Key Insights

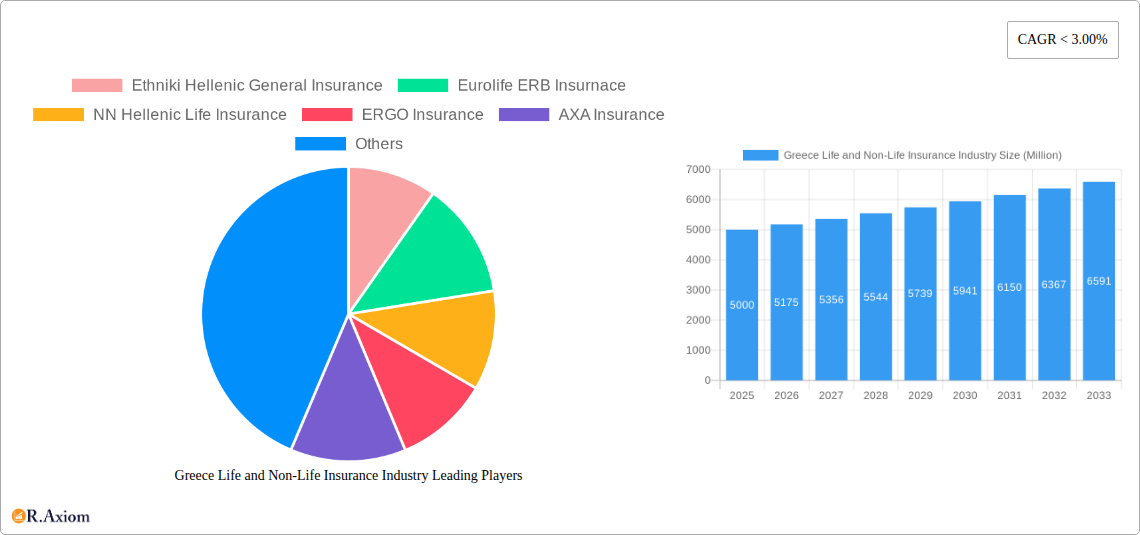

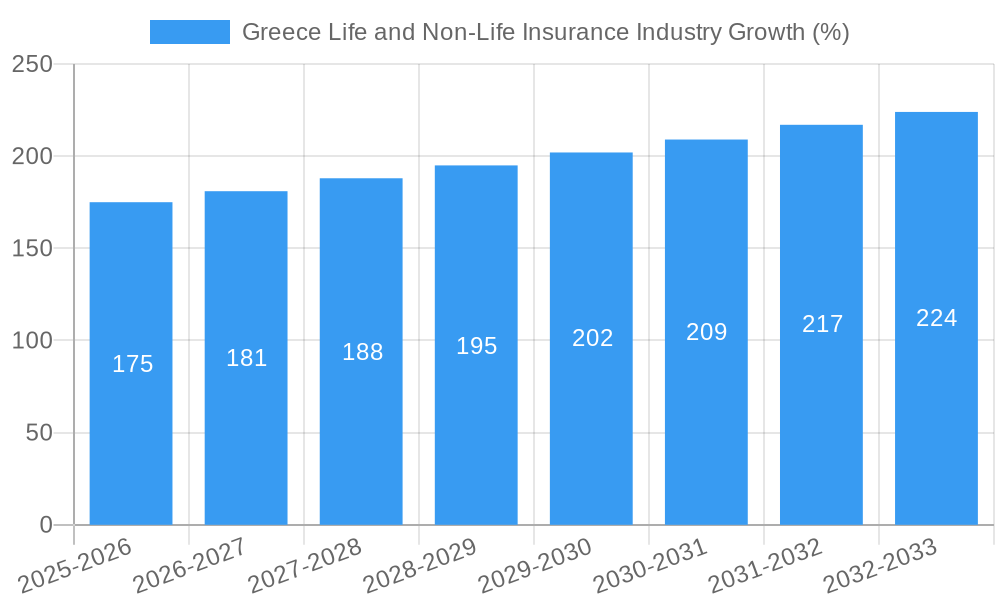

The Greek life and non-life insurance market, while exhibiting resilience amidst economic fluctuations, presents a complex landscape of opportunities and challenges. The historical period (2019-2024) likely saw moderate growth, influenced by factors such as the country's economic recovery from the sovereign debt crisis, evolving regulatory frameworks, and shifting consumer preferences towards specific insurance products like health and travel insurance given the rise in tourism. The base year of 2025 serves as a crucial benchmark, reflecting a market likely valued around €5 billion (a reasonable estimation considering the size of the Greek economy and penetration rates comparable to other Southern European nations). The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be around 3.5%, reflecting cautious optimism given anticipated GDP growth and increased consumer confidence. This growth will be driven by factors including a growing middle class, increased awareness of the importance of insurance, and the potential for digital transformation within the industry, improving efficiency and customer access.

However, significant challenges remain. These include an aging population, which while increasing the demand for certain products (like health insurance) also presents demographic shifts potentially impacting long-term growth. Furthermore, intense competition among both domestic and international players, coupled with lingering economic uncertainties and potential regulatory changes, necessitates strategic adaptation by insurers. The market's evolution will depend on successful product diversification, leveraging technological advancements, and a focus on building strong customer relationships within a competitive market landscape. The projected €7 billion market size by 2033 suggests sustained, albeit moderate, expansion based on these factors.

Greece Life and Non-Life Insurance Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Greek life and non-life insurance industry, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, key players, and future potential. The analysis includes detailed segmentation, competitive landscape, and key developments shaping the industry's trajectory.

Greece Life and Non-Life Insurance Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and merger & acquisition (M&A) activities within the Greek insurance sector. The Greek insurance market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, the presence of numerous smaller insurers ensures a degree of competition.

- Market Share: While precise market share data for each company is not publicly available for every year, Ethniki Hellenic General Insurance, Eurolife ERB Insurance, and NN Hellenic Life Insurance are estimated to hold the largest shares in the market. Further analysis within the report details this distribution across different segments (life, non-life).

- M&A Activity: Significant M&A activity has reshaped the market landscape. The 2021 sale of Ethniki Hellenic General Insurance to a private fund (CVC Capital acquiring 90.01%) and Generali's 2020 acquisition of AXA's Greek operations (at 12.2 times the 2019 price-to-earnings ratio) demonstrate the industry's consolidation trend. These transactions highlight the attractiveness of the Greek insurance market to foreign investors. The report provides a detailed breakdown of M&A deal values and their impact on market dynamics.

- Innovation: Innovation in the Greek insurance market is driven by technological advancements, particularly in areas such as digitalization, Insurtech solutions, and data analytics for risk assessment. Regulatory changes also encourage product innovation and improved customer service.

- Regulatory Framework: The regulatory framework within Greece plays a significant role in shaping industry practices, product offerings, and market dynamics. The report will thoroughly examine the relevant regulations and their influence on the market.

Greece Life and Non-Life Insurance Industry Industry Trends & Insights

This section explores the key trends driving growth and transformation within the Greek life and non-life insurance industry. Factors influencing market growth include shifting demographics (aging population impacting life insurance demand), evolving consumer preferences (demand for digital channels), and the rise of new technologies influencing both pricing and distribution strategies.

The Greek insurance market is projected to experience steady growth over the forecast period (2025-2033), driven by factors such as increasing awareness of insurance products, rising disposable incomes, and government initiatives promoting insurance penetration. However, economic uncertainties and intense competition might impact this growth rate. The report details the Compound Annual Growth Rate (CAGR) and market penetration rates based on historical data (2019-2024) and projected figures. The impact of technological disruptions, particularly the emergence of Insurtech, on market dynamics and competitive strategies, is also thoroughly analyzed. Specific discussion points include the penetration of digital insurance platforms and the acceptance of new insurance models. This section also dives into the evolving customer preferences for personalized products and convenient service delivery. A competitive landscape analysis sheds light on the strategies employed by different market players to maintain their market share or gain a competitive edge.

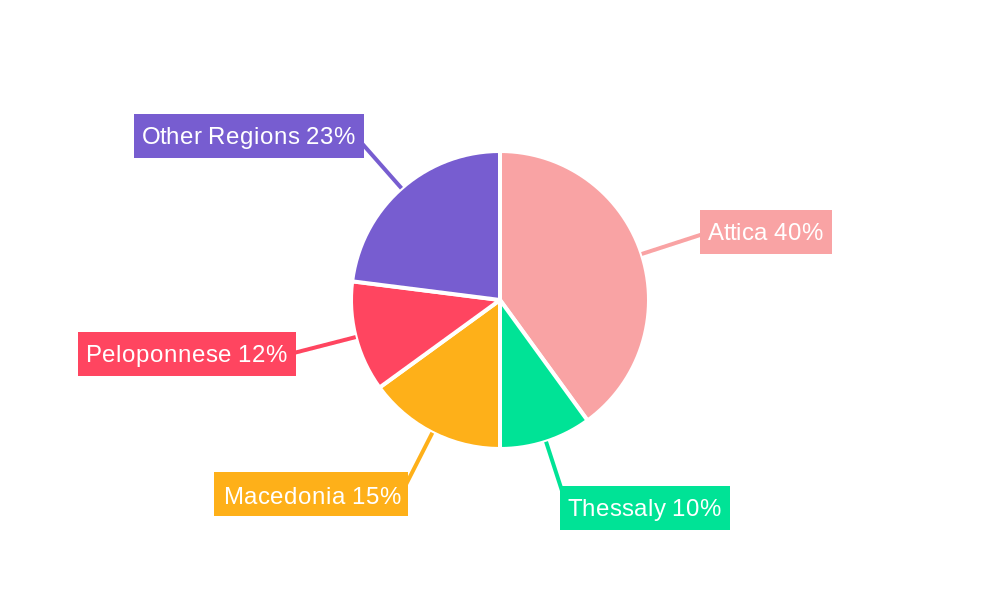

Dominant Markets & Segments in Greece Life and Non-Life Insurance Industry

The Greek life and non-life insurance industry shows significant regional variations in market penetration and growth rates. While detailed regional breakdowns require extensive data analysis which is within the scope of the main report, the report identifies the dominant market segments as follows:

Key Drivers of Dominance:

- Urban Centers: Higher population density, greater awareness of insurance products, and higher disposable incomes are major factors driving growth in urban centers.

- Economic Policies: Government policies promoting financial inclusion and insurance penetration can significantly impact market growth in different regions.

- Infrastructure: Effective infrastructure (particularly in terms of digital connectivity) facilitating the distribution of insurance products is another key driver.

Detailed Dominance Analysis: The report provides a thorough analysis of the reasons behind the dominance of specific regions or segments, factoring in economic development, consumer behavior, and regulatory dynamics. The impact of macroeconomic conditions and specific policies impacting insurance uptake are also considered.

Greece Life and Non-Life Insurance Industry Product Developments

The Greek insurance industry has witnessed several product innovations to cater to diverse customer needs and leverage technological advancements. This includes the integration of telematics data in motor insurance, personalized health insurance packages using predictive analytics, and the development of online platforms for efficient policy management. These innovations aim to offer greater value and convenience to customers. The report features an overview of various product innovations, describing their market fit and competitive advantages.

Report Scope & Segmentation Analysis

This report segments the Greek life and non-life insurance market based on product type (life insurance, non-life insurance, health insurance), distribution channel (online, offline), and customer demographics (age, income). Growth projections and market size estimates for each segment are provided, along with an analysis of the competitive landscape within each segment.

- Life Insurance: This segment is characterized by [Growth Projection, Market Size (Million)], with [Competitive Dynamics Description].

- Non-Life Insurance: This segment is characterized by [Growth Projection, Market Size (Million)], with [Competitive Dynamics Description].

- Health Insurance: This segment is characterized by [Growth Projection, Market Size (Million)], with [Competitive Dynamics Description].

Key Drivers of Greece Life and Non-Life Insurance Industry Growth

Several key factors contribute to the growth of the Greek life and non-life insurance industry. Economic growth leads to higher disposable incomes allowing greater spending on insurance. Government regulations promoting financial inclusion expand the market reach. Technological advancements, particularly digitalization, enable greater efficiency and personalization of insurance products. Rising awareness of the importance of insurance protection due to increased volatility and uncertainty also drives market growth.

Challenges in the Greece Life and Non-Life Insurance Industry Sector

Despite its growth potential, the Greek insurance industry faces several challenges. Economic instability can negatively impact consumer spending on insurance. Strict regulatory requirements and high compliance costs can limit profitability. Intense competition from both domestic and international players puts pressure on profit margins. Furthermore, the low level of insurance penetration in some segments of the population presents an obstacle to wider market expansion.

Emerging Opportunities in Greece Life and Non-Life Insurance Industry

The Greek insurance market presents several emerging opportunities. The increasing adoption of digital technologies creates new avenues for product innovation and customer engagement. Untapped segments within the population offer considerable potential for growth. The growth of Insurtech startups presents both challenges and opportunities. The expansion of microinsurance and tailored products to meet niche market needs represents considerable growth potential.

Leading Players in the Greece Life and Non-Life Insurance Industry Market

- Ethniki Hellenic General Insurance

- Eurolife ERB Insurance

- NN Hellenic Life Insurance

- ERGO Insurance

- AXA Insurance

- European Relaince General

- MetLife

- General Hellas

- Allianz Hellas

- Griupama Phoenix Hellenic Insurance

Key Developments in Greece Life and Non-Life Insurance Industry Industry

- 2020: Generali acquired AXA's Greek operations.

- 2021: CVC Capital Partners acquired a majority stake in Ethniki Hellenic General Insurance.

Strategic Outlook for Greece Life and Non-Life Insurance Industry Market

The Greek life and non-life insurance market is poised for continued growth, driven by several factors including rising disposable incomes, increasing insurance awareness, and technological advancements. The strategic focus will be on enhancing customer experience through digitalization, offering innovative products tailored to specific needs, and capitalizing on opportunities in untapped segments. The ongoing consolidation through M&A activity is expected to reshape the market landscape further. The ability to navigate the challenges of economic instability and regulatory changes will be crucial for sustained success.

Greece Life and Non-Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-Life Insurances

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Greece Life and Non-Life Insurance Industry Segmentation By Geography

- 1. Greece

Greece Life and Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Penetration Ratio of Insurance Premium and their Investments to GDP Increased Greece Life & Non-Life Insurance Industry Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Life and Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-Life Insurances

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ethniki Hellenic General Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eurolife ERB Insurnace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NN Hellenic Life Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ERGO Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AXA Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 European Relaince General

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MetLife

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Hellas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allianz Hellas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Griupama Phoenix Hellenic Insurance*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ethniki Hellenic General Insurance

List of Figures

- Figure 1: Greece Life and Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Greece Life and Non-Life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Greece Life and Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Life and Non-Life Insurance Industry?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Greece Life and Non-Life Insurance Industry?

Key companies in the market include Ethniki Hellenic General Insurance, Eurolife ERB Insurnace, NN Hellenic Life Insurance, ERGO Insurance, AXA Insurance, European Relaince General, MetLife, General Hellas, Allianz Hellas, Griupama Phoenix Hellenic Insurance*List Not Exhaustive.

3. What are the main segments of the Greece Life and Non-Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Penetration Ratio of Insurance Premium and their Investments to GDP Increased Greece Life & Non-Life Insurance Industry Size.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2021, Greek Insurance Conglomerate Ethniki Sold to Private Fund. Through its subsidiaries Garanta and Ethniki Asfalistiki Cyprus, it has a significant and dynamic presence in Romania and Cyprus, respectively. Its growth has attracted the interest of several foreign funds recently. In a statement, CVC Capital announced that it has entered into a definitive agreement to acquire 90.01% of Ethniki Insurance from NBG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Life and Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Life and Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Life and Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Greece Life and Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence