Key Insights

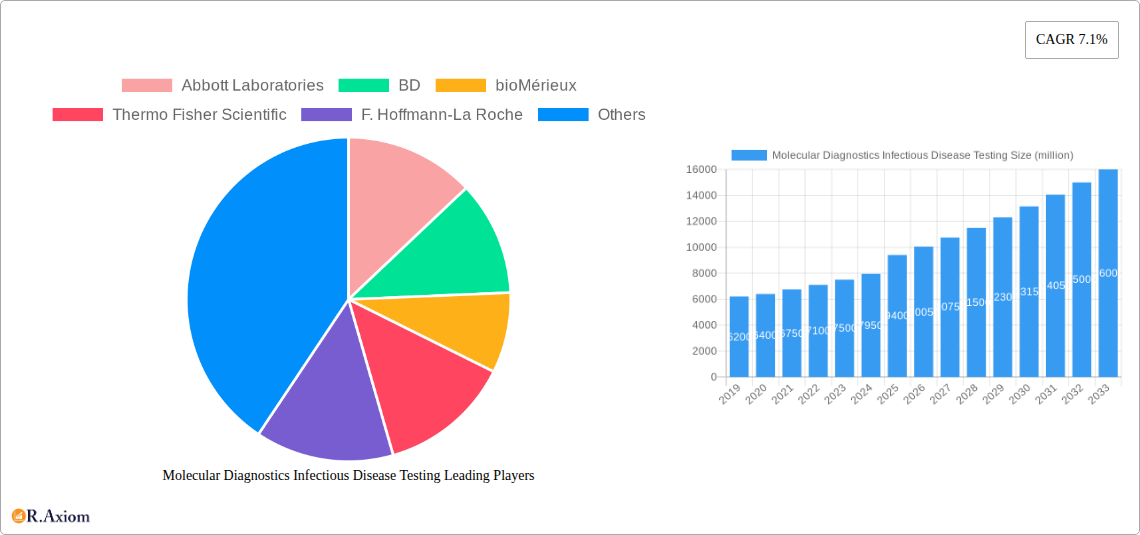

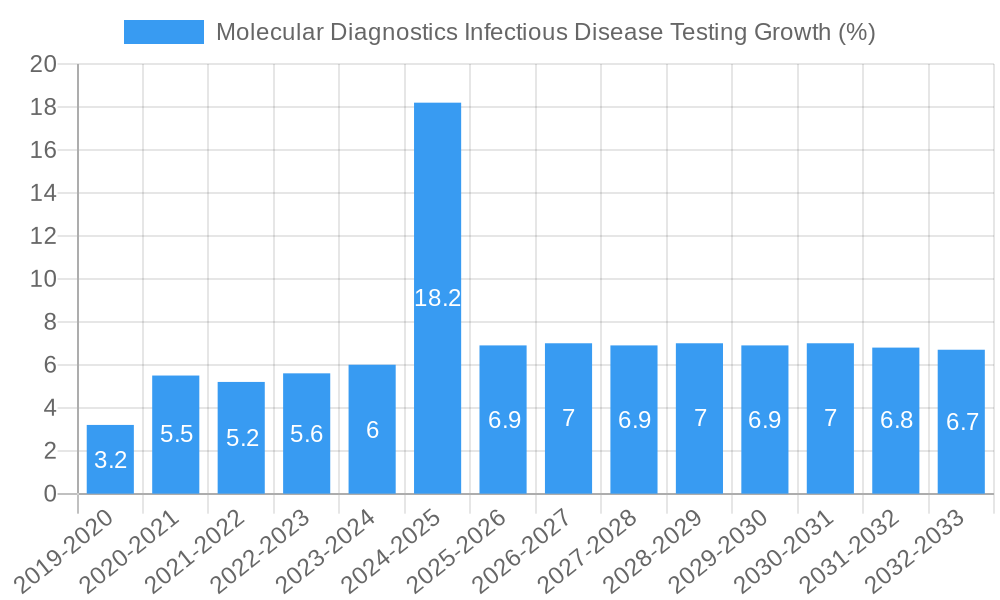

The global Molecular Diagnostics Infectious Disease Testing market is poised for substantial growth, projected to reach a market size of approximately $9,400 million by 2025. This robust expansion is driven by an estimated Compound Annual Growth Rate (CAGR) of 7.1% throughout the forecast period, indicating a dynamic and expanding sector within healthcare. The increasing prevalence of infectious diseases globally, coupled with advancements in diagnostic technologies and a growing emphasis on early and accurate disease detection, are key catalysts for this market's upward trajectory. Furthermore, rising healthcare expenditure, particularly in emerging economies, and the expanding applications of molecular diagnostics in both hospital settings and laboratory research contribute significantly to market demand. The ongoing battle against novel pathogens and the need for rapid identification and management of outbreaks further underscore the critical importance and growing reliance on molecular diagnostic solutions.

The market segmentation reveals a diverse landscape with significant opportunities across various applications and test types. Within applications, Hospitals are expected to be a dominant segment due to the critical need for point-of-care diagnostics and patient management. Laboratory Research also represents a crucial segment, supporting the development of new diagnostic tools and the understanding of disease mechanisms. In terms of testing types, Bacterial Infectious Disease Testing and Viral Infectious Disease Testing are anticipated to hold the largest market shares, reflecting the widespread impact of these pathogens. Parasitic Infectious Disease Testing, while a smaller segment, is also expected to witness steady growth, particularly in endemic regions. The competitive landscape is characterized by the presence of major global players like Abbott Laboratories, Thermo Fisher Scientific, and F. Hoffmann-La Roche, who are continuously investing in research and development to introduce innovative and cost-effective diagnostic solutions, thereby shaping the market's evolution.

The Molecular Diagnostics Infectious Disease Testing market exhibits a moderate to high concentration, with key players like Abbott Laboratories, Thermo Fisher Scientific, and F. Hoffmann-La Roche dominating significant market shares, estimated to be in the range of 15-25% each. Innovation is the primary engine driving market dynamics, fueled by advancements in PCR, isothermal amplification, and next-generation sequencing technologies. The market is further shaped by stringent regulatory frameworks established by bodies such as the FDA and EMA, which, while ensuring product safety and efficacy, also present a barrier to entry for new participants. Product substitutes, though less precise and slower, still exist in traditional culture-based methods, particularly in resource-limited settings. End-user trends are increasingly leaning towards point-of-care (POC) testing, decentralized testing, and multiplexing capabilities for faster and more comprehensive diagnostics. Merger and acquisition (M&A) activities are notable, with deal values in the hundreds of millions of dollars, driven by the desire for technology acquisition and market expansion. For instance, the acquisition of GenMark Diagnostics by Roche for an estimated $1,000 million highlights this trend.

Molecular Diagnostics Infectious Disease Testing Industry Trends & Insights

The Molecular Diagnostics Infectious Disease Testing market is experiencing robust growth, driven by a confluence of factors including the increasing global burden of infectious diseases, rising healthcare expenditures, and a growing demand for accurate and rapid diagnostic solutions. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be around 10-12%, translating to a market size expected to reach over $20,000 million by 2033. Technological disruptions, such as the miniaturization of instruments, the development of automated platforms, and the integration of artificial intelligence (AI) for data analysis, are revolutionizing the field. Consumer preferences are shifting towards non-invasive testing methods, home-based diagnostics, and personalized medicine approaches, demanding greater accessibility and convenience. Competitive dynamics are intense, with established giants like Abbott Laboratories, Thermo Fisher Scientific, and bioMérieux vying for market leadership alongside agile innovators like Luminex and Genomix Biotech. Market penetration is steadily increasing, particularly in developed regions, as healthcare providers recognize the superior sensitivity and specificity of molecular diagnostics over traditional methods. The ongoing threat of novel pathogens and the resurgence of old ones underscore the critical importance of advanced molecular diagnostics for effective disease surveillance and management. The development of syndromic testing panels, which can simultaneously detect multiple pathogens from a single sample, represents a significant advancement catering to clinician needs for efficient and comprehensive diagnoses.

Dominant Markets & Segments in Molecular Diagnostics Infectious Disease Testing

The Hospital application segment stands as the dominant force within the Molecular Diagnostics Infectious Disease Testing market. This dominance is driven by several key factors, including the high volume of infectious disease cases managed within hospital settings, the availability of advanced infrastructure and trained personnel, and the critical need for rapid and accurate diagnoses to guide patient treatment and prevent outbreaks. Hospitals are at the forefront of adopting cutting-edge molecular diagnostic technologies due to their ability to detect a wide range of pathogens, including those that are difficult to culture or are antibiotic-resistant. The economic policies in many countries favor the integration of advanced diagnostics into hospital workflows to improve patient outcomes and reduce hospital stays, further bolstering this segment.

- Key Drivers for Hospital Dominance:

- High Patient Load: Hospitals manage the majority of severe infectious disease cases, necessitating rapid and precise diagnostics.

- Technological Adoption: Hospitals are early adopters of advanced molecular diagnostic platforms due to their clinical utility and return on investment in terms of patient management.

- Infection Control: Robust molecular testing is crucial for effective infection control protocols within hospital environments, preventing nosocomial infections.

- Reimbursement Policies: Favorable reimbursement for molecular diagnostic tests in hospital settings supports their widespread use.

Within the Type segmentation, Viral Infectious Disease Testing currently holds the largest market share and is expected to continue its dominance. The global prevalence of viral infections, including influenza, HIV, hepatitis, and the persistent threat of emerging viral pandemics (such as COVID-19), fuels the demand for sophisticated viral detection and characterization. Technological advancements have made it possible to rapidly and accurately identify even low viral loads, crucial for early intervention and public health responses. The development of multiplex panels capable of detecting multiple respiratory viruses simultaneously, for instance, has significantly enhanced diagnostic efficiency in hospital and laboratory research settings.

- Key Drivers for Viral Infectious Disease Testing Dominance:

- Pandemic Preparedness: The global experience with pandemics has underscored the critical need for rapid and reliable viral diagnostics.

- Chronic Viral Infections: The management of chronic viral infections like HIV and hepatitis requires continuous monitoring and diagnosis.

- Technological Advancements: PCR and sequencing technologies have made viral detection highly sensitive and specific.

- Public Health Surveillance: Molecular diagnostics are essential for tracking viral spread and identifying new strains.

Molecular Diagnostics Infectious Disease Testing Product Developments

Product development in molecular diagnostics for infectious diseases is characterized by an ongoing pursuit of enhanced sensitivity, specificity, speed, and multiplexing capabilities. Innovations are heavily focused on point-of-care (POC) devices that enable rapid testing directly at the patient's bedside or in decentralized settings, reducing turnaround times and improving patient outcomes. The integration of AI and machine learning for data interpretation and pattern recognition is also a significant trend, offering more accurate diagnoses and predictive insights. Furthermore, the development of broad-spectrum panels that can detect a wide array of pathogens from a single sample is enhancing diagnostic efficiency and cost-effectiveness. These advancements offer a significant competitive advantage by addressing the unmet needs for faster, more accessible, and comprehensive infectious disease diagnostics.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Molecular Diagnostics Infectious Disease Testing market, segmented by Application and Type. The Hospital application segment is projected for substantial growth, driven by increased adoption of advanced diagnostics for patient care and infection control, with an estimated market size of over $12,000 million by 2033. The Laboratory Research segment, while smaller, will also experience steady growth, fueled by ongoing R&D efforts and the development of novel diagnostic assays, with an estimated market size of over $8,000 million by 2033.

In terms of Type, Viral Infectious Disease Testing is expected to maintain its leading position with an estimated market size exceeding $10,000 million by 2033, owing to the persistent threat of viral outbreaks and advancements in viral detection technologies. Bacterial Infectious Disease Testing is a significant and growing segment, driven by the rise of antibiotic resistance and the need for rapid pathogen identification, with an estimated market size of over $7,000 million by 2033. Parasitic Infectious Disease Testing, though currently a smaller segment, is poised for notable growth, particularly in endemic regions, with an estimated market size of over $3,000 million by 2033.

Key Drivers of Molecular Diagnostics Infectious Disease Testing Growth

The growth of the Molecular Diagnostics Infectious Disease Testing market is propelled by several key drivers. Technologically, advancements in Polymerase Chain Reaction (PCR), isothermal amplification, and next-generation sequencing (NGS) have dramatically improved sensitivity, specificity, and speed. Economically, rising healthcare expenditures globally, coupled with increasing investments in public health infrastructure and a growing demand for rapid diagnostics in response to emerging infectious diseases, are significant catalysts. Regulatory support, including faster approval pathways for innovative diagnostic tests and reimbursement policies that favor molecular diagnostics, further accelerates market penetration. The increasing prevalence of antibiotic-resistant bacteria also necessitates advanced molecular methods for accurate pathogen identification and susceptibility testing.

Challenges in the Molecular Diagnostics Infectious Disease Testing Sector

Despite robust growth, the Molecular Diagnostics Infectious Disease Testing sector faces several challenges. Regulatory hurdles remain a significant barrier, with lengthy and complex approval processes for new diagnostic tests potentially delaying market entry. High development and manufacturing costs for advanced molecular diagnostic platforms and reagents can limit accessibility, especially in low-resource settings. Supply chain disruptions, as evidenced during recent global health crises, can impact the availability of essential components and reagents. Furthermore, fierce competition among established players and emerging innovators leads to pricing pressures. The need for highly skilled personnel to operate and interpret complex molecular diagnostic instruments also presents a workforce challenge.

Emerging Opportunities in Molecular Diagnostics Infectious Disease Testing

Emerging opportunities in the Molecular Diagnostics Infectious Disease Testing market are abundant. The increasing demand for point-of-care (POC) diagnostics presents a significant avenue for growth, enabling faster decision-making at the patient's bedside. The development of multiplex assays that can simultaneously detect multiple pathogens from a single sample offers enhanced efficiency and cost-effectiveness. The integration of artificial intelligence (AI) and machine learning into diagnostic platforms for advanced data analysis and predictive diagnostics is a rapidly evolving area. Furthermore, the expansion of molecular diagnostics into new geographic markets, particularly in emerging economies with growing healthcare infrastructures and increasing awareness of infectious diseases, offers substantial potential. The focus on companion diagnostics for targeted therapies also represents a growing niche.

Leading Players in the Molecular Diagnostics Infectious Disease Testing Market

- Abbott Laboratories

- BD

- bioMérieux

- Thermo Fisher Scientific

- F. Hoffmann-La Roche

- Siemens AG

- Veridex

- Luminex

- GenMark Diagnostics

- Qiagen NV

- Genomix Biotech

- BioTheranostics

Key Developments in Molecular Diagnostics Infectious Disease Testing Industry

- 2023/Q4: Roche announces the launch of a new multiplex assay for the rapid detection of respiratory pathogens, enhancing syndromic testing capabilities.

- 2023/Q3: Abbott Laboratories receives FDA clearance for an updated version of its molecular diagnostic platform, offering increased throughput and reduced turnaround time.

- 2023/Q2: BD acquires a novel molecular diagnostics technology provider, strengthening its portfolio in infectious disease testing.

- 2022/Q4: Thermo Fisher Scientific expands its instrument manufacturing capacity to meet growing global demand for molecular diagnostics.

- 2022/Q3: bioMérieux introduces a new AI-powered interpretation software for its molecular diagnostic systems, improving diagnostic accuracy.

- 2022/Q1: Luminex partners with a leading academic institution to research advanced nucleic acid amplification techniques for infectious disease detection.

- 2021/Q4: GenMark Diagnostics receives CE-IVD marking for its ePlex SARS-CoV-2 test, broadening its European market reach.

- 2021/Q2: Qiagen NV launches a portable molecular diagnostic device for rapid on-site testing of infectious agents.

- 2020/Q4: Siemens Healthineers announces a strategic collaboration to advance point-of-care molecular diagnostics.

- 2020/Q1: Genomix Biotech receives funding to accelerate the development of its next-generation sequencing-based infectious disease diagnostic platform.

- 2019/Q4: BioTheranostics secures a significant partnership to integrate its molecular diagnostic tests for infectious diseases into hospital laboratory workflows.

Strategic Outlook for Molecular Diagnostics Infectious Disease Testing Market

- 2023/Q4: Roche announces the launch of a new multiplex assay for the rapid detection of respiratory pathogens, enhancing syndromic testing capabilities.

- 2023/Q3: Abbott Laboratories receives FDA clearance for an updated version of its molecular diagnostic platform, offering increased throughput and reduced turnaround time.

- 2023/Q2: BD acquires a novel molecular diagnostics technology provider, strengthening its portfolio in infectious disease testing.

- 2022/Q4: Thermo Fisher Scientific expands its instrument manufacturing capacity to meet growing global demand for molecular diagnostics.

- 2022/Q3: bioMérieux introduces a new AI-powered interpretation software for its molecular diagnostic systems, improving diagnostic accuracy.

- 2022/Q1: Luminex partners with a leading academic institution to research advanced nucleic acid amplification techniques for infectious disease detection.

- 2021/Q4: GenMark Diagnostics receives CE-IVD marking for its ePlex SARS-CoV-2 test, broadening its European market reach.

- 2021/Q2: Qiagen NV launches a portable molecular diagnostic device for rapid on-site testing of infectious agents.

- 2020/Q4: Siemens Healthineers announces a strategic collaboration to advance point-of-care molecular diagnostics.

- 2020/Q1: Genomix Biotech receives funding to accelerate the development of its next-generation sequencing-based infectious disease diagnostic platform.

- 2019/Q4: BioTheranostics secures a significant partnership to integrate its molecular diagnostic tests for infectious diseases into hospital laboratory workflows.

Strategic Outlook for Molecular Diagnostics Infectious Disease Testing Market

The strategic outlook for the Molecular Diagnostics Infectious Disease Testing market remains exceptionally positive, driven by an unrelenting need for accurate and timely disease detection in an increasingly interconnected world. Future growth will be significantly influenced by continued technological innovation, particularly in areas such as liquid biopsy, microfluidics, and AI-driven diagnostics, which promise even greater speed, sensitivity, and accessibility. The ongoing threat of emerging infectious diseases, coupled with the persistent challenge of antimicrobial resistance, will sustain demand for advanced molecular solutions. Strategic partnerships, mergers, and acquisitions will continue to reshape the competitive landscape, allowing companies to expand their portfolios, gain market share, and access new technologies. Investments in emerging economies and the expansion of point-of-care testing will be crucial for unlocking future market potential, making molecular diagnostics an indispensable tool in global health security and personalized medicine.

Molecular Diagnostics Infectious Disease Testing Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Laboratory Research

-

2. Type

- 2.1. Bacterial Infectious Disease Testing

- 2.2. Viral Infectious Disease Testing

- 2.3. Parasitic Infectious Disease Testing

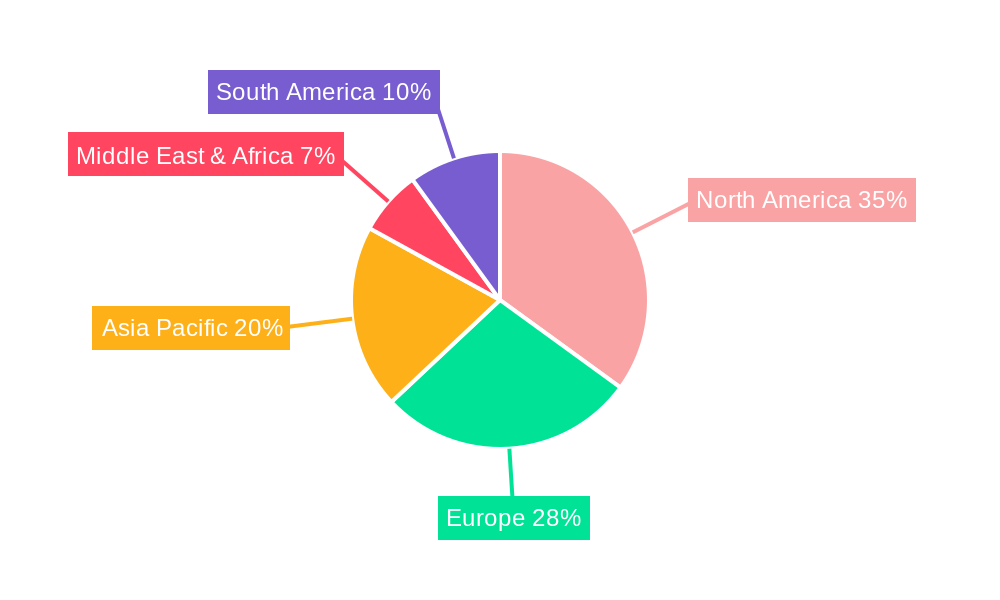

Molecular Diagnostics Infectious Disease Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Molecular Diagnostics Infectious Disease Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Molecular Diagnostics Infectious Disease Testing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Laboratory Research

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bacterial Infectious Disease Testing

- 5.2.2. Viral Infectious Disease Testing

- 5.2.3. Parasitic Infectious Disease Testing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Molecular Diagnostics Infectious Disease Testing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Laboratory Research

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Bacterial Infectious Disease Testing

- 6.2.2. Viral Infectious Disease Testing

- 6.2.3. Parasitic Infectious Disease Testing

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Molecular Diagnostics Infectious Disease Testing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Laboratory Research

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Bacterial Infectious Disease Testing

- 7.2.2. Viral Infectious Disease Testing

- 7.2.3. Parasitic Infectious Disease Testing

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Molecular Diagnostics Infectious Disease Testing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Laboratory Research

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Bacterial Infectious Disease Testing

- 8.2.2. Viral Infectious Disease Testing

- 8.2.3. Parasitic Infectious Disease Testing

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Molecular Diagnostics Infectious Disease Testing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Laboratory Research

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Bacterial Infectious Disease Testing

- 9.2.2. Viral Infectious Disease Testing

- 9.2.3. Parasitic Infectious Disease Testing

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Molecular Diagnostics Infectious Disease Testing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Laboratory Research

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Bacterial Infectious Disease Testing

- 10.2.2. Viral Infectious Disease Testing

- 10.2.3. Parasitic Infectious Disease Testing

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Abbott Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 bioMérieux

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F. Hoffmann-La Roche

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Veridex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Luminex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GenMark Diagnostics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qiagen NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Genomix Biotech

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BioTheranostics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GenMark Diagnostics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Abbott Laboratories

List of Figures

- Figure 1: Global Molecular Diagnostics Infectious Disease Testing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Molecular Diagnostics Infectious Disease Testing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Molecular Diagnostics Infectious Disease Testing Revenue (million), by Type 2024 & 2032

- Figure 5: North America Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Molecular Diagnostics Infectious Disease Testing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Molecular Diagnostics Infectious Disease Testing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Molecular Diagnostics Infectious Disease Testing Revenue (million), by Type 2024 & 2032

- Figure 11: South America Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Molecular Diagnostics Infectious Disease Testing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Molecular Diagnostics Infectious Disease Testing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Molecular Diagnostics Infectious Disease Testing Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Molecular Diagnostics Infectious Disease Testing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Molecular Diagnostics Infectious Disease Testing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Molecular Diagnostics Infectious Disease Testing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Molecular Diagnostics Infectious Disease Testing?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Molecular Diagnostics Infectious Disease Testing?

Key companies in the market include Abbott Laboratories, BD, bioMérieux, Thermo Fisher Scientific, F. Hoffmann-La Roche, Siemens AG, Veridex, Luminex, GenMark Diagnostics, Qiagen NV, Genomix Biotech, BioTheranostics, GenMark Diagnostics.

3. What are the main segments of the Molecular Diagnostics Infectious Disease Testing?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9400 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Molecular Diagnostics Infectious Disease Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Molecular Diagnostics Infectious Disease Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Molecular Diagnostics Infectious Disease Testing?

To stay informed about further developments, trends, and reports in the Molecular Diagnostics Infectious Disease Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence