Key Insights

The United States Private Equity (PE) market is poised for robust expansion, projecting a current market size of approximately USD 460 million and a Compound Annual Growth Rate (CAGR) exceeding 11.00% over the forecast period of 2025-2033. This significant growth is fueled by several key drivers, including increasing investor appetite for alternative assets, a steady stream of well-performing companies seeking capital infusion for expansion and innovation, and the continued strategic deployment of capital by established PE firms. The market's dynamism is also evident in its segmentation. Large-cap investments continue to dominate, representing a substantial portion of PE activity. However, there's a discernible upward trend in mid-cap and small-cap investments as PE firms increasingly seek out untapped growth opportunities and promising early-stage ventures. This diversification reflects a maturing market where diverse investment strategies are employed to capitalize on various market cycles and company stages. The application segment is primarily driven by early-stage venture capital, private equity buyouts, and leveraged buyouts, showcasing the multifaceted nature of PE operations in the US.

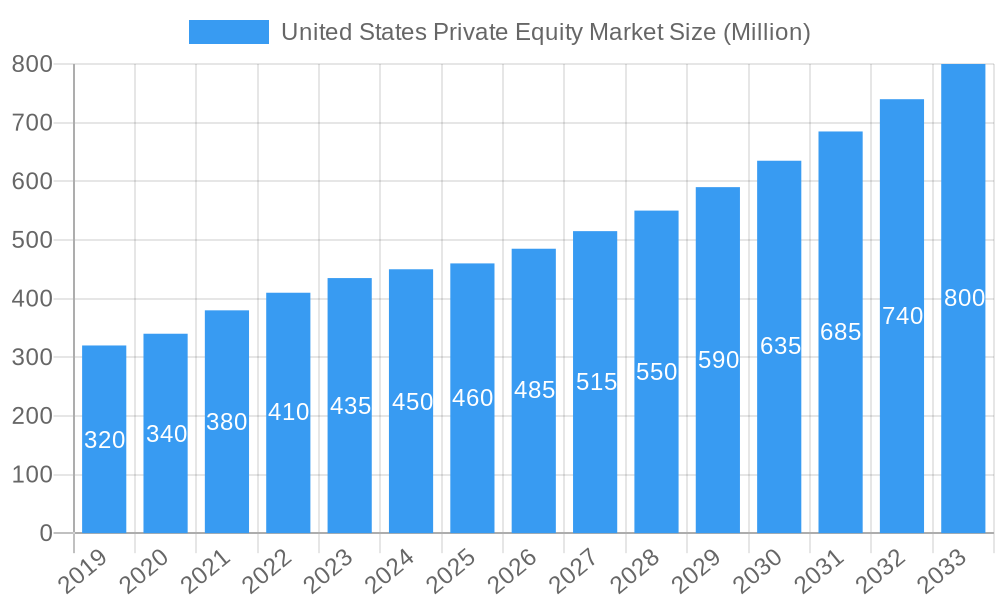

United States Private Equity Market Market Size (In Million)

The United States remains the epicenter of global private equity activity, demonstrating sustained investor confidence and deal-making momentum. Major players like Blackstone Group, Carlyle Group, KKR Company, TPG Capital, and Warburg Pincus LLC are instrumental in shaping market trends through their strategic investments and exits. Emerging trends indicate a growing focus on technology, healthcare, and sustainable businesses, aligning with broader economic shifts and societal demands. While the market is largely driven by strong fundamentals, certain restraints could influence its trajectory. These might include increasing regulatory scrutiny, rising interest rates impacting deal financing, and potential valuation mismatches between buyers and sellers. Nevertheless, the sheer scale of capital available for deployment and the continuous innovation within the PE landscape suggest that these challenges are likely to be navigated effectively, ensuring continued growth and profitability for stakeholders in the US private equity sector.

United States Private Equity Market Company Market Share

Unlock critical insights into the dynamic United States Private Equity Market with this in-depth report. Spanning the historical period of 2019-2024, a base year of 2025, and a comprehensive forecast period from 2025 to 2033, this analysis delves into market concentration, innovation, industry trends, dominant segments, and future growth catalysts. Featuring high-traffic keywords such as "private equity," "venture capital," "leveraged buyouts," and "M&A," this report is essential for investors, fund managers, corporate strategists, and industry stakeholders seeking to navigate the evolving landscape of US private equity.

United States Private Equity Market Market Concentration & Innovation

The United States Private Equity Market exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant share of assets under management (AUM). Innovation within the sector is driven by several key factors:

- Technological Advancements: The integration of AI, big data analytics, and sophisticated deal sourcing platforms allows firms to identify and evaluate investment opportunities more efficiently.

- ESG Integration: Growing emphasis on Environmental, Social, and Governance (ESG) factors is reshaping investment strategies and driving innovation in sustainable private equity.

- Niche Specialization: Many private equity firms are developing expertise in specific industries or investment strategies, such as technology, healthcare, or impact investing, leading to differentiated product offerings.

Regulatory Frameworks: The market is influenced by a complex web of regulations, including SEC guidelines, tax laws, and anti-trust regulations, which impact deal structures and operational compliance.

Product Substitutes: While direct private equity investments are primary, substitutes include public equities, venture debt, and real estate investments, each offering different risk-return profiles.

End-User Trends: Institutional investors (pension funds, endowments, sovereign wealth funds) remain primary LPs, while family offices and high-net-worth individuals are increasingly participating.

M&A Activities: The market is characterized by significant M&A activity, both by private equity firms acquiring portfolio companies and by private equity firms themselves merging or acquiring smaller entities. Deal values in the billions of dollars are common. For instance, the March 2023 acquisition of Cvent Holding Corp. by Blackstone for approximately USD 4.6 Billion underscores the substantial capital deployed in strategic acquisitions. The September 2023 sale of Everton to 777 Partners for over USD 685 Million highlights the increasing private equity involvement in sports assets.

United States Private Equity Market Industry Trends & Insights

The United States Private Equity Market is poised for robust growth, fueled by a confluence of favorable economic conditions, evolving investment strategies, and a persistent demand for alternative asset classes. The market is projected to witness a healthy Compound Annual Growth Rate (CAGR), with an estimated market penetration continuing to expand across various sectors. This growth is underpinned by several critical trends and insights:

One of the primary growth drivers is the continued search for yield by institutional investors. In an environment of fluctuating public market returns and historically low interest rates, private equity offers the potential for higher returns, albeit with increased illiquidity and risk. This persistent demand from Limited Partners (LPs) ensures a steady flow of capital into the market, enabling General Partners (GPs) to execute larger and more strategic deals. The sheer volume of dry powder – uncommitted capital – available to private equity firms globally, a significant portion of which is allocated to the US, provides a strong foundation for future investment activity.

Technological disruptions are not only creating new investment opportunities but also reshaping how private equity firms operate. The adoption of advanced data analytics and artificial intelligence is revolutionizing deal sourcing, due diligence, and portfolio management. Firms are leveraging these technologies to identify emerging trends, predict market movements, and optimize the performance of their portfolio companies. Sectors like software, cybersecurity, fintech, and digital health are witnessing intense private equity interest due to their high growth potential and scalability, often driven by technological innovation.

Consumer preferences are also playing a significant role. The rise of e-commerce, subscription models, and the demand for personalized experiences are creating fertile ground for private equity investments in companies that cater to these evolving consumer behaviors. Sectors such as direct-to-consumer (DTC) brands, logistics and supply chain solutions supporting online retail, and innovative consumer technology platforms are attracting substantial capital.

The competitive dynamics within the US private equity market are intensifying. While large, established players continue to dominate, there is a growing trend of specialization. Boutique firms focusing on specific industries (e.g., healthcare technology, renewable energy) or investment strategies (e.g., growth equity, distressed debt) are carving out significant niches. This specialization allows them to develop deep expertise and build strong networks within their chosen sectors, providing a competitive edge. Moreover, the increasing competition for attractive deal flow is driving up valuations and placing greater pressure on firms to demonstrate value creation beyond financial engineering.

Furthermore, the ongoing digital transformation across all industries is a constant theme. Private equity firms are actively investing in companies that are either driving this transformation or benefiting from it. This includes businesses involved in cloud computing, data analytics, automation, and digital infrastructure. The ability of these portfolio companies to adapt and thrive in a digital-first economy is a key determinant of their success and, consequently, the returns generated for investors. The increasing sophistication of LPs in their due diligence processes also means that firms must demonstrate robust operational value creation capabilities, not just financial acumen.

Dominant Markets & Segments in United States Private Equity Market

The United States Private Equity Market is characterized by significant dominance in certain segments and regions, driven by a robust economy, a mature financial ecosystem, and a strong entrepreneurial culture.

Leading Region: The United States itself is the undisputed leader in the global private equity market, consistently attracting the largest share of capital and deal activity. This dominance is attributable to its deep and liquid capital markets, a vibrant ecosystem of innovative companies, a well-established legal and regulatory framework conducive to investment, and a large pool of sophisticated institutional investors.

Investment Type Dominance:

- Large Cap Private Equity: This segment, typically involving acquisitions of companies with enterprise values exceeding USD 1 billion, commands the largest share of capital deployment and deal volume.

- Key Drivers:

- Access to Deep Capital Pools: Large institutional investors like pension funds and sovereign wealth funds have the capacity to invest significant sums in large-cap deals.

- Economies of Scale: Larger deals often offer opportunities for greater operational efficiencies and cost synergies.

- Mature Deal Ecosystem: A well-developed network of investment banks, legal advisors, and consultants supports the execution of large-cap transactions.

- Established Corporations: The presence of a vast number of large, publicly traded companies provides ample targets for leveraged buyouts and take-privates.

- Key Drivers:

- Mid Cap Private Equity: This segment, focusing on companies with enterprise values typically between USD 250 million and USD 1 billion, is also a significant and growing area of activity.

- Key Drivers:

- Growth Potential: Mid-cap companies often possess strong growth trajectories and are well-positioned for expansion with strategic capital infusion.

- Operational Improvement Opportunities: There is substantial scope for private equity firms to implement operational improvements and drive value creation.

- Attractive Valuation Multiples: Mid-cap companies can sometimes offer more attractive entry multiples compared to their larger counterparts.

- Sustained Investor Interest: A broad range of investors, including those focused on growth and mid-market buyouts, actively participate in this segment.

- Key Drivers:

- Small Cap Private Equity: While representing a smaller portion of overall capital deployed, the small-cap segment is crucial for early-stage and emerging companies.

- Key Drivers:

- Innovation Hubs: Proliferation of startups and innovative companies in sectors like technology and biotechnology.

- Exit Opportunities: Successful small-cap investments can lead to significant returns through IPOs or acquisitions by larger firms.

- Specialized Funds: Many specialized venture capital and private equity funds focus exclusively on this segment, developing deep expertise.

- Key Drivers:

Application Dominance:

- Private Equity (Buyouts): Leveraged buyouts, where private equity firms acquire controlling stakes in established companies, often using significant debt financing, remain the most dominant application. This strategy aims to improve operational performance, restructure the business, and then exit through an IPO or sale to another entity.

- Dominance Factors:

- Established Track Record: The buyout model has a long and successful history in the US.

- Access to Debt Markets: The US possesses deep and liquid debt markets, facilitating leveraged transactions.

- Corporate Governance Reforms: Post-financial crisis reforms have enhanced corporate governance, making buyouts more appealing.

- Dominance Factors:

- Leveraged Buyouts (LBOs): While closely related to private equity buyouts, LBOs specifically emphasize the significant use of debt. Their dominance is a testament to the efficiency of capital structure optimization in driving returns.

- Dominance Factors:

- Tax Deductibility of Interest: Interest payments on debt are tax-deductible, creating a financial advantage.

- Magnified Returns: Debt can magnify equity returns when investments are successful.

- Disciplined Management: The debt burden often imposes financial discipline on management teams.

- Dominance Factors:

- Early Stage Venture Capital: This segment, focusing on seed and early-stage investments in startups, is a critical engine of innovation and future growth, though it represents a smaller fraction of the overall private equity market in terms of capital deployed.

- Dominance Factors:

- Technological Advancement: The US is a global leader in technological innovation, generating a high volume of promising startups.

- Strong Venture Capital Ecosystem: A well-established network of venture capital firms, incubators, and accelerators supports early-stage companies.

- Risk Capital Availability: The willingness of investors to take on higher risk for potentially transformative returns is a hallmark of this segment.

- Dominance Factors:

The dominance of Large Cap Private Equity and Leveraged Buyouts reflects the maturity of the US financial markets and the established strategies employed by major private equity firms. However, the persistent growth in Early Stage Venture Capital signifies the ongoing drive for innovation and the creation of future market leaders.

United States Private Equity Market Product Developments

Product developments in the United States Private Equity Market are increasingly focused on innovative fund structures, specialized investment strategies, and enhanced technological integration. Firms are developing thematic funds targeting emerging sectors like decarbonization technology, AI-driven healthcare, and cybersecurity. The integration of ESG principles into fund mandates is no longer a niche offering but a core product development, catering to growing investor demand for sustainable investments. Furthermore, advancements in data analytics and AI are enabling the creation of more sophisticated deal sourcing and portfolio management tools, offering competitive advantages and improved operational efficiencies for portfolio companies. The emphasis is on delivering differentiated value propositions that align with evolving investor preferences and market opportunities, leading to more bespoke and impact-driven investment products.

United States Private Equity Market Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the United States Private Equity Market, segmented across key investment types and applications.

Investment Type Segmentation:

- Large Cap: This segment encompasses private equity deals involving companies with substantial enterprise values, typically exceeding USD 1 billion. Growth projections indicate continued strong activity, driven by large institutional capital. Market size is significant, with intense competition among major PE firms.

- Mid Cap: Focusing on companies with enterprise values between USD 250 million and USD 1 billion, this segment offers robust growth potential and operational improvement opportunities. Projections show steady growth, supported by a broad investor base.

- Small Cap: This segment targets smaller companies, often characterized by high growth potential and innovation. Projections indicate moderate but consistent growth, driven by venture capital and specialized small-cap funds.

Application Segmentation:

- Early Stage Venture Capitals: This segment involves seed and early-stage investments in startups with high growth potential. Growth projections are strong, reflecting ongoing innovation and the demand for disruptive technologies. Competitive dynamics are fierce, with a focus on identifying and nurturing nascent companies.

- Private Equity: This broadly covers buyout transactions of established companies with the aim of operational improvement and value creation. Growth is expected to be steady, underpinned by continued M&A activity and the availability of capital.

- Leveraged Buyouts: This specific strategy within private equity involves significant debt financing to acquire companies. Growth projections remain strong, leveraging the efficiency of capital structure and access to debt markets. Competitive dynamics are influenced by interest rate environments and lender appetite.

Key Drivers of United States Private Equity Market Growth

The United States Private Equity Market's growth is propelled by a multifaceted set of drivers:

- Abundant Liquidity and Capital Inflows: Significant "dry powder" or uncommitted capital from institutional investors, pension funds, and sovereign wealth funds provides ample resources for investment.

- Search for Yield: In a low-interest-rate environment, private equity offers the potential for higher returns compared to traditional asset classes, attracting sustained investor interest.

- Technological Innovation: The rapid pace of technological advancement creates new industries and disruptive companies, presenting attractive investment opportunities across various sectors like software, healthcare tech, and renewable energy.

- Corporate Restructuring and Consolidation: Companies are increasingly seeking strategic partnerships and capital infusions to enhance their competitive positioning, leading to M&A opportunities.

- Favorable Regulatory Environment (Relative): While regulations exist, the US market generally offers a relatively stable and predictable legal and financial framework for private equity operations.

Challenges in the United States Private Equity Market Sector

Despite its growth, the United States Private Equity Market faces several challenges:

- Intensifying Competition and Valuations: The high availability of capital has led to increased competition for attractive deals, driving up entry valuations and potentially compressing future returns.

- Regulatory Scrutiny and Compliance Costs: Evolving regulatory landscapes, including antitrust reviews and ESG disclosure requirements, can increase compliance burdens and transaction complexities.

- Talent Acquisition and Retention: Attracting and retaining experienced investment professionals and operational experts is crucial but challenging in a competitive market.

- Exit Environment Uncertainty: While exits have been robust, geopolitical instability, economic downturns, or shifts in public market sentiment can impact the timing and profitability of divestitures.

- ESG Implementation Complexities: Integrating ESG factors effectively across diverse portfolios requires specialized expertise and robust data management, posing operational challenges.

Emerging Opportunities in United States Private Equity Market

The United States Private Equity Market is ripe with emerging opportunities:

- Thematic Investing: Growth in specialized funds focused on areas like climate tech, artificial intelligence, cybersecurity, and the creator economy.

- Healthcare and Life Sciences Innovation: Continued investment in biotech, healthtech, and personalized medicine driven by demographic shifts and scientific advancements.

- Infrastructure Modernization: Significant government initiatives and private sector demand for upgrades in digital infrastructure, renewable energy, and transportation.

- Reshoring and Supply Chain Resilience: Opportunities in manufacturing, logistics, and advanced materials as companies prioritize supply chain security and domestic production.

- ESG Impact Investing: A growing market for investments that generate both financial returns and positive social or environmental impact, supported by increasing LP demand.

Leading Players in the United States Private Equity Market Market

- Blackstone Group

- Carlyle Group

- KKR Company

- TPG Capital

- Warburg Pincus LLC

- Neuberger Berman Group LLC

- Vista Equity Partners

- Chicago Capital Holdings

- CVC Capital Partners

- Apollo Global Management

- Kohlberg Kravis Roberts & Co

- Bain Capital LP

- Thoma Bravo LP

- Silver Lake

- Gottenberg Associates LLC

Key Developments in United States Private Equity Market Industry

- September 2023: Everton has been sold to 777 Partners, with the US private equity firm taking over from Farhad Moshiri in a deal reportedly worth more than USD 685 Million. The Miami-based investment fund had signed an agreement with British-Iranian billionaire Moshiri to acquire his 94.1 percent stake.

- March 2023: Cvent Holding Corp., an industry-leading meetings, events, and hospitality technology provider, has entered into a definitive agreement to be acquired by an affiliate of private equity funds managed by Blackstone in a transaction valued at an enterprise value of approximately USD 4.6 Billion.

Strategic Outlook for United States Private Equity Market Market

The strategic outlook for the United States Private Equity Market remains exceptionally strong, characterized by continued robust deal-making and value creation. The market is expected to benefit from ongoing technological innovation, creating new avenues for investment in disruptive sectors such as AI, quantum computing, and advanced materials. Furthermore, the increasing emphasis on ESG integration presents a significant opportunity for firms to develop specialized funds and cater to a growing investor base that prioritizes sustainable and impactful investments. The ongoing need for capital in infrastructure development and the trend of reshoring manufacturing operations will also fuel M&A activity. Strategic partnerships, operational enhancements, and a focus on specialized thematic investments will define the growth trajectory, ensuring the US private equity market remains a preeminent global force.

United States Private Equity Market Segmentation

-

1. Investment Type

- 1.1. Large Cap

- 1.2. Mid Cap

- 1.3. Small Cap

-

2. Application

- 2.1. Early Stage Venture Capitals

- 2.2. Private Equity

- 2.3. Leveraged Buyouts

United States Private Equity Market Segmentation By Geography

- 1. United States

United States Private Equity Market Regional Market Share

Geographic Coverage of United States Private Equity Market

United States Private Equity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Interest Rates in United States and Abundant Capital is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Low Interest Rates in United States and Abundant Capital is Driving the Market

- 3.4. Market Trends

- 3.4.1. Lower Interest Rates and Tax Benefits Raising the Private Equity Adaption In United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Private Equity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Large Cap

- 5.1.2. Mid Cap

- 5.1.3. Small Cap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Early Stage Venture Capitals

- 5.2.2. Private Equity

- 5.2.3. Leveraged Buyouts

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blackstone Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carlyle Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KKR Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TPG Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Warburg pincus LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Neuberger Berman group LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vista Equity Partners

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chicago Capital Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CVC Capital Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apollo Global Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kohlberg Kravis Roberts & Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bain Capital LP

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Thoma Bravo LP

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Silver Lake

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Gottenberg associates LLC**List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Blackstone Group

List of Figures

- Figure 1: United States Private Equity Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Private Equity Market Share (%) by Company 2025

List of Tables

- Table 1: United States Private Equity Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: United States Private Equity Market Volume Billion Forecast, by Investment Type 2020 & 2033

- Table 3: United States Private Equity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Private Equity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: United States Private Equity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Private Equity Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Private Equity Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 8: United States Private Equity Market Volume Billion Forecast, by Investment Type 2020 & 2033

- Table 9: United States Private Equity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: United States Private Equity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: United States Private Equity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Private Equity Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Private Equity Market?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the United States Private Equity Market?

Key companies in the market include Blackstone Group, Carlyle Group, KKR Company, TPG Capital, Warburg pincus LLC, Neuberger Berman group LLC, Vista Equity Partners, Chicago Capital Holdings, CVC Capital Partners, Apollo Global Management, Kohlberg Kravis Roberts & Co, Bain Capital LP, Thoma Bravo LP, Silver Lake, Gottenberg associates LLC**List Not Exhaustive.

3. What are the main segments of the United States Private Equity Market?

The market segments include Investment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 460 Million as of 2022.

5. What are some drivers contributing to market growth?

Low Interest Rates in United States and Abundant Capital is Driving the Market.

6. What are the notable trends driving market growth?

Lower Interest Rates and Tax Benefits Raising the Private Equity Adaption In United States.

7. Are there any restraints impacting market growth?

Low Interest Rates in United States and Abundant Capital is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Everton has been sold to 777 Partners, with the US private equity firm taking over from Farhad Moshiri in a deal reportedly worth more than USD 685 Million. The Miami-based investment fund had signed an agreement with British-Iranian billionaire Moshiri to acquire his 94.1 percent stake.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Private Equity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Private Equity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Private Equity Market?

To stay informed about further developments, trends, and reports in the United States Private Equity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence