Key Insights

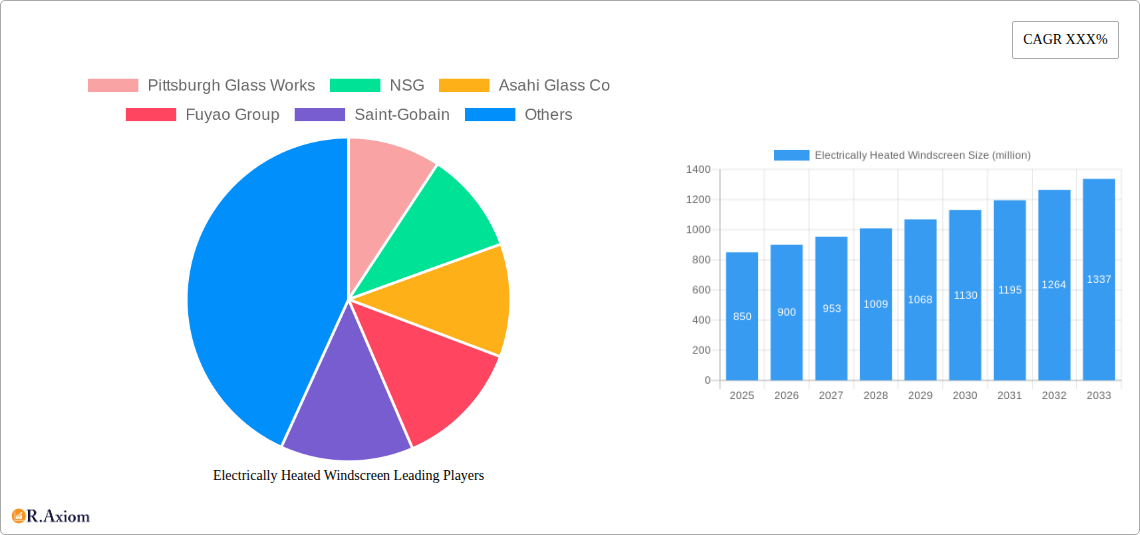

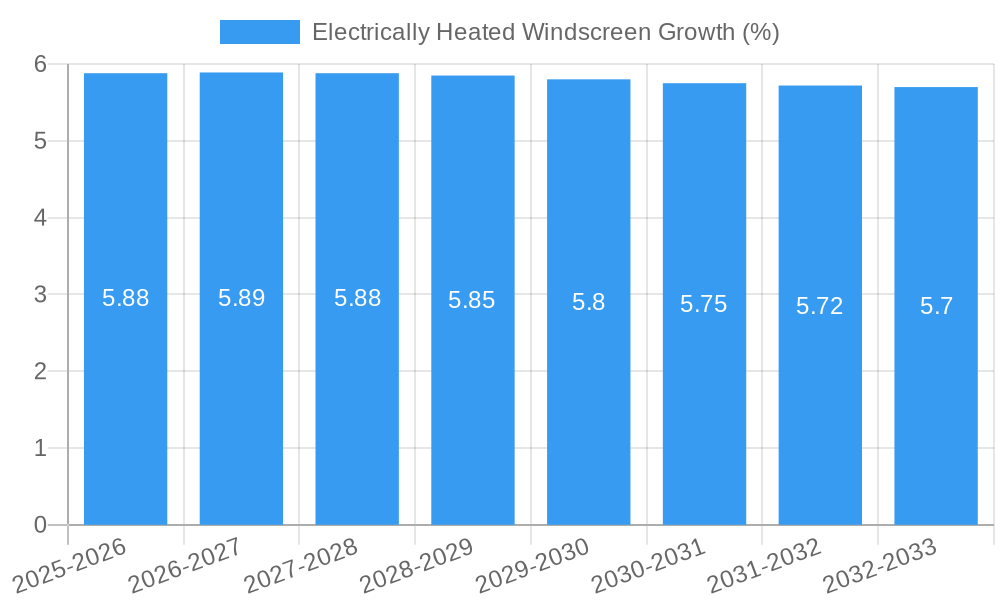

The global Electrically Heated Windscreen market is experiencing robust growth, projected to reach an estimated market size of USD 850 million in 2025. This expansion is driven by increasing consumer demand for enhanced vehicle safety, comfort, and convenience features. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, culminating in a substantial market value by the end of the forecast period. Key applications for these advanced windscreens span both Passenger Cars and Commercial Vehicles, with the automotive sector's continuous innovation in driver-assistance systems and premium features fueling this demand. The increasing adoption of Advanced Driver-Assistance Systems (ADAS) which rely on clear visibility in all weather conditions, and the growing preference for luxury and technologically advanced vehicles, are significant tailwinds for the electrically heated windscreen market. Furthermore, stringent automotive safety regulations across major regions are indirectly supporting the adoption of technologies that ensure optimal visibility for drivers.

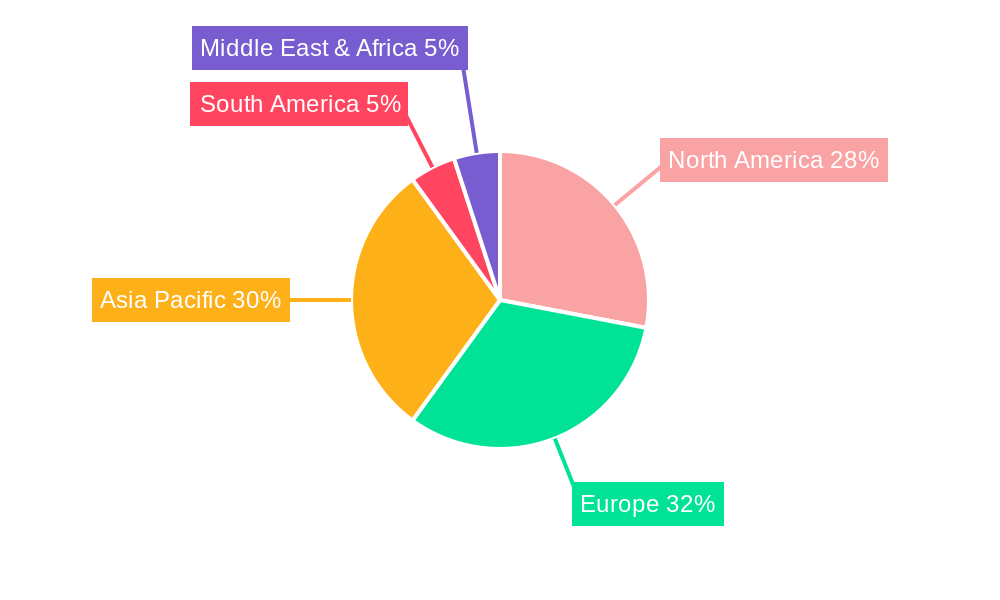

The market is segmented by type into Front Windscreen Glass, Rear Windscreen Glass, and Side Windscreen Glass. Front windscreens are expected to dominate the market due to their critical role in visibility and the integration of sensors. Leading companies such as Pittsburgh Glass Works, NSG, Asahi Glass Co, Fuyao Group, and Saint-Gobain are investing heavily in research and development to enhance the performance and cost-effectiveness of these systems. Emerging trends include the integration of smart technologies, such as embedded sensors and connectivity features, alongside advanced heating elements for faster defrosting and de-icing. However, challenges such as the higher manufacturing costs compared to conventional windscreens and the need for specialized installation and repair services may pose some restraints. Geographically, Asia Pacific, particularly China and India, is expected to witness the fastest growth due to the burgeoning automotive industry and increasing disposable incomes, while North America and Europe will continue to be significant markets driven by technological advancements and regulatory support for automotive safety.

Here is an SEO-optimized, detailed report description for the Electrically Heated Windscreen Market:

Electrically Heated Windscreen Market Concentration & Innovation

The Electrically Heated Windscreen market exhibits a moderate concentration, with key players like Pittsburgh Glass Works, NSG, Asahi Glass Co, Fuyao Group, and Saint-Gobain holding significant market share. Innovation is a primary driver, fueled by advancements in heating element integration, enhanced defrosting speed, and improved energy efficiency. Regulatory frameworks, particularly those mandating improved visibility and safety in adverse weather conditions, are also shaping market dynamics. While product substitutes like traditional defogging systems exist, their efficacy is limited compared to integrated heated windscreens, especially in extreme temperatures. End-user trends are increasingly favoring vehicles equipped with advanced driver-assistance systems (ADAS), which benefit from unobstructed sensor visibility facilitated by heated windscreens. Mergers and acquisitions (M&A) are anticipated to play a role in market consolidation, with potential deal values reaching several hundred million dollars as companies seek to expand their technological capabilities and geographical reach. Historical M&A activity from 2019–2024 indicates a trend towards strategic partnerships and acquisitions aimed at bolstering R&D and manufacturing capacity, with estimated deal values in the tens to hundreds of millions.

Electrically Heated Windscreen Industry Trends & Insights

The Electrically Heated Windscreen market is poised for significant expansion, driven by an escalating demand for enhanced automotive safety and comfort features. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033. The base year of 2025 sees a market penetration already exceeding 15% in premium vehicle segments, a figure expected to rise substantially. Technological disruptions, such as the development of more transparent and durable heating elements, alongside advancements in power management systems, are key to this upward trajectory. Consumer preferences are shifting towards vehicles that offer superior all-weather performance and convenience, making electrically heated windscreens a highly desirable feature. Competitive dynamics are intensifying, with manufacturers continuously innovating to offer integrated solutions that minimize visual obstruction and maximize defrosting efficiency. The integration of heated windscreens with smart glass technologies and sensor arrays for ADAS applications represents a major trend, promising to enhance their value proposition. Furthermore, the increasing stringency of automotive safety regulations globally, especially concerning visibility in fog, snow, and frost, is a powerful catalyst for market adoption. The study period from 2019–2033 encompasses this evolution, with historical data from 2019–2024 providing a baseline for understanding early adoption patterns and technological advancements. The estimated market size for 2025 is projected to be around $3.5 billion, with robust growth expected through 2033. Industry developments are continuously pushing the boundaries of what's possible, from lighter and more energy-efficient heating elements to seamless integration with vehicle electronics. This creates a fertile ground for further market penetration across a wider spectrum of vehicles, including electric vehicles (EVs) where efficient defrosting is crucial for maintaining optimal battery performance and range. The insights derived from this comprehensive analysis will be invaluable for stakeholders navigating this dynamic market.

Dominant Markets & Segments in Electrically Heated Windscreen

The Passenger Car segment represents the dominant market within the electrically heated windscreen industry, driven by escalating consumer demand for premium features and enhanced safety. Within this segment, Front Windscreen Glass is the primary application, accounting for an estimated 70% of the total market share. Key drivers contributing to this dominance include stringent vehicle safety regulations in major automotive markets, particularly North America and Europe, mandating improved visibility in adverse weather conditions. Economic policies in these regions, such as incentives for advanced vehicle technologies and rising disposable incomes, further fuel the adoption of electrically heated windscreens in passenger vehicles.

Infrastructure development, while not directly linked to the windscreens themselves, plays a role in encouraging the use of vehicles in all weather conditions, indirectly supporting the demand for features like heated windscreens. The market size for passenger car front windscreens in 2025 is estimated to be $2.5 billion.

- Regional Dominance: North America and Europe are the leading regions due to higher per capita vehicle ownership, stricter safety standards, and greater consumer willingness to invest in advanced automotive technologies. The market size in North America is projected to reach $1.2 billion in 2025, while Europe is expected to contribute $1.0 billion.

- Country-Specific Drivers: In the United States, consumer preference for SUVs and luxury vehicles, which frequently incorporate heated windscreens, drives adoption. Germany's strong automotive manufacturing base and its commitment to automotive innovation further solidify its position.

- Technological Advancements: The continuous improvement in the transparency, durability, and energy efficiency of heating elements makes them increasingly viable and attractive for passenger cars.

The Commercial Vehicle segment, while smaller, is showing a significant growth trajectory, with an estimated market size of $800 million in 2025. This growth is propelled by the need for uninterrupted operation of logistics and transportation fleets, especially in regions with harsh winter climates. Front Windscreen Glass also dominates this segment, critical for driver visibility and operational efficiency.

- Operational Efficiency: Heated windscreens in commercial vehicles minimize downtime caused by ice and snow accumulation, ensuring delivery schedules are met.

- Driver Safety and Comfort: Improved visibility enhances driver safety and reduces fatigue, contributing to a more productive workforce.

- Fleet Modernization: As fleet operators invest in newer, more advanced vehicles, the integration of electrically heated windscreens becomes a standard feature for enhanced performance.

The Other application segment, encompassing specialized vehicles and niche markets, represents a smaller but growing portion of the market, estimated at $200 million in 2025. This includes emergency vehicles, agricultural machinery, and off-road vehicles where visibility in challenging environments is paramount.

Electrically Heated Windscreen Product Developments

Recent product developments in electrically heated windscreens focus on integrating near-invisible heating elements, enhancing defrosting speed, and optimizing energy consumption. Innovations include the use of micro-fine wires embedded within the glass laminate or conductive coatings that provide uniform heat distribution without obstructing the driver's view. These advancements offer competitive advantages by improving safety in adverse weather conditions, reducing the need for manual defrosting, and supporting the functionality of ADAS sensors by maintaining clear vision. The market fit is driven by the automotive industry's push for enhanced occupant comfort and autonomous driving capabilities, making these technologically advanced windscreens a key differentiator.

Electrically Heated Windscreen Market Scope & Segmentation Analysis

The scope of the electrically heated windscreen market encompasses a comprehensive analysis of its various segments. The Passenger Car segment is projected to hold the largest market share, driven by increasing consumer demand for comfort and safety features, with an estimated market size of $2.5 billion in 2025. The Commercial Vehicle segment is also a significant contributor, expected to reach $800 million in 2025, fueled by the need for operational continuity in all weather conditions. The Other application segment, including specialized vehicles, is estimated at $200 million in 2025, with steady growth anticipated.

The market is further segmented by type. Front Windscreen Glass is the predominant type, representing the largest share across all applications due to its critical role in driver visibility. Rear Windscreen Glass and Side Windscreen Glass also contribute to the market, offering enhanced all-around visibility and de-icing capabilities, with their market sizes being comparatively smaller but showing steady growth.

Key Drivers of Electrically Heated Windscreen Growth

The growth of the electrically heated windscreen market is propelled by a confluence of critical factors. Technological advancements in heating element design, leading to greater transparency and energy efficiency, are paramount. The increasing stringency of automotive safety regulations worldwide, mandating improved visibility in challenging weather, acts as a significant regulatory driver. Consumer demand for enhanced comfort and convenience in vehicles, particularly in regions with extreme climates, is a major economic factor pushing adoption. Furthermore, the integration of heated windscreens with Advanced Driver-Assistance Systems (ADAS) to ensure unimpeded sensor functionality is a growing technological imperative.

Challenges in the Electrically Heated Windscreen Sector

Despite robust growth prospects, the electrically heated windscreen sector faces several challenges. The higher initial cost compared to conventional windscreens can be a deterrent for some consumers and vehicle manufacturers, particularly in budget-oriented segments, impacting market penetration. Energy consumption concerns, though diminishing with technological improvements, can still be a restraint, especially for electric vehicles where range optimization is critical. Manufacturing complexity and integration costs during vehicle assembly add to the overall price point. Additionally, supply chain disruptions and the need for specialized manufacturing processes can pose logistical hurdles. The competitive pressure from alternative de-icing technologies, while less effective, also presents a challenge.

Emerging Opportunities in Electrically Heated Windscreen

Emerging opportunities within the electrically heated windscreen market are diverse and promising. The rapid growth of the electric vehicle (EV) market presents a significant opportunity, as efficient defrosting is crucial for battery performance and range in cold climates. Advancements in smart glass technology integrating heating elements with other functionalities like variable tinting and augmented reality displays offer new avenues for product development and market differentiation. The increasing adoption of autonomous driving systems necessitates clear and unobstructed sensor views, making heated windscreens indispensable. Expansion into emerging automotive markets with rapidly developing economies and increasing vehicle ownership also presents substantial untapped potential.

Leading Players in the Electrically Heated Windscreen Market

- Pittsburgh Glass Works

- NSG

- Asahi Glass Co

- Fuyao Group

- Saint-Gobain

Key Developments in Electrically Heated Windscreen Industry

- 2023 September: Launch of next-generation, ultra-thin heating elements with improved transparency and reduced energy consumption by NSG.

- 2023 May: Pittsburgh Glass Works announces a strategic partnership with an ADAS sensor manufacturer to enhance integrated heated windscreen solutions.

- 2022 November: Fuyao Group expands its manufacturing capacity for electrically heated windscreens to meet growing demand in China.

- 2022 July: Saint-Gobain showcases advancements in conductive coating technology for heated windscreens at an automotive innovation expo.

- 2021 October: Asahi Glass Co patents a new method for embedding heating elements that significantly reduces manufacturing complexity.

Strategic Outlook for Electrically Heated Windscreen Market

The strategic outlook for the electrically heated windscreen market is highly positive, driven by an undeniable trend towards enhanced automotive safety, comfort, and technological integration. The increasing proliferation of EVs and autonomous driving systems will act as powerful growth catalysts, creating a sustained demand for advanced visibility solutions. Manufacturers focusing on cost optimization, energy efficiency, and seamless integration with ADAS will be well-positioned to capture significant market share. Furthermore, strategic partnerships and collaborations across the automotive value chain will be crucial for accelerating innovation and expanding market reach into new geographical territories and vehicle segments. The market is set for robust expansion, offering substantial opportunities for stakeholders adept at navigating technological advancements and evolving consumer expectations.

Electrically Heated Windscreen Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

- 1.3. Other

-

2. Type

- 2.1. Front Windscreen Glass

- 2.2. Rear Windscreen Glass

- 2.3. Side Windscreen Glass

Electrically Heated Windscreen Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electrically Heated Windscreen REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrically Heated Windscreen Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Front Windscreen Glass

- 5.2.2. Rear Windscreen Glass

- 5.2.3. Side Windscreen Glass

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electrically Heated Windscreen Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Front Windscreen Glass

- 6.2.2. Rear Windscreen Glass

- 6.2.3. Side Windscreen Glass

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electrically Heated Windscreen Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Front Windscreen Glass

- 7.2.2. Rear Windscreen Glass

- 7.2.3. Side Windscreen Glass

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electrically Heated Windscreen Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Front Windscreen Glass

- 8.2.2. Rear Windscreen Glass

- 8.2.3. Side Windscreen Glass

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electrically Heated Windscreen Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Front Windscreen Glass

- 9.2.2. Rear Windscreen Glass

- 9.2.3. Side Windscreen Glass

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electrically Heated Windscreen Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Front Windscreen Glass

- 10.2.2. Rear Windscreen Glass

- 10.2.3. Side Windscreen Glass

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pittsburgh Glass Works

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NSG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asahi Glass Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fuyao Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Saint-Gobain

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Pittsburgh Glass Works

List of Figures

- Figure 1: Global Electrically Heated Windscreen Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Electrically Heated Windscreen Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Electrically Heated Windscreen Revenue (million), by Application 2024 & 2032

- Figure 4: North America Electrically Heated Windscreen Volume (K), by Application 2024 & 2032

- Figure 5: North America Electrically Heated Windscreen Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Electrically Heated Windscreen Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Electrically Heated Windscreen Revenue (million), by Type 2024 & 2032

- Figure 8: North America Electrically Heated Windscreen Volume (K), by Type 2024 & 2032

- Figure 9: North America Electrically Heated Windscreen Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Electrically Heated Windscreen Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Electrically Heated Windscreen Revenue (million), by Country 2024 & 2032

- Figure 12: North America Electrically Heated Windscreen Volume (K), by Country 2024 & 2032

- Figure 13: North America Electrically Heated Windscreen Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Electrically Heated Windscreen Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Electrically Heated Windscreen Revenue (million), by Application 2024 & 2032

- Figure 16: South America Electrically Heated Windscreen Volume (K), by Application 2024 & 2032

- Figure 17: South America Electrically Heated Windscreen Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Electrically Heated Windscreen Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Electrically Heated Windscreen Revenue (million), by Type 2024 & 2032

- Figure 20: South America Electrically Heated Windscreen Volume (K), by Type 2024 & 2032

- Figure 21: South America Electrically Heated Windscreen Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Electrically Heated Windscreen Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Electrically Heated Windscreen Revenue (million), by Country 2024 & 2032

- Figure 24: South America Electrically Heated Windscreen Volume (K), by Country 2024 & 2032

- Figure 25: South America Electrically Heated Windscreen Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Electrically Heated Windscreen Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Electrically Heated Windscreen Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Electrically Heated Windscreen Volume (K), by Application 2024 & 2032

- Figure 29: Europe Electrically Heated Windscreen Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Electrically Heated Windscreen Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Electrically Heated Windscreen Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Electrically Heated Windscreen Volume (K), by Type 2024 & 2032

- Figure 33: Europe Electrically Heated Windscreen Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Electrically Heated Windscreen Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Electrically Heated Windscreen Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Electrically Heated Windscreen Volume (K), by Country 2024 & 2032

- Figure 37: Europe Electrically Heated Windscreen Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Electrically Heated Windscreen Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Electrically Heated Windscreen Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Electrically Heated Windscreen Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Electrically Heated Windscreen Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Electrically Heated Windscreen Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Electrically Heated Windscreen Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Electrically Heated Windscreen Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Electrically Heated Windscreen Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Electrically Heated Windscreen Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Electrically Heated Windscreen Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Electrically Heated Windscreen Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Electrically Heated Windscreen Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Electrically Heated Windscreen Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Electrically Heated Windscreen Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Electrically Heated Windscreen Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Electrically Heated Windscreen Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Electrically Heated Windscreen Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Electrically Heated Windscreen Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Electrically Heated Windscreen Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Electrically Heated Windscreen Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Electrically Heated Windscreen Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Electrically Heated Windscreen Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Electrically Heated Windscreen Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Electrically Heated Windscreen Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Electrically Heated Windscreen Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electrically Heated Windscreen Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electrically Heated Windscreen Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Electrically Heated Windscreen Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Electrically Heated Windscreen Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Electrically Heated Windscreen Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Electrically Heated Windscreen Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Electrically Heated Windscreen Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Electrically Heated Windscreen Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Electrically Heated Windscreen Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Electrically Heated Windscreen Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Electrically Heated Windscreen Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Electrically Heated Windscreen Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Electrically Heated Windscreen Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Electrically Heated Windscreen Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Electrically Heated Windscreen Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Electrically Heated Windscreen Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Electrically Heated Windscreen Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Electrically Heated Windscreen Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Electrically Heated Windscreen Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Electrically Heated Windscreen Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Electrically Heated Windscreen Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Electrically Heated Windscreen Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Electrically Heated Windscreen Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Electrically Heated Windscreen Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Electrically Heated Windscreen Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Electrically Heated Windscreen Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Electrically Heated Windscreen Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Electrically Heated Windscreen Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Electrically Heated Windscreen Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Electrically Heated Windscreen Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Electrically Heated Windscreen Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Electrically Heated Windscreen Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Electrically Heated Windscreen Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Electrically Heated Windscreen Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Electrically Heated Windscreen Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Electrically Heated Windscreen Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Electrically Heated Windscreen Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Electrically Heated Windscreen Volume K Forecast, by Country 2019 & 2032

- Table 81: China Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Electrically Heated Windscreen Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Electrically Heated Windscreen Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrically Heated Windscreen?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Electrically Heated Windscreen?

Key companies in the market include Pittsburgh Glass Works, NSG, Asahi Glass Co, Fuyao Group, Saint-Gobain.

3. What are the main segments of the Electrically Heated Windscreen?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrically Heated Windscreen," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrically Heated Windscreen report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrically Heated Windscreen?

To stay informed about further developments, trends, and reports in the Electrically Heated Windscreen, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence