Key Insights

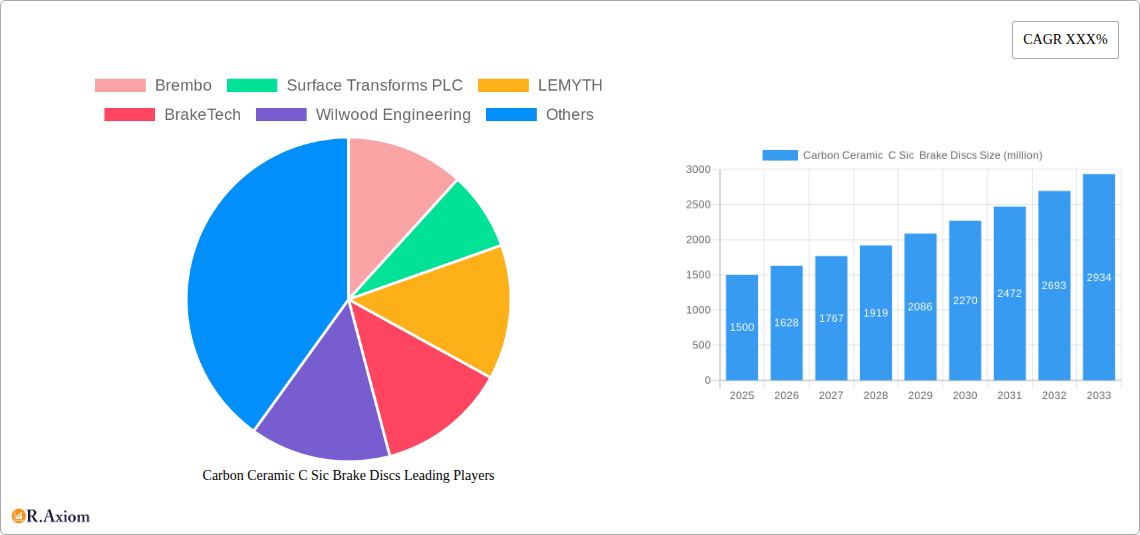

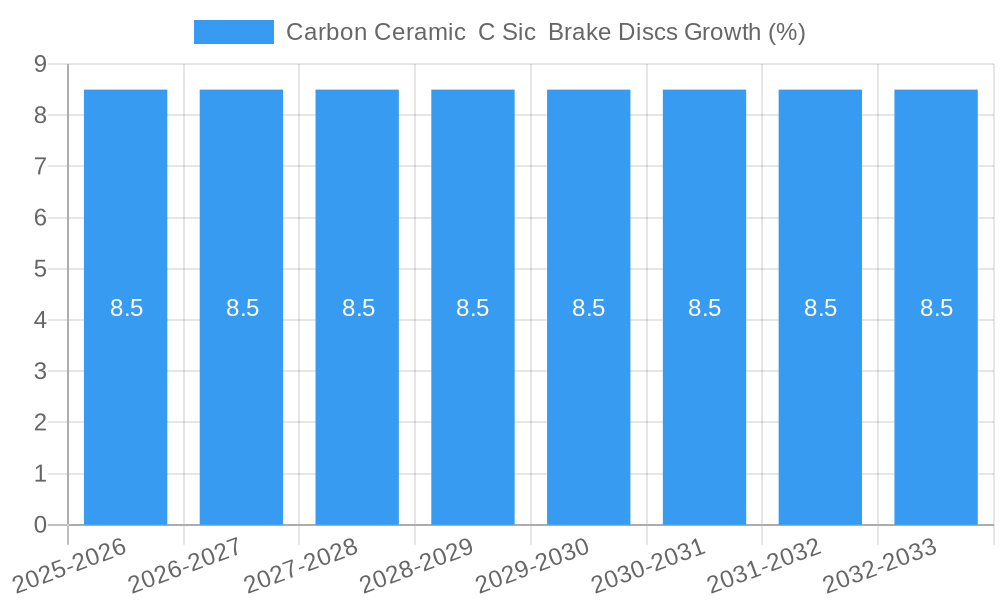

The global market for Carbon Ceramic C-SiC Brake Discs is experiencing robust growth, driven by increasing demand for high-performance braking systems across various automotive and motorsport applications. This advanced material offers superior heat dissipation, reduced weight, and exceptional durability compared to traditional cast iron discs, making it indispensable for performance vehicles, luxury cars, and racing applications. The market is projected to reach approximately $1.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 8.5% expected between 2025 and 2033. This sustained growth is fueled by advancements in material science, leading to more cost-effective production methods and wider adoption. Key applications like Automotive, particularly in the performance and luxury segments, are the primary revenue generators, followed by Aerospace and High-Speed Trains, which are increasingly leveraging the benefits of C-SiC technology for enhanced safety and performance.

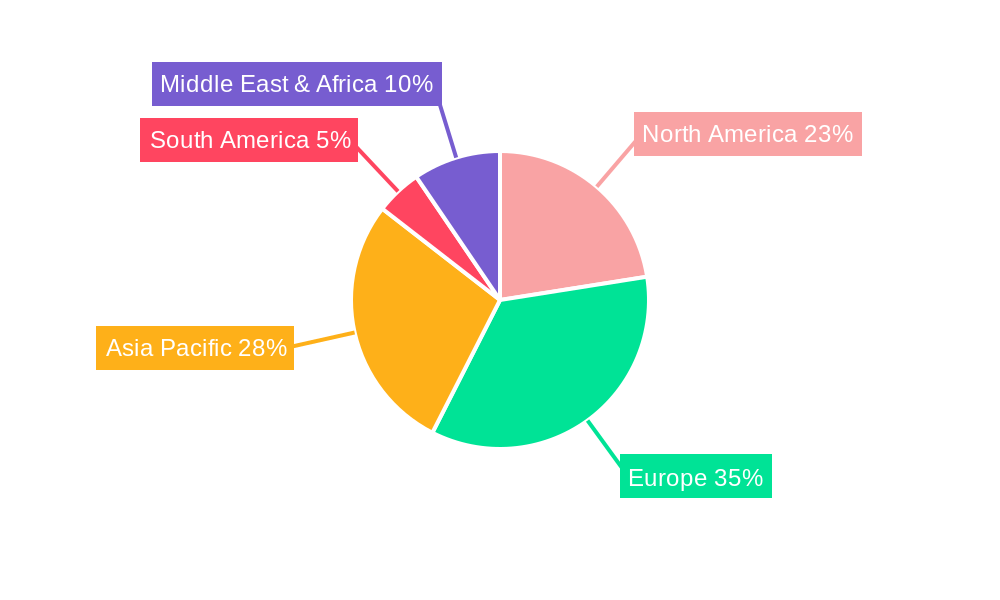

Emerging trends indicate a significant shift towards lighter, more efficient braking solutions. The rise of electric vehicles (EVs) further amplifies this demand, as the regenerative braking capabilities of EVs are complemented by the consistent, fade-resistant performance of C-SiC discs, especially under heavy use. While the initial cost of Carbon Ceramic C-SiC Brake Discs remains a restraining factor for widespread adoption in mass-market vehicles, ongoing technological innovations and increasing production volumes are expected to gradually bring down prices. Leading companies such as Brembo, Surface Transforms PLC, and SGL Carbon are at the forefront, investing heavily in research and development to expand their product portfolios and capture market share. The Asia Pacific region, particularly China and Japan, is emerging as a critical growth hub due to its burgeoning automotive industry and government initiatives promoting advanced materials.

This in-depth market research report provides a comprehensive analysis of the global Carbon Ceramic C SiC (Silicon Carbide) Brake Discs market. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period up to 2033, this report delves into market dynamics, key trends, growth drivers, challenges, and emerging opportunities. It offers actionable insights for stakeholders, including manufacturers, suppliers, investors, and industry professionals, navigating this high-performance braking solutions sector. With an estimated market size in the billions and a projected CAGR of xx%, this report is essential for understanding the evolving landscape of advanced braking technology.

Carbon Ceramic C Sic Brake Discs Market Concentration & Innovation

The Carbon Ceramic C SiC Brake Discs market exhibits a moderate to high concentration, driven by significant capital investment, proprietary technology, and stringent quality control requirements. Leading companies such as Brembo, Surface Transforms PLC, and SGL Carbon are at the forefront, commanding substantial market share due to their extensive R&D efforts and established supply chains. Innovation is a critical differentiator, with ongoing research focused on enhancing thermal management, reducing weight, improving wear resistance, and developing cost-effective manufacturing processes. Regulatory frameworks, particularly in automotive and aerospace sectors, are increasingly pushing for lighter, more durable, and environmentally friendly braking solutions, indirectly benefiting the adoption of these advanced materials. Product substitutes, such as advanced cast iron and other composite materials, are present but often fall short in extreme performance applications. End-user trends are strongly influenced by the demand for enhanced safety, fuel efficiency (through weight reduction), and superior performance in high-stress environments like motorsports and aviation. Mergers and acquisitions (M&A) are a notable aspect of market consolidation, with significant deal values ranging from tens of millions to hundreds of millions of dollars, aimed at acquiring cutting-edge technologies and expanding market reach. Key M&A activities are projected to reach over $500 million in value within the forecast period.

Carbon Ceramic C Sic Brake Discs Industry Trends & Insights

The Carbon Ceramic C SiC Brake Discs industry is experiencing robust growth, propelled by an escalating demand for high-performance braking systems across diverse applications. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx%, reaching a valuation of over $XX billion by 2033. This upward trajectory is primarily fueled by advancements in material science, leading to lighter, stronger, and more heat-resistant brake discs compared to traditional materials. The automotive sector, especially the luxury and performance vehicle segments, is a significant driver, with manufacturers increasingly integrating these advanced materials to meet stringent safety standards and enhance the driving experience. Furthermore, the aerospace industry's perpetual quest for weight reduction and improved reliability in critical components like braking systems provides a substantial avenue for market expansion. In the motorcycle segment, racing and high-performance applications are adopting these discs for their superior stopping power and fade resistance. Technological disruptions, including novel manufacturing techniques like advanced additive manufacturing and optimized ceramic matrix composite (CMC) formulations, are enhancing product performance and potentially lowering production costs. Consumer preferences are shifting towards systems that offer extended lifespan, reduced maintenance, and superior performance under extreme conditions. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on differentiating through product specialization and application-specific solutions. Market penetration is expected to increase from approximately xx% in 2025 to over xx% by 2033, particularly in specialized vehicle segments. The integration of advanced sensor technologies within brake discs for real-time monitoring also represents a growing trend, offering predictive maintenance capabilities.

Dominant Markets & Segments in Carbon Ceramic C Sic Brake Discs

The Automotive segment is the dominant market for Carbon Ceramic C SiC Brake Discs, driven by the insatiable demand for enhanced performance, safety, and fuel efficiency in modern vehicles. This segment alone is projected to account for over xx% of the global market revenue by 2033, valued at more than $XX billion.

- Key Drivers in Automotive:

- Performance Enhancement: High-performance and luxury vehicles require braking systems capable of withstanding extreme temperatures and delivering consistent stopping power, making C-SiC discs indispensable.

- Weight Reduction: The lightweight nature of C-SiC discs contributes to overall vehicle weight reduction, leading to improved fuel economy and reduced emissions, aligning with stringent environmental regulations and consumer demand for sustainability.

- Durability and Longevity: C-SiC discs offer significantly longer lifespans compared to traditional materials, reducing maintenance costs and offering a superior ownership experience.

- Motorsports Influence: The adoption of these discs in Formula 1 and other racing disciplines drives innovation and consumer interest in performance road cars.

- Technological Advancements: Continuous improvements in manufacturing processes and material composition are making C-SiC discs more accessible and cost-effective for a wider range of automotive applications.

The Aerospace sector represents another crucial and high-value market, where the absolute reliability and extreme performance characteristics of C-SiC discs are paramount for aircraft safety and operational efficiency.

- Key Drivers in Aerospace:

- Safety Criticality: The non-negotiable requirement for extreme reliability in aircraft braking systems makes C-SiC discs a preferred choice for commercial and military aircraft.

- Weight Savings: Significant weight reduction translates directly to lower fuel consumption and increased payload capacity for aircraft, a critical economic factor in aviation.

- High Temperature Resistance: Aircraft brakes experience immense heat during landing and emergency stops, a condition C-SiC discs are exceptionally suited to handle.

- Regulatory Compliance: Stringent aviation safety regulations often mandate or strongly recommend the use of advanced materials like C-SiC for critical braking components.

The Type: Long Carbon Fiber Disc segment is anticipated to hold a larger market share due to its superior mechanical properties and widespread applicability in high-performance scenarios. This segment is expected to grow at a CAGR of xx%.

- Key Drivers for Long Carbon Fiber Discs:

- Enhanced Strength and Stiffness: The longer carbon fibers provide superior structural integrity and resistance to thermal shock.

- Broader Application Range: Preferred for applications demanding the utmost in performance and durability.

- Established Manufacturing Expertise: The industry has a more mature understanding and established processes for manufacturing long carbon fiber discs.

The Type: Short Carbon Fiber Disc segment, while smaller, is experiencing significant growth driven by its cost-effectiveness and suitability for performance-oriented applications where extreme durability is not the sole priority. This segment is projected to grow at a CAGR of xx%.

- Key Drivers for Short Carbon Fiber Discs:

- Cost-Effectiveness: Offers a more accessible entry point for advanced braking technology.

- Versatility: Suitable for a wider array of performance-oriented vehicles and motorcycles.

- Emerging Manufacturing Techniques: Innovations in processing short fibers are improving their performance characteristics.

Carbon Ceramic C Sic Brake Discs Product Developments

Product developments in the Carbon Ceramic C SiC Brake Discs market are centered on enhancing performance, reducing weight, and improving cost-effectiveness. Innovations include advanced fiber architectures, novel matrix formulations for improved thermal conductivity and wear resistance, and optimized disc designs for better cooling. Companies are also focusing on integrating sensors for real-time monitoring and predictive maintenance. These developments provide a significant competitive advantage by enabling manufacturers to offer lighter, more durable, and higher-performing braking solutions tailored to specific application needs, from high-speed trains to luxury automobiles and aerospace.

Report Scope & Segmentation Analysis

This report segments the Carbon Ceramic C SiC Brake Discs market across key applications and product types.

- Application: Automotive: Encompasses passenger cars, sports cars, SUVs, and commercial vehicles. This segment is expected to reach a market size of over $XX billion by 2033, driven by increasing adoption in performance and luxury vehicles.

- Application: Aerospace: Includes commercial aircraft, military aircraft, and helicopters. This high-value segment is crucial for its stringent safety requirements and demand for weight optimization, with projected growth at a CAGR of xx%.

- Application: Motorcycle: Covers sportbikes, superbikes, and racing motorcycles. This segment, while smaller, is experiencing robust growth due to the demand for enhanced stopping power and performance, with an estimated market size of $XX million.

- Application: High Speed Train: Focuses on braking systems for high-speed rail transportation. This segment is driven by the need for reliable and efficient braking in demanding operational environments, projected to grow at a CAGR of xx%.

- Type: Long Carbon Fiber Disc: Characterized by longer carbon fibers within the composite matrix, offering superior mechanical strength and stiffness. This segment is expected to maintain a dominant market share.

- Type: Short Carbon Fiber Disc: Utilizes shorter carbon fibers, often offering a more cost-effective solution with good performance characteristics, showing strong growth potential.

Key Drivers of Carbon Ceramic C Sic Brake Discs Growth

The growth of the Carbon Ceramic C SiC Brake Discs market is propelled by several key factors. Technological advancements in material science and manufacturing processes are leading to lighter, stronger, and more durable brake discs. The increasing demand for enhanced safety and performance, particularly in the automotive and aerospace sectors, is a primary driver. Stringent regulatory frameworks pushing for fuel efficiency and reduced emissions indirectly favor lightweight materials. Furthermore, the growing popularity of motorsports and high-performance vehicles creates a significant pull for these advanced braking solutions. The lifecycle cost reduction offered by the extended durability of C-SiC discs also appeals to end-users, contributing to market expansion.

Challenges in the Carbon Ceramic C Sic Brake Discs Sector

Despite its strong growth, the Carbon Ceramic C SiC Brake Discs sector faces several challenges. The high initial cost of manufacturing and raw materials remains a significant barrier to widespread adoption, particularly in cost-sensitive segments. Complex manufacturing processes require specialized expertise and equipment, leading to higher production expenses. Supply chain disruptions for critical raw materials can impact production volumes and lead times. Intense competition from established players and potential new entrants necessitates continuous innovation and cost optimization. Furthermore, the longer lifespan and replacement cycle of these high-durability discs can affect aftermarket sales volume.

Emerging Opportunities in Carbon Ceramic C Sic Brake Discs

Emerging opportunities in the Carbon Ceramic C SiC Brake Discs market are multifaceted. The expansion of electric and hybrid vehicles presents a new avenue, as regenerative braking can be complemented by C-SiC friction brakes for superior performance and reduced wear. Advancements in additive manufacturing (3D printing) could unlock novel geometries and reduce production costs. The development of C-SiC discs for industrial applications, such as high-speed machinery and energy storage systems, offers new market frontiers. Growing interest in sustainable and environmentally friendly materials could further boost adoption, provided lifecycle assessment demonstrates clear advantages. Expansion into developing economies with increasing demand for premium and performance vehicles also represents a significant opportunity.

Leading Players in the Carbon Ceramic C Sic Brake Discs Market

- Brembo

- Surface Transforms PLC

- LEMYTH

- BrakeTech

- Wilwood Engineering

- CFC CARBON

- SGL Carbon

- Rotora

- Carbon SiC Technologies

- Hunan Jinbo Compound Materials

- Tianyishangjia New Material

- LeMyth Technology

- Hunan Shixin New Material

Key Developments in Carbon Ceramic C Sic Brake Discs Industry

- 2023/2024: Increased focus on developing cost-effective manufacturing processes for C-SiC discs to broaden market accessibility.

- 2023: Several companies announced partnerships with electric vehicle manufacturers to integrate advanced braking solutions.

- 2022: Significant advancements in C-SiC matrix formulations leading to improved thermal shock resistance and wear characteristics.

- 2022: Surface Transforms PLC secured major supply agreements for automotive applications, indicating growing market penetration.

- 2021: Introduction of novel disc designs with enhanced aerodynamic cooling properties for performance vehicles.

- 2020: Continued R&D into the integration of sensors for real-time brake monitoring and predictive maintenance.

Strategic Outlook for Carbon Ceramic C Sic Brake Discs Market

The strategic outlook for the Carbon Ceramic C SiC Brake Discs market is highly positive, driven by sustained demand for high-performance and lightweight braking solutions. Key growth catalysts include continued technological innovation in material science and manufacturing, leading to improved product performance and cost reduction. The burgeoning electric vehicle market, coupled with the automotive industry's persistent pursuit of efficiency and safety, will continue to be major growth engines. Strategic collaborations, targeted R&D investment, and expansion into emerging geographic markets will be crucial for companies to capitalize on the immense future potential of this advanced braking technology. The forecast indicates a strong upward trajectory, solidifying the position of C-SiC brake discs as a critical component in future mobility and high-performance applications.

Carbon Ceramic C Sic Brake Discs Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Aerospace

- 1.3. Motorcycle

- 1.4. High Speed Train

-

2. Type

- 2.1. Long Carbon Fiber Disc

- 2.2. Short Carbon Fiber Disc

Carbon Ceramic C Sic Brake Discs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Carbon Ceramic C Sic Brake Discs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Carbon Ceramic C Sic Brake Discs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Aerospace

- 5.1.3. Motorcycle

- 5.1.4. High Speed Train

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Long Carbon Fiber Disc

- 5.2.2. Short Carbon Fiber Disc

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Carbon Ceramic C Sic Brake Discs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Aerospace

- 6.1.3. Motorcycle

- 6.1.4. High Speed Train

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Long Carbon Fiber Disc

- 6.2.2. Short Carbon Fiber Disc

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Carbon Ceramic C Sic Brake Discs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Aerospace

- 7.1.3. Motorcycle

- 7.1.4. High Speed Train

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Long Carbon Fiber Disc

- 7.2.2. Short Carbon Fiber Disc

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Carbon Ceramic C Sic Brake Discs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Aerospace

- 8.1.3. Motorcycle

- 8.1.4. High Speed Train

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Long Carbon Fiber Disc

- 8.2.2. Short Carbon Fiber Disc

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Carbon Ceramic C Sic Brake Discs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Aerospace

- 9.1.3. Motorcycle

- 9.1.4. High Speed Train

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Long Carbon Fiber Disc

- 9.2.2. Short Carbon Fiber Disc

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Carbon Ceramic C Sic Brake Discs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive

- 10.1.2. Aerospace

- 10.1.3. Motorcycle

- 10.1.4. High Speed Train

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Long Carbon Fiber Disc

- 10.2.2. Short Carbon Fiber Disc

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Brembo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Surface Transforms PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LEMYTH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BrakeTech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wilwood Engineering

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CFC CARBON

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SGL Carbon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rotora

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carbon SiC Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hunan Jinbo Compound Materials

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tianyishangjia New Material

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LeMyth Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hunan Shixin New Material

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Brembo

List of Figures

- Figure 1: Global Carbon Ceramic C Sic Brake Discs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Carbon Ceramic C Sic Brake Discs Revenue (million), by Application 2024 & 2032

- Figure 3: North America Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Carbon Ceramic C Sic Brake Discs Revenue (million), by Type 2024 & 2032

- Figure 5: North America Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Carbon Ceramic C Sic Brake Discs Revenue (million), by Country 2024 & 2032

- Figure 7: North America Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Carbon Ceramic C Sic Brake Discs Revenue (million), by Application 2024 & 2032

- Figure 9: South America Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Carbon Ceramic C Sic Brake Discs Revenue (million), by Type 2024 & 2032

- Figure 11: South America Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Carbon Ceramic C Sic Brake Discs Revenue (million), by Country 2024 & 2032

- Figure 13: South America Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Carbon Ceramic C Sic Brake Discs Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Carbon Ceramic C Sic Brake Discs Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Carbon Ceramic C Sic Brake Discs Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Carbon Ceramic C Sic Brake Discs Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Carbon Ceramic C Sic Brake Discs Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Ceramic C Sic Brake Discs?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Carbon Ceramic C Sic Brake Discs?

Key companies in the market include Brembo, Surface Transforms PLC, LEMYTH, BrakeTech, Wilwood Engineering, CFC CARBON, SGL Carbon, Rotora, Carbon SiC Technologies, Hunan Jinbo Compound Materials, Tianyishangjia New Material, LeMyth Technology, Hunan Shixin New Material.

3. What are the main segments of the Carbon Ceramic C Sic Brake Discs?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Carbon Ceramic C Sic Brake Discs," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Carbon Ceramic C Sic Brake Discs report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Carbon Ceramic C Sic Brake Discs?

To stay informed about further developments, trends, and reports in the Carbon Ceramic C Sic Brake Discs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence