Key Insights

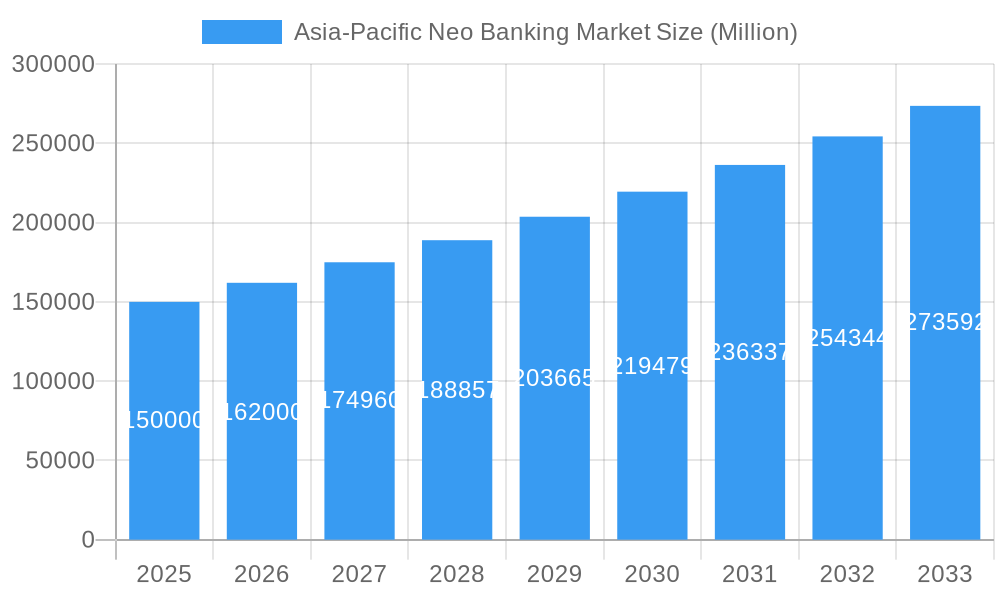

The Asia-Pacific neo banking market is projected for substantial growth, driven by an increasing digitally-native consumer base and widespread smartphone adoption. The market is expected to reach $261.4 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 47% through 2033. This expansion is attributed to the rising demand for convenient, accessible, and personalized financial solutions, particularly among younger demographics and Small and Medium-sized Enterprises (SMEs). The proliferation of innovative fintech solutions and favorable regulatory environments in key markets, including China, India, and Southeast Asian nations, are further accelerating adoption. Mobile banking and streamlined payment and transfer services are leading service adoption, meeting the evolving financial needs of both enterprise and individual customers.

Asia-Pacific Neo Banking Market Market Size (In Billion)

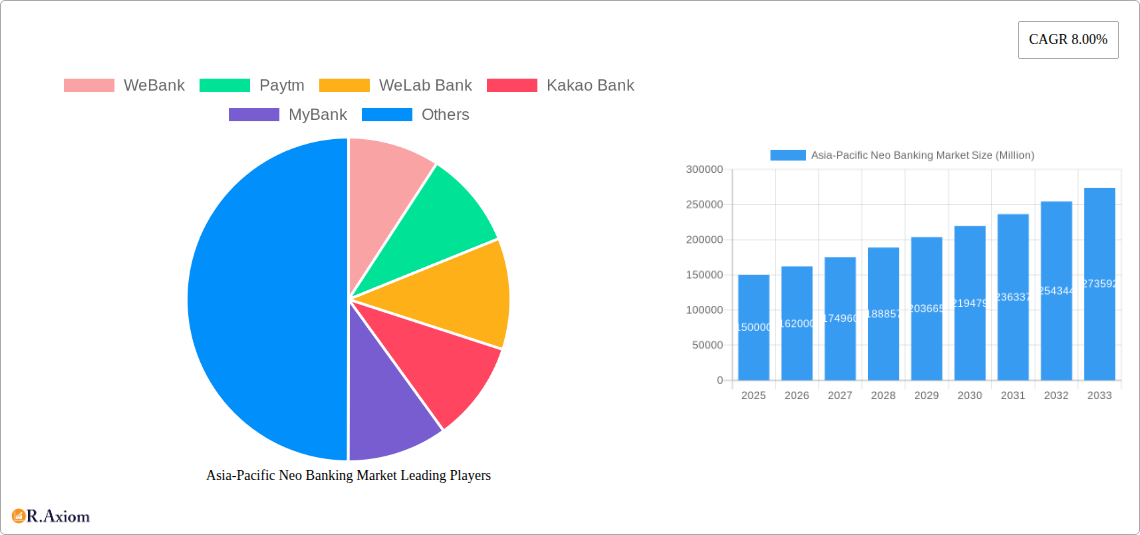

Despite the dynamic nature of the Asia-Pacific neo banking market, certain factors may influence its growth trajectory. Intensified competition from traditional banks rapidly digitizing their services, alongside evolving regulatory frameworks that may not always keep pace with technological advancements, present challenges. Cybersecurity concerns and data privacy remain critical considerations for both providers and consumers. Nevertheless, these challenges are being addressed through ongoing technological advancements and robust security measures. The market features a vibrant ecosystem of companies, such as WeBank, Paytm, and Kakao Bank, competing for market share through specialized offerings and strategic alliances, especially in high-growth regions like China and India. The "Rest of Asia-Pacific" segment, comprising emerging economies, presents significant untapped opportunities for future neo banking innovation and expansion.

Asia-Pacific Neo Banking Market Company Market Share

Asia-Pacific Neo Banking Market: Comprehensive Growth Analysis & Forecast (2019-2033)

This detailed report provides an in-depth analysis of the Asia-Pacific Neo Banking market, exploring its current landscape, future trajectory, and key growth drivers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study offers actionable insights for stakeholders seeking to capitalize on the burgeoning digital banking revolution across the region. We delve into market concentration, innovation, regulatory frameworks, emerging trends, dominant segments, product developments, and strategic outlooks, backed by robust data and expert analysis.

Asia-Pacific Neo Banking Market Market Concentration & Innovation

The Asia-Pacific neo banking market is characterized by a dynamic interplay between established players and agile disruptors, fostering an environment of intense competition and rapid innovation. Market concentration varies across key geographies, with China and India exhibiting significant fragmentation due to the presence of numerous domestic neo banks and fintech entities. For instance, the combined market share of the top 5 neo banks in China is estimated at XX%, while in India, it is XX%, indicating a more distributed landscape. Innovation is primarily driven by advancements in artificial intelligence (AI) and machine learning (ML) for personalized financial services, blockchain for secure and efficient transactions, and open banking APIs enabling seamless integration with third-party applications. Regulatory frameworks are evolving, with governments increasingly embracing supportive policies to foster digital finance, yet varying compliance requirements across nations present a complex operating environment. Product substitutes, such as traditional banking services and peer-to-peer lending platforms, still hold significant sway, but the superior user experience and cost-effectiveness offered by neo banking solutions are steadily eroding their market share. End-user trends highlight a growing preference for mobile-first banking, instant gratification, and tailored financial products, particularly among millennials and Gen Z. Mergers and acquisition (M&A) activities are on the rise as larger fintech companies and traditional banks seek to acquire innovative neo banking capabilities or expand their digital footprint. Estimated M&A deal values in the region are projected to reach over $XX Billion by 2028, underscoring strategic consolidation.

Asia-Pacific Neo Banking Market Industry Trends & Insights

The Asia-Pacific neo banking market is experiencing an unprecedented surge in growth, propelled by a confluence of transformative factors and a rapidly evolving digital landscape. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period, reflecting a sustained expansion driven by increasing smartphone penetration and internet accessibility across the region. This digital transformation is democratizing access to financial services, particularly for unbanked and underbanked populations who have historically been underserved by traditional financial institutions. Consumer preferences are shifting dramatically, with a clear inclination towards digital-first banking experiences that offer convenience, speed, and personalized solutions. Neo banks are adept at catering to these evolving demands by leveraging advanced technologies such as AI, ML, and big data analytics to offer bespoke financial products, real-time customer support, and intuitive user interfaces. The competitive dynamics are intensifying, with both homegrown neo banks and international fintech giants vying for market share. Traditional banks are also making significant investments in their digital capabilities or collaborating with neo banks to remain competitive, leading to a hybrid banking ecosystem. Technological disruptions, including the widespread adoption of cloud computing, APIs, and mobile payment solutions, are foundational to the operational efficiency and scalability of neo banking platforms. These advancements enable neo banks to offer lower transaction fees, faster service delivery, and a broader range of innovative financial products, from instant loans to digital investment services. The market penetration of neo banking services is rapidly increasing, especially in emerging economies like India and Southeast Asian nations, where the digital leapfrogging phenomenon is prominent. This trend is further fueled by supportive government initiatives and a growing middle class with increasing disposable incomes and a desire for modern financial tools.

Dominant Markets & Segments in Asia-Pacific Neo Banking Market

The Asia-Pacific neo banking market is characterized by distinct leadership in certain geographies and segments, driven by unique economic, technological, and regulatory landscapes.

Geography Dominance:

- China: Currently leading the market, China's dominance is fueled by a massive digital-savvy population, advanced technological infrastructure, and the early adoption of digital payment systems. The vastness of its market and the presence of large tech conglomerates have provided fertile ground for neo banking innovation. Key drivers include widespread smartphone usage, a high adoption rate of mobile payments, and supportive government policies promoting financial technology.

- India: Following closely, India's neo banking market is experiencing exponential growth. The country's large, young population, coupled with significant efforts to achieve financial inclusion, has created a massive opportunity for digital-first banking solutions. Economic policies aimed at promoting digital payments and financial inclusion are significant drivers.

- Southeast Asia (including Singapore and Hong Kong): This region presents a diverse yet rapidly growing neo banking landscape. Singapore and Hong Kong, with their strong financial hubs and advanced regulatory frameworks, are attracting significant investment and innovation. The rest of Southeast Asia, encompassing countries like Indonesia, Vietnam, and the Philippines, is witnessing a surge in neo banking adoption driven by increasing internet penetration and a large unbanked population seeking accessible financial services. Favorable regulatory sandboxes and the rapid growth of e-commerce are key contributors here.

Account Type Dominance:

- Saving Account: The demand for easily accessible and interest-bearing saving accounts, often with higher yields than traditional banks, makes this a dominant segment. Neo banks excel at offering seamless digital onboarding and attractive interest rates, appealing to individuals looking for straightforward savings solutions.

- Business Account: Small and medium-sized enterprises (SMEs) are increasingly turning to neo banks for simplified business banking services. Features like integrated accounting tools, faster payment processing, and lower fees are significant drivers for this segment.

Service Dominance:

- Mobile Banking: This is the cornerstone of the neo banking experience and the most dominant service. Neo banks are built on mobile-first platforms, offering a comprehensive suite of banking functionalities accessible entirely through smartphones, from account opening to transaction management.

- Payments and Transfers: Instant, low-cost domestic and international payments and transfers are a key value proposition of neo banks. Their efficiency and user-friendly interfaces in this domain are significant drivers of customer acquisition.

Application Dominance:

- Personal: The majority of neo banking adoption currently comes from individual consumers seeking a more convenient and personalized banking experience than what traditional banks offer. The ease of use and accessibility for everyday financial needs makes this the largest application segment.

- Enterprise: While still a developing segment, enterprise applications are gaining traction, particularly for SMEs looking for streamlined financial management solutions.

Asia-Pacific Neo Banking Market Product Developments

Neo banks in the Asia-Pacific region are continually innovating to offer advanced and user-centric financial products. Key developments include the integration of AI-powered financial advisory services, such as intelligent wealth management tools that provide personalized investment recommendations and portfolio tracking. Furthermore, the expansion of buy now, pay later (BNPL) options and instant loan facilities, often embedded within the banking app, caters to the growing demand for flexible credit solutions. Competitive advantages are being built through superior user experience, lower fee structures, and the ability to offer niche products that traditional banks may overlook. The focus remains on seamless digital onboarding, real-time transaction processing, and personalized financial insights, making neo banking an attractive alternative for consumers and businesses alike.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia-Pacific Neo Banking Market across several key dimensions to provide a comprehensive understanding of market dynamics.

Account Type: The market is analyzed based on Business Account and Saving Account. Business accounts are witnessing robust growth driven by the need for simplified financial management for SMEs, while saving accounts continue to attract retail customers with competitive interest rates and easy access.

Service: Key services evaluated include Mobile Banking, Payments and Transfer, Loans, and Others. Mobile Banking is the foundational service, with Payments and Transfer being a primary attraction for users. The Loans segment is expanding with innovative lending models.

Application: The report segments the market by Enterprise and Personal applications, with the Personal segment currently dominating due to widespread consumer adoption, while the Enterprise segment is showing significant potential for growth, particularly among SMEs.

Geography: The analysis covers prominent markets such as China, India, Australia, Singapore, Hong Kong, and the Rest of Asia-Pacific. China and India are identified as key growth hubs, while Singapore and Hong Kong are leading in terms of advanced digital financial services.

Key Drivers of Asia-Pacific Neo Banking Market Growth

The Asia-Pacific neo banking market is propelled by several transformative forces. A primary driver is the rapid adoption of smartphones and increasing internet penetration across the region, making digital banking accessible to a broader population. Government initiatives promoting financial inclusion and digital payments, such as India's Unified Payments Interface (UPI), significantly boost adoption. Furthermore, a growing young and tech-savvy demographic with a preference for digital-first, convenient, and cost-effective financial services acts as a major catalyst. The increasing dissatisfaction with traditional banking's legacy systems and fees also pushes consumers towards neo banking alternatives.

Challenges in the Asia-Pacific Neo Banking Market Sector

Despite its rapid growth, the Asia-Pacific neo banking market faces significant challenges. Regulatory complexities and varying compliance requirements across different countries can hinder scalability and expansion. Cybersecurity threats and data privacy concerns remain paramount, requiring substantial investment in robust security infrastructure to build and maintain customer trust. Intense competition from both established neo banks and traditional financial institutions adopting digital strategies necessitates continuous innovation and differentiation. Furthermore, the challenge of acquiring and retaining customers in a crowded market, coupled with the need to educate less digitally literate segments of the population about neo banking benefits, also presents hurdles.

Emerging Opportunities in Asia-Pacific Neo Banking Market

The Asia-Pacific neo banking market is ripe with emerging opportunities. The underserved populations in Southeast Asian countries, offering vast potential for financial inclusion through mobile-first banking solutions, represent a significant untapped market. The increasing demand for embedded finance, where banking services are integrated into non-financial platforms (e.g., e-commerce, ride-sharing apps), presents a new avenue for growth. The evolution of open banking APIs facilitates deeper partnerships and the creation of innovative super-app ecosystems, offering a holistic financial management experience. Advancements in AI and blockchain technology also unlock opportunities for personalized financial products, decentralized finance (DeFi) integration, and enhanced transaction security.

Leading Players in the Asia-Pacific Neo Banking Market Market

- WeBank

- Paytm

- WeLab Bank

- Kakao Bank

- MyBank

- Douugh

- Crypto com

- Toss Bank

- InstantPay

- Kyash

Key Developments in Asia-Pacific Neo Banking Market Industry

- April 2022: WeLab Bank became the first virtual bank in Hong Kong to be granted permission to provide digital wealth advising services, launching its intelligent wealth solution GoWealth Digital Wealth Advisory (GoWealth) after receiving Type 1 and Type 4 licenses from the Hong Kong Securities and Futures Commission (HKSFC).

- December 2021: Kakao Bank announced the signing of an MOU with Kyobo Life Insurance, Kyobo Bookstore, and Kyobo Securities for data cooperation and partnerships with other financial platform firms. This partnership aims to foster financial product planning and development, as well as cooperative marketing, with Kyobo Life Insurance and Kyobo Securities.

Strategic Outlook for Asia-Pacific Neo Banking Market Market

The strategic outlook for the Asia-Pacific neo banking market is exceptionally promising, driven by ongoing digital transformation and evolving consumer behaviors. Key growth catalysts include the continued expansion of mobile internet access, increasing smartphone adoption, and a growing demand for personalized, seamless financial services. Neo banks that can effectively leverage AI and big data to offer tailored products and proactive financial guidance will likely gain a competitive edge. Strategic partnerships with e-commerce platforms, fintech enablers, and even traditional financial institutions will be crucial for market penetration and service expansion. The focus on financial inclusion for previously unbanked and underbanked populations in emerging economies presents a substantial long-term growth opportunity. As regulatory environments continue to mature, providing clarity and support for digital banking, the market is poised for sustained and robust expansion in the coming years.

Asia-Pacific Neo Banking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments and Tranfer

- 2.3. Loans

- 2.4. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Australia

- 4.4. Singapore

- 4.5. Hongkong

- 4.6. Rest of Asia-Pacific

Asia-Pacific Neo Banking Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Singapore

- 5. Hongkong

- 6. Rest of Asia Pacific

Asia-Pacific Neo Banking Market Regional Market Share

Geographic Coverage of Asia-Pacific Neo Banking Market

Asia-Pacific Neo Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Number of Customers for Neo Banking is Raising Significantly in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Tranfer

- 5.2.3. Loans

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Australia

- 5.4.4. Singapore

- 5.4.5. Hongkong

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Australia

- 5.5.4. Singapore

- 5.5.5. Hongkong

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. China Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Business Account

- 6.1.2. Saving Account

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Mobile Banking

- 6.2.2. Payments and Tranfer

- 6.2.3. Loans

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Enterprise

- 6.3.2. Personal

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Australia

- 6.4.4. Singapore

- 6.4.5. Hongkong

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. India Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Business Account

- 7.1.2. Saving Account

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Mobile Banking

- 7.2.2. Payments and Tranfer

- 7.2.3. Loans

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Enterprise

- 7.3.2. Personal

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Australia

- 7.4.4. Singapore

- 7.4.5. Hongkong

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Australia Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Business Account

- 8.1.2. Saving Account

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Mobile Banking

- 8.2.2. Payments and Tranfer

- 8.2.3. Loans

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Enterprise

- 8.3.2. Personal

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Australia

- 8.4.4. Singapore

- 8.4.5. Hongkong

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Singapore Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Business Account

- 9.1.2. Saving Account

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Mobile Banking

- 9.2.2. Payments and Tranfer

- 9.2.3. Loans

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Enterprise

- 9.3.2. Personal

- 9.3.3. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Australia

- 9.4.4. Singapore

- 9.4.5. Hongkong

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. Hongkong Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Business Account

- 10.1.2. Saving Account

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Mobile Banking

- 10.2.2. Payments and Tranfer

- 10.2.3. Loans

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Enterprise

- 10.3.2. Personal

- 10.3.3. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Australia

- 10.4.4. Singapore

- 10.4.5. Hongkong

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Rest of Asia Pacific Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 11.1.1. Business Account

- 11.1.2. Saving Account

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Mobile Banking

- 11.2.2. Payments and Tranfer

- 11.2.3. Loans

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Enterprise

- 11.3.2. Personal

- 11.3.3. Others

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Australia

- 11.4.4. Singapore

- 11.4.5. Hongkong

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 WeBank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Paytm

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 WeLab Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kakao Bank

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MyBank

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Douugh

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Crypto com

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toss Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 InstantPay

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kyash**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 WeBank

List of Figures

- Figure 1: Global Asia-Pacific Neo Banking Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 3: China Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: China Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 5: China Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: China Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 7: China Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: China Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 9: China Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 11: China Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: India Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 13: India Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 14: India Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 15: India Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: India Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 17: India Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: India Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 19: India Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: India Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 21: India Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 23: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 24: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 25: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 33: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 34: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 35: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 36: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 43: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 44: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 45: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 46: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 49: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 53: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 54: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 55: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 56: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 57: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 59: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 2: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 7: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 12: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 13: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 17: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 22: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 23: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 27: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 28: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 32: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 33: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 35: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Neo Banking Market?

The projected CAGR is approximately 47%.

2. Which companies are prominent players in the Asia-Pacific Neo Banking Market?

Key companies in the market include WeBank, Paytm, WeLab Bank, Kakao Bank, MyBank, Douugh, Crypto com, Toss Bank, InstantPay, Kyash**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Neo Banking Market?

The market segments include Account Type, Service, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Number of Customers for Neo Banking is Raising Significantly in the Region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, WeLab Bank has become the first virtual bank in Hong Kong to be granted permission to provide digital wealth advising services. The Bank soft-launched its intelligent wealth solution GoWealth Digital Wealth Advisory (GoWealth) for selected customers after receiving Type 1 (Dealing in securities) and Type 4 (Advising on securities) licenses from the Hong Kong Securities and Futures Commission (HKSFC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Neo Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Neo Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Neo Banking Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Neo Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence