Key Insights

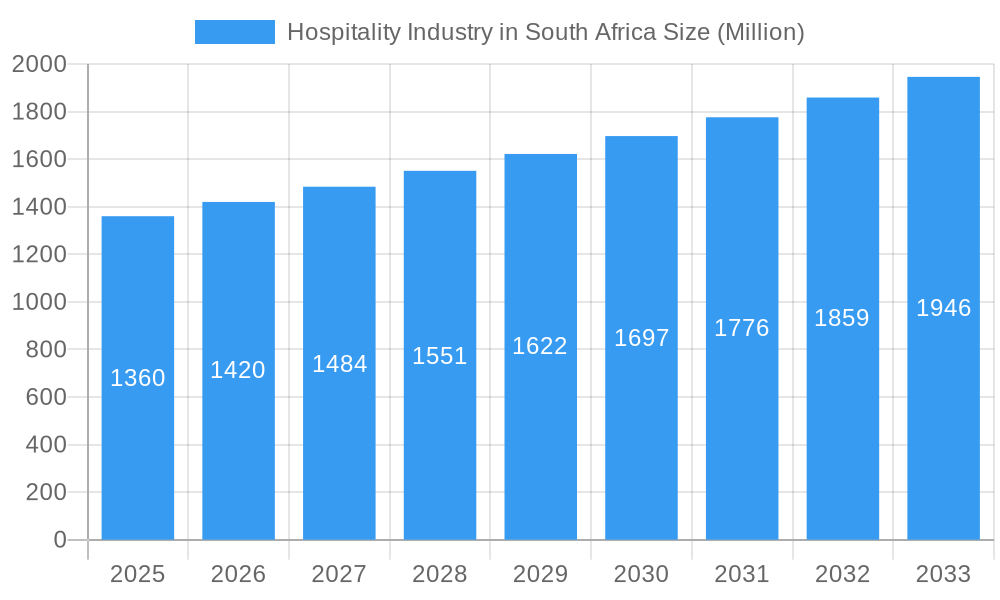

The South African hospitality industry, valued at $1.36 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 4.43% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing domestic and international tourism, driven by South Africa's diverse landscapes and rich cultural heritage, is a significant factor. Furthermore, the burgeoning business travel sector and the rise of leisure travel, particularly among the growing middle class, contribute substantially to market growth. The industry is segmented by hotel type (chain vs. independent) and service offerings (budget/economy, mid-scale, luxury, and service apartments). Chain hotels currently dominate the market, leveraging their brand recognition and established distribution networks. However, independent hotels are also witnessing growth, particularly those offering unique, localized experiences catering to discerning travellers seeking authentic South African encounters. Growth in the budget and mid-scale hotel segments is expected to outpace luxury hotel growth, reflecting the increasing demand for affordable yet comfortable accommodations. While challenges exist, including infrastructure limitations in certain regions and fluctuating exchange rates impacting international tourism, the overall outlook for the South African hospitality industry remains positive, particularly with targeted investments in tourism infrastructure and sustainable practices.

Hospitality Industry in South Africa Market Size (In Billion)

The competitive landscape is characterized by both international and domestic players. International chains like Hilton, Marriott, and InterContinental Hotels Group have a strong presence, competing alongside established regional brands like Radisson and Sun International. Smaller, independent hotels and boutique offerings are also carving out niche markets, appealing to tourists seeking unique and personalized experiences. Successful players are adapting to changing consumer preferences, embracing technological advancements in booking systems and customer relationship management, and focusing on sustainable and responsible tourism practices to appeal to environmentally conscious travelers. Future growth hinges on addressing infrastructure bottlenecks, improving safety and security, and fostering a collaborative environment between government, industry players, and local communities to promote sustainable and inclusive tourism development. This will further enhance the industry’s appeal to both domestic and international travelers, unlocking its full economic potential.

Hospitality Industry in South Africa Company Market Share

This comprehensive report provides a detailed analysis of the South African hospitality industry, encompassing market size, segmentation, competitive landscape, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period is 2019-2024. This report is crucial for investors, industry stakeholders, and businesses seeking to understand and navigate this dynamic market.

Hospitality Industry in South Africa Market Concentration & Innovation

This section analyzes the South African hospitality market's concentration, innovation drivers, regulatory environment, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with a handful of international and domestic chains holding significant market share. However, a large number of independent hotels also contribute significantly to the overall market.

Market Concentration:

- The top 5 hotel chains account for approximately xx% of the market share in 2024 (estimated).

- The M&A activity has been steadily increasing in recent years, with deal values exceeding ZAR xx Million in 2024 (estimated). Notable acquisitions include Kasada's purchase of the Cap Grace Hotel and Millat Investments' acquisition of the Winston Hotel.

Innovation Drivers:

- Technological advancements in online booking systems, revenue management, and customer relationship management (CRM).

- Focus on sustainable tourism practices and eco-friendly hotel operations.

- Growing demand for unique and experiential travel options, leading to the development of boutique hotels and specialized hospitality services.

Regulatory Framework:

- The South African government actively promotes tourism, providing incentives and support for hospitality businesses.

- However, regulatory hurdles, such as licensing and compliance requirements, can pose challenges for new entrants and existing operators.

Product Substitutes:

- The rise of alternative accommodation options such as Airbnb and home-sharing platforms poses a competitive threat to traditional hotels.

Hospitality Industry in South Africa Industry Trends & Insights

South Africa's hospitality industry presents substantial growth potential, fueled by a robust tourism sector that significantly contributes to the nation's GDP. Millions of international and domestic travelers visit annually, driving demand. While precise figures vary depending on the source and methodology, the hospitality market demonstrates consistent growth, with projections indicating a positive trajectory in the coming years. Market penetration by established hotel chains is also increasing, reflecting a dynamic and evolving landscape. This growth is expected to continue, although the exact CAGR will depend on macroeconomic factors and industry-specific trends.

However, the industry isn't without its hurdles. Economic volatility, infrastructural limitations in certain regions, and the intensifying competition from diverse accommodation options (including Airbnb and other short-term rentals) pose significant challenges. Furthermore, the industry must constantly adapt to technological advancements and evolving consumer preferences, which increasingly prioritize personalized, authentic, and sustainable travel experiences. This necessitates continuous innovation in both operations and guest service.

Dominant Markets & Segments in Hospitality Industry in South Africa

The South African hospitality market is geographically diverse, with key regions showing strong growth. The largest segment is currently Mid and Upper mid-scale Hotels, driven by growing middle-class spending and an increase in business travel.

Key Drivers:

- Economic Policies: Government initiatives supporting tourism development and infrastructure investment have fueled growth.

- Infrastructure: Improvements in transportation and communication networks have enhanced accessibility to various regions, boosting tourism.

Dominance Analysis:

- By Type: Chain hotels maintain a significant share, driven by brand recognition, consistent quality, and loyalty programs. However, independent hotels still hold a strong position due to their unique offerings and localized experiences.

- By Segment: Mid and Upper mid-scale hotels dominate due to their appeal to a broader range of travelers. Luxury hotels are experiencing growth due to increased high-net-worth individual tourism, while budget and economy hotels cater to cost-conscious travelers. The service apartment segment demonstrates moderate growth, appealing to business travelers seeking extended stays.

Hospitality Industry in South Africa Product Developments

Product innovations in the South African hospitality sector include the adoption of technology to improve operational efficiency, enhance the guest experience, and personalize services. Smart hotel rooms, mobile check-in/check-out, and automated concierge services are gaining traction. There's a growing emphasis on sustainable practices, incorporating eco-friendly amenities and energy-efficient technologies. These developments aim to improve the guest experience, lower operating costs and attract environmentally conscious travelers.

Report Scope & Segmentation Analysis

This report segments the South African hospitality market by hotel type (Chain Hotels and Independent Hotels) and by hotel segment (Service Apartments, Budget and Economy Hotels, Mid and Upper mid-scale Hotels, and Luxury Hotels). Each segment's growth projections, market sizes, and competitive dynamics are analyzed, providing insights into the evolving market landscape.

Chain Hotels: This segment is characterized by strong brand recognition and consistent service quality. Growth is projected at xx% CAGR during the forecast period. Competition is intense among established international and regional chains.

Independent Hotels: This segment offers unique and localized experiences. Growth is estimated at xx% CAGR. Competition hinges on differentiation, branding, and customer experience management.

Service Apartments: This segment caters to extended-stay travelers, particularly business professionals. Projected growth is at xx% CAGR. Competition focuses on providing fully furnished accommodation and enhanced amenities.

Budget and Economy Hotels: This segment focuses on providing affordable accommodation. Growth is expected at xx% CAGR. Competition centers around value-for-money offerings.

Mid and Upper mid-scale Hotels: This segment dominates the market. Growth is projected at xx% CAGR. Competition is focused on providing a balance of quality, service, and affordability.

Luxury Hotels: This segment focuses on providing high-end services and luxury experiences. Growth is projected at xx% CAGR. Competition centers on unique experiences, personalized services, and exclusivity.

Key Drivers of Hospitality Industry in South Africa Growth

Several key factors propel the expansion of South Africa's hospitality sector. The consistent influx of both international and domestic tourists remains a primary driver. Government initiatives designed to bolster tourism, coupled with infrastructural improvements in key areas and a rising middle class with increased disposable income, further stimulate growth. Technological advancements, particularly in online booking platforms and revenue management systems, enhance operational efficiency and market reach. The burgeoning popularity of experiential tourism and sustainable, eco-conscious travel options also contribute significantly to market expansion, attracting a discerning segment of travelers.

Challenges in the Hospitality Industry in South Africa Sector

The South African hospitality industry faces a complex array of challenges. Economic downturns directly impact tourist spending and investment, creating uncertainty. Insufficient infrastructure in certain areas limits accessibility and hinders tourism development, particularly in less-developed regions. Furthermore, regulatory compliance and stringent operational standards can increase costs for businesses. Fierce competition from established hotel chains and the rise of alternative accommodation providers pressure profit margins and market share. Finally, global events and economic uncertainty, as vividly illustrated by the COVID-19 pandemic, can significantly impact the industry's performance and recovery.

Emerging Opportunities in Hospitality Industry in South Africa

Despite the challenges, numerous opportunities exist for growth and innovation within the South African hospitality sector. The rising demand for experiential and sustainable tourism provides a significant avenue for expansion. Strategic adoption of technology can enhance operational efficiency, create personalized guest experiences, and foster greater customer loyalty. Focusing on niche markets, such as wellness tourism or adventure tourism, allows businesses to target specific demographics and potentially command higher prices. Finally, collaborations with local communities to offer authentic cultural experiences can enhance South Africa's overall tourism appeal and create unique selling points.

Leading Players in the Hospitality Industry in South Africa Market

- Hilton Worldwide Holdings Inc

- InterContinental Hotels Group

- Melia Hotels International SA

- Best Western Hotels & Resorts

- Radisson Hotels

- Rotana Hotels

- Mangalis Hotel Group

- Hyatt International

- Marriott International Inc

- Accor SA

Key Developments in Hospitality Industry in South Africa Industry

- March 2022: Kasada Hospitality acquired the Cap Grace Hotel in Cape Town, marking a significant entry into the South African market for this international investor.

- May 2022: Millat Investments expanded its hospitality portfolio with the acquisition of the Winston Hotel in Johannesburg, demonstrating continued investment in the sector.

- [Add more recent key developments here with dates and brief descriptions]

Strategic Outlook for Hospitality Industry in South Africa Market

The South African hospitality market presents a promising outlook, driven by increased tourism, government support, and technological advancements. Focusing on sustainable practices, personalized guest experiences, and innovative business models will be crucial for success. Addressing infrastructure limitations and adapting to evolving consumer preferences will be key for long-term growth and profitability. The market’s diverse segments offer opportunities for specialized offerings, catering to different traveler preferences. The potential for expansion in niche areas like eco-tourism and wellness tourism is particularly promising.

Hospitality Industry in South Africa Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper mid scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in South Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in South Africa Regional Market Share

Geographic Coverage of Hospitality Industry in South Africa

Hospitality Industry in South Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector

- 3.3. Market Restrains

- 3.3.1. High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector

- 3.4. Market Trends

- 3.4.1. Growth in Tourism Sector in South Africa is Expected to Outpace Hospitality Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper mid scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper mid scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper mid scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper mid scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper mid scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper mid scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hilton Worldwide Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 InterContinental Hotels Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Melia Hotels International SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Best Western Hotels & Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Radisson Hotels

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rotana Hotels

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mangalis Hotel Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyatt International**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Marriott International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Accor SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Hilton Worldwide Holdings Inc

List of Figures

- Figure 1: Global Hospitality Industry in South Africa Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in South Africa Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in South Africa Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in South Africa Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in South Africa Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in South Africa Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in South Africa Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in South Africa Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in South Africa Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in South Africa Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in South Africa Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in South Africa Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in South Africa Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in South Africa Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in South Africa Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in South Africa Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in South Africa Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in South Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in South Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in South Africa Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in South Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in South Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in South Africa Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in South Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in South Africa Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in South Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in South Africa Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in South Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in South Africa Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in South Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in South Africa Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in South Africa?

The projected CAGR is approximately 4.43%.

2. Which companies are prominent players in the Hospitality Industry in South Africa?

Key companies in the market include Hilton Worldwide Holdings Inc, InterContinental Hotels Group, Melia Hotels International SA, 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles, Best Western Hotels & Resorts, Radisson Hotels, Rotana Hotels, Mangalis Hotel Group, Hyatt International**List Not Exhaustive, Marriott International Inc, Accor SA.

3. What are the main segments of the Hospitality Industry in South Africa?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector.

6. What are the notable trends driving market growth?

Growth in Tourism Sector in South Africa is Expected to Outpace Hospitality Industry.

7. Are there any restraints impacting market growth?

High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector.

8. Can you provide examples of recent developments in the market?

In March 2022, Kasada announced the purchase of the Cap Grace Hotel in Cape Town, South Africa. Kasada's hotel acquisition marks the company's first foray into the South African hotel operator market. It also helps Kasada's strategy of expanding into all major cities in Sub-Saharan Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in South Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in South Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in South Africa?

To stay informed about further developments, trends, and reports in the Hospitality Industry in South Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence