Key Insights

The U.S. Anti-Money Laundering (AML) solutions market is projected for significant expansion, anticipating a market size of $4.13 billion by 2025, fueled by a robust Compound Annual Growth Rate (CAGR) of 17.8%. This growth is driven by increasingly stringent regulatory environments, the growing sophistication of financial crimes, and heightened institutional awareness of AML compliance imperatives. Safeguarding against financial crime, protecting brand reputation, and mitigating substantial regulatory penalties are key market accelerators. Escalating volumes of illicit financial activities, evolving AML regulations, and the proactive adoption of advanced technologies by organizations to enhance defense mechanisms are primary drivers. The market also benefits from a stronger focus on customer due diligence and effective suspicious transaction monitoring.

US Anti Money Laundering Solution Market Market Size (In Billion)

The market is defined by a diverse range of solutions, with Know Your Customer (KYC) systems and Transaction Monitoring systems identified as critical components, emphasizing preventative measures and real-time detection. The prominence of software solutions highlights technological advancements, complemented by essential services for effective implementation and support. Cloud-based deployments are increasingly favored for their scalability and flexibility, though on-premise solutions remain relevant for specific data security needs. Leading providers include Jumio, NICE Actimize, Tata Consultancy Service, Oracle Corporation, and LexisNexis, driving innovation and offering comprehensive AML platforms. North America, particularly the United States, leads the market due to its mature financial sector, strict regulatory enforcement, and substantial investment in compliance technology.

US Anti Money Laundering Solution Market Company Market Share

U.S. Anti-Money Laundering Solution Market: Growth Analysis & Forecast

This comprehensive report analyzes the U.S. Anti-Money Laundering (AML) solution market, forecasting a valuation of $4.13 billion by 2025, with a projected CAGR of 17.8% from the base year 2025. The analysis covers historical data (2019–2024), the base year 2025, and a forecast period extending to 2033. Utilizing high-impact keywords such as "US AML solutions," "anti-money laundering software," "KYC compliance," "transaction monitoring systems," and "financial crime prevention," this report offers actionable insights for financial institutions, regulatory bodies, technology providers, and industry stakeholders regarding market dynamics, competitive landscapes, and future growth potential.

US Anti Money Laundering Solution Market Market Concentration & Innovation

The US Anti-Money Laundering (AML) solution market is characterized by a moderate to high level of concentration, with key players investing heavily in innovation to address evolving regulatory landscapes and sophisticated financial crime tactics. Major companies like Jumio, NICE Actimize, Tata Consultancy Service, ACI Worldwide, Lexis Nexis, Oracle Corporation, Signicat, Trust Stamp, Trulioo, and Deloitte are at the forefront of this innovation. The market share of these leading entities is significant, with the top five players estimated to hold over 60% of the market. Innovation drivers include the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced fraud detection, the demand for real-time transaction monitoring, and the need for seamless integration of AML solutions with existing financial infrastructure. Regulatory frameworks, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, continue to shape product development, demanding greater transparency and robust compliance measures. Product substitutes are limited, primarily revolving around manual processes or less sophisticated legacy systems, which are steadily being phased out due to their inefficiency. End-user trends highlight a growing preference for cloud-based solutions offering scalability and cost-effectiveness. Mergers and acquisitions (M&A) are significant activities, with notable deal values in the range of $50 Million to $500 Million, aimed at expanding market reach, acquiring new technologies, and consolidating market position. For example, the acquisition of Sentinels by Fenergo in March 2022 underscored the trend of consolidation and technology acquisition within the AML space.

US Anti Money Laundering Solution Market Industry Trends & Insights

The US Anti-Money Laundering (AML) solution market is experiencing robust growth, propelled by a confluence of escalating regulatory scrutiny, the increasing sophistication of financial crimes, and the imperative for financial institutions to fortify their defenses against illicit activities. The market is projected to reach a valuation of $35,000 Million by 2033, exhibiting a CAGR of 15.5% during the forecast period. Technological disruptions are a pivotal trend, with the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing AML processes. These technologies enable more accurate and efficient transaction monitoring, suspicious activity detection, and customer due diligence, thereby reducing false positives and enhancing operational efficiency. Consumer preferences are shifting towards seamless digital onboarding processes that align with stringent AML requirements. Financial institutions are increasingly adopting Know Your Customer (KYC) systems and Customer Due Diligence (CDD) platforms to verify customer identities and assess risk profiles effectively. The competitive dynamics are intensifying, with established players continuously innovating and newer entrants offering specialized solutions. The growing complexity of money laundering schemes, including the rise of cryptocurrency-related illicit activities, necessitates constant adaptation and advancement in AML solutions. The market penetration of sophisticated AML software is steadily increasing as financial institutions recognize the long-term cost savings and risk mitigation benefits. Furthermore, regulatory bodies are imposing stricter penalties for non-compliance, incentivizing significant investments in comprehensive AML solutions. The continuous evolution of cyber threats also plays a crucial role, pushing the demand for proactive and intelligent AML systems. The proactive measures taken by financial institutions, spurred by regulatory mandates and the inherent risks of financial crime, are fundamental to the sustained expansion of the US AML solution market. The market's trajectory indicates a future where AML solutions are not merely a compliance requirement but a strategic imperative for maintaining financial integrity and public trust.

Dominant Markets & Segments in US Anti Money Laundering Solution Market

The US Anti-Money Laundering (AML) solution market is experiencing significant growth across its various segments, with certain areas exhibiting particular dominance.

Dominant Regions/Countries:

- United States: As the primary focus of this report, the United States consistently demonstrates the highest market share due to its stringent regulatory environment, the presence of a vast financial services sector, and substantial investments in financial crime prevention technologies. Economic policies promoting financial stability and robust infrastructure supporting digital finance further bolster its dominance.

Dominant Segments by Solution:

Know Your Customers (KYC) System: This segment holds a leading position, driven by the fundamental need for financial institutions to accurately identify and verify the identities of their customers to prevent fraud and money laundering.

- Key Drivers: Increasing digital onboarding, stringent customer identification regulations, and the need to combat identity theft and synthetic fraud.

- Dominance Analysis: The KYC segment is critical for initial customer engagement and risk assessment. Financial institutions are investing heavily in automated KYC solutions that leverage biometrics, AI-powered document verification, and data analytics to streamline the onboarding process while ensuring compliance. The market for KYC solutions is expected to continue its upward trajectory due to the persistent threat of synthetic identities and the growing volume of digital transactions.

Transaction Monitoring: This segment is also a major contributor to market growth, as real-time monitoring is essential for detecting suspicious financial activities and preventing illicit fund flows.

- Key Drivers: The increasing volume and complexity of financial transactions, the rise of cryptocurrencies, and the need for proactive fraud detection.

- Dominance Analysis: Advanced transaction monitoring systems, often powered by AI and ML, are crucial for analyzing vast amounts of data to identify anomalies and potential money laundering patterns. The ability to monitor transactions across various channels and asset classes is paramount.

Compliance Reporting: This segment is vital for meeting regulatory obligations.

- Key Drivers: Strict reporting requirements from regulatory bodies like FinCEN, and the need for accurate and timely submission of Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs).

- Dominance Analysis: Automated compliance reporting tools reduce manual effort, minimize errors, and ensure adherence to evolving regulatory mandates.

Auditing and Reporting: This segment supports internal and external audits of AML processes.

- Key Drivers: The need for robust internal controls, independent validation of AML program effectiveness, and preparation for regulatory audits.

- Dominance Analysis: Tools that facilitate comprehensive auditing and detailed reporting on AML program performance are critical for demonstrating compliance and identifying areas for improvement.

Other Solutions: This encompasses a range of services and technologies that support AML efforts.

- Key Drivers: Evolving financial crime typologies, specialized risk management needs, and emerging technologies.

Dominant Segments by Type:

Software: The software segment dominates the market, with a wide array of solutions for KYC, transaction monitoring, compliance reporting, and risk management.

- Key Drivers: Scalability, automation capabilities, and the continuous innovation in software features.

Services: While software is dominant, services, including consulting, implementation, and managed services, play a crucial supporting role and represent a significant market segment.

- Key Drivers: Expertise required for complex AML implementations, ongoing support, and regulatory guidance.

Dominant Segments by Deployment Model:

On-Cloud: Cloud-based AML solutions are gaining significant traction due to their flexibility, scalability, and cost-effectiveness.

- Key Drivers: Lower upfront investment, rapid deployment, and accessibility from any location.

- Dominance Analysis: The shift towards cloud deployment is a major trend, enabling financial institutions to adapt quickly to changing needs and regulatory requirements.

On-Premise: While traditional, on-premise solutions are still utilized, especially by larger institutions with specific security and control requirements.

- Key Drivers: Enhanced control over data and infrastructure, and compliance with specific industry regulations that mandate on-premise deployment.

US Anti Money Laundering Solution Market Product Developments

Product developments in the US Anti-Money Laundering (AML) solution market are primarily focused on enhancing the efficacy and efficiency of AML processes through technological advancements. Key innovations include the integration of AI and Machine Learning for more sophisticated anomaly detection in transaction monitoring, the deployment of advanced identity verification tools for robust Know Your Customer (KYC) processes, and the development of real-time compliance reporting modules. These developments offer significant competitive advantages by reducing false positives, improving risk scoring accuracy, and automating labor-intensive tasks. The market fit for these innovations is driven by the continuous need for financial institutions to adapt to evolving regulatory landscapes and combat increasingly sophisticated financial crimes, ensuring both compliance and robust risk management.

Report Scope & Segmentation Analysis

This report meticulously analyzes the US Anti-Money Laundering (AML) solution market across its comprehensive segmentation.

Solution Segmentation: The report delves into the Know Your Customers (KYC) System, Compliance Reporting, Transaction Monitoring, Auditing and Reporting, and Other Solutions. Each of these segments is analyzed for its market size, growth projections, and competitive dynamics, with KYC and Transaction Monitoring expected to exhibit the highest growth rates.

Type Segmentation: The market is segmented into Software and Services. Software solutions are anticipated to maintain a dominant market share due to their scalability and automation capabilities, while the Services segment is expected to grow steadily, driven by the need for expert implementation and ongoing support.

Deployment Model Segmentation: The analysis covers On-Cloud and On-Premise deployment models. The On-Cloud segment is projected to experience rapid expansion, driven by the demand for flexibility and cost-effectiveness, while On-Premise solutions will continue to cater to specific institutional needs for control and security.

Key Drivers of US Anti Money Laundering Solution Market Growth

The US Anti-Money Laundering (AML) solution market is propelled by several key factors. Firstly, the increasing stringency and ever-evolving nature of regulatory mandates from bodies like FinCEN are compelling financial institutions to invest in advanced AML solutions. Secondly, the escalating sophistication of financial crimes, including cyber fraud and the misuse of digital assets, necessitates more robust and intelligent detection and prevention mechanisms. Technological advancements, particularly in Artificial Intelligence (AI) and Machine Learning (ML), are enabling the development of more accurate and efficient AML tools, driving adoption. Furthermore, the growing focus on customer experience, where seamless yet secure onboarding is paramount, is fueling the demand for advanced KYC and identity verification solutions.

Challenges in the US Anti Money Laundering Solution Market Sector

Despite its strong growth trajectory, the US Anti-Money Laundering (AML) solution market faces several challenges. The complexity and constant changes in regulatory frameworks pose a significant hurdle, requiring continuous adaptation and investment in compliance technologies. The high cost of implementing and maintaining comprehensive AML systems can be a barrier, especially for smaller financial institutions. Moreover, the increasing volume of data generated by financial transactions presents challenges in processing and analyzing information effectively, often leading to high rates of false positives that strain operational resources. Competitive pressures are also intense, with a crowded marketplace requiring continuous innovation and differentiation.

Emerging Opportunities in US Anti Money Laundering Solution Market

Emerging opportunities within the US Anti-Money Laundering (AML) solution market are significant and diverse. The rapid growth of cryptocurrencies and Decentralized Finance (DeFi) presents a substantial opportunity for specialized AML solutions tailored to these asset classes. The increasing adoption of AI and ML technologies opens avenues for developing predictive analytics and real-time risk assessment tools that can proactively identify and mitigate financial crime. Furthermore, the growing demand for end-to-end digital onboarding solutions that seamlessly integrate KYC/AML processes offers a prime area for innovation and market expansion. The ongoing consolidation within the financial services industry also creates opportunities for AML solution providers to offer integrated platforms and services to a broader client base.

Leading Players in the US Anti Money Laundering Solution Market Market

- Jumio

- NICE Actimize

- Tata Consultancy Service

- ACI Worldwide

- Lexis Nexis

- Oracle Corporation

- Signicat

- Trust Stamp

- Trulioo

- Deloitte

Key Developments in US Anti Money Laundering Solution Market Industry

- June 2022: ACI Worldwide, a global leader in mission-critical real-time payment software, announced an agreement to divest its corporate online banking solutions ACI Digital Business Banking to One Equity Partners, a middle market private equity firm. This strategic move signifies a potential shift in focus for ACI Worldwide within the broader financial technology landscape, impacting its competitive positioning in related AML solution areas.

- March 2022: Sentinels was acquired by Fenergo, the leading provider of Customer Lifecycle Management technology solutions for financial institutions. Sentinels, founded in 2019 in Amsterdam, Netherlands, specialized in solving problems in transaction monitoring solutions. This acquisition by Fenergo enhances its capabilities in transaction monitoring, a critical component of AML, and signals increasing consolidation and technology integration within the market.

Strategic Outlook for US Anti Money Laundering Solution Market Market

The strategic outlook for the US Anti-Money Laundering (AML) solution market is exceptionally positive, characterized by sustained growth driven by ongoing regulatory pressures and the persistent threat of financial crime. Key growth catalysts include the continuous innovation in AI and ML to enhance fraud detection and compliance automation, the expansion of AML solutions into emerging financial sectors like cryptocurrency and DeFi, and the increasing demand for cloud-based, scalable platforms. Strategic partnerships and M&A activities are expected to continue as companies seek to broaden their offerings and market reach. The future success of market players will hinge on their ability to offer comprehensive, adaptable, and technologically advanced solutions that address the dynamic challenges of financial crime prevention and regulatory adherence.

US Anti Money Laundering Solution Market Segmentation

-

1. Solution

- 1.1. Know Your Customers (KYC) System

- 1.2. Compliance Reporting

- 1.3. Transaction Monitoring

- 1.4. Auditing and Reporting

- 1.5. Other Solutions

-

2. Type

- 2.1. Software

- 2.2. Services

-

3. Deployment Model

- 3.1. On-Cloud

- 3.2. On-Premise

US Anti Money Laundering Solution Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

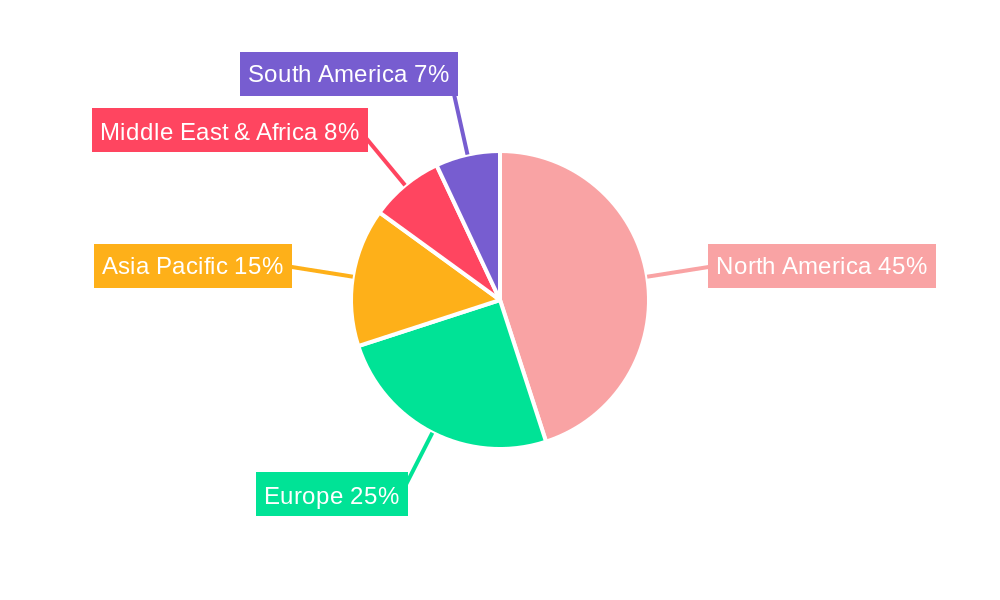

US Anti Money Laundering Solution Market Regional Market Share

Geographic Coverage of US Anti Money Laundering Solution Market

US Anti Money Laundering Solution Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. US-Anti Money laundering market is affected by development of New transaction meathods.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Anti Money Laundering Solution Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Know Your Customers (KYC) System

- 5.1.2. Compliance Reporting

- 5.1.3. Transaction Monitoring

- 5.1.4. Auditing and Reporting

- 5.1.5. Other Solutions

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Software

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by Deployment Model

- 5.3.1. On-Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America US Anti Money Laundering Solution Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Know Your Customers (KYC) System

- 6.1.2. Compliance Reporting

- 6.1.3. Transaction Monitoring

- 6.1.4. Auditing and Reporting

- 6.1.5. Other Solutions

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Software

- 6.2.2. Services

- 6.3. Market Analysis, Insights and Forecast - by Deployment Model

- 6.3.1. On-Cloud

- 6.3.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. South America US Anti Money Laundering Solution Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Know Your Customers (KYC) System

- 7.1.2. Compliance Reporting

- 7.1.3. Transaction Monitoring

- 7.1.4. Auditing and Reporting

- 7.1.5. Other Solutions

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Software

- 7.2.2. Services

- 7.3. Market Analysis, Insights and Forecast - by Deployment Model

- 7.3.1. On-Cloud

- 7.3.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Europe US Anti Money Laundering Solution Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Know Your Customers (KYC) System

- 8.1.2. Compliance Reporting

- 8.1.3. Transaction Monitoring

- 8.1.4. Auditing and Reporting

- 8.1.5. Other Solutions

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Software

- 8.2.2. Services

- 8.3. Market Analysis, Insights and Forecast - by Deployment Model

- 8.3.1. On-Cloud

- 8.3.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Middle East & Africa US Anti Money Laundering Solution Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Know Your Customers (KYC) System

- 9.1.2. Compliance Reporting

- 9.1.3. Transaction Monitoring

- 9.1.4. Auditing and Reporting

- 9.1.5. Other Solutions

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Software

- 9.2.2. Services

- 9.3. Market Analysis, Insights and Forecast - by Deployment Model

- 9.3.1. On-Cloud

- 9.3.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Asia Pacific US Anti Money Laundering Solution Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Know Your Customers (KYC) System

- 10.1.2. Compliance Reporting

- 10.1.3. Transaction Monitoring

- 10.1.4. Auditing and Reporting

- 10.1.5. Other Solutions

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Software

- 10.2.2. Services

- 10.3. Market Analysis, Insights and Forecast - by Deployment Model

- 10.3.1. On-Cloud

- 10.3.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jumio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NICE Actimize

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tata Consultancy Service

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ACI Worldwide

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lexis Nexis

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oracle Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Signicat**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trust Stamp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trulioo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Deloitte

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jumio

List of Figures

- Figure 1: Global US Anti Money Laundering Solution Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Anti Money Laundering Solution Market Revenue (billion), by Solution 2025 & 2033

- Figure 3: North America US Anti Money Laundering Solution Market Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America US Anti Money Laundering Solution Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America US Anti Money Laundering Solution Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America US Anti Money Laundering Solution Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 7: North America US Anti Money Laundering Solution Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 8: North America US Anti Money Laundering Solution Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Anti Money Laundering Solution Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Anti Money Laundering Solution Market Revenue (billion), by Solution 2025 & 2033

- Figure 11: South America US Anti Money Laundering Solution Market Revenue Share (%), by Solution 2025 & 2033

- Figure 12: South America US Anti Money Laundering Solution Market Revenue (billion), by Type 2025 & 2033

- Figure 13: South America US Anti Money Laundering Solution Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America US Anti Money Laundering Solution Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 15: South America US Anti Money Laundering Solution Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: South America US Anti Money Laundering Solution Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Anti Money Laundering Solution Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Anti Money Laundering Solution Market Revenue (billion), by Solution 2025 & 2033

- Figure 19: Europe US Anti Money Laundering Solution Market Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Europe US Anti Money Laundering Solution Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Europe US Anti Money Laundering Solution Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe US Anti Money Laundering Solution Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 23: Europe US Anti Money Laundering Solution Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 24: Europe US Anti Money Laundering Solution Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Anti Money Laundering Solution Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Anti Money Laundering Solution Market Revenue (billion), by Solution 2025 & 2033

- Figure 27: Middle East & Africa US Anti Money Laundering Solution Market Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Middle East & Africa US Anti Money Laundering Solution Market Revenue (billion), by Type 2025 & 2033

- Figure 29: Middle East & Africa US Anti Money Laundering Solution Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa US Anti Money Laundering Solution Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 31: Middle East & Africa US Anti Money Laundering Solution Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 32: Middle East & Africa US Anti Money Laundering Solution Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Anti Money Laundering Solution Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Anti Money Laundering Solution Market Revenue (billion), by Solution 2025 & 2033

- Figure 35: Asia Pacific US Anti Money Laundering Solution Market Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Asia Pacific US Anti Money Laundering Solution Market Revenue (billion), by Type 2025 & 2033

- Figure 37: Asia Pacific US Anti Money Laundering Solution Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific US Anti Money Laundering Solution Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 39: Asia Pacific US Anti Money Laundering Solution Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 40: Asia Pacific US Anti Money Laundering Solution Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Anti Money Laundering Solution Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 2: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 4: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 6: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 8: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 13: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 15: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 20: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 21: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 22: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 33: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 35: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Solution 2020 & 2033

- Table 43: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 45: Global US Anti Money Laundering Solution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Anti Money Laundering Solution Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Anti Money Laundering Solution Market?

The projected CAGR is approximately 17.8%.

2. Which companies are prominent players in the US Anti Money Laundering Solution Market?

Key companies in the market include Jumio, NICE Actimize, Tata Consultancy Service, ACI Worldwide, Lexis Nexis, Oracle Corporation, Signicat**List Not Exhaustive, Trust Stamp, Trulioo, Deloitte.

3. What are the main segments of the US Anti Money Laundering Solution Market?

The market segments include Solution, Type, Deployment Model.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

US-Anti Money laundering market is affected by development of New transaction meathods..

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022 - ACI Worldwide a global leader in mission-critical real-time payment software announced an agreement to divest its corporate online banking solutions ACI Digital Business Banking to One Equity Partners, a middle market private equity firm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Anti Money Laundering Solution Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Anti Money Laundering Solution Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Anti Money Laundering Solution Market?

To stay informed about further developments, trends, and reports in the US Anti Money Laundering Solution Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence