Key Insights

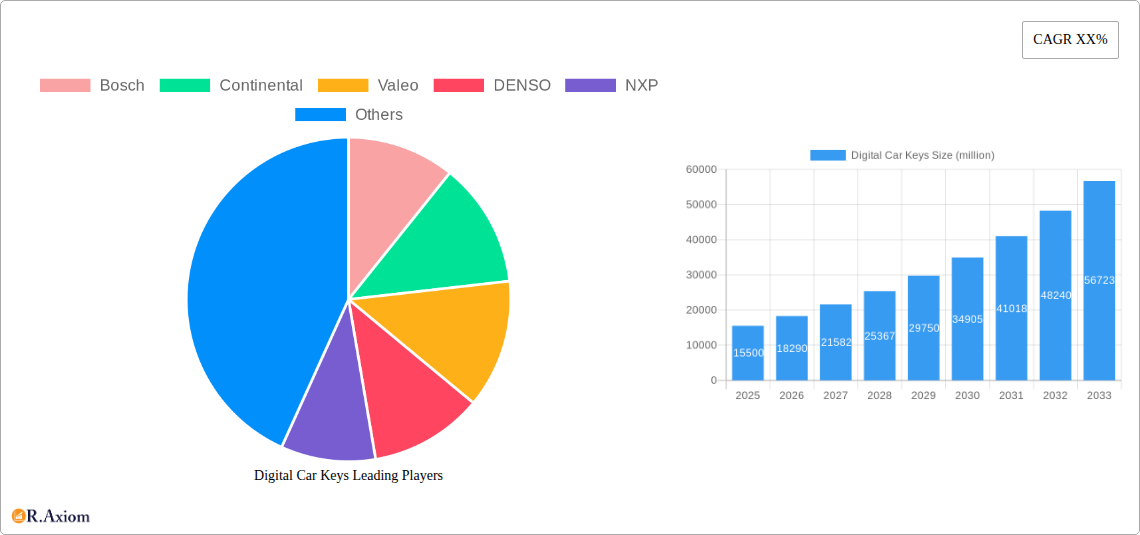

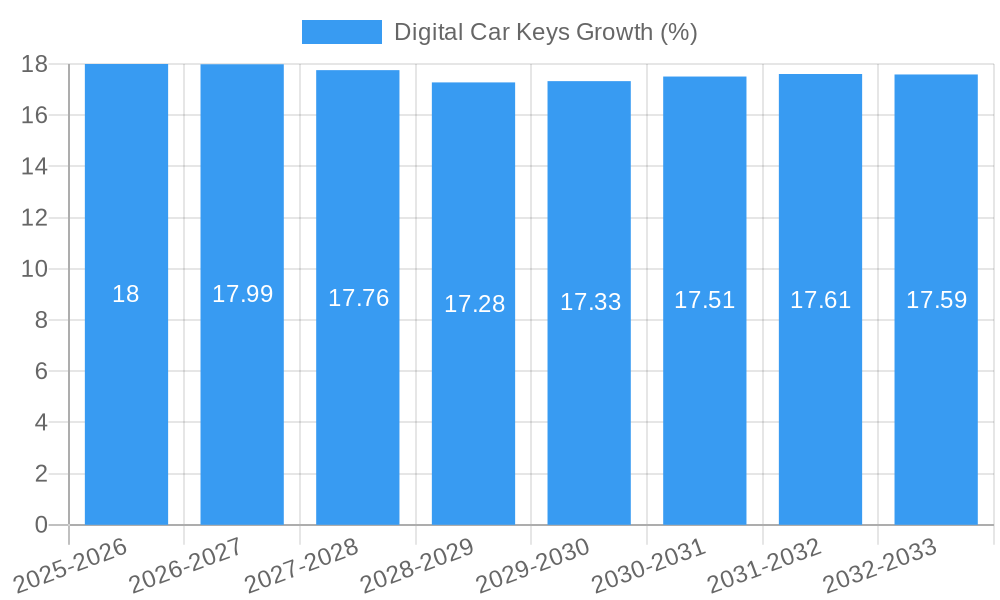

The global Digital Car Keys market is poised for significant expansion, driven by the accelerating adoption of connected vehicles and the inherent advantages of digital key technology. Anticipated to reach a market size of approximately $15,500 million by 2025, the industry is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 18% through 2033. This growth is primarily fueled by the increasing demand for enhanced vehicle security, seamless user experiences, and the integration of advanced features like remote access and vehicle sharing. The burgeoning electric vehicle (EV) and hybrid vehicle segments are particularly strong contributors, as these modern platforms readily incorporate digital key solutions to complement their sophisticated technological ecosystems. Furthermore, the convenience offered by smartphone-based access, eliminating the need for physical keys, is a key catalyst for broader consumer acceptance and market penetration.

The market is characterized by rapid innovation, with advancements in connectivity protocols such as Bluetooth Low Energy (BLE), Near Field Communication (NFC), and Ultra-Wideband (UWB) offering diverse functionalities and security levels. UWB technology, in particular, is gaining traction for its precise proximity detection and enhanced security features, setting new benchmarks for digital key performance. While the market exhibits strong growth potential, certain restraints could temper this expansion. These include the initial cost of implementation for manufacturers, the need for robust cybersecurity measures to mitigate potential threats, and consumer education regarding the security and usability of digital keys. However, the continuous efforts by leading automotive suppliers like Bosch, Continental, and Valeo, alongside technology giants such as NXP and STMicroelectronics, to develop more affordable and secure solutions, are expected to overcome these challenges, paving the way for widespread digital key adoption across all vehicle types.

Digital Car Keys Market Concentration & Innovation

The global Digital Car Keys market, projected to reach over one million million in value by 2025, exhibits a moderately concentrated landscape. Major players like Bosch, Continental, Valeo, DENSO, NXP, Alpine, STMicroelectronics, and Texas Instruments are at the forefront, driving innovation and technological advancements. Shanghai Yinji Information Security Consulting Associates, Giesecke+Devrient, Irdeto, TrustKernel, and PATEO are also significant contributors, particularly in security and software solutions. Innovation is primarily fueled by the increasing demand for seamless vehicle access, enhanced security features, and integration with connected car ecosystems. Regulatory frameworks are evolving to standardize digital key protocols and ensure data privacy, influencing product development. While direct product substitutes are limited, traditional physical keys and advanced keyless entry systems represent indirect competition. End-user trends favor convenience, personalization, and smartphone-centric solutions, pushing manufacturers towards robust BLE, NFC, and UWB based digital key technologies. Mergers and acquisitions are expected to increase, with an estimated one million million in M&A deal values over the forecast period, as companies aim to consolidate market share, acquire innovative technologies, and expand their geographical reach. Key M&A activities will focus on cybersecurity firms and software providers to bolster the security and functionality of digital car key solutions.

Digital Car Keys Industry Trends & Insights

The Digital Car Keys industry is experiencing a period of rapid expansion and transformation, driven by a confluence of technological advancements, evolving consumer expectations, and the increasing digitalization of the automotive sector. The global market is forecast to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reflecting a substantial increase in adoption across all vehicle types. This growth is underpinned by several key trends. Firstly, the surge in Electric Vehicle (EV) and Hybrid Vehicle sales directly correlates with the adoption of digital car keys, as these segments are typically equipped with more advanced technology. Consumers in these segments are more receptive to digital solutions for convenience and integration with their digital lifestyles. Secondly, advancements in wireless communication technologies, particularly Bluetooth Low Energy (BLE), Near Field Communication (NFC), and Ultra-Wideband (UWB), are enabling more secure, reliable, and feature-rich digital key experiences. UWB, in particular, offers precise proximity detection and enhanced security, becoming a critical differentiator. The market penetration of digital car keys is projected to reach over xx% of new vehicle sales by 2033, a significant leap from historical levels.

Consumer preferences are shifting dramatically. The convenience of using a smartphone as a car key, eliminating the need to carry multiple physical keys, is a primary driver. Furthermore, digital keys facilitate shared mobility services, allowing for temporary and remote access grants, which is revolutionizing car-sharing and rental platforms. The integration of digital keys with in-car infotainment systems and other smart devices is another significant trend, creating a more holistic connected car experience. Manufacturers are responding by developing interoperable platforms and offering customizable digital key features. Competitive dynamics are intensifying, with established automotive suppliers like Bosch, Continental, and Valeo investing heavily in R&D, alongside specialized technology providers like NXP and STMicroelectronics. Software and cybersecurity firms such as Irdeto and TrustKernel are also playing a crucial role in ensuring the integrity and security of digital key systems. The landscape is characterized by strategic partnerships and collaborations aimed at accelerating development and deployment. The increasing focus on cybersecurity threats and data privacy regulations is also shaping the industry, with companies emphasizing robust encryption and secure authentication mechanisms. The transition from traditional key fobs to digital solutions represents a fundamental shift in automotive access technology, promising a more connected, convenient, and secure future for vehicle ownership and usage. The overall market is expected to reach one million million by 2025, with significant growth projected thereafter.

Dominant Markets & Segments in Digital Car Keys

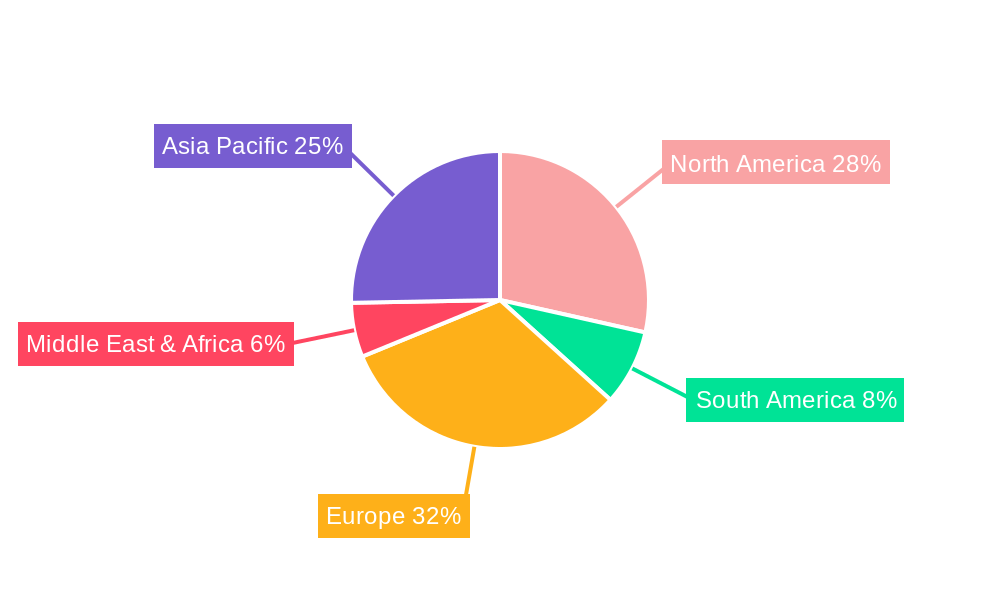

The Digital Car Keys market exhibits distinct regional dominance and segment leadership, driven by varying adoption rates, economic policies, and technological infrastructure. Europe is anticipated to lead the market, owing to stringent emissions regulations encouraging EV adoption and a strong existing infrastructure for connected car technologies. Germany, France, and the UK are expected to be key growth markets within Europe, with substantial government incentives for electric and hybrid vehicles, and a high consumer appetite for advanced automotive features.

Application Segments:

- Electric Vehicle (EV): This segment is the undisputed leader and fastest-growing application for digital car keys. The inherent technological sophistication of EVs aligns perfectly with the advanced features offered by digital key solutions. Government subsidies and mandates for EV adoption in major economies are directly boosting the demand for associated digital technologies, including digital car keys. The desire for seamless integration with charging infrastructure and smart home ecosystems further solidifies the dominance of digital keys in EVs. Market share for digital keys in EVs is projected to exceed xx% by 2033.

- Hybrid Vehicle: Hybrid vehicles represent the second-largest and a rapidly expanding segment. Similar to EVs, hybrid vehicles are increasingly equipped with advanced digital features, making digital keys a natural extension of their technological capabilities. As hybrid technology continues to mature and gain wider consumer acceptance, so too will the adoption of digital car keys within this segment.

- Fuel Vehicle: While traditionally lagging, the fuel vehicle segment is showing increasing adoption of digital keys, particularly in premium and performance models. This is driven by the desire to offer a modern user experience and competitive features, even in internal combustion engine vehicles. The growth in this segment is more moderate compared to EVs and hybrids but still represents a significant market opportunity.

Types of Digital Car Keys:

- UWB Keys: Ultra-Wideband (UWB) technology is emerging as the most dominant type of digital car key due to its superior security and precision. UWB enables highly accurate proximity sensing, significantly reducing the risk of relay attacks and enhancing the user experience with seamless, hands-free entry. Its ability to differentiate between a user's presence near the vehicle and a person holding a device behind a wall makes it a critical security advancement. The market share for UWB keys is expected to grow exponentially, reaching xx% by 2033.

- BLE Keys: Bluetooth Low Energy (BLE) remains a cornerstone of digital car key technology, offering a balance of functionality, power efficiency, and widespread device compatibility. BLE keys are well-established and continue to be a popular choice for their versatility in features like remote unlocking and starting. They are expected to maintain a significant market share, especially in mid-range vehicles.

- NFC Keys: Near Field Communication (NFC) offers a secure and convenient method for keyless entry, typically requiring close proximity between the device and the vehicle. While offering robust security for specific use cases, its range limitations make it less dominant than UWB or BLE for general-purpose digital car keys. However, NFC remains crucial for initial pairing and specific secure transactions.

- UWB Keys: Ultra-Wideband (UWB) technology is emerging as the most dominant type of digital car key due to its superior security and precision. UWB enables highly accurate proximity sensing, significantly reducing the risk of relay attacks and enhancing the user experience with seamless, hands-free entry. Its ability to differentiate between a user's presence near the vehicle and a person holding a device behind a wall makes it a critical security advancement. The market share for UWB keys is expected to grow exponentially, reaching xx% by 2033.

- BLE Keys: Bluetooth Low Energy (BLE) remains a cornerstone of digital car key technology, offering a balance of functionality, power efficiency, and widespread device compatibility. BLE keys are well-established and continue to be a popular choice for their versatility in features like remote unlocking and starting. They are expected to maintain a significant market share, especially in mid-range vehicles.

- NFC Keys: Near Field Communication (NFC) offers a secure and convenient method for keyless entry, typically requiring close proximity between the device and the vehicle. While offering robust security for specific use cases, its range limitations make it less dominant than UWB or BLE for general-purpose digital car keys. However, NFC remains crucial for initial pairing and specific secure transactions.

The dominance of these segments is further reinforced by the strategic investments from leading companies like Bosch, Continental, and NXP, who are actively developing and promoting these technologies. The regulatory landscape in regions like Europe, pushing for connected and secure vehicle access, also plays a pivotal role in shaping this market dominance.

Digital Car Keys Product Developments

Product developments in the digital car keys sector are rapidly advancing, focusing on enhanced security, user convenience, and seamless integration. Innovations include the widespread adoption of Ultra-Wideband (UWB) technology, offering superior precision and anti-spoofing capabilities compared to BLE and NFC. Manufacturers are also developing sophisticated software platforms that enable personalized access levels, temporary key sharing for family or services, and remote vehicle management via smartphone applications. Competitive advantages are being built around robust cybersecurity measures, including end-to-end encryption and secure element integration, alongside intuitive user interfaces and prolonged battery life for the mobile devices used as keys. The focus is on creating a ubiquitous, secure, and user-friendly experience that transcends traditional key fobs.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Digital Car Keys market, encompassing key applications and technological types.

Application Segments:

- Electric Vehicle (EV): This segment is projected to reach a market size of one million million by 2025 and is expected to witness a CAGR of xx% during the forecast period. Its growth is driven by government incentives, environmental consciousness, and the inherent technological compatibility with digital solutions.

- Hybrid Vehicle: Anticipated to achieve a market value of one million million by 2025, the hybrid vehicle segment is set for significant expansion with a projected CAGR of xx%. It benefits from a growing demand for fuel efficiency and reduced emissions, coupled with a consumer base open to advanced automotive features.

- Fuel Vehicle: Valued at one million million in 2025, this segment, while slower to adopt, still presents a substantial market. Its CAGR is estimated at xx%, driven by the desire to modernize traditional vehicles and compete on features in the premium segment.

Types of Digital Car Keys:

- BLE Keys: Expected to command a market size of one million million by 2025, BLE keys will continue to be a popular choice with a CAGR of xx%. Their widespread compatibility and power efficiency ensure continued relevance.

- NFC Keys: With a projected market value of one million million in 2025, NFC keys are anticipated to grow at a CAGR of xx%. Their secure, close-proximity authentication makes them valuable for specific applications.

- UWB Keys: This segment is poised for explosive growth, reaching one million million by 2025 with an impressive CAGR of xx%. UWB's advanced security and precision are positioning it as the future standard for digital car keys.

Key Drivers of Digital Car Keys Growth

The explosive growth in the Digital Car Keys market is propelled by several interconnected factors. Technologically, the maturation and widespread availability of advanced wireless communication protocols like Bluetooth Low Energy (BLE), Near Field Communication (NFC), and particularly Ultra-Wideband (UWB) are fundamental. UWB's enhanced security and precision are revolutionizing the user experience. Economically, the accelerating adoption of Electric Vehicles (EVs) and Hybrid Vehicles, often supported by government incentives and a growing consumer demand for sustainability, directly correlates with the uptake of digital key solutions. Furthermore, the expansion of the shared mobility sector and the increasing prevalence of smartphone ownership globally are creating a massive user base receptive to smartphone-based access. Regulatory frameworks are also evolving to standardize digital key functionalities and ensure robust cybersecurity, fostering consumer trust.

Challenges in the Digital Car Keys Sector

Despite its promising growth, the Digital Car Keys sector faces several significant challenges. Cybersecurity remains a paramount concern, with the potential for sophisticated hacking attempts and data breaches creating a need for constant vigilance and advanced security protocols. Ensuring robust, end-to-end encryption and secure authentication mechanisms is critical to building and maintaining consumer trust. Regulatory fragmentation across different regions can also hinder interoperability and widespread adoption, as varying standards and compliance requirements add complexity. The high cost of implementing advanced UWB technology in mass-market vehicles can also be a barrier, although this is expected to decrease with wider adoption. Furthermore, consumer education and the transition from familiar physical keys to digital alternatives require time and concerted effort. Supply chain disruptions for critical components can also impact production timelines and availability.

Emerging Opportunities in Digital Car Keys

The Digital Car Keys market is ripe with emerging opportunities. The increasing integration of digital keys with broader connected car ecosystems presents a significant avenue for growth, enabling features like predictive maintenance alerts, personalized in-car settings, and seamless integration with smart home devices. The expansion of digital key technology into fleet management and commercial vehicle applications, where efficient access management and remote control are crucial, is another key area. Furthermore, the development of standardized digital key platforms that allow for interoperability across different vehicle manufacturers and device operating systems could unlock massive market potential, akin to the early days of mobile app ecosystems. The growing demand for enhanced user experience, including customizable access permissions, gamified entry features, and seamless digital wallet integration, offers further avenues for innovation and market differentiation.

Leading Players in the Digital Car Keys Market

- Bosch

- Continental

- Valeo

- DENSO

- NXP

- Alpine

- STMicroelectronics

- Texas Instruments

- Shanghai Yinji Information Security Consulting Associates

- Giesecke+Devrient

- Irdeto

- TrustKernel

- PATEO

Key Developments in Digital Car Keys Industry

- 2023/11: Bosch announces advancements in UWB-based digital key technology, enhancing security and user experience.

- 2023/10: Continental unveils a new generation of secure digital key solutions with enhanced anti-spoofing capabilities.

- 2023/09: NXP Semiconductors releases a new chipset optimized for secure and efficient UWB digital car key applications.

- 2023/08: Valeo showcases its integrated approach to digital car keys, combining hardware and software solutions for seamless access.

- 2023/07: Irdeto partners with a leading automotive OEM to enhance the cybersecurity of their digital key platform.

- 2023/06: STMicroelectronics introduces new secure microcontrollers designed for next-generation digital car key systems.

- 2023/05: Texas Instruments demonstrates a novel approach to power-efficient BLE digital key solutions.

- 2023/04: PATEO expands its connected car services, integrating advanced digital key functionalities.

- 2023/03: Shanghai Yinji Information Security Consulting Associates releases a whitepaper on best practices for digital car key security.

- 2023/02: Giesecke+Devrient highlights its role in providing secure element solutions for digital car key implementations.

- 2023/01: Alpine introduces an integrated digital key solution for aftermarket vehicle upgrades.

- 2022/12: TrustKernel enhances its mobile security SDK to support robust digital car key applications.

Strategic Outlook for Digital Car Keys Market

The strategic outlook for the Digital Car Keys market is exceptionally positive, driven by an unstoppable wave of technological innovation and evolving consumer demands. The increasing focus on connected car ecosystems, autonomous driving features, and the burgeoning shared mobility economy will continue to fuel the adoption of digital key solutions. Companies that prioritize robust cybersecurity, seamless user experience, and interoperability across diverse platforms will be best positioned for success. Strategic partnerships between automotive manufacturers, semiconductor providers, and cybersecurity firms will be crucial for accelerating innovation and expanding market reach. The continuous development of advanced technologies like UWB, coupled with supportive regulatory frameworks, will pave the way for a future where digital keys are not just an option, but an integral and indispensable component of vehicle ownership and usage, offering unparalleled convenience, security, and integration.

Digital Car Keys Segmentation

-

1. Application

- 1.1. Electric Vehicle

- 1.2. Hybrid Vehicle

- 1.3. Fuel Vehicle

-

2. Types

- 2.1. BLE Keys

- 2.2. NFC Keys

- 2.3. UWB Keys

Digital Car Keys Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Car Keys REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Car Keys Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electric Vehicle

- 5.1.2. Hybrid Vehicle

- 5.1.3. Fuel Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. BLE Keys

- 5.2.2. NFC Keys

- 5.2.3. UWB Keys

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Car Keys Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electric Vehicle

- 6.1.2. Hybrid Vehicle

- 6.1.3. Fuel Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. BLE Keys

- 6.2.2. NFC Keys

- 6.2.3. UWB Keys

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Car Keys Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electric Vehicle

- 7.1.2. Hybrid Vehicle

- 7.1.3. Fuel Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. BLE Keys

- 7.2.2. NFC Keys

- 7.2.3. UWB Keys

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Car Keys Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electric Vehicle

- 8.1.2. Hybrid Vehicle

- 8.1.3. Fuel Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. BLE Keys

- 8.2.2. NFC Keys

- 8.2.3. UWB Keys

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Car Keys Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electric Vehicle

- 9.1.2. Hybrid Vehicle

- 9.1.3. Fuel Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. BLE Keys

- 9.2.2. NFC Keys

- 9.2.3. UWB Keys

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Car Keys Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electric Vehicle

- 10.1.2. Hybrid Vehicle

- 10.1.3. Fuel Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. BLE Keys

- 10.2.2. NFC Keys

- 10.2.3. UWB Keys

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bosch

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Continental

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Valeo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DENSO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NXP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alpine

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 STMicroelectronics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Texas Instruments

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanghai Yinji Information Security Consulting Associates

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Giesecke+Devrient

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Irdeto

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TrustKernel

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 PATEO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Bosch

List of Figures

- Figure 1: Global Digital Car Keys Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Car Keys Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Car Keys Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Car Keys Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital Car Keys Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital Car Keys Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Car Keys Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Car Keys Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Car Keys Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Car Keys Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital Car Keys Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital Car Keys Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Car Keys Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Car Keys Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Car Keys Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Car Keys Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital Car Keys Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital Car Keys Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Car Keys Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Car Keys Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Car Keys Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Car Keys Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital Car Keys Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital Car Keys Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Car Keys Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Car Keys Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Car Keys Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Car Keys Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital Car Keys Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital Car Keys Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Car Keys Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Car Keys Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Car Keys Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Car Keys Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital Car Keys Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Car Keys Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Car Keys Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital Car Keys Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Car Keys Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Car Keys Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital Car Keys Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Car Keys Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Car Keys Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital Car Keys Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Car Keys Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Car Keys Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital Car Keys Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Car Keys Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Car Keys Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital Car Keys Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Car Keys Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Car Keys?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Digital Car Keys?

Key companies in the market include Bosch, Continental, Valeo, DENSO, NXP, Alpine, STMicroelectronics, Texas Instruments, Shanghai Yinji Information Security Consulting Associates, Giesecke+Devrient, Irdeto, TrustKernel, PATEO.

3. What are the main segments of the Digital Car Keys?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Car Keys," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Car Keys report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Car Keys?

To stay informed about further developments, trends, and reports in the Digital Car Keys, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence