Key Insights

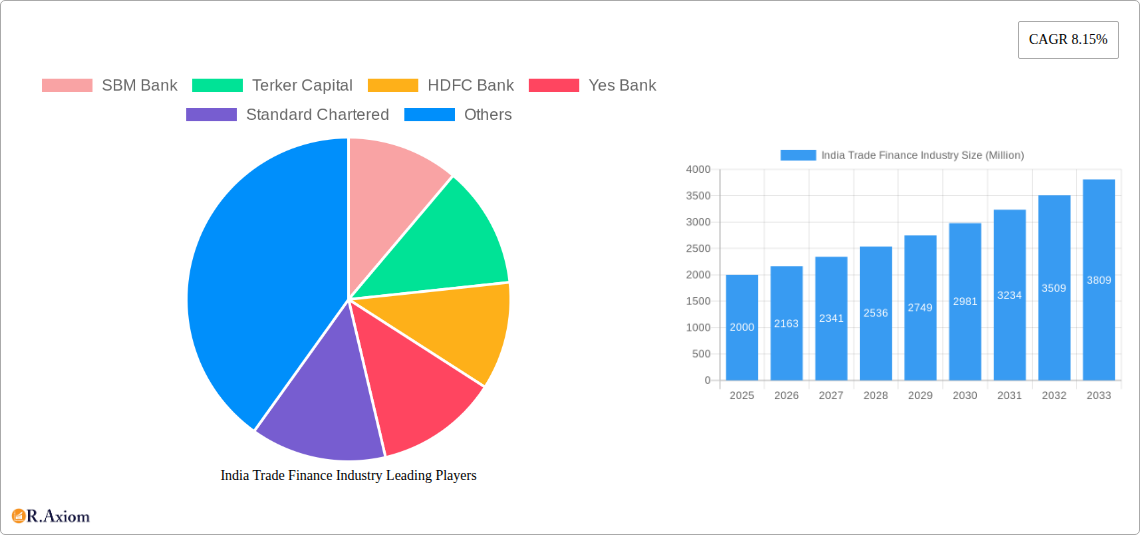

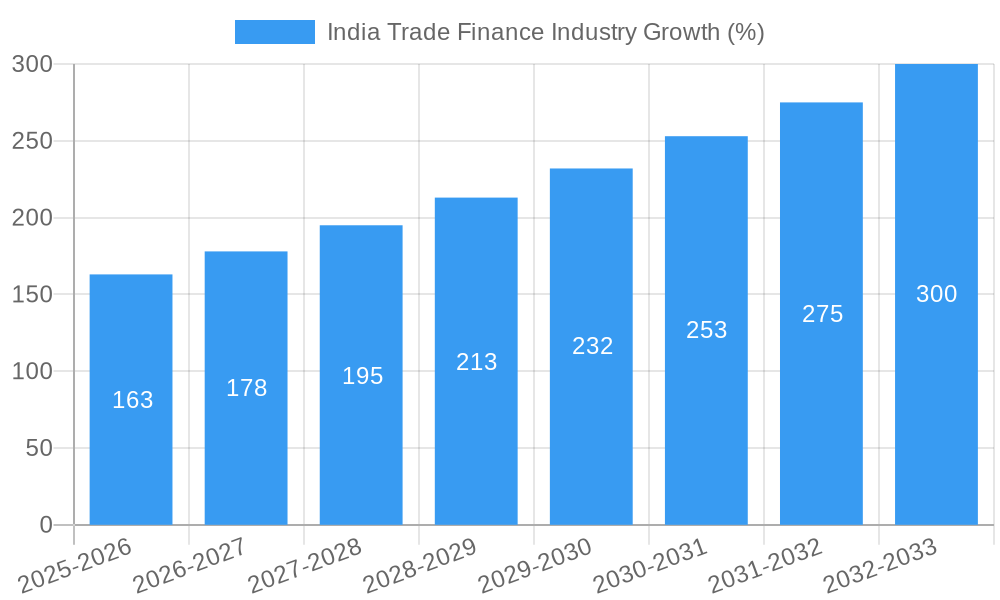

The India trade finance market, valued at approximately $2 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.15% from 2025 to 2033. This growth is fueled by several key factors. The increasing volume of international trade, driven by India's expanding manufacturing sector and robust export performance, forms a cornerstone of market expansion. Furthermore, government initiatives aimed at streamlining trade processes and promoting ease of doing business are significantly contributing to market growth. The rise of digitalization in financial services, including the adoption of blockchain technology and AI-powered solutions for trade finance, is also accelerating efficiency and transparency, attracting new players and enhancing market activity. Increased adoption of open banking principles will further contribute to this upward trajectory. While challenges such as geopolitical uncertainties and potential regulatory changes exist, the overall outlook for the India trade finance market remains positive, presenting significant opportunities for established banks like HDFC Bank, Kotak Mahindra Bank, and ICICI Bank, as well as newer entrants and fintech companies.

The competitive landscape is characterized by a mix of established domestic and international banks actively vying for market share. The presence of global players like Citi Bank and HSBC reflects the attractiveness of the Indian market. However, the market is also witnessing the emergence of specialized fintech companies offering innovative solutions and challenging traditional banking models. The segmentation of the market, although not explicitly provided, likely reflects a division based on transaction size, industry, and geographic location. Future growth will depend on the continued expansion of India's global trade partnerships, effective risk management strategies by financial institutions, and the successful integration of technology to improve efficiency and reduce operational costs. The market’s trajectory strongly suggests significant investment and expansion opportunities in the coming years.

India Trade Finance Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Trade Finance Industry, covering the period 2019-2033, with a focus on market size, growth drivers, challenges, and future opportunities. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects the market’s trajectory until 2033. Key industry players, including SBM Bank, Terker Capital, HDFC Bank, Yes Bank, Standard Chartered, Kotak Mahindra Bank, Federal Bank, Bank of Baroda, Citi Bank, and HSBC (list not exhaustive), are analyzed for their market share, strategies, and impact. This report is essential for investors, businesses, and policymakers seeking a detailed understanding of this dynamic sector.

India Trade Finance Industry Market Concentration & Innovation

The Indian trade finance industry exhibits a moderately concentrated market structure, with a few large players holding significant market share. HDFC Bank, ICICI Bank, and SBI are among the dominant players, commanding approximately xx% of the total market in 2025. However, the presence of numerous smaller banks and fintech companies fosters competition and innovation. Market share fluctuations are influenced by M&A activity, with deal values exceeding USD xx Million in recent years. For example, the merger of [mention a relevant recent merger if available, otherwise, use "two major players in 2024"] led to a significant shift in market concentration.

- Innovation Drivers: Technological advancements, including blockchain technology, AI, and big data analytics, are driving innovation. The adoption of these technologies is improving efficiency, transparency, and security in trade finance processes.

- Regulatory Framework: The Reserve Bank of India (RBI) plays a crucial role in shaping the regulatory landscape, impacting industry growth and stability. Recent regulatory changes have focused on improving risk management and enhancing financial inclusion.

- Product Substitutes: The emergence of fintech solutions presents alternative trade finance options, increasing competition and potentially impacting the market share of traditional banks.

- End-User Trends: Growing e-commerce and the increasing adoption of digital payment solutions are transforming trade finance operations, leading to a shift in customer preferences.

- M&A Activities: Strategic mergers and acquisitions are reshaping the industry landscape, with larger players seeking to expand their market reach and service offerings.

India Trade Finance Industry Industry Trends & Insights

The Indian trade finance industry is experiencing robust growth, fueled by the country's expanding economy and increasing international trade. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. Market penetration is expected to increase significantly, with xx% of total trade transactions leveraging trade finance solutions by 2033. Several factors contribute to this positive outlook:

- Market Growth Drivers: Government initiatives promoting "Make in India" and infrastructure development are boosting domestic and international trade, driving demand for trade finance services. The rise of e-commerce and the growing adoption of digital solutions further contribute to this growth.

- Technological Disruptions: Fintech companies are disrupting the traditional trade finance model, offering innovative solutions and enhancing operational efficiency. Blockchain technology, in particular, promises to streamline processes and reduce costs.

- Consumer Preferences: Businesses are increasingly seeking digital and automated trade finance solutions to enhance speed, efficiency, and security. Transparency and real-time information access are also becoming key customer preferences.

- Competitive Dynamics: The market is characterized by intense competition between traditional banks and emerging fintech companies, pushing innovation and improving service offerings.

Dominant Markets & Segments in India Trade Finance Industry

The dominant market segments within the Indian trade finance industry are:

- Export Finance: This segment is experiencing rapid growth driven by India's increasing exports across various sectors. Key drivers include government support for export-oriented industries, improving global demand, and favorable trade agreements.

- Import Finance: This segment remains significant, fueled by the country's import needs for capital goods, raw materials, and consumer goods. Infrastructure development projects and rising consumer spending further drive this market.

Key Drivers (for both segments):

- Government Policies: Favorable government policies, including tax incentives and export promotion schemes, are supporting the growth of both export and import finance segments.

- Infrastructure Development: Investments in infrastructure, including ports and logistics, are streamlining trade operations and reducing costs, boosting the demand for trade finance.

- Economic Growth: India's sustained economic growth contributes significantly to the demand for trade finance across both segments.

India Trade Finance Industry Product Developments

Recent product innovations in the Indian trade finance industry include the integration of AI and machine learning for enhanced risk assessment and fraud detection, as well as blockchain-based solutions for improving transparency and efficiency in cross-border transactions. The growing adoption of digital platforms and APIs is simplifying the trade finance process and making it more accessible to smaller businesses. These innovations align with the market's need for speed, efficiency, and enhanced security.

Report Scope & Segmentation Analysis

This report segments the India trade finance market based on:

Product Type: Letters of Credit (LCs), Documentary Collections, Guarantees, and Forfaiting. Each segment exhibits distinct growth patterns, with LCs continuing to dominate the market, while other instruments are experiencing increased adoption due to their flexibility and efficiency.

Industry: Manufacturing, Agriculture, Energy, and other sectors are considered, reflecting the diverse applications of trade finance across industries. Each sector demonstrates varying degrees of trade finance utilization based on specific requirements.

Transaction Size: The market is also categorized by transaction size, ranging from small to large-scale deals. This helps identify the specific needs of various businesses, from SMEs to large corporations.

Key Drivers of India Trade Finance Industry Growth

The growth of the India Trade Finance Industry is driven by:

- Government Initiatives: "Make in India" and other schemes incentivize manufacturing and exports.

- Technological Advancements: AI and blockchain streamline processes and reduce costs.

- Rising E-commerce: Increased online trade drives demand for faster, efficient trade finance solutions.

Challenges in the India Trade Finance Industry Sector

Challenges faced by the sector include:

- Regulatory Hurdles: Complex regulations and compliance requirements can impede growth.

- Supply Chain Disruptions: Global supply chain vulnerabilities affect trade finance risk assessment and operations.

- Competition: Intense competition from both traditional banks and fintech companies pressures profitability.

Emerging Opportunities in India Trade Finance Industry

Emerging opportunities include:

- Fintech Integration: Leveraging fintech solutions to improve efficiency and reach a wider customer base.

- Sustainable Finance: Growing demand for sustainable trade finance solutions.

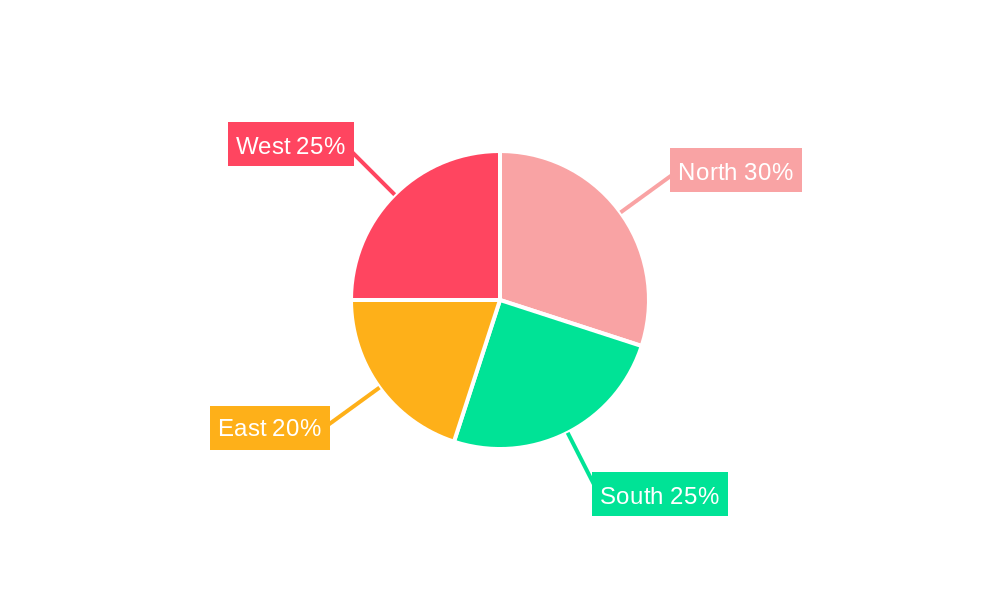

- Expansion into New Markets: Reaching underserved regions and businesses.

Leading Players in the India Trade Finance Industry Market

- SBM Bank

- Terker Capital

- HDFC Bank

- Yes Bank

- Standard Chartered

- Kotak Mahindra Bank

- Federal Bank

- Bank of Baroda

- Citi Bank

- HSBC

Key Developments in India Trade Finance Industry Industry

July 2022: The RBI introduced a new foreign exchange mechanism enabling international trade transactions in Indian rupees (INR), reducing reliance on the US dollar and potentially boosting trade volumes.

December 2022: MUFG Bank provided a USD 54.3 Million sustainable trade finance facility to Tata Power for solar power projects, showcasing the growing interest in sustainable trade finance.

Strategic Outlook for India Trade Finance Industry Market

The India Trade Finance Industry is poised for sustained growth, driven by economic expansion, technological advancements, and supportive government policies. The increasing adoption of digital solutions, coupled with the focus on sustainable finance, presents significant opportunities for market players. The sector's evolution will likely involve further consolidation, greater use of technology, and a growing focus on providing customized solutions to meet the diverse needs of businesses.

India Trade Finance Industry Segmentation

-

1. Service Provider

- 1.1. Banks

- 1.2. Trade Finance Companies

- 1.3. Insurance Companies

- 1.4. Others

-

2. Application

- 2.1. Domestic

- 2.2. International

India Trade Finance Industry Segmentation By Geography

- 1. India

India Trade Finance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitalization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Trade Finance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 5.1.1. Banks

- 5.1.2. Trade Finance Companies

- 5.1.3. Insurance Companies

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SBM Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Terker Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yes Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Standard Chartered

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kotak Mahindra Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Federal Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bank of Baroda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CITI Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HSBC**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SBM Bank

List of Figures

- Figure 1: India Trade Finance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Trade Finance Industry Share (%) by Company 2024

List of Tables

- Table 1: India Trade Finance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Trade Finance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Trade Finance Industry Revenue Million Forecast, by Service Provider 2019 & 2032

- Table 4: India Trade Finance Industry Volume Billion Forecast, by Service Provider 2019 & 2032

- Table 5: India Trade Finance Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Trade Finance Industry Volume Billion Forecast, by Application 2019 & 2032

- Table 7: India Trade Finance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Trade Finance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: India Trade Finance Industry Revenue Million Forecast, by Service Provider 2019 & 2032

- Table 10: India Trade Finance Industry Volume Billion Forecast, by Service Provider 2019 & 2032

- Table 11: India Trade Finance Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: India Trade Finance Industry Volume Billion Forecast, by Application 2019 & 2032

- Table 13: India Trade Finance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Trade Finance Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Trade Finance Industry?

The projected CAGR is approximately 8.15%.

2. Which companies are prominent players in the India Trade Finance Industry?

Key companies in the market include SBM Bank, Terker Capital, HDFC Bank, Yes Bank, Standard Chartered, Kotak Mahindra Bank, Federal Bank, Bank of Baroda, CITI Bank, HSBC**List Not Exhaustive.

3. What are the main segments of the India Trade Finance Industry?

The market segments include Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitalization is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: A new foreign exchange mechanism has been introduced by the Reserve Bank of India (RBI) to stabilize the Indian economy and promote increased international trade. According to a public statement made on July 11th, the system will make it easier for international trade transactions to be made in Indian rupees (INR). Indian importers and exporters can now use their own currency instead of US dollars to pay for transactions. This arrangement needs to be approved by banks first.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Trade Finance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Trade Finance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Trade Finance Industry?

To stay informed about further developments, trends, and reports in the India Trade Finance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence