Key Insights

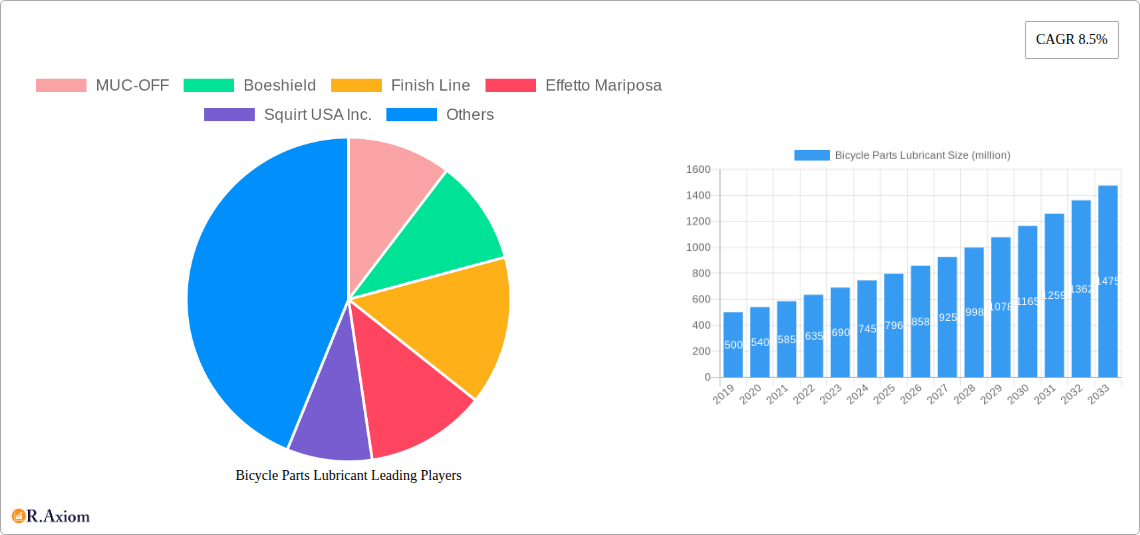

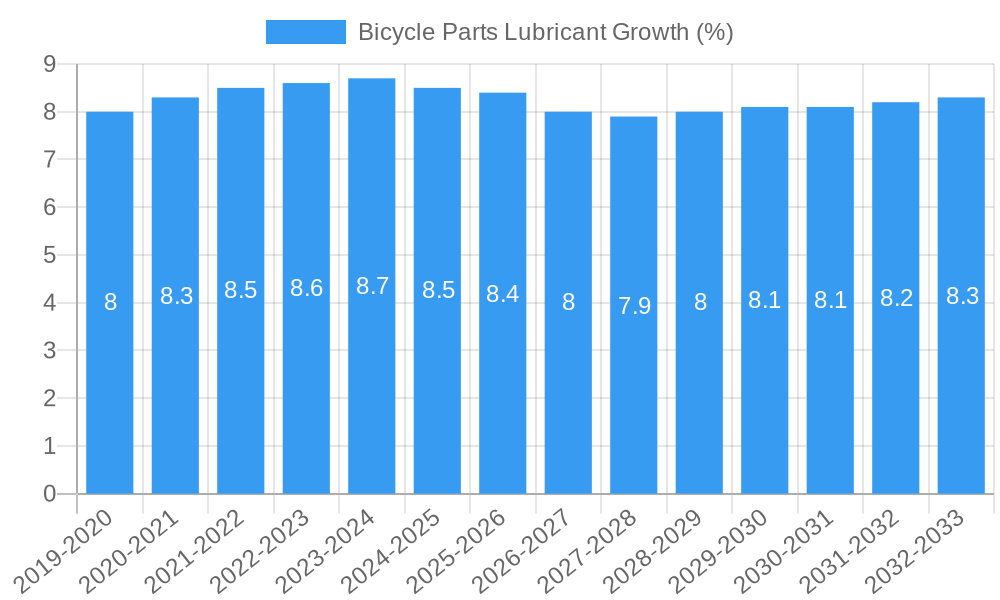

The global Bicycle Parts Lubricant market is poised for substantial expansion, projected to reach a valuation of $796 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.5% expected to propel it through the forecast period of 2025-2033. This robust growth is primarily driven by a confluence of factors, including the escalating global participation in cycling, both for recreational and competitive purposes, and a heightened awareness among cyclists regarding the critical role of lubrication in maintaining bicycle performance and longevity. The increasing demand for high-performance lubricants that offer superior friction reduction, water resistance, and dirt repellency further fuels market expansion. Furthermore, the burgeoning e-commerce landscape has democratized access to specialized bicycle parts lubricants, enabling a wider consumer base to procure these essential products. Innovations in lubricant technology, such as the development of ceramic-infused and biodegradable options, are also contributing to market dynamism, catering to evolving consumer preferences for eco-friendly and technologically advanced solutions.

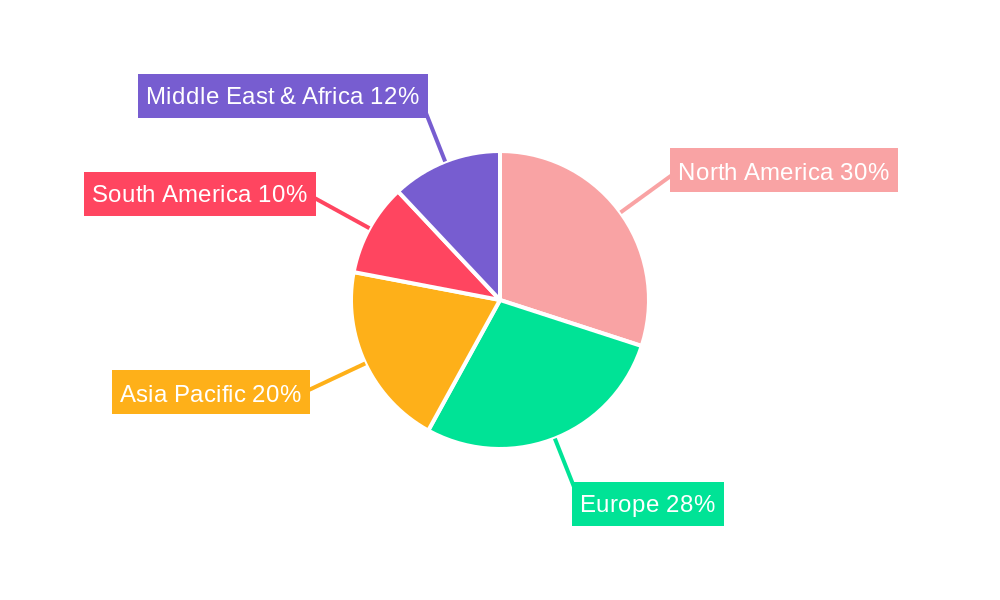

The market segmentation reveals a balanced demand across various applications and types of lubricants. Online sales channels are rapidly gaining traction, reflecting the broader trend in consumer purchasing behavior, while offline sales remain a significant contributor, particularly through dedicated bicycle retail stores and professional repair shops. Within lubricant types, dry lubricants are expected to witness strong demand owing to their low-friction properties and resistance to attracting dirt, making them ideal for drier conditions. Wet lubricants, offering enhanced protection in wet and muddy environments, also hold a substantial market share. Wax lubricants are emerging as a niche but growing segment, favored by performance-oriented cyclists for their clean operation and durability. Geographically, North America and Europe currently dominate the market, driven by established cycling cultures and a high disposable income. However, the Asia Pacific region is anticipated to exhibit the fastest growth, fueled by increasing urbanization, rising disposable incomes, and a surge in cycling as a popular mode of transport and recreation in countries like China and India.

Bicycle Parts Lubricant Market Concentration & Innovation

The global bicycle parts lubricant market, projected to reach millions by 2033, exhibits moderate concentration. Key players like MUC-OFF, Finish Line, and WD-40 hold significant market share, estimated at xx% collectively. Innovation is primarily driven by the demand for enhanced performance, durability, and environmental sustainability in bicycle chain lubricants and other maintenance products. The development of advanced formulations, including ceramic-infused lubricants and biodegradable options, is a critical innovation driver. Regulatory frameworks, while less stringent than in some other chemical sectors, focus on safety and environmental impact, influencing product development towards greener alternatives. Product substitutes, such as basic greases and oils, exist but lack the specialized performance benefits of dedicated bicycle lubricants. End-user trends showcase a growing preference for lubricants that offer extended protection against wear and tear, reduce friction for improved efficiency, and withstand diverse weather conditions, from dry summer rides to wet winter commutes. Mergers and acquisitions (M&A) activity is moderate, with deal values in the range of millions to tens of millions, often involving smaller niche lubricant brands being acquired by larger players to expand their product portfolios or gain access to new technologies and distribution channels. This strategic consolidation aims to capture a greater share of the expanding global cycling market.

Bicycle Parts Lubricant Industry Trends & Insights

The bicycle parts lubricant market is poised for substantial growth, driven by a confluence of factors that underscore the increasing global participation in cycling. The Compound Annual Growth Rate (CAGR) for this sector is estimated at a robust xx% over the forecast period of 2025–2033. This expansion is fueled by a rising interest in cycling for recreation, fitness, and sustainable transportation. As more individuals take up cycling, both as a hobby and a primary mode of commuting, the demand for high-quality bicycle maintenance products, particularly lubricants, escalates. Technological disruptions are playing a pivotal role, with manufacturers continuously innovating to create lubricants that offer superior performance characteristics. This includes formulations designed to reduce friction to the absolute minimum, thereby enhancing drivetrain efficiency and rider speed, and extending the lifespan of critical components like chains, derailleurs, and bearings. The development of lubricants resistant to extreme weather conditions – be it scorching heat, freezing cold, or heavy rain – is also a significant trend, catering to the needs of a global cycling community operating in diverse climates.

Consumer preferences are shifting towards specialized lubricants tailored to specific riding conditions and bicycle types. For instance, gravel riders may seek lubricants that offer enhanced dust and dirt repulsion, while mountain bikers might prioritize water and mud resistance. The "eco-conscious" consumer is also a growing segment, driving demand for biodegradable and environmentally friendly lubricant options. This has led to companies like Green Oil and Juice Lubes gaining traction. Competitive dynamics within the industry are characterized by intense product development and marketing efforts. Established players like MUC-OFF, Finish Line, and Boeshield are fiercely competing with newer entrants and niche brands such as Squirt USA Inc. and Effetto Mariposa, each vying for market share by emphasizing unique selling propositions like ceramic coatings, wax-based formulations, or advanced synthetic compositions. The influence of online sales channels has also grown exponentially, allowing brands to reach a wider audience and bypass traditional retail gatekeepers. Market penetration is steadily increasing as cycling infrastructure improves in urban and rural areas worldwide, further encouraging adoption and routine maintenance. The ongoing advancements in bicycle technology, such as the shift towards electronic shifting and increasingly complex drivetrain systems, also necessitate the use of sophisticated lubricants for optimal functionality and longevity.

Dominant Markets & Segments in Bicycle Parts Lubricant

The global bicycle parts lubricant market demonstrates clear dominance within specific regions and product segments, driven by varying economic, infrastructural, and cultural factors.

Leading Region & Country Dominance:

- Europe currently leads in market share, largely attributed to its well-established cycling culture, extensive network of dedicated cycling paths, and high disposable incomes that support the purchase of premium bicycle maintenance products. Countries like Germany, France, and the Netherlands are particularly strong markets, with a significant number of recreational and professional cyclists.

- North America, specifically the United States, represents another substantial market. The growing popularity of mountain biking, gravel cycling, and urban commuting, coupled with a strong e-commerce infrastructure, propels demand for bicycle lubricants. The presence of major brands like WD-40 and Wolf Tooth Components further solidifies its position.

- Emerging markets in Asia-Pacific, particularly China and India, are exhibiting rapid growth. Increasing urbanization, government initiatives promoting cycling, and a burgeoning middle class are contributing to a surge in bicycle ownership and, consequently, lubricant demand.

Dominant Segments:

Application:

- Offline Sales continue to hold a significant portion of the market. Local bicycle shops and sporting goods stores serve as crucial touchpoints for consumers seeking expert advice and immediate product availability. The tactile experience of purchasing and the trust established with local mechanics play a vital role here.

- Online Sales are experiencing exponential growth. E-commerce platforms and direct-to-consumer websites operated by brands like MUC-OFF and Silca offer unparalleled convenience, wider product selection, and competitive pricing, significantly expanding market reach. This segment is projected to see the highest growth rate in the coming years.

Type:

- Wet Lubricant remains a dominant type, especially in regions with frequent rainfall or for riders who frequently encounter wet conditions. These lubricants offer superior water resistance and long-lasting protection, making them a staple for many cyclists. Brands like Finish Line and Pedro's NA offer a wide range of wet lubes.

- Dry Lubricant is gaining substantial traction, particularly in arid and dusty climates, and for riders prioritizing drivetrain cleanliness and efficiency. These formulations are designed to attract less dirt and dust, leading to a cleaner chain and smoother operation.

- Wax Lubricant is an emerging and rapidly growing segment. Promoted for its exceptional chain cleanliness and friction reduction, wax-based lubricants like those from Squirt USA Inc. and Effetto Mariposa are attracting a dedicated following among performance-oriented cyclists. Their ability to create a dry, non-stick coating on the chain appeals to riders seeking maximum efficiency and minimal drivetrain maintenance hassle. CeramicSpeed also offers advanced ceramic-infused wax-like treatments.

Bicycle Parts Lubricant Product Developments

Application:

- Offline Sales continue to hold a significant portion of the market. Local bicycle shops and sporting goods stores serve as crucial touchpoints for consumers seeking expert advice and immediate product availability. The tactile experience of purchasing and the trust established with local mechanics play a vital role here.

- Online Sales are experiencing exponential growth. E-commerce platforms and direct-to-consumer websites operated by brands like MUC-OFF and Silca offer unparalleled convenience, wider product selection, and competitive pricing, significantly expanding market reach. This segment is projected to see the highest growth rate in the coming years.

Type:

- Wet Lubricant remains a dominant type, especially in regions with frequent rainfall or for riders who frequently encounter wet conditions. These lubricants offer superior water resistance and long-lasting protection, making them a staple for many cyclists. Brands like Finish Line and Pedro's NA offer a wide range of wet lubes.

- Dry Lubricant is gaining substantial traction, particularly in arid and dusty climates, and for riders prioritizing drivetrain cleanliness and efficiency. These formulations are designed to attract less dirt and dust, leading to a cleaner chain and smoother operation.

- Wax Lubricant is an emerging and rapidly growing segment. Promoted for its exceptional chain cleanliness and friction reduction, wax-based lubricants like those from Squirt USA Inc. and Effetto Mariposa are attracting a dedicated following among performance-oriented cyclists. Their ability to create a dry, non-stick coating on the chain appeals to riders seeking maximum efficiency and minimal drivetrain maintenance hassle. CeramicSpeed also offers advanced ceramic-infused wax-like treatments.

Bicycle Parts Lubricant Product Developments

The bicycle parts lubricant market is characterized by continuous product innovation focused on enhancing performance and rider experience. Key developments include the formulation of advanced synthetic lubricants with ceramic particles for reduced friction and increased durability, as seen with CeramicSpeed and absoluteBLACK. Wax-based lubricants are gaining popularity for their superior cleanliness and efficiency, exemplified by Squirt USA Inc. and Effetto Mariposa. Furthermore, a significant trend is the development of environmentally friendly and biodegradable lubricants, catering to the growing eco-conscious consumer base, with companies like Green Oil leading this charge. These innovations aim to provide longer-lasting protection, improved drivetrain efficiency, and cleaner operation across diverse riding conditions.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the global bicycle parts lubricant market, segmenting it by Application and Type. The study encompasses the Application segments of Online Sales and Offline Sales, detailing their respective market sizes, growth projections, and competitive dynamics. Online Sales are expected to exhibit a higher CAGR due to increasing e-commerce penetration and direct-to-consumer strategies. Offline Sales, while still significant, will see more moderate growth driven by physical retail presence and established dealer networks.

The analysis further delves into the Type segments: Dry Lubricant, Wet Lubricant, and Wax Lubricant. Wet Lubricants continue to hold a substantial market share due to their widespread applicability in various conditions. Dry Lubricants are projected for steady growth, driven by their ability to keep drivetrains cleaner in dusty environments. Wax Lubricants represent the fastest-growing segment, attracting performance-focused cyclists with their efficiency and cleanliness benefits. Competitive dynamics within each segment are shaped by brand reputation, product efficacy, and marketing efforts.

Key Drivers of Bicycle Parts Lubricant Growth

The bicycle parts lubricant market is propelled by several interconnected factors. The escalating global popularity of cycling, fueled by health consciousness, environmental concerns, and the pursuit of recreational activities, directly translates to increased demand for essential maintenance products. Technological advancements in lubricant formulations, such as the incorporation of ceramic particles and advanced synthetic compounds, offer superior friction reduction and wear protection, appealing to performance-oriented cyclists. Government initiatives promoting cycling infrastructure and sustainable transport further encourage bicycle adoption and, consequently, lubricant usage. The continuous evolution of bicycle components, demanding more specialized and effective maintenance solutions, also acts as a significant growth catalyst.

Challenges in the Bicycle Parts Lubricant Sector

Despite robust growth, the bicycle parts lubricant sector faces several challenges. Intense competition among numerous brands, from established giants like WD-40 to niche players like Effetto Mariposa, exerts downward pressure on pricing and necessitates continuous innovation to differentiate products. Supply chain disruptions, particularly for raw materials and specialized additives, can impact production and availability. Furthermore, the growing demand for "green" lubricants presents a challenge for manufacturers to balance performance with environmental sustainability and cost-effectiveness. Educating consumers on the nuances of different lubricant types and their optimal applications also remains an ongoing effort.

Emerging Opportunities in Bicycle Parts Lubricant

Emerging opportunities in the bicycle parts lubricant market are abundant and varied. The burgeoning e-bike segment presents a unique opportunity for lubricants optimized for higher torque and continuous engagement. The increasing popularity of gravel cycling and bikepacking creates demand for ultra-durable, weather-resistant lubricants. There is a significant opportunity in developing and marketing biodegradable and plant-based lubricant formulations to cater to the growing eco-conscious consumer segment, with brands like Green Oil and Juice Lubes already carving out a niche. Expansion into emerging markets with growing cycling adoption rates, particularly in Asia-Pacific and Latin America, offers substantial untapped potential. Furthermore, the integration of smart technologies and subscription-based maintenance services could unlock new revenue streams.

Leading Players in the Bicycle Parts Lubricant Market

- MUC-OFF

- Boeshield

- Finish Line

- Effetto Mariposa

- Squirt USA Inc.

- CeramicSpeed

- absoluteBLACK

- Silca

- WD-40

- Wolf Tooth Components

- Pedro's NA

- MOTOREX

- Rock 'N' Roll

- Maxima

- Fenwicks Ltd.

- Green Oil

- Juice Lubes

- Morgan Blue

Key Developments in Bicycle Parts Lubricant Industry

- 2019/2020: Increased focus on ceramic-infused lubricants, offering enhanced friction reduction and durability.

- 2021: Growing market penetration of wax-based lubricants, driven by demand for cleaner drivetrains and improved efficiency.

- 2022: Significant launches of biodegradable and eco-friendly lubricant formulations by niche and established brands.

- 2023: Expansion of online sales channels and direct-to-consumer models by leading lubricant manufacturers.

- 2024: Introduction of specialized lubricant ranges tailored for the rapidly growing e-bike market.

- 2025 (Projected): Continued innovation in synthetic formulations and exploration of novel additive technologies for extreme condition performance.

Strategic Outlook for Bicycle Parts Lubricant Market

The strategic outlook for the bicycle parts lubricant market remains exceptionally positive, driven by sustained global growth in cycling participation and continuous technological innovation. The market is expected to benefit from an increasing consumer focus on performance optimization, drivetrain longevity, and environmental sustainability. Companies that invest in developing advanced, eco-friendly formulations and effectively leverage online sales channels are well-positioned for success. Expanding into emerging markets and catering to the specific needs of the e-bike segment present significant avenues for future growth and revenue generation, ensuring a dynamic and expanding market landscape.

Bicycle Parts Lubricant Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Type

- 2.1. Dry Lubricant

- 2.2. Wet Lubricant

- 2.3. Wax Lubricant

Bicycle Parts Lubricant Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bicycle Parts Lubricant REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bicycle Parts Lubricant Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dry Lubricant

- 5.2.2. Wet Lubricant

- 5.2.3. Wax Lubricant

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bicycle Parts Lubricant Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Dry Lubricant

- 6.2.2. Wet Lubricant

- 6.2.3. Wax Lubricant

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bicycle Parts Lubricant Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Dry Lubricant

- 7.2.2. Wet Lubricant

- 7.2.3. Wax Lubricant

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bicycle Parts Lubricant Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Dry Lubricant

- 8.2.2. Wet Lubricant

- 8.2.3. Wax Lubricant

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bicycle Parts Lubricant Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Dry Lubricant

- 9.2.2. Wet Lubricant

- 9.2.3. Wax Lubricant

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bicycle Parts Lubricant Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Dry Lubricant

- 10.2.2. Wet Lubricant

- 10.2.3. Wax Lubricant

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MUC-OFF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Boeshield

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Finish Line

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Effetto Mariposa

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Squirt USA Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CeramicSpeed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 absoluteBLACK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Silca

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WD-40

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wolf Tooth Components

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pedro's NA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MOTOREX

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rock 'N' Roll

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxima

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Fenwicks Ltd.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Green Oil

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Juice Lubes

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Morgan Blue

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 MUC-OFF

List of Figures

- Figure 1: Global Bicycle Parts Lubricant Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Bicycle Parts Lubricant Revenue (million), by Application 2024 & 2032

- Figure 3: North America Bicycle Parts Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Bicycle Parts Lubricant Revenue (million), by Type 2024 & 2032

- Figure 5: North America Bicycle Parts Lubricant Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Bicycle Parts Lubricant Revenue (million), by Country 2024 & 2032

- Figure 7: North America Bicycle Parts Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bicycle Parts Lubricant Revenue (million), by Application 2024 & 2032

- Figure 9: South America Bicycle Parts Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Bicycle Parts Lubricant Revenue (million), by Type 2024 & 2032

- Figure 11: South America Bicycle Parts Lubricant Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Bicycle Parts Lubricant Revenue (million), by Country 2024 & 2032

- Figure 13: South America Bicycle Parts Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Bicycle Parts Lubricant Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Bicycle Parts Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Bicycle Parts Lubricant Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Bicycle Parts Lubricant Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Bicycle Parts Lubricant Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Bicycle Parts Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Bicycle Parts Lubricant Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Bicycle Parts Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Bicycle Parts Lubricant Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Bicycle Parts Lubricant Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Bicycle Parts Lubricant Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Bicycle Parts Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Bicycle Parts Lubricant Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Bicycle Parts Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Bicycle Parts Lubricant Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Bicycle Parts Lubricant Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Bicycle Parts Lubricant Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Bicycle Parts Lubricant Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bicycle Parts Lubricant Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bicycle Parts Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Bicycle Parts Lubricant Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Bicycle Parts Lubricant Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Bicycle Parts Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Bicycle Parts Lubricant Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Bicycle Parts Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Bicycle Parts Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Bicycle Parts Lubricant Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Bicycle Parts Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Bicycle Parts Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Bicycle Parts Lubricant Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Bicycle Parts Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Bicycle Parts Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Bicycle Parts Lubricant Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Bicycle Parts Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Bicycle Parts Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Bicycle Parts Lubricant Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Bicycle Parts Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Bicycle Parts Lubricant Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bicycle Parts Lubricant?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Bicycle Parts Lubricant?

Key companies in the market include MUC-OFF, Boeshield, Finish Line, Effetto Mariposa, Squirt USA Inc., CeramicSpeed, absoluteBLACK, Silca, WD-40, Wolf Tooth Components, Pedro's NA, MOTOREX, Rock 'N' Roll, Maxima, Fenwicks Ltd., Green Oil, Juice Lubes, Morgan Blue.

3. What are the main segments of the Bicycle Parts Lubricant?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 796 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bicycle Parts Lubricant," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bicycle Parts Lubricant report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bicycle Parts Lubricant?

To stay informed about further developments, trends, and reports in the Bicycle Parts Lubricant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence