Key Insights

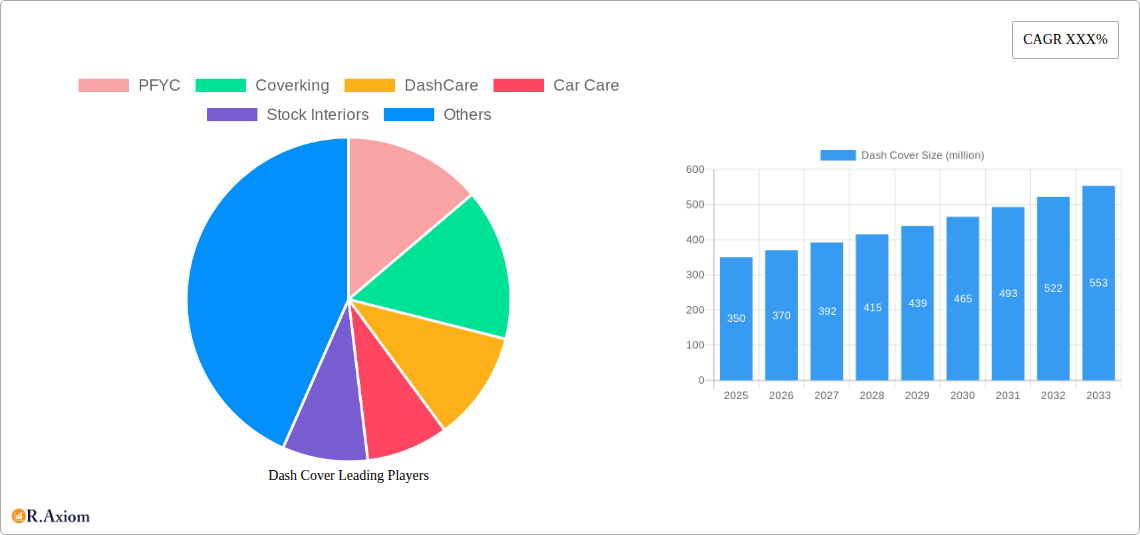

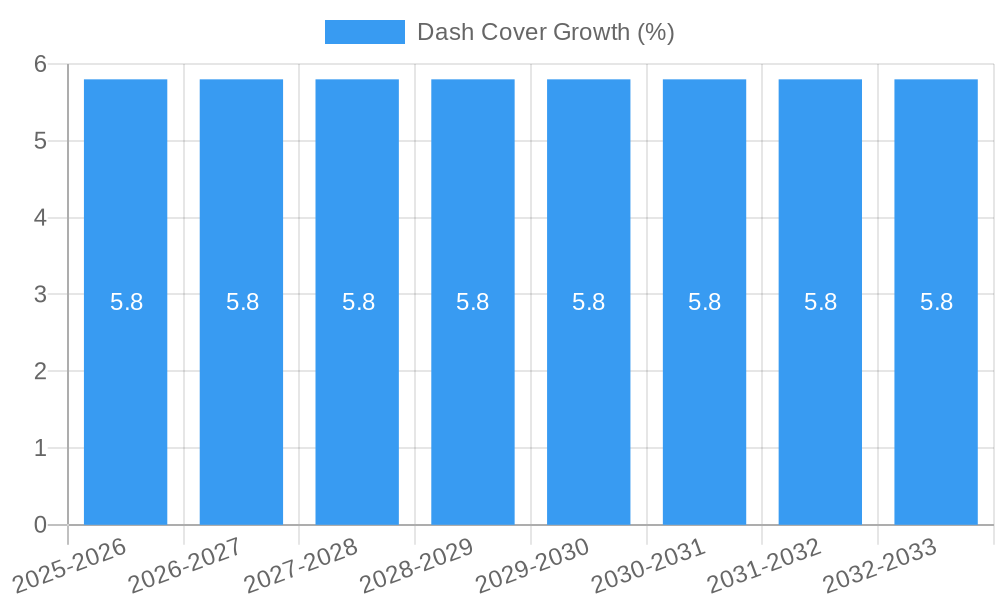

The global dash cover market is poised for significant expansion, projected to reach approximately $350 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.8% expected throughout the forecast period of 2025-2033. This growth is primarily propelled by an increasing awareness among vehicle owners regarding the protective benefits of dash covers, shielding dashboards from sun damage, cracks, and UV rays, thereby preserving their resale value. The rising average age of vehicles also contributes to market expansion, as older cars often require such accessories to maintain their aesthetic appeal and interior integrity. Furthermore, evolving consumer preferences for personalized and aesthetically pleasing vehicle interiors are driving demand for a wider variety of dash cover materials, colors, and custom designs. The aftermarket segment is expected to dominate, fueled by independent repair shops and DIY enthusiasts seeking to enhance their vehicles.

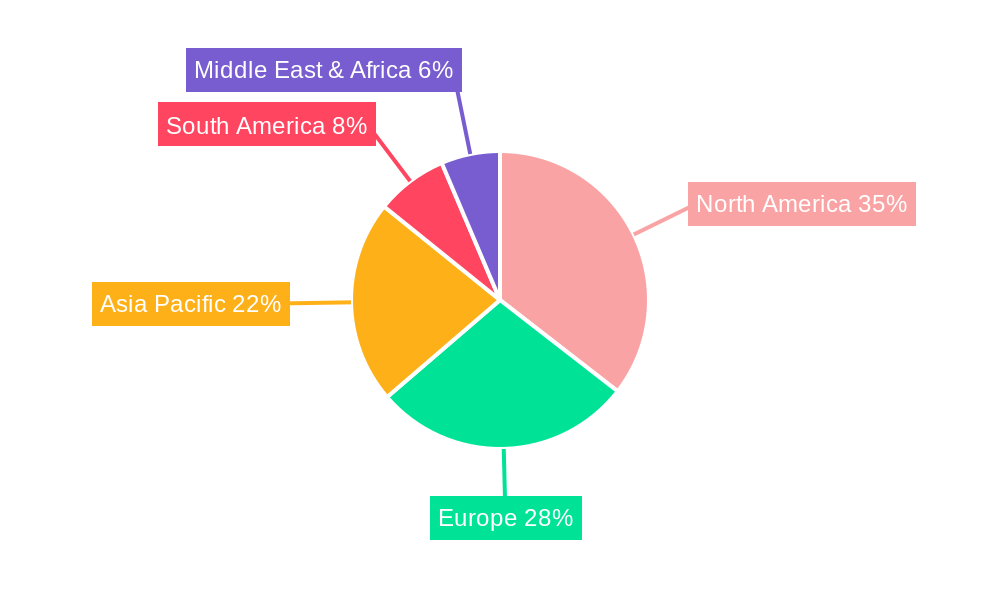

The market's upward trajectory is further supported by advancements in material technology, leading to more durable, heat-resistant, and eco-friendly dash cover options. Innovations in manufacturing processes are also contributing to the availability of custom-fit solutions for a broader range of vehicle models, enhancing consumer convenience. However, challenges such as intense competition among numerous players and potential price sensitivity in certain economic conditions could temper growth. Nevertheless, the increasing adoption of advanced driver-assistance systems (ADAS) in newer vehicles, which may require specific dash cover configurations to avoid sensor interference, presents a potential area for innovation and future market development. Emerging economies in Asia Pacific and Latin America, with their burgeoning automotive sectors and increasing disposable incomes, are anticipated to be key growth regions, offering substantial opportunities for market players.

Here is a detailed, SEO-optimized report description for the Dash Cover market, designed for immediate use:

Dash Cover Market Concentration & Innovation

The global dash cover market exhibits a moderate concentration, with key players like PFYC, Coverking, DashCare, Car Care, Stock Interiors, and Dash-Topper vying for market share. Innovation serves as a critical differentiator, driven by advancements in material science and manufacturing techniques, leading to enhanced durability, aesthetic appeal, and UV protection. Regulatory frameworks, while generally permissive, focus on safety standards and material composition. Product substitutes, such as integrated dashboard displays and vinyl wraps, present a minor challenge, but the cost-effectiveness and protective benefits of traditional dash covers maintain their relevance. End-user trends indicate a growing demand for customization, eco-friendly materials, and improved dashboard protection against sun damage and wear. Mergers and acquisitions (M&A) activity has been moderate, with an estimated total deal value exceeding one million dollars in recent periods, signaling strategic consolidation and expansion efforts by established companies. The market's trajectory is shaped by continuous innovation in materials and designs to meet evolving consumer preferences for both protection and personalization of vehicle interiors.

Dash Cover Industry Trends & Insights

The dash cover industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033. This significant expansion is fueled by several interconnected trends. An increasing automotive parc worldwide, coupled with a growing emphasis on vehicle longevity and resale value, directly bolsters demand for protective interior accessories like dash covers. Consumers are increasingly aware of the detrimental effects of prolonged sun exposure on vehicle dashboards, leading to a surge in demand for dash covers as a proactive measure. Technological disruptions are manifesting in the development of advanced materials, such as temperature-regulating fabrics and antimicrobial coatings, enhancing the functionality and appeal of dash covers. Furthermore, the proliferation of customized dashboards and the integration of sophisticated electronic displays within vehicles necessitate specialized dash cover solutions that offer precise fitment and protection without obstructing functionality. Consumer preferences are shifting towards sustainable and premium materials, influencing product development and marketing strategies. The competitive landscape is characterized by a blend of established manufacturers and emerging players, each striving to capture market share through product differentiation, price competitiveness, and effective distribution channels. Market penetration is expected to rise, particularly in developing economies with a rapidly growing middle class and increasing vehicle ownership. The aftermarket segment, in particular, is a significant contributor to market growth, driven by vehicle owners seeking to personalize and protect their investments.

Dominant Markets & Segments in Dash Cover

The dash cover market's dominance is significantly influenced by regional economic policies and automotive infrastructure. North America currently holds a leading position, driven by a high automotive parc and a consumer base that prioritizes vehicle customization and protection. The United States, in particular, represents a substantial market due to strong consumer spending on automotive aftermarket products and a climate conducive to dashboard sun damage.

Application: OEM (Original Equipment Manufacturer) While the aftermarket segment garners considerable attention, the OEM application is a foundational pillar of the dash cover market. Manufacturers are increasingly integrating dash covers as a standard or optional accessory during vehicle production, particularly in luxury and performance vehicles. This trend is driven by automotive manufacturers' focus on enhancing interior aesthetics and providing immediate protection against UV degradation from the point of sale. Economic policies that encourage longer vehicle ownership cycles and promote premium vehicle features indirectly support OEM dash cover adoption. Growth in this segment is closely tied to new vehicle sales figures, with an estimated market size in the OEM application exceeding one million dollars annually.

Application: Aftermarket The aftermarket segment is projected to be the most dynamic and expansive segment within the dash cover market. This is largely attributed to vehicle owners seeking to personalize their vehicles, protect existing dashboards from wear and tear, and mitigate sun damage accumulated over time. Factors like a robust used car market, where owners invest in maintaining and improving their vehicles, and the availability of a wide array of customization options fuel this segment's growth. Key drivers include the desire for aesthetic enhancement, protection against extreme weather conditions, and the ability to conceal existing dashboard imperfections. The aftermarket segment is estimated to be valued in the hundreds of millions of dollars and is expected to grow at a faster CAGR than the OEM segment.

Type: Plastic Plastic dash covers are a significant segment due to their durability, ease of maintenance, and cost-effectiveness. They offer robust protection against scratches, spills, and UV rays. The demand for plastic dash covers is driven by their widespread availability, variety of finishes, and compatibility with diverse vehicle models. Innovations in plastic formulations, such as UV-resistant additives and textured surfaces, further enhance their appeal. Economic policies promoting affordable automotive accessories and a strong consumer focus on practical protection contribute to the sustained demand for plastic dash covers, with an estimated market segment value in the tens of millions of dollars.

Type: Fiber Fiber dash covers, including those made from materials like carpet, felt, and blends, offer a softer aesthetic and enhanced sound dampening properties. They are particularly popular among consumers seeking a premium feel and improved cabin acoustics. The trend towards eco-friendly and recycled materials is also benefiting the fiber segment. Technological advancements in fiber weaving and finishing techniques are leading to more durable, stain-resistant, and aesthetically pleasing options. Consumer preferences for comfort and a sophisticated interior ambiance are key drivers for this segment, with its market value estimated in the tens of millions of dollars.

Type: Others This segment encompasses a range of materials and innovative solutions that extend beyond traditional plastic and fiber. This includes advanced composite materials, leatherette, and custom-molded options that offer unique benefits like temperature regulation, enhanced grip, and specific aesthetic finishes. Emerging technologies in material science and a growing demand for highly specialized and premium automotive interiors contribute to the growth of this segment. While smaller in volume compared to plastic and fiber, this segment often commands higher price points and caters to niche markets with specific demands, with its market value estimated in the millions of dollars.

Dash Cover Product Developments

Recent product developments in the dash cover market focus on integrating advanced materials for enhanced UV resistance, thermal regulation, and durability. Innovations include custom-molded covers for precise fitment across a wider range of vehicle models, and the introduction of eco-friendly and recycled fiber options. Competitive advantages are being built through superior materials that prevent dashboard cracking and fading, easy installation processes, and aesthetically pleasing finishes that complement modern vehicle interiors. Technological trends are pushing towards smart materials and designs that can adapt to varying temperatures, ensuring optimal dashboard protection and cabin comfort.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the global dash cover market, segmenting it by application into OEM and Aftermarket, and by type into Plastic, Fiber, and Others. The OEM segment, valued at approximately one million dollars, is expected to witness steady growth driven by new vehicle production. The Aftermarket segment, with an estimated market size in the hundreds of millions of dollars, is the primary growth engine, propelled by vehicle customization trends and the desire for dashboard protection. The Plastic segment, estimated at tens of millions of dollars, benefits from its durability and affordability. The Fiber segment, also valued in the tens of millions, appeals to consumers seeking comfort and acoustic benefits. The "Others" segment, encompassing niche and advanced materials, is projected to grow significantly, contributing millions in market value due to increasing demand for premium and specialized solutions.

Key Drivers of Dash Cover Growth

The dash cover market's growth is propelled by several key drivers. A primary economic factor is the expanding global automotive parc, leading to a larger pool of vehicles requiring protection. Increased consumer awareness regarding the detrimental effects of UV radiation on vehicle interiors, such as cracking and fading, acts as a significant demand catalyst. Furthermore, the rising trend of vehicle personalization and customization fuels the demand for aesthetic and functional dash covers in the aftermarket. Technological advancements in material science are enabling the development of more durable, UV-resistant, and aesthetically pleasing dash covers. Regulatory frameworks indirectly support growth by emphasizing vehicle safety and longevity, encouraging owners to maintain their vehicles effectively.

Challenges in the Dash Cover Sector

Despite its growth potential, the dash cover sector faces several challenges. Intense competition among manufacturers, particularly in the aftermarket, can lead to price wars and reduced profit margins. Ensuring consistent product quality and durability across different manufacturers and materials remains a challenge. Supply chain disruptions, particularly for raw materials, can impact production timelines and costs. Evolving automotive designs with integrated digital displays and complex dashboard layouts necessitate continuous innovation in dash cover design to ensure compatibility and avoid obstruction. Consumer perception and a lack of awareness about the long-term benefits of dash covers in certain demographics can also act as a restraint.

Emerging Opportunities in Dash Cover

Emerging opportunities in the dash cover market lie in the development of smart dash covers that offer temperature regulation or integrated charging capabilities. The increasing demand for sustainable and eco-friendly automotive accessories presents a significant opportunity for manufacturers utilizing recycled or biodegradable materials. Expansion into developing economies with a rapidly growing middle class and increasing vehicle ownership offers untapped market potential. The rise of electric vehicles (EVs) also presents unique opportunities, as their interiors may require specialized protection due to different material compositions or cooling systems. Collaborations with automotive OEMs for exclusive accessory lines can further drive market penetration.

Leading Players in the Dash Cover Market

- PFYC

- Coverking

- DashCare

- Car Care

- Stock Interiors

- Dash-Topper

Key Developments in Dash Cover Industry

- 2023: Introduction of advanced UV-resistant materials by Coverking, enhancing dashboard longevity.

- 2023: PFYC launches a new range of custom-fit fiber dash covers catering to niche vehicle models.

- 2022: DashCare expands its distribution network, increasing market reach in North America.

- 2022: Stock Interiors develops innovative, eco-friendly dash cover options using recycled materials.

- 2021: Car Care introduces a line of temperature-regulating dash covers for extreme climates.

- 2021: Dash-Topper enhances its online customization platform, offering a wider array of design choices.

Strategic Outlook for Dash Cover Market

The strategic outlook for the dash cover market remains highly positive, driven by sustained demand for vehicle protection and personalization. Key growth catalysts include ongoing innovation in material science leading to superior product offerings, expansion into emerging automotive markets, and the increasing adoption of custom and eco-friendly solutions. The aftermarket segment will continue to be the primary engine of growth, with opportunities for manufacturers to capitalize on consumer trends towards enhanced vehicle aesthetics and longevity. Strategic partnerships and a focus on sustainable practices will be crucial for long-term success and market leadership in this dynamic industry.

Dash Cover Segmentation

-

1. Application

- 1.1. OEM

- 1.2. Aftermarket

-

2. Type

- 2.1. Plastic

- 2.2. Fiber

- 2.3. Others

Dash Cover Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dash Cover REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dash Cover Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. OEM

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plastic

- 5.2.2. Fiber

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dash Cover Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. OEM

- 6.1.2. Aftermarket

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plastic

- 6.2.2. Fiber

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dash Cover Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. OEM

- 7.1.2. Aftermarket

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plastic

- 7.2.2. Fiber

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dash Cover Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. OEM

- 8.1.2. Aftermarket

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plastic

- 8.2.2. Fiber

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dash Cover Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. OEM

- 9.1.2. Aftermarket

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plastic

- 9.2.2. Fiber

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dash Cover Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. OEM

- 10.1.2. Aftermarket

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plastic

- 10.2.2. Fiber

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PFYC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coverking

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DashCare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Car Care

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Stock Interiors

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dash-Topper

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 PFYC

List of Figures

- Figure 1: Global Dash Cover Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Dash Cover Revenue (million), by Application 2024 & 2032

- Figure 3: North America Dash Cover Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Dash Cover Revenue (million), by Type 2024 & 2032

- Figure 5: North America Dash Cover Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Dash Cover Revenue (million), by Country 2024 & 2032

- Figure 7: North America Dash Cover Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dash Cover Revenue (million), by Application 2024 & 2032

- Figure 9: South America Dash Cover Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Dash Cover Revenue (million), by Type 2024 & 2032

- Figure 11: South America Dash Cover Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Dash Cover Revenue (million), by Country 2024 & 2032

- Figure 13: South America Dash Cover Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dash Cover Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Dash Cover Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Dash Cover Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Dash Cover Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Dash Cover Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Dash Cover Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dash Cover Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Dash Cover Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Dash Cover Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Dash Cover Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Dash Cover Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dash Cover Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dash Cover Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Dash Cover Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Dash Cover Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Dash Cover Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Dash Cover Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dash Cover Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dash Cover Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dash Cover Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Dash Cover Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Dash Cover Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Dash Cover Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Dash Cover Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Dash Cover Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Dash Cover Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Dash Cover Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Dash Cover Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Dash Cover Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Dash Cover Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Dash Cover Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Dash Cover Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Dash Cover Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Dash Cover Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Dash Cover Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Dash Cover Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Dash Cover Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dash Cover Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dash Cover?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Dash Cover?

Key companies in the market include PFYC, Coverking, DashCare, Car Care, Stock Interiors, Dash-Topper.

3. What are the main segments of the Dash Cover?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dash Cover," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dash Cover report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dash Cover?

To stay informed about further developments, trends, and reports in the Dash Cover, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence