Key Insights

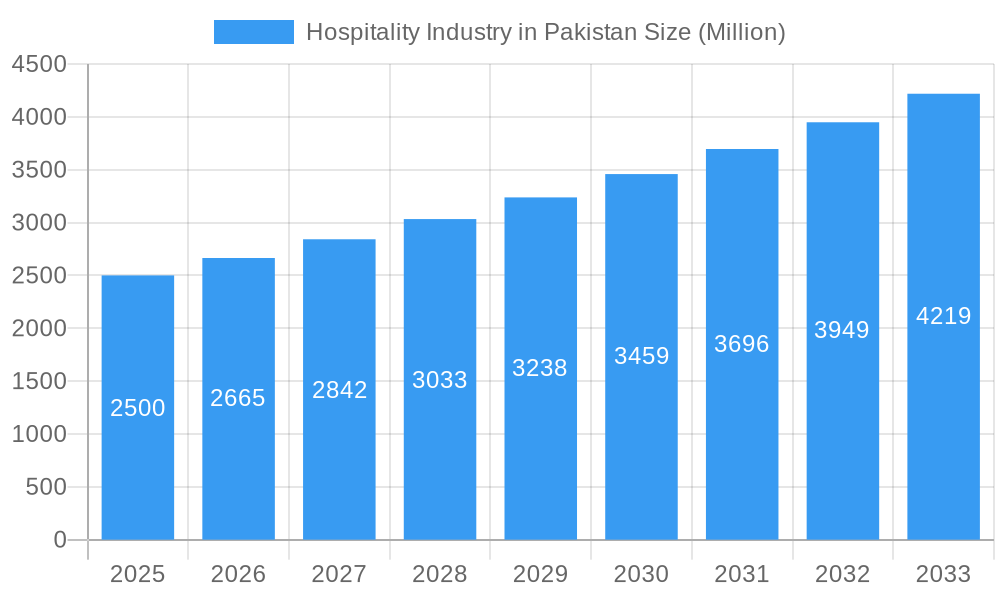

The Pakistani hospitality industry is poised for significant expansion, projected to reach $4.26 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.75% between 2025 and 2033. This robust growth trajectory is underpinned by a thriving tourism sector, increasing domestic disposable incomes, and strategic investments in infrastructure. The market is broadly segmented by tourism type (inbound and outbound) and accommodation offering (economy, mid-scale, upscale, luxury, and alternative options). A competitive landscape is evident, featuring both international brands and local enterprises.

Hospitality Industry in Pakistan Market Size (In Billion)

To harness emerging opportunities, industry players are prioritizing niche market development, service enhancement, and technology integration to elevate the guest experience. The proliferation of Online Travel Agencies (OTAs) and sophisticated digital marketing strategies are revolutionizing distribution channels. Government initiatives aimed at improving tourism infrastructure and promoting Pakistan as a destination are expected to further stimulate sector growth. Deeper dives into specific segments, such as eco-tourism and religious tourism, will unveil additional investment potential. Strategic mitigation of security concerns and seasonality will be crucial for sustained profitability.

Hospitality Industry in Pakistan Company Market Share

This report offers an in-depth analysis of the Pakistani hospitality sector, detailing market size, segmentation, key players, and growth forecasts from 2025 to 2033. It is an indispensable resource for stakeholders and investors seeking to comprehend the dynamics of this evolving market. The forecast period spans 2025-2033, with 2025 serving as the base year. Data is sourced from diverse origins and augmented with expert analysis to provide actionable insights.

Hospitality Industry in Pakistan Market Concentration & Innovation

The Pakistani hospitality industry is characterized by a dynamic market structure, balancing established luxury brands with a burgeoning segment of independent establishments. While a few major hotel chains command a significant share, particularly in the premium segment, a vast network of smaller hotels, guesthouses, and boutique accommodations caters to diverse traveler needs, from budget-conscious explorers to those seeking unique local experiences. The industry is actively embracing innovation, with technology playing a pivotal role in elevating guest experiences and streamlining operations. This technological integration is not just about efficiency; it's about creating more personalized and memorable stays.

- Market Concentration: While precise figures can fluctuate, the top 5 hotel chains are estimated to hold a substantial portion of the market share, contributing significantly to the overall revenue of the sector. (Further analysis on specific revenue percentages for 2025 would require current market data.)

- Innovation Drivers: The industry's innovative edge is being sharpened by the widespread adoption of digital solutions. This includes sophisticated online booking platforms, advanced revenue management systems that optimize pricing and occupancy, and the integration of smart hotel technologies for enhanced guest comfort and control. Beyond technology, a growing emphasis on sustainable tourism practices and the development of unique, experiential offerings are also key drivers of innovation, allowing businesses to differentiate themselves and attract a wider audience.

- Regulatory Framework: The hospitality landscape in Pakistan operates within a multifaceted regulatory environment, encompassing various licensing and operational guidelines. However, there's a discernible and increasing government commitment to promoting tourism. This focus has the potential to catalyze further regulatory reforms, creating a more conducive and supportive ecosystem for industry growth and investment.

- Product Substitutes: The rise of alternative accommodation providers, such as Airbnb and similar peer-to-peer rental platforms, presents a significant competitive landscape, particularly for budget-oriented travelers. Furthermore, the burgeoning domestic tourism market acts as a substantial substitute for outbound international travel, influencing demand patterns within the hospitality sector.

- End-User Trends: Modern travelers are increasingly seeking authentic and personalized experiences that go beyond conventional tourism. There's a pronounced preference for immersive local encounters and unique cultural engagements. The growing appeal of wellness tourism and eco-tourism is also creating new avenues for growth and specialization within the industry.

- M&A Activities: The hospitality sector in Pakistan has experienced a moderate level of mergers and acquisitions. The valuation of these deals is subject to market dynamics, with historical averages indicating a steady, albeit fluctuating, annual investment. Projections suggest a potential upward trend in M&A activities and deal values in the coming years, reflecting growing investor confidence. (Specific M&A value projections for 2025 would require detailed market analysis.)

Hospitality Industry in Pakistan Industry Trends & Insights

Pakistan's hospitality industry is experiencing significant growth driven by several factors. Increasing disposable incomes, a growing middle class, and the government's focus on developing the tourism sector are boosting demand for hotels and tourism-related services. Technological disruption is changing the way hotels operate and interact with customers, with online booking platforms and mobile apps gaining popularity. Consumer preferences are shifting towards personalized experiences and greater value for money.

The competitive landscape is becoming increasingly dynamic, with both international and domestic players vying for market share. The compound annual growth rate (CAGR) of the Pakistani hospitality industry is projected to be xx% during the forecast period (2025-2033). Market penetration of online booking platforms is expected to reach xx% by 2033. The industry also faces challenges such as infrastructure limitations, security concerns, and seasonality. The ongoing growth of inbound and outbound tourism is a critical factor in this assessment.

Dominant Markets & Segments in Hospitality Industry in Pakistan

The growth of the hospitality sector in Pakistan is influenced by several factors:

By Type of Tourism:

- Inbound Tourism: This segment is dominant, fueled by religious tourism, historical sites, and natural beauty, contributing to approximately xx% of the total revenue.

- Outbound Tourism: This segment is growing steadily, with increasing numbers of Pakistani citizens traveling internationally for leisure and business. This contributes to approximately xx% of revenue.

By Type of Hotel:

- Economy and Budget Hotels: This segment displays robust growth due to increasing affordability and cost-conscious travelers.

- Mid-Scale Hotels: This sector shows steady growth and attracts a broad range of travelers.

- Upper-Scale Hotels: This sector experiences consistent growth, driven by business travelers and high-spending tourists.

- Premium and Luxury Hotels: This segment showcases strong growth, with a higher concentration of international brands.

- Other Types of Hotel: The shared living space, rented apartments, and service apartments sectors are emerging rapidly, attracting budget-conscious and long-stay travelers.

Key Drivers:

- Economic Policies: Government initiatives promoting tourism, including infrastructure development and visa facilitation, significantly influence growth.

- Infrastructure: Improvement in transport infrastructure (airports, roads) enhances accessibility and boosts tourism.

Hospitality Industry in Pakistan Product Developments

The Pakistani hospitality industry is at the forefront of product innovation, with a strong focus on enhancing the guest journey through seamless technological integration. Hotels are increasingly deploying solutions for mobile check-in and check-out, allowing for faster arrivals and departures. Personalized room settings, controlled via mobile apps or in-room interfaces, are becoming more common, enabling guests to tailor their environment to their preferences. Advanced in-room entertainment systems are also being integrated to provide a more engaging and enjoyable stay. The emergence and growth of boutique hotels and uniquely themed properties are further diversifying the market, catering to specific consumer preferences and offering distinct experiences. Concurrently, a strong emphasis is being placed on sustainability, with new developments incorporating energy-efficient technologies and robust waste management systems. These advancements not only improve operational efficiency and reduce environmental impact but also significantly enhance customer satisfaction and foster stronger brand loyalty.

Report Scope & Segmentation Analysis

This report comprehensively segments the Pakistani hospitality market by type of tourism (inbound and outbound) and hotel type (economy and budget, mid-scale, upper-scale, premium and luxury, and other types). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The market is expected to grow significantly over the forecast period driven by increasing tourism, rising disposable incomes, and improving infrastructure.

Key Drivers of Hospitality Industry in Pakistan Growth

The hospitality sector in Pakistan is experiencing robust growth, propelled by a confluence of favorable factors. A burgeoning middle class with expanding disposable income is a primary driver, increasing the propensity for travel and leisure spending. Government initiatives aimed at bolstering tourism, including significant investments in infrastructure development and promotional campaigns, are creating a more accessible and attractive environment for both domestic and international visitors. The increasing global and local appeal of experiential travel, where travelers seek authentic cultural immersion and unique adventures, further fuels demand. Coupled with this is the rising popularity of wellness tourism, emphasizing health and rejuvenation. Moreover, continuous technological advancements within the hospitality sector itself are crucial. These innovations are not only improving operational efficiencies and enabling more personalized customer interactions but are also enhancing the overall quality and appeal of services offered, contributing to sustained growth and expansion.

Challenges in the Hospitality Industry in Pakistan Sector

The Pakistani hospitality industry faces several challenges, including infrastructure limitations, particularly in less developed regions. Security concerns can deter tourists, impacting occupancy rates. Seasonality of tourism also impacts revenue streams, and the industry faces fierce competition from new entrants and established players alike. Regulatory hurdles and fluctuating currency exchange rates also pose considerable difficulties.

Emerging Opportunities in Hospitality Industry in Pakistan

Emerging opportunities in the Pakistani hospitality sector include the growth of eco-tourism and adventure tourism, leveraging the country’s diverse landscapes. The development of specialized niche tourism focusing on heritage sites and cultural experiences offers considerable potential. The expanding use of technology offers streamlined operations and enhanced customer service opportunities.

Leading Players in the Hospitality Industry in Pakistan Market

- Adventure Tours Pakistan

- Ramada by Wyndham Lahore

- Islamabad Serena Hotel

- Awari Towers Karachi

- Heritage Luxury Suites

- Karachi Marriott Hotel

- Pearl Continental

- Pakistan Tours Limited

- Sitara Travel

- Rakaposhi Tours (Pvt) Ltd

- Zeb Travels

- Movenpick Hotel Karachi

- Cox & Kings Pakistan (Pvt) Ltd

- Click Pakistan

Key Developments in Hospitality Industry in Pakistan Industry

-

March 2023: Radisson Hotel Group significantly expanded its footprint in Pakistan by announcing the signing of two new properties in Islamabad: the Radisson Blu Hotel & Residences, featuring a substantial 432 rooms, suites, and serviced apartments, and the Radisson Hotel Islamabad Multi Gardens, with 165 rooms including four executive suites. This strategic expansion bolsters the upscale hotel segment in the capital city and reinforces Radisson's growing presence across South Asia.

-

February 2023: Valor Hospitality Partners marked its entry into Southwest Asia with the commencement of operations at the Hyatt Regency Lahore DHA. This development signifies an increase in international investment and operational expertise entering the Pakistani hospitality sector, signaling confidence in the market's potential.

Strategic Outlook for Hospitality Industry in Pakistan Market

The Pakistani hospitality industry is poised for significant growth over the next decade. Continued government support for tourism, improving infrastructure, and the rising affluence of the Pakistani population will drive demand for hospitality services. The strategic focus on sustainable and experiential tourism will attract a wider range of international and domestic visitors, leading to higher occupancy rates and revenue growth. The successful integration of technology will enhance efficiency and competitiveness.

Hospitality Industry in Pakistan Segmentation

-

1. Type of Tourism

- 1.1. Inbound Tourism

- 1.2. Outbound Tourism

-

2. Type of Hotel

- 2.1. Economy and Budget Hotels

- 2.2. Mid-Scale Hotels

- 2.3. Upper Scale Hotels

- 2.4. Premium and Luxury Hotels

- 2.5. Other Ty

Hospitality Industry in Pakistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Pakistan Regional Market Share

Geographic Coverage of Hospitality Industry in Pakistan

Hospitality Industry in Pakistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels

- 3.3. Market Restrains

- 3.3.1. Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market

- 3.4. Market Trends

- 3.4.1. Rising Inbound Tourism

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 5.1.1. Inbound Tourism

- 5.1.2. Outbound Tourism

- 5.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 5.2.1. Economy and Budget Hotels

- 5.2.2. Mid-Scale Hotels

- 5.2.3. Upper Scale Hotels

- 5.2.4. Premium and Luxury Hotels

- 5.2.5. Other Ty

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 6. North America Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 6.1.1. Inbound Tourism

- 6.1.2. Outbound Tourism

- 6.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 6.2.1. Economy and Budget Hotels

- 6.2.2. Mid-Scale Hotels

- 6.2.3. Upper Scale Hotels

- 6.2.4. Premium and Luxury Hotels

- 6.2.5. Other Ty

- 6.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 7. South America Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 7.1.1. Inbound Tourism

- 7.1.2. Outbound Tourism

- 7.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 7.2.1. Economy and Budget Hotels

- 7.2.2. Mid-Scale Hotels

- 7.2.3. Upper Scale Hotels

- 7.2.4. Premium and Luxury Hotels

- 7.2.5. Other Ty

- 7.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 8. Europe Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 8.1.1. Inbound Tourism

- 8.1.2. Outbound Tourism

- 8.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 8.2.1. Economy and Budget Hotels

- 8.2.2. Mid-Scale Hotels

- 8.2.3. Upper Scale Hotels

- 8.2.4. Premium and Luxury Hotels

- 8.2.5. Other Ty

- 8.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 9. Middle East & Africa Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 9.1.1. Inbound Tourism

- 9.1.2. Outbound Tourism

- 9.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 9.2.1. Economy and Budget Hotels

- 9.2.2. Mid-Scale Hotels

- 9.2.3. Upper Scale Hotels

- 9.2.4. Premium and Luxury Hotels

- 9.2.5. Other Ty

- 9.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 10. Asia Pacific Hospitality Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 10.1.1. Inbound Tourism

- 10.1.2. Outbound Tourism

- 10.2. Market Analysis, Insights and Forecast - by Type of Hotel

- 10.2.1. Economy and Budget Hotels

- 10.2.2. Mid-Scale Hotels

- 10.2.3. Upper Scale Hotels

- 10.2.4. Premium and Luxury Hotels

- 10.2.5. Other Ty

- 10.1. Market Analysis, Insights and Forecast - by Type of Tourism

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adventure Tours Pakistan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ramada by Wyndham Lahore

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Islamabad Serena Hotel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Awari Towers Karachi**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Heritage Luxury Suites

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Karachi Marriott Hotel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pearl Continental

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pakistan Tours Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sitara Travel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rakaposhi Tours (Pvt) Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zeb Travels

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Movenpick Hotel Karachi

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cox & Kings Pakistan (Pvt) Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Click Pakistan

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Adventure Tours Pakistan

List of Figures

- Figure 1: Global Hospitality Industry in Pakistan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 3: North America Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 4: North America Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 5: North America Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 6: North America Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 9: South America Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 10: South America Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 11: South America Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 12: South America Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 15: Europe Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 16: Europe Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 17: Europe Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 18: Europe Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Pakistan Revenue (billion), by Type of Tourism 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Pakistan Revenue Share (%), by Type of Tourism 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Pakistan Revenue (billion), by Type of Hotel 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Pakistan Revenue Share (%), by Type of Hotel 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Pakistan Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 2: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 3: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 5: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 6: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 11: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 12: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 17: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 18: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 29: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 30: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Tourism 2020 & 2033

- Table 38: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Type of Hotel 2020 & 2033

- Table 39: Global Hospitality Industry in Pakistan Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Pakistan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Pakistan?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Hospitality Industry in Pakistan?

Key companies in the market include Adventure Tours Pakistan, Ramada by Wyndham Lahore, Islamabad Serena Hotel, Awari Towers Karachi**List Not Exhaustive, Heritage Luxury Suites, Karachi Marriott Hotel, Pearl Continental, Pakistan Tours Limited, Sitara Travel, Rakaposhi Tours (Pvt) Ltd, Zeb Travels, Movenpick Hotel Karachi, Cox & Kings Pakistan (Pvt) Ltd, Click Pakistan.

3. What are the main segments of the Hospitality Industry in Pakistan?

The market segments include Type of Tourism, Type of Hotel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.26 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Share Of Inbound Tourism; Rise In Number of 3 Star and 5 star Hotels.

6. What are the notable trends driving market growth?

Rising Inbound Tourism.

7. Are there any restraints impacting market growth?

Major Share Of Tourism Is Concentrated Domestically; Decline in business travel in the region affecting the market.

8. Can you provide examples of recent developments in the market?

March 2023: Radisson Hotel Group announced the signing of two new hotels in Islamabad, Pakistan, with a commitment to expanding its footprint in the South Asian market. The two new hotels, Radisson Blu Hotel & Residences (consisting of 432 rooms, suites, and serviced apartments) and Radisson Hotel Islamabad Multi Gardens, include 165 rooms, including four executive suites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Pakistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Pakistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Pakistan?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Pakistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence