Key Insights

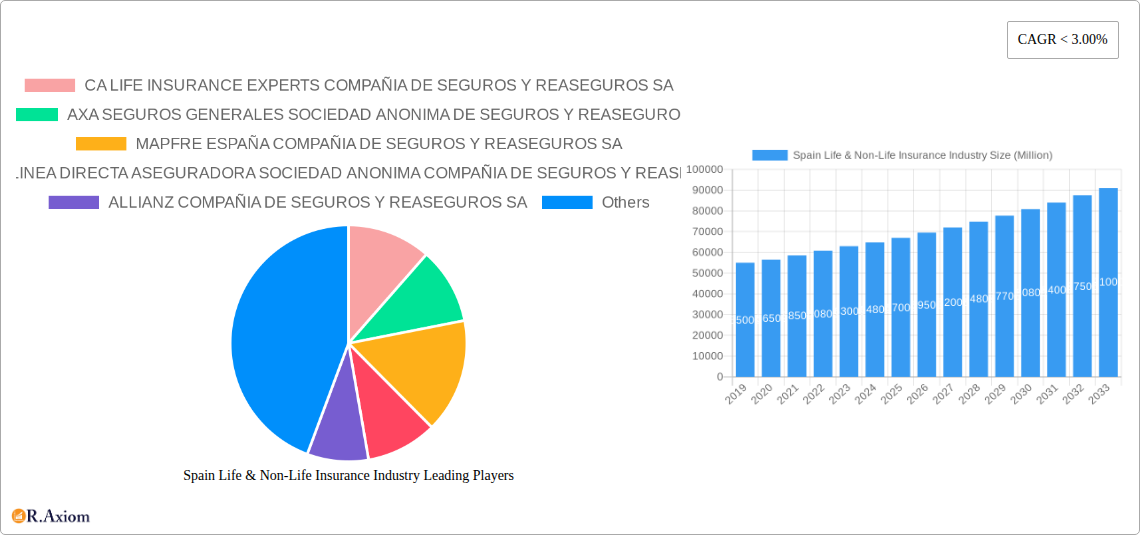

The Spanish insurance market, encompassing life and non-life sectors, is set for significant expansion. With a projected market size of 85.77 billion in 2024, the industry is driven by a Compound Annual Growth Rate (CAGR) of 6.1%. This growth trajectory, observed from 2019 to the present base year of 2024, reflects rising consumer confidence and a heightened awareness of financial security and asset protection. Key growth catalysts include economic recovery, an aging demographic boosting demand for life insurance and pension solutions, and the increasing adoption of digital channels for sales and claims processing. The non-life segment, in particular, is experiencing elevated demand for motor, home, and travel insurance, influenced by economic activity and evolving consumer lifestyles. Regulatory advancements and a dynamic competitive landscape further stimulate innovation and service enhancement.

Spain Life & Non-Life Insurance Industry Market Size (In Billion)

The forecast period, spanning from 2025 to 2033, anticipates sustained market growth. Strategic initiatives by insurers are focusing on personalized products, superior customer experiences, and the integration of InsurTech to optimize operations and expand market reach. The life insurance segment is expected to thrive with protection, savings, and investment-linked policies. Concurrently, the non-life sector will witness innovation in cyber insurance, parametric insurance, and connected device services, addressing emerging risks and offering tailored coverage. The Spanish insurance industry is positioned to become an integral part of the nation's financial ecosystem, providing security and assurance to individuals and businesses.

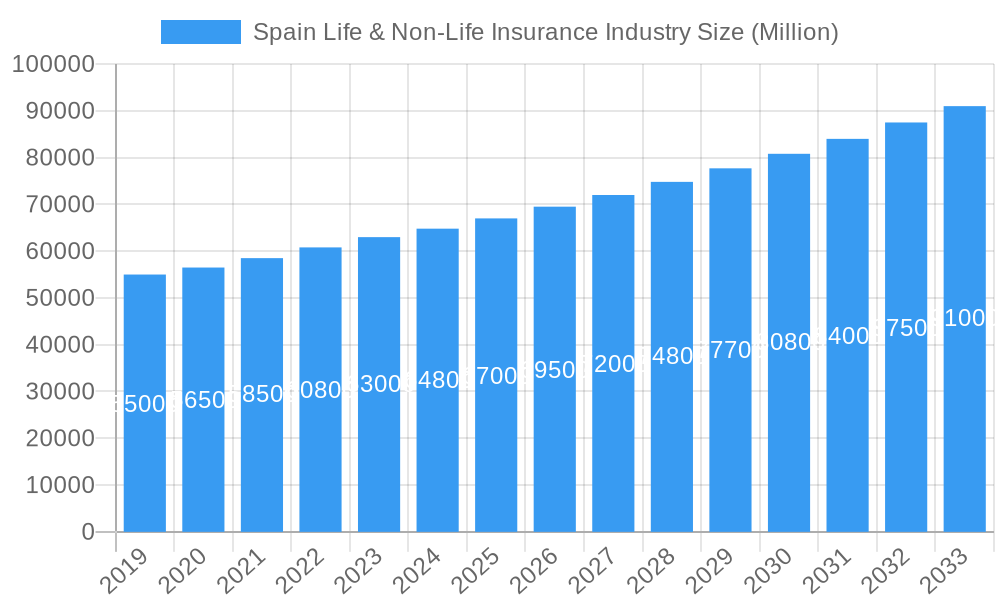

Spain Life & Non-Life Insurance Industry Company Market Share

This comprehensive report analyzes the market concentration and innovation within Spain's life and non-life insurance industry. It evaluates key players such as CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA, AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS, MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA, LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS, ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA, REALE SEGUROS GENERALES SA, MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA, FIATC MUTUA DE SEGUROS Y REASEGUROS, MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS, and LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA, assessing their market shares. Drivers of innovation, including InsurTech adoption and product development, are meticulously examined, as is the influence of evolving regulatory frameworks on market entry and competition. The report also scrutinizes product substitutes and end-user trends to project future market shaping. Furthermore, a detailed analysis of Mergers & Acquisitions (M&A) activities provides insights into industry consolidation and strategic partnerships. The historical period (2019–2024) and the forecast period (up to 2033), with a base year of 2024, establish a robust analytical foundation.

Spain Life & Non-Life Insurance Industry Industry Trends & Insights

The Spain life and non-life insurance industry is poised for dynamic growth, driven by a confluence of economic recovery, increasing consumer awareness of risk management, and significant technological advancements. The CAGR for the overall market is projected to be substantial, reflecting a robust recovery and expansion trajectory. Market penetration for both life and non-life insurance products is expected to deepen as a growing middle class seeks comprehensive financial security. Key growth drivers include an aging population demanding robust life and health insurance solutions, coupled with an increased incidence of natural disasters and the evolving nature of work influencing demand for non-life policies, particularly property and motor insurance. Technological disruptions are at the forefront, with the widespread adoption of Artificial Intelligence (AI) for claims processing and underwriting, Big Data analytics for personalized product offerings, and the Internet of Things (IoT) for enhanced risk assessment in areas like motor and home insurance. Consumer preferences are shifting towards digital-first interactions, demand for flexible and customizable policies, and a greater emphasis on value-added services beyond basic coverage. The competitive landscape is intensifying, marked by the emergence of InsurTech startups challenging traditional insurers with innovative digital platforms and niche products. Established players are responding by investing heavily in digital transformation and strategic partnerships to enhance customer experience and operational efficiency. The integration of blockchain technology for secure data management and fraud prevention is another emerging trend that will reshape the industry's operational paradigms. Furthermore, a growing awareness of environmental, social, and governance (ESG) factors is influencing product development, with a rise in demand for sustainable and ethical insurance solutions. The economic policies enacted by the Spanish government, aimed at fostering economic stability and consumer spending, are also expected to provide a conducive environment for insurance market expansion. The interplay of these factors—economic resilience, technological innovation, evolving consumer behavior, and strategic competitive responses—will define the growth trajectory of the Spain life and non-life insurance industry throughout the forecast period.

Dominant Markets & Segments in Spain Life & Non-Life Insurance Industry

Spain's insurance market exhibits distinct dominance across various segments, with Non-Life insurance generally holding a larger share of the overall premium volume, driven by mandatory motor insurance and the widespread need for home protection. Within Non-Life, the Motor insurance segment remains paramount, due to the high vehicle ownership rates and regulatory requirements. The Home insurance segment also demonstrates significant penetration, reflecting the prevalence of homeownership and a growing awareness of asset protection against various risks.

Life Insurance Dominance:

- Individual Life Insurance leads within the life segment, driven by increasing financial literacy, long-term savings goals, and the growing demand for retirement planning solutions.

- Group Life Insurance plays a crucial role in employee benefits packages, contributing to overall market penetration.

- Key drivers include favorable economic policies promoting savings, an aging demographic seeking financial security for dependents, and a rising disposable income enabling individuals to invest in life cover.

Non-Life Insurance Dominance:

- Motor Insurance is the undisputed leader, bolstered by extensive road networks and high vehicle density. Regulatory mandates ensure consistent demand.

- Home Insurance is a strong performer, supported by property ownership trends and increasing awareness of protection against damages, theft, and natural calamities.

- Other Non-Life Segments like travel, health (often considered non-life in Spain), and commercial insurance are experiencing steady growth, fueled by a recovering economy and evolving lifestyle needs.

- Key drivers include robust economic policies stimulating consumer spending on essential protections, infrastructure development enhancing accessibility to insurance services, and a sustained demand for safety and security.

Distribution Channel Dominance:

- The Agency channel continues to be a dominant force, particularly for complex products requiring personalized advice and relationship building. Agents provide crucial trust and expertise.

- Direct channels (online and call centers) are rapidly gaining traction, fueled by technological advancements, cost efficiencies, and a segment of consumers who prefer self-service and convenience.

- Bankassurance remains a significant channel, leveraging the established trust and customer base of financial institutions to distribute insurance products, especially life and savings-related policies.

- Other channels, including brokers and partnerships, cater to specific market niches and corporate clients.

- Key drivers for channel dominance include evolving consumer preferences for convenience and personalized service, the regulatory environment influencing distribution practices, and the strategic investments made by insurers in their respective channels.

The analysis of these segments highlights the multi-faceted nature of the Spanish insurance market, with specific sub-sectors and distribution methods exhibiting distinct growth patterns and strategic importance.

Spain Life & Non-Life Insurance Industry Product Developments

The Spain life and non-life insurance industry is witnessing a surge in product innovation, driven by technological integration and evolving consumer needs. This includes the development of parametric insurance solutions, which offer automated payouts based on pre-defined triggers like weather events or flight delays, enhancing speed and efficiency. InsurTech startups are pioneering personalized insurance products leveraging AI and Big Data, offering flexible coverage that adapts to individual risk profiles and usage patterns, especially in motor and home insurance. Cybersecurity insurance is also gaining prominence as businesses and individuals face escalating digital threats. Furthermore, a growing emphasis on health and wellness is leading to the introduction of integrated life and health insurance policies with preventative care benefits and digital health monitoring features, providing a competitive advantage through value-added services and enhanced market fit.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Spain life and non-life insurance industry, meticulously segmented across key areas. The Life Insurance segment is further categorized into Individual Life Insurance, focusing on policies for personal protection and long-term savings, and Group Life Insurance, covering employee benefit schemes. The Non-Life Insurance segment encompasses Home Insurance, addressing property protection, Motor Insurance, for vehicles, and Others, which includes a broad range of products such as travel, health, and commercial liability. Distribution channels are analyzed through Direct sales (online, mobile apps), Agency networks, Bankassurance, and Others, representing various intermediary partnerships. Each segment is analyzed for its market size in millions, projected growth rates, and competitive dynamics, offering a granular view of market opportunities and challenges within the forecast period of 2025–2033.

Key Drivers of Spain Life & Non-Life Insurance Industry Growth

Several key factors are propelling the growth of the Spain life and non-life insurance industry. Economically, a stable and recovering Spanish economy, coupled with increased consumer disposable income, directly translates to higher spending on insurance products. Regulatory frameworks that support fair competition and consumer protection foster trust and encourage market participation. Technologically, the widespread adoption of InsurTech, AI, and Big Data analytics is enabling insurers to offer more personalized, efficient, and cost-effective products, thereby expanding market reach. Socially, an aging population necessitates greater demand for life, health, and retirement solutions, while a growing awareness of climate change and associated risks is driving demand for property and casualty insurance.

Challenges in the Spain Life & Non-Life Insurance Industry Sector

The Spain life and non-life insurance industry faces several persistent challenges. Intense competition from both established insurers and new InsurTech entrants is exerting downward pressure on premiums and margins. Evolving regulatory landscapes, while often beneficial, can also introduce compliance complexities and costs. Macroeconomic uncertainties, such as inflation and interest rate fluctuations, can impact investment returns and product affordability for consumers. Furthermore, a perception of insurance as a commodity rather than a vital service can hinder deeper market penetration and customer engagement, requiring continuous efforts in education and value communication.

Emerging Opportunities in Spain Life & Non-Life Insurance Industry

The Spain life and non-life insurance industry is ripe with emerging opportunities. The increasing demand for customized and on-demand insurance products, particularly in the gig economy and for specialized risks, presents a significant avenue for growth. Digital transformation and the use of AI for personalized underwriting and claims management can unlock new customer segments and improve operational efficiency. The growing focus on ESG principles offers opportunities to develop sustainable insurance products that align with consumer values. Furthermore, the expansion of embedded insurance, where insurance is integrated into the purchase of other goods and services, particularly in e-commerce and automotive sectors, is poised to significantly boost premium volumes.

Leading Players in the Spain Life & Non-Life Insurance Industry Market

- CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

- AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- REALE SEGUROS GENERALES SA

- MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA

- FIATC MUTUA DE SEGUROS Y REASEGUROS

- MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA

Key Developments in Spain Life & Non-Life Insurance Industry Industry

- March 2023: Citizens, Inc. entered into a white-label partnership with Alliance Group, a prominent Independent Marketing Organization, to expand its life insurance offerings with living benefits, enhancing its market reach in specialized life insurance products.

- Oct 2022: Generali Spain and Sanitas forged a strategic agreement to provide Generali Spain's extensive customer base, numbering over 150,000, with access to an augmented health insurance portfolio and enhanced services, thereby strengthening their competitive position in the health insurance market.

Strategic Outlook for Spain Life & Non-Life Insurance Industry Market

The strategic outlook for the Spain life and non-life insurance industry is characterized by a strong emphasis on digital innovation, customer-centricity, and product diversification. Insurers are investing heavily in InsurTech solutions to streamline operations, enhance customer experience through personalized offerings, and improve risk assessment capabilities. The expansion into niche markets, such as cyber insurance, parametric policies, and sustainable insurance products, presents significant growth potential. Strategic partnerships and collaborations, including those with technology providers and financial institutions, will be crucial for expanding market reach and developing integrated solutions. The focus on leveraging data analytics for personalized marketing and product development will enable insurers to better anticipate and meet evolving consumer needs, ensuring sustained growth and a competitive edge in the dynamic Spanish insurance landscape.

Spain Life & Non-Life Insurance Industry Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Bank

- 2.4. Others

Spain Life & Non-Life Insurance Industry Segmentation By Geography

- 1. Spain

Spain Life & Non-Life Insurance Industry Regional Market Share

Geographic Coverage of Spain Life & Non-Life Insurance Industry

Spain Life & Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing in fintech adoption in top European Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Bank

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 REALE SEGUROS GENERALES SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIATC MUTUA DE SEGUROS Y REASEGUROS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

List of Figures

- Figure 1: Spain Life & Non-Life Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Life & Non-Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Life & Non-Life Insurance Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: Spain Life & Non-Life Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Spain Life & Non-Life Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain Life & Non-Life Insurance Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: Spain Life & Non-Life Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Spain Life & Non-Life Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Life & Non-Life Insurance Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Spain Life & Non-Life Insurance Industry?

Key companies in the market include CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA, AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS, MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA, LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS, ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA, REALE SEGUROS GENERALES SA, MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA, FIATC MUTUA DE SEGUROS Y REASEGUROS, MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS, LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA**List Not Exhaustive.

3. What are the main segments of the Spain Life & Non-Life Insurance Industry?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.77 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing in fintech adoption in top European Countries.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Citizens, Inc., a diversified financial services company providing life, living benefits, final expense, and limited liability property insurance, announced that it entered into a white-label partnership with Alliance Group (Alliance). It is a large Independent Marketing Organization that is a leader in providing life insurance with living benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Life & Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Life & Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Life & Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Spain Life & Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence