Key Insights

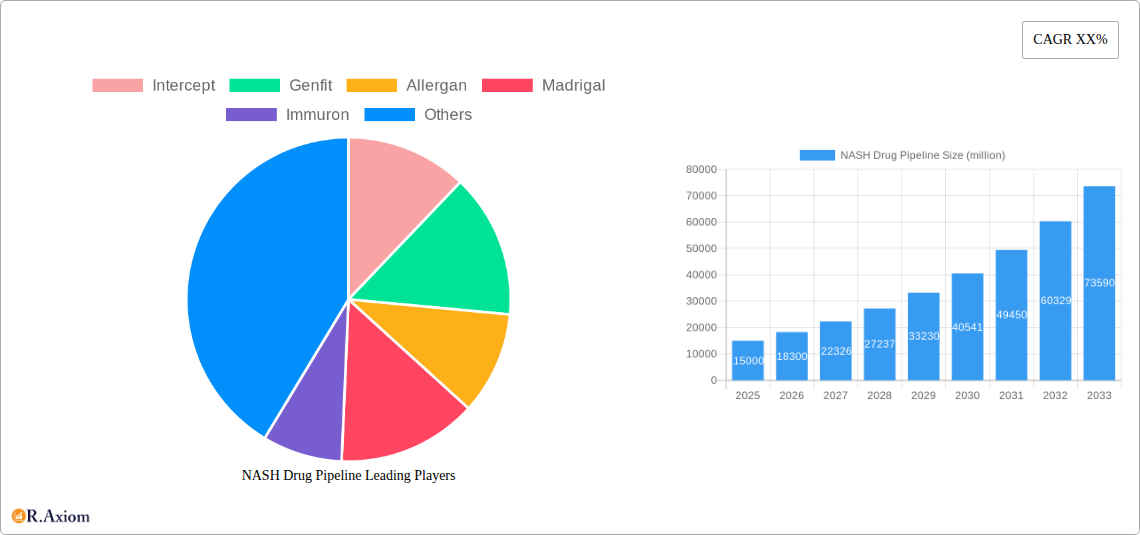

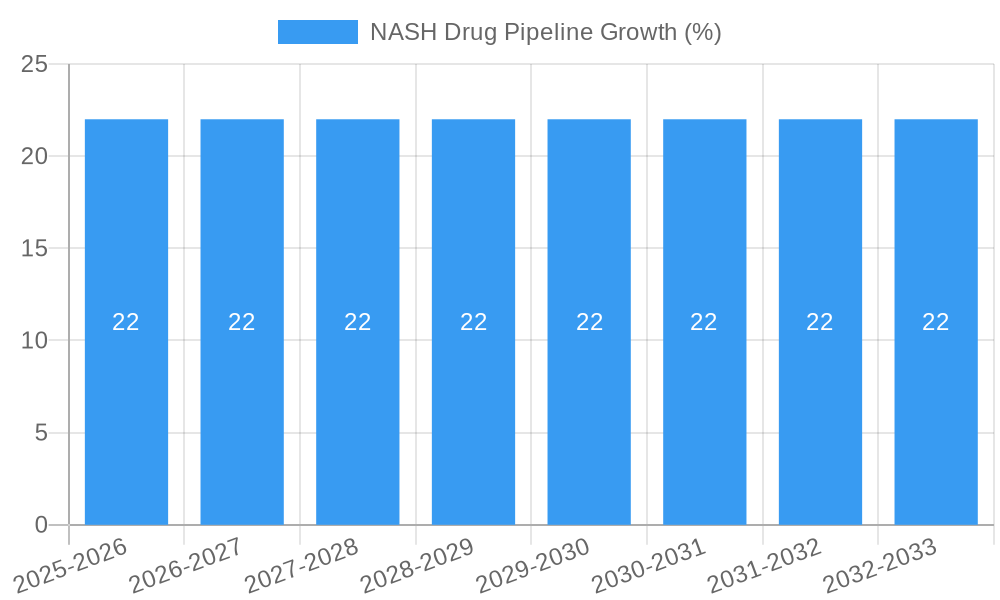

The Non-alcoholic Steatohepatitis (NASH) Drug Pipeline market is poised for substantial growth, projected to reach a market size of approximately \$15,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 22% over the forecast period (2025-2033). This robust expansion is primarily driven by the escalating global prevalence of obesity and type 2 diabetes, key risk factors for NASH. The increasing awareness and early diagnosis of the disease, coupled with significant investments in research and development by pharmaceutical giants and emerging biotechs, are further fueling market dynamism. The pipeline is rich with innovative therapeutic modalities, including protease inhibitors, immunomodulatory agents, and multiple kinase inhibitors, each aiming to address the complex inflammatory and fibrotic pathways implicated in NASH. Companies like Intercept, Genfit, Allergan, Madrigal, and Gilead are at the forefront, actively developing and advancing novel treatments.

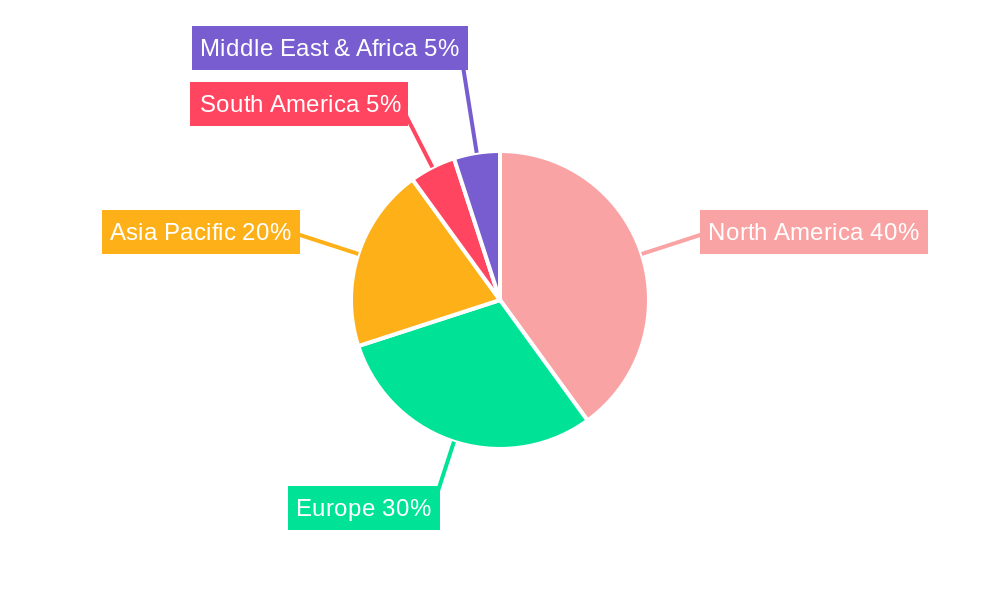

The market's trajectory is characterized by a strong emphasis on addressing unmet medical needs, particularly for patients with advanced fibrosis. While the market is propelled by favorable demographic trends and a burgeoning R&D landscape, certain restraints, such as the high cost of drug development and the complexities of clinical trial designs, could temper the pace of market penetration. Nonetheless, the sheer burden of NASH-related liver disease and the promise of disease-modifying therapies suggest a highly promising future. The North America region is expected to lead the market share, owing to advanced healthcare infrastructure and high disease incidence, followed by Europe and the Asia Pacific, with significant growth potential driven by increasing diagnosis rates in countries like China and India. The strategic focus on developing combination therapies and novel drug delivery systems will be critical for future market success.

This in-depth report provides a critical examination of the Non-alcoholic steatohepatitis (NASH) drug pipeline, offering actionable insights for pharmaceutical companies, investors, researchers, and regulatory bodies. Spanning the historical period of 2019–2024, a base year of 2025, and a forecast period extending to 2033, this analysis meticulously dissects market concentration, innovation drivers, industry trends, dominant segments, product developments, and future opportunities. With a focus on high-traffic keywords such as "NASH drug development," "liver disease therapeutics," "fibrosis treatment," and "metabolic syndrome drugs," this report aims to enhance search visibility and deliver unparalleled value to industry stakeholders navigating this dynamic and rapidly evolving therapeutic area.

NASH Drug Pipeline Market Concentration & Innovation

The NASH drug pipeline is characterized by a dynamic market concentration, with a significant number of pharmaceutical giants and innovative biotech firms vying for leadership. Innovation is primarily driven by advancements in understanding disease pathogenesis, leading to the development of novel therapeutic targets such as FXR agonists, PPAR agonists, and anti-fibrotic agents. Regulatory frameworks, particularly from the FDA and EMA, play a pivotal role in shaping development pathways and approval timelines, with a growing emphasis on robust clinical trial data demonstrating efficacy in reversing fibrosis and improving liver histology. Product substitutes are currently limited, increasing the attractiveness of successful novel therapies, although lifestyle interventions and supportive care remain important. End-user trends favor treatments that offer significant clinical benefit with manageable side effect profiles. Mergers and acquisitions (M&A) are a significant feature, with substantial deal values, as larger companies seek to bolster their portfolios with promising late-stage assets. For instance, M&A deal values in this sector have reached upwards of five hundred million, reflecting the high stakes and potential rewards. Market share distribution is fluid, with companies like Madrigal Pharmaceuticals currently leading the charge in late-stage development.

NASH Drug Pipeline Industry Trends & Insights

The NASH drug pipeline is experiencing unprecedented growth and transformation, fueled by a confluence of escalating global obesity rates, increasing prevalence of metabolic syndrome, and a growing understanding of the complex pathophysiology of non-alcoholic fatty liver disease (NAFLD) and its progression to NASH and cirrhosis. This burgeoning market is projected to witness a compound annual growth rate (CAGR) of approximately 25% over the forecast period, indicating substantial commercial potential. Technological disruptions, including advancements in artificial intelligence (AI) for drug discovery and personalized medicine approaches, are accelerating the identification of novel drug candidates and optimizing clinical trial designs. Consumer preferences are shifting towards therapies that offer not only disease modification but also improvement in quality of life and a reduction in the risk of liver-related complications such as hepatocellular carcinoma (HCC). Competitive dynamics are intense, with a crowded pipeline featuring diverse mechanisms of action. Companies are investing heavily in clinical research, with over ten thousand million dedicated to ongoing trials. Market penetration of approved therapies is expected to increase significantly once breakthrough treatments receive regulatory approval, driven by unmet medical needs and favorable reimbursement policies. The focus is shifting from symptom management to addressing the underlying disease processes, including inflammation, steatosis, and fibrosis.

Dominant Markets & Segments in NASH Drug Pipeline

The NASH drug pipeline market is predominantly driven by Clinical Application, which commands the largest market share, estimated at over eight thousand million in 2025. This dominance stems from the direct translation of research into therapeutic interventions for patients diagnosed with NASH. Within the Clinical segment, a significant portion of investment is channeled into the development of drugs targeting fibrosis reversal, a key endpoint for regulatory approval. The Academic Research segment, while smaller in market size (estimated at one thousand million in 2025), plays a crucial foundational role by uncovering novel disease mechanisms and identifying potential drug targets.

Among the Types of NASH drugs in development, Immunomodulatory agents represent a significant and rapidly growing segment, projected to reach over five thousand million by 2033. These therapies aim to dampen the inflammatory cascade characteristic of NASH. Protease Inhibitors, while a critical class, are currently seeing more targeted development for specific pathways, with a market size estimated at two thousand million in 2025. Multiple Kinase Inhibitors are also gaining traction, particularly those targeting inflammatory signaling pathways involved in NASH progression, with an estimated market of three thousand million in 2025.

Leading Regions and Countries: North America, particularly the United States, stands as the dominant market due to its robust healthcare infrastructure, high prevalence of metabolic diseases, and a strong pharmaceutical R&D ecosystem. The region's economic policies actively support drug development through tax incentives and grants. Europe, with countries like Germany and the UK, also represents a significant market, driven by a strong focus on public health initiatives and advanced clinical research capabilities. Asia-Pacific is emerging as a key growth region, fueled by rising healthcare expenditure and increasing diagnosis rates of NASH.

Key Drivers for Dominance:

- High Prevalence of Metabolic Diseases: Rising rates of obesity and type 2 diabetes directly correlate with an increased incidence of NAFLD and NASH, creating a large patient pool.

- Robust R&D Infrastructure: Significant investment in pharmaceutical research and development, coupled with a skilled scientific workforce, accelerates innovation.

- Favorable Regulatory Pathways: Regulatory agencies are prioritizing NASH drug development, offering expedited review pathways for promising therapies.

- Unmet Medical Needs: The absence of a universally approved, disease-modifying therapy creates a significant demand for effective treatments.

- Advancements in Diagnostics: Improved imaging and non-invasive biomarkers facilitate earlier and more accurate NASH diagnosis, expanding the addressable market.

NASH Drug Pipeline Product Developments

The NASH drug pipeline is a hotbed of innovation, with companies actively developing diverse therapeutic modalities. Key product developments include novel small molecules targeting key fibrotic pathways, biologics modulating inflammatory responses, and combination therapies designed to address multiple aspects of NASH pathogenesis. Companies are focusing on compounds that demonstrate significant improvements in liver histology, particularly fibrosis reduction, and improved metabolic markers. Competitive advantages lie in superior efficacy, favorable safety profiles, and novel mechanisms of action that address unmet needs. Technological trends are pushing towards oral formulations and less frequent dosing regimens to improve patient adherence and convenience.

Report Scope & Segmentation Analysis

This report segments the NASH drug pipeline market based on Application and Types.

Application Segments:

- Clinical: This segment focuses on drugs in various stages of clinical trials and those nearing regulatory approval. It represents the largest market share and is projected for robust growth as new therapies enter the market. Estimated market size for clinical application in 2025 is over eight thousand million.

- Academic Research: This segment encompasses early-stage drug discovery, preclinical research, and foundational studies into NASH pathogenesis. While smaller in market size (estimated at one thousand million in 2025), it is crucial for identifying future drug candidates.

Type Segments:

- Protease Inhibitor: This segment targets specific proteases involved in liver inflammation and fibrosis. The estimated market size for protease inhibitors in 2025 is two thousand million, with moderate growth expected.

- Immunomodulatory: This segment includes drugs that modulate the immune system to reduce inflammation in the liver. It is a rapidly expanding segment with an estimated market size of five thousand million in 2025, projected for substantial growth.

- Multiple Kinase Inhibitor: This segment focuses on inhibiting various kinases that play a role in NASH progression. The estimated market size for multiple kinase inhibitors in 2025 is three thousand million, with strong growth potential.

Key Drivers of NASH Drug Pipeline Growth

The NASH drug pipeline growth is propelled by several significant drivers. Firstly, the epidemic of obesity and metabolic syndrome globally has led to a surge in NAFLD, creating a vast and underserved patient population. Secondly, advancements in scientific understanding of NASH pathogenesis have unveiled novel therapeutic targets, encouraging extensive R&D efforts. Thirdly, regulatory incentives, such as fast-track designations and priority reviews from agencies like the FDA, are accelerating the development and approval timelines for promising NASH drugs. Fourthly, growing patient and physician awareness regarding the long-term risks associated with NASH, including cirrhosis and hepatocellular carcinoma, is increasing demand for effective treatments. Finally, significant investment from pharmaceutical companies and venture capitalists signals strong confidence in the commercial viability of the NASH market.

Challenges in the NASH Drug Pipeline Sector

Despite the promising outlook, the NASH drug pipeline faces considerable challenges. High attrition rates in clinical trials remain a significant barrier, with many promising candidates failing to demonstrate efficacy or safety in later stages. Complex disease heterogeneity makes it difficult to develop one-size-fits-all treatments, necessitating more targeted approaches and sophisticated patient stratification. Regulatory hurdles related to defining and measuring disease modification, particularly fibrosis reversal, continue to present a challenge for drug approvals. The cost of drug development is substantial, with R&D expenses running into hundreds of millions for each successful drug. Furthermore, diagnostic challenges and variability in NASH diagnosis can impact trial recruitment and real-world patient identification. The current lack of a clear, universally accepted surrogate endpoint for fibrosis reversal also adds to the complexity of development.

Emerging Opportunities in NASH Drug Pipeline

Emerging opportunities in the NASH drug pipeline are manifold. The development of novel combination therapies that target multiple pathways simultaneously holds significant promise for enhanced efficacy. Advances in biomarker discovery and diagnostics are opening doors for more precise patient selection and personalized treatment strategies. The growing understanding of the gut-microbiome axis in NASH is leading to exploration of microbiome-based therapeutics. Furthermore, the potential for repurposing existing drugs with established safety profiles for NASH treatment presents a cost-effective avenue. The increasing prevalence of NASH in emerging economies also represents a significant untapped market opportunity.

Leading Players in the NASH Drug Pipeline Market

- Intercept

- Genfit

- Allergan

- Madrigal

- Immuron

- Galectin

- Gilead

- 89bio Inc

- ABIONYX Pharma SA

- Abivax SA

- Abliva AB

- Acquist Therapeutics

- AdAlta Ltd

- Afimmune Biopharma Ltd

- Zhejiang Doer Biologics Corp

- Dicerna Pharmaceuticals Inc

- ChemomAb Ltd

- DURECT Corp

- Eli Lilly and Co

- Enanta Pharmaceuticals Inc

- EncuraGen Inc

- Engitix Ltd

- Heprotech Inc

- Hinova Pharmaceuticals Inc

- HK inno.N Corp

- HotSpot Therapeutics Inc

Key Developments in NASH Drug Pipeline Industry

- 2023 Q4: Madrigal Pharmaceuticals announces positive top-line results for resmetirom (THR-beta agonist) in its Phase 3 MAESTRO-NASH study, showing significant fibrosis improvement without worsening NASH.

- 2023 Q3: Gilead Sciences advances its ASK1 inhibitor, selonsertib, into Phase 3 trials for NASH patients with advanced fibrosis.

- 2023 Q2: Intercept Pharmaceuticals' obeticholic acid (FXR agonist) faces regulatory hurdles for NASH indication due to safety concerns, but continues development for primary biliary cholangitis.

- 2023 Q1: 89bio Inc. reports encouraging Phase 2b data for pegozafermin (FGF21 analog) in NASH patients, demonstrating improvements in fibrosis and liver inflammation.

- 2022 Q4: Genfit advances its dual PPAR agonist, elafibranor, into Phase 3 development for NASH patients with moderate to advanced fibrosis.

- 2022 Q3: Numerous early-stage companies, including Immuron and Galectin Therapeutics, report progress in preclinical and Phase 1 studies for novel NASH therapeutics.

- 2022 Q2: AbbVie acquires Allergan, potentially consolidating its NASH pipeline efforts.

- 2022 Q1: Dicerna Pharmaceuticals Inc. (now Novo Nordisk) continues to advance its RNAi-based therapies targeting NASH pathways.

Strategic Outlook for NASH Drug Pipeline Market

- 2023 Q4: Madrigal Pharmaceuticals announces positive top-line results for resmetirom (THR-beta agonist) in its Phase 3 MAESTRO-NASH study, showing significant fibrosis improvement without worsening NASH.

- 2023 Q3: Gilead Sciences advances its ASK1 inhibitor, selonsertib, into Phase 3 trials for NASH patients with advanced fibrosis.

- 2023 Q2: Intercept Pharmaceuticals' obeticholic acid (FXR agonist) faces regulatory hurdles for NASH indication due to safety concerns, but continues development for primary biliary cholangitis.

- 2023 Q1: 89bio Inc. reports encouraging Phase 2b data for pegozafermin (FGF21 analog) in NASH patients, demonstrating improvements in fibrosis and liver inflammation.

- 2022 Q4: Genfit advances its dual PPAR agonist, elafibranor, into Phase 3 development for NASH patients with moderate to advanced fibrosis.

- 2022 Q3: Numerous early-stage companies, including Immuron and Galectin Therapeutics, report progress in preclinical and Phase 1 studies for novel NASH therapeutics.

- 2022 Q2: AbbVie acquires Allergan, potentially consolidating its NASH pipeline efforts.

- 2022 Q1: Dicerna Pharmaceuticals Inc. (now Novo Nordisk) continues to advance its RNAi-based therapies targeting NASH pathways.

Strategic Outlook for NASH Drug Pipeline Market

The strategic outlook for the NASH drug pipeline market remains exceptionally bright, driven by the urgent need for effective treatments and the significant unmet medical need. The increasing understanding of NASH pathogenesis, coupled with technological advancements in drug discovery and development, will continue to fuel innovation. Strategic collaborations, mergers, and acquisitions are expected to intensify as companies seek to consolidate their market positions and acquire promising late-stage assets. Focus will increasingly shift towards demonstrating clinically meaningful improvements in fibrosis and liver function, along with favorable safety profiles. The successful launch of disease-modifying therapies will unlock substantial market potential, estimated to exceed fifty thousand million by 2033, transforming the treatment landscape for millions of patients worldwide.

NASH Drug Pipeline Segmentation

-

1. Application

- 1.1. Clinical

- 1.2. Academic Research

-

2. Types

- 2.1. Protease Inhibitor

- 2.2. Immunomodulatory

- 2.3. Multiple Kinase Inhibitor

NASH Drug Pipeline Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

NASH Drug Pipeline REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NASH Drug Pipeline Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clinical

- 5.1.2. Academic Research

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Protease Inhibitor

- 5.2.2. Immunomodulatory

- 5.2.3. Multiple Kinase Inhibitor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America NASH Drug Pipeline Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clinical

- 6.1.2. Academic Research

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Protease Inhibitor

- 6.2.2. Immunomodulatory

- 6.2.3. Multiple Kinase Inhibitor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America NASH Drug Pipeline Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clinical

- 7.1.2. Academic Research

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Protease Inhibitor

- 7.2.2. Immunomodulatory

- 7.2.3. Multiple Kinase Inhibitor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe NASH Drug Pipeline Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clinical

- 8.1.2. Academic Research

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Protease Inhibitor

- 8.2.2. Immunomodulatory

- 8.2.3. Multiple Kinase Inhibitor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa NASH Drug Pipeline Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clinical

- 9.1.2. Academic Research

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Protease Inhibitor

- 9.2.2. Immunomodulatory

- 9.2.3. Multiple Kinase Inhibitor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific NASH Drug Pipeline Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clinical

- 10.1.2. Academic Research

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Protease Inhibitor

- 10.2.2. Immunomodulatory

- 10.2.3. Multiple Kinase Inhibitor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intercept

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Genfit

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allergan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Madrigal

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Immuron

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Galectin

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gilead

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 89bio Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABIONYX Pharma SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abivax SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Abliva AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Acquist Therapeutics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AdAlta Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Afimmune Biopharma Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zhejiang Doer Biologics Corp

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dicerna Pharmaceuticals Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ChemomAb Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 DURECT Corp

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Eli Lilly and Co

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Enanta Pharmaceuticals Inc

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 EncuraGen Inc

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Engitix Ltd

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Heprotech Inc

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Hinova Pharmaceuticals Inc

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 HK inno.N Corp

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 HotSpot Therapeutics Inc

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 Intercept

List of Figures

- Figure 1: Global NASH Drug Pipeline Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America NASH Drug Pipeline Revenue (million), by Application 2024 & 2032

- Figure 3: North America NASH Drug Pipeline Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America NASH Drug Pipeline Revenue (million), by Types 2024 & 2032

- Figure 5: North America NASH Drug Pipeline Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America NASH Drug Pipeline Revenue (million), by Country 2024 & 2032

- Figure 7: North America NASH Drug Pipeline Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America NASH Drug Pipeline Revenue (million), by Application 2024 & 2032

- Figure 9: South America NASH Drug Pipeline Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America NASH Drug Pipeline Revenue (million), by Types 2024 & 2032

- Figure 11: South America NASH Drug Pipeline Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America NASH Drug Pipeline Revenue (million), by Country 2024 & 2032

- Figure 13: South America NASH Drug Pipeline Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe NASH Drug Pipeline Revenue (million), by Application 2024 & 2032

- Figure 15: Europe NASH Drug Pipeline Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe NASH Drug Pipeline Revenue (million), by Types 2024 & 2032

- Figure 17: Europe NASH Drug Pipeline Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe NASH Drug Pipeline Revenue (million), by Country 2024 & 2032

- Figure 19: Europe NASH Drug Pipeline Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa NASH Drug Pipeline Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa NASH Drug Pipeline Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa NASH Drug Pipeline Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa NASH Drug Pipeline Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa NASH Drug Pipeline Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa NASH Drug Pipeline Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific NASH Drug Pipeline Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific NASH Drug Pipeline Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific NASH Drug Pipeline Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific NASH Drug Pipeline Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific NASH Drug Pipeline Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific NASH Drug Pipeline Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global NASH Drug Pipeline Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global NASH Drug Pipeline Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global NASH Drug Pipeline Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global NASH Drug Pipeline Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global NASH Drug Pipeline Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global NASH Drug Pipeline Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global NASH Drug Pipeline Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global NASH Drug Pipeline Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global NASH Drug Pipeline Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global NASH Drug Pipeline Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global NASH Drug Pipeline Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global NASH Drug Pipeline Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global NASH Drug Pipeline Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global NASH Drug Pipeline Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global NASH Drug Pipeline Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global NASH Drug Pipeline Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global NASH Drug Pipeline Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global NASH Drug Pipeline Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global NASH Drug Pipeline Revenue million Forecast, by Country 2019 & 2032

- Table 41: China NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific NASH Drug Pipeline Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NASH Drug Pipeline?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the NASH Drug Pipeline?

Key companies in the market include Intercept, Genfit, Allergan, Madrigal, Immuron, Galectin, Gilead, 89bio Inc, ABIONYX Pharma SA, Abivax SA, Abliva AB, Acquist Therapeutics, AdAlta Ltd, Afimmune Biopharma Ltd, Zhejiang Doer Biologics Corp, Dicerna Pharmaceuticals Inc, ChemomAb Ltd, DURECT Corp, Eli Lilly and Co, Enanta Pharmaceuticals Inc, EncuraGen Inc, Engitix Ltd, Heprotech Inc, Hinova Pharmaceuticals Inc, HK inno.N Corp, HotSpot Therapeutics Inc.

3. What are the main segments of the NASH Drug Pipeline?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NASH Drug Pipeline," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NASH Drug Pipeline report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NASH Drug Pipeline?

To stay informed about further developments, trends, and reports in the NASH Drug Pipeline, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence