Key Insights

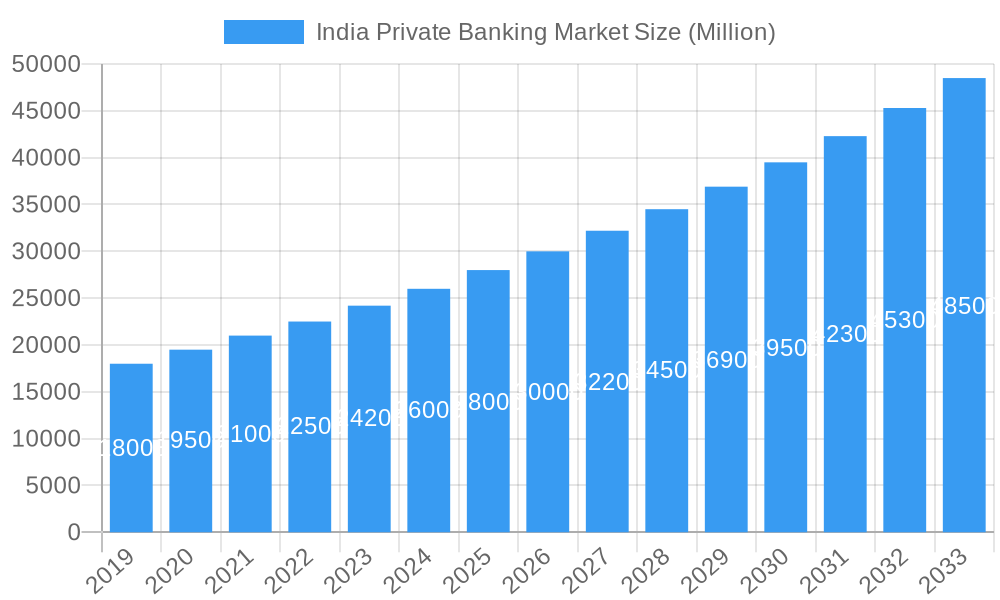

The Indian Private Banking Market is projected for substantial growth, estimated to reach USD 505.61 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 7.4% from 2025 to 2033. This expansion is propelled by increasing wealth creation, a growing affluent demographic seeking advanced financial solutions, and a heightened awareness of wealth preservation and growth strategies. Digital banking innovations and personalized wealth management services are key enablers, catering to High-Net-Worth Individuals (HNIs) and Ultra-High-Net-Worth Individuals (UHNWIs). The retail banking segment, including commercial and investment banking services for private clients, is expected to drive this growth, meeting demand for comprehensive financial planning, investment advisory, and estate management.

India Private Banking Market Market Size (In Billion)

The competitive landscape features major players like Axis Bank Ltd, HDFC Bank Ltd, ICICI Bank Ltd, and Kotak Mahindra Bank Ltd, who are enhancing their private banking offerings. Focus is placed on technology adoption for superior customer experiences, customized investment portfolios, and exclusive financial products. Key trends include the adoption of hybrid advisory models, blending digital convenience with human expertise, and a rising interest in sustainable and impact investing. Market restraints include evolving regulatory environments, the necessity for continuous technological upgrades, and the inherent sensitivity of wealth management to economic fluctuations. Despite these challenges, strong wealth accumulation drivers and increasing demand for specialized financial services position the Indian private banking sector for a promising future.

India Private Banking Market Company Market Share

This report delivers an in-depth analysis of the India Private Banking Market, a dynamic sector influenced by economic progress, technological advancements, and demographic shifts. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Historical data from 2019-2024 is also analyzed, providing strategic insights for stakeholders in this evolving market.

India Private Banking Market Market Concentration & Innovation

The India Private Banking Market exhibits a moderate to high market concentration, with a few dominant players controlling a significant share. Leading institutions like HDFC Bank Ltd, ICICI Bank Ltd, and Axis Bank Ltd have strategically expanded their private banking offerings, leveraging strong brand recognition and extensive branch networks. Innovation in this sector is primarily driven by the imperative to cater to the burgeoning wealth of High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs). Key innovation drivers include the adoption of digital banking platforms, personalized wealth management solutions, and sophisticated investment products. Regulatory frameworks, while evolving to ensure stability and transparency, also play a crucial role in shaping market dynamics. The Reserve Bank of India (RBI) continues to adapt policies related to capital adequacy, customer protection, and digital banking, influencing the strategies of private banks. Product substitutes, such as wealth management services offered by independent financial advisors and international wealth management firms, present a competitive challenge, pushing domestic players to enhance their value proposition. End-user trends are characterized by an increasing demand for holistic financial planning, including estate planning, philanthropy advisory, and specialized investment opportunities in alternative assets. Merger and acquisition (M&A) activities are on the rise, signaling consolidation and strategic expansion. For instance, the proposed acquisition of Citibank's consumer businesses by Axis Bank Ltd in March 2022 signifies a move to strengthen market share and leverage acquired customer bases. While specific M&A deal values are proprietary, the strategic intent behind such moves underscores the competitive drive within the market.

India Private Banking Market Industry Trends & Insights

The India Private Banking Market is poised for substantial growth, driven by a confluence of robust economic expansion, a rapidly increasing number of affluent individuals, and a growing preference for sophisticated wealth management solutions. The Compound Annual Growth Rate (CAGR) for the India Private Banking Market is projected to be robust, indicative of sustained expansion over the forecast period. Market penetration for private banking services is steadily increasing as more individuals achieve HNWI status and seek professional guidance for wealth preservation and growth. Technological disruptions are fundamentally reshaping the industry, with digital transformation at the forefront. Private banks are investing heavily in advanced digital platforms that offer seamless customer onboarding, personalized portfolio management tools, secure online transactions, and AI-powered advisory services. This technological integration is crucial for enhancing customer experience and operational efficiency. Consumer preferences are evolving towards more personalized and holistic wealth management. Clients are no longer satisfied with mere investment advice; they expect comprehensive financial planning encompassing estate planning, succession planning, tax advisory, and philanthropic guidance. This shift necessitates a move from product-centric to client-centric approaches. The competitive dynamics within the market are intensifying. Established players are enhancing their offerings, while new entrants and fintech companies are also vying for a share of this lucrative market. Data analytics is becoming a critical tool for understanding customer behavior, identifying opportunities, and tailoring bespoke solutions. The increasing financial literacy among the affluent population further fuels the demand for more complex and diversified investment avenues, including alternative investments like private equity and hedge funds.

Dominant Markets & Segments in India Private Banking Market

The Retail Banking segment, encompassing both Commercial Banking and Investment Banking activities tailored for individual wealth, stands as the dominant segment within the India Private Banking Market. This dominance is propelled by several key drivers, including favorable economic policies aimed at fostering wealth creation and investment, significant growth in the country's GDP, and the continuous development of financial infrastructure that supports sophisticated banking services. The sheer volume of High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs) in India, driven by a growing economy and entrepreneurial spirit, provides a vast and expanding client base for private banking services.

Key Drivers of Dominance:

- Economic Growth and Wealth Accumulation: India's consistent economic expansion has led to a significant increase in disposable income and wealth accumulation across various segments, creating a larger pool of potential private banking clients.

- Favorable Regulatory Environment: While robust, the regulatory framework, guided by the Reserve Bank of India (RBI), has been adaptive in allowing for innovative product development and service delivery in the banking sector. This includes measures to facilitate cross-border investments and manage wealth effectively.

- Increasing Financial Literacy and Sophistication: As the affluent population becomes more financially educated, there is a growing demand for advanced financial planning, wealth management, and investment advisory services, which are core offerings of private banking.

- Technological Adoption: The widespread adoption of digital technologies by banks, including mobile banking, online platforms, and AI-driven advisory tools, has made private banking services more accessible and user-friendly, further boosting demand.

- Demographic Dividend: A large young population, coupled with a growing entrepreneurial class, contributes to wealth creation and a future pipeline of private banking clients.

Within the broader Retail Banking umbrella, the Commercial Banking arm of private banking focuses on providing tailored banking solutions for affluent individuals, including premium current and savings accounts, preferential loan facilities, and dedicated relationship managers. The Investment Banking component is crucial for wealth growth, offering sophisticated investment strategies, access to diverse asset classes (equities, bonds, mutual funds, alternative investments), and structured financial products. The integration of these two aspects allows private banks to offer a comprehensive suite of services that cater to the full spectrum of a client's financial needs, from day-to-day banking to complex wealth creation and preservation strategies. The ongoing expansion of private banking divisions by major banks like HDFC Bank Ltd, ICICI Bank Ltd, and Kotak Mahindra Bank Ltd underscores the strategic importance and growth potential of this segment.

India Private Banking Market Product Developments

Product developments in the India Private Banking Market are increasingly focused on digital integration and personalized wealth solutions. Banks are launching advanced mobile and web platforms offering seamless client onboarding, real-time portfolio tracking, and AI-powered investment recommendations. Innovations include the development of sophisticated alternative investment products, such as private equity, hedge funds, and real estate opportunities, catering to the demand for diversification. Enhanced estate and succession planning tools are also gaining prominence, alongside philanthropic advisory services. Competitive advantages are being built through the integration of these offerings with dedicated relationship managers, providing a hybrid model of digital convenience and human expertise.

Report Scope & Segmentation Analysis

The India Private Banking Market is segmented primarily BY Banking Sector: Retail Banking, which further divides into Commercial Banking and Investment Banking.

Retail Banking: This segment forms the cornerstone of private banking services, focusing on managing the wealth of affluent individuals.

- Commercial Banking: This sub-segment offers tailored banking products and services for high-net-worth individuals, including premium current and savings accounts, preferential loan facilities, foreign exchange services, and dedicated relationship managers. Growth projections for this sub-segment are robust, driven by increasing deposit bases and demand for exclusive banking services.

- Investment Banking: This sub-segment is crucial for wealth creation and preservation, providing access to diverse investment opportunities, including equities, fixed income, mutual funds, alternative investments, and structured products. Its market size is significant and expected to grow substantially as clients seek higher returns and diversification. Competitive dynamics are intense, with banks differentiating through advisory expertise and product innovation.

Key Drivers of India Private Banking Market Growth

The India Private Banking Market is propelled by several key growth drivers. Firstly, the robust economic growth of India has led to a significant increase in the number of High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs), creating a larger client base. Secondly, technological advancements, particularly in digital banking and AI, are enabling banks to offer more personalized, efficient, and accessible services. Thirdly, there is a growing demand for holistic wealth management, extending beyond investments to include estate planning, succession planning, and philanthropy. Lastly, favorable regulatory frameworks that support wealth management and cross-border investments also contribute to market expansion.

Challenges in the India Private Banking Market Sector

The India Private Banking Market faces several challenges. Intensifying competition from domestic banks, international wealth managers, and fintech firms puts pressure on margins and requires continuous innovation. Regulatory hurdles, while aimed at stability, can sometimes create complexities in product development and cross-border transactions. Talent acquisition and retention of skilled relationship managers and investment advisors remains a significant challenge due to high demand. Cybersecurity threats and the need for robust data protection are critical concerns, especially with increased digital operations. Furthermore, ensuring consistent service quality across all touchpoints as the client base expands is crucial for maintaining client satisfaction and loyalty.

Emerging Opportunities in India Private Banking Market

Emerging opportunities in the India Private Banking Market are abundant. The growing affluent population in Tier 2 and Tier 3 cities presents a significant untapped market. The increasing interest in alternative investments like private equity, venture capital, and real estate offers avenues for product diversification. The digitalization of wealth management opens opportunities for innovative fintech collaborations and the development of sophisticated robo-advisory services. Furthermore, there is a growing demand for ESG (Environmental, Social, and Governance) investing, allowing private banks to offer sustainable investment portfolios. Succession planning and legacy management services are also gaining traction as wealth holders focus on intergenerational wealth transfer.

Leading Players in the India Private Banking Market Market

- Axis Bank Ltd

- HDFC Bank Ltd

- Yes Bank Ltd

- ICICI Bank Ltd

- Kotak Mahindra Bank Ltd

- Induslnd Bank

- IDBI Bank Ltd

- Federal Bank

- IDFC First Bank Ltd

- City Union Bank Ltd

Key Developments in India Private Banking Market Industry

- December 2022: Housing Development Finance Corporation (HDFC) announced a merger with HDFC Bank. The merger is expected to conclude in Q2 of 2023. This strategic move aims to create a financial powerhouse, enhancing the combined entity's scale and market reach in the banking and financial services sector, including private banking.

- March 2022: Axis Bank proposed the acquisition of Citibank's consumer businesses in India. This will help Axis Bank to strongly position itself in the growing market share. This acquisition is expected to bolster Axis Bank's private banking client base and product offerings, significantly strengthening its competitive standing.

Strategic Outlook for India Private Banking Market Market

The strategic outlook for the India Private Banking Market is overwhelmingly positive, characterized by sustained growth and an increasing demand for sophisticated financial solutions. Key growth catalysts include the continued economic expansion of India, leading to a larger pool of affluent individuals. The ongoing digital transformation of banking services will enable private banks to offer more personalized, efficient, and accessible wealth management experiences. The rising demand for comprehensive financial planning, encompassing investment, estate, and succession planning, presents significant opportunities for value-added services. Banks that successfully leverage technology, focus on client-centricity, and adapt to evolving regulatory landscapes will be well-positioned to capture market share and drive future growth in this dynamic sector. The market is expected to see further consolidation and strategic alliances as players aim to enhance their capabilities and competitive edge.

India Private Banking Market Segmentation

-

1. BY Banking Sector

-

1.1. Retail Banking

- 1.1.1. Commercial Banking

- 1.1.2. Investment Banking

-

1.1. Retail Banking

India Private Banking Market Segmentation By Geography

- 1. India

India Private Banking Market Regional Market Share

Geographic Coverage of India Private Banking Market

India Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Private Sector Bank Assets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Private Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Banking Sector

- 5.1.1. Retail Banking

- 5.1.1.1. Commercial Banking

- 5.1.1.2. Investment Banking

- 5.1.1. Retail Banking

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by BY Banking Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axis Bank Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HDFC Bank Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yes Bank Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ICICI Bank Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kotak Mahindra Bank Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Induslnd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IDBI Bank Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Federal Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IDFC First Bank Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 City Union Bank Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Axis Bank Ltd

List of Figures

- Figure 1: India Private Banking Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Private Banking Market Share (%) by Company 2025

List of Tables

- Table 1: India Private Banking Market Revenue billion Forecast, by BY Banking Sector 2020 & 2033

- Table 2: India Private Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Private Banking Market Revenue billion Forecast, by BY Banking Sector 2020 & 2033

- Table 4: India Private Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Private Banking Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the India Private Banking Market?

Key companies in the market include Axis Bank Ltd, HDFC Bank Ltd, Yes Bank Ltd, ICICI Bank Ltd, Kotak Mahindra Bank Ltd, Induslnd Bank, IDBI Bank Ltd, Federal Bank, IDFC First Bank Ltd, City Union Bank Ltd *List Not Exhaustive.

3. What are the main segments of the India Private Banking Market?

The market segments include BY Banking Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 505.61 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Private Sector Bank Assets is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Housing Development Finance Corporation (HDFC) announced a merger with HDFC Bank. The merger is expected to conclude in Q2 of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Private Banking Market?

To stay informed about further developments, trends, and reports in the India Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence