Key Insights

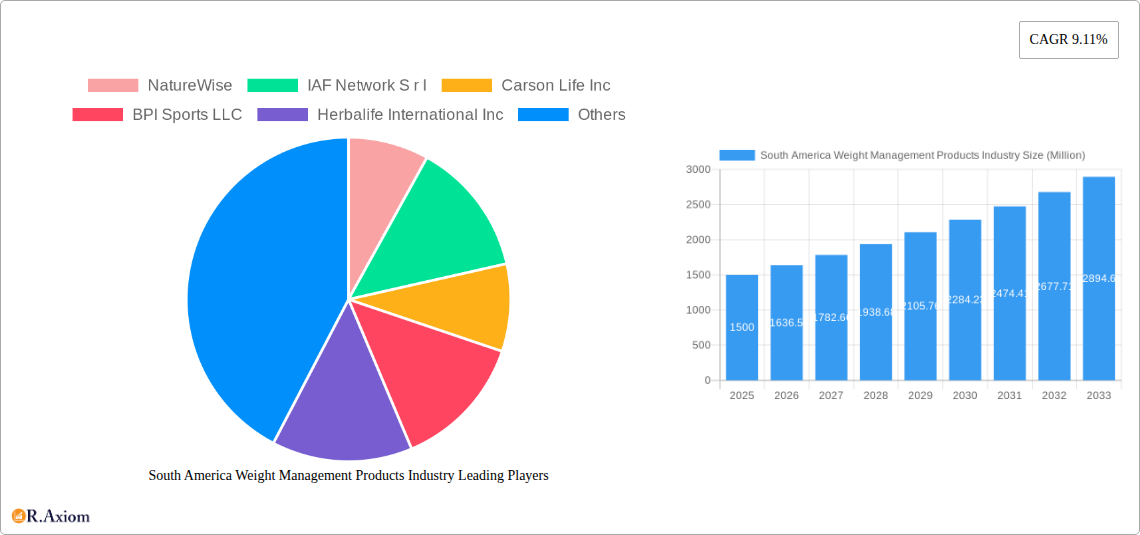

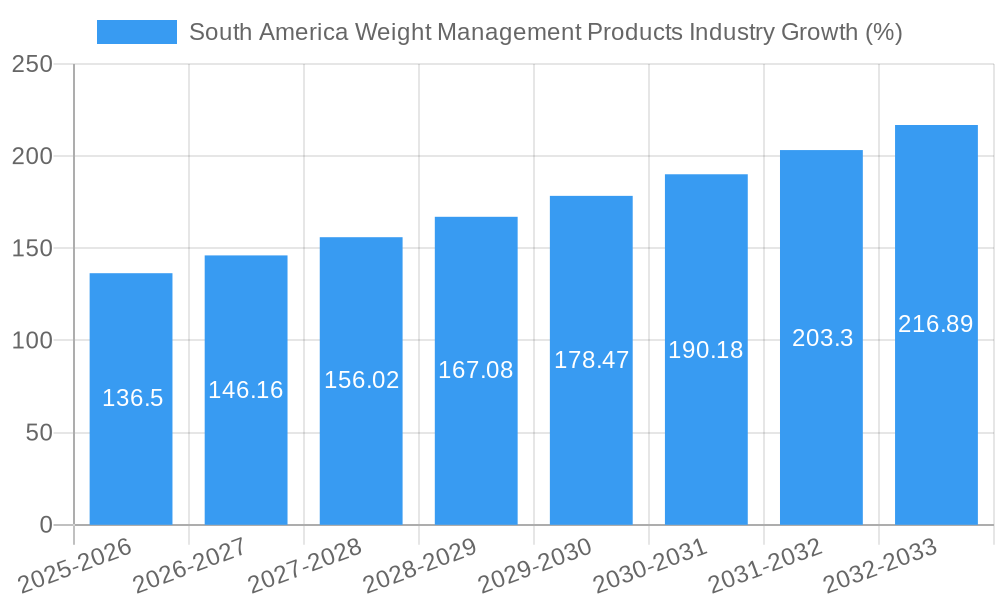

The South American weight management products market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). Driven by increasing health consciousness, rising obesity rates, and a growing awareness of the benefits of proactive health management, the market is anticipated to expand considerably. The rising disposable incomes in key South American economies like Brazil and Argentina are further fueling demand for premium weight management products, including meal replacements, beverages, and supplements. The convenience offered by online retail channels is also a significant driver, supplementing the traditional distribution channels like hypermarkets and convenience stores. While challenges remain, such as affordability concerns in certain segments of the population and potential regulatory hurdles regarding supplement efficacy and labeling, the overall market outlook remains positive.

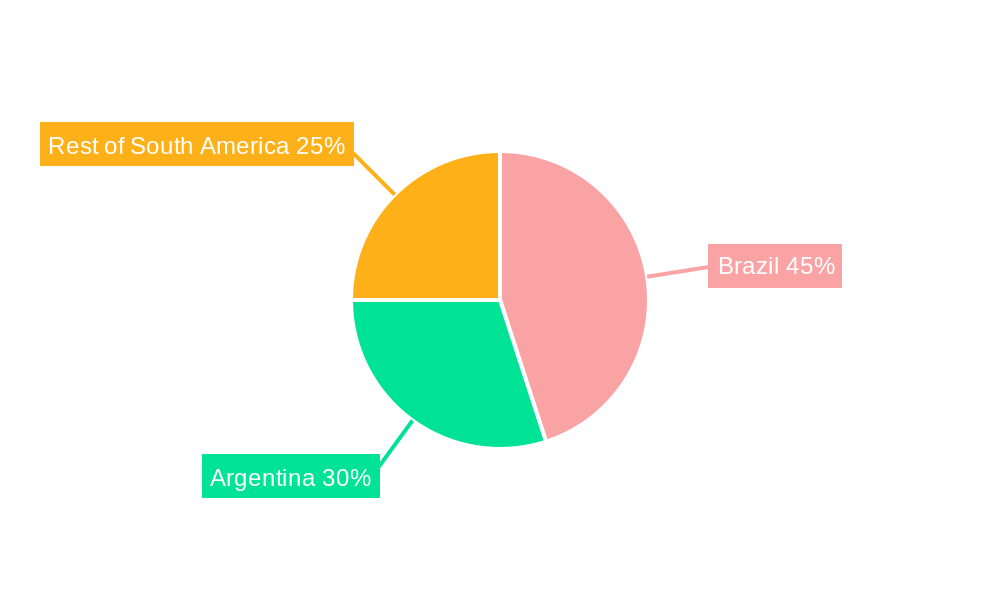

Segmentation analysis reveals a diverse market landscape. The meal replacement segment likely holds a substantial share, driven by the convenience and portion control these products offer. Beverages, including functional drinks and protein shakes, are also experiencing significant growth. Supplements, encompassing a wide array of products like fat burners and appetite suppressants, represent a considerable portion of the market. Online retail is exhibiting rapid growth as consumers increasingly embrace e-commerce platforms for health and wellness products. Brazil and Argentina, with their large populations and growing middle classes, represent the largest market segments within South America, with the rest of South America showing promising, albeit slower, growth. Key players are investing heavily in product innovation, marketing, and distribution to capture market share, leading to increased competition and consumer benefits. The market's continuous evolution will necessitate adaptation and strategic maneuvering from both established players and new entrants.

South America Weight Management Products Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America weight management products industry, covering market size, segmentation, key players, trends, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, investors, and regulatory bodies.

South America Weight Management Products Industry Market Concentration & Innovation

The South America weight management products market exhibits a moderately concentrated landscape, with a few large multinational corporations and several regional players competing for market share. Market concentration is influenced by factors such as brand recognition, distribution networks, and product innovation. While exact market share figures for individual companies are proprietary, Nestle SA and Herbalife International Inc. are estimated to hold significant portions of the market. Recent M&A activity further shapes the competitive landscape. For instance, Nestlé Health Science's acquisition of Puravida in May 2022 significantly boosted its presence and product portfolio in Brazil, demonstrating the strategic importance of the region. The total value of such deals in the observed period is estimated at xx Million.

Innovation is a key driver in this dynamic market. Companies are continually developing new products with improved formulations, enhanced delivery systems, and functional ingredients to cater to evolving consumer preferences. Regulatory frameworks, such as those concerning labeling and ingredient safety, play a significant role in shaping product development and market entry. The presence of substitute products, including traditional weight management methods and alternative health solutions, creates competitive pressure, requiring continuous innovation to maintain market relevance. End-user trends, including growing health awareness, demand for natural and organic products, and preference for convenient formats, are shaping product innovation trajectories.

South America Weight Management Products Industry Industry Trends & Insights

The South American weight management products market is experiencing robust growth, fueled by several key factors. Rising health consciousness among consumers, increasing prevalence of obesity and related health issues, and growing disposable incomes are driving demand for weight management solutions. Technological advancements, such as personalized nutrition platforms and advanced ingredient formulations, are disrupting the traditional approach to weight management, leading to the development of more effective and targeted products. The market is witnessing a shift towards natural and organic products, as consumers increasingly seek healthier and sustainable alternatives. Competitive dynamics are intense, with companies focusing on product differentiation, brand building, and strategic partnerships to gain a competitive edge. The CAGR (Compound Annual Growth Rate) for the forecast period (2025-2033) is projected at xx%, with market penetration reaching xx% by 2033. This growth is being influenced by several factors, including the increasing adoption of online retail channels and the growing awareness among consumers regarding healthy lifestyle choices.

Dominant Markets & Segments in South America Weight Management Products Industry

Leading Region: Brazil is the dominant market within South America for weight management products, driven by its large population, rising health concerns, and increasing disposable incomes.

Dominant Country: Brazil's significant market share is further fueled by strong economic growth and a substantial middle class with increased purchasing power.

Dominant Segment (By Type): Supplements represent the largest segment by type, owing to the convenience and targeted nature of supplement formulations. This is closely followed by the beverage segment, which is experiencing significant growth due to the increasing preference for functional beverages.

Dominant Segment (By Distribution Channel): Hypermarkets/Supermarkets remain the primary distribution channel, due to their widespread accessibility and established customer base. Online retail stores are showing rapid growth, facilitated by increased internet penetration and e-commerce adoption.

Key Drivers for Brazil's Dominance:

- Economic Growth: A growing economy increases disposable income, allowing consumers to spend more on health and wellness products.

- Rising Obesity Rates: The increasing prevalence of obesity and related health problems drives the demand for weight management solutions.

- Improved Infrastructure: Better infrastructure facilitates efficient distribution of products throughout the country.

- Government Initiatives: Government programs promoting healthy lifestyles and initiatives addressing health issues could also contribute to market growth.

South America Weight Management Products Industry Product Developments

Recent years have witnessed significant product innovations in the South American weight management market. Companies are introducing products with enhanced formulations, incorporating natural and organic ingredients, and focusing on convenient formats such as ready-to-drink beverages and meal replacements. Technological advancements, such as personalized nutrition programs and advanced ingredient delivery systems, further enhance product efficacy and market appeal. The market is also witnessing the rise of products catering to specific dietary needs, such as vegan, gluten-free, and low-carb options, reflecting the growing diversity of consumer preferences.

Report Scope & Segmentation Analysis

This report segments the South America weight management products market by type (Meal replacements, Beverages, Supplements) and distribution channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels). Each segment’s growth trajectory, market size, and competitive landscape are analyzed in detail. For example, the Supplements segment is projected to experience significant growth driven by increased consumer awareness and the availability of specialized formulations. Similarly, the online retail segment is expected to exhibit rapid growth fueled by growing e-commerce adoption. The hypermarkets/supermarkets segment, while established, will maintain its significance due to its wide accessibility.

Key Drivers of South America Weight Management Products Industry Growth

Several factors fuel the growth of the South American weight management products industry. Rising health consciousness is a major driver, as consumers are increasingly aware of the importance of maintaining a healthy weight. The increasing prevalence of obesity and associated health problems creates substantial demand for effective weight management solutions. Furthermore, technological advancements, such as improved formulations, personalized nutrition platforms, and convenient delivery systems, are contributing to market growth. Economic factors, such as increasing disposable incomes, further enhance market potential.

Challenges in the South America Weight Management Products Industry Sector

The South American weight management products industry faces certain challenges. Regulatory hurdles relating to product labeling, ingredient approval, and marketing claims can impede market entry and growth. Supply chain complexities and fluctuations in raw material costs can affect product pricing and profitability. Intense competition, both from established players and new entrants, requires continuous innovation and effective marketing strategies. These factors combined create considerable challenges for companies seeking to operate successfully within the sector. The cumulative impact of these challenges, while difficult to quantify precisely, is estimated to have reduced the market's growth by an estimated xx Million in 2024.

Emerging Opportunities in South America Weight Management Products Industry

Several opportunities exist for growth in the South American weight management products industry. The expansion of e-commerce platforms presents a significant opportunity for market expansion and improved reach. The increasing adoption of personalized nutrition programs, utilizing technology to tailor weight management strategies to individual needs, offers substantial growth potential. The rising demand for natural, organic, and sustainably sourced ingredients provides opportunities for companies offering such products. Finally, tapping into the growing health and wellness market through strategic partnerships and collaborations will be key for gaining a competitive advantage.

Leading Players in the South America Weight Management Products Industry Market

- NatureWise

- IAF Network S r l

- Carson Life Inc

- BPI Sports LLC

- Herbalife International Inc

- Nestle SA

- The Hut com Limited (Myprotein)

- Ultimate Nutrition inc

- N V Perricone LLC

- California Medical Weight Management LLC

Key Developments in South America Weight Management Products Industry Industry

- July 2022: Herbalife launched a new weight management product featuring prickly pear cactus fiber, backed by clinical trials. This significantly impacts market competition by showcasing innovation in effective, scientifically-backed products.

- May 2022: Nestlé Health Science acquired Puravida in Brazil, expanding its presence and product offerings in a key South American market. This significantly alters the market landscape and increases competition.

- April 2023: Herbalife unveiled 106 new wellness products globally, including in Brazil, addressing diverse well-being aspects. This broadened product portfolio increases the company's competitive edge and market share.

Strategic Outlook for South America Weight Management Products Industry Market

The South American weight management products market is poised for continued growth, driven by increasing health consciousness, rising obesity rates, and growing disposable incomes. The ongoing technological advancements and the rise of personalized nutrition strategies offer significant opportunities for market expansion. Companies that effectively leverage these trends, adapt to evolving consumer preferences, and navigate the regulatory landscape are best positioned for long-term success in this dynamic and competitive market. The market's future potential rests on the ability of companies to deliver innovative, effective, and accessible weight management solutions tailored to the diverse needs of the South American population.

South America Weight Management Products Industry Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of the South America

South America Weight Management Products Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of the South America

South America Weight Management Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Incidence and Weight Consciousness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of the South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of the South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of the South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of the South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of the South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 NatureWise

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IAF Network S r l

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Carson Life Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BPI Sports LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Herbalife International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nestle SA*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Hut com Limited (Myprotein)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Ultimate Nutrition inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 N V Perricone LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 California Medical Weight Management LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 NatureWise

List of Figures

- Figure 1: South America Weight Management Products Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Weight Management Products Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Weight Management Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Weight Management Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Weight Management Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Weight Management Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Weight Management Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Weight Management Products Industry?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the South America Weight Management Products Industry?

Key companies in the market include NatureWise, IAF Network S r l, Carson Life Inc, BPI Sports LLC, Herbalife International Inc, Nestle SA*List Not Exhaustive, The Hut com Limited (Myprotein), Ultimate Nutrition inc, N V Perricone LLC, California Medical Weight Management LLC.

3. What are the main segments of the South America Weight Management Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Rising Obesity Incidence and Weight Consciousness.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Herbalife unveiled 106 innovative Wellness Products on a global scale, catering to a diverse audience spanning 95 markets where the company maintains a strong presence, including Brazil. These new product additions are strategically designed to address various facets of well-being, including nutrient supplementation, weight management, digestion, and other essential segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Weight Management Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Weight Management Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Weight Management Products Industry?

To stay informed about further developments, trends, and reports in the South America Weight Management Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence