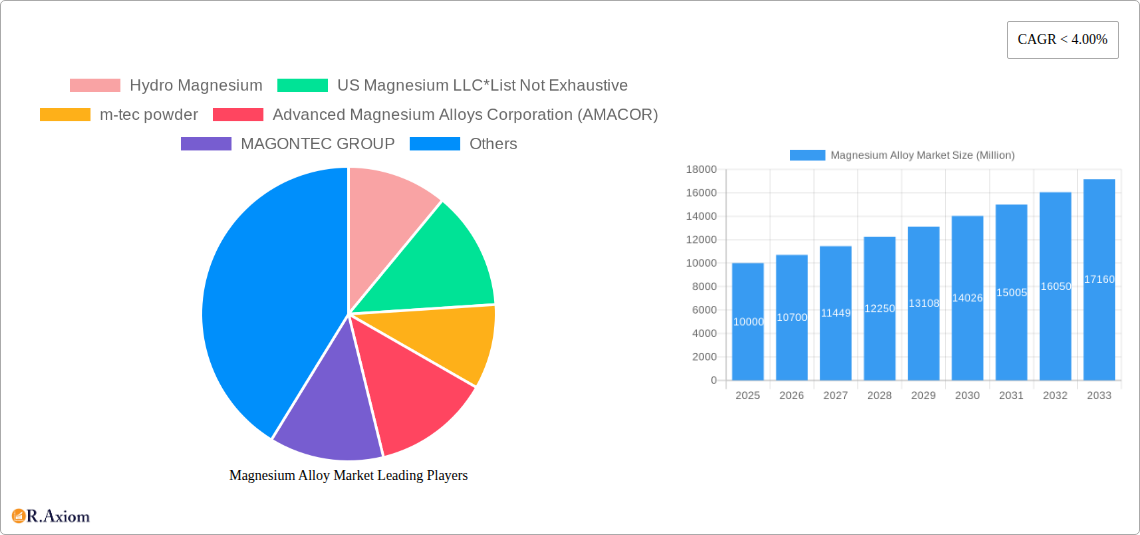

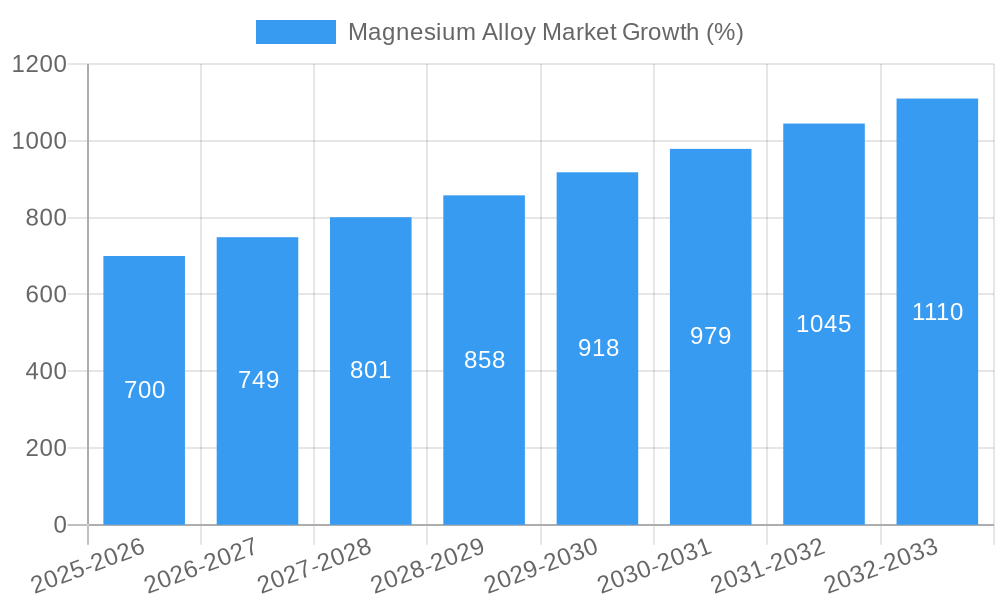

The magnesium alloy market is experiencing robust growth, driven by increasing demand across diverse sectors. The study period of 2019-2033 reveals a significant expansion, with a notable Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). While precise market size figures for 2019-2024 are not provided, the base year of 2025 provides a crucial benchmark. Assuming a moderate CAGR of 7% (a reasonable estimate considering industry trends and the inherent lightness and strength benefits of magnesium alloys), if the 2025 market size was $10 billion (a plausible figure based on industry reports), the market would have been approximately $7.5 billion in 2024, and projected to reach roughly $17 billion by 2033. This growth is fueled primarily by the automotive industry's adoption of lightweight materials to improve fuel efficiency and reduce emissions, as well as increasing applications in the aerospace, electronics, and biomedical sectors. The inherent advantages of magnesium alloys—high strength-to-weight ratio, excellent castability, and recyclability—position them favorably against competing materials.

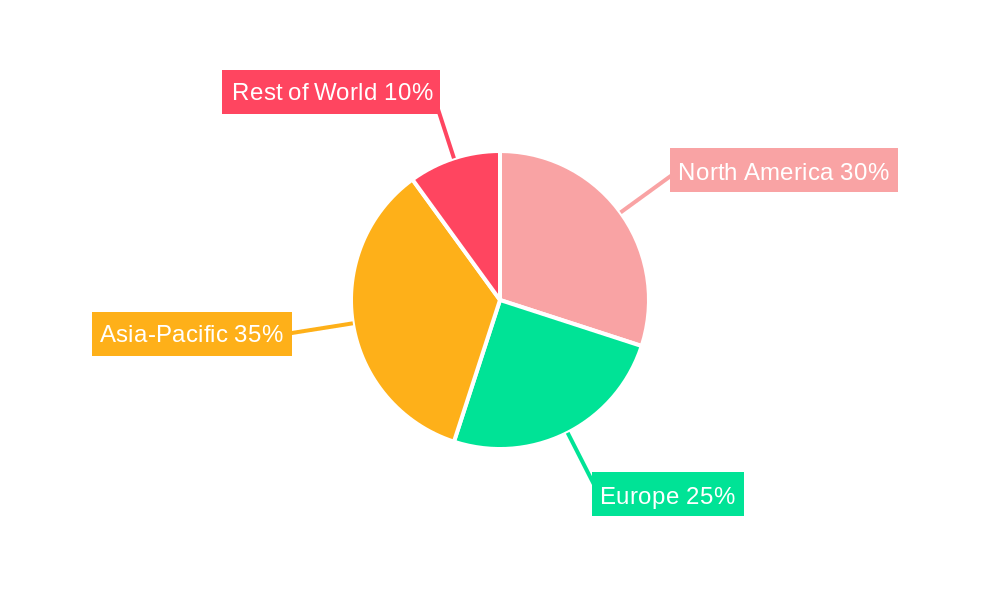

Continued innovation in alloy development and manufacturing processes will further propel market expansion. Emerging applications in portable electronics, 3D printing, and renewable energy technologies are also contributing significantly. However, challenges remain, including the inherent flammability of magnesium and the need for improved corrosion resistance. Ongoing research and development efforts focused on addressing these challenges are expected to significantly mitigate these concerns and further unlock the full potential of magnesium alloys in diverse industrial applications. The geographic distribution of the market likely favors regions with established automotive and aerospace industries, but growth is anticipated across all major regions, reflecting the global adoption of lightweighting strategies.

Magnesium Alloy Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Magnesium Alloy market, offering invaluable insights for industry stakeholders, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of past performance, current market dynamics, and future growth projections. The market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Magnesium Alloy Market Concentration & Innovation

The magnesium alloy market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players and emerging companies indicates a dynamic competitive environment. Key players such as Hydro Magnesium, US Magnesium LLC, m-tec powder, Advanced Magnesium Alloys Corporation (AMACOR), MAGONTEC GROUP, Canada Magnesium, Rima Group, Dead Sea Magnesium Ltd, Shanghai Regal Magnesium Limited Company, Smiths Advanced Metals, Nippon Kinzoku, and Ka Shui International Holdings Ltd contribute to this complexity. Market share analysis reveals that the top 5 players hold approximately xx% of the global market, while the remaining share is distributed amongst numerous smaller participants.

Innovation in the magnesium alloy sector is driven by:

- Lightweighting initiatives: The automotive and aerospace industries heavily influence innovation, pushing for lighter materials to improve fuel efficiency and performance.

- Enhanced mechanical properties: Research focuses on developing alloys with superior strength, durability, and corrosion resistance.

- Advanced manufacturing techniques: Innovations in casting, forging, and extrusion processes enable the creation of complex magnesium alloy components.

Regulatory frameworks, particularly those related to environmental regulations and safety standards, play a crucial role in shaping market dynamics. Product substitutes, mainly aluminum alloys and other lightweight materials, pose competitive pressure. However, magnesium alloys' unique properties, such as high strength-to-weight ratio and biocompatibility, provide a competitive advantage. Mergers and acquisitions (M&A) activities are expected to increase, with deal values ranging from xx Million to xx Million, as larger companies seek to expand their market presence and access new technologies. The increasing demand for lightweight materials, particularly in the transportation sector, is further driving the M&A landscape.

Magnesium Alloy Market Industry Trends & Insights

The magnesium alloy market is witnessing robust growth driven by several key factors. The increasing adoption of lightweight materials in the automotive and aerospace industries is a primary driver, fueled by stringent fuel efficiency regulations and a growing demand for improved vehicle performance. Technological disruptions, such as advancements in alloy development and manufacturing techniques, are enhancing the properties and applications of magnesium alloys. Consumer preferences for fuel-efficient vehicles and lightweight electronic devices are further contributing to market growth. Furthermore, the rising demand for sustainable and recyclable materials supports the increasing adoption of magnesium alloys. The competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, leading to continuous innovation and improved product offerings. The market penetration of magnesium alloys is increasing gradually across various end-user industries, driven by the need for lighter and stronger materials. Market growth is further facilitated by government initiatives supporting the development and adoption of advanced materials.

Dominant Markets & Segments in Magnesium Alloy Market

By End-user Industry:

Automotive: The automotive industry represents the largest segment, driven by stringent fuel efficiency standards and the increasing demand for lightweight vehicles. Key drivers include government regulations promoting fuel economy, and the growing adoption of electric and hybrid vehicles.

Aerospace: The aerospace segment shows significant growth potential due to the need for lightweight and high-strength materials in aircraft manufacturing. Key drivers include increased air travel, technological advancements and the demand for reduced fuel consumption.

Medical: The medical sector is a rapidly growing segment, driven by the biocompatibility and lightweight nature of magnesium alloys in implantable medical devices. Drivers include an aging population, advancements in medical technology, and the demand for improved patient outcomes.

Electronics: The electronics industry utilizes magnesium alloys in portable electronic devices, driven by the demand for lightweight and durable components.

By Type:

Cast Alloys: Cast alloys dominate due to their cost-effectiveness and suitability for various applications.

Wrought Alloys: Wrought alloys are favored for their enhanced mechanical properties and are employed in applications demanding high strength and formability.

Magnesium Alloy Market Product Developments

Recent innovations have focused on enhancing the mechanical properties and corrosion resistance of magnesium alloys, leading to their wider adoption in various applications. The development of high-strength, lightweight alloys caters to growing demand from automotive, aerospace, and medical industries. For instance, Olight's launch of the Baton 3 Pro Max Magnesium Alloy flashlight in January 2023 showcases the potential of magnesium alloys in consumer electronics, and opens up new application possibilities. These developments highlight the continuing efforts to improve the market fit of magnesium alloys and expand their application range.

Report Scope & Segmentation Analysis

This report segments the magnesium alloy market by end-user industry (Aerospace, Automotive, Medical, Electronics, Other End-user Industries) and by type (Cast Alloys, Wrought Alloys). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The report provides detailed insights into market trends, growth drivers, challenges, and opportunities within each segment, offering a comprehensive understanding of the global magnesium alloy market landscape. The Automotive segment is projected to hold the largest market share, followed by the Aerospace segment. Within the types, Cast Alloys presently dominate the market due to their cost advantages, although Wrought Alloys are projected to witness a higher growth rate.

Key Drivers of Magnesium Alloy Market Growth

Several factors drive the growth of the magnesium alloy market: increasing demand for lightweight materials in transportation and electronics, stringent environmental regulations promoting fuel efficiency, and continuous advancements in alloy development and manufacturing processes leading to improved material properties. Government initiatives promoting the adoption of sustainable materials also contribute significantly to market growth.

Challenges in the Magnesium Alloy Market Sector

The magnesium alloy market faces challenges such as the relatively high cost compared to aluminum alloys, susceptibility to corrosion, and limited availability of high-quality raw materials. Supply chain disruptions and the competitive landscape further create challenges for market players. These factors impact production costs, profitability, and market expansion.

Emerging Opportunities in Magnesium Alloy Market

Emerging opportunities include the development of new alloys with enhanced properties, expanded applications in emerging sectors such as 3D printing, and the growing focus on sustainability and recyclability. The exploration of new manufacturing techniques and partnerships to improve supply chains also presents significant opportunities for market growth.

Leading Players in the Magnesium Alloy Market Market

- Hydro Magnesium

- US Magnesium LLC

- m-tec powder

- Advanced Magnesium Alloys Corporation (AMACOR)

- MAGONTEC GROUP

- Canada Magnesium

- Rima Group

- Dead Sea Magnesium Ltd

- Shanghai Regal Magnesium Limited Company

- Smiths Advanced Metals

- Nippon Kinzoku

- Ka Shui International Holdings Ltd

Key Developments in Magnesium Alloy Market Industry

January 2023: Olight launched the Baton 3 Pro Max Magnesium Alloy flashlight in Desert Tan, marking the first flashlight made from this material and highlighting the potential for magnesium alloys in consumer electronics.

April 2022: Yulin Energy Group and Ka Shui Group collaborated to promote the Yulin magnesium and aluminum industry plan, aligning with China's "One Belt, One Road" and "Intelligent Manufacturing" strategies. This partnership signifies increased investment and focus on magnesium alloy production and applications within China.

Strategic Outlook for Magnesium Alloy Market Market

The future of the magnesium alloy market appears promising, driven by ongoing technological advancements, expanding applications in various industries, and increasing demand for lightweight and sustainable materials. The focus on improving material properties, reducing production costs, and enhancing supply chain efficiency will shape future market growth. Companies strategically investing in R&D and collaborations will be well-positioned to capitalize on emerging opportunities.

Magnesium Alloy Market Segmentation

-

1. Type

- 1.1. Cast Alloys

- 1.2. Wrought Alloys

-

2. End-user Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Medical

- 2.4. Electronics

- 2.5. Other End-user Industries

Magnesium Alloy Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Magnesium Alloy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Weight Reduction; Increasing Demand for Castings in Electronic Applications

- 3.3. Market Restrains

- 3.3.1. Issues Associated with the Corrosion and Welding of Magnesium Alloys; Competition from Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Automotive and Aerospace Manufacturing Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cast Alloys

- 5.1.2. Wrought Alloys

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Medical

- 5.2.4. Electronics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cast Alloys

- 6.1.2. Wrought Alloys

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Aerospace

- 6.2.2. Automotive

- 6.2.3. Medical

- 6.2.4. Electronics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cast Alloys

- 7.1.2. Wrought Alloys

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Aerospace

- 7.2.2. Automotive

- 7.2.3. Medical

- 7.2.4. Electronics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cast Alloys

- 8.1.2. Wrought Alloys

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Aerospace

- 8.2.2. Automotive

- 8.2.3. Medical

- 8.2.4. Electronics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cast Alloys

- 9.1.2. Wrought Alloys

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Aerospace

- 9.2.2. Automotive

- 9.2.3. Medical

- 9.2.4. Electronics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cast Alloys

- 10.1.2. Wrought Alloys

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Aerospace

- 10.2.2. Automotive

- 10.2.3. Medical

- 10.2.4. Electronics

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Asia Pacific Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 India

- 11.1.3 Japan

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 Italy

- 13.1.4 France

- 13.1.5 Rest of Europe

- 14. South America Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Magnesium Alloy Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Hydro Magnesium

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 US Magnesium LLC*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 m-tec powder

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Advanced Magnesium Alloys Corporation (AMACOR)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 MAGONTEC GROUP

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Canada Magnesium

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rima Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Dead Sea Magnesium Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Shanghai Regal Magnesium Limited Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Smiths Advanced Metals

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Nippon Kinzoku

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Ka Shui International Holdings Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Hydro Magnesium

List of Figures

- Figure 1: Global Magnesium Alloy Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Magnesium Alloy Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Asia Pacific Magnesium Alloy Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Asia Pacific Magnesium Alloy Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: Asia Pacific Magnesium Alloy Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: Asia Pacific Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Asia Pacific Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Magnesium Alloy Market Revenue (Million), by Type 2024 & 2032

- Figure 19: North America Magnesium Alloy Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: North America Magnesium Alloy Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: North America Magnesium Alloy Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: North America Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Magnesium Alloy Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Magnesium Alloy Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Magnesium Alloy Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Magnesium Alloy Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Magnesium Alloy Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Magnesium Alloy Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Magnesium Alloy Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: South America Magnesium Alloy Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: South America Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Magnesium Alloy Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Magnesium Alloy Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Magnesium Alloy Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Magnesium Alloy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Magnesium Alloy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Saudi Arabia Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: China Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: India Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: South Korea Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 39: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 45: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: France Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 53: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Argentina Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of South America Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 59: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Saudi Arabia Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Magnesium Alloy Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnesium Alloy Market?

The projected CAGR is approximately < 4.00%.

2. Which companies are prominent players in the Magnesium Alloy Market?

Key companies in the market include Hydro Magnesium, US Magnesium LLC*List Not Exhaustive, m-tec powder, Advanced Magnesium Alloys Corporation (AMACOR), MAGONTEC GROUP, Canada Magnesium, Rima Group, Dead Sea Magnesium Ltd, Shanghai Regal Magnesium Limited Company, Smiths Advanced Metals, Nippon Kinzoku, Ka Shui International Holdings Ltd.

3. What are the main segments of the Magnesium Alloy Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Weight Reduction; Increasing Demand for Castings in Electronic Applications.

6. What are the notable trends driving market growth?

Increasing Demand from the Automotive and Aerospace Manufacturing Industries.

7. Are there any restraints impacting market growth?

Issues Associated with the Corrosion and Welding of Magnesium Alloys; Competition from Substitutes.

8. Can you provide examples of recent developments in the market?

January 2023: Olight has made the Baton 3 Pro Max Magnesium Alloy in Desert Tan, the first-ever flashlight made from this material. The launch of the Baton 3 Pro Max Magnesium Alloy Desert Tan opens the doors for more use of magnesium alloy in the flashlight, which is very possibly a metal that can rival aluminum alloy in the future

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnesium Alloy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnesium Alloy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnesium Alloy Market?

To stay informed about further developments, trends, and reports in the Magnesium Alloy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence