Key Insights

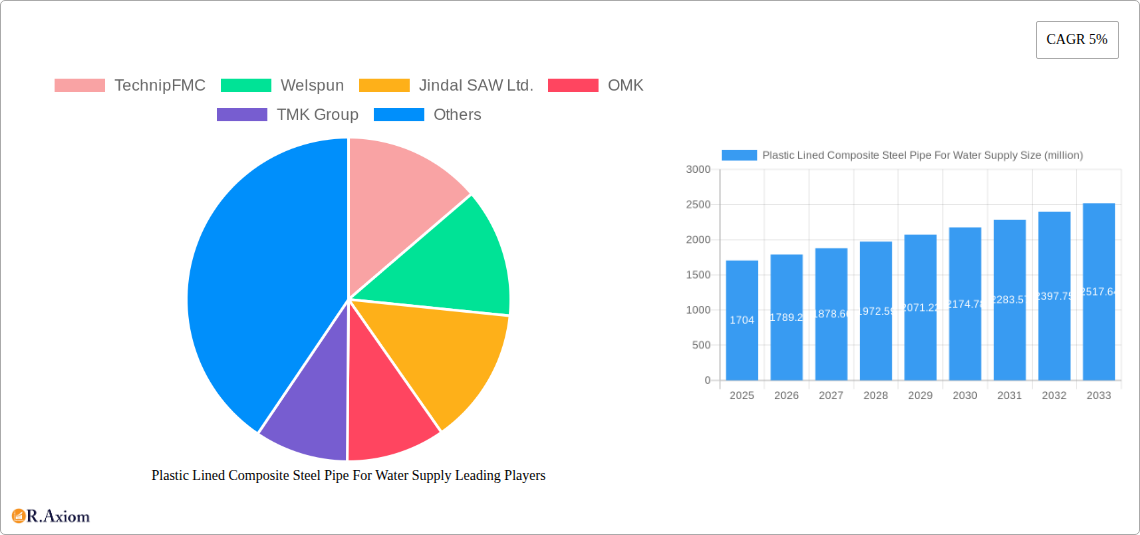

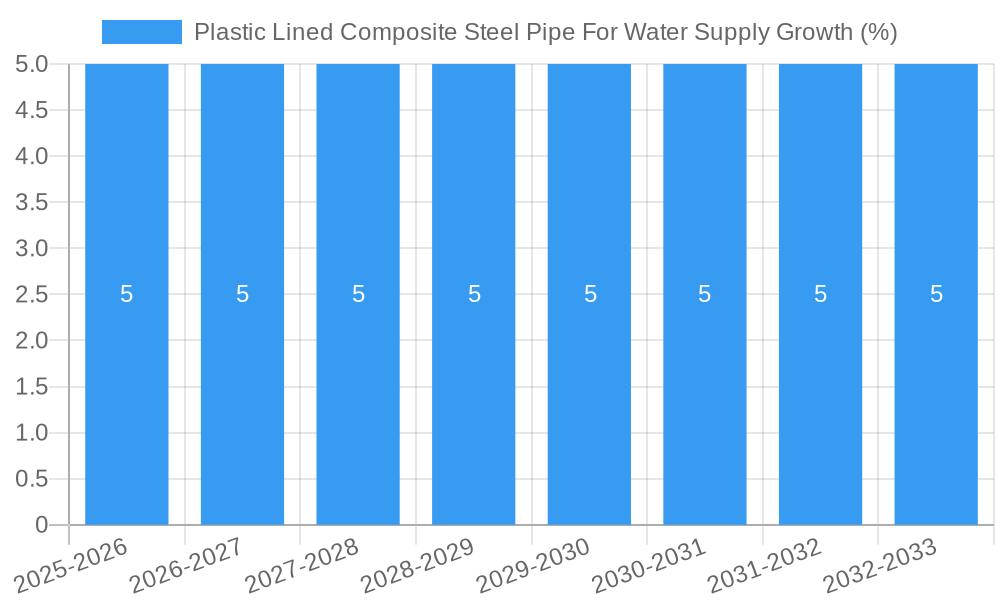

The global Plastic Lined Composite Steel Pipe for Water Supply market is poised for robust growth, projected to reach an estimated $1704 million in 2025. This expansion is driven by a compelling compound annual growth rate (CAGR) of 5% throughout the forecast period (2025-2033). The increasing global demand for reliable and efficient water infrastructure, coupled with stringent regulations for water quality and public health, forms the bedrock of this market's ascent. Municipal water supply and drinking water applications are anticipated to be the dominant segments, benefiting from significant investments in upgrading aging water networks and expanding access to clean water in both developed and developing economies. Furthermore, the inherent advantages of plastic-lined steel pipes, such as superior corrosion resistance, enhanced durability, and improved flow characteristics compared to traditional materials, are making them the preferred choice for various water conveyance systems. The growing awareness of the detrimental effects of contaminated water on public health is also a significant impetus for the adoption of high-quality piping solutions.

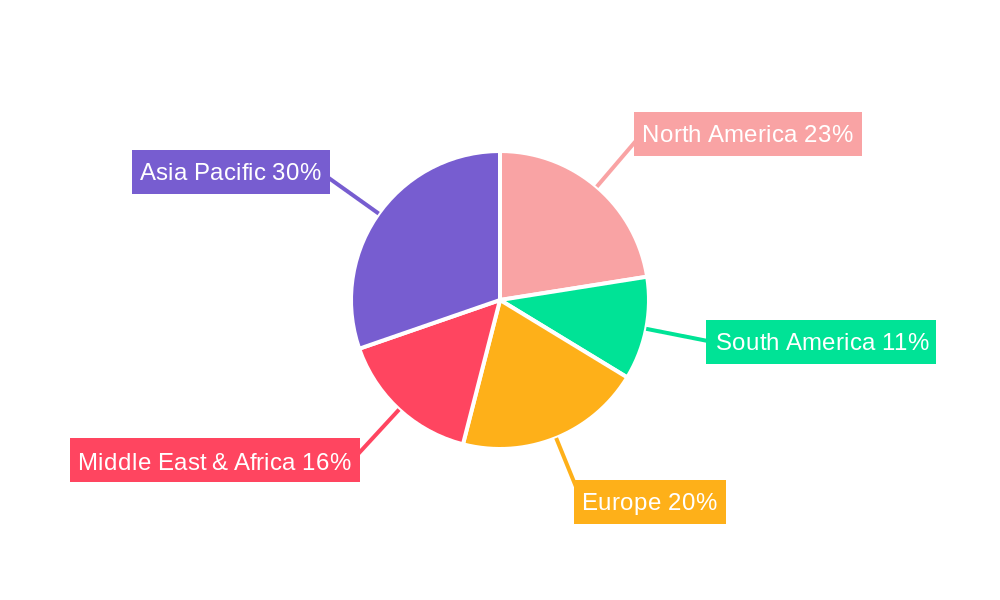

Emerging trends in the Plastic Lined Composite Steel Pipe for Water Supply market include advancements in lining technologies, leading to improved performance and a wider range of applications, including more demanding hot water systems. The integration of smart technologies for leak detection and monitoring within these pipe systems is also gaining traction, promising to further optimize water management and reduce losses. Geographically, the Asia Pacific region, particularly China and India, is expected to exhibit the fastest growth due to rapid urbanization, massive infrastructure development projects, and a burgeoning population that necessitates enhanced water supply capabilities. North America and Europe, with their established water infrastructure, will continue to be significant markets driven by replacement and upgrade projects. While the market exhibits strong growth potential, factors such as the initial cost of installation compared to some traditional materials and the availability of alternative piping solutions present moderate restraints that manufacturers and suppliers will need to strategically address through competitive pricing and enhanced value propositions.

Here's an SEO-optimized, detailed report description for "Plastic Lined Composite Steel Pipe For Water Supply," incorporating high-traffic keywords and structured as requested.

Plastic Lined Composite Steel Pipe For Water Supply Market Concentration & Innovation

The global Plastic Lined Composite Steel Pipe market exhibits a moderate to high concentration, driven by a select group of prominent manufacturers. Innovation remains a crucial differentiator, fueled by advancements in plastic lining materials (such as HDPE, PEX, and PP) offering enhanced corrosion resistance, longer lifespan, and improved flow efficiency for critical water infrastructure. Regulatory frameworks governing water quality and safety standards play a significant role in shaping product development and market entry. The increasing demand for durable and reliable water supply pipes is intensifying competition, prompting manufacturers to focus on cost-effectiveness and sustainable production methods. The threat of product substitutes, though present, is mitigated by the superior strength and longevity of composite steel pipes in demanding applications. End-user trends are shifting towards solutions that minimize maintenance, reduce water loss, and ensure the purity of potable water. Mergers and acquisitions (M&A) activities are expected to continue, with a projected total deal value of over $500 million within the forecast period, as companies seek to expand their geographical reach and product portfolios, thereby consolidating market share and driving innovation.

- Key Innovation Drivers: Enhanced corrosion resistance, improved flow rates, extended service life, cost-effectiveness, and adherence to stringent environmental and safety regulations.

- Regulatory Impact: Stringent quality standards for drinking water and wastewater management are pushing for advanced pipe materials.

- End-User Preferences: Growing demand for durable, low-maintenance, and chemically resistant piping solutions for both potable and non-potable water systems.

- M&A Activity Projection: Anticipated over $500 million in M&A deal values to consolidate market position and expand technological capabilities.

Plastic Lined Composite Steel Pipe For Water Supply Industry Trends & Insights

The Plastic Lined Composite Steel Pipe for Water Supply industry is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period (2025-2033). This robust expansion is primarily propelled by escalating global demand for clean and reliable water infrastructure, especially in emerging economies and rapidly urbanizing regions. Significant investments in municipal water supply projects, coupled with the imperative to upgrade aging water networks, are creating a sustained demand for durable and high-performance piping solutions. Technological disruptions are at the forefront, with ongoing research and development focused on improving the performance characteristics of plastic linings, such as enhanced thermal stability for hot water applications and superior chemical resistance for pollution discharge systems. The development of advanced manufacturing techniques is also contributing to more efficient production processes and a reduction in overall pipe costs, thereby enhancing market penetration. Consumer preferences are increasingly aligned with sustainability and long-term value, favoring pipes that offer extended service life and minimal environmental impact. Market penetration is expected to rise significantly as awareness of the benefits of plastic-lined composite steel pipes, including their ability to withstand extreme pressures and corrosive environments, gains traction. Competitive dynamics are characterized by a balance between established global players and emerging regional manufacturers, all vying for market share through product innovation, strategic partnerships, and competitive pricing. The increasing focus on water conservation and efficient water management further underscores the importance of these pipes in minimizing leaks and ensuring water quality. The global market size for plastic lined composite steel pipes for water supply is estimated to reach over $8,000 million by the end of the forecast period.

- Market Growth Drivers: Growing global population, increasing urbanization, aging infrastructure requiring replacement, and government initiatives for water security.

- Technological Disruptions: Innovations in plastic lining materials (e.g., advanced polymers, multi-layer linings) and manufacturing processes are improving pipe performance and reducing costs.

- Consumer Preferences: Demand for sustainable, long-lasting, corrosion-resistant, and easy-to-install piping solutions that ensure water purity.

- Competitive Dynamics: Intense competition driven by product differentiation, technological advancements, strategic alliances, and cost leadership.

- Projected CAGR: Approximately 7.5% over the 2025-2033 forecast period.

- Estimated Market Size (End of Forecast): Over $8,000 million.

Dominant Markets & Segments in Plastic Lined Composite Steel Pipe For Water Supply

The global plastic lined composite steel pipe market is significantly influenced by its dominant regions and application segments. Asia Pacific is projected to emerge as the leading market, driven by massive investments in water infrastructure across China and India. The region's rapid industrialization, coupled with a growing emphasis on providing safe drinking water to a vast population, underpins this dominance. Economic policies promoting infrastructure development and large-scale urban planning initiatives are key drivers. Furthermore, the presence of major manufacturing hubs for steel and plastics within the region provides a competitive advantage.

Within the Application segment, Municipal Water Supply accounts for the largest market share, estimated to be over 45% of the total market value. This dominance is a direct consequence of extensive government-backed projects aimed at expanding and modernizing urban water distribution networks. Cities worldwide are grappling with aging infrastructure that is prone to leaks and contamination, necessitating the replacement of conventional pipes with more robust and durable alternatives like plastic-lined composite steel pipes.

Drinking Water is another crucial application, holding an estimated market share of over 30%. The increasing global focus on public health and the stringent regulations surrounding potable water quality are driving the demand for pipes that guarantee water purity and prevent contamination. The inert nature of the plastic lining ensures that the water quality is maintained throughout the distribution system.

The Pollution Discharge segment, while smaller, is experiencing steady growth, with an estimated market share of around 15%. This is driven by the need for corrosion-resistant and durable pipes capable of handling industrial effluents and wastewater without degradation. Strict environmental regulations regarding the safe disposal of industrial waste are fueling this demand.

In terms of Type, Plastic Lined Steel Pipe for Cold Water is the dominant category, accounting for an estimated market share exceeding 60%. This is due to the ubiquitous nature of cold water distribution systems for domestic and industrial use. However, the Plastic Lined Steel Pipe for Hot Water segment is witnessing a higher growth rate, with an estimated market share of over 35%, as advancements in lining materials enable these pipes to withstand higher temperatures and pressures, making them suitable for more demanding applications.

- Leading Region: Asia Pacific, driven by extensive infrastructure investments in countries like China and India.

- Key Drivers: Government policies on infrastructure development, rapid urbanization, and population growth.

- Dominant Application Segment: Municipal Water Supply (over 45% market share).

- Key Drivers: Urban development projects, replacement of aging infrastructure, and need for efficient water distribution.

- Significant Application Segment: Drinking Water (over 30% market share).

- Key Drivers: Public health initiatives, strict water quality regulations, and demand for pure water delivery.

- Growing Application Segment: Pollution Discharge (around 15% market share).

- Key Drivers: Industrial waste management, environmental protection regulations, and need for corrosion-resistant pipes.

- Dominant Type: Plastic Lined Steel Pipe for Cold Water (over 60% market share).

- Key Drivers: Widespread use in domestic and industrial cold water systems.

- High-Growth Type: Plastic Lined Steel Pipe for Hot Water (over 35% market share).

- Key Drivers: Technological advancements in lining materials for high-temperature applications, growing demand in industrial processes.

Plastic Lined Composite Steel Pipe For Water Supply Product Developments

Recent product developments in plastic lined composite steel pipes for water supply are centered on enhancing durability, chemical resistance, and temperature tolerance. Innovations include the use of advanced polymer linings such as high-density polyethylene (HDPE) and cross-linked polyethylene (PEX) that offer superior abrasion resistance and extended service life, even in corrosive environments. Manufacturers are also developing multi-layer linings to provide an added barrier against specific chemicals and to improve mechanical strength. These advancements are crucial for applications involving aggressive industrial wastewater and for ensuring the long-term integrity of potable water systems. The competitive advantage lies in offering solutions that reduce lifecycle costs, minimize environmental impact, and meet increasingly stringent international standards.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Plastic Lined Composite Steel Pipe market, covering the period from 2019 to 2033, with a base year of 2025. The segmentation encompasses key applications and product types.

Application Segments:

- Drinking Water: This segment focuses on pipes used for the delivery of potable water, emphasizing purity and health standards. Market size for this segment is projected to reach approximately $2,400 million by 2033, with a CAGR of around 7.0%.

- Municipal Water Supply: This segment covers pipes used in public water distribution networks, including supply and sewage systems. It is the largest segment, estimated to reach over $3,600 million by 2033, with a CAGR of approximately 7.8%.

- Pollution Discharge: This segment includes pipes for industrial effluents and wastewater, requiring high corrosion resistance. Market size for this segment is expected to reach about $1,200 million by 2033, with a CAGR of around 7.2%.

- Others: This segment includes miscellaneous applications such as agricultural irrigation and fire suppression systems. It is projected to reach around $800 million by 2033, with a CAGR of approximately 6.8%.

Type Segments:

- Plastic Lined Steel Pipe for Cold Water: This segment focuses on pipes designed for cold water applications. It is expected to reach approximately $4,800 million by 2033, with a CAGR of around 7.3%.

- Plastic Lined Steel Pipe for Hot Water: This segment covers pipes capable of handling hot water and higher temperatures. It is projected to reach over $3,200 million by 2033, with a CAGR of approximately 7.7%.

Key Drivers of Plastic Lined Composite Steel Pipe For Water Supply Growth

The growth of the Plastic Lined Composite Steel Pipe market is propelled by several key factors. Firstly, increasing global investments in water infrastructure are paramount, driven by government initiatives to upgrade aging systems and expand access to clean water, particularly in developing nations. Secondly, growing awareness of water scarcity and the need for efficient water management is encouraging the adoption of durable and leak-proof piping solutions. Thirdly, technological advancements in plastic lining materials, such as improved corrosion resistance and thermal stability, are expanding the applicability of these pipes. Finally, stringent environmental regulations mandating the safe discharge of industrial wastewater and the protection of groundwater resources are creating sustained demand.

Challenges in the Plastic Lined Composite Steel Pipe For Water Supply Sector

Despite robust growth, the Plastic Lined Composite Steel Pipe sector faces several challenges. High initial manufacturing costs compared to conventional pipes can be a barrier to widespread adoption, especially in price-sensitive markets. Supply chain disruptions, exacerbated by global geopolitical events and raw material price volatility, can impact production timelines and costs. Technical expertise required for installation and maintenance can also pose a challenge in regions with limited skilled labor. Furthermore, competition from alternative piping materials like ductile iron and PVC, which may offer lower upfront costs, remains a persistent concern, necessitating continuous innovation and value proposition highlighting.

Emerging Opportunities in Plastic Lined Composite Steel Pipe For Water Supply

The Plastic Lined Composite Steel Pipe market is ripe with emerging opportunities. The increasing focus on smart water management systems presents an opportunity for pipes with integrated sensor capabilities or designed for seamless integration with digital monitoring technologies. The growing demand for sustainable construction practices and green building certifications favors the long-term durability and reduced environmental impact of these pipes. Furthermore, the expansion of industrial sectors requiring specialized chemical resistance, such as the petrochemical and food and beverage industries, opens new avenues for application-specific pipe solutions. Finally, emerging markets in Africa and Southeast Asia with significant unmet needs for water infrastructure represent substantial untapped growth potential.

Leading Players in the Plastic Lined Composite Steel Pipe For Water Supply Market

- TechnipFMC

- Welspun

- Jindal SAW Ltd.

- OMK

- TMK Group

- Arabian Pipes Company

- Zekelman Industries

- Tianjin Youfa Steel Pipe Group

- Zhejiang Kingland Pipeline & Technologies

- Hengshui Jinghua Steel PIPE

- China LESSO Group Holdings Limited

- Nantong Wantong Steel Pipe

- Fujian Shengyang Pipeline Technology

- Shanghai Metal Corporation

- Tianjin Juncheng Pipeline Industrial Group

- Tianjin Lida Steel Pipe Group

- Xinxing Ductile Iron Pipe

- Hubei Xingxin Technology

Key Developments in Plastic Lined Composite Steel Pipe For Water Supply Industry

- 2023: Tianjin Youfa Steel Pipe Group launched a new generation of ultra-high molecular weight polyethylene (UHMWPE) lined steel pipes offering enhanced abrasion resistance for demanding industrial applications.

- 2023: Welspun announced a significant expansion of its manufacturing capacity for plastic-lined steel pipes to meet increasing global demand for water infrastructure projects.

- 2022: Jindal SAW Ltd. secured a major contract for the supply of plastic-lined steel pipes for a large-scale municipal water supply project in the Middle East.

- 2022: Zekelman Industries acquired a specialized manufacturer of corrosion-resistant coatings, aiming to enhance its product offerings for water and wastewater applications.

- 2021: TMK Group invested in advanced research and development for innovative composite lining technologies to improve the performance of pipes in extreme temperature and pressure environments.

- 2021: Arabian Pipes Company expanded its product portfolio to include a wider range of plastic-lined steel pipes specifically designed for potable water applications, meeting stringent international certifications.

Strategic Outlook for Plastic Lined Composite Steel Pipe For Water Supply Market

The strategic outlook for the Plastic Lined Composite Steel Pipe market is highly positive, characterized by sustained demand driven by global infrastructure development and water management needs. Key growth catalysts include continued investment in smart water networks, the adoption of sustainable construction materials, and the expansion into underserved emerging markets. Companies that focus on technological innovation to enhance pipe performance, reduce lifecycle costs, and meet evolving regulatory requirements will be well-positioned for success. Strategic partnerships and M&A activities will likely continue to shape the competitive landscape, enabling players to expand their market reach and technological capabilities, ensuring the long-term viability and growth of this critical industry.

Plastic Lined Composite Steel Pipe For Water Supply Segmentation

-

1. Application

- 1.1. Drinking Water

- 1.2. Municipal Water Supply

- 1.3. Pollution Discharge

- 1.4. Others

-

2. Type

- 2.1. Plastic Lined Steel Pipe for Cold Water

- 2.2. Plastic Lined Steel Pipe for Hot Water

Plastic Lined Composite Steel Pipe For Water Supply Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plastic Lined Composite Steel Pipe For Water Supply REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plastic Lined Composite Steel Pipe For Water Supply Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drinking Water

- 5.1.2. Municipal Water Supply

- 5.1.3. Pollution Discharge

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plastic Lined Steel Pipe for Cold Water

- 5.2.2. Plastic Lined Steel Pipe for Hot Water

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plastic Lined Composite Steel Pipe For Water Supply Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drinking Water

- 6.1.2. Municipal Water Supply

- 6.1.3. Pollution Discharge

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plastic Lined Steel Pipe for Cold Water

- 6.2.2. Plastic Lined Steel Pipe for Hot Water

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plastic Lined Composite Steel Pipe For Water Supply Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drinking Water

- 7.1.2. Municipal Water Supply

- 7.1.3. Pollution Discharge

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plastic Lined Steel Pipe for Cold Water

- 7.2.2. Plastic Lined Steel Pipe for Hot Water

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plastic Lined Composite Steel Pipe For Water Supply Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drinking Water

- 8.1.2. Municipal Water Supply

- 8.1.3. Pollution Discharge

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plastic Lined Steel Pipe for Cold Water

- 8.2.2. Plastic Lined Steel Pipe for Hot Water

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drinking Water

- 9.1.2. Municipal Water Supply

- 9.1.3. Pollution Discharge

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plastic Lined Steel Pipe for Cold Water

- 9.2.2. Plastic Lined Steel Pipe for Hot Water

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drinking Water

- 10.1.2. Municipal Water Supply

- 10.1.3. Pollution Discharge

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plastic Lined Steel Pipe for Cold Water

- 10.2.2. Plastic Lined Steel Pipe for Hot Water

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TechnipFMC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Welspun

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jindal SAW Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OMK

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TMK Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arabian Pipes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zekelman Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tianjin Youfa Steel Pipe Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zhejiang Kingland Pipeline & Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hengshui Jinghua Steel PIPE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China LESSO Group Holdings Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nantong Wantong Steel Pipe

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Fujian Shengyang Pipeline Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shanghai Metal Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tianjin Juncheng Pipeline Industrial Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Tianjin Lida Steel Pipe Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Xinxing Ductile Iron Pipe

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Hubei Xingxin Technology

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 TechnipFMC

List of Figures

- Figure 1: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Type 2024 & 2032

- Figure 5: North America Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Type 2024 & 2032

- Figure 11: South America Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Plastic Lined Composite Steel Pipe For Water Supply Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plastic Lined Composite Steel Pipe For Water Supply Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Lined Composite Steel Pipe For Water Supply?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Plastic Lined Composite Steel Pipe For Water Supply?

Key companies in the market include TechnipFMC, Welspun, Jindal SAW Ltd., OMK, TMK Group, Arabian Pipes Company, Zekelman Industries, Tianjin Youfa Steel Pipe Group, Zhejiang Kingland Pipeline & Technologies, Hengshui Jinghua Steel PIPE, China LESSO Group Holdings Limited, Nantong Wantong Steel Pipe, Fujian Shengyang Pipeline Technology, Shanghai Metal Corporation, Tianjin Juncheng Pipeline Industrial Group, Tianjin Lida Steel Pipe Group, Xinxing Ductile Iron Pipe, Hubei Xingxin Technology.

3. What are the main segments of the Plastic Lined Composite Steel Pipe For Water Supply?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1704 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plastic Lined Composite Steel Pipe For Water Supply," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plastic Lined Composite Steel Pipe For Water Supply report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plastic Lined Composite Steel Pipe For Water Supply?

To stay informed about further developments, trends, and reports in the Plastic Lined Composite Steel Pipe For Water Supply, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence