Key Insights

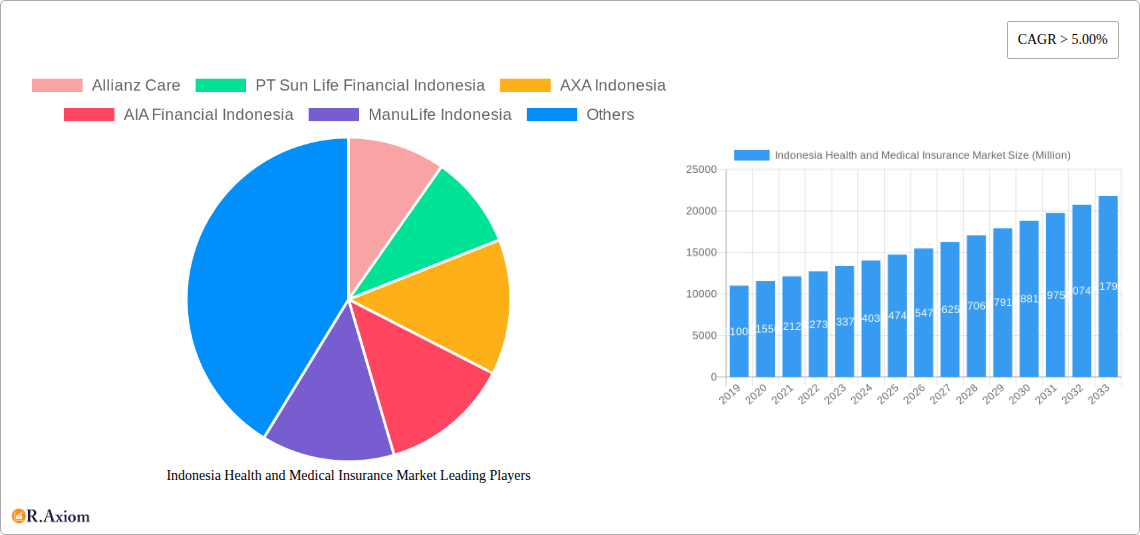

The Indonesia Health and Medical Insurance Market is poised for robust expansion, projected to reach a substantial market size of approximately USD 15,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) exceeding 5.00%. This growth trajectory is primarily propelled by a confluence of factors, including an escalating awareness of health and wellness among the Indonesian population, a rising incidence of lifestyle-related diseases, and the increasing demand for comprehensive healthcare solutions. The government's commitment to improving healthcare infrastructure and accessibility further bolsters market confidence. Key market drivers include a growing middle class with enhanced disposable incomes, a greater understanding of the financial implications of unexpected medical expenses, and the continuous innovation in insurance products offering wider coverage and tailored benefits. The market is witnessing a surge in demand for individual health plans, family packages, and corporate health insurance, reflecting diverse consumer needs.

Indonesia Health and Medical Insurance Market Market Size (In Billion)

Further segmentation of the market reveals significant activity across production, consumption, import, and export analyses, each contributing to the overall market dynamics. While specific figures for each segment are not provided, the sustained growth indicates a healthy balance and increasing engagement in all these areas. The price trend analysis likely reflects a dynamic environment where competitive pressures and evolving policy benefits influence pricing strategies. Leading insurance providers such as Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, and Cigna Insurance are actively shaping the market through product development and strategic partnerships. The robust performance is further supported by key trends such as the adoption of digital platforms for policy management and claims processing, the increasing popularity of critical illness coverage, and the growing interest in preventive healthcare initiatives. However, potential restraints might include affordability concerns for a segment of the population, regulatory complexities, and the need for continuous product innovation to keep pace with evolving healthcare needs and technological advancements.

Indonesia Health and Medical Insurance Market Company Market Share

This in-depth report provides a thorough analysis of the Indonesia Health and Medical Insurance Market, encompassing historical performance, current trends, and future projections. Examining key market dynamics, competitive landscapes, and strategic initiatives, this report is an essential resource for stakeholders seeking to understand and capitalize on the growth opportunities within Indonesia's burgeoning healthcare insurance sector.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Indonesia Health and Medical Insurance Market Market Concentration & Innovation

The Indonesia Health and Medical Insurance Market is characterized by a moderate to high market concentration, with a few key players holding significant market share. Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, and Cigna Insurance are among the prominent entities shaping the competitive landscape. Innovation in this sector is driven by the increasing demand for comprehensive health coverage, the adoption of digital platforms for policy management and claims processing, and the development of specialized health insurance products catering to diverse demographic needs. Regulatory frameworks, primarily governed by OJK (Otoritas Jasa Keuangan), are continuously evolving to ensure consumer protection and market stability. While direct product substitutes are limited, the availability of government-backed health schemes (like BPJS Kesehatan) presents an indirect competitive pressure. End-user trends highlight a growing preference for flexible and personalized insurance plans, with a strong emphasis on preventative care and wellness benefits. Merger and acquisition (M&A) activities, though not extensively documented in public domain for specific values, are anticipated to play a role in consolidating market share and expanding service portfolios. The market share of leading players is estimated to be between 15% and 25% each, contributing to the consolidated nature of the industry.

Indonesia Health and Medical Insurance Market Industry Trends & Insights

The Indonesia Health and Medical Insurance Market is experiencing robust growth, driven by a confluence of factors including rising per capita income, increasing health consciousness among the population, and a growing awareness of the financial implications of healthcare expenses. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be approximately 12.5%, reflecting the significant potential of this market. Market penetration, currently standing at around 25%, is expected to rise substantially as more Indonesians seek financial protection against health-related uncertainties.

Technological disruptions are playing a pivotal role in transforming the industry. The adoption of InsurTech solutions, including AI-powered chatbots for customer service, mobile applications for policy management and claims submission, and data analytics for personalized product offerings, is becoming increasingly prevalent. These innovations enhance operational efficiency, improve customer experience, and enable insurers to better assess risks and develop tailored products.

Consumer preferences are evolving, with a noticeable shift towards comprehensive health insurance plans that cover a wider range of medical services, including critical illnesses, hospitalization, outpatient treatments, and specialized therapies. There is also a growing demand for digital-first insurance solutions that offer convenience and transparency. Furthermore, younger demographics are showing a greater inclination towards proactive health management, leading to an increased demand for wellness programs and preventive care benefits integrated into insurance policies.

The competitive dynamics within the Indonesia Health and Medical Insurance Market are intense. Established international and domestic players are vying for market share, continuously innovating their product portfolios and distribution channels. Strategic partnerships with banks and other financial institutions are crucial for expanding reach and customer acquisition. The market is also seeing increased activity from digital-native insurers, challenging traditional models with their agile approach and focus on customer-centricity. The regulatory environment, overseen by the Financial Services Authority (OJK), continues to emphasize consumer protection and financial soundness, influencing product development and operational strategies.

Dominant Markets & Segments in Indonesia Health and Medical Insurance Market

The Indonesia Health and Medical Insurance Market exhibits dominance across several key analytical segments.

Production Analysis: The production of health and medical insurance products is predominantly concentrated in Java, the most populous island and economic hub of Indonesia. This region benefits from a higher concentration of businesses, a larger middle-class population with disposable income, and greater access to healthcare facilities. Key drivers for this dominance include:

- Economic Policies: Favorable government policies supporting the financial services sector and healthcare infrastructure development.

- Infrastructure: Well-developed banking and telecommunication infrastructure facilitating the distribution and administration of insurance products.

- Demographics: A large, young, and increasingly health-conscious population base.

Consumption Analysis: Consumption of health and medical insurance is also heavily skewed towards urban centers, particularly Jakarta and other major cities. This is driven by:

- Higher Healthcare Costs: Urban areas typically have more advanced and expensive healthcare facilities, making insurance a necessity.

- Increased Health Awareness: Greater exposure to health information and the benefits of insurance through media and public health campaigns.

- Employer-Sponsored Plans: A significant portion of consumption comes from corporate group policies, which are more prevalent in urban business districts.

Import Market Analysis (Value & Volume): The import market for health and medical insurance services, particularly in terms of reinsurance and specialized insurance products not readily available domestically, is relatively small but growing. The value of imports is estimated to be in the range of $50 Million for the historical period. Key drivers include:

- Need for Specialized Coverage: Reinsurance for catastrophic events or niche medical treatments.

- Technological Expertise: Importing knowledge and services related to advanced risk assessment and claims management.

- Global Best Practices: Adopting international standards and product designs. The volume is difficult to quantify precisely as it often involves service contracts rather than physical goods.

Export Market Analysis (Value & Volume): Indonesia's export market for health and medical insurance services is currently nascent. The primary focus is on serving the domestic market. However, there is potential for future growth in providing services to neighboring ASEAN countries. The current export value is estimated to be less than $10 Million annually.

- Potential Expansion: Future opportunities lie in offering digital insurance solutions and niche expertise to less developed markets within the region.

- Limited Capacity: Domestic insurers are primarily focused on building their capacity to meet local demand.

Price Trend Analysis: The price of health and medical insurance in Indonesia has been on an upward trend, influenced by factors such as rising medical inflation, increasing utilization of healthcare services, and the introduction of more comprehensive benefit packages. Average annual premiums are estimated to have grown by 8-10% over the historical period.

- Medical Inflation: The primary driver of premium increases.

- Demand Growth: Increasing demand allows insurers to implement price adjustments.

- Product Features: Enhanced benefits and wider coverage naturally lead to higher premiums.

Indonesia Health and Medical Insurance Market Product Developments

Product development in the Indonesia Health and Medical Insurance Market is increasingly focused on innovation and customer-centricity. Insurers are introducing digital-first products accessible via mobile apps, offering streamlined policy issuance and claims processing. There's a growing emphasis on preventative care and wellness programs, with integrated benefits for fitness trackers, health check-ups, and telemedicine services. Companies are also developing customizable plans that allow policyholders to tailor coverage based on their specific needs and budgets, such as customizable deductibles and benefit riders. These developments aim to enhance customer engagement, improve health outcomes, and reduce long-term healthcare costs, thereby providing a competitive advantage in a rapidly evolving market.

Report Scope & Segmentation Analysis

This report meticulously segments the Indonesia Health and Medical Insurance Market across Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis.

Production Analysis: This segment analyzes the creation and underwriting of health insurance products within Indonesia. Growth projections for this segment are robust, driven by increasing demand, with market sizes expected to expand significantly. Competitive dynamics are shaped by product innovation and distribution network strength.

Consumption Analysis: This segment focuses on the uptake and utilization of health insurance policies by individuals and corporations. Projections indicate strong growth as market penetration increases. The market size here reflects the total sum insured and premium payments. Competition is fierce, with a focus on customer acquisition and retention.

Import Market Analysis (Value & Volume): This segment examines the inflow of specialized insurance services and reinsurance into Indonesia. While currently a smaller segment, it is projected to experience moderate growth as the market matures and seeks advanced risk management solutions.

Export Market Analysis (Value & Volume): This segment explores the potential and current limited activities of Indonesian insurers providing services outside the domestic market. Future growth is anticipated as regional markets develop and Indonesian firms gain expertise.

Price Trend Analysis: This segment tracks the historical and projected evolution of insurance premiums. Growth projections are linked to medical inflation and evolving benefit structures. Market sizes are reflected in the total premium collected. Competitive dynamics here involve insurers’ pricing strategies and their ability to manage costs.

Key Drivers of Indonesia Health and Medical Insurance Market Growth

Several key factors are driving the growth of the Indonesia Health and Medical Insurance Market.

- Rising Health Awareness & Per Capita Income: A growing middle class with increased disposable income is more willing and able to invest in health insurance for financial security.

- Increasing Healthcare Costs & Burden of Disease: Escalating medical expenses and a higher prevalence of chronic diseases necessitate robust financial protection.

- Government Initiatives & Regulatory Support: While the primary focus is on basic healthcare coverage, supportive regulatory frameworks for private insurance encourage market development and product innovation.

- Digital Transformation & InsurTech Adoption: The integration of technology streamlines operations, enhances customer experience, and enables the creation of more accessible and personalized insurance products.

Challenges in the Indonesia Health and Medical Insurance Market Sector

Despite its growth potential, the Indonesia Health and Medical Insurance Market faces several challenges.

- Low Market Penetration & Awareness: A significant portion of the population remains uninsured or underinsured, indicating a need for greater public awareness about the importance of health insurance.

- Affordability Concerns: The cost of comprehensive health insurance remains a barrier for many low- and middle-income individuals and families.

- Fraudulent Claims & Misuse: The prevalence of fraudulent claims can inflate operational costs and impact profitability, necessitating stricter claims verification processes.

- Inadequate Healthcare Infrastructure in Rural Areas: Uneven distribution of quality healthcare facilities can limit the perceived value of insurance in some regions.

- Intense Competition & Price Wars: The highly competitive landscape can lead to price wars, potentially eroding profit margins for insurers.

Emerging Opportunities in Indonesia Health and Medical Insurance Market

Emerging opportunities abound within the Indonesia Health and Medical Insurance Market.

- Digital Health & Telemedicine Integration: Leveraging digital platforms for remote consultations, health monitoring, and personalized wellness programs presents a significant growth avenue.

- Niche Market Segmentation: Developing specialized insurance products for specific demographics (e.g., expatriates, gig economy workers) or health conditions (e.g., critical illness, maternity) can tap into underserved markets.

- Corporate Wellness Programs: Partnering with corporations to offer comprehensive wellness and health insurance solutions for employees is a lucrative opportunity.

- Expansion into Tier 2 & 3 Cities: Increasing access to health insurance in smaller cities and rural areas through digital channels and targeted distribution strategies.

- Parametric Insurance: Exploring innovative insurance models like parametric insurance for health-related events can offer swift payouts and simplified claims.

Leading Players in the Indonesia Health and Medical Insurance Market Market

The following companies are prominent players in the Indonesia Health and Medical Insurance Market. This list is not exhaustive.

- Allianz Care

- PT Sun Life Financial Indonesia

- AXA Indonesia

- AIA Financial Indonesia

- ManuLife Indonesia

- Prudential Indonesia

- Cigna Insurance

- PT Reasuransi Indonesia Utama (Persero)

- AVIVA

- PT Great Eastern Life Indonesia

- BNI Life

- BCA Life

Key Developments in Indonesia Health and Medical Insurance Market Industry

- June 2022: Allianz Asia Pacific and HSBC have signed a 15-year extension of their strategic partnership. As part of the partnership, HSBC will be distributing Allianz insurance products, enhancing distribution reach and customer access.

- April 2022: PT Sun Life Financial Indonesia, a subsidiary of Sun Life Financial Inc., and PT Bank CIMB Niaga Tbk are in a strategic partnership in Indonesia. This partnership combines Sun Life Indonesia's comprehensive range of insurance solutions and expert Client care across all life stages with CIMB Niaga's extensive distribution network of 427 branches serving seven (7) million customers across Indonesia, significantly expanding Sun Life's market presence and customer base.

Strategic Outlook for Indonesia Health and Medical Insurance Market Market

The strategic outlook for the Indonesia Health and Medical Insurance Market is highly positive, fueled by a growing demand for comprehensive healthcare coverage and increasing financial literacy. Insurers are expected to focus on digital transformation to enhance customer experience and operational efficiency, with a strong emphasis on leveraging InsurTech for personalized product offerings and streamlined claims processing. Strategic partnerships with financial institutions and healthcare providers will remain crucial for expanding distribution networks and offering integrated health solutions. The market is poised for sustained growth, driven by a young and expanding population, rising incomes, and a greater appreciation for health security. The continuous evolution of regulatory frameworks will also play a role in shaping a more robust and consumer-centric insurance landscape, creating significant opportunities for both domestic and international players to capitalize on the market's immense potential.

Indonesia Health and Medical Insurance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Health and Medical Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Health and Medical Insurance Market Regional Market Share

Geographic Coverage of Indonesia Health and Medical Insurance Market

Indonesia Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Public Health Insurance is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allianz Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Sun Life Financial Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AXA Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIA Financial Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ManuLife Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Prudential Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cigna Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Reasuransi Indonesia Utama (Persero)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AVIVA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Great Eastern Life Indonesia**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BNI Life

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BCA Life

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Allianz Care

List of Figures

- Figure 1: Indonesia Health and Medical Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Health and Medical Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Health and Medical Insurance Market?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the Indonesia Health and Medical Insurance Market?

Key companies in the market include Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, Cigna Insurance, PT Reasuransi Indonesia Utama (Persero), AVIVA, PT Great Eastern Life Indonesia**List Not Exhaustive, BNI Life, BCA Life.

3. What are the main segments of the Indonesia Health and Medical Insurance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Public Health Insurance is Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Allianz Asia Pacific and HSBC have signed a 15-year extension of their strategic partnership. As part of the partnership, HSBC will be distributing Allianz insurance products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence