Key Insights

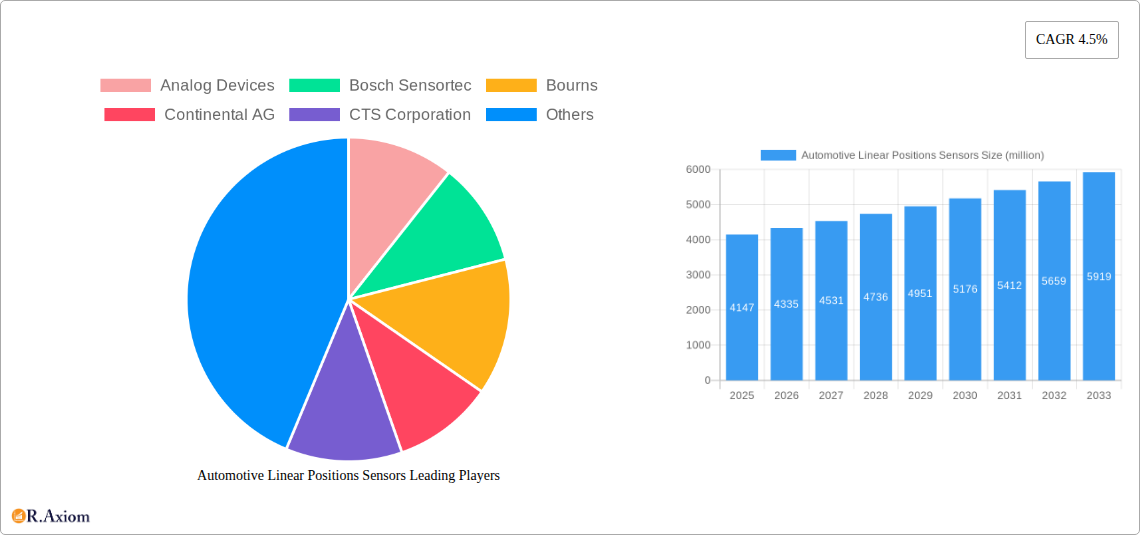

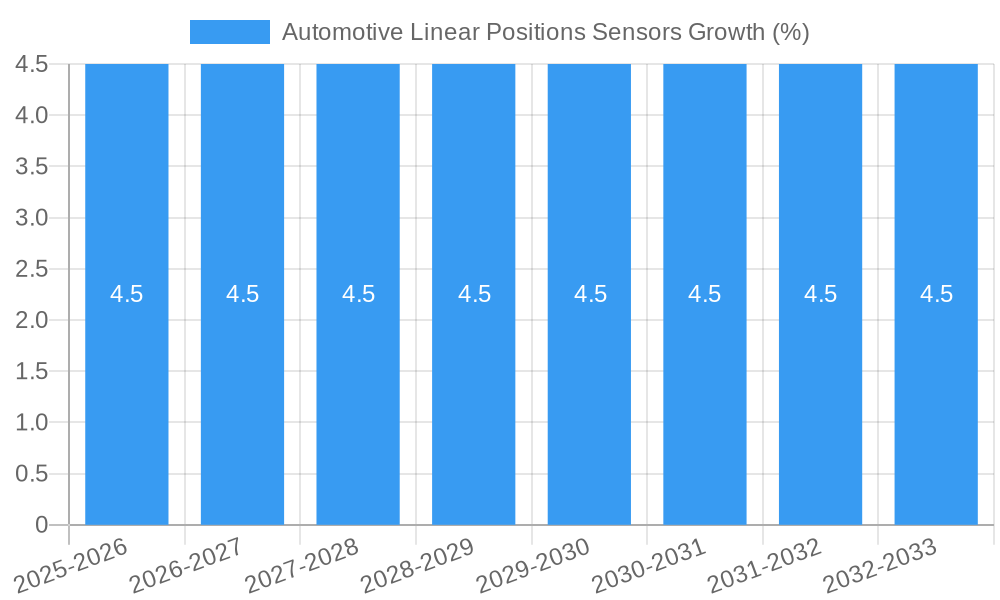

The global Automotive Linear Position Sensors market is poised for robust expansion, with an estimated market size of $4,147 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This sustained growth is underpinned by several key drivers within the automotive industry, including the increasing sophistication of vehicle electronics, the escalating demand for advanced driver-assistance systems (ADAS), and the continuous evolution of electric and hybrid vehicles. As vehicles become more automated and reliant on precise positional data for critical functions like steering, braking, and throttle control, the need for accurate and reliable linear position sensors intensifies. Furthermore, the aftermarket segment is expected to witness significant traction as aging vehicles are retrofitted with newer sensor technologies to enhance safety and performance, alongside the ongoing production of original equipment manufacturers (OEMs) requiring these sensors for new vehicle integration.

The market's trajectory is shaped by discernible trends such as the miniaturization of sensors for more efficient integration into increasingly compact vehicle architectures, and the growing adoption of non-contact sensing technologies to improve durability and reduce wear. Innovations in sensor materials and signal processing are also contributing to enhanced accuracy and reliability. However, the market faces certain restraints, including the high initial cost associated with advanced sensor development and manufacturing, and the complexities in integrating new sensor technologies with existing vehicle electronic architectures. Supply chain volatilities and the need for stringent quality control also present ongoing challenges. The market is segmented by application into Aftermarket and Original Equipment Manufacturer, and by type into Chassis Sensors and Vehicle Body Sensors, with each segment exhibiting unique growth dynamics influenced by evolving automotive manufacturing and maintenance practices.

This comprehensive report delves into the dynamic global Automotive Linear Position Sensors market, offering an in-depth analysis of its current state, future trajectory, and key influencing factors. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this report provides actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and automotive OEMs. We meticulously examine market concentration, technological innovations, regulatory landscapes, competitive dynamics, and emerging opportunities, providing a robust understanding of this critical automotive component market. The report is designed for immediate use without further modification, ensuring all data and analysis are ready for integration.

Automotive Linear Position Sensors Market Concentration & Innovation

The Automotive Linear Position Sensors market exhibits a moderate level of concentration, with several key players dominating specific product categories and geographic regions. In 2025, the top five players are estimated to hold approximately 60% of the global market share, a figure projected to remain relatively stable throughout the forecast period. Innovation is a primary driver of market growth, fueled by the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving technologies, and enhanced vehicle safety features. Regulatory frameworks, such as those mandating specific safety functionalities, are also compelling OEMs to adopt sophisticated linear position sensing solutions. Product substitutes, while present in some legacy applications, are increasingly being outpaced by the performance and precision offered by modern linear position sensors, particularly Hall effect and magnetoresistive technologies. End-user trends are heavily influenced by the automotive industry's push towards electrification and digitalization, necessitating highly accurate and reliable sensor data for battery management, powertrain control, and chassis adjustments. Mergers and acquisitions (M&A) activities, valued at an estimated $200 million in the historical period (2019-2024), are expected to continue as larger companies seek to acquire innovative technologies and expand their market reach.

Automotive Linear Position Sensors Industry Trends & Insights

The Automotive Linear Position Sensors market is experiencing robust growth, driven by an insatiable demand for enhanced vehicle functionality, safety, and efficiency. The compound annual growth rate (CAGR) is projected to be a healthy 8.5% during the forecast period of 2025-2033. This expansion is underpinned by several pivotal trends. Firstly, the accelerating adoption of electric vehicles (EVs) is a significant catalyst. Linear position sensors are crucial for precise battery pack monitoring, thermal management systems, and electric motor control, ensuring optimal performance and longevity. Secondly, the proliferation of ADAS and autonomous driving technologies is creating an unprecedented demand for highly accurate and redundant sensing solutions. Linear position sensors play a vital role in systems like electronic stability control, adaptive cruise control, lane-keeping assist, and autonomous parking, where real-time and precise positional data is paramount. The market penetration of advanced sensor technologies, such as non-contacting Hall effect and magnetoresistive sensors, is rapidly increasing, displacing older, less reliable technologies. Consumer preferences are increasingly leaning towards vehicles equipped with advanced safety features and a more connected driving experience, directly translating into higher demand for sophisticated sensor integration. Furthermore, the ongoing advancements in miniaturization and cost reduction of these sensors are making them more accessible for integration across a wider range of vehicle models, including entry-level segments. The competitive landscape is characterized by continuous innovation, strategic partnerships between sensor manufacturers and automotive OEMs, and a growing focus on sensor fusion to create more intelligent and responsive vehicle systems. The trend towards software-defined vehicles also emphasizes the need for highly accurate sensor inputs for complex algorithms.

Dominant Markets & Segments in Automotive Linear Position Sensors

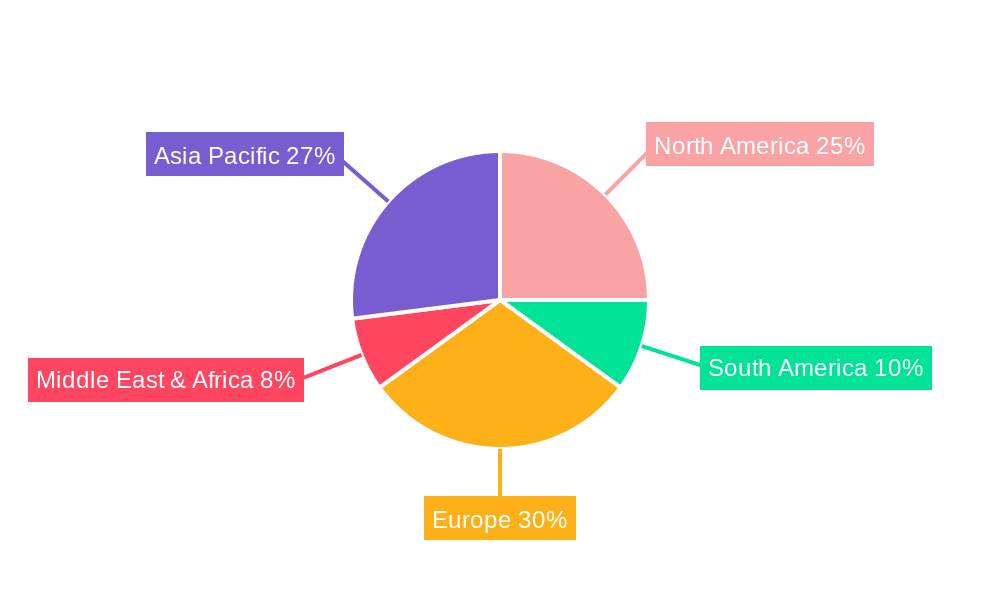

The global Automotive Linear Position Sensors market is dominated by several key regions and segments, driven by distinct factors. Asia-Pacific, particularly China and Japan, is emerging as a dominant region, accounting for an estimated 35% of the market share in 2025. This dominance is fueled by the region's status as a global automotive manufacturing hub, substantial investments in EV development, and supportive government policies promoting advanced automotive technologies. The Original Equipment Manufacturer (OEM) segment commands the largest market share, representing approximately 75% of the total market value in 2025. This is primarily due to the direct integration of these sensors during vehicle manufacturing. Key drivers for OEM dominance include stringent vehicle safety standards, the continuous introduction of new vehicle models with advanced features, and the long-term supply agreements established between sensor manufacturers and automotive giants.

Within the "Type" segmentation, Chassis Sensors are projected to hold the leading position, accounting for an estimated 55% of the market in 2025. This dominance is attributed to their critical role in vehicle dynamics and safety systems.

- Economic Policies: Favorable automotive manufacturing policies and incentives in key Asian economies are driving OEM production and, consequently, demand for chassis sensors.

- Infrastructure Development: The expansion of automotive manufacturing facilities and R&D centers in emerging economies supports the growth of the chassis sensor segment.

- Technological Advancement: Continuous innovation in electronic stability control, active suspension, and steering systems necessitates precise linear position sensing for chassis components.

Vehicle Body Sensors, while a smaller segment, are experiencing rapid growth, driven by applications in power liftgates, sliding doors, and occupant detection systems.

- Consumer Convenience: The increasing demand for user-friendly features like hands-free tailgate operation is boosting the adoption of vehicle body sensors.

- Safety Regulations: Evolving safety regulations for vehicle entry and exit systems are also contributing to the growth of this segment.

- ADAS Integration: The integration of sensors for advanced driver-assistance systems that monitor vehicle body positioning and movement further propels this segment.

The Aftermarket segment, though smaller, presents significant opportunities for growth as vehicles age and require replacement parts, as well as for retrofitting older vehicles with enhanced sensing capabilities.

Automotive Linear Position Sensors Product Developments

Recent product developments in Automotive Linear Position Sensors are characterized by an increased focus on non-contacting technologies such as Hall effect and magnetoresistive sensors, offering enhanced durability, precision, and resistance to harsh automotive environments. Innovations are geared towards miniaturization for easier integration into increasingly complex automotive architectures and improved robustness against vibration and temperature fluctuations. These advancements are enabling more sophisticated applications in powertrain control, steering angle sensing, and advanced driver-assistance systems, providing manufacturers with a competitive edge through improved performance and reliability.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Automotive Linear Position Sensors market across several key segmentations. The Application segment is divided into Aftermarket and Original Equipment Manufacturer (OEM). The OEM segment is expected to dominate, driven by new vehicle production and the integration of advanced features. The Aftermarket segment, while smaller, offers consistent demand for replacement parts. The Type segmentation categorizes sensors into Chassis Sensors and Vehicle Body Sensors. Chassis sensors are projected to hold a larger share due to their integral role in vehicle dynamics and safety. Vehicle body sensors are experiencing rapid growth, spurred by convenience features and evolving safety standards. Each segment's growth projections, market sizes, and competitive dynamics are meticulously detailed within the report.

Key Drivers of Automotive Linear Position Sensors Growth

The growth of the Automotive Linear Position Sensors market is propelled by several interconnected factors.

- Technological Advancements: The relentless pursuit of enhanced vehicle safety, performance, and comfort drives demand for more sophisticated and accurate linear position sensing technologies. The increasing prevalence of ADAS and autonomous driving systems is a primary catalyst.

- Electrification of Vehicles: The shift towards electric vehicles necessitates precise control and monitoring of battery systems, powertrains, and thermal management, all of which rely heavily on accurate linear position data.

- Stringent Safety Regulations: Global regulatory bodies are continually introducing and tightening safety standards for vehicles, mandating the inclusion of advanced safety features that depend on reliable sensor inputs.

- Consumer Demand for Advanced Features: The growing consumer preference for technologically advanced vehicles with features like adaptive cruise control, automated parking, and enhanced interior comfort directly fuels the demand for integrated linear position sensors.

Challenges in the Automotive Linear Position Sensors Sector

Despite the robust growth, the Automotive Linear Position Sensors sector faces several challenges.

- Intensifying Competition: A crowded market with numerous players leads to significant pricing pressures and demands for continuous innovation to maintain market share.

- Supply Chain Volatility: Global supply chain disruptions, including raw material shortages and logistics issues, can impact production timelines and cost-effectiveness.

- Regulatory Compliance Complexity: Navigating diverse and evolving international safety and emissions regulations requires significant investment in R&D and compliance efforts.

- Technological Obsolescence: The rapid pace of technological advancement means that sensor technologies can quickly become outdated, requiring ongoing investment in next-generation solutions.

Emerging Opportunities in Automotive Linear Position Sensors

The Automotive Linear Position Sensors market is ripe with emerging opportunities.

- Growth in Autonomous Driving: As autonomous driving technology matures, the demand for highly precise, redundant, and fault-tolerant linear position sensors will surge.

- Smart Cockpit Integration: The development of intelligent and interactive vehicle interiors, including advanced seat adjustment and steering wheel positioning, presents new application avenues.

- Retrofitting and Upgrading: Opportunities exist in the aftermarket for upgrading older vehicles with advanced sensing capabilities to improve safety and functionality.

- Industrial IoT Integration: The convergence of automotive and industrial technologies opens doors for linear position sensors in vehicle-to-infrastructure (V2I) and vehicle-to-everything (V2X) communication systems.

Leading Players in the Automotive Linear Position Sensors Market

- Analog Devices

- Bosch Sensortec

- Bourns

- Continental AG

- CTS Corporation

- Gill Sensors & Controls

- HELLA

- Infineon

- NXP Semiconductors

- Sensata Technologies

- Stoneridge

- Illinois Tool Works

- Stanley Black & Decker

- Denso

- Autoliv

- Hitachi Astemo Americas

- Broadcom

- Piher Sensors & Controls

- Elmos Semiconductor

Key Developments in Automotive Linear Position Sensors Industry

- 2023/11: Infineon Technologies launched a new generation of high-performance linear Hall effect sensors with enhanced accuracy for automotive steering applications.

- 2023/10: Bosch Sensortec introduced a compact magnetoresistive linear position sensor family designed for space-constrained automotive modules.

- 2023/09: Sensata Technologies acquired a specialist in non-contact linear position sensing technology to expand its portfolio.

- 2023/08: Continental AG announced significant investment in R&D for next-generation autonomous driving sensors, including advanced linear position sensors.

- 2023/07: NXP Semiconductors unveiled an integrated linear position sensing solution for electric vehicle powertrain applications.

- 2023/06: HELLA introduced an innovative linear position sensor with integrated diagnostics for improved vehicle safety.

Strategic Outlook for Automotive Linear Position Sensors Market

- 2023/11: Infineon Technologies launched a new generation of high-performance linear Hall effect sensors with enhanced accuracy for automotive steering applications.

- 2023/10: Bosch Sensortec introduced a compact magnetoresistive linear position sensor family designed for space-constrained automotive modules.

- 2023/09: Sensata Technologies acquired a specialist in non-contact linear position sensing technology to expand its portfolio.

- 2023/08: Continental AG announced significant investment in R&D for next-generation autonomous driving sensors, including advanced linear position sensors.

- 2023/07: NXP Semiconductors unveiled an integrated linear position sensing solution for electric vehicle powertrain applications.

- 2023/06: HELLA introduced an innovative linear position sensor with integrated diagnostics for improved vehicle safety.

Strategic Outlook for Automotive Linear Position Sensors Market

The strategic outlook for the Automotive Linear Position Sensors market remains exceptionally positive, driven by the ongoing automotive revolution. The relentless push towards electrification, automation, and enhanced safety will continue to be the primary growth catalysts. Companies that focus on developing highly integrated, intelligent, and cost-effective sensor solutions, while also investing in robust supply chain management and adherence to evolving regulatory standards, are poised for significant success. Strategic partnerships with OEMs and a proactive approach to adopting emerging technologies like AI and machine learning for sensor data analysis will be crucial for maintaining a competitive edge and capturing future market opportunities. The market is expected to see sustained innovation and consolidation.

Automotive Linear Positions Sensors Segmentation

-

1. Application

- 1.1. Aftermarket

- 1.2. Original Equipment Manufacturer

-

2. Type

- 2.1. Chassis Sensors

- 2.2. Vehicle Body Sensors

Automotive Linear Positions Sensors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Linear Positions Sensors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Linear Positions Sensors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aftermarket

- 5.1.2. Original Equipment Manufacturer

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Chassis Sensors

- 5.2.2. Vehicle Body Sensors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Linear Positions Sensors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aftermarket

- 6.1.2. Original Equipment Manufacturer

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Chassis Sensors

- 6.2.2. Vehicle Body Sensors

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Linear Positions Sensors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aftermarket

- 7.1.2. Original Equipment Manufacturer

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Chassis Sensors

- 7.2.2. Vehicle Body Sensors

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Linear Positions Sensors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aftermarket

- 8.1.2. Original Equipment Manufacturer

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Chassis Sensors

- 8.2.2. Vehicle Body Sensors

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Linear Positions Sensors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aftermarket

- 9.1.2. Original Equipment Manufacturer

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Chassis Sensors

- 9.2.2. Vehicle Body Sensors

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Linear Positions Sensors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aftermarket

- 10.1.2. Original Equipment Manufacturer

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Chassis Sensors

- 10.2.2. Vehicle Body Sensors

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Analog Devices

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch Sensortec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bourns

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Continental AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CTS Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gill Sensors & Controls

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HELLA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Infineon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NXP Semiconductors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sensata Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Stoneridge

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Illinois Tool Works

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stanley Black & Decker

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Denso

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Autoliv

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hitachi Astemo Americas

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Broadcom

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Piher Sensors & Controls

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Elmos Semiconductor

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Analog Devices

List of Figures

- Figure 1: Global Automotive Linear Positions Sensors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Linear Positions Sensors Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Linear Positions Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Linear Positions Sensors Revenue (million), by Type 2024 & 2032

- Figure 5: North America Automotive Linear Positions Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Automotive Linear Positions Sensors Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Linear Positions Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Linear Positions Sensors Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Linear Positions Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Linear Positions Sensors Revenue (million), by Type 2024 & 2032

- Figure 11: South America Automotive Linear Positions Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Automotive Linear Positions Sensors Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Linear Positions Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Linear Positions Sensors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Linear Positions Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Linear Positions Sensors Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Automotive Linear Positions Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Automotive Linear Positions Sensors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Linear Positions Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Linear Positions Sensors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Linear Positions Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Linear Positions Sensors Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Automotive Linear Positions Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Automotive Linear Positions Sensors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Linear Positions Sensors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Linear Positions Sensors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Linear Positions Sensors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Linear Positions Sensors Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Linear Positions Sensors Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Linear Positions Sensors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Linear Positions Sensors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Linear Positions Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Linear Positions Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Linear Positions Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Automotive Linear Positions Sensors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Linear Positions Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Linear Positions Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Automotive Linear Positions Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Linear Positions Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Linear Positions Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Automotive Linear Positions Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Linear Positions Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Linear Positions Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Automotive Linear Positions Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Linear Positions Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Linear Positions Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Automotive Linear Positions Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Linear Positions Sensors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Linear Positions Sensors Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Automotive Linear Positions Sensors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Linear Positions Sensors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Linear Positions Sensors?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Automotive Linear Positions Sensors?

Key companies in the market include Analog Devices, Bosch Sensortec, Bourns, Continental AG, CTS Corporation, Gill Sensors & Controls, HELLA, Infineon, NXP Semiconductors, Sensata Technologies, Stoneridge, Illinois Tool Works, Stanley Black & Decker, Denso, Autoliv, Hitachi Astemo Americas, Broadcom, Piher Sensors & Controls, Elmos Semiconductor.

3. What are the main segments of the Automotive Linear Positions Sensors?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4147 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Linear Positions Sensors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Linear Positions Sensors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Linear Positions Sensors?

To stay informed about further developments, trends, and reports in the Automotive Linear Positions Sensors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence