Key Insights

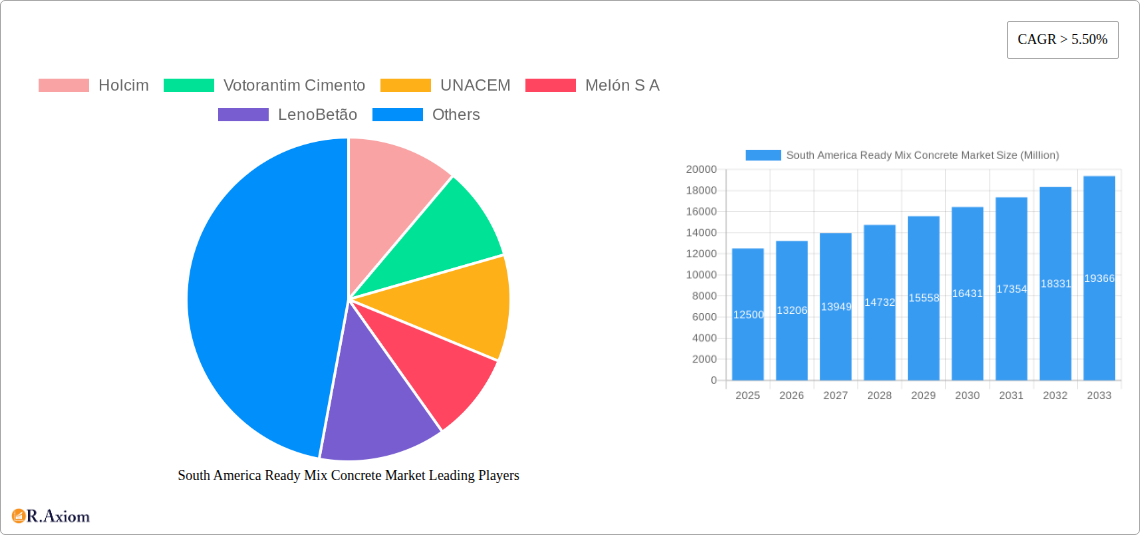

The South America Ready Mix Concrete Market is poised for robust growth, projected to exceed a market size of approximately $12,500 million by 2025, with a compound annual growth rate (CAGR) surpassing 5.50% through 2033. This significant expansion is primarily propelled by the burgeoning infrastructure development across the region, driven by government investments in transportation networks, utilities, and urban renewal projects. The increasing urbanization, coupled with a growing demand for modern and sustainable construction practices, further fuels the adoption of ready-mix concrete for its efficiency, quality control, and reduced environmental impact compared to traditional on-site mixing. Key drivers include ongoing large-scale construction projects in countries like Brazil, Colombia, and Peru, which are seeing substantial investments in housing, commercial complexes, and industrial facilities. The industrial and institutional segments are particularly strong contributors, reflecting the expansion of manufacturing capabilities and public service infrastructure.

South America Ready Mix Concrete Market Market Size (In Billion)

Emerging trends in the South America Ready Mix Concrete Market are leaning towards enhanced sustainability and technological integration. Innovations in concrete formulations, such as the incorporation of supplementary cementitious materials (SCMs) like fly ash and slag, are gaining traction to reduce the carbon footprint of construction. Furthermore, the adoption of advanced mixing technologies, including shrink-mixed and transit-mixed concrete, is optimizing logistics and ensuring consistent product quality. While the market demonstrates strong growth potential, certain restraints, such as fluctuating raw material prices and logistical challenges in remote areas, need to be navigated. The competitive landscape features prominent players like Holcim, Votorantim Cimento, and CEMEX S.A.B. de C.V., who are actively investing in expanding their production capacities and diversifying their product portfolios to cater to the evolving demands for specialized and eco-friendly concrete solutions.

South America Ready Mix Concrete Market Company Market Share

This in-depth report provides a strategic overview of the South America Ready Mix Concrete market, offering actionable insights for industry stakeholders, investors, and decision-makers. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis delves into market concentration, key trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. Gain a competitive edge with detailed segmentation across end-use sectors (Commercial, Industrial and Institutional, Infrastructure, Residential) and product types (Central Mixed, Shrink Mixed, Transit Mixed).

South America Ready Mix Concrete Market Market Concentration & Innovation

The South America Ready Mix Concrete market exhibits a moderate to high level of concentration, with a few key players dominating significant market share. Companies like Holcim, Votorantim Cimento, and CEMEX S.A.B. de C.V. hold substantial influence through their extensive production capacities and established distribution networks. Innovation in this sector is primarily driven by the demand for sustainable concrete solutions, enhanced performance characteristics, and efficient construction practices. Regulatory frameworks, such as building codes and environmental standards, play a crucial role in shaping market dynamics and influencing product development. While direct product substitutes for ready-mix concrete are limited in large-scale construction, alternative construction methods can pose indirect competition. End-user trends favor customized mixes for specific project requirements, leading to greater demand for specialized products. Mergers and acquisitions (M&A) activities are strategic tools for market expansion and consolidation. For instance, Holcim's divestment of its Brazilian business in September 2022, valued at USD 1.025 billion, involved 19 ready-mix concrete plants, indicating significant M&A activity and market restructuring.

South America Ready Mix Concrete Market Industry Trends & Insights

The South America Ready Mix Concrete market is poised for robust growth, propelled by significant infrastructure development, urbanization, and a growing emphasis on sustainable construction practices. The CAGR for the forecast period (2025-2033) is projected to be substantial, reflecting the region's economic development and investment in construction projects. Urbanization in major economies like Brazil, Argentina, and Colombia fuels demand for residential, commercial, and industrial buildings, consequently increasing the consumption of ready-mix concrete. Infrastructure projects, including roads, bridges, public transportation, and energy facilities, represent a significant market penetration driver. Technological disruptions, such as advancements in admixture technology, self-compacting concrete, and digitalized plant management systems, are enhancing efficiency, performance, and sustainability. Consumer preferences are shifting towards eco-friendly materials and construction methods, pushing manufacturers to develop low-carbon footprint concrete options. Competitive dynamics are characterized by strategic partnerships, capacity expansions, and a focus on operational efficiency. The market penetration of ready-mix concrete is expected to deepen as traditional on-site mixing methods are phased out in favor of more efficient and controlled batching. Economic policies and government initiatives promoting construction and infrastructure development are critical in shaping the market's trajectory. The demand for high-performance concrete, resistant to harsh environmental conditions, is also a growing trend.

Dominant Markets & Segments in South America Ready Mix Concrete Market

The Infrastructure end-use sector is a dominant force in the South America Ready Mix Concrete market, driven by substantial government investments in transportation networks, utilities, and public facilities across the region. Countries like Brazil, with its vast geographical expanse and ongoing development projects, lead this segment. Economic policies that prioritize infrastructure upgrades and connectivity are key drivers.

- Infrastructure:

- Key Drivers: Government spending on highways, bridges, airports, dams, and public transport projects. Urban regeneration initiatives and expansion of energy infrastructure.

- Dominance Analysis: Significant demand from large-scale civil engineering projects. Long-term contracts and project-based sales characterize this segment. Investment in sustainable and durable concrete solutions for critical infrastructure is a growing trend.

The Residential segment is another major contributor, fueled by a growing population, increasing urbanization, and rising disposable incomes. As economies expand, the demand for housing, from affordable units to luxury apartments, escalates.

- Residential:

- Key Drivers: Population growth, increasing urbanization, demand for affordable and mid-rise housing. Government housing programs and real estate development.

- Dominance Analysis: Consistent demand from developers and individual builders. Focus on cost-effectiveness and timely delivery. Rise of precast concrete elements for faster construction.

The Commercial, Industrial and Institutional segment also plays a vital role, encompassing the construction of offices, retail spaces, factories, hospitals, and educational institutions. This segment is closely tied to economic activity and business investment.

- Commercial, Industrial and Institutional:

- Key Drivers: Business expansion, industrial growth, development of commercial hubs and retail centers, investments in healthcare and education facilities.

- Dominance Analysis: Demand for specialized concrete mixes for specific industrial processes or building functionalities. Emphasis on durability, safety, and aesthetic appeal.

In terms of product types, Central Mixed concrete, where all ingredients are mixed at a stationary plant before being transported, often holds a significant market share due to its controlled quality and consistency, especially for larger projects.

- Central Mixed:

- Key Drivers: Superior quality control and consistency for large-scale construction projects. Reduced on-site labor and improved efficiency.

- Dominance Analysis: Preferred for major infrastructure and commercial developments. Allows for precise mix designs and batch verification.

Transit Mixed concrete, where mixing is completed during transportation to the construction site, offers flexibility and is widely used.

- Transit Mixed:

- Key Drivers: Flexibility in delivery and batch size. Suitable for a wide range of construction projects. Cost-effectiveness for smaller to medium-sized projects.

- Dominance Analysis: Versatile and widely adopted across various construction types. Balances quality with logistical efficiency.

Shrink Mixed concrete, a hybrid approach, is also utilized, offering a balance between central and transit mixing.

- Shrink Mixed:

- Key Drivers: Offers a compromise between central and transit mixing, allowing for some mixing at the plant and final mixing during transit.

- Dominance Analysis: Used for projects requiring specific mixing durations and where transport distances might be a factor.

South America Ready Mix Concrete Market Product Developments

Product development in the South America Ready Mix Concrete market is increasingly focused on sustainability and performance enhancement. Innovations include the development of low-carbon concrete utilizing supplementary cementitious materials (SCMs) like fly ash and slag, and the incorporation of recycled aggregates. High-performance concrete with enhanced strength, durability, and resistance to aggressive environments is also a key trend, catering to demanding infrastructure projects and challenging climatic conditions.

Report Scope & Segmentation Analysis

This report encompasses the South America Ready Mix Concrete market, segmented by End Use Sector into Commercial, Industrial and Institutional, Infrastructure, and Residential. The market is also segmented by Product into Central Mixed, Shrink Mixed, and Transit Mixed. Growth projections and market sizes for each segment are analyzed, considering competitive dynamics and regional economic factors.

- Commercial, Industrial and Institutional: Projected to witness steady growth driven by business expansion and development in urban centers.

- Infrastructure: Expected to be the largest segment, propelled by significant government investment in transportation and energy projects.

- Residential: Forecasted for substantial growth due to urbanization and increasing housing demand.

- Central Mixed: Anticipated to maintain a strong market share, particularly for large-scale projects demanding high quality control.

- Shrink Mixed: Expected to cater to specific project needs requiring a balanced mixing approach.

- Transit Mixed: Forecasted to remain a versatile and widely adopted product, especially for smaller to medium-sized applications.

Key Drivers of South America Ready Mix Concrete Market Growth

The South America Ready Mix Concrete market is primarily driven by a confluence of factors. Robust economic growth across several nations fuels construction activity, leading to increased demand for ready-mix concrete. Significant government investments in infrastructure projects, such as transportation networks, energy facilities, and public works, are a major catalyst. Urbanization trends and the resulting demand for residential and commercial buildings also contribute significantly. Furthermore, a growing awareness and adoption of sustainable construction practices are pushing for the use of eco-friendly concrete formulations.

Challenges in the South America Ready Mix Concrete Market Sector

Despite the positive outlook, the South America Ready Mix Concrete market faces several challenges. Volatility in raw material prices, particularly cement and aggregates, can impact profitability and pricing strategies. Infrastructural limitations in certain regions can hinder efficient logistics and timely delivery of concrete. Stringent environmental regulations, while driving sustainability, can also increase compliance costs. Intense competition among market players can lead to price wars, affecting profit margins. Furthermore, economic and political instability in some countries can deter investment and slow down construction projects.

Emerging Opportunities in South America Ready Mix Concrete Market

Emerging opportunities lie in the development and adoption of innovative, sustainable concrete technologies. The demand for self-healing concrete, high-strength concrete for advanced structures, and concrete made with recycled materials presents significant growth potential. The expansion of construction in previously underserved regions, coupled with the increasing adoption of precast concrete solutions, also offers new avenues for market penetration. Digitalization of operations, including advanced plant management systems and logistics optimization, can improve efficiency and competitiveness.

Leading Players in the South America Ready Mix Concrete Market Market

- Holcim

- Votorantim Cimento

- UNACEM

- Melón S A

- LenoBetão

- ULTRACEM S A S

- CEMEX S A B de C V

- Argos Group

- Polimix Concreto

- Supermix

Key Developments in South America Ready Mix Concrete Market Industry

- August 2023: Polimix Concreto augmented its presence in Brazil's concrete market by inaugurating a new production facility for ready-mix concrete in Campinas, Sao Paulo.

- May 2023: Polimix Concreto expanded its presence in Brazil's concrete market by commissioning a new manufacturing facility in Mooca, Sao Paulo. Polimix Concreto aims to cater to more customers through this expansion.

- September 2022: Holcim completed divesting its business in Brazil to Companhia Siderúrgica Nacional for USD 1.025 billion. The divestment includes Holcim's 19 ready-mix concrete plants.

Strategic Outlook for South America Ready Mix Concrete Market Market

The strategic outlook for the South America Ready Mix Concrete market is exceptionally promising, driven by sustained infrastructure development, robust urbanization, and a growing emphasis on sustainable construction. Key growth catalysts include ongoing large-scale infrastructure projects in countries like Brazil and Colombia, which will continue to propel demand for ready-mix concrete. Furthermore, the increasing adoption of advanced concrete technologies and eco-friendly solutions presents significant opportunities for market leaders to innovate and differentiate. Strategic partnerships, capacity expansions in high-demand regions, and a focus on operational efficiency will be crucial for capitalizing on the expanding market potential. The shift towards digitalization in concrete production and logistics is also expected to enhance competitiveness and service delivery.

South America Ready Mix Concrete Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Central Mixed

- 2.2. Shrink Mixed

- 2.3. Transit Mixed

South America Ready Mix Concrete Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Ready Mix Concrete Market Regional Market Share

Geographic Coverage of South America Ready Mix Concrete Market

South America Ready Mix Concrete Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Ready Mix Concrete Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Central Mixed

- 5.2.2. Shrink Mixed

- 5.2.3. Transit Mixed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Holcim

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Votorantim Cimento

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UNACEM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melón S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LenoBetão

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ULTRACEM S A S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEMEX S A B de C V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Argos Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Polimix Concreto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Supermix

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Holcim

List of Figures

- Figure 1: South America Ready Mix Concrete Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Ready Mix Concrete Market Share (%) by Company 2025

List of Tables

- Table 1: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 2: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: South America Ready Mix Concrete Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Ready Mix Concrete Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 8: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: South America Ready Mix Concrete Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Ready Mix Concrete Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Ready Mix Concrete Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South America Ready Mix Concrete Market?

Key companies in the market include Holcim, Votorantim Cimento, UNACEM, Melón S A, LenoBetão, ULTRACEM S A S, CEMEX S A B de C V, Argos Group, Polimix Concreto, Supermix.

3. What are the main segments of the South America Ready Mix Concrete Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

August 2023: Polimix Concreto augmented its presence in Brazil's concrete market by inaugurating a new production facility for ready-mix concrete in Campinas, Sao Paulo.May 2023: Polimix Concreto expanded its presence in Brazil's concrete market by commissioning a new manufacturing facility in Mooca, Sao Paulo. Polimix Concreto aims to cater to more customers through this expansion.September 2022: Holcim completed divesting its business in Brazil to Companhia Siderúrgica Nacional for USD 1.025 billion. The divestment includes Holcim's 19 ready-mix concrete plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Ready Mix Concrete Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Ready Mix Concrete Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Ready Mix Concrete Market?

To stay informed about further developments, trends, and reports in the South America Ready Mix Concrete Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence