Key Insights

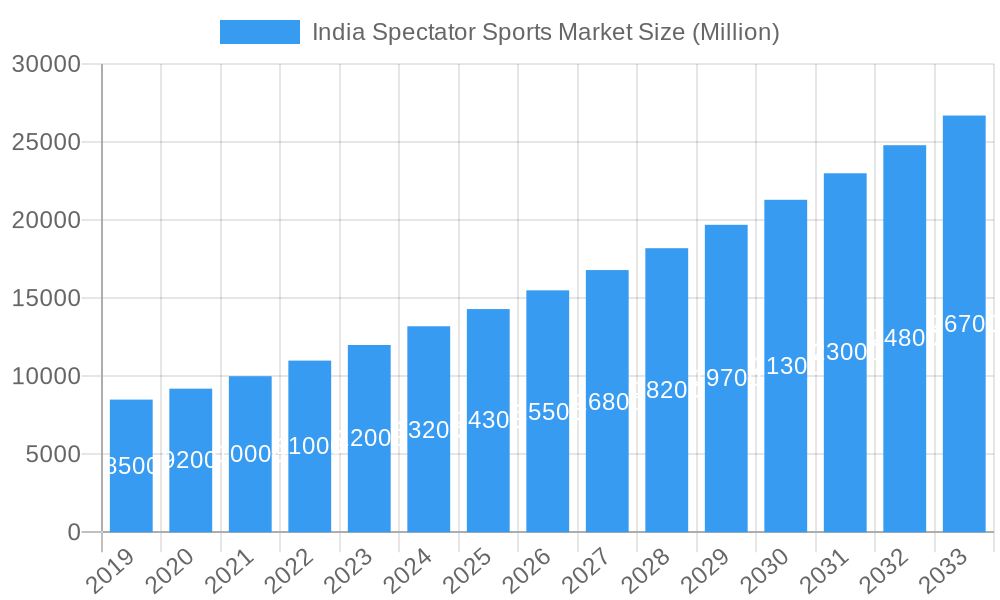

The Indian Spectator Sports Market is projected to reach $235.23 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 6% through 2033. This expansion is driven by heightened fan engagement and the commercialization of sports nationwide. Key growth factors include the popularity of cricket, hockey, and football, attracting significant media rights deals. Investments in sports infrastructure and government initiatives further support market growth. Merchandising and ticket sales are also increasing as sports become a prominent entertainment and social activity. A growing middle class with higher disposable incomes fuels spending on live events and merchandise. The market's vitality is also evident in the proliferation of professional leagues and tournaments.

India Spectator Sports Market Market Size (In Billion)

Revenue streams in the Indian Spectator Sports Market are dominated by media rights, followed by merchandising, ticket sales, and sponsorship. Cricket leads in fan following and revenue, with hockey, football, and badminton showing increasing traction. Sports academies and management companies are crucial for talent development. Challenges include the need for greater investment in grassroots development for less popular sports and logistical complexities in event organization. Emerging trends include digital fan engagement and the influence of social media. Regional disparities in infrastructure and fan engagement present both challenges and opportunities.

India Spectator Sports Market Company Market Share

India Spectator Sports Market: In-Depth Analysis and Forecast (2019-2033)

This comprehensive report delves into the dynamic India Spectator Sports Market, providing critical insights, detailed segmentation, and future projections from 2019 to 2033, with a base year of 2025. We explore the market's growth drivers, challenges, emerging opportunities, and the competitive landscape shaped by key players and industry developments. Leveraging high-traffic keywords, this analysis is essential for stakeholders seeking to understand and capitalize on the burgeoning Indian spectator sports ecosystem. The study period encompasses historical data (2019-2024), the estimated year (2025), and a robust forecast period (2025-2033).

India Spectator Sports Market Market Concentration & Innovation

The India Spectator Sports Market exhibits a moderate level of concentration, with established entities like the Board of Control for Cricket in India (BCCI) wielding significant influence, particularly in cricket. Innovation in the sector is driven by several factors, including the adoption of advanced broadcasting technologies, the increasing demand for fan engagement platforms, and the integration of data analytics to enhance athlete performance and viewer experience. Regulatory frameworks, such as those governing broadcasting rights and sports federation operations, play a crucial role in shaping market dynamics. Product substitutes, while not directly competing with live sporting events, include other forms of entertainment like movies and gaming, which vie for consumer leisure time and spending. End-user trends are shifting towards more interactive and personalized experiences, with fans seeking deeper engagement beyond just watching the game. Mergers and acquisitions (M&A) activities, though not extensively documented in publicly available data, are anticipated to increase as larger entities seek to consolidate their market position and acquire promising startups in sports technology and management. For example, recent media rights deals in football, such as Viacom18's acquisition, represent significant strategic moves.

India Spectator Sports Market Industry Trends & Insights

The India Spectator Sports Market is poised for substantial growth, fueled by a confluence of favorable economic, demographic, and technological trends. The rising disposable incomes across India, coupled with a burgeoning young population with a keen interest in sports, are creating an ever-expanding consumer base for live and broadcasted sporting events. The projected Compound Annual Growth Rate (CAGR) for the market is expected to be robust, indicating a healthy expansion trajectory. A key trend is the increasing market penetration of digital streaming platforms, which are democratizing access to a wider array of sports beyond traditional television viewership. This digital shift is transforming how fans consume content, demanding more on-demand options, interactive features, and multi-platform accessibility.

Technological disruptions are at the forefront of this evolution. The implementation of AI and machine learning is enhancing broadcast quality, providing real-time analytics for commentators and fans, and personalizing content delivery. Virtual reality (VR) and augmented reality (AR) are beginning to offer immersive fan experiences, allowing viewers to feel closer to the action, even from their homes. The growth of fantasy sports and esports further diversifies the spectator sports landscape, attracting a new demographic and generating additional revenue streams.

Consumer preferences are evolving to demand more than just the game itself. Fans are increasingly interested in the entire ecosystem surrounding a sport, including athlete stories, behind-the-scenes content, and interactive fan communities. This has led to a greater emphasis on fan engagement strategies by sports leagues and teams. The competitive dynamics are intensifying, with traditional broadcasters facing competition from digital-native platforms. This has sparked innovation in content packaging, sponsorship models, and fan loyalty programs.

Dominant Markets & Segments in India Spectator Sports Market

Cricket undeniably holds the dominant position within the India Spectator Sports Market, reflecting its cultural significance and widespread appeal. Its dominance is underpinned by a well-established infrastructure, massive fan following, and lucrative broadcasting and sponsorship deals. The Type of Sports segment sees cricket leading by a significant margin, followed by football, which is experiencing a surge in popularity, particularly with the growth of leagues like the Indian Super League (ISL). Hockey, though historically significant, occupies a smaller but dedicated niche. Badminton and racing are emerging segments, attracting increasing attention and investment.

In terms of Revenue Source, Media Rights represent the largest contributor to the market's revenue. The immense viewership for major cricketing events, in particular, commands substantial broadcasting fees. This is followed by Sponsoring, where brands actively seek association with popular sports and athletes to reach a broad audience. Ticket sales, while crucial for individual event revenues, represent a smaller proportion of the overall market when compared to media rights and sponsorships. Merchandising, though growing, still has significant untapped potential.

Dominance of Cricket:

- Cultural Integration: Cricket is deeply ingrained in Indian society, transcending sport to become a religion for many.

- Strong Governing Body: The Board of Control for Cricket in India (BCCI) is one of the most powerful and financially robust sports organizations globally, driving the sport's commercial success.

- High-Value Broadcasting Deals: Indian cricket rights consistently fetch multi-billion dollar deals, a testament to its unparalleled viewership.

- Extensive Infrastructure: A well-developed network of stadiums and training facilities supports the sport across the country.

Emerging Power of Football:

- Growing Fan Base: The ISL has successfully cultivated a dedicated fan base, with increasing stadium attendance and digital engagement.

- Increased Media Coverage: Broadcast deals for ISL and other football leagues are improving, expanding reach.

- Grassroots Development: Investments in academies and youth development programs are fostering local talent.

Revenue Drivers:

- Media Rights: The primary engine of growth, with digital platforms increasingly competing with traditional broadcasters for exclusive rights.

- Sponsorships: Brands leverage the emotional connect of sports to enhance their market presence, with major events attracting significant corporate backing.

- Ticket Sales: While important for event-specific revenue, its overall market share is dwarfed by media rights and sponsorships.

- Merchandising: Potential for significant growth with improved product offerings and wider distribution.

India Spectator Sports Market Product Developments

Product developments in the India Spectator Sports Market are increasingly focused on enhancing fan experience and operational efficiency. Innovations include sophisticated broadcast technologies that offer multi-angle viewing, augmented reality overlays for real-time stats, and immersive audio. Fan engagement platforms are evolving to incorporate interactive polls, fantasy leagues integrated with live games, and direct fan-to-athlete communication channels. In terms of athlete performance, advanced data analytics, wearable technology, and AI-powered training regimens are providing competitive advantages. These developments aim to create richer, more personalized, and accessible sports consumption, thereby increasing viewership and revenue opportunities.

Report Scope & Segmentation Analysis

This report segmentally analyzes the India Spectator Sports Market across the Type of Sports and Revenue Source.

The Type of Sports segmentation includes:

- Cricket: Expected to maintain its lead, driven by strong fan loyalty and commercial viability.

- Hockey: Possesses a dedicated following and potential for resurgence with strategic investment.

- Football: Demonstrating rapid growth, propelled by professional leagues and increasing grassroots development.

- Badminton: Garnering significant interest, especially with the success of Indian players on the international stage.

- Racing: A niche but growing segment with potential for expansion in urban centers.

- Other Types of Sports: Encompasses emerging sports and niche events, contributing to market diversification.

The Revenue Source segmentation includes:

- Media Rights: Projected to remain the dominant revenue stream, with ongoing competition between digital and traditional media.

- Merchandising: Exhibits considerable growth potential as brands and leagues invest in product lines and distribution.

- Ticket: Crucial for live event revenue, with growth tied to stadium capacity and event popularity.

- Sponsoring: Continues to be a robust revenue driver, with increasing opportunities for brands across various sports.

Key Drivers of India Spectator Sports Market Growth

The India Spectator Sports Market growth is propelled by several key drivers. Economic growth and rising disposable incomes are enabling more people to afford tickets, merchandise, and subscriptions to sports content. The young demographic of India, with a high propensity for sports consumption and digital adoption, is a significant advantage. Technological advancements, particularly in broadcasting and digital streaming, are expanding reach and enhancing fan engagement. Favorable government policies and increasing investment in sports infrastructure also play a crucial role. The passionate fan culture and the aspirational value associated with sports heroes further fuel demand.

Challenges in the India Spectator Sports Market Sector

Despite its strong growth trajectory, the India Spectator Sports Market faces several challenges. Regulatory hurdles and complex licensing agreements can impede market expansion and create competitive imbalances. Infrastructure limitations in certain regions, particularly for smaller sports, can restrict audience reach and event hosting capabilities. Piracy and illegal streaming pose a significant threat to revenue streams, particularly for media rights holders. Intense competition for consumer attention from other entertainment forms and the need for continuous innovation to retain audience interest are ongoing challenges.

Emerging Opportunities in India Spectator Sports Market

The India Spectator Sports Market presents numerous emerging opportunities. The digitalization of sports content offers a vast avenue for growth, with potential for innovative streaming models and direct-to-fan engagement. The increasing popularity of esports and fantasy sports caters to a younger, digitally-savvy audience and represents a significant untapped market. Untapped regional markets beyond major metropolitan areas offer substantial potential for growth in viewership and fan engagement. Furthermore, the rise of data analytics and AI in sports presents opportunities for enhanced performance insights, personalized fan experiences, and optimized marketing strategies.

Leading Players in the India Spectator Sports Market Market

- Assam Cricket Association

- Ahmedabad Sports Academy

- Anantapur Sports Academy

- Adani Sportsline

- Calcutta Cricket Academy

- Aarka Sports Management

- AllSportsFit

- AIFF Masters

- Board of Control for Cricket in India

- Aavhan IIT Bombay

Key Developments in India Spectator Sports Market Industry

- September 2023: Football Sports Development Limited (FSDL) announced Viacom18 Media Private Limited as the 'new home of Indian Football' for the 2023-24 and 2024-25 seasons. Viacom18 will likely be the exclusive media rights holder for ISL, India's top-tier football league, across Digital and Linear TV platforms. This development signifies a major shift in Indian football broadcasting and a significant investment in the sport's digital future.

- October 2022: MCC'S New Code Of Laws for 2022 officially came into Force. The code was well received and has had a positive impact on cricket all over the world. The changes are intended to shape the game of cricket as it should be played. This initiative by the Marylebone Cricket Club aims to enhance the spirit and flow of the game, potentially influencing spectator engagement and the technical aspects of cricket.

Strategic Outlook for India Spectator Sports Market Market

The strategic outlook for the India Spectator Sports Market is exceptionally promising, driven by sustained economic development, a youthful population, and rapid technological adoption. Future growth catalysts lie in further leveraging digital platforms for content distribution and fan interaction, fostering the development of niche sports, and enhancing the overall fan experience through immersive technologies. The increasing focus on sports as a viable career option and the government's continued support for sports infrastructure development will further solidify its position. Strategic collaborations between sports organizations, media companies, and technology providers will be crucial for unlocking new revenue streams and expanding market reach, ensuring a vibrant and expanding spectator sports ecosystem in India.

India Spectator Sports Market Segmentation

-

1. Type of Sports

- 1.1. Cricket

- 1.2. Hockey

- 1.3. Football

- 1.4. Badminton

- 1.5. Racing

- 1.6. Other Types of Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Ticket

- 2.4. Sponsoring

India Spectator Sports Market Segmentation By Geography

- 1. India

India Spectator Sports Market Regional Market Share

Geographic Coverage of India Spectator Sports Market

India Spectator Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sponsorships; Viewership of Multiple Sports Channels

- 3.3. Market Restrains

- 3.3.1. Threat From Home Entertainment

- 3.4. Market Trends

- 3.4.1. The Rise of Cricket in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 5.1.1. Cricket

- 5.1.2. Hockey

- 5.1.3. Football

- 5.1.4. Badminton

- 5.1.5. Racing

- 5.1.6. Other Types of Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Ticket

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Assam Cricket Association

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ahmedabad Sports Academy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anantapur Sports Academy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adani Sportsline

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Calcutta Cricket Academy**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aarka Sports Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AllSportsFit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIFF Masters

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Board of Control for Cricket in India

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aavhan IIT Bombay

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Assam Cricket Association

List of Figures

- Figure 1: India Spectator Sports Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Spectator Sports Market Share (%) by Company 2025

List of Tables

- Table 1: India Spectator Sports Market Revenue billion Forecast, by Type of Sports 2020 & 2033

- Table 2: India Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: India Spectator Sports Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Spectator Sports Market Revenue billion Forecast, by Type of Sports 2020 & 2033

- Table 5: India Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: India Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Spectator Sports Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the India Spectator Sports Market?

Key companies in the market include Assam Cricket Association, Ahmedabad Sports Academy, Anantapur Sports Academy, Adani Sportsline, Calcutta Cricket Academy**List Not Exhaustive, Aarka Sports Management, AllSportsFit, AIFF Masters, Board of Control for Cricket in India, Aavhan IIT Bombay.

3. What are the main segments of the India Spectator Sports Market?

The market segments include Type of Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 235.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sponsorships; Viewership of Multiple Sports Channels.

6. What are the notable trends driving market growth?

The Rise of Cricket in India.

7. Are there any restraints impacting market growth?

Threat From Home Entertainment.

8. Can you provide examples of recent developments in the market?

September 2023: Football Sports Development Limited (FSDL) announced Viacom18 Media Private Limited as the 'new home of Indian Football' for the 2023-24 and 2024-25 seasons. Viacom18 will likely be the exclusive media rights holder for ISL, India's top-tier football league, across Digital and Linear TV platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Spectator Sports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Spectator Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Spectator Sports Market?

To stay informed about further developments, trends, and reports in the India Spectator Sports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence