Key Insights

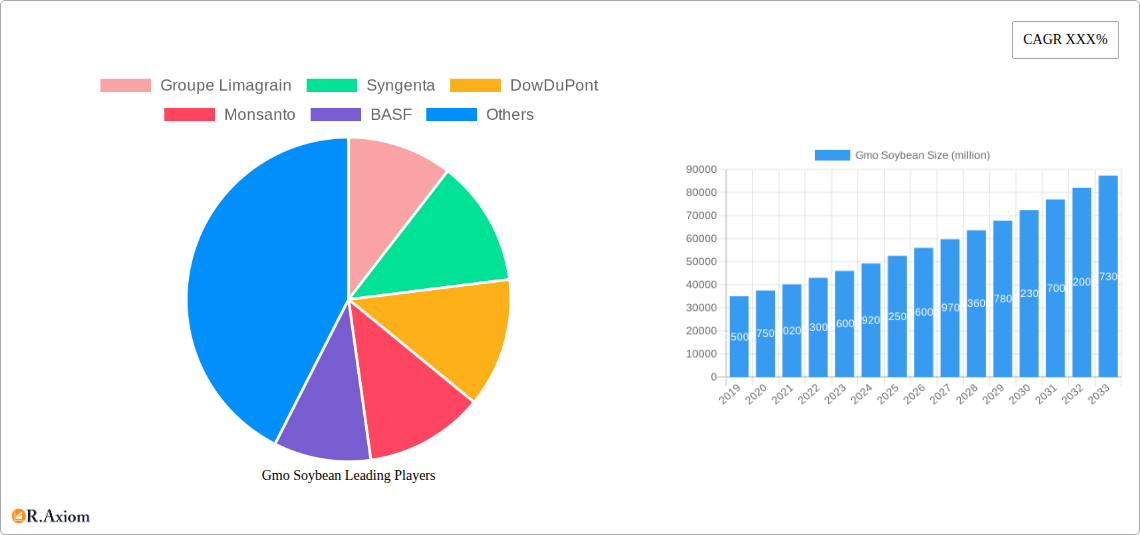

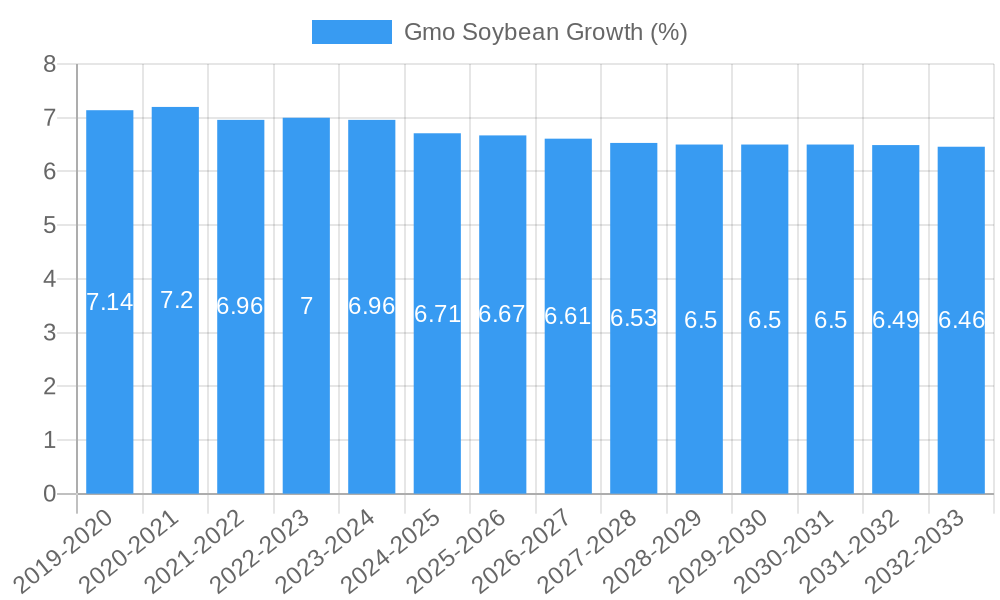

The global GMO soybean market is poised for significant expansion, projected to reach a substantial market size of approximately USD 60 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% anticipated to drive its value to an estimated USD 95 billion by 2033. This robust growth is primarily fueled by the increasing demand for genetically modified soybeans in various applications, most notably in animal feed production, which constitutes a significant portion of the market. The inherent benefits of GMO soybeans, such as enhanced yield, pest resistance, and herbicide tolerance, directly address the growing need for efficient and sustainable agricultural practices. Furthermore, the rising global population and the corresponding increase in demand for protein sources are propelling the consumption of soybeans for both human food and animal feed, making GMO varieties a crucial component of the modern agricultural landscape. The development and adoption of new, more resilient, and productive GMO traits are expected to further stimulate market growth, particularly in key agricultural regions.

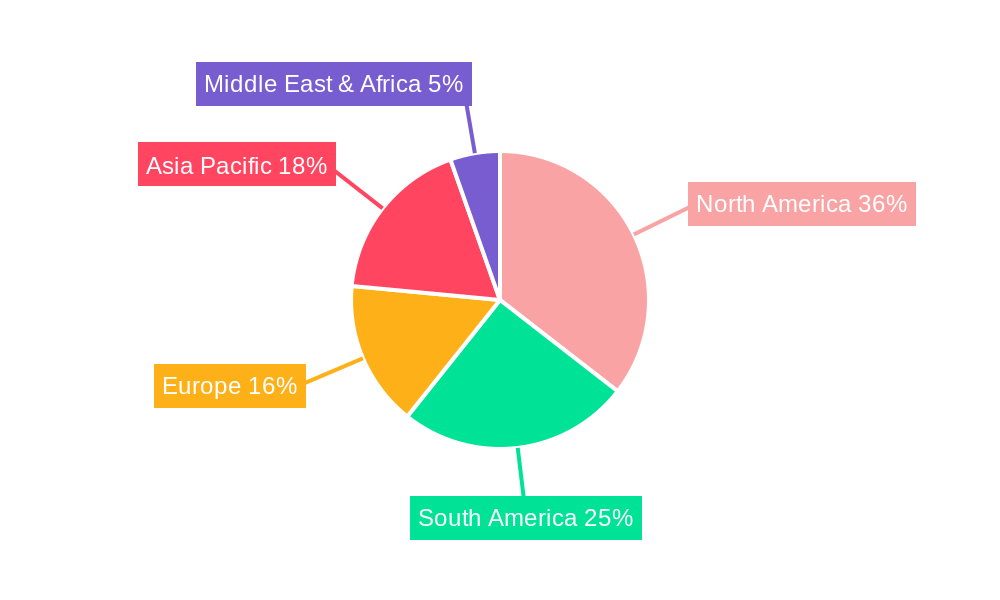

The market is strategically segmented by application and type, highlighting distinct growth trajectories. The "Feed & Residual" segment is expected to dominate due to the continuous demand from the livestock industry. The "Biodiesel" segment also presents a promising avenue for growth, driven by the global push towards renewable energy sources. In terms of type, herbicide-tolerant and insect-tolerant soybeans are expected to witness substantial adoption, as they offer farmers greater control over crop management and reduce losses. Geographically, the Asia Pacific region, led by China and India, is anticipated to be a major growth engine, owing to its large agricultural base and increasing adoption of advanced farming technologies. North America, with its established soybean cultivation and robust demand for animal feed, will continue to be a significant market. While the market benefits from strong drivers, potential restraints such as regulatory hurdles in certain regions and consumer perception concerns regarding genetically modified organisms need to be carefully navigated by market players. Companies like Syngenta, Bayer CropScience, and BASF are at the forefront, investing in research and development to introduce innovative GMO soybean traits and expand their market presence.

Here is a detailed, SEO-optimized report description for the GMO Soybean market, designed for immediate use and high search visibility.

GMO Soybean Market Concentration & Innovation

The global GMO Soybean market is characterized by a moderate to high concentration, with key players like Bayer CropScience (acquiring Monsanto), Syngenta, DowDuPont, and Groupe Limagrain holding significant market shares. Innovation within this sector is primarily driven by advancements in genetic engineering, leading to the development of soybeans with enhanced traits such as herbicide tolerance, insect resistance, and improved nutritional profiles. These innovations aim to increase crop yields, reduce the need for chemical inputs, and cater to evolving agricultural practices and consumer demands. Regulatory frameworks play a pivotal role in shaping market entry and product approval, with varying stringency across regions. The landscape of product substitutes, while present in traditional soybean varieties and alternative protein sources, is increasingly challenged by the superior performance and economic benefits offered by GMO counterparts. End-user trends are leaning towards sustainable agriculture, higher protein content in animal feed, and the demand for non-genetically modified ingredients in specific food markets, creating a dynamic environment for GMO soybean adoption. Mergers and acquisitions (M&A) have been a significant strategy for market consolidation and expansion. For instance, the acquisition of Monsanto by Bayer CropScience, valued in the tens of millions, significantly reshaped the competitive landscape. Other notable M&A activities have involved strategic partnerships and acquisitions to secure intellectual property and expand product portfolios. The total market size is projected to reach $XX million by 2033, with a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. The base year for this estimation is 2025, with a historical analysis covering 2019–2024.

GMO Soybean Industry Trends & Insights

The GMO Soybean industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and global food security imperatives. Market growth is significantly propelled by the increasing demand for enhanced crop yields and reduced cultivation costs, directly impacting the profitability of farmers worldwide. Technological disruptions, particularly in the realm of precision agriculture and advanced breeding techniques, are continuously refining GMO soybean traits. These include superior resistance to pests and diseases, tolerance to adverse environmental conditions like drought, and improved nutritional content, making them a more sustainable and efficient agricultural input. Consumer preferences are a complex factor, with a growing segment demanding transparency and non-GMO products, yet a substantial global market continues to rely on the efficiency and affordability that GMO soybeans provide, especially in animal feed and industrial applications. The competitive dynamics are intense, with major agrochemical and seed companies investing heavily in research and development to maintain their market edge. The projected market penetration of GMO soybeans is expected to rise, particularly in developing economies where agricultural productivity enhancements are critical. The market size is anticipated to reach approximately $XX million in 2025, with a projected CAGR of XX% from 2025 to 2033. The historical period from 2019 to 2024 has laid the groundwork for this expansion, characterized by steady adoption and innovation.

Dominant Markets & Segments in GMO Soybean

The dominance within the GMO Soybean market is multifaceted, with the "Feed & Residual" application segment emerging as a leading force. This segment's prominence is driven by the global demand for animal protein, necessitating efficient and cost-effective feed solutions. GMO soybeans, with their high protein content and consistent yields, are indispensable in livestock and aquaculture feed formulations, contributing to a significant portion of the market's revenue, estimated to be over $XX million in 2025.

- Application: Feed & Residual:

- Key Drivers: The ever-growing global population and increasing per capita meat consumption are the primary economic policies driving demand. Advancements in animal husbandry technology necessitate high-quality, readily available feed ingredients. The cost-effectiveness of GMO soybean meal compared to traditional protein sources makes it a favored choice. Infrastructure development supporting large-scale animal farming operations further bolsters this segment.

- Dominance Analysis: This segment is projected to account for over XX% of the total GMO soybean market in 2025. Its dominance is further cemented by its substantial role in the global food supply chain, indirectly influencing human consumption through animal products.

The "Herbicide Tolerant" type segment also exhibits significant leadership. This trait allows farmers to effectively manage weed populations using specific herbicides, leading to higher yields and reduced labor costs. The widespread availability and proven efficacy of herbicide-tolerant GMO soybeans have made them a cornerstone of modern agricultural practices.

- Type: Herbicide Tolerant:

- Key Drivers: Agricultural policies promoting efficient land use and reduced chemical application are indirectly supportive. The technological simplicity and effectiveness of herbicide tolerance offer immediate and tangible benefits to farmers. Market penetration is high due to established product lines and farmer familiarity.

- Dominance Analysis: This segment is estimated to represent over XX% of the GMO soybean market in 2025, with a projected market value exceeding $XX million. Its widespread adoption across major soybean-producing regions underscores its critical role.

While "Food" applications are also significant, they are influenced by consumer perceptions and regulatory hurdles related to genetic modification, leading to a slightly slower growth trajectory compared to feed and herbicide-tolerant varieties. The "Biodiesel" segment, though promising, remains a niche area dependent on biofuel mandates and crude oil prices. The "Others" category encompasses industrial applications, which are steadily growing but do not yet command the same market share as the primary segments. The forecast period of 2025–2033 is expected to see continued dominance of these segments, with potential shifts influenced by emerging bio-technologies and consumer advocacy.

GMO Soybean Product Developments

Recent product developments in the GMO Soybean market are focused on enhancing inherent crop capabilities. Innovations include the introduction of soybeans with multi-trait stacked genetics, offering combined resistance to various insects and herbicides, thus simplifying farm management and increasing yield potential. Furthermore, research is actively exploring soybeans engineered for improved oil profiles, such as higher oleic acid content, catering to both food and industrial applications by offering healthier fat options and improved processing characteristics. These developments aim to provide farmers with superior crop performance, greater resilience to environmental stressors, and a competitive advantage in a dynamic agricultural landscape. The market is witnessing advancements in gene-editing technologies like CRISPR, promising even more precise and efficient trait development in the near future.

Report Scope & Segmentation Analysis

This comprehensive report segments the GMO Soybean market across key application and type categories. The Application segmentation includes Food, Feed & Residual, Biodiesel, and Others. The Feed & Residual segment is projected to hold the largest market share, estimated at $XX million in 2025, driven by global demand for animal protein. The Food segment, valued at approximately $XX million in 2025, is influenced by consumer perception and regulatory landscapes. Biodiesel and Others (industrial applications) represent emerging and niche segments, with respective market sizes of $XX million and $XX million in 2025.

The Type segmentation encompasses Herbicide Tolerant, Insect Tolerant, and Others. The Herbicide Tolerant segment is dominant, anticipated to reach $XX million in 2025, due to its widespread adoption and proven benefits for weed management. The Insect Tolerant segment, valued at $XX million in 2025, offers critical protection against pests, while the Others category includes traits like drought resistance and disease resistance, with a combined market size of $XX million in 2025. The forecast period of 2025–2033 is expected to witness steady growth across all segments, with competitive dynamics intensifying as new traits and technologies emerge.

Key Drivers of GMO Soybean Growth

The growth of the GMO Soybean market is underpinned by several critical factors. Economically, the continuous increase in global population, particularly in developing nations, escalates the demand for food and animal feed, making efficient crop production paramount. Technological advancements in genetic engineering and biotechnology enable the development of soybeans with enhanced traits like herbicide tolerance and insect resistance, leading to higher yields and reduced input costs for farmers. Regulatory frameworks in many key agricultural regions are becoming more supportive of GMO crops, facilitating market access and adoption. Furthermore, the growing awareness and demand for sustainable agricultural practices, which GMO soybeans can contribute to by reducing pesticide usage and improving land utilization, also serve as a significant growth catalyst.

Challenges in the GMO Soybean Sector

Despite its growth potential, the GMO Soybean sector faces several challenges. Significant regulatory hurdles exist in certain geographical regions, where stringent approval processes and varying labeling requirements can impede market penetration and increase R&D costs. Public perception and consumer apprehension regarding genetically modified organisms, fueled by misinformation and ethical concerns, create resistance in some food markets, impacting demand. Supply chain complexities, including seed distribution, intellectual property protection, and potential cross-contamination issues, require careful management. Competitive pressures from conventional soybean varieties and alternative protein sources, coupled with price volatility in the agricultural commodity markets, also present ongoing challenges to sustained growth.

Emerging Opportunities in GMO Soybean

Emerging opportunities in the GMO Soybean market are primarily driven by innovation and evolving global needs. The development of soybeans with enhanced nutritional profiles, such as increased protein or healthier fatty acid compositions, presents a significant opportunity to cater to growing health-conscious consumer segments and specialized food applications. Advancements in climate-resilient GMO soybeans, engineered to withstand drought, salinity, and extreme temperatures, offer a critical solution for agriculture in regions facing the brunt of climate change. The expansion of industrial applications beyond biodiesel, such as bioplastics and biofuels, opens new avenues for market diversification. Furthermore, increasing adoption in developing economies, where the need for enhanced agricultural productivity is most acute, presents substantial untapped market potential.

Leading Players in the GMO Soybean Market

- Bayer CropScience

- Syngenta

- DowDuPont

- Groupe Limagrain

- BASF

- KWS Saat

Key Developments in GMO Soybean Industry

- 2023: Introduction of new multi-trait stacked GMO soybean varieties offering enhanced resistance to a broader spectrum of pests and diseases.

- 2022: Significant investment in CRISPR-based gene editing for faster and more precise development of novel soybean traits.

- 2021: Increased focus on developing GMO soybeans with improved drought tolerance to combat climate change impacts.

- 2020: Strategic partnerships formed to expand the market reach of GMO soybean seeds in emerging economies.

- 2019: Launch of GMO soybean products with enhanced oleic acid content, targeting the food and industrial oil markets.

Strategic Outlook for GMO Soybean Market

The strategic outlook for the GMO Soybean market remains robust, driven by the ongoing need for efficient and sustainable food production. Future growth catalysts include continued innovation in developing climate-resilient and nutritionally enhanced soybean varieties. The increasing adoption of precision agriculture technologies will further optimize the benefits of GMO soybeans, leading to higher yields and reduced environmental impact. As regulatory landscapes evolve and technological advancements become more accessible, market penetration is expected to deepen, particularly in developing regions. Strategic collaborations and mergers will likely continue to shape the competitive environment, fostering further development and market consolidation. The market is poised for sustained expansion as it addresses global food security challenges and caters to diverse agricultural and industrial demands.

Gmo Soybean Segmentation

-

1. Application

- 1.1. Food

- 1.2. Feed & Residual

- 1.3. Biodiesel

- 1.4. Others

-

2. Type

- 2.1. Herbicide Tolerant

- 2.2. Insect Tolerant

- 2.3. Others

Gmo Soybean Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gmo Soybean REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gmo Soybean Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.2. Feed & Residual

- 5.1.3. Biodiesel

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Herbicide Tolerant

- 5.2.2. Insect Tolerant

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gmo Soybean Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food

- 6.1.2. Feed & Residual

- 6.1.3. Biodiesel

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Herbicide Tolerant

- 6.2.2. Insect Tolerant

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Gmo Soybean Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food

- 7.1.2. Feed & Residual

- 7.1.3. Biodiesel

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Herbicide Tolerant

- 7.2.2. Insect Tolerant

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Gmo Soybean Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food

- 8.1.2. Feed & Residual

- 8.1.3. Biodiesel

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Herbicide Tolerant

- 8.2.2. Insect Tolerant

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Gmo Soybean Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food

- 9.1.2. Feed & Residual

- 9.1.3. Biodiesel

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Herbicide Tolerant

- 9.2.2. Insect Tolerant

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Gmo Soybean Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food

- 10.1.2. Feed & Residual

- 10.1.3. Biodiesel

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Herbicide Tolerant

- 10.2.2. Insect Tolerant

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Groupe Limagrain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Syngenta

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DowDuPont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Monsanto

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bayer CropScience

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KWS Saat

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Groupe Limagrain

List of Figures

- Figure 1: Global Gmo Soybean Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Gmo Soybean Revenue (million), by Application 2024 & 2032

- Figure 3: North America Gmo Soybean Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Gmo Soybean Revenue (million), by Type 2024 & 2032

- Figure 5: North America Gmo Soybean Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Gmo Soybean Revenue (million), by Country 2024 & 2032

- Figure 7: North America Gmo Soybean Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Gmo Soybean Revenue (million), by Application 2024 & 2032

- Figure 9: South America Gmo Soybean Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Gmo Soybean Revenue (million), by Type 2024 & 2032

- Figure 11: South America Gmo Soybean Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Gmo Soybean Revenue (million), by Country 2024 & 2032

- Figure 13: South America Gmo Soybean Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gmo Soybean Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Gmo Soybean Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Gmo Soybean Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Gmo Soybean Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Gmo Soybean Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Gmo Soybean Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Gmo Soybean Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Gmo Soybean Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Gmo Soybean Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Gmo Soybean Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Gmo Soybean Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Gmo Soybean Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Gmo Soybean Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Gmo Soybean Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Gmo Soybean Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Gmo Soybean Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Gmo Soybean Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Gmo Soybean Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gmo Soybean Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gmo Soybean Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Gmo Soybean Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Gmo Soybean Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Gmo Soybean Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Gmo Soybean Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Gmo Soybean Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Gmo Soybean Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Gmo Soybean Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Gmo Soybean Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Gmo Soybean Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Gmo Soybean Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Gmo Soybean Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Gmo Soybean Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Gmo Soybean Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Gmo Soybean Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Gmo Soybean Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Gmo Soybean Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Gmo Soybean Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Gmo Soybean Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gmo Soybean?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Gmo Soybean?

Key companies in the market include Groupe Limagrain, Syngenta, DowDuPont, Monsanto, BASF, Bayer CropScience, KWS Saat.

3. What are the main segments of the Gmo Soybean?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gmo Soybean," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gmo Soybean report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gmo Soybean?

To stay informed about further developments, trends, and reports in the Gmo Soybean, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence